Key Insights

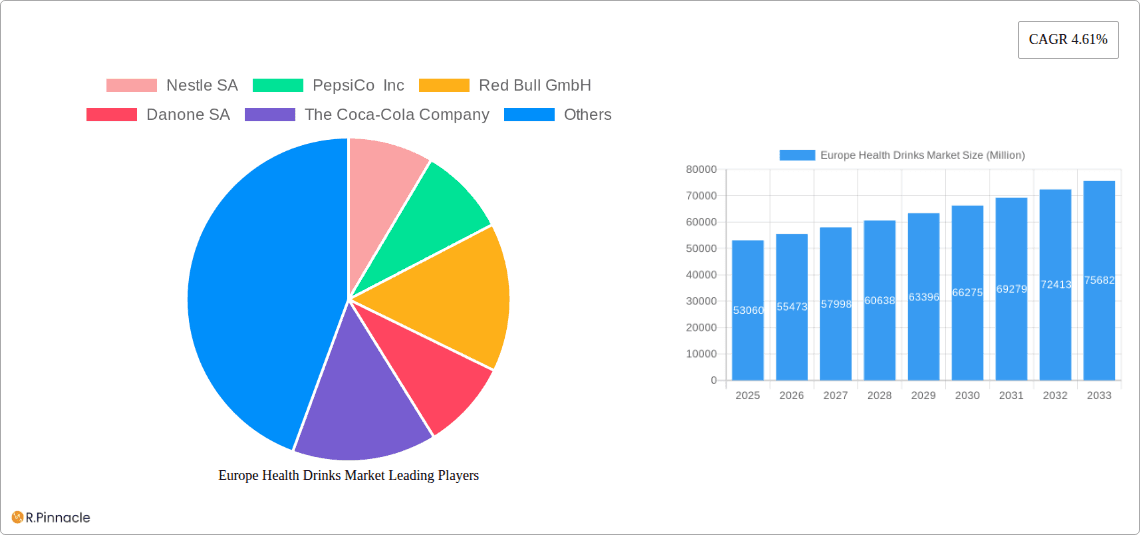

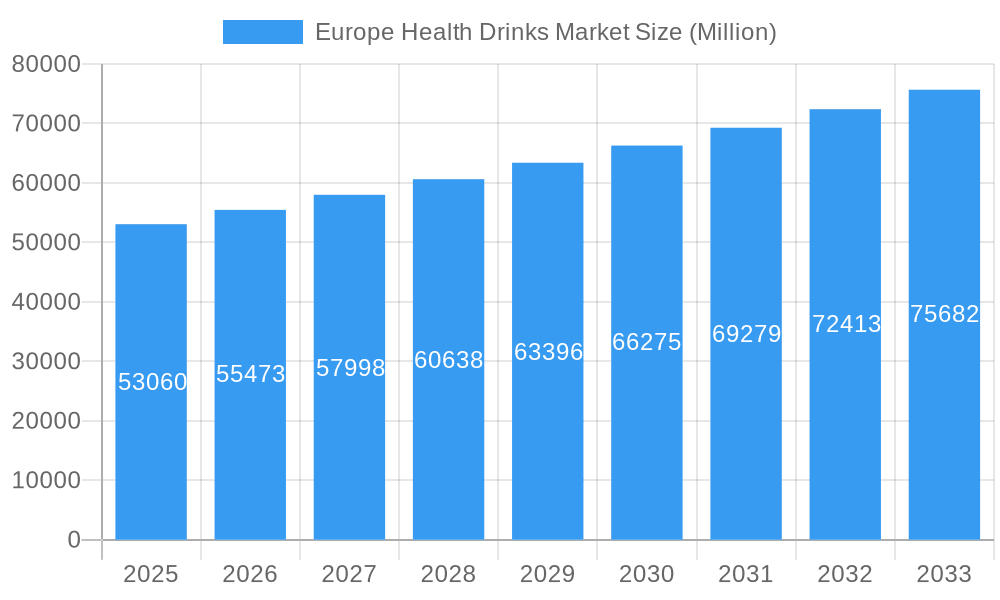

The European health drinks market, valued at €53.06 billion in 2025, is projected to experience robust growth, driven by increasing health consciousness among consumers and a rising preference for functional beverages. This market segment is characterized by a compound annual growth rate (CAGR) of 4.61% from 2025 to 2033, indicating a significant expansion over the forecast period. Key drivers include the growing prevalence of lifestyle diseases, increased demand for natural and organic ingredients, and the proliferation of innovative product formulations offering specific health benefits such as improved immunity, enhanced energy levels, and better digestive health. The market is segmented by product type (e.g., functional waters, energy drinks, fruit juices, probiotic drinks), distribution channels (e.g., supermarkets, online retailers, specialized health stores), and target demographics (e.g., age groups, fitness enthusiasts). Major players like Nestle, PepsiCo, Red Bull, and Coca-Cola are actively shaping the market through product innovation, strategic partnerships, and aggressive marketing campaigns.

Europe Health Drinks Market Market Size (In Billion)

The continued growth of the European health drinks market is expected to be fueled by several trends, including the rising adoption of plant-based alternatives, the increasing focus on sustainability and ethically sourced ingredients, and the growing popularity of personalized nutrition. However, potential restraints include the fluctuating prices of raw materials, stringent regulatory frameworks concerning health claims, and the potential for consumer skepticism regarding the efficacy of certain health drinks. Furthermore, competitive intensity among established brands and emerging players adds another layer of complexity to the market dynamics. Despite these challenges, the long-term outlook for the European health drinks market remains optimistic, with substantial opportunities for both established players and new entrants aiming to capitalize on the rising consumer demand for healthier beverage options.

Europe Health Drinks Market Company Market Share

Europe Health Drinks Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Health Drinks Market, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The report leverages rigorous data analysis and incorporates key industry developments to provide a clear understanding of market trends, growth drivers, challenges, and future opportunities. The market is projected to reach xx Million by 2033, presenting substantial growth potential.

Europe Health Drinks Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European health drinks market. We delve into market concentration, assessing the market share held by key players like Nestle SA, PepsiCo Inc, Red Bull GmbH, Danone SA, The Coca-Cola Company, Suntory Holdings Limited, Oatly Group AB, Biona Organic, Monster Beverage Corporation, and Yakult Honsha Co Ltd (list not exhaustive). We examine the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their influence on market dynamics. The report also explores the regulatory frameworks governing health drink production and marketing, analyzing their impact on innovation and market access. Finally, we analyze product substitutes, end-user demographics, and the overall market structure contributing to the market's xx Million valuation in 2025.

- Market Concentration: Analysis of market share distribution among major players. (e.g., Nestle SA holds x% market share, PepsiCo Inc holds y% market share).

- Innovation Drivers: Examination of factors driving product innovation, including consumer demand for healthier options and technological advancements.

- Regulatory Frameworks: Assessment of the impact of EU regulations on market growth and innovation.

- M&A Activities: Analysis of significant M&A deals in the health drinks sector and their effects on market consolidation. (e.g., Deal value analysis for xx number of deals).

- Product Substitutes: Evaluation of competitive pressure from alternative beverage categories.

- End-user Demographics: Detailed analysis of consumer segments driving demand for health drinks.

Europe Health Drinks Market Dynamics & Trends

This section provides a comprehensive overview of the market's dynamic landscape. It examines key growth drivers, including the rising health consciousness among European consumers, the increasing prevalence of lifestyle diseases, and the growing demand for functional beverages. The analysis also incorporates technological disruptions, exploring the impact of emerging technologies on product innovation, production processes, and consumer experience. Moreover, we assess evolving consumer preferences, identifying key trends shaping demand, such as preferences for natural ingredients, low-sugar options, and personalized nutrition. The competitive dynamics are also explored, analyzing the strategies employed by major players to gain market share and maintain competitiveness. The report provides specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates to offer a detailed market projection, reaching xx Million by 2033.

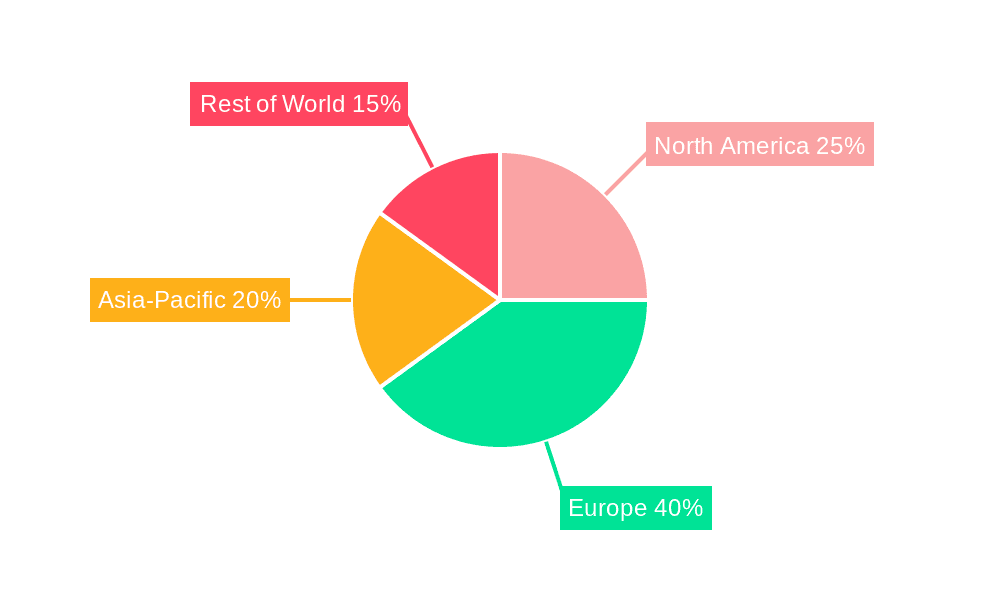

Dominant Regions & Segments in Europe Health Drinks Market

This section identifies the leading regions and segments within the European health drinks market. We analyze key drivers for each dominant region, including economic policies, infrastructure, and consumer behavior. We utilize detailed analysis to explain why specific regions and segments exhibit higher growth rates and market dominance. The analysis is structured around key metrics and trends to pinpoint the leading areas within the market, with a projection of xx Million market value for the leading segment in 2025.

- Leading Region/Country: (e.g., Germany, UK, France) - Detailed explanation of dominance factors.

- Key Drivers: Bullet points outlining the factors contributing to the dominance of the leading region(s) or segment(s). (e.g., strong economy, favorable regulations, high consumer demand).

Europe Health Drinks Market Product Innovations

This section summarizes recent product developments in the European health drinks market, highlighting key innovations and their competitive advantages. The focus is on technological trends that are shaping product development, including the incorporation of natural ingredients, the use of advanced packaging technologies, and the development of functional beverages with specific health benefits. The analysis assesses the market fit of new products and their potential to disrupt the market.

Report Scope & Segmentation Analysis

This report segments the European health drinks market based on (provide detailed segmentations based on product type, distribution channel etc.). Each segment's growth projections, market size, and competitive dynamics are examined, contributing to the overall market value projection of xx Million in 2025.

- Segment 1: (e.g., Energy Drinks): Growth projections, market size, competitive landscape.

- Segment 2: (e.g., Sports Drinks): Growth projections, market size, competitive landscape.

- Segment 3: (e.g., Functional Beverages): Growth projections, market size, competitive landscape. (Add more segments as needed)

Key Drivers of Europe Health Drinks Market Growth

The growth of the European health drinks market is fueled by several key factors. Increasing health awareness among consumers is leading to a greater demand for healthier beverage options. Technological advancements are driving innovation in product formulation and packaging. Favorable regulatory environments in some European countries are also encouraging market expansion. Further, the growing popularity of sports and fitness activities are boosting the demand for sports and energy drinks. These factors collectively contribute to the robust market growth projections of xx Million in 2025.

Challenges in the Europe Health Drinks Market Sector

The European health drinks market faces certain challenges, including stringent regulations regarding product labeling and marketing claims. Supply chain disruptions caused by geopolitical events and fluctuating raw material prices can also impact production and profitability. Intense competition among established players and emerging brands also puts pressure on profit margins. These factors need to be considered when assessing future market growth, projected to reach xx Million in 2033.

Emerging Opportunities in Europe Health Drinks Market

Despite challenges, the European health drinks market presents several opportunities. The growing demand for personalized nutrition is creating opportunities for customized products catering to specific dietary needs and preferences. The rise of e-commerce is also opening new distribution channels for health drinks. Finally, advancements in sustainable packaging solutions can help companies improve their environmental footprint and attract environmentally conscious consumers. These factors collectively suggest significant future potential within this segment of the market, which is projected to reach xx Million in 2033.

Leading Players in the Europe Health Drinks Market Market

- Nestle SA

- PepsiCo Inc

- Red Bull GmbH

- Danone SA

- The Coca-Cola Company

- Suntory Holdings Limited

- Oatly Group AB

- Biona Organic

- Monster Beverage Corporation

- Yakult Honsha Co Ltd

- (List Not Exhaustive)

Key Developments in Europe Health Drinks Market Industry

- January 2024: Celsius Holdings expands into the UK and Irish markets through a partnership with Suntory Beverage & Food Great Britain. This signifies increased international expansion within the energy drink sector.

- August 2023: FC Bayern Munich partners with PRIME Hydration, highlighting the increasing importance of sports sponsorships in the health drinks market. This demonstrates the rising influence of brand collaborations within the sports drink sector.

- March 2023: Boost launches a limited-edition flavored sports drink, illustrating the ongoing efforts of companies to diversify their product portfolio and enhance brand appeal. This reflects the importance of product innovation and targeted marketing strategies.

Future Outlook for Europe Health Drinks Market Market

The future of the European health drinks market is bright. Continued growth is expected, driven by sustained consumer demand for healthy and functional beverages. Innovation in product development and distribution strategies will play a key role in shaping the market's future trajectory. Strategic partnerships and acquisitions will further consolidate the market landscape. The focus on sustainability and ethical sourcing will also influence consumer choices and market dynamics, contributing to a robust growth forecast, reaching xx Million by 2033.

Europe Health Drinks Market Segmentation

-

1. Type

- 1.1. Fruit and Vegetable Juices

- 1.2. Sports Drinks

- 1.3. Energy Drinks

- 1.4. Kombucha Drinks

- 1.5. Functional and Fortified Bottled Water

- 1.6. Dairy and Dairy Alternative Drinks

- 1.7. RTD Tea and Coffee

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Stores

- 2.2.4. Other Off-trade Channels

Europe Health Drinks Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Spain

- 5. Italy

- 6. Belgium

- 7. Netherlands

- 8. Rest of Europe

Europe Health Drinks Market Regional Market Share

Geographic Coverage of Europe Health Drinks Market

Europe Health Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Energy Drinks Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fruit and Vegetable Juices

- 5.1.2. Sports Drinks

- 5.1.3. Energy Drinks

- 5.1.4. Kombucha Drinks

- 5.1.5. Functional and Fortified Bottled Water

- 5.1.6. Dairy and Dairy Alternative Drinks

- 5.1.7. RTD Tea and Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Belgium

- 5.3.7. Netherlands

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fruit and Vegetable Juices

- 6.1.2. Sports Drinks

- 6.1.3. Energy Drinks

- 6.1.4. Kombucha Drinks

- 6.1.5. Functional and Fortified Bottled Water

- 6.1.6. Dairy and Dairy Alternative Drinks

- 6.1.7. RTD Tea and Coffee

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fruit and Vegetable Juices

- 7.1.2. Sports Drinks

- 7.1.3. Energy Drinks

- 7.1.4. Kombucha Drinks

- 7.1.5. Functional and Fortified Bottled Water

- 7.1.6. Dairy and Dairy Alternative Drinks

- 7.1.7. RTD Tea and Coffee

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fruit and Vegetable Juices

- 8.1.2. Sports Drinks

- 8.1.3. Energy Drinks

- 8.1.4. Kombucha Drinks

- 8.1.5. Functional and Fortified Bottled Water

- 8.1.6. Dairy and Dairy Alternative Drinks

- 8.1.7. RTD Tea and Coffee

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fruit and Vegetable Juices

- 9.1.2. Sports Drinks

- 9.1.3. Energy Drinks

- 9.1.4. Kombucha Drinks

- 9.1.5. Functional and Fortified Bottled Water

- 9.1.6. Dairy and Dairy Alternative Drinks

- 9.1.7. RTD Tea and Coffee

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fruit and Vegetable Juices

- 10.1.2. Sports Drinks

- 10.1.3. Energy Drinks

- 10.1.4. Kombucha Drinks

- 10.1.5. Functional and Fortified Bottled Water

- 10.1.6. Dairy and Dairy Alternative Drinks

- 10.1.7. RTD Tea and Coffee

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Stores

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Belgium Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fruit and Vegetable Juices

- 11.1.2. Sports Drinks

- 11.1.3. Energy Drinks

- 11.1.4. Kombucha Drinks

- 11.1.5. Functional and Fortified Bottled Water

- 11.1.6. Dairy and Dairy Alternative Drinks

- 11.1.7. RTD Tea and Coffee

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience/Grocery Stores

- 11.2.2.3. Online Stores

- 11.2.2.4. Other Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Netherlands Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Fruit and Vegetable Juices

- 12.1.2. Sports Drinks

- 12.1.3. Energy Drinks

- 12.1.4. Kombucha Drinks

- 12.1.5. Functional and Fortified Bottled Water

- 12.1.6. Dairy and Dairy Alternative Drinks

- 12.1.7. RTD Tea and Coffee

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience/Grocery Stores

- 12.2.2.3. Online Stores

- 12.2.2.4. Other Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Europe Europe Health Drinks Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Fruit and Vegetable Juices

- 13.1.2. Sports Drinks

- 13.1.3. Energy Drinks

- 13.1.4. Kombucha Drinks

- 13.1.5. Functional and Fortified Bottled Water

- 13.1.6. Dairy and Dairy Alternative Drinks

- 13.1.7. RTD Tea and Coffee

- 13.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.2.1. On-trade

- 13.2.2. Off-trade

- 13.2.2.1. Supermarkets/Hypermarkets

- 13.2.2.2. Convenience/Grocery Stores

- 13.2.2.3. Online Stores

- 13.2.2.4. Other Off-trade Channels

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 PepsiCo Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Red Bull GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Danone SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 The Coca-Cola Company

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Suntory Holdings Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Oatly Group AB

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Biona Organic

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Monster Beverage Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Yakult Honsha Co Ltd*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Global Europe Health Drinks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Health Drinks Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United Kingdom Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United Kingdom Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United Kingdom Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United Kingdom Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United Kingdom Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: United Kingdom Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: United Kingdom Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: United Kingdom Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: United Kingdom Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 12: United Kingdom Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: United Kingdom Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Germany Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Germany Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Germany Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Germany Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Germany Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Germany Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: Germany Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Germany Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Germany Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Germany Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Germany Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Germany Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 27: France Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 28: France Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 29: France Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: France Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 31: France Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: France Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: France Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: France Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: France Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 36: France Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 37: France Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: France Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Spain Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Spain Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Spain Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Spain Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Spain Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Spain Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Spain Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Spain Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Spain Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Spain Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Spain Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Spain Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Italy Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Italy Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Italy Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Italy Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Italy Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Italy Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Italy Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Italy Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Italy Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Italy Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Italy Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Italy Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Belgium Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Belgium Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 65: Belgium Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Belgium Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Belgium Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 68: Belgium Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 69: Belgium Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 70: Belgium Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 71: Belgium Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Belgium Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Belgium Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Belgium Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Netherlands Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 76: Netherlands Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 77: Netherlands Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 78: Netherlands Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 79: Netherlands Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 80: Netherlands Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 81: Netherlands Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 82: Netherlands Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 83: Netherlands Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 84: Netherlands Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 85: Netherlands Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Netherlands Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

- Figure 87: Rest of Europe Europe Health Drinks Market Revenue (Million), by Type 2025 & 2033

- Figure 88: Rest of Europe Europe Health Drinks Market Volume (Billion), by Type 2025 & 2033

- Figure 89: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Type 2025 & 2033

- Figure 90: Rest of Europe Europe Health Drinks Market Volume Share (%), by Type 2025 & 2033

- Figure 91: Rest of Europe Europe Health Drinks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 92: Rest of Europe Europe Health Drinks Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 93: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 94: Rest of Europe Europe Health Drinks Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 95: Rest of Europe Europe Health Drinks Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Europe Europe Health Drinks Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Rest of Europe Europe Health Drinks Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Europe Europe Health Drinks Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Europe Health Drinks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Health Drinks Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 43: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Europe Health Drinks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Europe Health Drinks Market Volume Billion Forecast, by Type 2020 & 2033

- Table 51: Global Europe Health Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Europe Health Drinks Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Europe Health Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Europe Health Drinks Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Health Drinks Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Europe Health Drinks Market?

Key companies in the market include Nestle SA, PepsiCo Inc, Red Bull GmbH, Danone SA, The Coca-Cola Company, Suntory Holdings Limited, Oatly Group AB, Biona Organic, Monster Beverage Corporation, Yakult Honsha Co Ltd*List Not Exhaustive.

3. What are the main segments of the Europe Health Drinks Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Growing Popularity of Energy Drinks Driving the Market.

7. Are there any restraints impacting market growth?

Augmented Expenditure on Advertisement and Promotional Activities; Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages.

8. Can you provide examples of recent developments in the market?

January 2024: Celsius Holdings, an energy drink manufacturer based in Florida, United States, broadened its international reach with distribution deals in the United Kingdom. Celsius named Suntory Beverage & Food Great Britain as its exclusive sales and distribution partner to enter the Irish and UK markets. The energy drinks maker has identified Germany and other European countries as “big opportunities” for new markets as it increases its reach outside the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Health Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Health Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Health Drinks Market?

To stay informed about further developments, trends, and reports in the Europe Health Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence