Key Insights

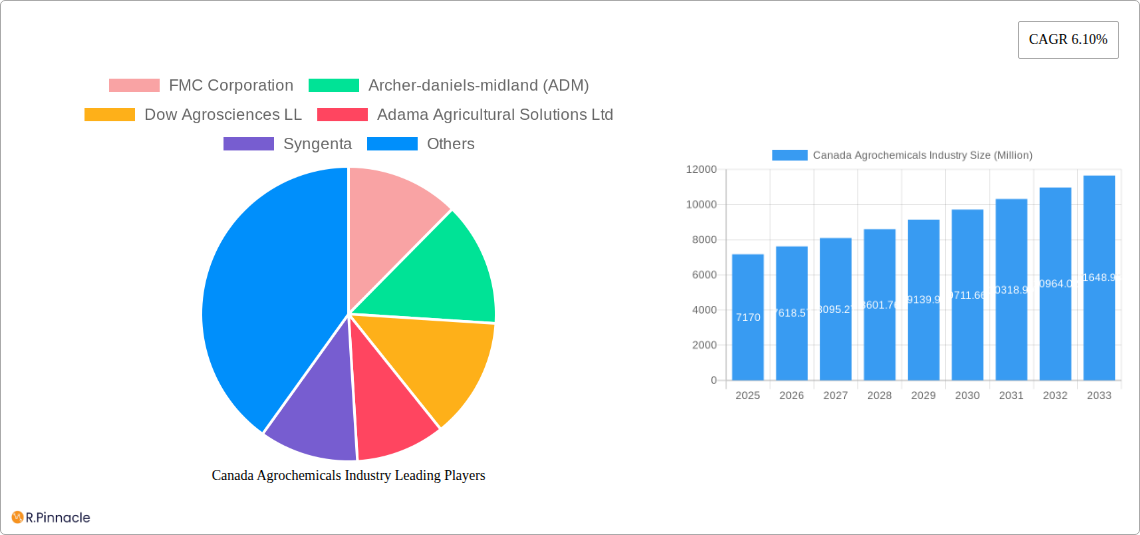

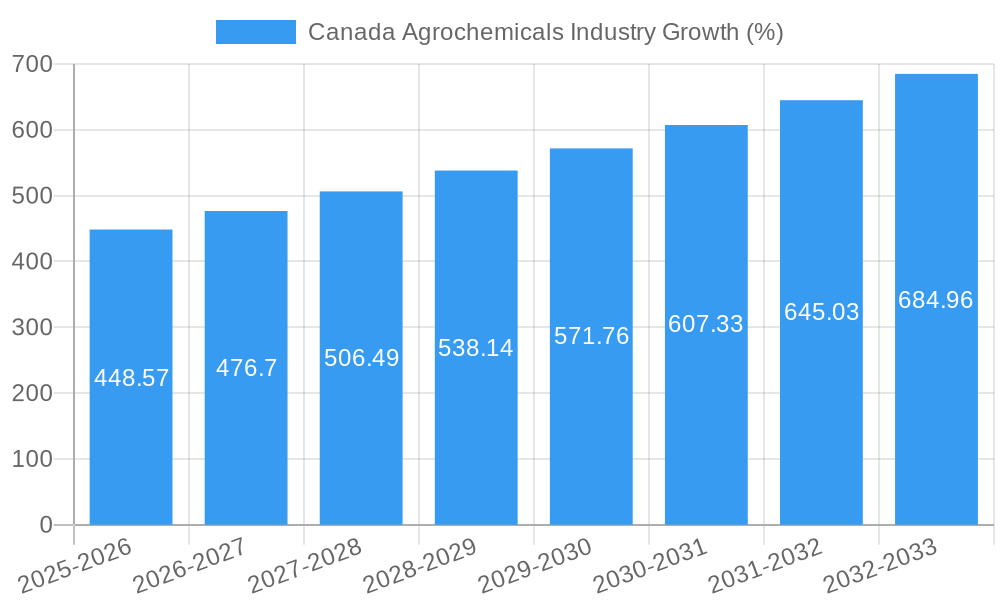

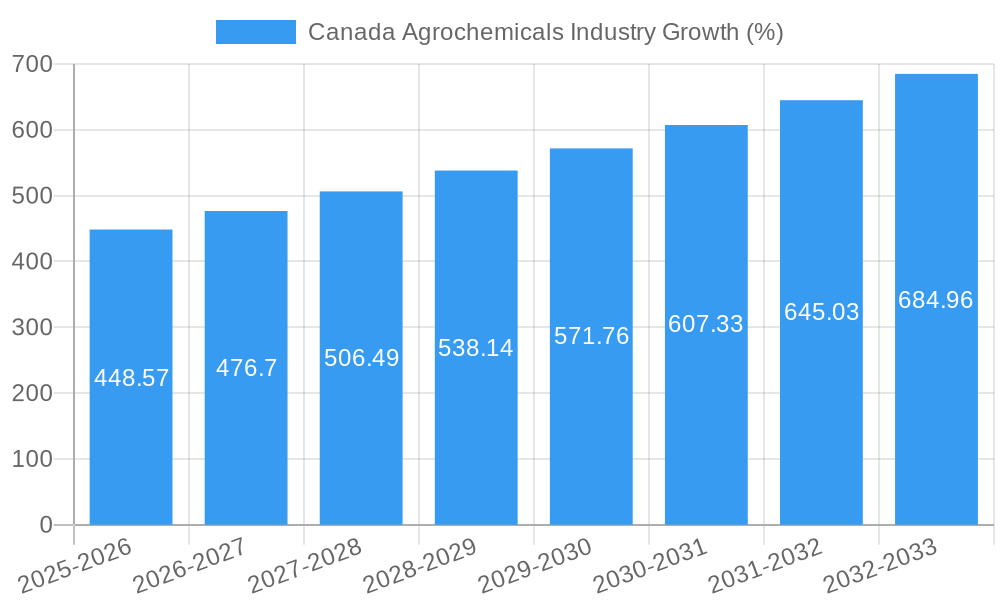

The Canadian agrochemicals market, valued at $7.17 billion in 2025, is projected to experience robust growth, driven by increasing agricultural production to meet rising domestic and export demands. Factors such as government initiatives promoting sustainable agricultural practices and technological advancements in crop protection solutions are key contributors to this expansion. The market is segmented by product type (fertilizers, pesticides, adjuvants, plant growth regulators) and application (grains and cereals, pulses and oilseeds, fruits and vegetables, turf and ornamental grass). The significant presence of major global players like FMC Corporation, ADM, and Syngenta underscores the market's competitiveness and sophistication. Regional variations exist, with potentially higher growth in Western Canada due to its larger agricultural landmass and specific crop compositions. Challenges include environmental concerns surrounding pesticide use, stringent regulatory frameworks, and potential volatility in commodity prices impacting farmer investment.

The forecast period (2025-2033) anticipates a CAGR of 6.10%, indicating steady market expansion. This growth will be fueled by continuous innovation in agrochemical formulations, a focus on precision agriculture, and increasing awareness of crop disease and pest management. However, the market's growth trajectory will be influenced by factors like climate change impacting crop yields and the ongoing development and adoption of bio-based and integrated pest management strategies. The competitive landscape suggests ongoing consolidation and strategic alliances among market participants, as companies strive for market share and efficient distribution networks across Canada's diverse agricultural regions. Further research into specific sub-segments like organic fertilizers and biopesticides will be vital to understand emerging niche opportunities within the Canadian agrochemicals landscape.

Canada Agrochemicals Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian agrochemicals market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The study encompasses key segments, including fertilizers, pesticides, adjuvants, and plant growth regulators, across various applications like grains and cereals, pulses and oilseeds, fruits and vegetables, and turf and ornamental grass.

Canada Agrochemicals Industry Market Structure & Innovation Trends

This section analyzes the structure of the Canadian agrochemicals market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The report details mergers and acquisitions (M&A) activity with estimated deal values (in Millions). We evaluate the influence of substitute products, end-user demographics, and the overall competitive landscape. Key metrics such as market share for leading players will be provided. The xx Million Canadian agrochemicals market is characterized by:

- High Market Concentration: A few multinational corporations dominate the market, holding a significant share. Further analysis will detail the precise market share breakdown of leading players.

- Innovation Drivers: Technological advancements in formulation, delivery systems, and biological products are key innovation drivers. Stringent environmental regulations are pushing the development of more sustainable and eco-friendly agrochemicals.

- Regulatory Framework: The report thoroughly examines the regulatory landscape, including pesticide registration processes and environmental protection policies.

- M&A Activity: The report documents recent mergers and acquisitions, analyzing their impact on market consolidation and competitive dynamics. Total M&A deal value in the historical period is estimated at xx Million.

Canada Agrochemicals Industry Market Dynamics & Trends

This section delves into the market dynamics driving growth, technological disruptions, and evolving consumer preferences within the Canadian agrochemicals sector. We will explore the competitive landscape, identifying key players and their strategies. The report provides a comprehensive assessment using metrics such as Compound Annual Growth Rate (CAGR) and market penetration. Key aspects explored include:

- Market Growth Drivers: Increasing agricultural production, rising demand for high-yielding crops, and government support for agricultural modernization are identified as key growth drivers.

- Technological Disruptions: The adoption of precision agriculture technologies, including GPS-guided application, sensor-based monitoring, and data analytics, is transforming the industry.

- Consumer Preferences: Growing consumer awareness of environmental sustainability is influencing the demand for biopesticides and other eco-friendly agrochemicals.

- Competitive Dynamics: The report assesses competitive intensity, analyzing pricing strategies, product differentiation, and market share battles among key players. The CAGR for the forecast period (2025-2033) is projected at xx%.

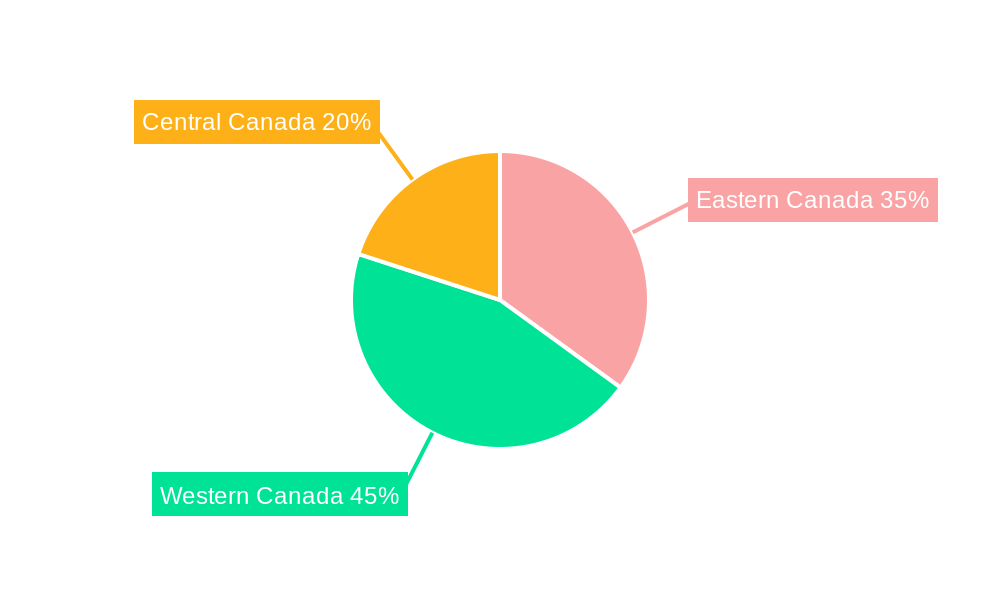

Dominant Regions & Segments in Canada Agrochemicals Industry

This section pinpoints the leading regions and segments within the Canadian agrochemicals market. We analyze the dominance of various application areas (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamental Grass) and product types (Fertilizers, Pesticides, Adjuvants, Plant Growth Regulators).

Leading Regions: The Prairie provinces (Alberta, Saskatchewan, Manitoba) are expected to remain dominant due to their extensive arable land and significant agricultural output. Ontario also holds substantial importance due to its diverse agricultural sector.

Key Drivers:

- Economic Policies: Government subsidies and support programs for farmers significantly impact market growth.

- Infrastructure: Efficient transportation networks and storage facilities are critical for the distribution of agrochemicals.

Dominant Segments: The report provides a detailed breakdown of the market share held by each segment, identifying the fastest-growing and most lucrative areas. For example, the demand for fertilizers and pesticides is expected to remain high, driven by the need to enhance crop yields.

Canada Agrochemicals Industry Product Innovations

Recent product developments demonstrate a strong focus on sustainable and efficient agrochemical solutions. The introduction of new formulations with improved efficacy and reduced environmental impact is a significant trend. Innovation in biological control agents and precision application technologies are also transforming the market. The market is witnessing the launch of targeted products addressing specific pest and disease pressures.

Report Scope & Segmentation Analysis

The report provides a detailed segmentation analysis across both product type and application.

By Type: Fertilizers, Pesticides, Adjuvants, Plant Growth Regulators. Each segment's market size, growth projections, and competitive dynamics are thoroughly examined.

By Application: Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamental Grass. The report explores the unique characteristics and growth potential of each application segment. Estimated market size for each segment in 2025 is provided (in Millions).

Key Drivers of Canada Agrochemicals Industry Growth

Several factors fuel the growth of the Canadian agrochemicals industry. These include:

- Technological advancements: Precision agriculture technologies improve efficiency and reduce environmental impact.

- Government support: Policies encouraging sustainable agriculture and investment in agricultural research contribute to growth.

- Rising agricultural production: The increasing demand for food globally drives the need for higher crop yields.

Challenges in the Canada Agrochemicals Industry Sector

Despite the growth potential, the industry faces challenges:

- Stringent regulations: Meeting stringent environmental and health regulations can be costly and time-consuming.

- Supply chain disruptions: Global supply chain issues can impact the availability and price of raw materials.

- Competitive pressures: Intense competition among established players and emerging companies puts pressure on pricing and margins.

Emerging Opportunities in Canada Agrochemicals Industry

The Canadian agrochemicals market presents several emerging opportunities:

- Biopesticides and biofertilizers: The increasing demand for sustainable alternatives creates opportunities for bio-based products.

- Precision agriculture technologies: The adoption of advanced technologies offers opportunities for improving efficiency and reducing environmental impact.

- Data analytics and digital farming: The use of data to optimize crop management offers significant potential for growth.

Leading Players in the Canada Agrochemicals Industry Market

- FMC Corporation

- Archer-daniels-midland (ADM)

- Dow Agrosciences LL

- Adama Agricultural Solutions Ltd

- Syngenta

- UPL Limited

- Corteva Agriscience

- Bayer CropScience AG

- Nufarm Ltd

- BASF SE

Key Developments in Canada Agrochemicals Industry Industry

September 2022: Gowan Canada and ISK BioSciences launched 'Insight 339SC', a new group 14 herbicide for pre-seed burnoff applications. This launch expands herbicide options for Canadian farmers.

July 2022: Pivot Bio's expansion into Canada signals a growing interest in sustainable nitrogen solutions, potentially disrupting traditional fertilizer markets.

May 2022: The USD 19 Million Protein Industries Canada project highlights the focus on sustainable agriculture and reduced carbon emissions, driving innovation in micronutrient fertilizers.

Future Outlook for Canada Agrochemicals Industry Market

The Canadian agrochemicals market is poised for continued growth, driven by technological innovation, government support for sustainable agriculture, and the increasing demand for food. The focus on sustainable and efficient solutions, including biopesticides and precision agriculture technologies, will shape the future of the industry. Strategic partnerships and investments in research and development will be crucial for companies to succeed in this evolving market.

Canada Agrochemicals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Canada Agrochemicals Industry Segmentation By Geography

- 1. Canada

Canada Agrochemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Need for Improving Productivity by Limiting the Crop Damage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Agrochemicals Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Eastern Canada Canada Agrochemicals Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Agrochemicals Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Agrochemicals Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 FMC Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Archer-daniels-midland (ADM)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Dow Agrosciences LL

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Adama Agricultural Solutions Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Syngenta

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 UPL Limited

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Corteva Agriscience

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Bayer CropScience AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nufarm Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 BASF SE

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 FMC Corporation

List of Figures

- Figure 1: Canada Agrochemicals Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Agrochemicals Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Agrochemicals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Agrochemicals Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Canada Agrochemicals Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Canada Agrochemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Canada Agrochemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Canada Agrochemicals Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Canada Agrochemicals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Agrochemicals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada Agrochemicals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Canada Canada Agrochemicals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Central Canada Canada Agrochemicals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Agrochemicals Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 13: Canada Agrochemicals Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 14: Canada Agrochemicals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 15: Canada Agrochemicals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Canada Agrochemicals Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 17: Canada Agrochemicals Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Agrochemicals Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Canada Agrochemicals Industry?

Key companies in the market include FMC Corporation, Archer-daniels-midland (ADM), Dow Agrosciences LL, Adama Agricultural Solutions Ltd, Syngenta, UPL Limited, Corteva Agriscience, Bayer CropScience AG, Nufarm Ltd, BASF SE.

3. What are the main segments of the Canada Agrochemicals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Need for Improving Productivity by Limiting the Crop Damage.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

September 2022: Gowan Canada and ISK BioSciences launched 'Insight 339SC', a new group 14 herbicide for pre-seed burnoff applications in wheat, corn, and soybean. Insight 339SC provides rapid and effective pre-seed burndown of important broadleaf weeds like kochia, redroot pigweed, common lamb's quarters, and wild buckwheat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Agrochemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Agrochemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Agrochemicals Industry?

To stay informed about further developments, trends, and reports in the Canada Agrochemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence