Key Insights

The Canadian foodservice packaging market is projected to reach $110.29 billion by 2025, with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. This growth is propelled by increasing demand for takeout and delivery services, a thriving restaurant and hospitality sector, and a growing emphasis on food safety and hygiene. Rigid packaging materials are in high demand, particularly for fruits, vegetables, and dairy products, serving the institutional and hospitality end-user segments. While fluctuating raw material prices and environmental concerns present challenges, the market benefits from the introduction of eco-friendly alternatives such as compostable and biodegradable packaging. Provinces like Ontario and British Columbia are expected to lead growth due to higher population density and robust foodservice industries.

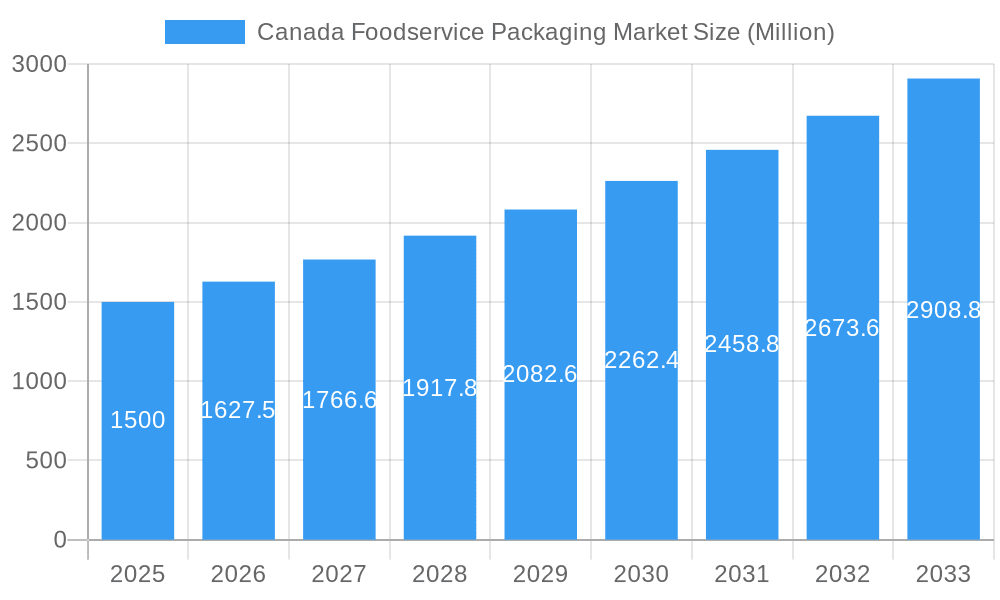

Canada Foodservice Packaging Market Market Size (In Billion)

The competitive landscape features a blend of multinational corporations and regional players, with key companies competing on pricing, product innovation, and sustainability. The shift towards sustainable packaging is anticipated to redefine competitive dynamics, favoring businesses that offer eco-friendly solutions affordably. Future growth hinges on the foodservice industry's expansion, evolving consumer preferences for convenience and sustainability, and supportive government policies for environmentally responsible packaging.

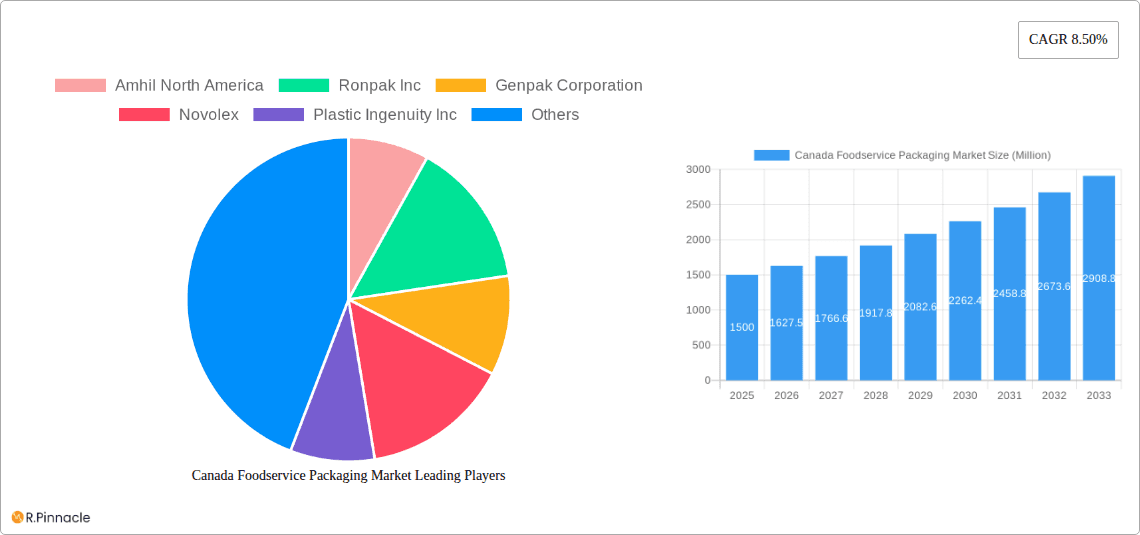

Canada Foodservice Packaging Market Company Market Share

Canada Foodservice Packaging Market Analysis (2025-2033)

This report delivers a detailed analysis of the Canada Foodservice Packaging Market, including market size, growth drivers, challenges, and future opportunities from 2025 to 2033. It serves as a critical resource for industry professionals, investors, and stakeholders seeking to understand this dynamic market.

Canada Foodservice Packaging Market Market Structure & Innovation Trends

The Canadian foodservice packaging market exhibits a moderately concentrated structure, with several key players holding significant market share. Amhil North America, Ronpak Inc, Genpak Corporation, Novolex, and Pactiv Evergreen Inc are among the leading companies, although precise market share data requires further proprietary research and is unavailable here, but is estimated at xx%. Innovation is driven by factors including increased consumer demand for sustainable packaging, stringent government regulations concerning waste reduction, and the continuous evolution of foodservice operations.

The regulatory landscape is actively shaping the market, prompting companies to adopt eco-friendly materials and packaging designs. Mergers and acquisitions (M&A) activity has been relatively modest in recent years; however, M&A deals valued at approximately xx Million have been observed within the sector (2019-2024), mostly focused on consolidating smaller players. The substitution of traditional plastics with compostable and recyclable alternatives is a growing trend. End-user demographics, specifically the rising popularity of quick-service restaurants and the growth of delivery services, strongly influence packaging demand.

- Market Concentration: Moderately Concentrated (xx% held by top 5 players)

- Innovation Drivers: Sustainability, Regulation, Evolving Foodservice

- M&A Activity: xx Million in total deal value (2019-2024)

- Product Substitutes: Compostable and Recyclable Materials

- End-User Demographics: Growing Quick-Service and Delivery Sectors

Canada Foodservice Packaging Market Market Dynamics & Trends

The Canada Foodservice Packaging Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of sustainable packaging options is increasing, driven by consumer preference for eco-friendly products and regulatory pressure. Technological disruptions, such as advancements in biodegradable materials and automated packaging systems, are further influencing market dynamics. Competitive dynamics are marked by intense competition among established players and the emergence of innovative start-ups. Consumer preferences are shifting towards convenience, hygiene, and sustainability, leading to increased demand for ready-to-eat packaging and eco-conscious alternatives. The total market size in 2025 is estimated at xx Million and is expected to reach xx Million by 2033.

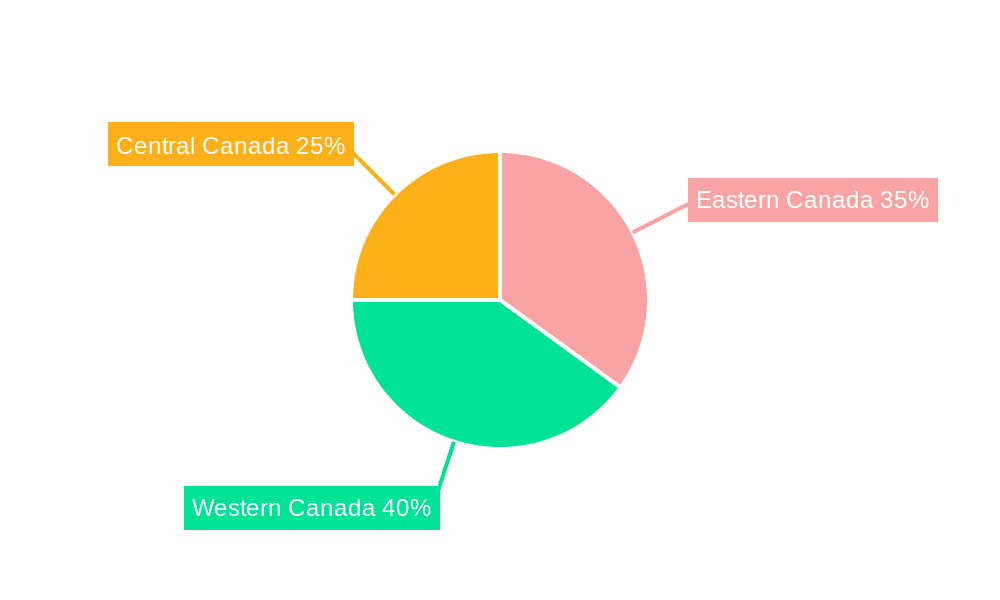

Dominant Regions & Segments in Canada Foodservice Packaging Market

While precise regional dominance data requires detailed proprietary research and is not available here, the market is expected to be relatively evenly distributed across Canada's major provinces, aligning with population density and foodservice activity. However, urban centers likely experience higher demand due to concentrated restaurant and institutional foodservice operations.

By Material Type:

- Rigid: Dominated by plastics (e.g., polypropylene, polystyrene), driven by its durability and cost-effectiveness. However, the market is rapidly transitioning towards more sustainable rigid alternatives.

- Other Rigid Material Types (Stirrer/Straws, Cutlery, etc.): Experiencing growth driven by the increasing demand for convenience and single-use items.

- Flexible: Growing popularity for packaging of various food items, especially for convenience and sealing purposes.

By Application:

- Fruits and Vegetables: High demand for packaging that protects produce during transportation and storage.

- Baked Goods: Focus on packaging that maintains freshness, while offering strong visual appeal.

- Dairy Products: Demand for leak-proof and hygienic packaging, often incorporating temperature control features.

- Meat and Poultry: Emphasis on packaging that maintains food safety, preventing contamination and spoilage.

- Specialty Processed Foods: Packaging tailored to specific product requirements and brand image.

- Other Applications: Variety of packaging types to meet diverse demands of other food items.

By End-user Industry:

- Restaurants: The largest segment, driven by the wide variety of restaurants and establishments across Canada.

- Institutional and Hospitality: Significant demand from hotels, hospitals, and other institutions.

Key drivers across segments include increased food consumption, rising disposable income levels, and expanding foodservice sectors. Economic policies influencing food pricing and consumer behavior also play a significant role. Infrastructure development supporting efficient transportation and distribution networks facilitates market expansion.

Canada Foodservice Packaging Market Product Innovations

Recent innovations include advancements in biodegradable and compostable materials, like PLA and sugarcane-based products, as well as improved barrier properties in flexible packaging to extend shelf life. This focus on sustainability is driven by both consumer preference and government initiatives to reduce waste. New technologies include improved sealing methods, intelligent packaging that monitors freshness, and active packaging that enhances food safety. The market fit of these innovations is largely determined by cost-effectiveness and regulatory compliance.

Report Scope & Segmentation Analysis

This report comprehensively segments the Canada Foodservice Packaging Market by material type (rigid, other rigid materials, flexible), application (fruits and vegetables, baked goods, dairy products, meat and poultry, specialty processed foods, other applications), and end-user industry (restaurants, institutional and hospitality). Each segment’s growth projections, market size, and competitive dynamics are analyzed. The report further examines the competitive dynamics between leading companies, considering the factors mentioned in this description.

Key Drivers of Canada Foodservice Packaging Market Growth

Key growth drivers include the rising popularity of takeaway and delivery services, increasing consumer demand for convenient food options, and government regulations promoting sustainable packaging solutions. Economic growth and rising disposable incomes further fuel the market, as does the ongoing expansion of the restaurant and foodservice sector. The government's investment in sustainable packaging initiatives, as seen in the CPMA investment, is a strong catalyst.

Challenges in the Canada Foodservice Packaging Market Sector

The sector faces challenges such as fluctuating raw material costs and potential supply chain disruptions. Stringent regulations on packaging materials and waste disposal pose significant hurdles. Intense competition and pressure to adopt sustainable and innovative packaging increase operational costs. This can affect the competitiveness of smaller packaging manufacturers compared to large, established players.

Emerging Opportunities in Canada Foodservice Packaging Market

Emerging opportunities lie in the growth of sustainable and eco-friendly packaging options, such as compostable materials and reusable packaging solutions. Increased demand for customized and value-added packaging, as well as advancements in food preservation and smart packaging technology, create lucrative avenues for growth. The expansion into new food service sectors (like ready-made meal kits) presents additional opportunities.

Leading Players in the Canada Foodservice Packaging Market Market

- Amhil North America

- Ronpak Inc

- Genpak Corporation

- Novolex

- Plastic Ingenuity Inc

- Pactiv Evergreen Inc

- Berry Global Inc

- Tellus Product

- Huhtamaki Americas Inc

- Dart Container Corporation

Key Developments in Canada Foodservice Packaging Market Industry

- April 2022: The Canadian government invested CAD 376,200 (USD 299,869) in the CPMA to promote sustainable food and produce packaging, significantly impacting the market's shift towards sustainability.

- April 2022: Swiss Chalet's commitment to 100% recyclable, renewable, and recycled packaging demonstrates a significant industry shift towards sustainability and influences consumer perception and competitive dynamics.

Future Outlook for Canada Foodservice Packaging Market Market

The Canada Foodservice Packaging Market is poised for continued growth, driven by sustained demand for convenient food options, a focus on sustainability, and technological advancements. Strategic opportunities exist for companies that can offer innovative, eco-friendly, and cost-effective solutions while adhering to stringent regulations. The market's future depends on successfully balancing sustainability concerns with economic viability.

Canada Foodservice Packaging Market Segmentation

-

1. Material Type

-

1.1. Rigid

- 1.1.1. Corrugated Boxes

- 1.1.2. Paperbaord Boxes

- 1.1.3. Plastic Containers

- 1.1.4. Metal Cans

- 1.1.5. Other Ri

-

1.2. Flexible

- 1.2.1. Pouches

- 1.2.2. Paper, Film, and Foil

- 1.2.3. Bags and Sacks

- 1.2.4. Trays, Plates, and Food Bowls

- 1.2.5. Other Flexible Material Types

-

1.1. Rigid

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Baked Goods

- 2.3. Dairy Products

- 2.4. Meat and Poultry

- 2.5. Specialty Processed Foods

- 2.6. Other Applications

-

3. End-user Industry

-

3.1. Restaurants

- 3.1.1. Quick-service

- 3.1.2. Full-service

- 3.1.3. Other Restaurants

- 3.2. Institutional and Hospitality

-

3.1. Restaurants

Canada Foodservice Packaging Market Segmentation By Geography

- 1. Canada

Canada Foodservice Packaging Market Regional Market Share

Geographic Coverage of Canada Foodservice Packaging Market

Canada Foodservice Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenience Food Remains High in Canada; Growing Demand for Sustainable Packaging Solution

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Demand for Convenience Food Remains High in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Foodservice Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Rigid

- 5.1.1.1. Corrugated Boxes

- 5.1.1.2. Paperbaord Boxes

- 5.1.1.3. Plastic Containers

- 5.1.1.4. Metal Cans

- 5.1.1.5. Other Ri

- 5.1.2. Flexible

- 5.1.2.1. Pouches

- 5.1.2.2. Paper, Film, and Foil

- 5.1.2.3. Bags and Sacks

- 5.1.2.4. Trays, Plates, and Food Bowls

- 5.1.2.5. Other Flexible Material Types

- 5.1.1. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Baked Goods

- 5.2.3. Dairy Products

- 5.2.4. Meat and Poultry

- 5.2.5. Specialty Processed Foods

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Restaurants

- 5.3.1.1. Quick-service

- 5.3.1.2. Full-service

- 5.3.1.3. Other Restaurants

- 5.3.2. Institutional and Hospitality

- 5.3.1. Restaurants

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amhil North America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ronpak Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genpak Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novolex

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plastic Ingenuity Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pactiv Evergreen Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tellus Product

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huhtamaki Americas Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dart Container Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amhil North America

List of Figures

- Figure 1: Canada Foodservice Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Foodservice Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Foodservice Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Canada Foodservice Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Canada Foodservice Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Canada Foodservice Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Foodservice Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Canada Foodservice Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Canada Foodservice Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Canada Foodservice Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Foodservice Packaging Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Canada Foodservice Packaging Market?

Key companies in the market include Amhil North America, Ronpak Inc, Genpak Corporation, Novolex, Plastic Ingenuity Inc, Pactiv Evergreen Inc, Berry Global Inc, Tellus Product, Huhtamaki Americas Inc, Dart Container Corporation.

3. What are the main segments of the Canada Foodservice Packaging Market?

The market segments include Material Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenience Food Remains High in Canada; Growing Demand for Sustainable Packaging Solution.

6. What are the notable trends driving market growth?

Demand for Convenience Food Remains High in Canada.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

April 2022: The Canadian government announced an investment to help Canada's fresh produce industry transition to sustainable food and produce packaging. The government aimed to reduce packaging waste and increase food and produce packaging sustainability. Agriculture and Agri-Food Minister Marie-Claude Bibeau said the government would invest up to CAD 376,200 (USD 299,869) in the Canadian Produce Marketing Association (CPMA). They were developing a new packaging circular economy, leveraging composting systems across Canada, and enhancing industry alignment with leading sustainable packaging in food and produce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Foodservice Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Foodservice Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Foodservice Packaging Market?

To stay informed about further developments, trends, and reports in the Canada Foodservice Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence