Key Insights

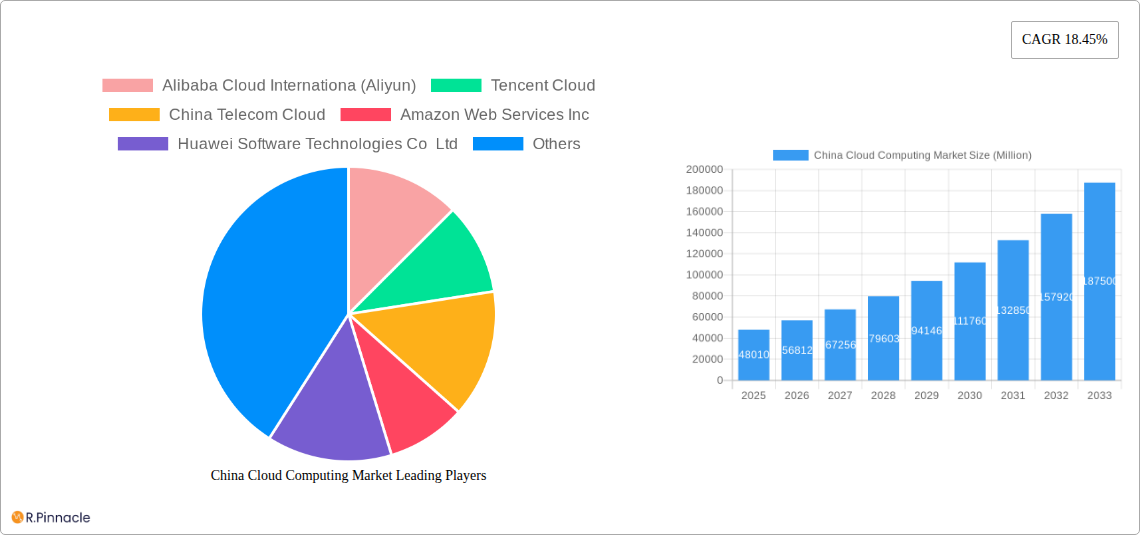

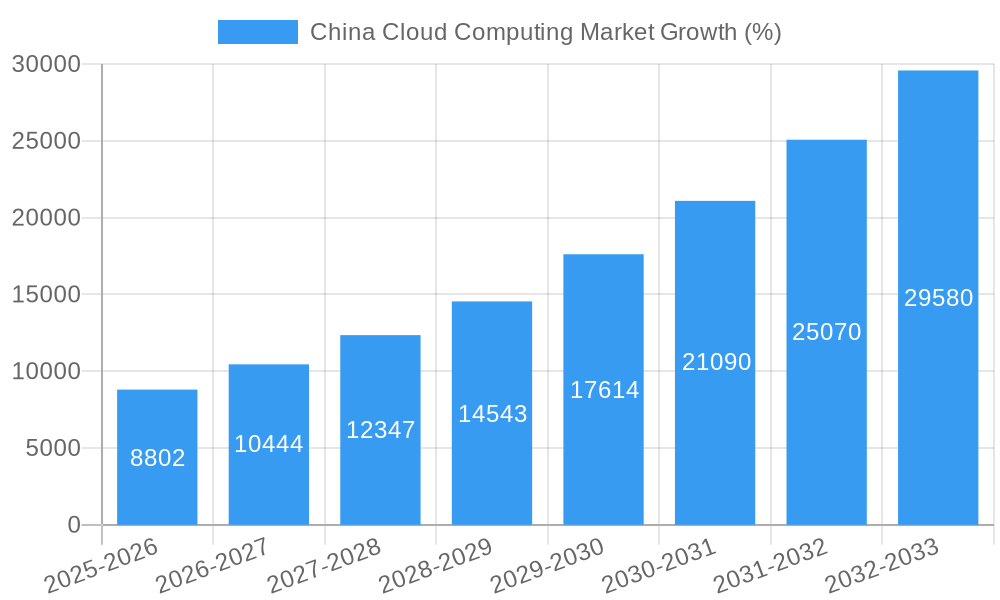

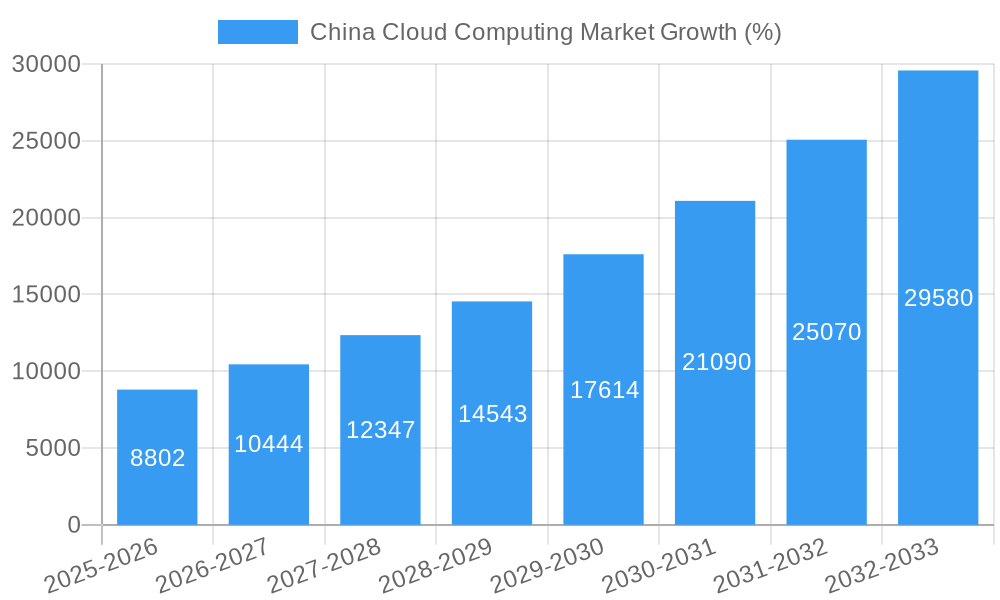

The China cloud computing market exhibits robust growth, projected to reach $48.01 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 18.45% from 2025 to 2033. This significant expansion is fueled by several key drivers. Firstly, the increasing adoption of digital technologies across various sectors, including e-commerce, finance, and government, is creating a surge in demand for cloud-based services. Secondly, the supportive government policies aimed at promoting digital transformation and fostering innovation in the technology sector are accelerating market growth. Furthermore, the rise of big data analytics, artificial intelligence, and the Internet of Things (IoT) is driving the adoption of cloud infrastructure for data storage, processing, and analysis. However, challenges remain, including concerns regarding data security and privacy, infrastructure limitations in certain regions, and the need for skilled professionals to manage and operate cloud systems. Competition within the market is intense, with both domestic and international players vying for market share. Key players like Alibaba Cloud, Tencent Cloud, and Amazon Web Services are engaged in fierce competition, constantly innovating to provide advanced solutions and enhance their service offerings. The market segmentation likely includes Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), with IaaS currently dominating. This market is expected to continue its rapid expansion over the forecast period, driven by ongoing technological advancements and increasing digital adoption across China's diverse industries.

The future of the China cloud computing market is bright, yet nuanced. Continued investment in 5G infrastructure and ongoing government support for technological advancement will significantly influence market growth. However, careful attention to cybersecurity and data privacy regulations will be crucial for sustained expansion. The competitive landscape will remain dynamic, with existing market leaders likely strengthening their positions while smaller players seek to carve out niche market segments. Strategic partnerships and mergers and acquisitions are expected to shape the competitive environment. The increasing demand for hybrid cloud models, combining public and private cloud solutions, is likely to present new growth opportunities. Furthermore, the increasing adoption of cloud-native technologies and edge computing is anticipated to further fuel market expansion in the coming years. This dynamic interplay of factors will continue to shape the trajectory of the China cloud computing market, positioning it for significant growth in the next decade.

China Cloud Computing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China cloud computing market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report leverages rigorous data analysis and expert insights to project market growth and identify key trends. The forecast period covers 2025-2033, while the historical period examined is 2019-2024. Expect detailed analysis of market dynamics, leading players like Alibaba Cloud, Tencent Cloud, and AWS, and emerging opportunities.

China Cloud Computing Market Structure & Innovation Trends

The China cloud computing market is characterized by a dynamic interplay of established giants and emerging players. Market concentration is high, with Alibaba Cloud, Tencent Cloud, and Huawei dominating market share. However, increasing competition from international players like Amazon Web Services (AWS) is reshaping the competitive landscape. Precise market share figures for 2024 are unavailable, but estimates suggest Alibaba Cloud holds a significant lead, followed by Tencent Cloud and others. Innovation is driven by the government's "Digital China" initiative, increasing demand for AI and big data solutions, and a growing need for cloud-based services across various sectors. Regulatory frameworks, while evolving, are generally supportive of cloud adoption, although data privacy and security regulations pose significant challenges. Product substitutes, such as on-premise data centers, are gradually losing market share due to the cost-effectiveness and scalability of cloud solutions. The end-user demographics are diversifying, encompassing large enterprises, SMEs, and government agencies. M&A activity has been robust in recent years, with deal values reaching xx Million in 2024, primarily focused on expanding capabilities and market reach.

- Market Concentration: High, with Alibaba Cloud, Tencent Cloud, and Huawei dominating.

- Innovation Drivers: Government initiatives, AI/big data demand, rising cloud adoption.

- Regulatory Frameworks: Supportive, but with challenges around data privacy and security.

- M&A Activity: Significant, with deal values reaching xx Million in 2024.

China Cloud Computing Market Dynamics & Trends

The China cloud computing market exhibits robust growth, driven by increasing digitalization across industries, the expanding adoption of AI and IoT, and favorable government policies. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, exceeding the global average. Technological disruptions, particularly in areas like serverless computing and edge computing, are continuously reshaping the market. Consumer preferences are shifting towards cloud-based solutions offering greater flexibility, scalability, and cost-effectiveness. Competitive dynamics are intensifying, with players focusing on innovation, price competitiveness, and strategic partnerships to secure market share. Market penetration is still relatively low compared to mature markets, indicating significant growth potential.

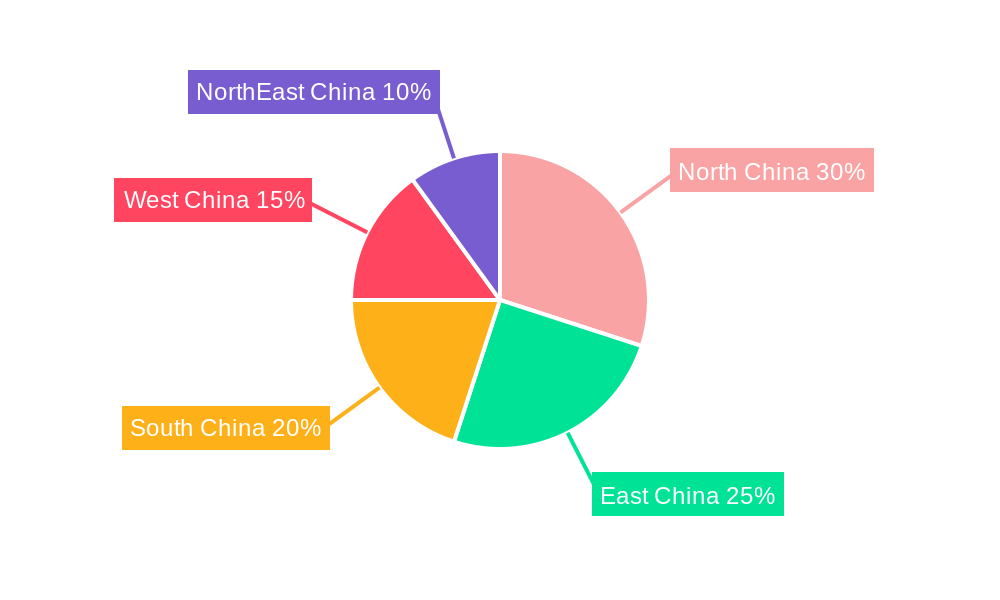

Dominant Regions & Segments in China Cloud Computing Market

The eastern coastal regions of China, including Beijing, Shanghai, and Guangdong, dominate the cloud computing market, benefiting from robust infrastructure, skilled workforce, and a high concentration of tech companies. Key drivers for this dominance include:

- Advanced Infrastructure: Extensive fiber optic networks and data centers.

- Government Support: Favorable policies and incentives for cloud adoption.

- Talent Pool: High concentration of skilled IT professionals.

Other regions are experiencing rapid growth, but the coastal areas maintain a significant lead due to their established ecosystem. Within segments, the public cloud segment currently holds the largest share, driven by its cost-effectiveness and scalability. The private cloud segment is also experiencing steady growth, particularly among enterprises with stringent data security requirements. The hybrid cloud segment is emerging as a key growth area, driven by the need for greater flexibility and integration. The market size for the public cloud segment in 2025 is estimated at xx Million, with significant growth expected in the forecast period.

China Cloud Computing Market Product Innovations

The market is witnessing rapid product innovation, with vendors focusing on AI-powered solutions, serverless computing, edge computing, and enhanced security features. These advancements cater to the growing demand for intelligent and secure cloud services. The competitive advantage lies in providing innovative, cost-effective, and secure solutions that meet the unique needs of different industries.

Report Scope & Segmentation Analysis

This report segments the China cloud computing market by deployment model (public, private, hybrid), service model (IaaS, PaaS, SaaS), industry vertical (BFSI, IT & Telecom, Government, Healthcare, Retail, Manufacturing), and region. Growth projections vary across segments, with the public cloud and IaaS segments expected to experience the highest growth rates. Market sizes for each segment are detailed within the full report. Competitive dynamics differ across segments, reflecting the diverse needs and preferences of various users.

Key Drivers of China Cloud Computing Market Growth

Several key factors fuel the growth of China's cloud computing market:

- Government Initiatives: The "Digital China" initiative promotes digital transformation and cloud adoption across all sectors.

- Technological Advancements: Innovations in AI, big data, and IoT are driving demand for cloud-based solutions.

- Cost Optimization: Cloud computing offers cost-effective solutions for businesses of all sizes.

- Increased Data Security: Improved data security measures enhance cloud adoption.

Challenges in the China Cloud Computing Market Sector

The market faces challenges including:

- Data Security and Privacy Concerns: Stringent regulations on data localization and protection.

- Cybersecurity Threats: Increased risk of cyberattacks and data breaches.

- Competition: Intense competition among both domestic and international players.

- Infrastructure Limitations: Uneven distribution of cloud infrastructure across regions.

Emerging Opportunities in China Cloud Computing Market

- Expansion into Underserved Regions: Significant potential for growth in less developed regions.

- Growth of Edge Computing: Increasing demand for low-latency and high-bandwidth applications.

- AI and ML Integration: Integrating AI and ML capabilities in cloud services.

Leading Players in the China Cloud Computing Market Market

- Alibaba Cloud International (Aliyun)

- Tencent Cloud

- China Telecom Cloud

- Amazon Web Services Inc

- Huawei Software Technologies Co Ltd

- Kingsoft Cloud Holdings Ltd

- Baidu Cloud (Baidu Inc)

- Inspur Cloud (Inspur Group Co Ltd)

- China Unicom Cloud (China Unicom Global Limited)

- China Mobile Cloud (China Mobile International Limited)

Key Developments in China Cloud Computing Market Industry

- February 2024: Alibaba Cloud announced a historic price cut, reducing prices by up to 55% on over 100 core cloud products. This move aims to democratize public cloud services and accelerate adoption.

- February 2024: Tencent launched a new microgrid at its High-Tech Cloud Data Center in Tianjin, boosting energy efficiency and sustainability.

Future Outlook for China Cloud Computing Market Market

The China cloud computing market is poised for continued robust growth, driven by increasing digitalization, technological advancements, and government support. Strategic opportunities abound for players focusing on innovation, strategic partnerships, and expansion into underserved markets. The market is expected to reach xx Million by 2033, presenting significant potential for investors and industry participants.

China Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industries

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. Telecom and IT

- 3.8. Government and Public Sector

- 3.9. Others (Utilities, Media & Entertainment etc)

China Cloud Computing Market Segmentation By Geography

- 1. China

China Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.3. Market Restrains

- 3.3.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.4. Market Trends

- 3.4.1. Major Advancements in Digital Change Nationwide

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Cloud Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. Telecom and IT

- 5.3.8. Government and Public Sector

- 5.3.9. Others (Utilities, Media & Entertainment etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Alibaba Cloud Internationa (Aliyun)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tencent Cloud

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Telecom Cloud

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Web Services Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huawei Software Technologies Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kingsoft Cloud Holdings Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Baidu Cloud (Baidu Inc )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inspur Cloud (Inspur Group Co Ltd )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Unicom Cloud (China Unicom Global Limited)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Mobile Cloud (China Mobile International Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alibaba Cloud Internationa (Aliyun)

List of Figures

- Figure 1: China Cloud Computing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Cloud Computing Market Share (%) by Company 2024

List of Tables

- Table 1: China Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: China Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: China Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 7: China Cloud Computing Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 8: China Cloud Computing Market Volume Billion Forecast, by End-user Industries 2019 & 2032

- Table 9: China Cloud Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Cloud Computing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: China Cloud Computing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: China Cloud Computing Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: China Cloud Computing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 14: China Cloud Computing Market Volume Billion Forecast, by Organization Size 2019 & 2032

- Table 15: China Cloud Computing Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 16: China Cloud Computing Market Volume Billion Forecast, by End-user Industries 2019 & 2032

- Table 17: China Cloud Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Cloud Computing Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Cloud Computing Market?

The projected CAGR is approximately 18.45%.

2. Which companies are prominent players in the China Cloud Computing Market?

Key companies in the market include Alibaba Cloud Internationa (Aliyun), Tencent Cloud, China Telecom Cloud, Amazon Web Services Inc, Huawei Software Technologies Co Ltd, Kingsoft Cloud Holdings Ltd, Baidu Cloud (Baidu Inc ), Inspur Cloud (Inspur Group Co Ltd ), China Unicom Cloud (China Unicom Global Limited), China Mobile Cloud (China Mobile International Limited.

3. What are the main segments of the China Cloud Computing Market?

The market segments include Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

6. What are the notable trends driving market growth?

Major Advancements in Digital Change Nationwide.

7. Are there any restraints impacting market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

8. Can you provide examples of recent developments in the market?

February 2024: Alibaba Cloud announced a historic price cut, reducing prices by up to 55% on over 100 core cloud products. The company stated that this initiative seeks to democratize public cloud services in the age of artificial intelligence and accelerate the widespread adoption of cloud computing across various sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Cloud Computing Market?

To stay informed about further developments, trends, and reports in the China Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence