Key Insights

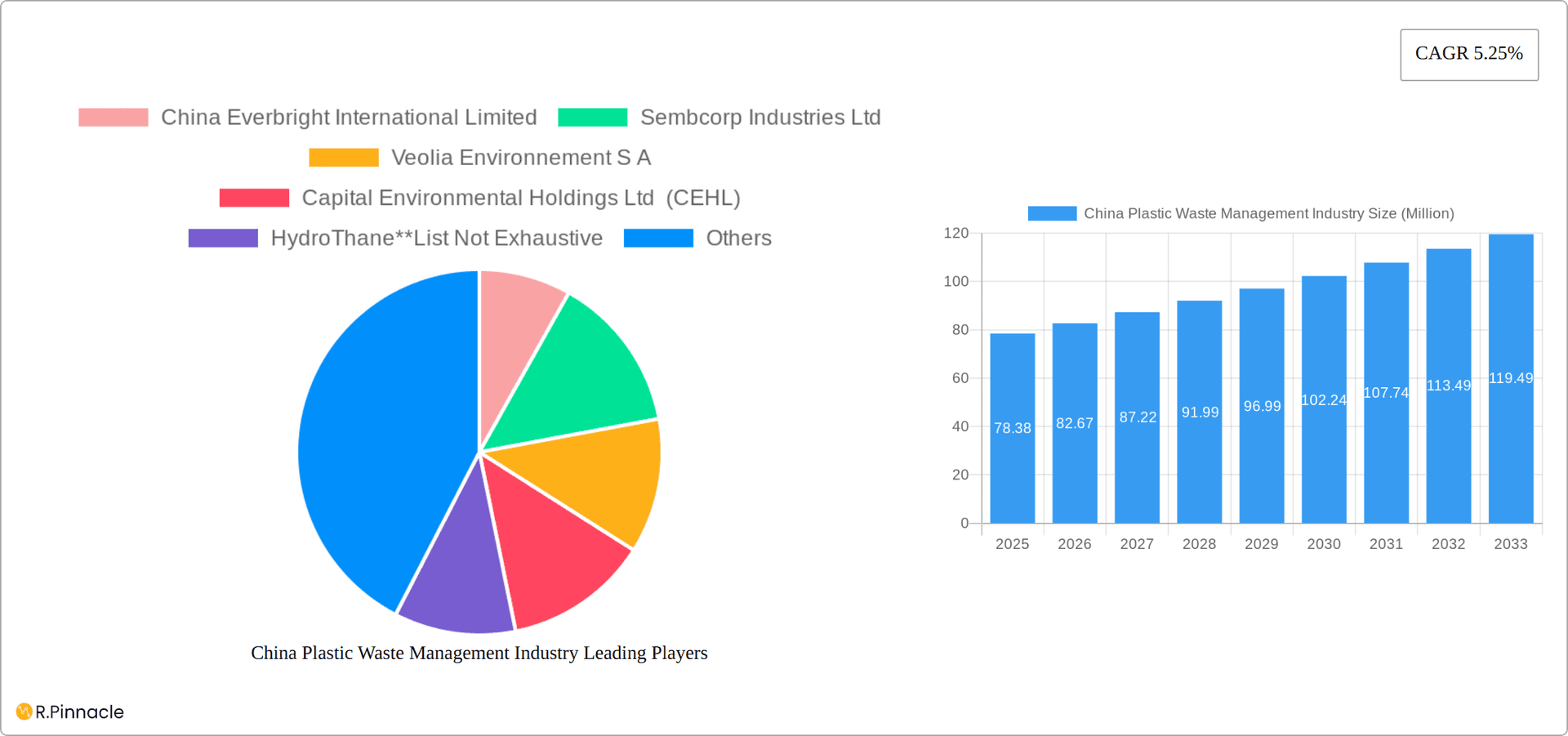

The China plastic waste management industry is experiencing robust growth, projected to reach a market size of $78.38 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This growth is fueled by increasing environmental awareness, stringent government regulations aimed at reducing plastic pollution, and a rising demand for sustainable waste management solutions. The industry is witnessing a shift towards advanced recycling technologies, including chemical recycling and pyrolysis, offering more efficient and environmentally friendly methods for plastic waste processing. Key drivers include the implementation of the "National Sword" policy, which significantly restricted the import of foreign waste, forcing China to develop its domestic recycling infrastructure. Furthermore, the growing adoption of Extended Producer Responsibility (EPR) schemes is pushing manufacturers to take greater responsibility for the end-of-life management of their plastic products, driving investment in collection and recycling systems. However, challenges remain, including the lack of standardized recycling infrastructure across the country and the complexities of dealing with mixed plastic waste streams. The industry landscape is comprised of a mix of both domestic and international players, including China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S.A., Capital Environmental Holdings Ltd (CEHL), and HydroThane, among others, competing in a market with significant growth potential.

China Plastic Waste Management Industry Market Size (In Million)

The competitive landscape is dynamic, with companies focusing on strategic partnerships, technological advancements, and geographical expansion to gain market share. Future growth will depend on overcoming infrastructure limitations, fostering innovation in recycling technologies, and enhancing public awareness about responsible plastic waste disposal. The increasing adoption of circular economy principles, coupled with governmental support for sustainable waste management initiatives, presents significant opportunities for growth and investment in this sector. Specifically, investment in sorting facilities, advanced recycling technologies, and waste-to-energy projects will be crucial for future success. The industry is also expected to see consolidation as larger players acquire smaller companies to expand their reach and capabilities.

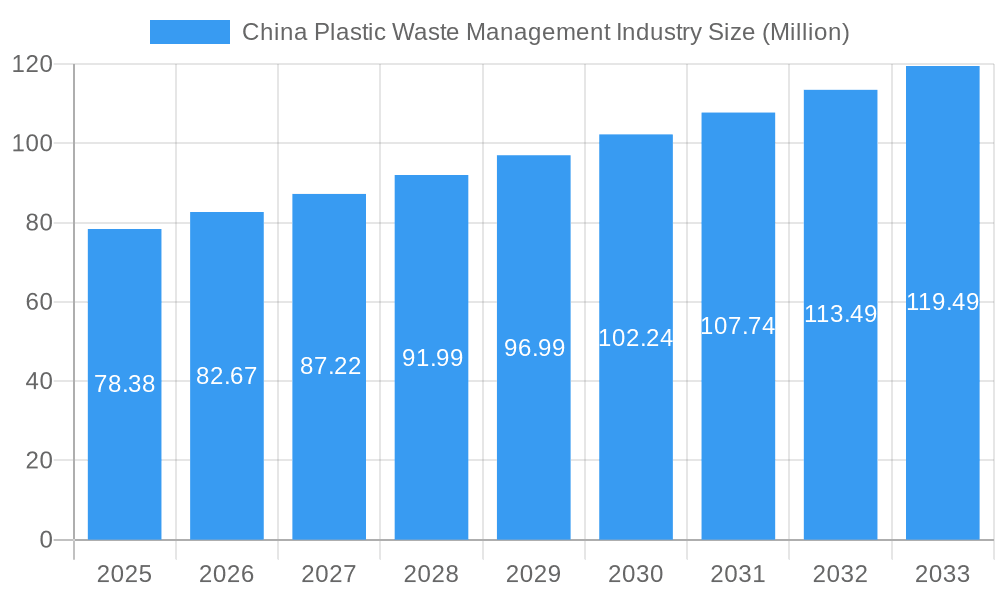

China Plastic Waste Management Industry Company Market Share

China Plastic Waste Management Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China plastic waste management industry, offering invaluable insights for industry professionals, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report delivers actionable intelligence for strategic decision-making. The historical period covered is 2019-2024. The market is segmented by [Insert Segmentation details here, e.g., technology, waste type, region]. Key players analyzed include China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), and HydroThane, though the list is not exhaustive. The report projects a market size of xx Million by 2033.

China Plastic Waste Management Industry Market Structure & Innovation Trends

The Chinese plastic waste management industry is a dynamic and evolving landscape, characterized by a growing number of stakeholders and an increasing focus on sustainable solutions. This section analyzes the competitive landscape, examining market concentration, key innovation drivers, and the overarching regulatory frameworks that are meticulously shaping the industry's trajectory. We delve into the intricacies of product substitutes, the diverse end-user demographics, and the significant mergers and acquisitions (M&A) activities, providing critical insights into market share dynamics and the value of strategic deals. Our comprehensive analysis reveals a moderately concentrated market, with approximately [Number, e.g., 5-7] major players commanding an estimated xx% of the market share in 2025. Innovation is significantly driven by a confluence of factors, including stricter environmental regulations, groundbreaking technological advancements in recycling technologies, and robust government incentives promoting circular economy principles.

- Market Share Distribution (2025): Insert estimated market share data for major players. This includes a breakdown for key players such as [Player A], [Player B], [Player C], and others.

- M&A Activity (2019-2024): Summarize key M&A activities, including strategic acquisitions, joint ventures, and significant deal values where available. For instance, [Year] saw a notable acquisition in the chemical recycling sector, valued at approximately [Deal Value]. If specific data is not available for certain periods or deals, it will be clearly stated as "Data unavailable".

- Regulatory Framework: Describe the key regulations and their profound impact on the market. This includes the "Law on the Prevention and Control of Environmental Pollution by Solid Waste," extended producer responsibility schemes, and national targets for plastic reduction and recycling.

- Product Substitutes: Discuss alternative materials such as biodegradable plastics, bioplastics, and paper-based packaging, as well as innovative technologies like advanced sorting systems and waste-to-energy solutions that are impacting the market's growth and composition.

China Plastic Waste Management Industry Market Dynamics & Trends

This section explores the market's growth trajectory, dissecting key drivers, technological disruptions, consumer preferences, and competitive dynamics. The Chinese plastic waste management market exhibits significant growth potential, driven by [List Key Drivers, e.g., increasing environmental awareness, stringent government policies on waste management, growing urbanization]. Technological advancements in [List Technological Advancements, e.g., chemical recycling, advanced sorting technologies, AI-powered waste management systems] are further accelerating market expansion. We project a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The competitive landscape is characterized by [Describe competitive intensity - e.g., intense competition among both domestic and international players].

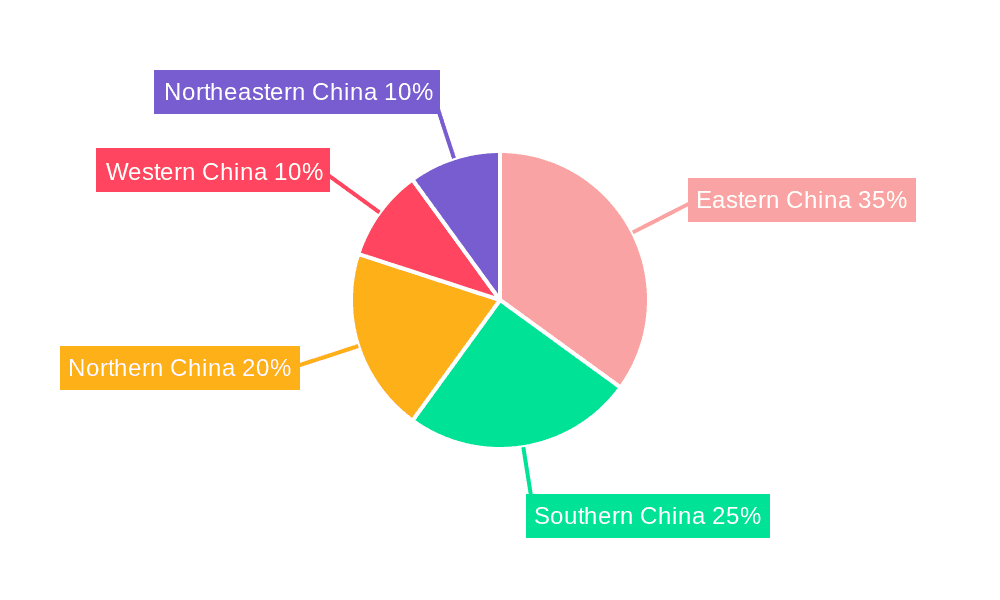

Dominant Regions & Segments in China Plastic Waste Management Industry

This section meticulously identifies the leading geographical regions and the most impactful segments within the expansive Chinese plastic waste management market. Currently, Coastal Regions, particularly the eastern provinces such as Guangdong, Jiangsu, and Shandong, dominate the market. This dominance is primarily attributable to a higher concentration of plastic waste generation due to extensive manufacturing and industrial activities, coupled with better-established and more advanced infrastructure for waste collection, sorting, and processing.

- Key Drivers for Dominance in Coastal Regions:

- Well-established waste collection and processing infrastructure: Significant investments in modern sorting facilities, recycling plants, and logistical networks.

- Stringent environmental regulations and government initiatives: Proactive implementation of national and regional policies aimed at improving waste management and promoting a circular economy.

- Higher concentration of manufacturing and industrial activities: These sectors are major generators of plastic waste, creating a substantial feedstock for management operations.

- Proximity to major consumption centers: Higher population density leads to increased household plastic waste.

- Dominant Segment: The Plastic Recycling segment currently holds the largest market share. This dominance is driven by substantial government support for recycling initiatives, including subsidies and policy mandates, and the growing demand for recycled plastics from various industries, such as packaging, textiles, and automotive. A detailed analysis of other significant segments, including [Waste-to-Energy, Landfilling, Collection & Logistics], is also provided, highlighting their respective market sizes and growth prospects.

China Plastic Waste Management Industry Product Innovations

The industry witnesses continuous innovation in plastic waste management technologies. Recent developments include [List product innovations, e.g., advanced sorting technologies, enzymatic depolymerization, chemical recycling processes]. These innovations offer improved efficiency, reduced environmental impact, and enhanced cost-effectiveness, leading to increased market adoption. The focus is shifting towards sustainable solutions that address the challenges of plastic pollution while creating economic opportunities.

Report Scope & Segmentation Analysis

This comprehensive report segments the Chinese plastic waste management market into several key categories to provide an in-depth understanding of its diverse landscape. The primary segmentations include: Waste Type (e.g., PET, HDPE, PVC, LDPE, PP, PS, and Others), Technology (e.g., Mechanical Recycling, Chemical Recycling, Waste-to-Energy), and Region (e.g., East China, North China, South China, Central China, West China). Each segment's growth projections, estimated market size for key years (including 2025 and projected to 2033), and competitive dynamics are analyzed in meticulous detail. For instance, the PET segment is projected to grow at a CAGR of X% from 2024 to 2033, reaching an estimated market size of $Y billion in 2033. Chemical recycling technologies, while nascent, are expected to witness the fastest growth due to advancements in depolymerization and feedstock recovery.

Key Drivers of China Plastic Waste Management Industry Growth

The robust growth of the Chinese plastic waste management industry is propelled by a multi-faceted array of powerful drivers. Foremost among these are the stringent government regulations, such as the National Sword policy and ambitious targets for plastic pollution reduction and circularity, which are creating an undeniable and increasing demand for efficient and advanced waste management solutions. Concurrently, a palpable surge in environmental awareness among consumers and businesses is further catalyzing the adoption of sustainable practices. Furthermore, significant technological advancements in recycling and waste processing, including AI-powered sorting and innovative chemical recycling methods, are not only improving efficiency but also unlocking new value streams from plastic waste. The growing availability of funding for green initiatives and sustainable projects from both governmental and private sectors is also a pivotal factor driving market expansion and investment in crucial infrastructure and research.

Challenges in the China Plastic Waste Management Industry Sector

Despite significant growth potential, the industry faces challenges. These include the lack of standardized waste collection and sorting infrastructure in certain regions, the high cost of advanced recycling technologies, and the complexity of managing diverse types of plastic waste. Supply chain issues, including the lack of sufficient recycling facilities and the inconsistent quality of recycled materials, also pose significant hurdles.

Emerging Opportunities in China Plastic Waste Management Industry

The market presents several opportunities for growth. The increasing adoption of circular economy principles, coupled with the rising demand for recycled plastics in various industries, creates lucrative opportunities for companies offering innovative solutions. The development of new technologies, such as chemical recycling and advanced sorting systems, is expected to further drive market expansion. Investing in research and development and fostering international collaboration will be crucial to seize these emerging opportunities.

Leading Players in the China Plastic Waste Management Industry Market

- China Everbright International Limited

- Sembcorp Industries Ltd

- Veolia Environnement S A

- Capital Environmental Holdings Ltd (CEHL)

- HydroThane

Key Developments in China Plastic Waste Management Industry Industry

- [Month, Year]: [Development - e.g., Launch of a new chemical recycling plant by Company X].

- [Month, Year]: [Development - e.g., Government announcement of new regulations on plastic waste import].

- [Month, Year]: [Development - e.g., Merger between two waste management companies].

Future Outlook for China Plastic Waste Management Industry Market

The future outlook for the China plastic waste management market is exceptionally positive and poised for substantial expansion. Continued and strengthened government support for sustainable practices, including policy enhancements and financial incentives, will remain a cornerstone of this growth. Alongside this, ongoing technological advancements, particularly in areas like advanced recycling and waste-to-value processes, will unlock new efficiencies and business models. Heightened and sustained consumer and corporate awareness regarding environmental responsibility will further fuel demand for eco-friendly solutions. Significant opportunities exist in developing and scaling up innovative recycling technologies, expanding waste management infrastructure to meet evolving needs, and fostering the creation of a truly robust circular economy. The market is well on track for continued exponential growth, presenting promising and lucrative prospects for both established industry giants and agile new entrants looking to capitalize on the transformative shift towards a sustainable future for plastic waste management in China.

China Plastic Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public - Private Patnership

China Plastic Waste Management Industry Segmentation By Geography

- 1. China

China Plastic Waste Management Industry Regional Market Share

Geographic Coverage of China Plastic Waste Management Industry

China Plastic Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the China e-waste generation and its effective management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public - Private Patnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Everbright International Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environnement S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital Environmental Holdings Ltd (CEHL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HydroThane**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 China Everbright International Limited

List of Figures

- Figure 1: China Plastic Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Plastic Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 6: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 7: China Plastic Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Plastic Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 14: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 15: China Plastic Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Plastic Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Waste Management Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the China Plastic Waste Management Industry?

Key companies in the market include China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), HydroThane**List Not Exhaustive.

3. What are the main segments of the China Plastic Waste Management Industry?

The market segments include Waste type, Disposal methods, Type of ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.38 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the China e-waste generation and its effective management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Waste Management Industry?

To stay informed about further developments, trends, and reports in the China Plastic Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence