Key Insights

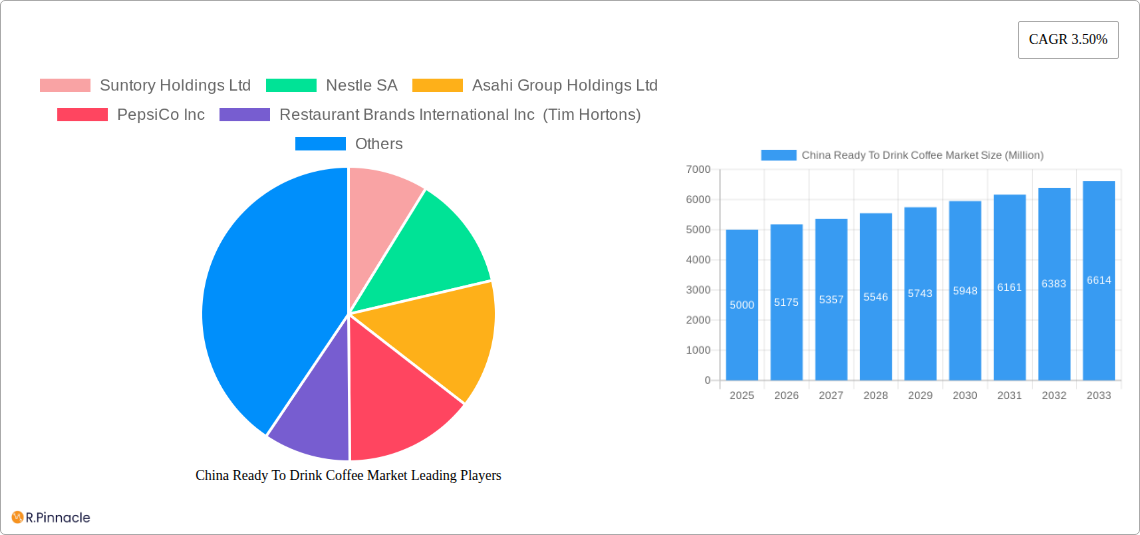

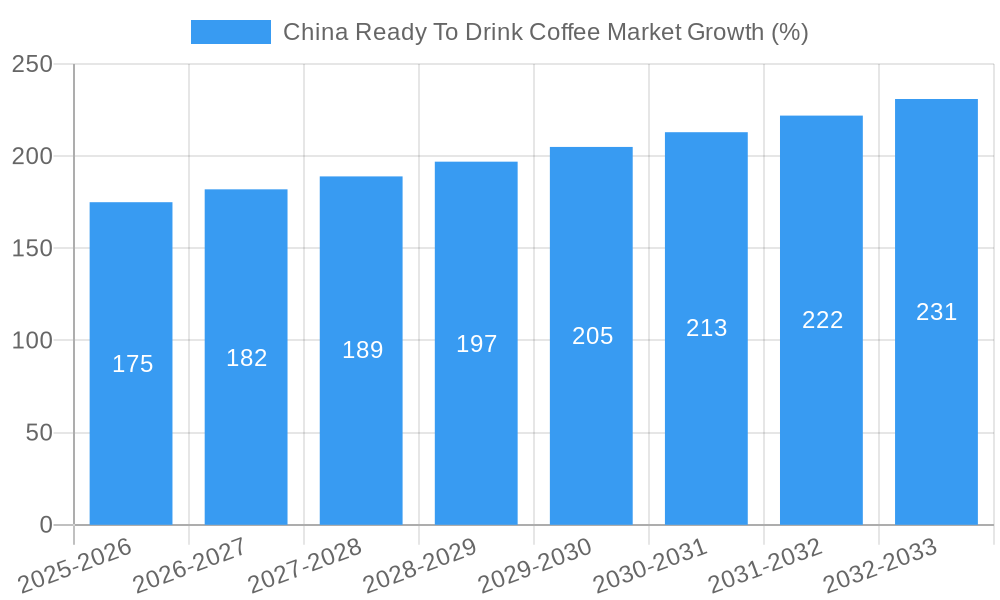

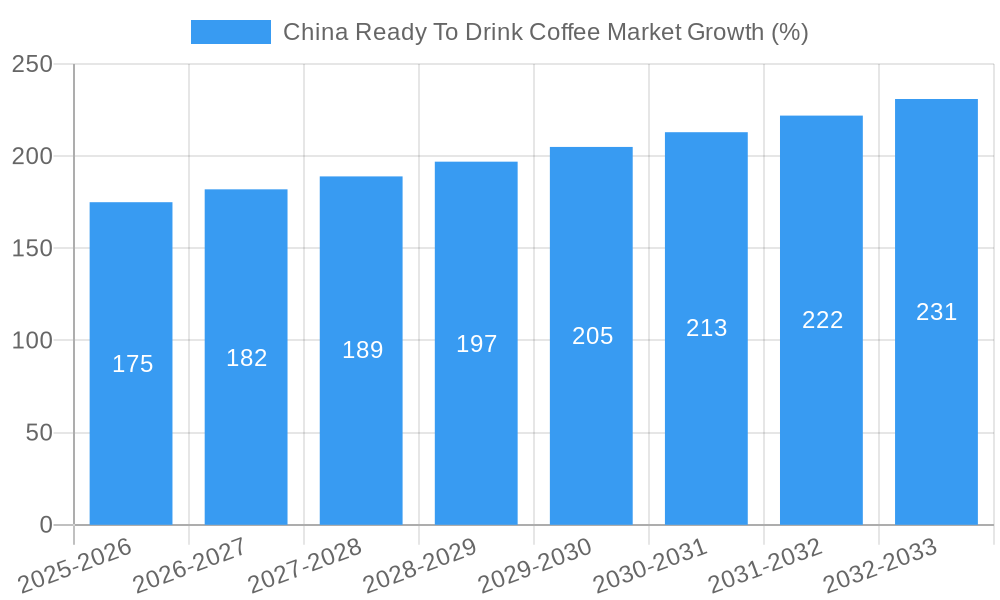

The China Ready-to-Drink (RTD) coffee market is experiencing robust growth, fueled by several key factors. Rising disposable incomes, particularly among young urban consumers, are driving increased spending on premium beverages. A burgeoning coffee culture, influenced by international trends and a desire for convenient caffeine fixes, is further fueling market expansion. The market is segmented by packaging (bottles, cans, other) and distribution channels (supermarkets, convenience stores, foodservice, online, others). Bottles are likely the dominant packaging type, given their suitability for RTD beverages, while convenience stores and supermarkets represent the most significant distribution channels, due to high consumer accessibility. The market's strong growth is further enhanced by innovative product offerings, including flavored RTD coffees, functional coffee drinks with added health benefits (e.g., vitamins, collagen), and collaborations with popular brands to appeal to specific consumer demographics. While precise market size figures for China aren't provided, based on a global RTD coffee market CAGR of 3.5%, and considering China's significant population and economic growth, a reasonable estimation of the 2025 market size for China's RTD coffee market would be in the range of several billion USD.

However, challenges exist. Competition is intense, with both domestic and international players vying for market share. Maintaining consistent product quality and meeting evolving consumer preferences are crucial for success. Price sensitivity, particularly in lower-tier cities, poses a challenge for premium-priced brands. Further, supply chain disruptions and fluctuating raw material costs can impact profitability. Despite these hurdles, the long-term outlook for the China RTD coffee market remains positive, projecting continued expansion driven by sustained economic growth, shifting consumer habits, and the ongoing evolution of product innovation. The market will likely witness further segmentation, with niche players catering to specific consumer tastes and preferences, driving both growth and complexity in the coming years.

China Ready To Drink Coffee Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China Ready To Drink (RTD) coffee market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. We delve into key players, significant developments, and emerging opportunities, equipping you with the data-driven intelligence needed to navigate this rapidly evolving market. The report projects a xx Million market size by 2033, offering a CAGR of xx% during the forecast period.

China Ready To Drink Coffee Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Chinese RTD coffee market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of both established global players and ambitious domestic brands.

Market Concentration: The market exhibits moderate concentration, with key players like Suntory Holdings Ltd, Nestle SA, Asahi Group Holdings Ltd, PepsiCo Inc, Restaurant Brands International Inc (Tim Hortons), Tsing Hsin International Group, The Coca-Cola Company, Uni-President Enterprises Corp, Starbucks Corporation, and Arla Foods amba holding significant market share. However, the presence of numerous smaller players and new entrants indicates a dynamic and competitive environment. Market share data for 2025 shows Nestle holding approximately xx% followed by Suntory at xx%, with Coca-Cola at xx%.

Innovation Drivers: Key drivers for innovation include the rising demand for convenient and premium coffee options, evolving consumer preferences, and the introduction of novel flavors and formats.

Regulatory Frameworks: The report analyses existing and anticipated regulations impacting the RTD coffee market in China, including food safety standards and labeling requirements.

Product Substitutes: The main substitutes for RTD coffee include instant coffee, brewed coffee from cafes, and tea-based beverages.

End-User Demographics: The primary consumers of RTD coffee in China are young adults (18-35 years old) belonging to the middle and upper-middle class, who value convenience and premium experiences.

M&A Activities: Significant M&A activity has been witnessed, with deal values totaling xx Million in the past five years, primarily driven by efforts to gain market share and expand product portfolios.

China Ready To Drink Coffee Market Market Dynamics & Trends

The Chinese RTD coffee market is experiencing substantial growth, fueled by several key factors. Rising disposable incomes, a burgeoning middle class with a growing preference for Westernized beverages, and increasing urbanization contribute significantly to market expansion. The market exhibits a strong positive correlation with consumer spending, which is projected to increase further in the forecast period, leading to even higher demand.

Technological advancements in beverage processing and packaging are also driving growth. The market is seeing an upsurge in innovative product offerings, such as functional coffee blends and plant-based alternatives, aligning with consumer trends and preferences. These factors contribute to the overall market expansion. The report projects a CAGR of xx% for the period 2025-2033, with market penetration reaching xx% by 2033.

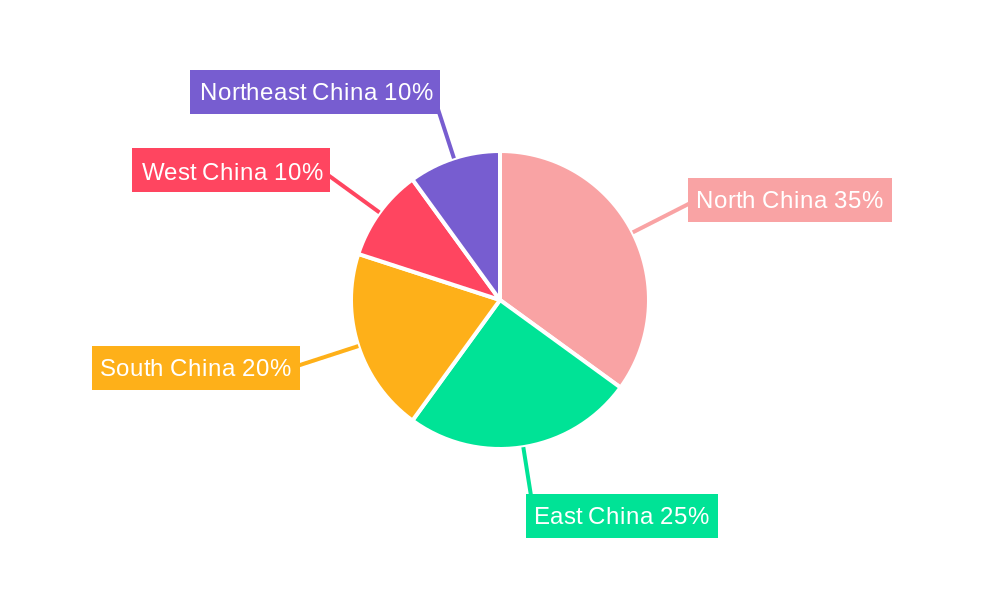

Dominant Regions & Segments in China Ready To Drink Coffee Market

The report identifies key regions and segments within the Chinese RTD coffee market demonstrating exceptional growth. The analysis considers both packaging types and distribution channels.

Packaging Type:

- Bottles: Bottles remain a dominant packaging type due to their association with premium offerings and ease of consumption. Growth is driven by the introduction of innovative bottle designs and sizes.

- Cans: Cans are preferred for their portability and longer shelf life. Growth in this segment is fueled by attractive pricing and convenience, although bottles retain higher market share.

- Other Packaging Types: This category includes pouches, cartons, and other packaging solutions that offer convenience, sustainability, or unique branding opportunities.

Distribution Channel:

- Convenience Stores: This channel enjoys strong growth due to its wide reach and accessibility. High foot traffic and strategic store locations increase sales.

- Supermarkets/Hypermarkets: Supermarkets and hypermarkets offer wider product selections and larger quantities which are attractive to consumers, thus contributing to this segment's growth.

- Foodservice Channels: This segment includes cafes, restaurants, and other foodservice establishments. Its growth is fueled by the rising popularity of coffee as a daily beverage.

- Online Retail Stores: The growth of e-commerce has opened new avenues for RTD coffee sales. The convenience and wide range of online platforms contribute significantly.

The eastern coastal regions of China, particularly major cities like Shanghai, Beijing, and Guangzhou, exhibit the strongest market growth due to higher disposable incomes, consumer awareness, and developed infrastructure.

China Ready To Drink Coffee Market Product Innovations

The RTD coffee market in China witnesses continuous product innovation, focusing on enhanced flavor profiles, functional ingredients (e.g., added vitamins or collagen), sustainable packaging, and premiumization. Technological advancements in extraction and processing technologies allow for better taste and shelf life. These innovations cater to specific consumer segments with distinct tastes and lifestyle preferences, contributing to increased market penetration and higher sales.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the China RTD coffee market, segmented by packaging type (bottles, cans, other packaging types) and distribution channel (supermarkets/hypermarkets, convenience stores, foodservice channels, online retail stores, other distribution channels). Each segment's growth projections, market size estimations for 2025, and competitive dynamics are detailed in the report. This granular level of analysis provides a clearer insight into the diverse aspects of the market and future potential.

Key Drivers of China Ready To Drink Coffee Market Growth

Several factors contribute to the growth of the China RTD coffee market. Rising disposable incomes are boosting purchasing power, while changing lifestyles and a preference for convenience are driving higher demand. The expanding middle class and urban population further fuel market expansion. Government initiatives promoting domestic consumption also play a significant role.

Challenges in the China Ready To Drink Coffee Market Sector

The China RTD coffee market also faces challenges. Intense competition from both domestic and international brands necessitates continuous innovation and strategic brand positioning. Maintaining consistent supply chain efficiency amid fluctuating raw material prices poses another challenge. Fluctuations in consumer preferences and changing economic conditions can impact sales as well. Regulatory compliance regarding labeling and health regulations is also crucial.

Emerging Opportunities in China Ready To Drink Coffee Market

The China RTD coffee market presents significant opportunities. The expanding reach of e-commerce platforms provides new avenues for sales growth. The potential for tapping into niche markets with specialized RTD coffee products, such as organic or functional coffees, is high. Moreover, the growing demand for premium and sustainable products opens doors for companies that offer both superior quality and environmental consciousness.

Leading Players in the China Ready To Drink Coffee Market Market

- Suntory Holdings Ltd

- Nestle SA

- Asahi Group Holdings Ltd

- PepsiCo Inc

- Restaurant Brands International Inc (Tim Hortons)

- Tsing Hsin International Group

- The Coca-Cola Company

- Uni-President Enterprises Corp

- Starbucks Corporation

- Arla Foods amba

- *List Not Exhaustive

Key Developments in China Ready To Drink Coffee Market Industry

- September 2022: Sinopec's Easy Joy and Tim Hortons launched co-branded RTD coffee products, expanding Tim Horton's presence in China’s convenience store market.

- September 2021: Yum China and Lavazza invested USD 200 Million in a joint venture to open 1,000 Lavazza cafes and distribute Lavazza RTD coffee in China.

- April 2021: Nestlé invested in a new RTD coffee product innovation center in China, focusing on Nescafé RTD coffee and related products, demonstrating a commitment to R&D and market expansion.

Future Outlook for China Ready To Drink Coffee Market Market

The China RTD coffee market is poised for continued growth. Increased consumer spending, the ongoing expansion of the middle class, and favorable demographic trends are expected to drive market demand. Innovation in product offerings and distribution channels will continue to shape the competitive landscape. Companies with a strong focus on brand building, product differentiation, and effective distribution networks will likely secure a prominent position within this dynamic market.

China Ready To Drink Coffee Market Segmentation

-

1. Packaging Type

- 1.1. Bottles

- 1.2. Can

- 1.3. Other Packaging Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Foodservice Channels

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

China Ready To Drink Coffee Market Segmentation By Geography

- 1. China

China Ready To Drink Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Growing Preference for Coffee Over Tea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Bottles

- 5.1.2. Can

- 5.1.3. Other Packaging Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Foodservice Channels

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Japan China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. China China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Australia China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 10. South Korea China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11. Thailand China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12. New Zeland China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 13. Others China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Suntory Holdings Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nestle SA

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Asahi Group Holdings Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Restaurant Brands International Inc (Tim Hortons)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Tsing Hsin International Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 The Coca-Cola Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Uni-President Enterprises Corp

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Starbucks Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Arla Foods amba*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Suntory Holdings Ltd

List of Figures

- Figure 1: China Ready To Drink Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Ready To Drink Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: China Ready To Drink Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Ready To Drink Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 3: China Ready To Drink Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Ready To Drink Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Ready To Drink Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Japan China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: China China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Australia China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Thailand China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: New Zeland China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Others China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Ready To Drink Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 15: China Ready To Drink Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: China Ready To Drink Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Ready To Drink Coffee Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the China Ready To Drink Coffee Market?

Key companies in the market include Suntory Holdings Ltd, Nestle SA, Asahi Group Holdings Ltd, PepsiCo Inc, Restaurant Brands International Inc (Tim Hortons), Tsing Hsin International Group, The Coca-Cola Company, Uni-President Enterprises Corp, Starbucks Corporation, Arla Foods amba*List Not Exhaustive.

3. What are the main segments of the China Ready To Drink Coffee Market?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Growing Preference for Coffee Over Tea.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

In September 2022, a convenience store in China, Sinopec's Easy Joy, and Tim Horton's International Limited, the exclusive operator of Tim Hortons coffee shops in China, partnered and launched two co-branded ready-to-drink coffee products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Ready To Drink Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Ready To Drink Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Ready To Drink Coffee Market?

To stay informed about further developments, trends, and reports in the China Ready To Drink Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence