Key Insights

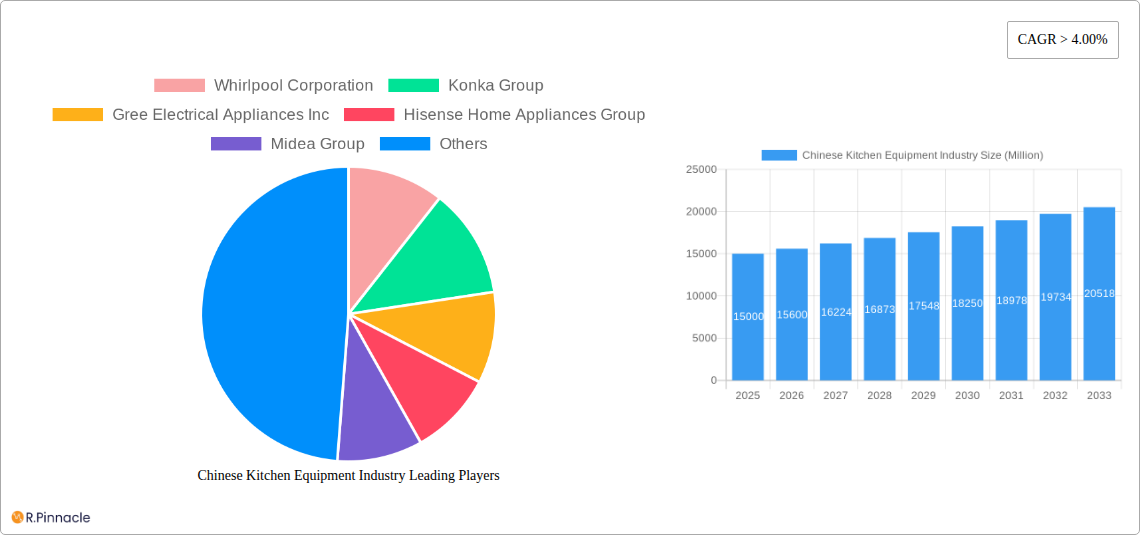

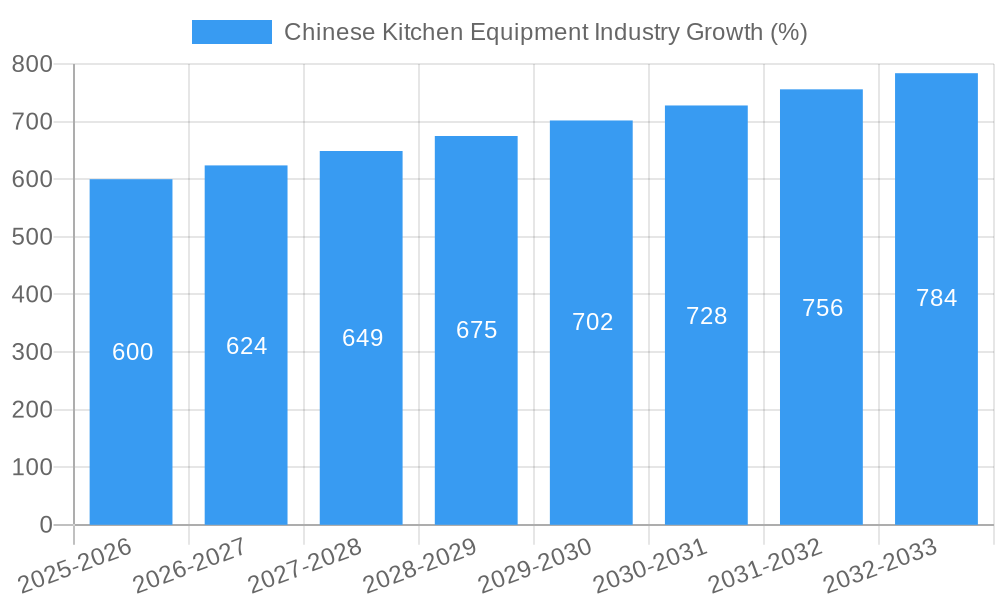

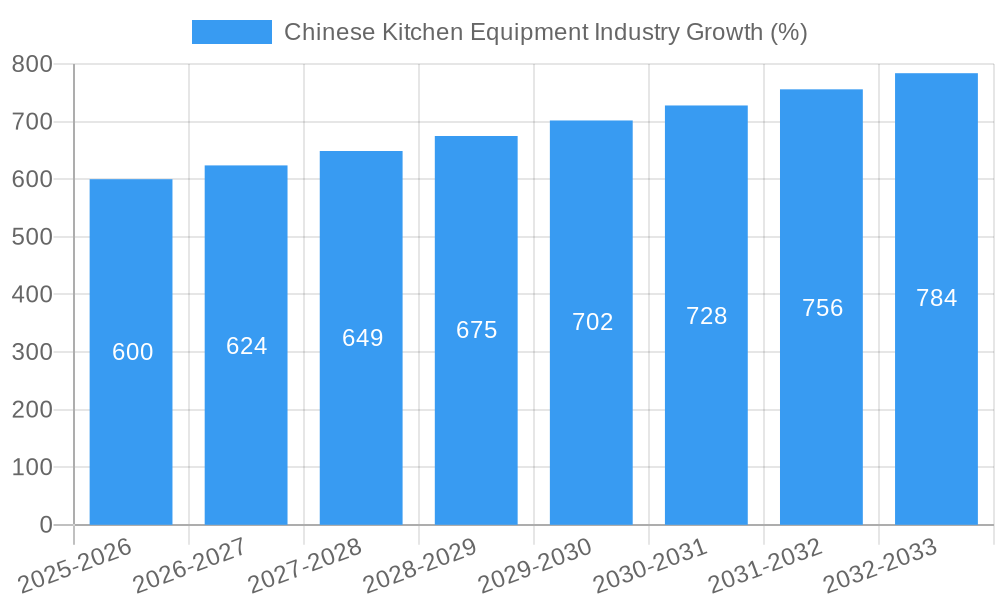

The Chinese kitchen equipment market, currently experiencing robust growth with a CAGR exceeding 4%, presents a significant opportunity for both domestic and international players. Driven by rising disposable incomes, urbanization, and a growing preference for modern, convenient kitchen appliances, the market is projected to expand considerably over the next decade. Key segments like refrigerators and freezers, dishwashers, and microwave ovens are leading the charge, fueled by increasing consumer demand for energy-efficient and technologically advanced products. The residential sector dominates the market, although commercial applications are also showing promising growth, particularly within the burgeoning food service and hospitality industries. Online distribution channels are gaining traction, reflecting the broader shift towards e-commerce in China. However, challenges remain, including intense competition, fluctuating raw material prices, and potential supply chain disruptions. Major players like Haier, Midea, and Whirlpool are vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The market's geographic distribution is largely concentrated in urban centers, with significant potential for expansion in less developed regions.

The future of the Chinese kitchen equipment market hinges on continued economic growth, evolving consumer preferences, and the ability of manufacturers to adapt to changing technological landscapes. Smart appliances featuring connectivity and automated features are gaining prominence, presenting opportunities for companies to differentiate their offerings. Government initiatives aimed at promoting energy efficiency and sustainable practices are also shaping the market dynamics, driving demand for eco-friendly products. The competitive landscape is expected to remain fiercely contested, with a focus on brand building, superior product quality, and robust after-sales service. Successful players will need to leverage advanced manufacturing techniques, efficient supply chains, and effective marketing strategies to maintain a competitive edge in this dynamic market. Analyzing market segmentation by product type, end-user, and distribution channel provides valuable insights for strategic planning and investment decisions.

Chinese Kitchen Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Chinese kitchen equipment industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, competitive landscape, and future growth potential of this rapidly evolving sector. The report utilizes data and analysis to forecast market trends and opportunities, providing actionable intelligence for informed business strategies. The market size is expected to reach xx Million by 2033.

Chinese Kitchen Equipment Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitution, end-user demographics, and M&A activity within the Chinese kitchen equipment industry. The market is characterized by a mix of established multinational players and rapidly growing domestic brands.

- Market Concentration: Midea Group, Haier Smart Home, and Whirlpool Corporation hold significant market share, but the industry is highly competitive with numerous smaller players. The precise market share for each major player is constantly shifting; however, it is estimated that the top three companies collectively hold approximately xx% of the market share as of 2025.

- Innovation Drivers: Technological advancements, changing consumer preferences (towards smart appliances and health-conscious cooking), and government policies promoting energy efficiency are key innovation drivers.

- Regulatory Framework: Stringent safety and energy efficiency regulations influence product design and manufacturing processes. Government incentives for green technologies are shaping the market.

- Product Substitutes: The rise of online food delivery services presents some level of substitution, although it hasn't significantly impacted the overall market demand for kitchen equipment.

- End-User Demographics: Growing urbanization and rising disposable incomes are driving demand, particularly within the residential segment. The commercial segment is also expanding, with significant growth in restaurants and hotels.

- M&A Activities: The past five years have seen numerous M&A deals, with total deal values estimated at xx Million. These transactions reflect consolidation within the industry and efforts by larger players to expand their product portfolios and market reach. Examples include (but aren't limited to) strategic acquisitions to expand into new product categories or geographical regions.

Chinese Kitchen Equipment Industry Market Dynamics & Trends

This section explores the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Chinese kitchen equipment market. The market exhibits a robust growth trajectory, driven by factors such as increasing urbanization, rising disposable incomes, and evolving consumer lifestyles.

The industry is witnessing significant technological disruption, with the emergence of smart appliances, Internet of Things (IoT) integration, and advanced cooking technologies. Consumer preferences are shifting towards energy-efficient, multifunctional, and aesthetically pleasing appliances. The competitive landscape is dynamic, with both domestic and international players vying for market share through product innovation, branding, and distribution strategies. The market is estimated to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration of smart appliances expected to reach xx% by 2033.

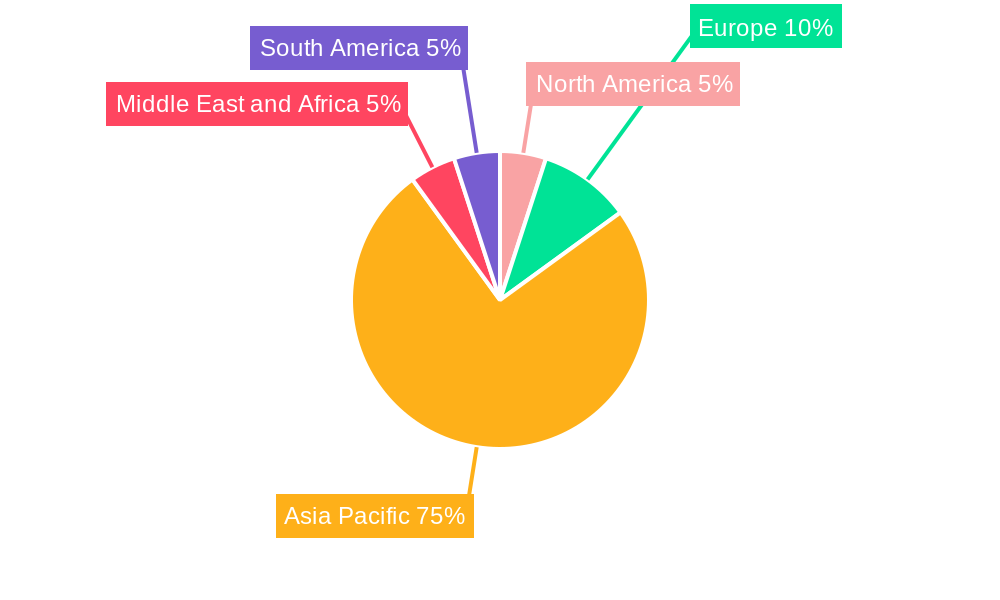

Dominant Regions & Segments in Chinese Kitchen Equipment Industry

This section identifies the leading regions, countries, and segments within the Chinese kitchen equipment market.

By Product: Refrigerators and freezers consistently dominate the market, followed by dishwashers and microwave ovens. Mixers and grinders show strong growth potential in the residential market. The "Other Kitchen Appliances" segment, encompassing smaller appliances like air fryers and slow cookers, is also expanding rapidly.

By End User: The residential segment accounts for the largest share, driven by increasing household incomes and urbanization. The commercial segment, encompassing restaurants, hotels, and food service establishments, is also experiencing substantial growth.

By Distribution Channel: Online channels are growing rapidly, driven by increased internet penetration and e-commerce adoption. However, multi-brand stores and exclusive brand stores remain significant distribution channels.

- Key Drivers:

- Economic Policies: Government initiatives promoting consumer spending and infrastructure development have fueled market growth.

- Infrastructure: Improved logistics and supply chain networks facilitate efficient product distribution.

Chinese Kitchen Equipment Industry Product Innovations

Recent years have witnessed significant product innovations, driven by technological advancements and changing consumer preferences. Key innovations include the integration of smart features, such as app control, voice assistants, and automated cooking functions. Energy-efficient designs, focusing on reduced power consumption and water usage, are gaining prominence. The market is also witnessing the introduction of health-conscious appliances, such as air fryers and steam ovens, catering to the growing demand for healthier cooking options. Companies are increasingly focusing on creating appliances with better aesthetics and design, aligning with modern kitchen aesthetics.

Report Scope & Segmentation Analysis

This report covers the Chinese kitchen equipment market, segmented by product type (Refrigerators and Freezers, Dishwashers, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, Other Kitchen Appliances), end-user (Residential, Commercial), and distribution channel (Multi-Brand Stores, Exclusive Stores, Online, Other Distribution Channels). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. Market values are expressed in Millions.

Key Drivers of Chinese Kitchen Equipment Industry Growth

The Chinese kitchen equipment industry's growth is propelled by several factors: Rising disposable incomes and urbanization are boosting demand for modern kitchen appliances. Technological advancements in smart appliances and IoT integration are creating exciting new product categories. Government policies promoting energy efficiency and sustainable practices are encouraging innovation and adoption of eco-friendly appliances. Furthermore, increasing consumer awareness of health and wellness is driving the demand for appliances that support healthy cooking styles.

Challenges in the Chinese Kitchen Equipment Industry Sector

The industry faces challenges including intense competition, fluctuating raw material prices impacting production costs, and the need to adapt to rapidly changing consumer preferences and technological advancements. Supply chain disruptions, particularly those caused by geopolitical events, can significantly impact production and distribution. Maintaining brand loyalty in a competitive market requires continuous investment in product innovation and marketing. The complexities of regulatory compliance adds to operational costs.

Emerging Opportunities in Chinese Kitchen Equipment Industry

Emerging opportunities include the growth of the smart home market, increasing demand for customized and high-end appliances, and expansion into rural markets. The development of sustainable and energy-efficient appliances is another significant growth area. The industry can also tap into the increasing consumer interest in healthy cooking and innovative food preparation techniques. There are potential for niche markets catering to specific dietary requirements or preferences.

Leading Players in the Chinese Kitchen Equipment Industry Market

- Whirlpool Corporation

- Konka Group

- Gree Electrical Appliances Inc

- Hisense Home Appliances Group

- Midea Group

- TCL Corporation

- Haier Smart Home

- Xiaomi Smart Home

- Hangzhou Miyoung Smart Home Co Ltd

- LG Electronics

Key Developments in Chinese Kitchen Equipment Industry

- September 2022: Xiaomi launched the MIJIA Cooking Robot, offering 35 cooking options and a 2.2-liter capacity. This launch significantly impacted the market, introducing a multifunctional and technologically advanced product.

- August 2023: Xiaomi launched the Mijia 5.5L Visual Air Fryer with a 6.8-inch viewing window and oil removal features, highlighting the growing trend toward healthy cooking appliances.

Future Outlook for Chinese Kitchen Equipment Industry Market

The Chinese kitchen equipment market is poised for continued growth, driven by sustained economic development, rising consumer spending, and technological innovation. The integration of smart technology, focus on energy efficiency, and increasing demand for health-conscious appliances will shape future market trends. Strategic partnerships and investments in research and development will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities.

Chinese Kitchen Equipment Industry Segmentation

-

1. Product

- 1.1. Refrigerators and Freezers

- 1.2. Dishwashers

- 1.3. Mixers and Grinders

- 1.4. Microwave Ovens

- 1.5. Grills and Roasters

- 1.6. Water Purifiers

- 1.7. Other Kitchen Appliances

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi- Brand Stores

- 3.2. Exclusive Stores

- 3.3. Online

- 3.4. Other Distribution Channel

Chinese Kitchen Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Kitchen Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances

- 3.3. Market Restrains

- 3.3.1. High power consumption from smart home appliances; Limited spaces in households for appliances

- 3.4. Market Trends

- 3.4.1. Smart Kitchen Appliances are driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators and Freezers

- 5.1.2. Dishwashers

- 5.1.3. Mixers and Grinders

- 5.1.4. Microwave Ovens

- 5.1.5. Grills and Roasters

- 5.1.6. Water Purifiers

- 5.1.7. Other Kitchen Appliances

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi- Brand Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators and Freezers

- 6.1.2. Dishwashers

- 6.1.3. Mixers and Grinders

- 6.1.4. Microwave Ovens

- 6.1.5. Grills and Roasters

- 6.1.6. Water Purifiers

- 6.1.7. Other Kitchen Appliances

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Multi- Brand Stores

- 6.3.2. Exclusive Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators and Freezers

- 7.1.2. Dishwashers

- 7.1.3. Mixers and Grinders

- 7.1.4. Microwave Ovens

- 7.1.5. Grills and Roasters

- 7.1.6. Water Purifiers

- 7.1.7. Other Kitchen Appliances

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Multi- Brand Stores

- 7.3.2. Exclusive Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators and Freezers

- 8.1.2. Dishwashers

- 8.1.3. Mixers and Grinders

- 8.1.4. Microwave Ovens

- 8.1.5. Grills and Roasters

- 8.1.6. Water Purifiers

- 8.1.7. Other Kitchen Appliances

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Multi- Brand Stores

- 8.3.2. Exclusive Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Refrigerators and Freezers

- 9.1.2. Dishwashers

- 9.1.3. Mixers and Grinders

- 9.1.4. Microwave Ovens

- 9.1.5. Grills and Roasters

- 9.1.6. Water Purifiers

- 9.1.7. Other Kitchen Appliances

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Multi- Brand Stores

- 9.3.2. Exclusive Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Refrigerators and Freezers

- 10.1.2. Dishwashers

- 10.1.3. Mixers and Grinders

- 10.1.4. Microwave Ovens

- 10.1.5. Grills and Roasters

- 10.1.6. Water Purifiers

- 10.1.7. Other Kitchen Appliances

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Multi- Brand Stores

- 10.3.2. Exclusive Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 USA

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia

- 13.1.4 India

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 Egypt

- 14.1.3 UAE

- 14.1.4 Rest of Middle East and Africa

- 15. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Argentina

- 15.1.2 Colombia

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Whirlpool Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Konka Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Gree Electrical Appliances Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Hisense Home Appliances Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Midea Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 TCL Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Haier Smart Home

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Xiaomi Smart Home

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 LG Electronics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global Chinese Kitchen Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: South America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 23: South America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 24: South America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Europe Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 45: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 46: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 47: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 48: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: USA Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Egypt Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: UAE Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United Kingdom Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Russia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Benelux Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Nordics Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 61: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Turkey Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: GCC Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: North Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 70: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 71: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 72: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 73: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: ASEAN Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Oceania Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Kitchen Equipment Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Chinese Kitchen Equipment Industry?

Key companies in the market include Whirlpool Corporation, Konka Group, Gree Electrical Appliances Inc, Hisense Home Appliances Group, Midea Group, TCL Corporation, Haier Smart Home, Xiaomi Smart Home, Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive, LG Electronics.

3. What are the main segments of the Chinese Kitchen Equipment Industry?

The market segments include Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances.

6. What are the notable trends driving market growth?

Smart Kitchen Appliances are driving the growth of the market.

7. Are there any restraints impacting market growth?

High power consumption from smart home appliances; Limited spaces in households for appliances.

8. Can you provide examples of recent developments in the market?

August 2023: Xiamoi launched The Mijia 5.5L Visual Air Fryer, which comes with a host of features designed to elevate the cooking experience. Its standout feature is the 6.8-inch ingredient viewing window, allowing users to monitor their dishes without interrupting the cooking process. The appliance supports efficient oil removal and no-flip cooking techniques, ensuring convenient and healthier meals. The device also features a circular OLED display, which shows the temperature, timer, and different modes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Kitchen Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Kitchen Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Kitchen Equipment Industry?

To stay informed about further developments, trends, and reports in the Chinese Kitchen Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence