Key Insights

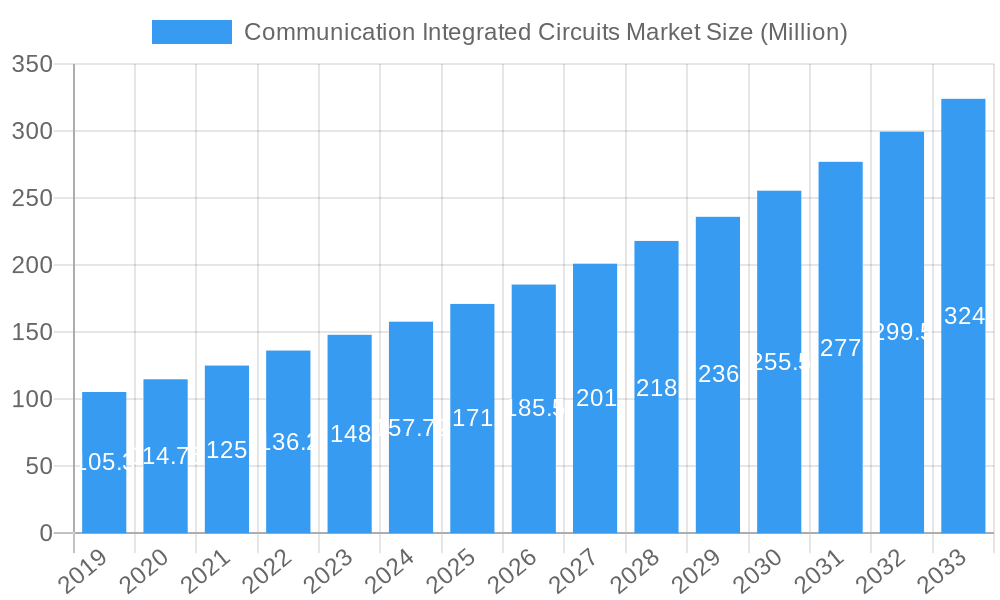

The Communication Integrated Circuits (ICs) market is poised for significant expansion, projected to reach USD 157.72 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.75% expected to sustain its momentum through 2033. This growth is fundamentally driven by the escalating demand for faster, more efficient, and increasingly interconnected communication systems across various sectors. Key drivers include the relentless proliferation of smartphones and mobile devices, the ongoing deployment of 5G networks, and the burgeoning adoption of the Internet of Things (IoT) across industrial, automotive, and consumer applications. Furthermore, advancements in cloud computing and the increasing complexity of data processing requirements are necessitating more sophisticated communication ICs, fueling innovation and market expansion.

Communication Integrated Circuits Market Market Size (In Million)

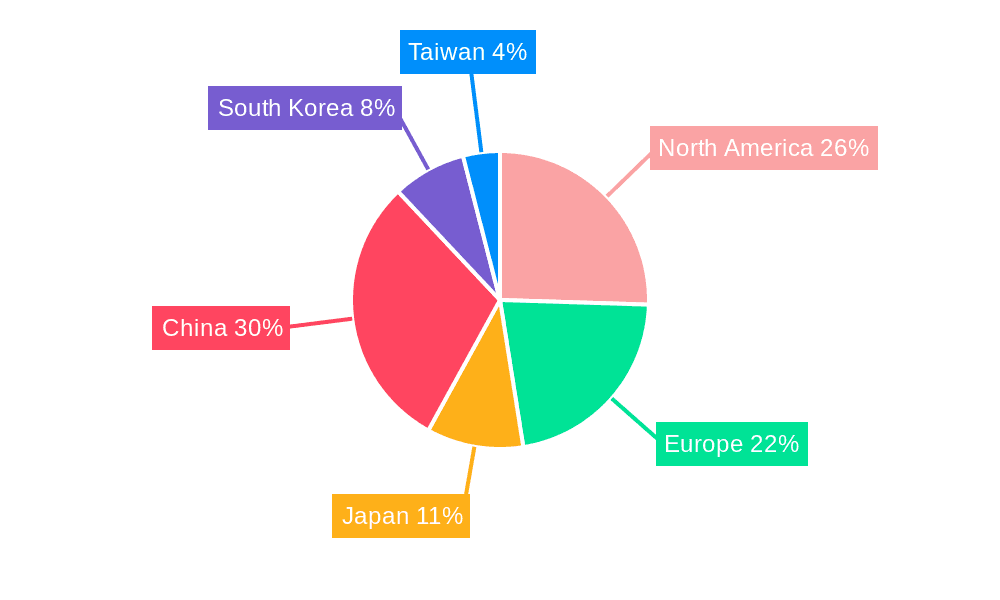

The market exhibits a diverse segmentation, with Analog ICs and Microprocessors (MPUs) identified as prominent segments. Analog ICs are critical for signal conditioning and conversion in communication systems, while MPUs are the brains behind complex data processing and control functions. Logic ICs and Memory ICs also play vital roles in enabling data storage and logical operations within communication infrastructure. The market is also characterized by significant regional contributions, with Asia-Pacific, particularly China, leading in both production and consumption due to its extensive manufacturing capabilities and rapid technological adoption. North America and Europe remain strong markets, driven by innovation and the demand for advanced communication solutions in enterprise and consumer segments. Key players such as Intel Corporation, Texas Instruments Inc., and Qualcomm are actively investing in research and development to introduce next-generation communication ICs, addressing emerging trends like AI integration and enhanced connectivity solutions.

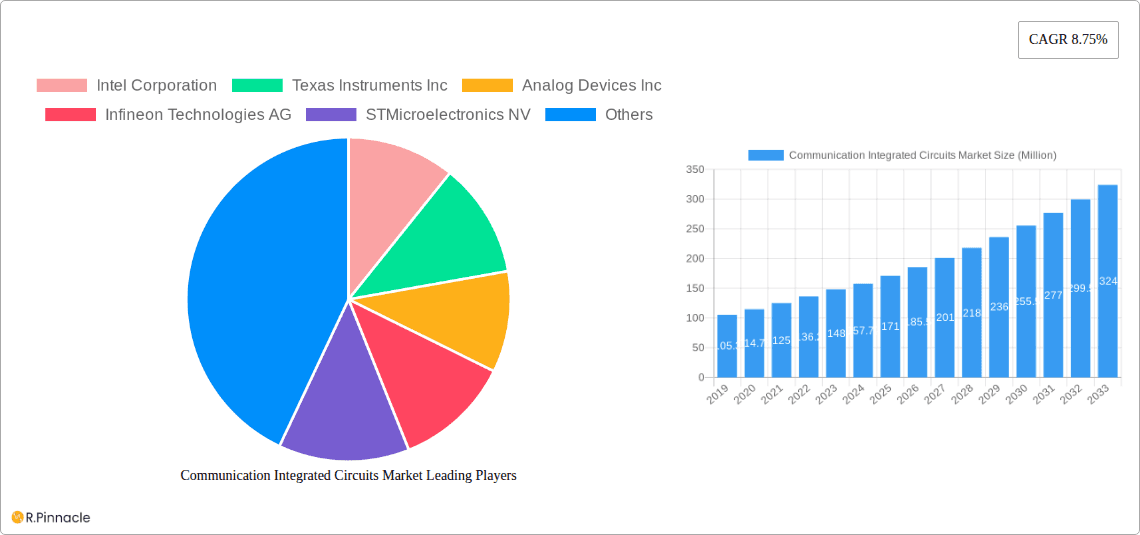

Communication Integrated Circuits Market Company Market Share

This in-depth report provides a definitive analysis of the global Communication Integrated Circuits (ICs) market, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033. Leveraging high-ranking keywords such as "communication IC market," "semiconductor trends," "wireless communication chips," and "embedded systems ICs," this report offers critical insights for industry professionals, strategists, and investors navigating this dynamic sector. We dissect market structure, dynamics, regional dominance, product innovations, and future opportunities, offering actionable intelligence for strategic decision-making.

Communication Integrated Circuits Market Market Structure & Innovation Trends

The Communication Integrated Circuits (ICs) market exhibits a moderately concentrated structure, characterized by the presence of a few dominant players alongside a dynamic landscape of emerging innovators. Key players like Intel Corporation, Texas Instruments Inc., Analog Devices Inc., Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc., Renesas Electronics Corporation, and MediaTek Inc. collectively hold significant market share. Innovation drivers are primarily fueled by the relentless demand for enhanced connectivity, miniaturization, lower power consumption, and increased processing capabilities across diverse end-user industries. Regulatory frameworks, particularly those pertaining to supply chain security and environmental standards, are increasingly influencing market dynamics. Product substitutes, while present in lower-tier applications, struggle to match the performance and integration levels of advanced communication ICs. End-user demographics are shifting towards sectors demanding high-bandwidth, low-latency solutions, such as 5G infrastructure, IoT devices, and automotive electronics. Mergers and acquisition (M&A) activities, valued at an estimated $15,000 Million in the historical period, remain a strategic tool for companies to expand their product portfolios, gain access to new technologies, and consolidate market positions. The market share of leading players hovers around 70% in key segments.

Communication Integrated Circuits Market Market Dynamics & Trends

The Communication Integrated Circuits (ICs) market is poised for significant expansion, driven by a confluence of robust growth drivers and transformative technological advancements. The escalating demand for high-speed data transmission, fueled by the proliferation of 5G networks, the Internet of Things (IoT) ecosystem, and the ever-increasing volume of digital content consumption, acts as a primary catalyst. The average annual growth rate (CAGR) for the Communication ICs market is projected to be approximately 12.5% during the forecast period. This surge in demand is directly linked to the need for sophisticated ICs that can handle complex signal processing, efficient data routing, and seamless connectivity. Technological disruptions, including advancements in semiconductor manufacturing processes, the adoption of AI and machine learning for chip design optimization, and the development of novel materials, are continuously pushing the boundaries of performance and efficiency. Consumer preferences are evolving towards more connected, intelligent, and personalized devices, necessitating ICs that support advanced features like augmented reality (AR), virtual reality (VR), and sophisticated sensor integration. Competitive dynamics within the market are intense, with companies continuously investing in research and development to maintain a competitive edge through product differentiation and cost optimization. Market penetration of advanced communication ICs is rapidly increasing across industries, driven by the compelling value proposition of enhanced functionality and improved user experience. The ongoing digital transformation across various sectors, from healthcare and manufacturing to transportation and entertainment, further solidifies the indispensable role of communication ICs. Emerging applications like smart cities, autonomous driving, and industrial automation are creating new avenues for market growth, demanding highly specialized and integrated communication solutions. The market penetration for high-performance communication ICs in emerging applications is expected to reach 45% by 2030.

Dominant Regions & Segments in Communication Integrated Circuits Market

North America currently holds a dominant position in the Communication Integrated Circuits (ICs) market, driven by its robust technological infrastructure, significant investments in research and development, and the presence of major technology hubs. The United States, in particular, leads in innovation and adoption of advanced communication technologies, supported by favorable government policies and a strong ecosystem of semiconductor manufacturers and end-users. Economic policies in North America, such as tax incentives for R&D and manufacturing, have been instrumental in fostering growth. The region's advanced digital infrastructure, including widespread 5G network deployment and a high concentration of data centers, further bolsters the demand for sophisticated communication ICs.

- Key Drivers of North American Dominance:

- Technological Prowess: Leading semiconductor research institutions and companies driving innovation.

- Strong 5G Rollout: Rapid deployment of 5G infrastructure requiring advanced communication chips.

- High IoT Adoption: Extensive implementation of IoT devices across various sectors.

- Government Support: Favorable policies and funding for semiconductor industry growth.

Within the segment analysis, Micro (Microprocessors (MPU), Microcontrollers (MCU), Digital Signal Processors) emerges as the largest and fastest-growing segment. The increasing demand for embedded intelligence in a wide array of applications, from consumer electronics and industrial automation to automotive systems and medical devices, fuels this segment's growth. Microcontrollers, with their high integration and cost-effectiveness, are particularly instrumental in driving the proliferation of IoT devices. Microprocessors, on the other hand, are crucial for high-performance computing and data processing in telecommunication infrastructure and advanced computing platforms. Digital Signal Processors (DSPs) are vital for real-time signal manipulation in applications like audio and video processing, wireless communication, and radar systems. The continuous evolution of these sub-segments, with advancements in power efficiency, processing power, and specialized functionalities, ensures their sustained dominance in the communication ICs market.

Communication Integrated Circuits Market Product Innovations

Product innovations in the Communication Integrated Circuits (ICs) market are characterized by a relentless pursuit of enhanced performance, miniaturization, and power efficiency. Companies are actively developing advanced analog ICs for high-frequency applications, logic ICs with improved switching speeds, and memory solutions with higher densities and faster access times. The Micro segment, encompassing MPUs, MCUs, and DSPs, is witnessing significant advancements in multi-core architectures, AI-accelerating capabilities, and ultra-low-power consumption for battery-operated devices. These innovations are critical for powering next-generation wireless communication systems, sophisticated IoT platforms, and advanced automotive electronics, offering competitive advantages through superior functionality, reduced form factors, and lower operational costs.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Communication Integrated Circuits (ICs) market across key segments. The Analog IC segment, vital for signal conditioning and conversion, is projected to experience steady growth driven by its indispensable role in wireless communication and sensor interfaces. Logic ICs, crucial for digital operations and control, are expected to witness robust expansion due to their integration into complex electronic systems. The Memory segment, encompassing various memory technologies, will see sustained demand driven by data storage needs across all connected devices. The Micro segment, including Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors (DSP), is forecast to be the largest and fastest-growing segment, fueled by the increasing intelligence and connectivity in end-user applications. Each segment's market size, growth projections, and competitive dynamics have been meticulously analyzed.

Key Drivers of Communication Integrated Circuits Market Growth

The Communication Integrated Circuits (ICs) market growth is propelled by several key factors. The relentless expansion of the 5G network infrastructure globally necessitates a significant increase in the deployment of advanced communication ICs for base stations, user equipment, and network infrastructure. The burgeoning Internet of Things (IoT) ecosystem, spanning smart homes, industrial automation, and wearable technology, creates substantial demand for low-power, highly integrated communication ICs. Advancements in artificial intelligence (AI) and machine learning are driving the need for powerful processing capabilities within communication chips, enabling sophisticated data analysis and decision-making at the edge. Furthermore, the increasing adoption of connected vehicles and the development of autonomous driving technologies require sophisticated ICs for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. Government initiatives promoting digital transformation and smart city development also contribute significantly to market expansion.

Challenges in the Communication Integrated Circuits Market Sector

Despite the strong growth trajectory, the Communication Integrated Circuits (ICs) market faces several challenges. The highly complex and capital-intensive nature of semiconductor manufacturing leads to significant barriers to entry and necessitates substantial ongoing investment in advanced fabrication facilities. Global supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, pose a continuous threat to production timelines and component availability. Intense competition among established players and the emergence of new entrants can lead to price pressures and margin erosion. Stringent regulatory requirements related to product safety, environmental impact, and data security add to the operational complexities and compliance costs for manufacturers. The rapid pace of technological evolution also demands continuous innovation, making it challenging for companies to keep pace with the latest advancements and avoid product obsolescence.

Emerging Opportunities in Communication Integrated Circuits Market

The Communication Integrated Circuits (ICs) market is ripe with emerging opportunities. The ongoing expansion of satellite internet constellations presents a significant opportunity for specialized communication ICs designed for high-throughput, low-latency satellite communications. The growing adoption of edge computing, which processes data closer to the source, is driving demand for powerful and energy-efficient communication ICs capable of performing complex computations at the network edge. The metaverse and augmented/virtual reality (AR/VR) technologies are poised to create new markets for high-bandwidth, low-latency communication ICs that enable immersive experiences. Furthermore, the increasing focus on sustainability and energy efficiency in electronics is driving innovation in low-power communication ICs and advanced power management solutions. The ongoing digital transformation in emerging economies also presents substantial untapped market potential.

Leading Players in the Communication Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc.

- Analog Devices Inc.

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc.

- Renesas Electronics Corporation

- MediaTek Inc.

Key Developments in Communication Integrated Circuits Market Industry

- March 2024: Toshiba expanded its TXZ+ Family of advanced 32-bit microcontrollers with the addition of eight new products in the M4K Group. These new offerings feature Cortex-M4 cores with FPU and offer enhanced flash memory capacity (512 KB/1 MB) and RAM (up to 64 KB), significantly increasing their capabilities for embedded applications.

- January 2024: NXP Semiconductors launched the MCX A14x and MCX A15x, marking the debut of the A Series within their MCX portfolio. These cost-effective and user-friendly microcontrollers, designed with a compact footprint, empower engineers with versatile solutions for a wide range of embedded applications.

Future Outlook for Communication Integrated Circuits Market Market

The future outlook for the Communication Integrated Circuits (ICs) market is exceptionally bright, driven by sustained technological advancements and the ever-expanding digital landscape. The ongoing evolution of wireless communication standards, including the eventual rollout of 6G, will continue to demand more sophisticated and integrated IC solutions. The pervasive integration of AI and edge computing across all industries will further elevate the importance of intelligent and powerful communication chips. The increasing demand for immersive digital experiences, such as those promised by the metaverse, will necessitate ICs capable of handling massive data throughput and ultra-low latency. Strategic opportunities lie in focusing on specialized high-growth application areas like autonomous systems, advanced healthcare technologies, and sustainable energy solutions, where the demand for cutting-edge communication ICs will be paramount. Companies that can consistently innovate, optimize their supply chains, and adapt to evolving regulatory environments will be best positioned for long-term success in this dynamic market.

Communication Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

Communication Integrated Circuits Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Communication Integrated Circuits Market Regional Market Share

Geographic Coverage of Communication Integrated Circuits Market

Communication Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World

- 3.3. Market Restrains

- 3.3.1. The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World

- 3.4. Market Trends

- 3.4.1. Logic IC Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog IC

- 6.1.2. Logic IC

- 6.1.3. Memory

- 6.1.4. Micro

- 6.1.4.1. Microprocessors (MPU)

- 6.1.4.2. Microcontrollers (MCU)

- 6.1.4.3. Digital Signal Processors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog IC

- 7.1.2. Logic IC

- 7.1.3. Memory

- 7.1.4. Micro

- 7.1.4.1. Microprocessors (MPU)

- 7.1.4.2. Microcontrollers (MCU)

- 7.1.4.3. Digital Signal Processors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog IC

- 8.1.2. Logic IC

- 8.1.3. Memory

- 8.1.4. Micro

- 8.1.4.1. Microprocessors (MPU)

- 8.1.4.2. Microcontrollers (MCU)

- 8.1.4.3. Digital Signal Processors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. China Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog IC

- 9.1.2. Logic IC

- 9.1.3. Memory

- 9.1.4. Micro

- 9.1.4.1. Microprocessors (MPU)

- 9.1.4.2. Microcontrollers (MCU)

- 9.1.4.3. Digital Signal Processors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analog IC

- 10.1.2. Logic IC

- 10.1.3. Memory

- 10.1.4. Micro

- 10.1.4.1. Microprocessors (MPU)

- 10.1.4.2. Microcontrollers (MCU)

- 10.1.4.3. Digital Signal Processors

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Taiwan Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Analog IC

- 11.1.2. Logic IC

- 11.1.3. Memory

- 11.1.4. Micro

- 11.1.4.1. Microprocessors (MPU)

- 11.1.4.2. Microcontrollers (MCU)

- 11.1.4.3. Digital Signal Processors

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intel Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Texas Instruments Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Analog Devices Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Infineon Technologies AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 STMicroelectronics NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NXP Semiconductors NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 On Semiconductor Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Microchip Technology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Renesas Electronics Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 MediaTek Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Intel Corporation

List of Figures

- Figure 1: Global Communication Integrated Circuits Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Communication Integrated Circuits Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United States Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United States Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United States Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 12: Europe Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 13: Europe Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Japan Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Japan Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Japan Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Japan Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 28: China Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 29: China Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: China Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 31: China Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 36: South Korea Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 37: South Korea Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: South Korea Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 39: South Korea Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Taiwan Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Taiwan Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Taiwan Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Taiwan Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Communication Integrated Circuits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Communication Integrated Circuits Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 7: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 23: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Communication Integrated Circuits Market?

The projected CAGR is approximately 8.75%.

2. Which companies are prominent players in the Communication Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the Communication Integrated Circuits Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 157.72 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World.

6. What are the notable trends driving market growth?

Logic IC Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World.

8. Can you provide examples of recent developments in the market?

March 2024: Toshiba added eight new products with 512 KB/1 MB flash memory capacity and four types of packages to the M4K Group of the TXZ+ Family Advanced Class 32-bit microcontrollers equipped with Cortex-M4 core with FPU. The new products expand code flash memory capacity from the 256 kb maximum of Toshiba’s current product to 512 KB/1 MB, depending on the product, and RAM capacity from 24 KB to 64 KB.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Communication Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Communication Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Communication Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Communication Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence