Key Insights

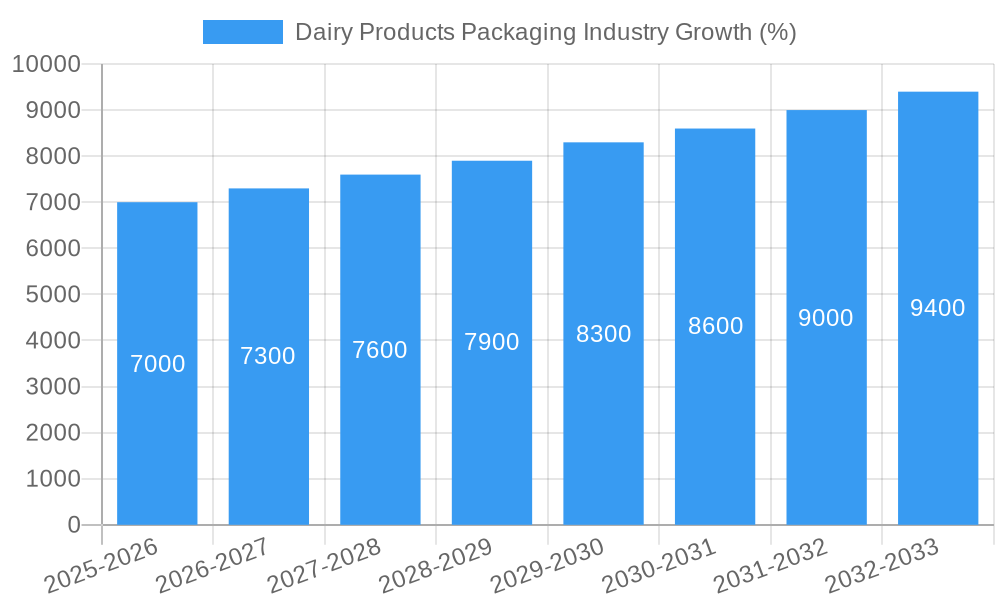

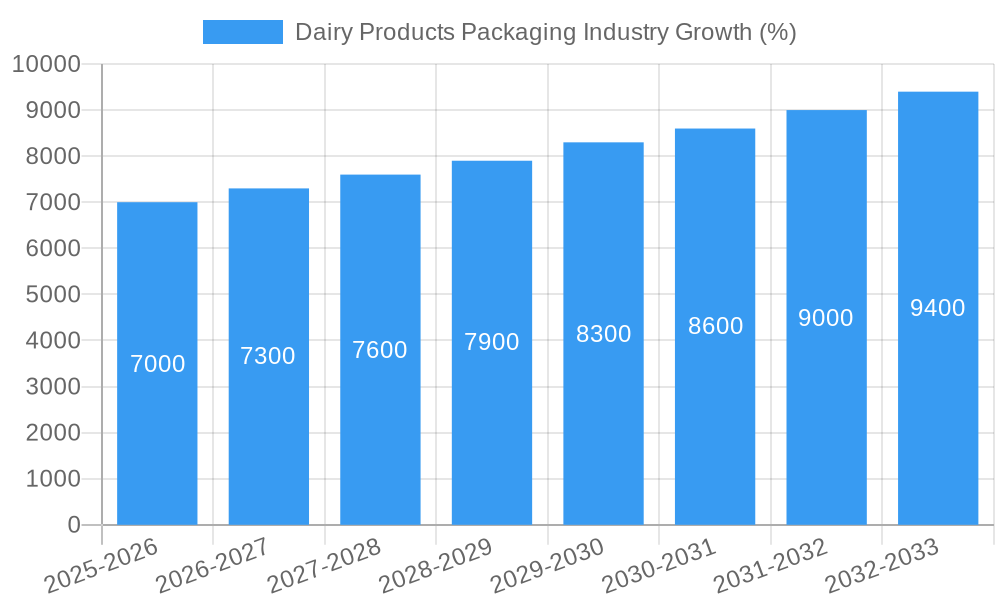

The dairy products packaging market, exhibiting a CAGR of 4.61%, presents a significant growth opportunity. Driven by increasing consumer demand for convenient and shelf-stable dairy products, coupled with a rising global population and changing lifestyles, this market is projected to expand considerably. Key trends include the increasing adoption of sustainable packaging materials like paperboard and recycled plastics, responding to growing environmental concerns. Furthermore, advancements in packaging technology, such as flexible pouches offering extended shelf life and improved barrier properties, are shaping market dynamics. The market segmentation reveals a diverse landscape, with plastic maintaining a significant share due to its cost-effectiveness and versatility, yet facing increasing competition from sustainable alternatives. Milk and yogurt packaging dominate the product segment, while bottles and cartons are prevalent packaging types. Major players such as Amcor PLC, Berry Global Group Inc, and Tetra Pak (implied by the listed companies) are actively investing in innovation and expanding their product portfolios to capitalize on these trends. However, fluctuating raw material prices and stringent regulatory requirements related to food safety and environmental impact present challenges to market growth. Regional variations are expected, with developed markets showing steady growth, while emerging economies like those in Asia Pacific offer high-growth potential due to increasing disposable incomes and changing consumption patterns. The competition is intense, with companies focused on differentiating their offerings through innovative designs, sustainable materials, and enhanced functionalities.

The forecast period of 2025-2033 suggests continued market expansion, influenced by factors such as the growing preference for ready-to-eat dairy products, the rise of e-commerce platforms increasing the demand for protective and convenient packaging, and the continuous development of smart packaging solutions. Regional growth is anticipated to vary depending on economic factors, infrastructure development, and consumer preferences for sustainable packaging. The market will likely witness further consolidation as companies strategically acquire smaller players to enhance their market share and technological capabilities. Companies that successfully integrate sustainable practices and cater to evolving consumer demands will be best positioned for success in this dynamic market. The adoption of advanced technologies, like smart labels that communicate freshness and product authenticity, will further enhance market growth, contributing to an overall positive outlook for the dairy products packaging industry.

Dairy Products Packaging Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Dairy Products Packaging Industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, and future trends. The global market size is projected to reach xx Million by 2033.

Dairy Products Packaging Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the dairy products packaging industry, focusing on market concentration, innovation drivers, regulatory frameworks, and mergers & acquisitions (M&A) activity. The industry is moderately concentrated, with key players like Amcor PLC, Berry Global Group Inc, and Huhtamaki Group holding significant market share. However, smaller players also contribute substantially, particularly in niche segments. The total M&A deal value in the dairy packaging sector from 2019-2024 reached approximately xx Million.

- Market Share: Amcor PLC: xx%, Berry Global Group Inc: xx%, Huhtamaki Group: xx%, Others: xx%

- Innovation Drivers: Sustainability concerns (e.g., reduced plastic use), evolving consumer preferences for convenience and extended shelf life, and advancements in packaging materials and technologies.

- Regulatory Frameworks: Growing emphasis on recyclable and compostable packaging materials, alongside regulations limiting certain types of plastics are significantly impacting the industry.

- Product Substitutes: Alternative packaging materials like bioplastics and fiber-based containers are emerging as competitive alternatives.

- End-User Demographics: The report explores changing consumer demographics and their impact on packaging choices, including increased demand for sustainable and convenient packaging options.

- M&A Activity: Recent years have seen increased M&A activity, driven by a desire to expand market share, access new technologies, and improve supply chain efficiency. The Huhtamaki acquisition of Elif Holding A.S. in 2021 is a prime example.

Dairy Products Packaging Industry Market Dynamics & Trends

This section delves into the key factors shaping the market's growth trajectory. The dairy products packaging market is experiencing significant growth, driven primarily by the increasing demand for dairy products globally. This growth is expected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of sustainable packaging solutions is also increasing, driven by consumer awareness and regulatory pressures. The report assesses several key trends, including the rise of e-commerce and its impact on packaging requirements, the shift towards lightweighting to reduce material costs and environmental impact, and the growth of personalized packaging solutions. Competitive dynamics are analyzed, focusing on pricing strategies, product differentiation, and innovation efforts by major players.

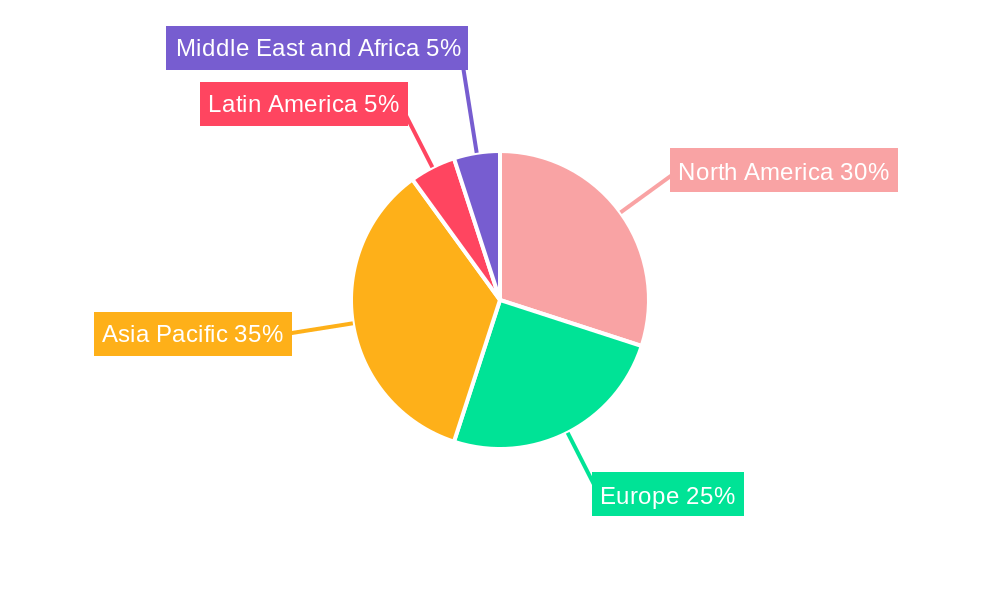

Dominant Regions & Segments in Dairy Products Packaging Industry

North America currently dominates the dairy products packaging market, followed by Europe and Asia Pacific. However, emerging economies are exhibiting strong growth potential. The dominance of specific regions is linked to factors like high dairy consumption, well-developed packaging infrastructure, and strong regulatory support for sustainable packaging.

- By Material: Plastic remains the dominant material due to its versatility and cost-effectiveness, although there is a growing shift towards sustainable alternatives like paper and paperboard.

- By Product: Milk packaging dominates due to high volume consumption, followed by yogurt and cheese.

- By Package Type: Cartons and boxes represent the largest segment due to their suitability for various dairy products and their efficiency in cold chain logistics.

Key Drivers:

- North America: High dairy consumption, robust infrastructure, and a focus on sustainable packaging solutions.

- Europe: Stringent environmental regulations driving the adoption of sustainable packaging materials.

- Asia Pacific: Rapid economic growth, expanding middle class, and increasing demand for convenience foods.

Dairy Products Packaging Industry Product Innovations

The dairy packaging industry is witnessing continuous innovation, focusing on enhancing product shelf life, improving sustainability, and increasing convenience for consumers. New materials like chemically recycled polypropylene and fiber-based alternatives are gaining traction. These innovations cater to growing consumer preferences for environmentally friendly packaging, while simultaneously addressing the need for robust and efficient solutions to maintain the quality and freshness of dairy products throughout the supply chain.

Report Scope & Segmentation Analysis

This report comprehensively segments the dairy products packaging market by material (plastic, paper and paperboard, glass, metal), product (milk, cheese, frozen foods, yogurt, cultured products), and package type (bottles, pouches, cartons and boxes, bags and wraps, other package types). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For example, the plastic segment is projected to maintain a significant market share but face growing competition from sustainable alternatives.

Key Drivers of Dairy Products Packaging Industry Growth

The dairy products packaging market is propelled by several key factors. Firstly, the increasing global demand for dairy products fuels the need for efficient and effective packaging solutions. Secondly, advancements in packaging technology, such as improved barrier properties and lightweighting techniques, drive industry growth. Thirdly, stringent environmental regulations and heightened consumer awareness of sustainability are promoting the adoption of eco-friendly packaging alternatives.

Challenges in the Dairy Products Packaging Industry Sector

The industry faces challenges including fluctuating raw material prices, stringent environmental regulations, and intense competition from alternative packaging solutions. These factors influence manufacturing costs and necessitate continuous innovation to maintain competitiveness and meet consumer demands for sustainable and cost-effective packaging. Supply chain disruptions, particularly those seen in recent years, also significantly impact the industry’s ability to meet demand.

Emerging Opportunities in Dairy Products Packaging Industry

Growing consumer demand for convenient and sustainable packaging presents significant opportunities. The expansion of e-commerce creates a demand for specialized packaging solutions capable of withstanding the rigors of shipping and delivery. The rising popularity of plant-based dairy alternatives also presents an opportunity for specialized packaging solutions designed to maintain the quality and freshness of these products.

Leading Players in the Dairy Products Packaging Industry Market

- Consolidated Container Company LLC

- Stora Enso Oyj

- Ball Corporation

- Greiner Packaging international Gmb

- Berry Global Group Inc

- Huhtamaki Group

- Winpak Ltd

- Amcor PLC

- International Paper Company

- Sealed Air Corporation

- Saudi Basic Industries Corporation

Key Developments in Dairy Products Packaging Industry Industry

- May 2021: Stora Enso partners with Pulpex to produce fiber-based bottles, offering a sustainable alternative.

- August 2021: Huhtamaki acquires Elif Holding A.S., expanding its presence in emerging markets.

- September 2021: Greiner Packaging incorporates chemically recycled polypropylene into its packaging, showcasing advancements in sustainability.

Future Outlook for Dairy Products Packaging Industry Market

The dairy products packaging market is poised for sustained growth, driven by factors such as increasing dairy consumption, the ongoing shift towards sustainable packaging solutions, and advancements in packaging technology. Strategic opportunities exist for companies focusing on innovation, sustainability, and catering to the evolving demands of consumers. The market will likely see continued consolidation as larger players seek to expand their market share and enhance their capabilities.

Dairy Products Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Metal

-

2. Product

- 2.1. Milk

- 2.2. Cheese

- 2.3. Frozen Foods

- 2.4. Yogurt

- 2.5. Cultured Products

-

3. Package Type

- 3.1. Bottles

- 3.2. Pouches

- 3.3. Cartons and Boxes

- 3.4. Bags and Wraps

- 3.5. Other Package Types

Dairy Products Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Dairy Products Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference Towards Protein-based Products; Increasing Adoption of Packages Incorporating Small Portion Size

- 3.3. Market Restrains

- 3.3.1. ; Greenhouse Gas Emission due to Dairy Activities Leading to Legislative Issues

- 3.4. Market Trends

- 3.4.1. Milk Occupies the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Milk

- 5.2.2. Cheese

- 5.2.3. Frozen Foods

- 5.2.4. Yogurt

- 5.2.5. Cultured Products

- 5.3. Market Analysis, Insights and Forecast - by Package Type

- 5.3.1. Bottles

- 5.3.2. Pouches

- 5.3.3. Cartons and Boxes

- 5.3.4. Bags and Wraps

- 5.3.5. Other Package Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper and Paperboard

- 6.1.3. Glass

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Milk

- 6.2.2. Cheese

- 6.2.3. Frozen Foods

- 6.2.4. Yogurt

- 6.2.5. Cultured Products

- 6.3. Market Analysis, Insights and Forecast - by Package Type

- 6.3.1. Bottles

- 6.3.2. Pouches

- 6.3.3. Cartons and Boxes

- 6.3.4. Bags and Wraps

- 6.3.5. Other Package Types

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper and Paperboard

- 7.1.3. Glass

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Milk

- 7.2.2. Cheese

- 7.2.3. Frozen Foods

- 7.2.4. Yogurt

- 7.2.5. Cultured Products

- 7.3. Market Analysis, Insights and Forecast - by Package Type

- 7.3.1. Bottles

- 7.3.2. Pouches

- 7.3.3. Cartons and Boxes

- 7.3.4. Bags and Wraps

- 7.3.5. Other Package Types

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper and Paperboard

- 8.1.3. Glass

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Milk

- 8.2.2. Cheese

- 8.2.3. Frozen Foods

- 8.2.4. Yogurt

- 8.2.5. Cultured Products

- 8.3. Market Analysis, Insights and Forecast - by Package Type

- 8.3.1. Bottles

- 8.3.2. Pouches

- 8.3.3. Cartons and Boxes

- 8.3.4. Bags and Wraps

- 8.3.5. Other Package Types

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper and Paperboard

- 9.1.3. Glass

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Milk

- 9.2.2. Cheese

- 9.2.3. Frozen Foods

- 9.2.4. Yogurt

- 9.2.5. Cultured Products

- 9.3. Market Analysis, Insights and Forecast - by Package Type

- 9.3.1. Bottles

- 9.3.2. Pouches

- 9.3.3. Cartons and Boxes

- 9.3.4. Bags and Wraps

- 9.3.5. Other Package Types

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper and Paperboard

- 10.1.3. Glass

- 10.1.4. Metal

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Milk

- 10.2.2. Cheese

- 10.2.3. Frozen Foods

- 10.2.4. Yogurt

- 10.2.5. Cultured Products

- 10.3. Market Analysis, Insights and Forecast - by Package Type

- 10.3.1. Bottles

- 10.3.2. Pouches

- 10.3.3. Cartons and Boxes

- 10.3.4. Bags and Wraps

- 10.3.5. Other Package Types

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. North America Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Dairy Products Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Consolidated Container Company LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Stora Enso Oyj

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ball Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Greiner Packaging international Gmb

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Berry Global Group Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Huhtamaki Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Winpak Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Amcor PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 International Paper Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Sealed Air Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Saudi Basic Industries Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Consolidated Container Company LLC

List of Figures

- Figure 1: Global Dairy Products Packaging Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Dairy Products Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 13: North America Dairy Products Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 14: North America Dairy Products Packaging Industry Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Dairy Products Packaging Industry Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Dairy Products Packaging Industry Revenue (Million), by Package Type 2024 & 2032

- Figure 17: North America Dairy Products Packaging Industry Revenue Share (%), by Package Type 2024 & 2032

- Figure 18: North America Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Dairy Products Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 21: Europe Dairy Products Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 22: Europe Dairy Products Packaging Industry Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Dairy Products Packaging Industry Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Dairy Products Packaging Industry Revenue (Million), by Package Type 2024 & 2032

- Figure 25: Europe Dairy Products Packaging Industry Revenue Share (%), by Package Type 2024 & 2032

- Figure 26: Europe Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Dairy Products Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 29: Asia Pacific Dairy Products Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 30: Asia Pacific Dairy Products Packaging Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Asia Pacific Dairy Products Packaging Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Asia Pacific Dairy Products Packaging Industry Revenue (Million), by Package Type 2024 & 2032

- Figure 33: Asia Pacific Dairy Products Packaging Industry Revenue Share (%), by Package Type 2024 & 2032

- Figure 34: Asia Pacific Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Dairy Products Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 37: Latin America Dairy Products Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 38: Latin America Dairy Products Packaging Industry Revenue (Million), by Product 2024 & 2032

- Figure 39: Latin America Dairy Products Packaging Industry Revenue Share (%), by Product 2024 & 2032

- Figure 40: Latin America Dairy Products Packaging Industry Revenue (Million), by Package Type 2024 & 2032

- Figure 41: Latin America Dairy Products Packaging Industry Revenue Share (%), by Package Type 2024 & 2032

- Figure 42: Latin America Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Dairy Products Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 45: Middle East and Africa Dairy Products Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 46: Middle East and Africa Dairy Products Packaging Industry Revenue (Million), by Product 2024 & 2032

- Figure 47: Middle East and Africa Dairy Products Packaging Industry Revenue Share (%), by Product 2024 & 2032

- Figure 48: Middle East and Africa Dairy Products Packaging Industry Revenue (Million), by Package Type 2024 & 2032

- Figure 49: Middle East and Africa Dairy Products Packaging Industry Revenue Share (%), by Package Type 2024 & 2032

- Figure 50: Middle East and Africa Dairy Products Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Dairy Products Packaging Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dairy Products Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 5: Global Dairy Products Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Dairy Products Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Dairy Products Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Dairy Products Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Dairy Products Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Dairy Products Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 17: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 19: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 21: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 23: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 25: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 26: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 27: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 29: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 31: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Dairy Products Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 33: Global Dairy Products Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Dairy Products Packaging Industry Revenue Million Forecast, by Package Type 2019 & 2032

- Table 35: Global Dairy Products Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dairy Products Packaging Industry?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Dairy Products Packaging Industry?

Key companies in the market include Consolidated Container Company LLC, Stora Enso Oyj, Ball Corporation, Greiner Packaging international Gmb, Berry Global Group Inc, Huhtamaki Group, Winpak Ltd, Amcor PLC, International Paper Company, Sealed Air Corporation, Saudi Basic Industries Corporation.

3. What are the main segments of the Dairy Products Packaging Industry?

The market segments include Material, Product, Package Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference Towards Protein-based Products; Increasing Adoption of Packages Incorporating Small Portion Size.

6. What are the notable trends driving market growth?

Milk Occupies the Largest Market Share.

7. Are there any restraints impacting market growth?

; Greenhouse Gas Emission due to Dairy Activities Leading to Legislative Issues.

8. Can you provide examples of recent developments in the market?

September 2021 - Greiner Packaging announced Emmi CAFFÈ LATTE, Europe's leading ready-to-drink iced coffee brand, will start incorporating its new chemically recycled polypropylene into packaging. Greiner Packaging makes these cups from chemically recycled material that comes from Borealis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dairy Products Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dairy Products Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dairy Products Packaging Industry?

To stay informed about further developments, trends, and reports in the Dairy Products Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence