Key Insights

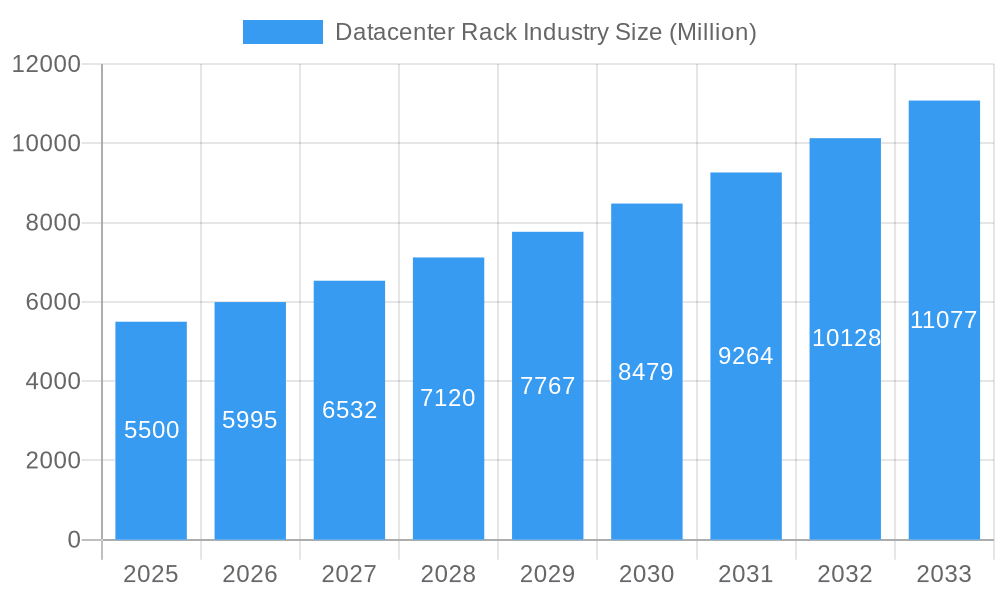

The global datacenter rack market is projected for significant expansion, with an estimated market size of $2.93 billion by 2025 and a projected Compound Annual Growth Rate (CAGR) of 10.9% through 2033. This growth is driven by the increasing demand for robust IT infrastructure due to the exponential rise in data generation and consumption across industries. Key catalysts include the widespread adoption of cloud computing, the growth of Big Data analytics, and the expansion of the Internet of Things (IoT), all of which require scalable datacenter solutions. Digital transformation initiatives in sectors like BFSI, IT & Telecom, and Manufacturing are creating substantial opportunities for datacenter rack providers. The market is also influenced by the focus on energy efficiency and advanced cooling systems, driving demand for innovative rack designs. Market segmentation includes Rack Units (Small, Medium, Large) and End-user Industries, catering to diverse application needs from small deployments to hyperscale datacenters.

Datacenter Rack Industry Market Size (In Billion)

The competitive landscape features established leaders such as Vertiv Group Corporation, Schneider Electric SE, and Rittal GmbH & Co KG, alongside emerging innovators. These companies are competing through advanced features like modularity, enhanced security, and superior thermal management. Investments in datacenter construction and upgrades, particularly in rapidly growing digital economies like North America and Asia Pacific, will further fuel market expansion. Potential challenges include high initial investment costs for advanced rack technologies and the increasing complexity of datacenter management. However, the overarching trend towards data-intensive applications and the critical need for reliable data storage and processing infrastructure ensure a sustained positive outlook for the datacenter rack market. Continuous technological advancements, including AI and machine learning, will necessitate more powerful and denser datacenter environments, underpinning the enduring demand for specialized datacenter racks.

Datacenter Rack Industry Company Market Share

This comprehensive Datacenter Rack Industry report provides an in-depth analysis of the global market, offering crucial insights for stakeholders. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study details market structure, dynamics, dominant regions, product innovations, key drivers, challenges, emerging opportunities, and leading players. Leverage high-ranking keywords and actionable data to inform your strategic decisions and gain a competitive edge in this dynamic market.

Datacenter Rack Industry Market Structure & Innovation Trends

The datacenter rack industry is characterized by a moderately consolidated market structure, with a few major players holding significant market share. Innovation is a key driver, fueled by the increasing demand for high-density computing, efficient cooling solutions, and robust power management within racks. Regulatory frameworks, particularly those concerning data security, energy efficiency, and environmental impact, are increasingly influencing product development and market entry. Product substitutes, while limited in the core rack functionality, can include specialized cabinets or modular solutions that offer integrated power and cooling. End-user demographics are diverse, spanning from large enterprises to small and medium-sized businesses, with a growing focus on edge computing deployments. Mergers and acquisitions (M&A) activities are prevalent as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A deals in the broader IT infrastructure space have seen valuations in the hundreds of millions, signaling consolidation and strategic growth. The market share of leading companies is estimated to be in the billions, with key players actively vying for dominance.

Datacenter Rack Industry Market Dynamics & Trends

The global datacenter rack industry is experiencing robust growth, driven by an insatiable demand for digital infrastructure to support an ever-expanding digital economy. This growth is propelled by several interconnected factors. The proliferation of cloud computing services continues to necessitate the expansion of hyperscale and enterprise data centers, each requiring a significant number of high-performance racks. The surge in data generation from diverse sources, including the Internet of Things (IoT), big data analytics, and artificial intelligence (AI), further intensifies the need for scalable and efficient data storage and processing capabilities, directly translating into increased demand for datacenter racks.

Technological disruptions are actively reshaping the market. Advances in cooling technologies, such as liquid cooling and immersion cooling, are becoming integral to rack design, enabling higher power densities and improved energy efficiency. This is crucial as computing hardware becomes more powerful and generates more heat. Furthermore, the evolution of intelligent racks with integrated power distribution units (PDUs), remote monitoring capabilities, and sophisticated management software is enhancing operational efficiency and reducing downtime. The trend towards edge computing, driven by the need for low latency and localized data processing for applications like autonomous vehicles and smart cities, is creating new market segments for smaller, more modular rack solutions deployed closer to the end-users.

Consumer preferences are shifting towards solutions that offer greater flexibility, scalability, and sustainability. Businesses are increasingly looking for datacenter racks that can adapt to evolving IT needs, support a mix of hardware, and contribute to their environmental, social, and governance (ESG) goals. This includes a focus on energy-efficient designs and materials. The competitive dynamics within the industry are intense, with established players continuously innovating and new entrants emerging, particularly in specialized areas like edge rack solutions. Strategic partnerships and collaborations, as seen with Schneider Electric's ventures into edge computing, are becoming crucial for market players to offer comprehensive solutions and maintain a competitive edge. The market penetration of advanced datacenter rack technologies is steadily increasing, with the Compound Annual Growth Rate (CAGR) projected to remain strong in the double digits over the forecast period, potentially reaching xx% by 2033.

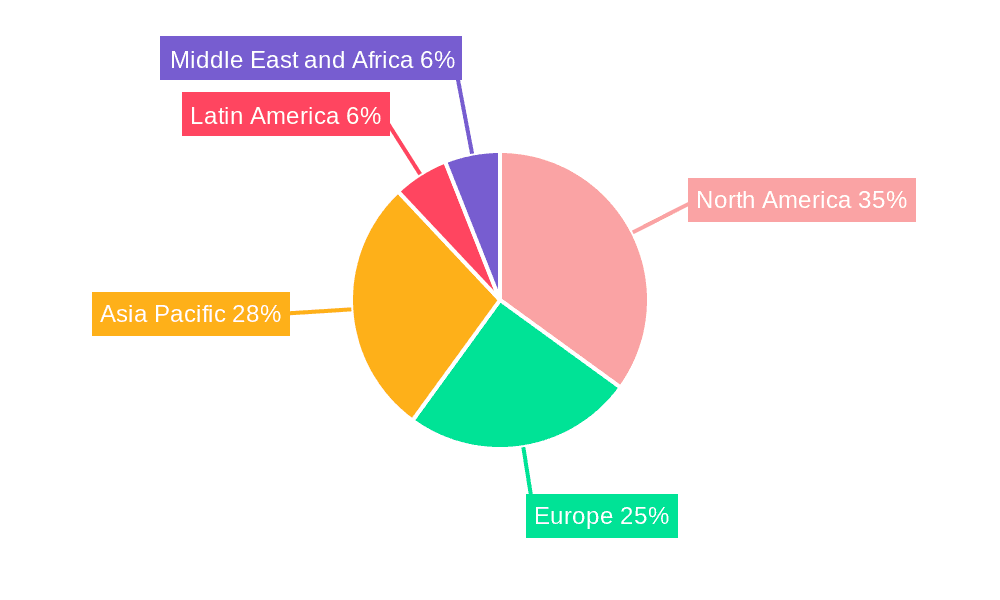

Dominant Regions & Segments in Datacenter Rack Industry

The North American region currently holds a dominant position in the global datacenter rack industry, largely driven by the presence of major technology hubs, extensive hyperscale data center investments, and a strong adoption of advanced IT infrastructure. The United States, in particular, is a key market due to its significant concentration of cloud providers and enterprise data centers, fueling substantial demand for various types of datacenter racks. Economic policies that support technological innovation and digital transformation further bolster this dominance.

Within the Rack Units segmentation, Large datacenter racks represent the largest market share. This is a direct consequence of the expansion of hyperscale data centers operated by cloud service providers and large enterprises. These facilities require extensive deployments of large-capacity racks to house vast amounts of servers, storage, and networking equipment. The demand for these units is driven by the continuous need for scalable infrastructure to support growing data volumes and compute-intensive workloads.

In terms of End-user Industry, the IT and Telecom sector is the most significant contributor to the datacenter rack market. This segment encompasses cloud service providers, internet service providers, telecommunications companies, and enterprise IT departments, all of which are primary consumers of datacenter infrastructure. The rapid evolution of digital services, mobile technologies, and network infrastructure fuels constant upgrades and expansions, leading to sustained demand for datacenter racks. The BFSI (Banking, Financial Services, and Insurance) sector also represents a substantial market due to the critical need for secure, reliable, and high-performance data storage and processing for financial transactions and customer data management.

- Key Drivers for North America's Dominance:

- High concentration of hyperscale data center investments.

- Proactive government initiatives supporting digital infrastructure development.

- Strong presence of leading technology companies and cloud providers.

- Early adoption of advanced cooling and power management technologies.

- Key Drivers for Large Rack Units Dominance:

- Continuous expansion of hyperscale cloud infrastructure.

- Increasing demand for high-density computing solutions.

- Need for scalability to accommodate growing data volumes.

- Key Drivers for IT and Telecom Industry Dominance:

- Explosive growth of cloud services and data consumption.

- Ongoing 5G network deployments and infrastructure upgrades.

- Intense competition driving innovation and capacity expansion.

Datacenter Rack Industry Product Innovations

Product innovations in the datacenter rack industry are increasingly focused on enhancing thermal management, improving power density, and integrating intelligent features. Advancements in liquid cooling solutions, such as direct-to-chip cooling and immersion cooling, are enabling higher power densities within racks, accommodating more powerful hardware. Intelligent racks are incorporating advanced power distribution units (PDUs) with granular monitoring and control capabilities, alongside integrated sensors for environmental monitoring (temperature, humidity, airflow). These innovations offer significant competitive advantages by reducing operational costs, improving energy efficiency, and enhancing data center reliability. The market is seeing a rise in modular and pre-fabricated rack solutions designed for rapid deployment, particularly for edge computing scenarios.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the datacenter rack industry, segmented by Rack Units into Small, Medium, and Large categories. Small racks are critical for micro-data centers and edge deployments, experiencing steady growth driven by IoT and localized processing needs. Medium racks cater to enterprise data centers and colocation facilities, offering a balance of capacity and flexibility with significant market share. Large racks dominate the hyperscale data center segment, characterized by massive deployments and a continuous need for expansion, representing the largest portion of the market.

The industry is further segmented by End-user Industry, including BFSI, IT and Telecom, Manufacturing, Retail, and Other End-user Industries. The IT and Telecom sector leads in market size and growth projections due to the ubiquitous demand for cloud services and network infrastructure. The BFSI sector follows closely, driven by stringent security and performance requirements. Manufacturing is witnessing increased adoption for industrial IoT (IIoT) and automation, while Retail leverages data analytics and e-commerce growth for its infrastructure needs. "Other End-user Industries" encompasses a diverse range of sectors like healthcare, education, and government, each contributing to the overall market expansion.

Key Drivers of Datacenter Rack Industry Growth

The datacenter rack industry is propelled by several synergistic growth drivers. The relentless expansion of cloud computing services is a primary catalyst, necessitating increased data center capacity. The exponential growth in data generation from sources like IoT, big data analytics, and AI demands more robust and scalable infrastructure. Technological advancements, particularly in areas like artificial intelligence and machine learning, require high-density computing, which in turn drives demand for advanced racks with superior cooling and power capabilities. Furthermore, the global push for digital transformation across all industries is accelerating the adoption of data-intensive technologies. Regulatory support for digital infrastructure development in various countries also plays a crucial role.

Challenges in the Datacenter Rack Industry Sector

Despite robust growth, the datacenter rack industry faces significant challenges. Supply chain disruptions, exacerbated by global events, can lead to increased lead times and higher raw material costs for rack components. Rising energy costs and increasing pressure for environmental sustainability necessitate continuous innovation in energy-efficient designs, adding to R&D expenses. Intense price competition among manufacturers, particularly for standard rack solutions, can compress profit margins. Furthermore, the rapid pace of technological obsolescence requires continuous investment in product development to keep pace with evolving hardware and computing demands. Meeting the diverse and stringent requirements of different end-user industries also presents a complex challenge.

Emerging Opportunities in Datacenter Rack Industry

Emerging opportunities in the datacenter rack industry are primarily linked to the growth of edge computing, the demand for sustainable solutions, and the increasing adoption of modular data centers. The decentralization of data processing for applications requiring low latency presents a significant market for smaller, intelligent, and rapidly deployable edge racks. The growing emphasis on sustainability is creating opportunities for racks made from recycled materials, with enhanced energy efficiency features, and designed for circular economy principles. Modular data centers, offering quick scalability and flexibility, are also gaining traction, especially in remote or rapidly developing regions. The integration of advanced AI-powered management systems within racks represents another promising avenue for future growth and value creation.

Leading Players in the Datacenter Rack Industry Market

- Belkin International Inc

- Vertiv Group Corporation

- Dell EMC

- Martin International Enclosures

- Hewlett Packard Enterprise

- Schneider Electric SE

- Rittal GmbH & Co KG

- Legrand SA

- Black Box Corporation

- Kendall Howard LLC

- Oracle Corporation

- Fujitsu Corporation

Key Developments in Datacenter Rack Industry Industry

- October 2022 - NetRack developed the iRack Block to address large-scale requirements, moving towards intelligent infra capsules or modular data centers with self-cooking, self-powered, and self-contained capabilities, contrasting with its smaller iRack solution.

- June 2022 - Schneider Electric partnered with Stratus Technologies and Avnet Integrated to deliver streamlined, zero-touch edge computing, enabling a new wave of industrial innovation in data centers.

Future Outlook for Datacenter Rack Industry Market

The future outlook for the datacenter rack industry is exceptionally positive, driven by a confluence of technological advancements and increasing digital adoption. The ongoing demand for hyperscale cloud infrastructure, coupled with the rapid growth of edge computing deployments, will continue to fuel substantial market expansion. Innovations in thermal management, particularly liquid cooling technologies, are expected to enable higher compute densities, making racks more efficient and cost-effective. The increasing emphasis on sustainability will drive the development and adoption of eco-friendly materials and energy-efficient designs. Furthermore, the integration of AI and advanced analytics into rack management systems will enhance operational efficiency and predictive maintenance, offering significant value to data center operators. Strategic partnerships and acquisitions will likely continue as companies seek to consolidate their market positions and expand their product offerings in this rapidly evolving landscape, presenting significant opportunities for growth and innovation for all stakeholders.

Datacenter Rack Industry Segmentation

-

1. Rack Units

- 1.1. Small

- 1.2. Medium

- 1.3. Large

-

2. End-user Industry

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Manufacturing

- 2.4. Retail

- 2.5. Other End-user Industries

Datacenter Rack Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Datacenter Rack Industry Regional Market Share

Geographic Coverage of Datacenter Rack Industry

Datacenter Rack Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share

- 3.3. Market Restrains

- 3.3.1. Increasing Utilization of Blade Servers

- 3.4. Market Trends

- 3.4.1. BFSI Sector Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rack Units

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Manufacturing

- 5.2.4. Retail

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Rack Units

- 6. North America Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Rack Units

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. BFSI

- 6.2.2. IT and Telecom

- 6.2.3. Manufacturing

- 6.2.4. Retail

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Rack Units

- 7. Europe Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Rack Units

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. BFSI

- 7.2.2. IT and Telecom

- 7.2.3. Manufacturing

- 7.2.4. Retail

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Rack Units

- 8. Asia Pacific Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Rack Units

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. BFSI

- 8.2.2. IT and Telecom

- 8.2.3. Manufacturing

- 8.2.4. Retail

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Rack Units

- 9. Latin America Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Rack Units

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. BFSI

- 9.2.2. IT and Telecom

- 9.2.3. Manufacturing

- 9.2.4. Retail

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Rack Units

- 10. Middle East and Africa Datacenter Rack Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Rack Units

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. BFSI

- 10.2.2. IT and Telecom

- 10.2.3. Manufacturing

- 10.2.4. Retail

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Rack Units

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Belkin International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vertiv Group Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dell EMC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Martin International Enclosures

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hewlett Packard Enterprise

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rittal GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Legrand SA*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Black Box Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kendall Howard LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fujitsu Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Belkin International Inc

List of Figures

- Figure 1: Global Datacenter Rack Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Datacenter Rack Industry Revenue (billion), by Rack Units 2025 & 2033

- Figure 3: North America Datacenter Rack Industry Revenue Share (%), by Rack Units 2025 & 2033

- Figure 4: North America Datacenter Rack Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Datacenter Rack Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Datacenter Rack Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Datacenter Rack Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Datacenter Rack Industry Revenue (billion), by Rack Units 2025 & 2033

- Figure 9: Europe Datacenter Rack Industry Revenue Share (%), by Rack Units 2025 & 2033

- Figure 10: Europe Datacenter Rack Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Datacenter Rack Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Datacenter Rack Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Datacenter Rack Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Datacenter Rack Industry Revenue (billion), by Rack Units 2025 & 2033

- Figure 15: Asia Pacific Datacenter Rack Industry Revenue Share (%), by Rack Units 2025 & 2033

- Figure 16: Asia Pacific Datacenter Rack Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Datacenter Rack Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Datacenter Rack Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Datacenter Rack Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Datacenter Rack Industry Revenue (billion), by Rack Units 2025 & 2033

- Figure 21: Latin America Datacenter Rack Industry Revenue Share (%), by Rack Units 2025 & 2033

- Figure 22: Latin America Datacenter Rack Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Datacenter Rack Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Datacenter Rack Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Datacenter Rack Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Datacenter Rack Industry Revenue (billion), by Rack Units 2025 & 2033

- Figure 27: Middle East and Africa Datacenter Rack Industry Revenue Share (%), by Rack Units 2025 & 2033

- Figure 28: Middle East and Africa Datacenter Rack Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Datacenter Rack Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Datacenter Rack Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Datacenter Rack Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 2: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Datacenter Rack Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 5: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Datacenter Rack Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 8: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Datacenter Rack Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 11: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Datacenter Rack Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 14: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Datacenter Rack Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Datacenter Rack Industry Revenue billion Forecast, by Rack Units 2020 & 2033

- Table 17: Global Datacenter Rack Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Datacenter Rack Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Datacenter Rack Industry?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Datacenter Rack Industry?

Key companies in the market include Belkin International Inc, Vertiv Group Corporation, Dell EMC, Martin International Enclosures, Hewlett Packard Enterprise, Schneider Electric SE, Rittal GmbH & Co KG, Legrand SA*List Not Exhaustive, Black Box Corporation, Kendall Howard LLC, Oracle Corporation, Fujitsu Corporation.

3. What are the main segments of the Datacenter Rack Industry?

The market segments include Rack Units, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share.

6. What are the notable trends driving market growth?

BFSI Sector Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Increasing Utilization of Blade Servers.

8. Can you provide examples of recent developments in the market?

October 2022 - In contrast to the smaller installations provided by the iRack solution, NetRack created iRack Block to cater to large requirements primarily. The rack is a step toward intelligent infra capsules or modular data centers because it includes self-cooking, self-powered, and self-contained capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Datacenter Rack Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Datacenter Rack Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Datacenter Rack Industry?

To stay informed about further developments, trends, and reports in the Datacenter Rack Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence