Key Insights

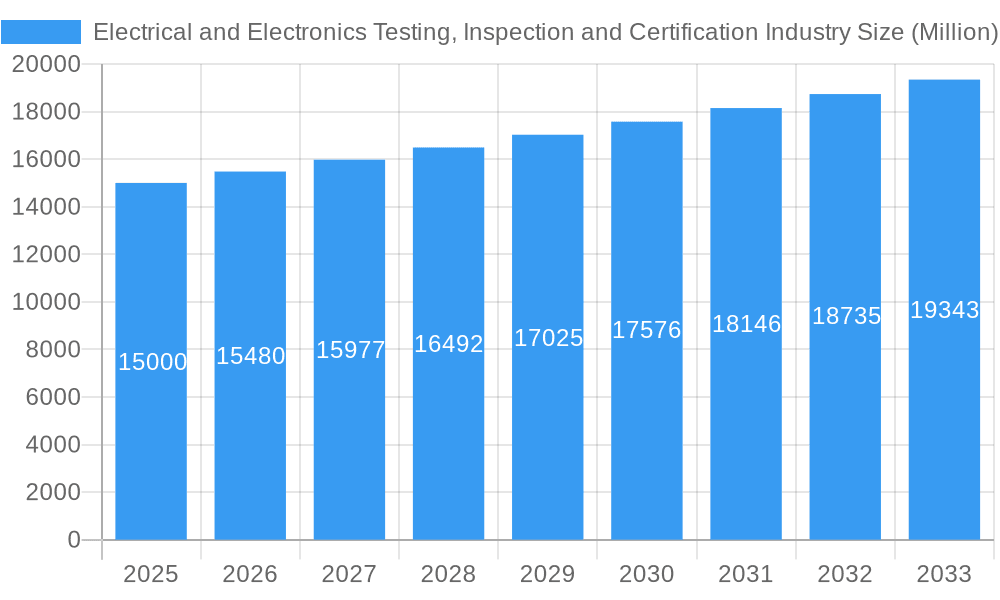

The Electrical and Electronics Testing, Inspection, and Certification (E&E T&I&C) industry is experiencing steady growth, driven by increasing regulatory compliance needs, heightened consumer safety concerns, and the rapid expansion of electronics in diverse sectors. The market, currently valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of 3.20% and a plausible initial market size), is projected to maintain a Compound Annual Growth Rate (CAGR) of around 3.20% through 2033. This growth is fueled by several key factors. The proliferation of sophisticated electronic devices across various industries, from consumer electronics to automotive and healthcare, necessitates rigorous testing and certification to ensure quality, safety, and compliance with global standards. Furthermore, the increasing focus on sustainability and environmental regulations is driving demand for environmentally compliant testing and certifications. The growing adoption of IoT devices and the rise of electric vehicles are also significant contributors to market expansion. The industry is segmented by sourcing type (in-house vs. outsourced) and end-user vertical, with construction & engineering, chemicals, food & healthcare, energy & commodities, transportation, products & retail, and industrial sectors being prominent consumers of E&E T&I&C services. Outsourcing is expected to maintain its dominant share due to cost-effectiveness and access to specialized expertise. Geographic distribution shows North America and Europe currently holding significant market shares; however, the Asia-Pacific region, especially China and India, exhibits substantial growth potential driven by robust manufacturing and increasing electronics adoption.

Electrical and Electronics Testing, Inspection and Certification Industry Market Size (In Billion)

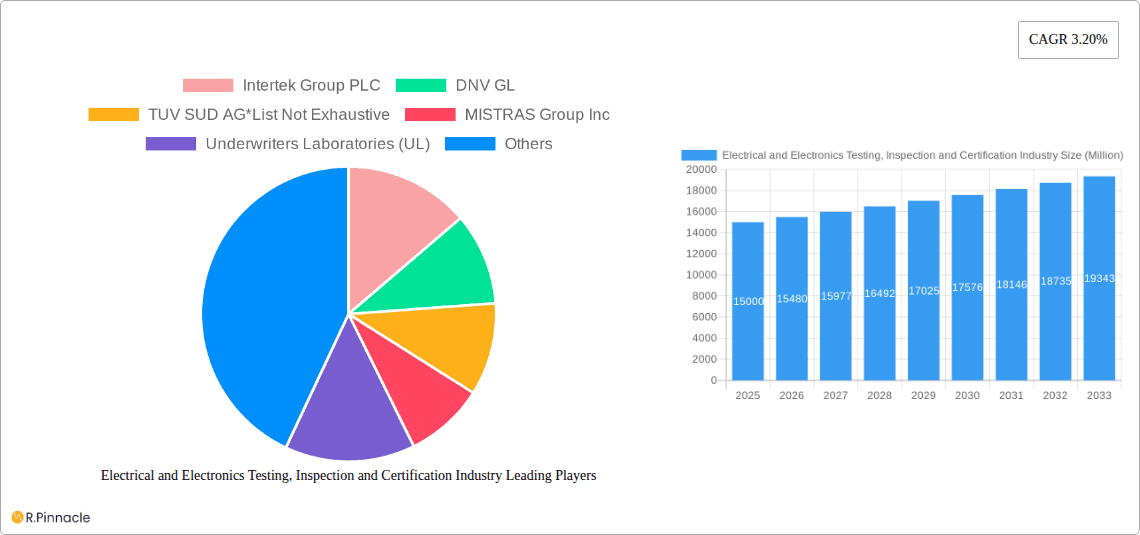

Competition within the E&E T&I&C industry is intense, with numerous multinational companies and specialized firms vying for market share. Established players like Intertek, DNV GL, TÜV SÜD, UL, and SGS hold significant market positions, leveraging their global network, accreditation, and established reputation. However, smaller, specialized firms are emerging, focusing on niche technologies and providing customized solutions. Challenges include maintaining consistency across global standards and regulations, adapting to rapid technological advancements in electronics, and managing cybersecurity risks associated with the increasing digitalization of testing processes. Successfully navigating these challenges will be crucial for companies to maintain their competitive edge and capitalize on the continued growth opportunities within this dynamic market.

Electrical and Electronics Testing, Inspection and Certification Industry Company Market Share

Electrical and Electronics Testing, Inspection, and Certification Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Electrical and Electronics Testing, Inspection, and Certification industry, offering invaluable insights for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report projects a market exceeding $XX Million by 2033, driven by robust growth across diverse segments.

Electrical and Electronics Testing, Inspection and Certification Industry Market Structure & Innovation Trends

The Electrical and Electronics Testing, Inspection, and Certification market is characterized by a moderately concentrated structure. Key players such as Intertek Group PLC, DNV GL, TÜV SÜD AG, MISTRAS Group Inc, Underwriters Laboratories (UL), BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, and Exova Group PLC hold significant market share, though the exact distribution remains dynamic. Recent years have witnessed several mergers and acquisitions (M&A), with deal values exceeding $XX Million in aggregate between 2019 and 2024, reflecting industry consolidation and expansion strategies. Market share data for individual companies is unavailable at this time and has been set to XX.

Innovation is driven by stringent regulatory requirements for product safety and performance, increasing demand for advanced testing technologies, and the need for efficient quality control procedures across diverse industries. The adoption of automation, AI, and IoT-enabled solutions is reshaping the industry landscape, enhancing efficiency and accuracy in testing processes. Product substitutes are limited, as compliance with safety and regulatory standards remains paramount, reinforcing the importance of this industry. End-user demographics are diverse and span various sectors, from construction and engineering to healthcare and transportation, influencing the demand for specific testing services.

Electrical and Electronics Testing, Inspection and Certification Industry Market Dynamics & Trends

The Electrical and Electronics Testing, Inspection, and Certification market is experiencing robust growth, driven by several key factors. The rising adoption of advanced technologies, such as renewable energy sources and electric vehicles (EVs), necessitates rigorous testing and certification. Furthermore, increasing globalization and stringent product regulations worldwide are contributing to market expansion. Technological disruptions are evident in the form of AI-powered testing systems, automated inspection robots, and advanced data analytics, enabling faster and more efficient processes. Consumer preferences for high-quality, safe, and reliable products are reinforcing the demand for comprehensive testing services.

The competitive dynamics are shaped by industry consolidation, with major players focused on expanding their geographical reach and service offerings. The market is expected to register a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration is increasing across emerging economies, driven by rising infrastructure investments and industrialization.

Dominant Regions & Segments in Electrical and Electronics Testing, Inspection and Certification Industry

The North American region currently holds a dominant position in the Electrical and Electronics Testing, Inspection, and Certification market, fueled by robust economic activity, a strong focus on product safety standards, and significant investments in infrastructure development. However, the Asia-Pacific region exhibits substantial growth potential, particularly in countries such as China and India, due to rapid industrialization, rising manufacturing activity, and favorable government policies promoting product quality and safety. Europe maintains a strong presence and its markets are relatively mature.

Key Drivers for Regional Dominance:

- North America: Stringent regulatory environment, high consumer awareness of product safety, advanced testing infrastructure.

- Asia-Pacific: Rapid industrialization, increasing manufacturing activity, rising disposable incomes.

- Europe: Well-established regulatory framework, focus on sustainable development, strong presence of leading testing companies.

Segment Dominance (By Sourcing Type): The outsourced segment currently holds a larger market share compared to the in-house segment. This preference for outsourcing is primarily driven by cost-effectiveness, access to specialized expertise, and improved operational efficiency.

Segment Dominance (By End-user Vertical): The construction and engineering sector accounts for a significant portion of the market due to stringent construction codes and building regulations. This sector is followed by the Energy and Commodities segment.

Electrical and Electronics Testing, Inspection and Certification Industry Product Innovations

Recent product innovations include the development of advanced testing equipment using AI and machine learning for improved accuracy and efficiency. Wireless and IoT-enabled devices, remote monitoring solutions, and data analytics platforms are streamlining processes and enhancing real-time insights. These advancements address the growing demands for faster turnaround times, reduced costs, and enhanced data security. The competitive advantage lies in offering comprehensive and integrated solutions, encompassing testing, inspection, and certification services.

Report Scope & Segmentation Analysis

By Sourcing Type: The report analyzes the market size and growth projections for both in-house and outsourced testing services, outlining the competitive dynamics and influencing factors within each segment.

By End-user Vertical: The report provides detailed segmentation analysis for Construction and Engineering, Chemicals, Food and Healthcare, Energy and Commodities, Transportation, Products and Retail, Industrial, and Other End-user Verticals, including market size estimations and growth projections for each. Competitive landscapes vary significantly across these verticals, reflecting differing regulatory demands and technological needs.

Key Drivers of Electrical and Electronics Testing, Inspection and Certification Industry Growth

Several factors contribute to the industry's growth. Stringent global regulations for product safety and performance are driving demand for testing services. The growing adoption of advanced technologies like electric vehicles and renewable energy necessitates rigorous testing and certification. Increased focus on product quality and reliability by consumers is further fueling market expansion.

Challenges in the Electrical and Electronics Testing, Inspection and Certification Industry Sector

The industry faces challenges, including the high costs of advanced testing equipment and maintaining skilled personnel. Navigating complex and evolving regulatory landscapes across different geographical regions presents logistical hurdles. Intense competition from established players and new entrants also adds pressure on profit margins.

Emerging Opportunities in Electrical and Electronics Testing, Inspection and Certification Industry

Emerging opportunities exist in developing economies with rapid infrastructure development. The growing adoption of IoT devices and connected systems will increase demand for cybersecurity testing and compliance services. There is also potential growth in specialized testing services for emerging technologies like AI and 5G.

Leading Players in the Electrical and Electronics Testing, Inspection and Certification Industry Market

- Intertek Group PLC

- DNV GL

- TÜV SÜD AG

- MISTRAS Group Inc

- Underwriters Laboratories (UL)

- BSI Group

- SAI Global Limited

- Dekra Certification GmbH

- SGS SA

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- Exova Group PLC

Key Developments in Electrical and Electronics Testing, Inspection and Certification Industry Industry

- 2023-Q4: Intertek Group PLC announced the acquisition of a specialized testing facility in Germany.

- 2022-Q3: TÜV SÜD AG launched a new AI-powered testing platform for autonomous vehicles.

- Further key developments will be detailed in the full report.

Future Outlook for Electrical and Electronics Testing, Inspection and Certification Industry Market

The Electrical and Electronics Testing, Inspection, and Certification market is poised for continued growth, driven by technological advancements, increasing regulatory scrutiny, and heightened consumer demand for quality and safety. Strategic partnerships, acquisitions, and the expansion into new geographical markets will be crucial for maintaining a competitive edge. The development and adoption of innovative testing methods will be paramount for future success.

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation

-

1. Sourcing Type

- 1.1. In-house

- 1.2. Outsourced

-

2. End-user Vertical

- 2.1. Construction and Engineering

- 2.2. Chemicals

- 2.3. Food and Healthcare

- 2.4. Energy and Commodities

- 2.5. Transportation

- 2.6. Products and Retail

- 2.7. Industrial

- 2.8. Other End-user Vertical

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Electrical and Electronics Testing, Inspection and Certification Industry Regional Market Share

Geographic Coverage of Electrical and Electronics Testing, Inspection and Certification Industry

Electrical and Electronics Testing, Inspection and Certification Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products

- 3.3. Market Restrains

- 3.3.1. ; Trade Wars and Growth Fluctuations of End-user Industries

- 3.4. Market Trends

- 3.4.1. Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction and Engineering

- 5.2.2. Chemicals

- 5.2.3. Food and Healthcare

- 5.2.4. Energy and Commodities

- 5.2.5. Transportation

- 5.2.6. Products and Retail

- 5.2.7. Industrial

- 5.2.8. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. North America Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.1.1. In-house

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Construction and Engineering

- 6.2.2. Chemicals

- 6.2.3. Food and Healthcare

- 6.2.4. Energy and Commodities

- 6.2.5. Transportation

- 6.2.6. Products and Retail

- 6.2.7. Industrial

- 6.2.8. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7. Europe Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.1.1. In-house

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Construction and Engineering

- 7.2.2. Chemicals

- 7.2.3. Food and Healthcare

- 7.2.4. Energy and Commodities

- 7.2.5. Transportation

- 7.2.6. Products and Retail

- 7.2.7. Industrial

- 7.2.8. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8. Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.1.1. In-house

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Construction and Engineering

- 8.2.2. Chemicals

- 8.2.3. Food and Healthcare

- 8.2.4. Energy and Commodities

- 8.2.5. Transportation

- 8.2.6. Products and Retail

- 8.2.7. Industrial

- 8.2.8. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9. Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.1.1. In-house

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Construction and Engineering

- 9.2.2. Chemicals

- 9.2.3. Food and Healthcare

- 9.2.4. Energy and Commodities

- 9.2.5. Transportation

- 9.2.6. Products and Retail

- 9.2.7. Industrial

- 9.2.8. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DNV GL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TUV SUD AG*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MISTRAS Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Underwriters Laboratories (UL)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BSI Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SAI Global Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dekra Certification GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SGS SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ALS Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bureau Veritas SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eurofins Scientific SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Exova Group PLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 3: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 4: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 9: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 10: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 15: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 16: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 21: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 22: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 10: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: UK Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 17: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 25: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 26: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrical and Electronics Testing, Inspection and Certification Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Electrical and Electronics Testing, Inspection and Certification Industry?

Key companies in the market include Intertek Group PLC, DNV GL, TUV SUD AG*List Not Exhaustive, MISTRAS Group Inc, Underwriters Laboratories (UL), BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, Exova Group PLC.

3. What are the main segments of the Electrical and Electronics Testing, Inspection and Certification Industry?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products.

6. What are the notable trends driving market growth?

Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Trade Wars and Growth Fluctuations of End-user Industries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrical and Electronics Testing, Inspection and Certification Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrical and Electronics Testing, Inspection and Certification Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrical and Electronics Testing, Inspection and Certification Industry?

To stay informed about further developments, trends, and reports in the Electrical and Electronics Testing, Inspection and Certification Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence