Key Insights

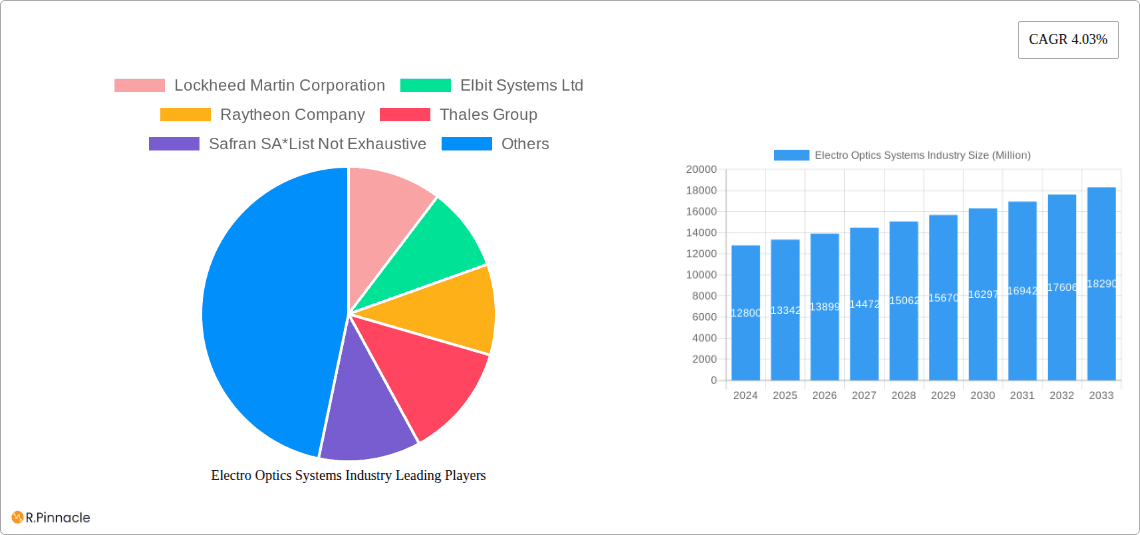

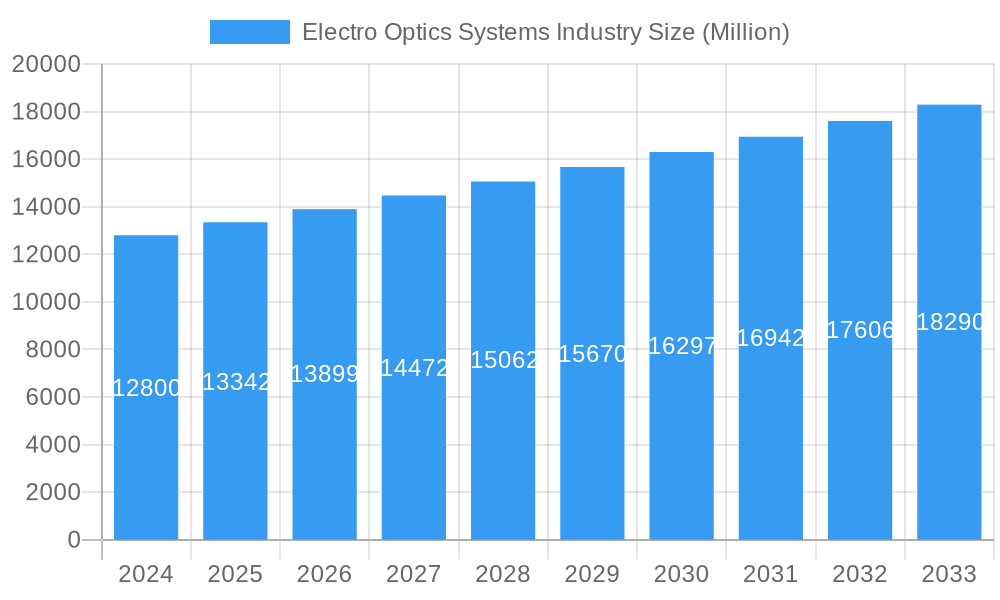

The Electro-Optics Systems industry is poised for significant expansion, driven by escalating defense expenditures and advancements in aerospace technology. In 2024, the global market for electro-optics systems is valued at $12.8 billion, with a projected Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This robust growth is fueled by critical applications in defense, aerospace, and homeland security, where sophisticated electro-optical solutions are indispensable for surveillance, targeting, reconnaissance, and situational awareness. The increasing demand for enhanced imaging capabilities, from infrared and thermal sensors to advanced laser systems, underscores the industry's pivotal role in modern security and defense infrastructures. Furthermore, the integration of artificial intelligence and machine learning with electro-optic systems is creating new avenues for data analysis and threat detection, further stimulating market demand.

Electro Optics Systems Industry Market Size (In Billion)

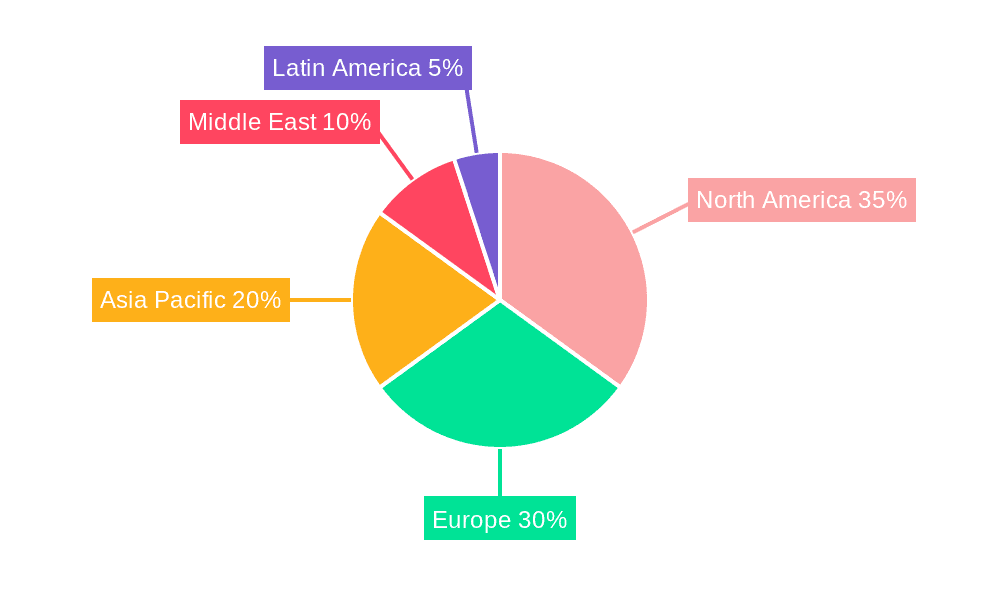

The market is characterized by a diverse range of applications, spanning air-based, land-based, and naval platforms, catering to the complex operational needs of defense forces and civil aviation. Key players such as Lockheed Martin Corporation, Elbit Systems Ltd, and Raytheon Company are at the forefront of innovation, investing heavily in research and development to introduce next-generation electro-optic solutions. While the market benefits from strong government support and technological progress, it also faces certain restraints. These include stringent regulatory frameworks, high research and development costs, and the long product development cycles inherent in defense-related industries. Geographically, North America and Europe are expected to remain dominant markets due to substantial defense budgets and a strong presence of leading industry players. However, the Asia Pacific region is emerging as a significant growth frontier, driven by increasing defense modernization efforts and rising geopolitical tensions.

Electro Optics Systems Industry Company Market Share

Unlock critical insights into the rapidly evolving Electro Optics Systems industry with this in-depth market report. Spanning from 2019 to 2033, this research provides an indispensable tool for strategists, investors, and decision-makers aiming to capitalize on growth opportunities and navigate market complexities. Featuring data from the base year 2025 and a detailed forecast period of 2025-2033, this report offers a granular view of market dynamics, technological advancements, and competitive landscapes.

Gain a strategic advantage by understanding the key market drivers, challenges, and emerging opportunities within this high-growth sector. Analyze the contributions of leading players and their pivotal developments, all presented with actionable insights and robust market segmentation.

Electro Optics Systems Industry Market Structure & Innovation Trends

The Electro Optics Systems industry exhibits a moderately concentrated market structure, with a few key players dominating significant market share, estimated at over 70% collectively for top 5 entities. Innovation is a primary driver, fueled by advancements in sensor technology, artificial intelligence integration, and miniaturization. Regulatory frameworks, particularly within defense and homeland security, play a crucial role in shaping market access and product development. The emergence of advanced imaging capabilities and predictive analytics presents both opportunities and challenges related to data security and ethical considerations. Product substitutes, while evolving, currently face limitations in replicating the comprehensive performance of sophisticated electro-optical systems. End-user demographics are increasingly sophisticated, demanding higher precision, real-time data processing, and enhanced situational awareness. Mergers and acquisitions (M&A) activity is prevalent, with notable deals valued in the billions of dollars, indicating consolidation and strategic expansion. For instance, recent M&A activities have involved entities seeking to bolster their sensor fusion capabilities and expand their product portfolios, contributing to a dynamic competitive environment.

Electro Optics Systems Industry Market Dynamics & Trends

The Electro Optics Systems industry is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period of 2025–2033. This expansion is primarily propelled by escalating global security concerns, the increasing adoption of advanced surveillance and reconnaissance technologies across defense and homeland security sectors, and the relentless pursuit of enhanced situational awareness in aerospace applications. Technological disruptions, particularly in the realm of uncooled infrared detectors, artificial intelligence-driven image processing, and miniaturized optical components, are fundamentally reshaping the industry's landscape. These innovations are not only improving the performance and reducing the cost of electro-optical systems but also enabling new applications in areas such as autonomous vehicles and advanced medical imaging, thereby expanding market penetration beyond traditional defense and aerospace domains.

Consumer preferences are shifting towards more integrated, intelligent, and cost-effective solutions. End-users are demanding systems that offer superior resolution, extended detection ranges, and seamless data integration with existing command and control infrastructures. This evolving demand is compelling manufacturers to invest heavily in research and development to produce sophisticated systems capable of real-time threat detection, target identification, and advanced analytics. The competitive dynamics within the industry are intensifying, characterized by a race to innovate and secure market share through product differentiation and strategic partnerships. Companies are increasingly focusing on developing specialized electro-optical solutions tailored to specific application requirements, from advanced targeting pods for fighter jets to compact surveillance cameras for unmanned aerial vehicles. The global market penetration of electro-optical systems is steadily increasing, driven by both the modernization of existing infrastructure and the deployment of new technologies in emerging markets. The ongoing digital transformation across various sectors is further accentuating the need for robust electro-optical capabilities, solidifying the industry's growth trajectory.

Dominant Regions & Segments in Electro Optics Systems Industry

The North America region stands as the dominant force in the global Electro Optics Systems industry, primarily driven by the United States' substantial defense spending, a robust aerospace sector, and significant investments in homeland security initiatives. Economic policies that prioritize national security and technological advancement, coupled with extensive infrastructure for research, development, and manufacturing, contribute to its leading position.

- Key Drivers in North America:

- High Defense Budgets: Continuous modernization programs and the development of next-generation military hardware necessitate advanced electro-optical systems.

- Technological Innovation Hubs: Proximity to leading research institutions and technology companies fosters rapid innovation and adoption of cutting-edge solutions.

- Homeland Security Focus: Post-9/11 emphasis on border security, critical infrastructure protection, and counter-terrorism drives demand for surveillance and detection technologies.

- Strong Aerospace Industry: The presence of major aerospace manufacturers fuels demand for electro-optical systems in commercial aviation, satellite technology, and unmanned aerial vehicles.

Within North America, the Defense end-user segment commands the largest market share, accounting for an estimated 60% of the regional market value. This dominance is attributed to the widespread deployment of electro-optical systems in fighter jets, naval vessels, ground combat vehicles, and surveillance platforms. The Air Based application platform is also a significant contributor, driven by the demand for advanced targeting pods, infrared search and track (IRST) systems, and electro-optical/infrared (EO/IR) sensors for reconnaissance and surveillance aircraft and drones. The constant evolution of aerial warfare tactics and the increasing reliance on unmanned systems further bolster this segment's growth. The Homeland Security segment is experiencing robust growth, fueled by the need for advanced border surveillance, public safety monitoring, and threat detection technologies, particularly in urban environments.

Electro Optics Systems Industry Product Innovations

Product innovation in the Electro Optics Systems industry is characterized by miniaturization, increased resolution, and enhanced spectral capabilities. Companies are developing advanced infrared detectors, high-performance imaging sensors, and integrated optical systems for a wider range of applications. These innovations provide competitive advantages by enabling smaller, lighter, and more powerful systems with superior detection and identification abilities. The market fit for these products is expanding beyond traditional defense and aerospace into emerging areas like autonomous systems, industrial inspection, and medical diagnostics, driven by evolving technological trends.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Electro Optics Systems industry across key segmentation criteria.

Application Platform:

- Air Based: This segment includes systems integrated into aircraft, drones, and satellites for surveillance, targeting, and reconnaissance. Growth projections are robust due to the increasing deployment of UAVs and advanced aerial platforms, with market sizes expected to reach billions.

- Land Based: Encompassing systems for ground vehicles, infantry equipment, and fixed installations, this segment is driven by the need for battlefield awareness and perimeter security. Market sizes are substantial and projected for steady growth.

- Naval Based: This segment covers electro-optical systems for ships, submarines, and maritime surveillance, crucial for naval defense and reconnaissance. Significant market sizes are projected, supported by naval modernization efforts.

End User:

- Defense: The largest segment, driven by military modernization programs and global security imperatives. This segment projects significant market sizes and sustained growth.

- Aerospace: Including commercial aviation and space applications, this segment is influenced by advancements in aircraft technology and satellite development. Market sizes are substantial with moderate growth expectations.

- Homeland Security: This segment is experiencing rapid growth due to increased government spending on public safety, border control, and counter-terrorism. Market sizes are expanding significantly.

Key Drivers of Electro Optics Systems Industry Growth

The growth of the Electro Optics Systems industry is propelled by several key factors:

- Technological Advancements: Innovations in sensor technology, AI integration, and miniaturization enable more sophisticated and versatile systems.

- Rising Defense Expenditure: Increased geopolitical tensions and modernization efforts by governments worldwide are driving demand for advanced electro-optical solutions.

- Homeland Security Needs: Growing concerns over terrorism, border security, and public safety necessitate enhanced surveillance and detection capabilities.

- Growth in Unmanned Systems: The proliferation of drones and autonomous vehicles across defense, commercial, and civilian applications requires integrated electro-optical payloads.

- Aerospace Industry Expansion: Advancements in aircraft and satellite technology, coupled with the rise of space exploration, create sustained demand for optical systems.

Challenges in the Electro Optics Systems Industry Sector

The Electro Optics Systems industry faces several challenges that can impact its growth trajectory. Regulatory hurdles, particularly concerning export controls and standardization, can slow down market entry and product adoption. Supply chain disruptions, exacerbated by global events, can lead to increased costs and production delays. Intense competitive pressures, especially from emerging market players offering lower-cost alternatives, necessitate continuous innovation and cost optimization. Furthermore, the high cost of research and development for cutting-edge technologies can be a significant barrier for smaller companies. The need for skilled personnel in specialized fields like photonics and AI also presents a recruitment and retention challenge.

Emerging Opportunities in Electro Optics Systems Industry

Emerging opportunities within the Electro Optics Systems industry are vast and diverse. The increasing demand for advanced sensors in the burgeoning autonomous vehicle market presents a significant growth avenue. Furthermore, the expansion of the space economy, including satellite constellations for communication and earth observation, is creating new frontiers for electro-optical technologies. The application of AI and machine learning to analyze electro-optical data is unlocking new possibilities in predictive maintenance, anomaly detection, and intelligent surveillance. Advancements in spectral imaging are opening up opportunities in agriculture, environmental monitoring, and medical diagnostics. The growing focus on smart cities and critical infrastructure protection also presents a substantial market for integrated electro-optical surveillance and security systems.

Leading Players in the Electro Optics Systems Industry Market

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Raytheon Company

- Thales Group

- Safran SA

- Leonardo DRS

- BAE Systems plc

- Northrop Grumman Corporation

- FLIR Systems

- L-3 Technologies

Key Developments in Electro Optics Systems Industry Industry

- 2023/10: Company X launched a new generation of compact, high-resolution infrared cameras, enhancing drone surveillance capabilities.

- 2023/08: Major merger between Company Y and Company Z to form a leading provider of integrated photonic solutions for defense applications.

- 2023/05: Introduction of AI-powered target recognition algorithms by Company A, significantly improving the accuracy of electro-optical targeting systems.

- 2023/02: Company B secured a multi-billion dollar contract for advanced sensor systems for next-generation fighter aircraft.

- 2022/11: Development of novel hyperspectral imaging technology by Company C, opening new avenues in remote sensing and industrial inspection.

- 2022/07: Company D announced a breakthrough in uncooled infrared detector technology, promising lower costs and wider adoption.

Future Outlook for Electro Optics Systems Industry Market

The future outlook for the Electro Optics Systems industry is exceptionally bright, driven by persistent global security demands, relentless technological innovation, and expanding application horizons. The continuous integration of artificial intelligence, machine learning, and advanced signal processing will lead to the development of more intelligent and autonomous electro-optical systems. The growing adoption of these systems in commercial sectors, particularly in autonomous driving, smart manufacturing, and advanced medical imaging, will significantly diversify market revenue streams. Strategic investments in research and development, coupled with potential consolidation through M&A, will further shape the competitive landscape, enabling companies to offer comprehensive, end-to-end solutions. The industry is well-positioned for sustained growth, offering substantial opportunities for players who can adapt to evolving technological paradigms and meet the increasing demand for sophisticated optical sensing and imaging capabilities.

Electro Optics Systems Industry Segmentation

-

1. Application Platform

- 1.1. Air Based

- 1.2. Land Based

- 1.3. Naval Based

-

2. End User

- 2.1. Defense

- 2.2. Aerospace

- 2.3. Homeland Security

Electro Optics Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Electro Optics Systems Industry Regional Market Share

Geographic Coverage of Electro Optics Systems Industry

Electro Optics Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Deployment of Electro Optics for Unmanned Vehicles

- 3.3. Market Restrains

- 3.3.1. ; High Implementation Cost and Long-term Return on Investment

- 3.4. Market Trends

- 3.4.1. Defense Segment to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Platform

- 5.1.1. Air Based

- 5.1.2. Land Based

- 5.1.3. Naval Based

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Defense

- 5.2.2. Aerospace

- 5.2.3. Homeland Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application Platform

- 6. North America Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Platform

- 6.1.1. Air Based

- 6.1.2. Land Based

- 6.1.3. Naval Based

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Defense

- 6.2.2. Aerospace

- 6.2.3. Homeland Security

- 6.1. Market Analysis, Insights and Forecast - by Application Platform

- 7. Europe Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Platform

- 7.1.1. Air Based

- 7.1.2. Land Based

- 7.1.3. Naval Based

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Defense

- 7.2.2. Aerospace

- 7.2.3. Homeland Security

- 7.1. Market Analysis, Insights and Forecast - by Application Platform

- 8. Asia Pacific Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Platform

- 8.1.1. Air Based

- 8.1.2. Land Based

- 8.1.3. Naval Based

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Defense

- 8.2.2. Aerospace

- 8.2.3. Homeland Security

- 8.1. Market Analysis, Insights and Forecast - by Application Platform

- 9. Latin America Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Platform

- 9.1.1. Air Based

- 9.1.2. Land Based

- 9.1.3. Naval Based

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Defense

- 9.2.2. Aerospace

- 9.2.3. Homeland Security

- 9.1. Market Analysis, Insights and Forecast - by Application Platform

- 10. Middle East Electro Optics Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Platform

- 10.1.1. Air Based

- 10.1.2. Land Based

- 10.1.3. Naval Based

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Defense

- 10.2.2. Aerospace

- 10.2.3. Homeland Security

- 10.1. Market Analysis, Insights and Forecast - by Application Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lockheed Martin Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elbit Systems Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thales Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safran SA*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leonardo DRS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BAE Systems plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumman Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FLIR Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 L-3 Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global Electro Optics Systems Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electro Optics Systems Industry Revenue (undefined), by Application Platform 2025 & 2033

- Figure 3: North America Electro Optics Systems Industry Revenue Share (%), by Application Platform 2025 & 2033

- Figure 4: North America Electro Optics Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Electro Optics Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Electro Optics Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electro Optics Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electro Optics Systems Industry Revenue (undefined), by Application Platform 2025 & 2033

- Figure 9: Europe Electro Optics Systems Industry Revenue Share (%), by Application Platform 2025 & 2033

- Figure 10: Europe Electro Optics Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Electro Optics Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Electro Optics Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Electro Optics Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electro Optics Systems Industry Revenue (undefined), by Application Platform 2025 & 2033

- Figure 15: Asia Pacific Electro Optics Systems Industry Revenue Share (%), by Application Platform 2025 & 2033

- Figure 16: Asia Pacific Electro Optics Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Electro Optics Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Electro Optics Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Electro Optics Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electro Optics Systems Industry Revenue (undefined), by Application Platform 2025 & 2033

- Figure 21: Latin America Electro Optics Systems Industry Revenue Share (%), by Application Platform 2025 & 2033

- Figure 22: Latin America Electro Optics Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America Electro Optics Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Electro Optics Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Electro Optics Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Electro Optics Systems Industry Revenue (undefined), by Application Platform 2025 & 2033

- Figure 27: Middle East Electro Optics Systems Industry Revenue Share (%), by Application Platform 2025 & 2033

- Figure 28: Middle East Electro Optics Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East Electro Optics Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Electro Optics Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Electro Optics Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 2: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Electro Optics Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 5: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Electro Optics Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 8: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Electro Optics Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 11: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Electro Optics Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 14: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Electro Optics Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Electro Optics Systems Industry Revenue undefined Forecast, by Application Platform 2020 & 2033

- Table 17: Global Electro Optics Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Electro Optics Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electro Optics Systems Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Electro Optics Systems Industry?

Key companies in the market include Lockheed Martin Corporation, Elbit Systems Ltd, Raytheon Company, Thales Group, Safran SA*List Not Exhaustive, Leonardo DRS, BAE Systems plc, Northrop Grumman Corporation, FLIR Systems, L-3 Technologies.

3. What are the main segments of the Electro Optics Systems Industry?

The market segments include Application Platform, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increased Deployment of Electro Optics for Unmanned Vehicles.

6. What are the notable trends driving market growth?

Defense Segment to Witness High Growth.

7. Are there any restraints impacting market growth?

; High Implementation Cost and Long-term Return on Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electro Optics Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electro Optics Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electro Optics Systems Industry?

To stay informed about further developments, trends, and reports in the Electro Optics Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence