Key Insights

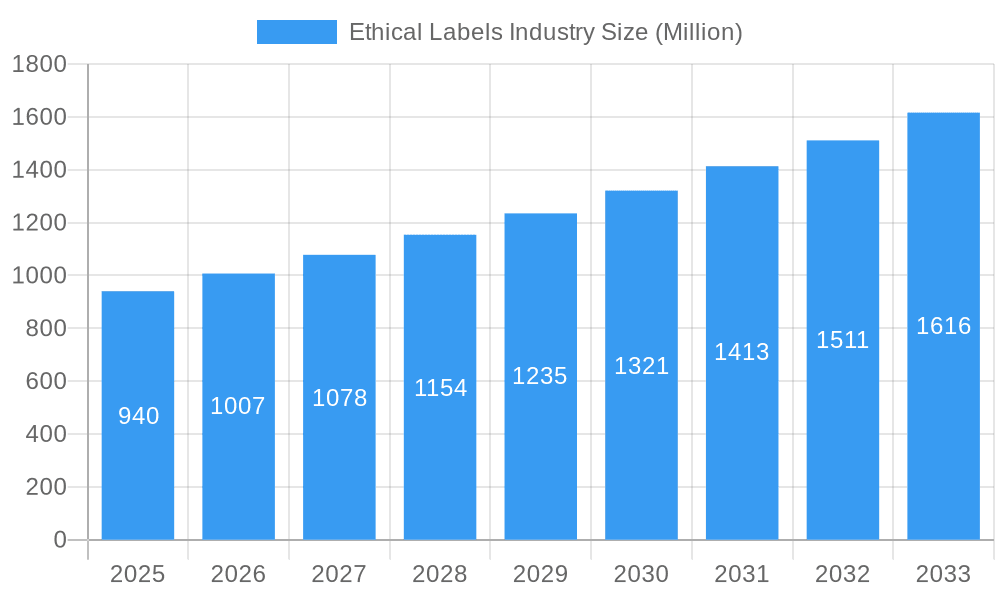

The ethical labels market, valued at $0.94 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.10% from 2025 to 2033. This growth is fueled by rising consumer demand for transparency and ethically sourced products. Increasing awareness of environmental and social issues, coupled with a growing preference for sustainable and responsible consumption patterns, are key drivers. The market segmentation reveals significant opportunities across various label types, including Halal, organic, clean, sustainability, fair trade, animal welfare, and vegan labels, catering to diverse consumer preferences and ethical concerns. The food and beverage sectors dominate product-type segmentation, reflecting the significant impact of ethical considerations on food choices. Distribution channels are witnessing a shift towards online platforms, reflecting broader e-commerce trends and the convenience it offers to consumers seeking ethically labeled products. Major players like PepsiCo, Ingredion, DSM, Kraft Heinz, Kerry Group, Cargill, and others are actively involved, indicating significant industry competition and potential for further consolidation and innovation. Geographic distribution likely reflects established consumer markets in North America and Europe, with significant growth potential in the Asia Pacific region driven by increasing disposable incomes and changing consumer attitudes.

Ethical Labels Industry Market Size (In Million)

The forecast period (2025-2033) suggests a continued upward trajectory for the ethical labels market, driven by factors such as stricter regulations promoting ethical sourcing and labeling, the expansion of e-commerce, and ongoing technological advancements aiding in traceability and transparency. However, challenges remain, including potential inconsistencies in labeling standards across different regions and the need for robust verification mechanisms to ensure authenticity and consumer trust. Successful players will likely focus on building strong supply chains, ensuring product traceability, and actively engaging with consumers to communicate their ethical commitment. Innovation in label technologies, coupled with strategic partnerships across the value chain, will be crucial for sustained growth and market leadership in the coming years.

Ethical Labels Industry Company Market Share

Ethical Labels Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Ethical Labels Industry, projecting a market size of $XX Million by 2033. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategists seeking actionable insights into this rapidly evolving market. The report covers key segments including Halal, Organic, Vegan, and Fairtrade labels across food and beverage products, distributed both online and offline. Leading companies like PepsiCo Inc, Ingredion Incorporated, Koninklijke DSM N V, and others are profiled, offering a detailed competitive landscape.

Ethical Labels Industry Market Structure & Innovation Trends

The Ethical Labels Industry exhibits a moderately concentrated market structure, with several large multinational corporations holding significant market share. PepsiCo Inc, for example, holds an estimated xx% market share in the beverage segment. However, smaller, specialized companies are also gaining traction, particularly in niche label types like vegan and animal welfare certifications. The market is driven by increasing consumer demand for ethical and sustainable products. Regulatory frameworks, such as those related to organic certification and fair trade practices, are significant drivers of industry growth. The market is also witnessing substantial M&A activity, with deal values exceeding $XX Million in the past five years. These deals are primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with major players holding significant shares.

- Innovation Drivers: Growing consumer demand for ethical products, stringent regulations.

- M&A Activity: Significant M&A activity valued at over $XX Million in the last five years.

- Regulatory Frameworks: Stringent regulations drive innovation and standardization.

- Product Substitutes: Limited substitutes, as ethical labels offer unique value propositions.

Ethical Labels Industry Market Dynamics & Trends

The Ethical Labels Industry is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several key factors. Rising consumer awareness of ethical sourcing and sustainable practices is a major driver. Technological advancements, such as blockchain technology for traceability, are enhancing transparency and trust. Changing consumer preferences, particularly among millennials and Gen Z, are pushing demand for products with ethical labels. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration of ethical labels is projected to reach xx% by 2033.

Dominant Regions & Segments in Ethical Labels Industry

The Ethical Labels Industry shows strong regional variations. Europe and North America are currently the dominant regions, driven by high consumer awareness and strong regulatory frameworks. However, Asia-Pacific is expected to experience significant growth in the forecast period due to increasing disposable incomes and growing environmental consciousness.

By Label Type:

- Organic: Remains a dominant segment, driven by strong consumer preference for natural and healthy products.

- Vegan: Shows strong growth potential, fuelled by the increasing adoption of vegan lifestyles.

- Fairtrade: Steady growth reflecting consumer support for fair labor practices.

By Product Type:

- Food: Holds the largest market share due to widespread consumer preference for ethical food products.

- Beverages: Shows strong growth potential due to the increasing adoption of plant-based beverages.

By Distribution Channel:

Offline: Remains the dominant channel, especially for food products.

Online: Growing rapidly, driven by increased e-commerce penetration and convenience.

Key Drivers (Europe & North America): Strong consumer awareness, robust regulatory frameworks.

Key Drivers (Asia-Pacific): Rising disposable incomes, growing environmental consciousness.

Ethical Labels Industry Product Innovations

Recent product innovations focus on enhancing transparency, traceability, and sustainability. Blockchain technology is increasingly being used to track products from farm to shelf, building consumer trust. Companies are also developing innovative solutions to reduce their environmental footprint, such as using recycled materials and minimizing waste. These innovations improve the competitive advantage of manufacturers by demonstrating commitment to ethical practices.

Report Scope & Segmentation Analysis

This report segments the Ethical Labels Industry by Label Type (Halal, Organic, Clean, Sustainability and Fairtrade labels, Animal Welfare Labels, Vegan Labels, Other Label Types), Product Type (Food, Beverages), and Distribution Channel (Offline, Online). Each segment's growth projections, market size, and competitive dynamics are analyzed extensively. Market size for each segment is projected to reach $XX Million by 2033 with varying CAGRs based on segment attractiveness. Competitive intensity varies across segments, with some experiencing more competition than others.

Key Drivers of Ethical Labels Industry Growth

Several factors drive the growth of the Ethical Labels Industry. Increased consumer awareness of ethical and sustainable sourcing is a primary driver. Stringent government regulations and certifications are also bolstering industry growth. Technological advancements such as blockchain are making traceability easier, building consumer confidence. Growing consumer disposable incomes, particularly in developing economies, further contribute to market expansion.

Challenges in the Ethical Labels Industry Sector

The Ethical Labels Industry faces challenges, including inconsistent regulatory frameworks across different regions, leading to complexities in compliance. Supply chain complexities and ensuring ethical practices throughout the entire supply chain are ongoing concerns. Competition from companies making unsubstantiated claims about ethical sourcing presents another challenge. These challenges result in an estimated xx% loss in revenue annually due to non-compliance and supply chain issues.

Emerging Opportunities in Ethical Labels Industry

Emerging opportunities exist in the expansion into new markets, particularly in developing economies with growing middle classes. Technological advancements, such as AI-powered solutions for supply chain management and fraud detection, are opening new avenues for growth. Focus on specific niche ethical labels, such as those related to carbon footprint or water usage, presents significant opportunities.

Leading Players in the Ethical Labels Industry Market

Key Developments in Ethical Labels Industry Industry

- September 2023: Maranello launched its ethical label, focusing on sustainability and social responsibility in promotional objects. This is expected to influence the promotional materials market within the ethical label sphere.

- June 2023: Kerry introduced Biobake EgR, an enzyme solution promoting the use of free-range or organic eggs, aligning with consumer demand for ethical egg-based products. This innovation directly impacts the market for animal welfare labels in baked goods.

Future Outlook for Ethical Labels Industry Market

The Ethical Labels Industry is poised for significant growth, driven by increasing consumer demand for ethical and sustainable products. Expanding into new markets, particularly in developing economies, presents substantial opportunities. Continuous technological innovation, focusing on transparency and traceability, will further enhance the industry's prospects. The strategic focus on achieving broader industry standards and certifications will drive future growth and market consolidation.

Ethical Labels Industry Segmentation

-

1. Label Type

- 1.1. Halal

- 1.2. Organic

- 1.3. Clean

- 1.4. Sustainability and Fairtrade labels

- 1.5. Animal Welfare Labels

- 1.6. Vegan Labels

- 1.7. Other Label Types

-

2. Product Type

- 2.1. Food

- 2.2. Beverages

-

3. Distribution Channel

- 3.1. Offline

- 3.2. Online

Ethical Labels Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Ethical Labels Industry Regional Market Share

Geographic Coverage of Ethical Labels Industry

Ethical Labels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumer Conscious toward Health and Ethical Values; Growth due to Online Retailing and CSR Activities; Reduction in Meat Consumption for Environmental Sustainability

- 3.3. Market Restrains

- 3.3.1. Increasing Competition Among Players

- 3.4. Market Trends

- 3.4.1. Beverages To Occupy Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Label Type

- 5.1.1. Halal

- 5.1.2. Organic

- 5.1.3. Clean

- 5.1.4. Sustainability and Fairtrade labels

- 5.1.5. Animal Welfare Labels

- 5.1.6. Vegan Labels

- 5.1.7. Other Label Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Food

- 5.2.2. Beverages

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Label Type

- 6. North America Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Label Type

- 6.1.1. Halal

- 6.1.2. Organic

- 6.1.3. Clean

- 6.1.4. Sustainability and Fairtrade labels

- 6.1.5. Animal Welfare Labels

- 6.1.6. Vegan Labels

- 6.1.7. Other Label Types

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Food

- 6.2.2. Beverages

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline

- 6.3.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Label Type

- 7. Europe Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Label Type

- 7.1.1. Halal

- 7.1.2. Organic

- 7.1.3. Clean

- 7.1.4. Sustainability and Fairtrade labels

- 7.1.5. Animal Welfare Labels

- 7.1.6. Vegan Labels

- 7.1.7. Other Label Types

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Food

- 7.2.2. Beverages

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline

- 7.3.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Label Type

- 8. Asia Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Label Type

- 8.1.1. Halal

- 8.1.2. Organic

- 8.1.3. Clean

- 8.1.4. Sustainability and Fairtrade labels

- 8.1.5. Animal Welfare Labels

- 8.1.6. Vegan Labels

- 8.1.7. Other Label Types

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Food

- 8.2.2. Beverages

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline

- 8.3.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Label Type

- 9. Australia and New Zealand Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Label Type

- 9.1.1. Halal

- 9.1.2. Organic

- 9.1.3. Clean

- 9.1.4. Sustainability and Fairtrade labels

- 9.1.5. Animal Welfare Labels

- 9.1.6. Vegan Labels

- 9.1.7. Other Label Types

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Food

- 9.2.2. Beverages

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline

- 9.3.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Label Type

- 10. Latin America Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Label Type

- 10.1.1. Halal

- 10.1.2. Organic

- 10.1.3. Clean

- 10.1.4. Sustainability and Fairtrade labels

- 10.1.5. Animal Welfare Labels

- 10.1.6. Vegan Labels

- 10.1.7. Other Label Types

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Food

- 10.2.2. Beverages

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline

- 10.3.2. Online

- 10.1. Market Analysis, Insights and Forecast - by Label Type

- 11. Middle East and Africa Ethical Labels Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Label Type

- 11.1.1. Halal

- 11.1.2. Organic

- 11.1.3. Clean

- 11.1.4. Sustainability and Fairtrade labels

- 11.1.5. Animal Welfare Labels

- 11.1.6. Vegan Labels

- 11.1.7. Other Label Types

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Food

- 11.2.2. Beverages

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Offline

- 11.3.2. Online

- 11.1. Market Analysis, Insights and Forecast - by Label Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PepsiCo Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ingredion Incorporated*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Koninklijke DSM N V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 The Kraft Heinz Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kerry Group PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cargill Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Go Macro LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Archer-Daniels-Midland Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Garden of Life (Nestlé S A )

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 The Hershey Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 PepsiCo Inc

List of Figures

- Figure 1: Global Ethical Labels Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 3: North America Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 4: North America Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 11: Europe Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 12: Europe Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 13: Europe Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 19: Asia Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 20: Asia Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 27: Australia and New Zealand Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 28: Australia and New Zealand Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Australia and New Zealand Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Australia and New Zealand Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Australia and New Zealand Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Australia and New Zealand Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 35: Latin America Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 36: Latin America Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Latin America Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Latin America Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Latin America Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Latin America Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Ethical Labels Industry Revenue (Million), by Label Type 2025 & 2033

- Figure 43: Middle East and Africa Ethical Labels Industry Revenue Share (%), by Label Type 2025 & 2033

- Figure 44: Middle East and Africa Ethical Labels Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 45: Middle East and Africa Ethical Labels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Middle East and Africa Ethical Labels Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Middle East and Africa Ethical Labels Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Middle East and Africa Ethical Labels Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Ethical Labels Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 2: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Ethical Labels Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 6: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 10: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 14: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 18: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 19: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 22: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Ethical Labels Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 26: Global Ethical Labels Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Ethical Labels Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Ethical Labels Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethical Labels Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Ethical Labels Industry?

Key companies in the market include PepsiCo Inc, Ingredion Incorporated*List Not Exhaustive, Koninklijke DSM N V, The Kraft Heinz Company, Kerry Group PLC, Cargill Inc, Go Macro LLC, Archer-Daniels-Midland Company, Garden of Life (Nestlé S A ), The Hershey Company.

3. What are the main segments of the Ethical Labels Industry?

The market segments include Label Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumer Conscious toward Health and Ethical Values; Growth due to Online Retailing and CSR Activities; Reduction in Meat Consumption for Environmental Sustainability.

6. What are the notable trends driving market growth?

Beverages To Occupy Highest Market Share.

7. Are there any restraints impacting market growth?

Increasing Competition Among Players.

8. Can you provide examples of recent developments in the market?

September 2023: Maranello launched its ethical label. To obtain the Maranello on Earth label, a product must fulfill one of 4 criteria: a useful, sustainable promotional object that can be recycled and that is biodegradable, or a renewable promotional object that uses fewer materials or eco-designed materials produced using organic and recycled materials. It can also be a promotional object with a low carbon footprint, using locally-produced raw materials and green transport over short distances, or a promotional object with a socially positive contribution, environmentally ethical, using European, national, or even local know-how; using local or international, charity-based, socially responsible or fair-trade manufacture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethical Labels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethical Labels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethical Labels Industry?

To stay informed about further developments, trends, and reports in the Ethical Labels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence