Key Insights

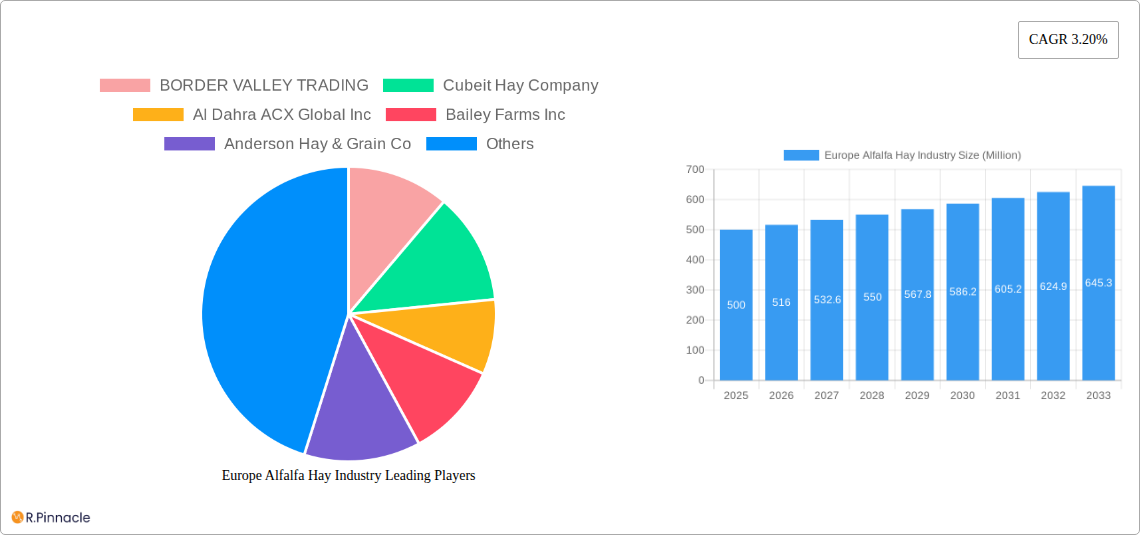

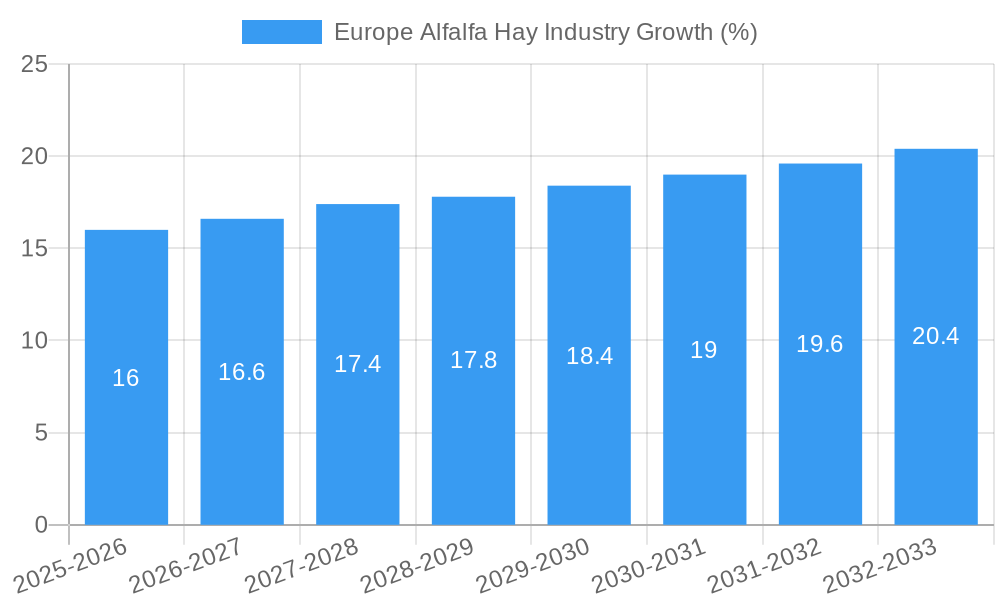

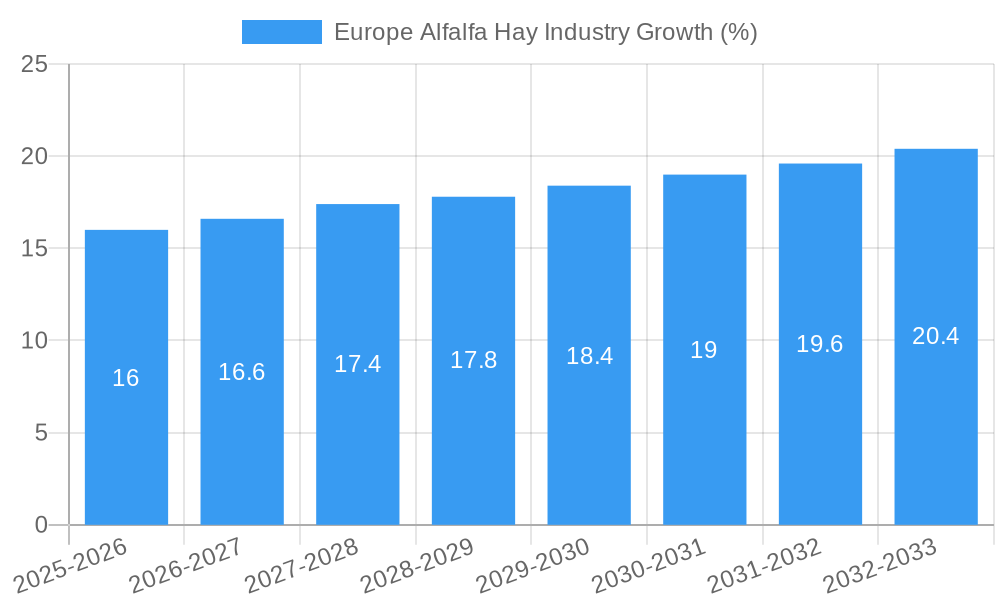

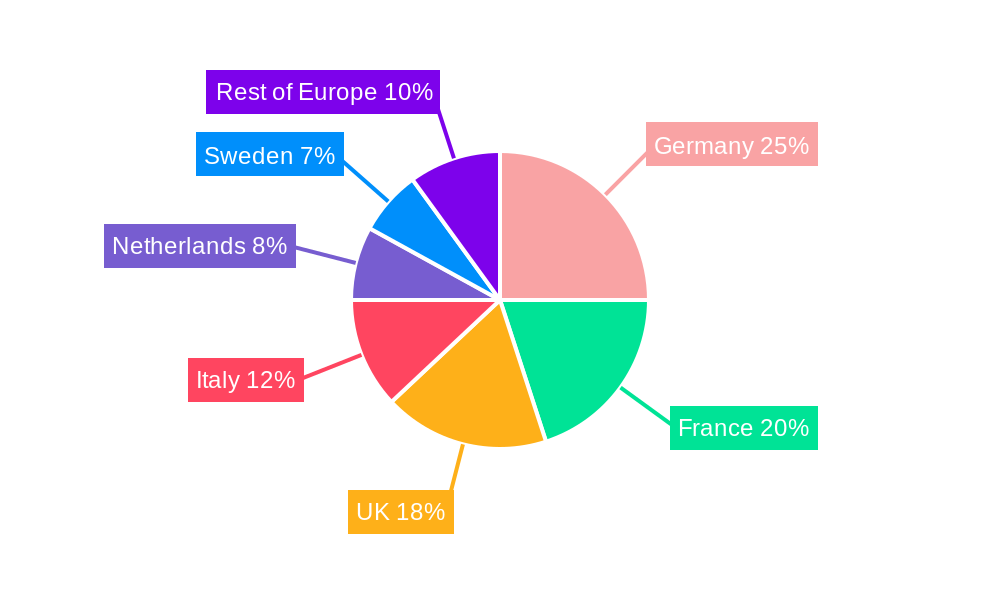

The European alfalfa hay market, valued at approximately €[Estimate based on market size XX and assuming XX is in Million Euros. For example, if XX = 500, then the value would be €500 million] in 2025, is projected to exhibit steady growth at a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key factors. The increasing demand for high-quality animal feed, particularly within the dairy and meat sectors, is a primary driver. The European livestock industry's ongoing focus on improving animal health and productivity necessitates the use of nutritious forage like alfalfa hay, stimulating market expansion. Furthermore, the rising popularity of horses as leisure animals, coupled with a growing awareness of the nutritional benefits of alfalfa in equine diets, further contributes to market growth. The market segmentation reveals that bales remain the dominant form, followed by pellets and cubes, reflecting established distribution channels and consumer preferences. However, the increasing adoption of pelletized and cubed alfalfa hay, favored for their ease of handling and storage, presents an interesting market trend. Germany, France, and the UK are expected to be the largest markets within Europe, driven by their substantial livestock populations and developed agricultural sectors.

Despite the positive outlook, the European alfalfa hay market faces certain challenges. Fluctuations in weather patterns and agricultural yields can impact supply and, consequently, prices. Moreover, increased competition from alternative forages and feed ingredients may pose a restraint on growth. However, the industry’s response to these challenges may include investments in improved cultivation techniques and sustainable farming practices to ensure consistent supply and quality. Innovation in processing and packaging is also likely to play a role, further enhancing the market's appeal to consumers. The key players in the market, including BORDER VALLEY TRADING, Cubeit Hay Company, and Al Dahra ACX Global Inc., are likely to leverage strategic partnerships and product diversification to gain a competitive edge in this evolving landscape. The forecast period suggests continued expansion, driven by the sustained growth of the livestock and equine industries, alongside technological advancements in alfalfa cultivation and processing.

Europe Alfalfa Hay Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Alfalfa Hay Industry, offering valuable insights for industry professionals, investors, and stakeholders. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We examine market size, growth drivers, challenges, and future opportunities, providing actionable intelligence to navigate this dynamic market. The report encompasses detailed segmentation by type (Bales, Pellets, Cubes) and application (Meat/Dairy Animal Feed, Poultry, Horse Feed, Other Applications), along with key player analysis and recent industry developments. Expect detailed analysis using Million as the unit for all values.

Europe Alfalfa Hay Industry Market Structure & Innovation Trends

The European alfalfa hay market exhibits a moderately concentrated structure, with several key players holding significant market share. BORDER VALLEY TRADING, Cubeit Hay Company, Al Dahra ACX Global Inc, and Anderson Hay & Grain Co are among the prominent names, though precise market share data remains proprietary for many companies, ranging from xx% to xx% depending on the specific segment. Innovation is driven by increasing demand for high-quality, value-added products, including organic options and specialized blends for specific animal needs. Regulatory frameworks focusing on animal feed safety and sustainability are shaping industry practices. Product substitutes, such as other forages or alternative feed sources, exert competitive pressure, albeit limited, given alfalfa's nutritional profile. End-user demographics, primarily focused on livestock farmers and feed producers, are a key aspect of market segmentation. M&A activity in the sector has been moderate in recent years, with deal values generally ranging from xx Million to xx Million. Key transactions have focused on expanding geographic reach and product portfolios.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: High-quality product demand, organic options, specialized blends.

- Regulatory Frameworks: Animal feed safety and sustainability.

- Product Substitutes: Other forages and alternative feed sources.

- M&A Activity: Moderate, with values ranging from xx Million to xx Million.

Europe Alfalfa Hay Industry Market Dynamics & Trends

The European alfalfa hay market is experiencing steady growth, driven by factors such as increasing livestock populations, growing demand for animal protein, and rising awareness of alfalfa's nutritional benefits. The CAGR for the period 2025-2033 is estimated at xx%, with market penetration varying across different segments and geographical areas. Technological disruptions, such as advancements in harvesting and processing technologies, are enhancing efficiency and quality. Consumer preferences are shifting towards organic and sustainably produced alfalfa, creating opportunities for producers adopting these practices. Competitive dynamics are characterized by both price competition and differentiation based on product quality, sustainability certifications, and customer service. Market expansion is propelled by increased agricultural efficiency and favorable government policies supporting the livestock industry across the EU.

Dominant Regions & Segments in Europe Alfalfa Hay Industry

The analysis reveals that Germany and France are currently the dominant regions for alfalfa hay consumption and production in Europe, driven by strong livestock sectors, well-developed agricultural infrastructure, and supportive government policies. The meat/dairy animal feed segment accounts for the largest share of alfalfa hay consumption, followed by the horse feed segment.

- Key Drivers in Germany and France:

- Strong livestock sectors

- Well-developed agricultural infrastructure

- Supportive government policies

- High levels of agricultural expertise

- Efficient logistics and distribution networks.

Segment Dominance:

- Type: Bales remain the dominant form, however, the pellet and cube segments are experiencing faster growth due to convenience and improved feed efficiency.

- Application: Meat/dairy animal feed represents the largest market segment, followed by horse feed and poultry feed.

Europe Alfalfa Hay Industry Product Innovations

Recent innovations focus on improving alfalfa quality, enhancing digestibility, and developing value-added products. This includes the introduction of organic alfalfa pellets, dehydrated and ground alfalfa granules, and specialized blends tailored to specific animal nutritional needs. These developments enhance feed efficiency, animal health, and overall market appeal, driving growth within the premium segment of the market. The industry is witnessing a push towards sustainable practices and environmentally friendly production methods.

Report Scope & Segmentation Analysis

This report segments the European alfalfa hay market by type (bales, pellets, cubes) and application (meat/dairy animal feed, poultry, horse feed, other applications). Each segment's market size, growth projections, and competitive dynamics are detailed within the full report. The growth in pellets and cubes is expected to surpass the growth of bales, driven by increased convenience and improved feed efficiency. The meat/dairy animal feed application maintains the largest market share due to the significant demand from intensive livestock farming.

Key Drivers of Europe Alfalfa Hay Industry Growth

Growth is propelled by several factors including rising livestock populations, increasing demand for animal protein, a growing focus on improving animal nutrition, and the ongoing development of specialized alfalfa products tailored to diverse animal needs. Favorable government policies and investments in agricultural technologies also contribute to market expansion. The push towards sustainable and organic farming practices is further fueling market growth in niche segments.

Challenges in the Europe Alfalfa Hay Industry Sector

The industry faces challenges including fluctuating alfalfa yields due to weather patterns, variations in feed prices, and increasing competition from alternative feed sources. Supply chain disruptions and rising transportation costs also impact profitability. Stricter environmental regulations and compliance requirements add to operational costs and complexity for businesses.

Emerging Opportunities in Europe Alfalfa Hay Industry

The report highlights significant opportunities in organic alfalfa production, the expansion of value-added products (like specialized blends and enriched feeds), and exploration of new export markets. Technological advancements in farming and processing techniques present opportunities to enhance efficiency and sustainability. A growing focus on animal welfare and traceability also provides opportunities for businesses to differentiate themselves in the market.

Leading Players in the Europe Alfalfa Hay Industry Market

- BORDER VALLEY TRADING

- Cubeit Hay Company

- Al Dahra ACX Global Inc

- Bailey Farms Inc

- Anderson Hay & Grain Co

- S&S Agrisource Holding LLC

- Grupo Oses

- Coaba

- Aldahra Fagavi

- Alfalfa Monegros SL

- The Accomazzo Company

Key Developments in Europe Alfalfa Hay Industry Industry

- October 2021: Al Dhara Holdings opened 5 new animal feed plants in Serbia, Romania, and Bulgaria, significantly expanding its international operations and green feed production capacity.

- February 2022: Nafosa Firm launched an organic alfalfa pellet, broadening its product line and catering to the growing demand for organic animal feed.

Future Outlook for Europe Alfalfa Hay Industry Market

The future of the European alfalfa hay market appears promising, driven by a combination of factors including rising demand for animal protein, increasing focus on animal nutrition, and a growing preference for organic and sustainable products. Strategic opportunities exist for companies focusing on technological innovation, sustainable production practices, and value-added product development. The market is poised for continued growth, albeit with challenges related to environmental sustainability and supply chain resilience.

Europe Alfalfa Hay Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Alfalfa Hay Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Alfalfa Hay Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Dairy and Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Alfalfa Hay Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BORDER VALLEY TRADING

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cubeit Hay Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Al Dahra ACX Global Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bailey Farms Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Anderson Hay & Grain Co

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 S&S Agrisource Holding LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Grupo Oses

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Coaba

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Aldahra Fagavi

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Alfalfa Monegros SL

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 The Accomazzo Company

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 BORDER VALLEY TRADING

List of Figures

- Figure 1: Europe Alfalfa Hay Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Alfalfa Hay Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Alfalfa Hay Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Alfalfa Hay Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Alfalfa Hay Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Alfalfa Hay Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Alfalfa Hay Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Alfalfa Hay Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Alfalfa Hay Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Alfalfa Hay Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Alfalfa Hay Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Alfalfa Hay Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Alfalfa Hay Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Alfalfa Hay Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Alfalfa Hay Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Alfalfa Hay Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Alfalfa Hay Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Alfalfa Hay Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Europe Alfalfa Hay Industry?

Key companies in the market include BORDER VALLEY TRADING, Cubeit Hay Company, Al Dahra ACX Global Inc, Bailey Farms Inc, Anderson Hay & Grain Co, S&S Agrisource Holding LLC, Grupo Oses, Coaba, Aldahra Fagavi, Alfalfa Monegros SL, The Accomazzo Company.

3. What are the main segments of the Europe Alfalfa Hay Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing Demand for Dairy and Meat Products.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

February 2022: Nafosa Firm added an organic alfalfa pellet to its animal feed production line. They have put organic, dehydrated, ground, and pressed alfalfa into granules made available to their customers for the best nutrition of their animals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Alfalfa Hay Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Alfalfa Hay Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Alfalfa Hay Industry?

To stay informed about further developments, trends, and reports in the Europe Alfalfa Hay Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence