Key Insights

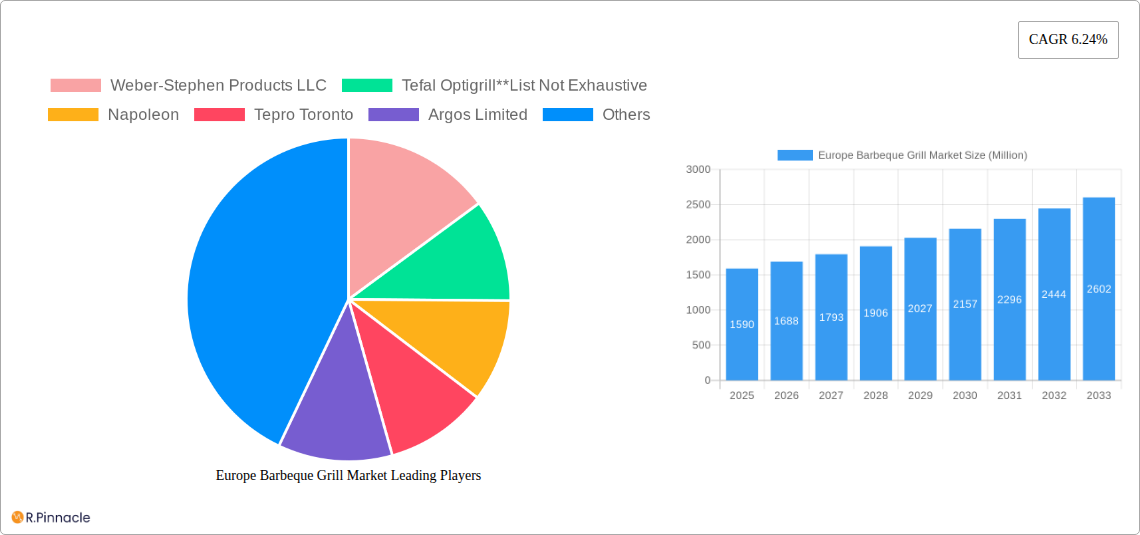

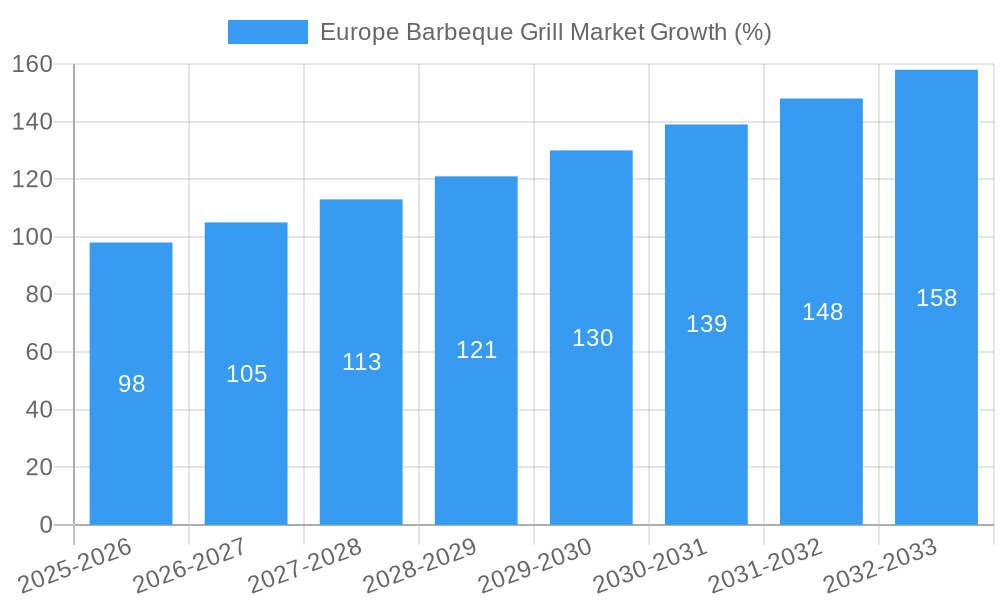

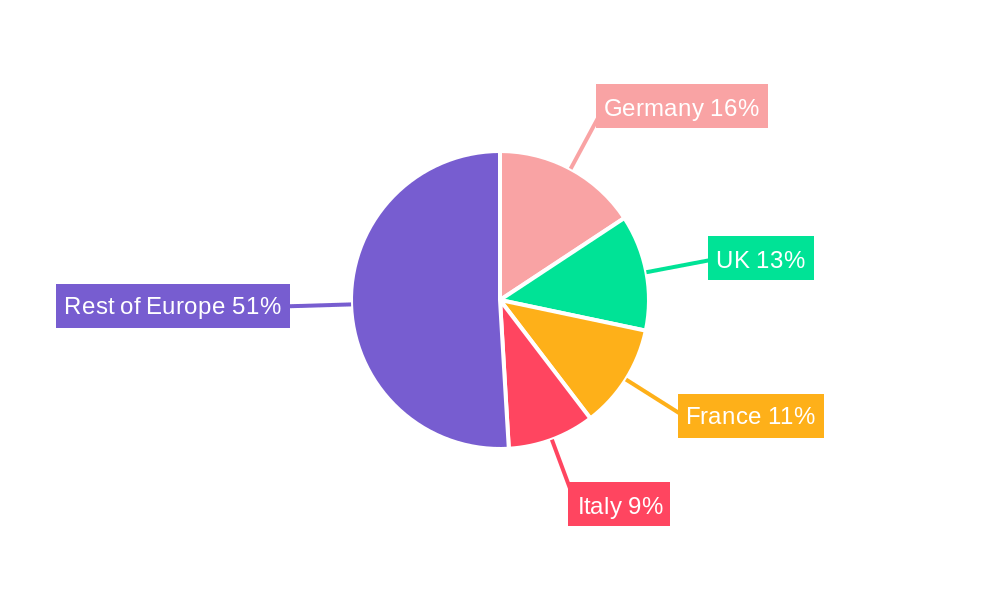

The European barbeque grill market, valued at €1.59 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising popularity of outdoor cooking and entertaining, coupled with increased disposable incomes across several European nations, fuels consistent demand. Furthermore, the market is witnessing a shift towards premium, feature-rich grills, reflecting consumers' willingness to invest in higher-quality products for enhanced grilling experiences. Innovation in grill technology, including advancements in gas grills offering precise temperature control and smart features, and the growing appeal of electric grills for ease of use and reduced environmental impact, are further stimulating market expansion. The segment breakdown reveals a diverse landscape, with gas grills holding a significant share due to convenience and performance, followed by charcoal grills appealing to traditionalists and enthusiasts seeking authentic smoky flavors. The household segment dominates application-wise, while online stores are gaining traction as a distribution channel, reflecting evolving consumer preferences for convenience and wider product selection. Germany, the United Kingdom, and France represent the largest national markets, mirroring the higher concentration of population and stronger purchasing power within the region. However, growth potential exists across smaller European nations, presenting opportunities for expansion. The ongoing 6.24% CAGR indicates a sustained upward trajectory for the foreseeable future, promising continued market dynamism and competitive landscape.

While the market exhibits strong growth potential, several challenges persist. These include fluctuating raw material prices (particularly for charcoal and certain metals), increasing competition among established and emerging brands vying for market share, and the potential impact of economic downturns on consumer spending habits. However, manufacturers are actively addressing these challenges through diversification of sourcing, strategic pricing models, and product differentiation, ensuring long-term market sustainability. The continued diversification of products offered, including built-in grills and innovative accessories, contributes to market expansion and caters to an increasingly sophisticated consumer base. The overall positive outlook, fueled by strong consumer demand and innovative product development, signifies a promising future for the European barbeque grill market.

Europe Barbeque Grill Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Barbeque Grill Market, offering actionable insights for industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, segmentation, key players, and future trends. The report leverages extensive data analysis to deliver a clear understanding of the market's current state and projected growth.

Europe Barbeque Grill Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors influencing the European barbeque grill market. The market is characterized by a mix of established players like Weber-Stephen Products LLC and Tefal, alongside emerging brands. Market concentration is moderate, with the top 5 players holding an estimated xx% market share in 2025. Innovation is driven by consumer demand for versatile, efficient, and convenient grilling solutions, leading to the development of smart grills, electric grills, and pellet grills. Regulatory frameworks concerning emissions and energy efficiency play a significant role, influencing product development and market acceptance. Product substitutes, such as indoor grilling appliances and alternative cooking methods, pose a moderate competitive threat. End-user demographics are increasingly diverse, with a growing segment of younger consumers seeking convenient and sophisticated grilling experiences. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction. Examples include:

- High Market Share Players: Weber-Stephen Products LLC, Tefal Optigrill, Napoleon, Tepro Toronto, Argos Limited.

- Emerging Players: Barbecook, Bull Europe Limited, Landmann, Pit Boss Grills, Copreci, and others.

- M&A Activity: Strategic acquisitions have focused on expanding product lines and geographical reach, particularly in high-growth segments like electric and pellet grills.

Europe Barbeque Grill Market Dynamics & Trends

The European barbeque grill market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing urbanization, and a growing preference for outdoor dining are fueling demand. Technological advancements, such as smart grill technology and improved fuel efficiency, are also contributing to market expansion. Consumer preferences are shifting towards versatile grills that offer multiple cooking options, easy cleanup, and convenient features. The market is becoming increasingly competitive, with established players facing pressure from both new entrants and private label brands. The market is forecast to exhibit a CAGR of xx% during the forecast period (2025-2033). Market penetration of smart grills is currently low but projected to increase significantly, reaching xx% by 2033. The gas grill segment maintains the largest market share, but the electric grill segment is witnessing the fastest growth, driven by increasing demand for convenient and eco-friendly grilling solutions.

Dominant Regions & Segments in Europe Barbeque Grill Market

Germany, the United Kingdom, and France are the dominant markets within Europe, accounting for over xx% of the total market value in 2025. This dominance is attributable to:

- Germany: Strong consumer spending on home improvement, established distribution networks, and a high prevalence of outdoor entertaining.

- United Kingdom: High demand for premium and technologically advanced grills, robust e-commerce infrastructure, and a large and diverse population.

- France: Growing interest in outdoor cooking and a well-developed retail landscape, favoring both offline and online stores.

By Product: The Gas grill segment holds the largest market share, followed by charcoal and electric grills. The electric segment is projected to grow the fastest.

By Application: Household use dominates the market, but the commercial segment is expected to show significant growth, fueled by the popularity of outdoor dining experiences in restaurants and hotels.

By Distribution Channel: Offline stores currently represent the majority of sales, but online channels are rapidly gaining traction, driven by e-commerce growth and enhanced online shopping experiences.

Europe Barbeque Grill Market Product Innovations

Recent innovations include the integration of smart technology, offering features such as temperature control via mobile apps, precise cooking settings, and improved fuel efficiency. Electric grills are gaining popularity due to their convenience and reduced emissions. Pellet grills are also experiencing increased demand for their ability to deliver consistent and flavorful results. These advancements cater to consumer demands for versatility, convenience, and ease of use, while aligning with the growing trend towards healthier and more sustainable cooking practices. Competition is driving continuous innovation, resulting in the emergence of increasingly sophisticated and feature-rich barbeque grills.

Report Scope & Segmentation Analysis

This report segments the European barbeque grill market by product type (Gas, Charcoal, Electric), application (Household, Commercial), distribution channel (Online Stores, Offline Stores), and country (Germany, United Kingdom, Poland, France, Italy, Rest of Europe). Growth projections are provided for each segment, considering factors such as market size, competitive intensity, and consumer preferences. For example, the electric grill segment is projected to exhibit the highest growth rate, fueled by evolving consumer preferences and technological advancements. The report also analyzes the competitive dynamics within each segment, highlighting key players and their market strategies.

Key Drivers of Europe Barbeque Grill Market Growth

Several factors are driving the growth of the European barbeque grill market. Increased disposable incomes among consumers are allowing for higher spending on leisure products. The rise in popularity of outdoor living and entertaining provides a strong impetus for demand. Technological innovations, leading to better features and increased efficiency, also significantly enhance the market. Finally, growing consumer awareness of healthy cooking methods further encourages the adoption of barbeque grills.

Challenges in the Europe Barbeque Grill Market Sector

The market faces challenges such as fluctuating raw material prices, impacting production costs. Increased competition from private-label brands is squeezing profit margins for some manufacturers. Stringent environmental regulations regarding emissions from grills represent another potential hurdle. Supply chain disruptions, especially since 2020, have created manufacturing bottlenecks and increased material costs, negatively impacting production and pricing.

Emerging Opportunities in Europe Barbeque Grill Market

Growing interest in sustainable grilling options, combined with innovation in electric and pellet grills, opens significant opportunities. The increasing popularity of outdoor entertaining, fueled by social gatherings and hospitality businesses, represents another key opportunity. Expansion into emerging markets within Europe provides scope for further market penetration and revenue generation. Finally, targeted marketing campaigns leveraging digital channels can enhance brand awareness and sales.

Leading Players in the Europe Barbeque Grill Market Market

- Weber-Stephen Products LLC

- Tefal Optigrill

- Napoleon

- Tepro Toronto

- Argos Limited

- The Middle by Corporation

- Barbecook

- Bull Europe Limited

- Landmann

- Pit Boss Grills

- Copreci

Key Developments in Europe Barbeque Grill Market Industry

- January 2023: Weber-Stephen Products LLC launched new electric, griddle, and pellet grilling machines, including the LUMIN electric barbecue, targeting consumers with limited outdoor space. This launch broadened product offerings and addressed a key consumer need for space-saving appliances.

- June 2022: Big Green Egg partnered with Smokey Bones restaurant chain for a summer sweepstakes. This collaboration raised brand awareness and potentially expanded the market reach within the commercial segment.

Future Outlook for Europe Barbeque Grill Market Market

The European barbeque grill market is poised for continued growth, driven by sustained consumer demand for outdoor cooking experiences. Technological advancements, particularly in smart grill technology and sustainable fuel options, will further drive market expansion. Growth opportunities exist in both the household and commercial sectors. Increased focus on healthy cooking and sustainability will shape future product development and consumer preferences. Continued innovation and strategic partnerships will be crucial for maintaining competitiveness in this dynamic market.

Europe Barbeque Grill Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Barbeque Grill Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Barbeque Grill Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health-conscious Lifestyle

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives in the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Barbeque Activities Owing to Changing Lifestyle in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Barbeque Grill Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Weber-Stephen Products LLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tefal Optigrill**List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Napoleon

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tepro Toronto

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Argos Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Middle by Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Barbecook

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bull Europe Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Landmann

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pit Boss Grills

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Copreci

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Weber-Stephen Products LLC

List of Figures

- Figure 1: Europe Barbeque Grill Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Barbeque Grill Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Barbeque Grill Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Barbeque Grill Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Barbeque Grill Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Barbeque Grill Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Barbeque Grill Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Barbeque Grill Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Barbeque Grill Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Barbeque Grill Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Barbeque Grill Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Barbeque Grill Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Barbeque Grill Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Barbeque Grill Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Barbeque Grill Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Barbeque Grill Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Barbeque Grill Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Barbeque Grill Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Europe Barbeque Grill Market?

Key companies in the market include Weber-Stephen Products LLC, Tefal Optigrill**List Not Exhaustive, Napoleon, Tepro Toronto, Argos Limited, The Middle by Corporation, Barbecook, Bull Europe Limited, Landmann, Pit Boss Grills, Copreci.

3. What are the main segments of the Europe Barbeque Grill Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Health-conscious Lifestyle.

6. What are the notable trends driving market growth?

Growing Demand for Barbeque Activities Owing to Changing Lifestyle in United Kingdom.

7. Are there any restraints impacting market growth?

Availability of Alternatives in the Market.

8. Can you provide examples of recent developments in the market?

January 2023: Weber-Stephen Products LLC announced the release of new products, including electric, griddle, and pellet grilling machines. One of their new releases is the LUMIN electric barbecue, which was designed for those with limited outdoor space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Barbeque Grill Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Barbeque Grill Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Barbeque Grill Market?

To stay informed about further developments, trends, and reports in the Europe Barbeque Grill Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence