Key Insights

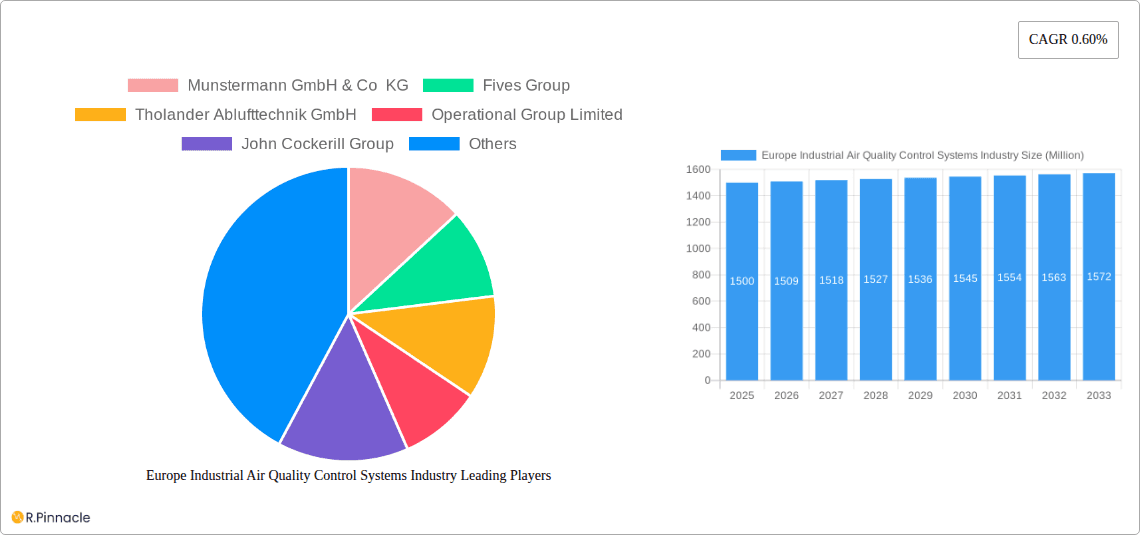

The European Industrial Air Quality Control Systems market, valued at €97.9 billion in the 2025 base year, is poised for consistent expansion through 2033. A Compound Annual Growth Rate (CAGR) of 0.6% highlights a stable, mature market primarily driven by increasingly stringent environmental regulations across key industrial sectors. Power generation leads application segments, followed by cement and chemical industries. Growth opportunities are evident in sub-segments like Selective Catalytic Reduction (SCR) systems, crucial for NOx emission control amidst escalating regulatory demands. Continuous technological advancements in filter efficiency, energy consumption, and monitoring capabilities will sustain market momentum. The competitive landscape features established leaders such as Andritz AG, Fives Group, and John Wood Group PLC, fostering innovation and strategic alliances. Emerging technologies like AI-driven predictive maintenance and IoT sensor integration for real-time monitoring present substantial avenues for future growth.

Europe Industrial Air Quality Control Systems Industry Market Size (In Billion)

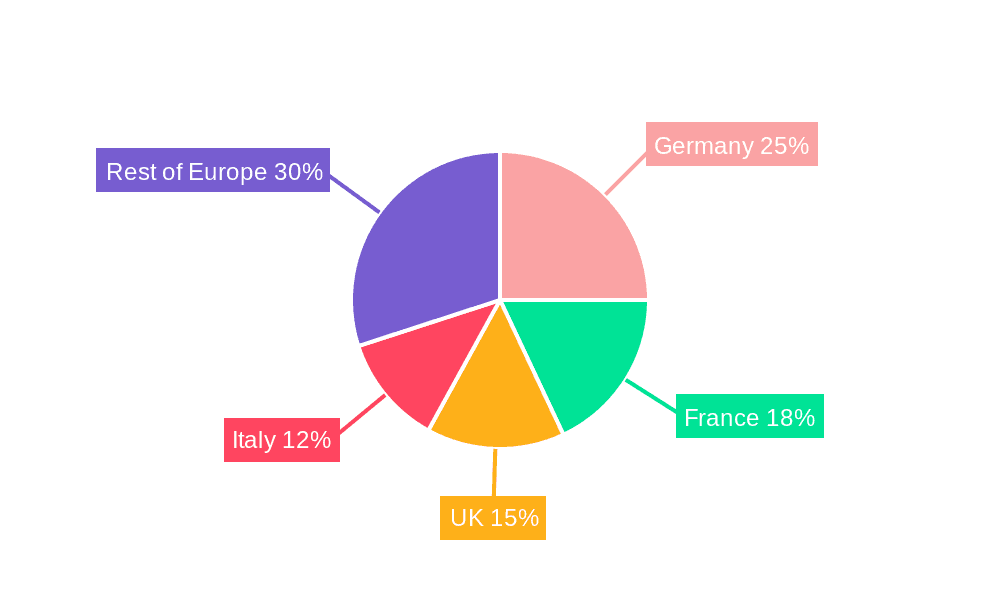

Geographic expansion will vary, with Germany, France, and the UK expected to maintain market dominance due to their robust industrial infrastructure and stringent regulatory frameworks. Other European nations will experience moderate growth, fueled by investments in infrastructure upgrades and the adoption of advanced air quality control solutions to meet evolving environmental standards. Potential growth restraints include high initial capital expenditures for system installation and maintenance, alongside the impact of economic downturns on industrial investment. Nevertheless, persistent environmental concerns and compliance necessities will ensure sustained market growth. The EU's overarching commitment to sustainable industrial practices will significantly influence future market dynamics.

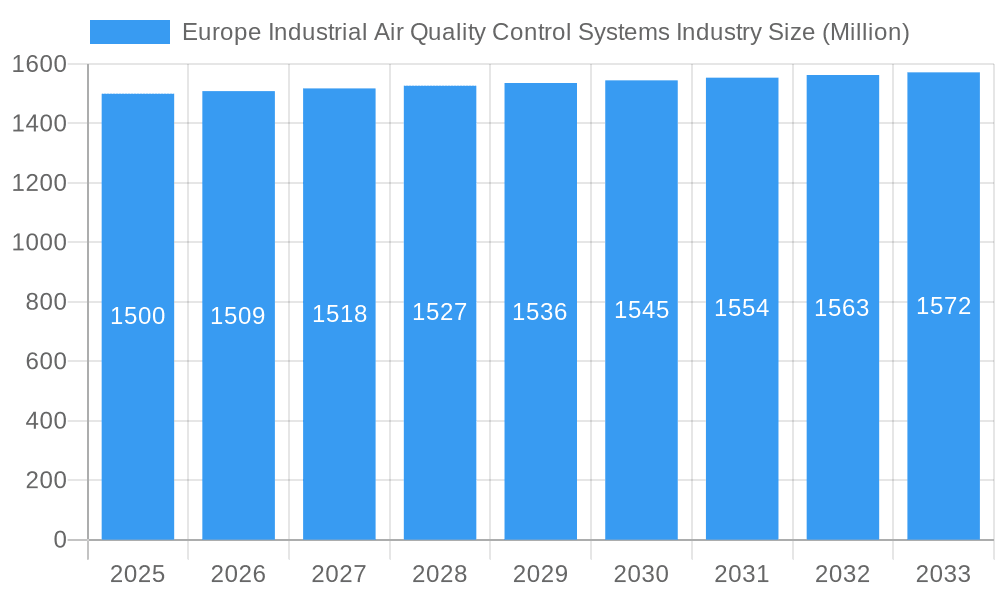

Europe Industrial Air Quality Control Systems Industry Company Market Share

Europe Industrial Air Quality Control Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European industrial air quality control systems market, offering valuable insights for industry professionals, investors, and policymakers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by system type, application, and pollutant, providing a granular understanding of market dynamics and future growth potential. The total market size is expected to reach xx Million by 2033.

Europe Industrial Air Quality Control Systems Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European industrial air quality control systems market. The market exhibits moderate concentration, with key players like Fives Group, John Cockerill Group, Andritz AG, and Munstermann GmbH & Co KG holding significant market share (estimated at xx% collectively in 2025). Smaller players like Tholander Ablufttechnik GmbH, Operational Group Limited, John Wood Group PLC, Exeon Ltd, Chemisch Thermische Prozesstechnik GmbH, and Anguil Environmental Systems Inc. contribute to a dynamic competitive environment.

- Market Concentration: Moderate, with a few major players and numerous smaller participants.

- Innovation Drivers: Stringent environmental regulations, advancements in emission control technologies (e.g., AI-powered monitoring systems), and the increasing focus on sustainability are driving innovation.

- Regulatory Frameworks: The European Green Deal and national-level regulations are key drivers, mandating stricter emission standards and influencing market growth.

- Product Substitutes: Limited substitutes exist, mostly involving alternative approaches to emission reduction, but these often involve higher costs or lower efficacy.

- End-User Demographics: The market is primarily driven by energy-intensive industries like power generation, cement, chemicals, iron & steel, and oil & gas.

- M&A Activities: The value of M&A deals within the sector has averaged xx Million annually over the historical period (2019-2024), with a predicted increase in activity during the forecast period driven by consolidation and expansion strategies of larger players.

Europe Industrial Air Quality Control Systems Industry Market Dynamics & Trends

The European industrial air quality control systems market is experiencing significant growth, driven by several factors. Stringent environmental regulations across Europe are pushing industrial players to adopt more efficient and advanced emission control technologies. The increasing awareness of air pollution's health and environmental impacts further fuels this demand. Technological advancements, such as the integration of AI and IoT in monitoring and control systems, are improving system efficiency and data analysis capabilities. The market is also witnessing a shift towards integrated solutions that address multiple pollutants simultaneously, leading to optimized cost-effectiveness. The overall market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate expected to reach xx% by 2033 in key industrial sectors. Competitive dynamics are characterized by a blend of both intense competition among established players and opportunities for new entrants with specialized technologies or niche market focus.

Dominant Regions & Segments in Europe Industrial Air Quality Control Systems Industry

Germany, France, and the UK are the leading markets in Europe for industrial air quality control systems, driven by robust industrial bases, stringent environmental regulations, and significant investments in infrastructure upgrades. The power generation and cement industries represent the largest application segments due to their high emission profiles.

- Leading Region: Western Europe, particularly Germany, France, and the UK.

- Key Drivers:

- Stringent Environmental Regulations: EU directives and national legislation drive adoption.

- Economic Growth: Industrial activity and infrastructure development fuel demand.

- Government Incentives: Subsidies and grants for clean technology adoption.

- Dominant Segments (by Type): Electrostatic Precipitators (ESP) and Fabric Filters currently dominate, but SCR and FGD systems are showing increasing growth due to stricter NOx and SO2 regulations.

- Dominant Segments (by Application): Power Generation and Cement industries are the largest consumers, followed by Chemicals and Fertilizers.

Dominant Segments (by Pollutant): Particulate Matter (PM) control systems hold the largest market share, followed by systems targeting Nitrogen Oxides (NOx) and Sulphur Oxides (SO2). This reflects the emphasis placed on reducing PM2.5 levels across Europe.

Europe Industrial Air Quality Control Systems Industry Product Innovations

Recent innovations focus on improving efficiency, reducing operational costs, and enhancing monitoring capabilities. This includes the integration of advanced sensors, AI-driven predictive maintenance, and IoT-based remote monitoring. Furthermore, there's a growing trend towards modular and customizable systems, allowing for greater flexibility and adaptation to specific industrial needs. These innovations improve market fit by addressing the specific challenges and requirements of various industrial sectors.

Report Scope & Segmentation Analysis

The report segments the market by system type (Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, Selective Catalytic Reduction (SCR), Fabric Filters, Others), application (Power Generation Industry, Cement Industry, Chemicals and Fertilizers, Iron and Steel Industry, Automotive Industry, Oil & Gas Industry, Other Applications), and pollutant (Nitrogen Oxides (NOx), Sulphur Oxides (SO2), Particulate Matter (PM)). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. For example, the ESP segment is expected to maintain a significant market share driven by its established technology and cost-effectiveness, while SCR systems are experiencing rapid growth due to increasingly stringent NOx emission standards.

Key Drivers of Europe Industrial Air Quality Control Systems Industry Growth

Growth is driven by stringent environmental regulations (like the European Green Deal), rising awareness of air pollution's health impacts, increasing industrial activity in certain sectors, and technological advancements leading to more efficient and cost-effective solutions. Government incentives and support for clean technologies also play a significant role.

Challenges in the Europe Industrial Air Quality Control Systems Industry Sector

Challenges include high initial investment costs for advanced systems, potential supply chain disruptions impacting raw materials and components, intense competition among established and emerging players, and the complexity of regulatory compliance across different European countries. These factors may lead to a slowdown in adoption in specific segments or regions, impacting overall market growth.

Emerging Opportunities in Europe Industrial Air Quality Control Systems Industry

Opportunities exist in developing advanced monitoring and control technologies, focusing on integrated solutions for multiple pollutants, expanding into smaller industrial segments, and exploring new business models (e.g., performance-based contracting). Growing demand for customized and modular systems provides significant potential for tailored solutions.

Leading Players in the Europe Industrial Air Quality Control Systems Industry Market

- Munstermann GmbH & Co KG

- Fives Group

- Tholander Ablufttechnik GmbH

- Operational Group Limited

- John Cockerill Group

- John Wood Group PLC

- Exeon Ltd

- Chemisch Thermische Prozesstechnik GmbH

- Andritz AG

- Anguil Environmental Systems Inc

Key Developments in Europe Industrial Air Quality Control Systems Industry Industry

- October 2022: The European Green Deal's recommendations for stricter air quality regulations will significantly impact market growth over the next decade, driving demand for advanced emission control systems. This is expected to prevent over 75% of deaths caused by PM2.5 pollution exceeding WHO guidelines within 10 years.

- September 2022: Breathe Warsaw's initiative to create a comprehensive air quality database highlights the growing focus on data-driven approaches to pollution control, potentially creating demand for sophisticated monitoring and analysis technologies.

Future Outlook for Europe Industrial Air Quality Control Systems Market

The European industrial air quality control systems market is poised for continued growth, driven by increasingly stringent environmental regulations, technological advancements, and a growing awareness of air pollution's health and environmental impacts. Strategic opportunities lie in developing innovative solutions, expanding into new markets, and forging strategic partnerships to capitalize on the increasing demand for efficient and sustainable emission control technologies.

Europe Industrial Air Quality Control Systems Industry Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions (Qualitative Analysis only)

- 3.1. Nitrogen Oxides (NOx)

- 3.2. Sulphur Oxides (SO2)

- 3.3. Particulate Matter (PM)

Europe Industrial Air Quality Control Systems Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Rest of Europe

Europe Industrial Air Quality Control Systems Industry Regional Market Share

Geographic Coverage of Europe Industrial Air Quality Control Systems Industry

Europe Industrial Air Quality Control Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Stringent Regulation for Air Quality Management

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital is Required for the Installation of an Air Quality Control System

- 3.4. Market Trends

- 3.4.1. Power Generation Industry Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 5.3.1. Nitrogen Oxides (NOx)

- 5.3.2. Sulphur Oxides (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. France

- 5.4.3. United Kingdom

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 6.3.1. Nitrogen Oxides (NOx)

- 6.3.2. Sulphur Oxides (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. France Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 7.3.1. Nitrogen Oxides (NOx)

- 7.3.2. Sulphur Oxides (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 8.3.1. Nitrogen Oxides (NOx)

- 8.3.2. Sulphur Oxides (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electrostatic Precipitators (ESP)

- 9.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 9.1.3. Selective Catalytic Reduction (SCR)

- 9.1.4. Fabric Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation Industry

- 9.2.2. Cement Industry

- 9.2.3. Chemicals and Fertilizers

- 9.2.4. Iron and Steel Industry

- 9.2.5. Automotive Industry

- 9.2.6. Oil & Gas Industry

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 9.3.1. Nitrogen Oxides (NOx)

- 9.3.2. Sulphur Oxides (SO2)

- 9.3.3. Particulate Matter (PM)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Munstermann GmbH & Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fives Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tholander Ablufttechnik GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Operational Group Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 John Cockerill Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 John Wood Group PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exeon Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Chemisch Thermische Prozesstechnik GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Andritz AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Anguil Environmental Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Munstermann GmbH & Co KG

List of Figures

- Figure 1: Europe Industrial Air Quality Control Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Air Quality Control Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 4: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 8: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 12: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 16: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 20: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Air Quality Control Systems Industry?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Europe Industrial Air Quality Control Systems Industry?

Key companies in the market include Munstermann GmbH & Co KG, Fives Group, Tholander Ablufttechnik GmbH, Operational Group Limited, John Cockerill Group, John Wood Group PLC, Exeon Ltd, Chemisch Thermische Prozesstechnik GmbH, Andritz AG, Anguil Environmental Systems Inc.

3. What are the main segments of the Europe Industrial Air Quality Control Systems Industry?

The market segments include Type, Application, Emissions (Qualitative Analysis only).

4. Can you provide details about the market size?

The market size is estimated to be USD 97.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Stringent Regulation for Air Quality Management.

6. What are the notable trends driving market growth?

Power Generation Industry Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Capital is Required for the Installation of an Air Quality Control System.

8. Can you provide examples of recent developments in the market?

October 2022: In the European Green Deal, the Commission recommended stricter regulations for sewage treatment from cities, surface and groundwater pollution, and ambient air quality. In ten years, the new regulations will prevent more than 75% of deaths brought on by levels of the major pollutant PM2.5 above WHO recommendations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Air Quality Control Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Air Quality Control Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Air Quality Control Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Industrial Air Quality Control Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence