Key Insights

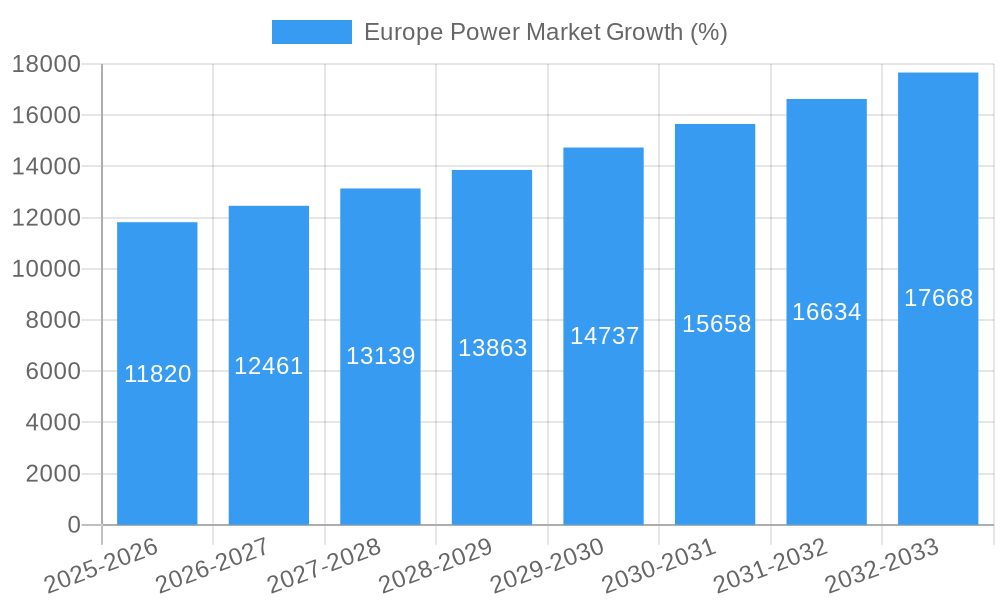

The European power market, valued at approximately €[Estimate based on XX million and currency conversion – e.g., €200 billion] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.91% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for electricity fueled by industrialization and rising energy consumption across diverse sectors, including residential, commercial, and transportation, is a significant contributor. Secondly, the European Union's ambitious renewable energy targets and policies aimed at reducing carbon emissions are accelerating the adoption of renewable energy sources like solar, wind, and hydropower, driving significant investments in these sectors. Furthermore, technological advancements in energy storage solutions and smart grid technologies are enhancing the efficiency and reliability of the power grid, supporting market growth.

However, the market also faces certain constraints. Fluctuations in fossil fuel prices, geopolitical instability impacting energy supply chains, and the intermittent nature of renewable energy sources pose challenges to maintaining a stable and affordable energy supply. Regulatory hurdles and the complexities involved in integrating renewable energy into existing grids also contribute to the market's complexities. Nevertheless, the long-term outlook remains positive, with significant opportunities for market players involved in the development, deployment, and management of renewable energy projects, grid modernization initiatives, and energy efficiency solutions. The growth is expected to be particularly strong in countries with ambitious renewable energy targets and supportive regulatory frameworks, such as Germany, France, and the United Kingdom, while other European nations will follow suit at varying paces. The competitive landscape is characterized by both large multinational corporations and smaller specialized players, fostering innovation and driving market competition.

Europe Power Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Europe Power Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period runs from 2025 to 2033, while historical data encompasses 2019-2024.

Europe Power Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European power market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The report assesses market share distribution among key players and quantifies the value of significant M&A deals.

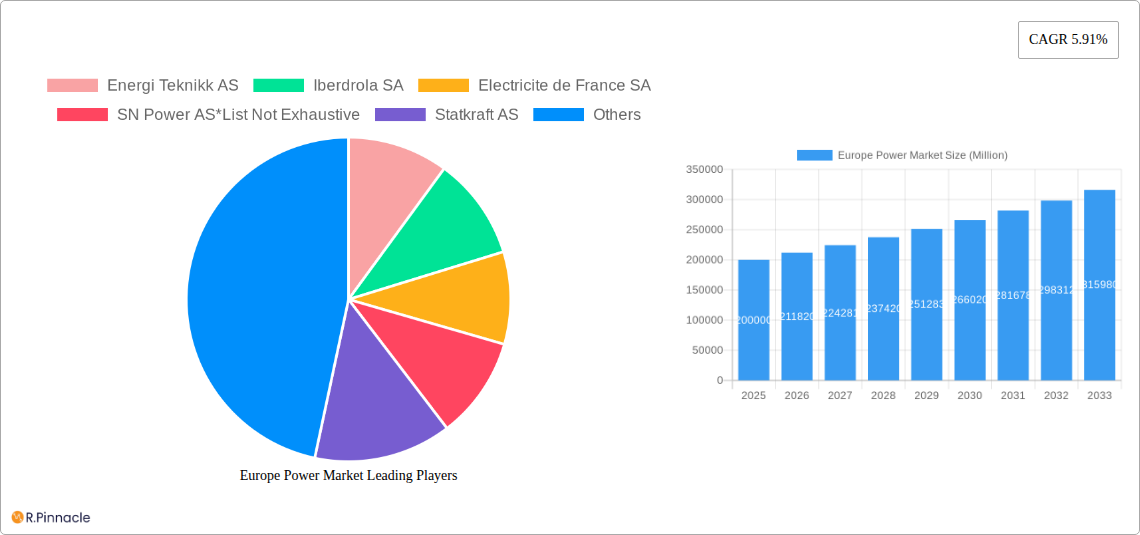

Market Concentration: The European power market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report provides detailed analysis of market share data for key players, including but not limited to Energi Teknikk AS, Iberdrola SA, Electricite de France SA, SN Power AS, Statkraft AS, Agder Energi SA, National Grid plc, Rainpower Holding AS, and Enel Green Power SpA. xx% of the market is controlled by the top 5 players.

Innovation Drivers: Stringent environmental regulations, coupled with the increasing demand for renewable energy sources, are driving significant innovation within the sector. This includes advancements in renewable energy technologies, smart grids, and energy storage solutions.

Regulatory Frameworks: The EU's commitment to carbon neutrality by 2050 is significantly shaping the regulatory landscape, influencing investments in renewable energy and driving the adoption of stricter emission standards.

M&A Activity: The report analyzes recent M&A activity in the sector, providing details on deal values and strategic rationale behind significant transactions. The total value of M&A deals in the past 5 years is estimated at €xx Million.

Product Substitutes: The growing affordability and efficiency of renewable energy sources are presenting a significant challenge to traditional power generation technologies.

End-User Demographics: The report details the composition of end-users, analyzing their energy consumption patterns and preferences, which will influence the future of the European power market.

Europe Power Market Market Dynamics & Trends

This section delves into the key market drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the European power market. The analysis includes projections of Compound Annual Growth Rate (CAGR) and market penetration for key segments.

The European power market is experiencing dynamic shifts driven by several factors. The transition towards renewable energy sources, spurred by stringent environmental regulations and the declining cost of renewable technologies, is a key driver. Technological disruptions, such as advancements in battery storage and smart grid technologies, are further accelerating this transition. Consumer preferences are shifting towards cleaner energy sources, increasing the demand for renewable energy products and services. The competitive dynamics are intense, with established players facing increasing pressure from new entrants and disruptive technologies. The report forecasts a CAGR of xx% for the European power market between 2025 and 2033, with renewable energy segments exhibiting the highest growth rates. Market penetration of renewable energy is projected to reach xx% by 2033.

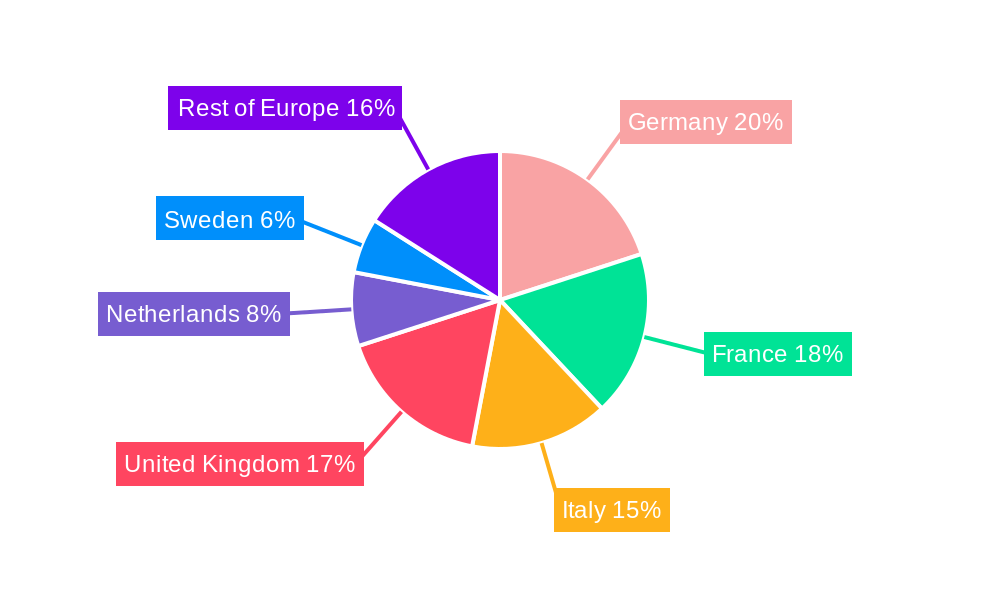

Dominant Regions & Segments in Europe Power Market

This section identifies the leading regions, countries, and segments within the European power market, providing detailed analysis of their market dominance.

Leading Regions: Germany, France, and the UK are expected to remain dominant regions, owing to their robust energy infrastructure and supportive policy environments.

Leading Segments: Renewables (solar and wind power) are experiencing rapid growth and are poised to become the dominant segment in the long-term. Hydroelectric remains significant, while thermal power generation is gradually declining due to environmental concerns. The "Other Types" segment encompasses emerging technologies, which are currently a smaller part of the total market.

Key Drivers: Several factors contribute to the dominance of specific regions and segments. These include:

- Government policies: Supportive policies, including subsidies, tax incentives, and renewable energy targets, are crucial in driving growth.

- Infrastructure: Existing energy infrastructure plays a pivotal role in shaping the growth of different segments.

- Economic conditions: Economic factors, such as investment levels and energy prices, influence the pace of growth in various regions and segments.

The detailed analysis within the report dissects the drivers contributing to the prominence of each region and segment, providing a clear picture of market dynamics.

Europe Power Market Product Innovations

Recent years have witnessed significant advancements in power generation technologies. Renewables are leading the innovation charge, with improvements in solar panel efficiency, wind turbine capacity, and energy storage solutions. Smart grid technologies are enhancing grid efficiency and integrating renewable energy sources seamlessly. These innovations improve the cost-effectiveness and reliability of renewable energy, making it increasingly competitive with traditional sources. The market is witnessing a strong focus on improving the efficiency and lowering the cost of renewable energy generation and storage.

Report Scope & Segmentation Analysis

This report segments the European power market based on power generation type: Thermal, Hydroelectric, Renewables (Solar, Wind, Geothermal, Biomass), and Other Types. Each segment's market size, growth projections, and competitive dynamics are analyzed.

Thermal Power Generation: This segment is projected to experience a decline in market share due to environmental concerns and the shift towards renewable sources. The market size is projected to be €xx Million in 2025, with a CAGR of xx% during the forecast period. Competition is intense amongst existing thermal power plants, with increasing pressure to improve efficiency and reduce emissions.

Hydroelectric Power Generation: This segment maintains a stable position, benefitting from established infrastructure and relatively low operating costs. The market size is estimated at €xx Million in 2025, with a CAGR of xx% projected through 2033.

Renewables (Solar, Wind, Geothermal, Biomass): This segment is the fastest-growing, driven by supportive policies, technological advancements, and decreasing costs. The market size is expected to reach €xx Million in 2025, with a CAGR of xx% during the forecast period. The competitive landscape is dynamic, with both established and emerging players vying for market share.

Other Types: This segment encompasses emerging technologies like tidal, wave, and hydrogen power. The market size is relatively small but is expected to grow significantly in the coming years. The CAGR is projected to be xx% through 2033.

Key Drivers of Europe Power Market Growth

The growth of the European power market is driven by several factors:

Increasing demand for electricity: Rising energy consumption across various sectors drives the need for increased power generation capacity.

Stringent environmental regulations: EU regulations targeting carbon neutrality are accelerating the adoption of renewable energy technologies.

Technological advancements: Innovations in renewable energy sources, energy storage, and smart grid technologies are boosting market growth.

Government support: Financial incentives and policy support for renewable energy projects are creating a favorable environment for market expansion.

Challenges in the Europe Power Market Sector

The European power market faces several challenges:

Intermittency of renewable energy sources: The unpredictable nature of renewable energy sources poses challenges for grid stability and reliability.

High initial investment costs: The substantial capital expenditure required for renewable energy projects can act as a barrier to entry for some players.

Grid infrastructure limitations: Existing grid infrastructure may not be fully equipped to handle the influx of renewable energy sources. Upgrading the infrastructure requires substantial investments.

These challenges, while significant, are not insurmountable and are being actively addressed by policymakers and industry players.

Emerging Opportunities in Europe Power Market

The European power market presents various emerging opportunities:

Smart grid technologies: The deployment of smart grids offers opportunities for improved grid efficiency, integration of renewable energy sources, and enhanced demand-side management.

Energy storage solutions: Technological advancements in energy storage are enabling the wider adoption of renewable energy, particularly solar and wind power.

Green hydrogen: Hydrogen generated from renewable sources presents a promising opportunity for decarbonizing various sectors.

These emerging opportunities are attracting significant investments and driving innovation within the market.

Leading Players in the Europe Power Market Market

- Energi Teknikk AS

- Iberdrola SA

- Electricite de France SA

- SN Power AS

- Statkraft AS

- Agder Energi SA

- National Grid plc

- Rainpower Holding AS

- Enel Green Power SpA

Key Developments in Europe Power Market Industry

March 2023: EDF's LOI with Ansaldo Energia, Ansaldo Nucleare, and Edison to develop SMRs in Europe signals a renewed focus on nuclear power, driven by carbon-neutrality goals.

September 2022: Germany's tender for 1.5 GW of solar energy demonstrates a strong commitment to accelerating solar energy growth.

April 2022: General Electric's onshore wind project in Spain highlights the continued expansion of wind energy capacity in the region.

Future Outlook for Europe Power Market Market

The future of the European power market is bright, driven by sustained growth in renewable energy, technological advancements, and supportive policy frameworks. The increasing demand for electricity, coupled with the transition to a low-carbon economy, presents significant opportunities for growth. Strategic investments in renewable energy infrastructure, smart grids, and energy storage solutions will be crucial in shaping the future landscape of the European power market. The market is expected to witness continued consolidation through mergers and acquisitions, as companies seek to gain scale and expand their market share.

Europe Power Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Renewables

- 1.4. Other Types

- 2. Power Transmission & Distribution

Europe Power Market Segmentation By Geography

- 1. Norway

- 2. Germany

- 3. Netherlands

- 4. The United Kingdom

- 5. Italy

- 6. Rest of Europe

Europe Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Adoption of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Limited Natural Resources

- 3.4. Market Trends

- 3.4.1. Renewables is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Renewables

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.3.2. Germany

- 5.3.3. Netherlands

- 5.3.4. The United Kingdom

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Norway Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Power Generation

- 6.1.1. Thermal

- 6.1.2. Hydroelectric

- 6.1.3. Renewables

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 6.1. Market Analysis, Insights and Forecast - by Power Generation

- 7. Germany Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Power Generation

- 7.1.1. Thermal

- 7.1.2. Hydroelectric

- 7.1.3. Renewables

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 7.1. Market Analysis, Insights and Forecast - by Power Generation

- 8. Netherlands Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Power Generation

- 8.1.1. Thermal

- 8.1.2. Hydroelectric

- 8.1.3. Renewables

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 8.1. Market Analysis, Insights and Forecast - by Power Generation

- 9. The United Kingdom Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Power Generation

- 9.1.1. Thermal

- 9.1.2. Hydroelectric

- 9.1.3. Renewables

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 9.1. Market Analysis, Insights and Forecast - by Power Generation

- 10. Italy Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Power Generation

- 10.1.1. Thermal

- 10.1.2. Hydroelectric

- 10.1.3. Renewables

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 10.1. Market Analysis, Insights and Forecast - by Power Generation

- 11. Rest of Europe Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Power Generation

- 11.1.1. Thermal

- 11.1.2. Hydroelectric

- 11.1.3. Renewables

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Power Transmission & Distribution

- 11.1. Market Analysis, Insights and Forecast - by Power Generation

- 12. Germany Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Power Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Energi Teknikk AS

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Iberdrola SA

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Electricite de France SA

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 SN Power AS*List Not Exhaustive

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Statkraft AS

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Agder Energi SA

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 National Grid plc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Rainpower Holding AS

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Enel Green Power SpA

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.1 Energi Teknikk AS

List of Figures

- Figure 1: Europe Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Power Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 4: Europe Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 14: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 15: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 17: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 18: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 20: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 21: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 23: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 24: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 26: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 27: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Power Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 29: Europe Power Market Revenue Million Forecast, by Power Transmission & Distribution 2019 & 2032

- Table 30: Europe Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Power Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Europe Power Market?

Key companies in the market include Energi Teknikk AS, Iberdrola SA, Electricite de France SA, SN Power AS*List Not Exhaustive, Statkraft AS, Agder Energi SA, National Grid plc, Rainpower Holding AS, Enel Green Power SpA.

3. What are the main segments of the Europe Power Market?

The market segments include Power Generation, Power Transmission & Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Adoption of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Renewables is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Limited Natural Resources.

8. Can you provide examples of recent developments in the market?

March 2023: EDF signed a letter of intent (LOI) with Ansaldo Energia, Ansaldo Nucleare, and Edison to develop small modular reactors (SMRs) in Europe. Through the project, the partners are required to determine the potential for the development and execution of new nuclear power in Italy. The plans are casting a glance at the 2050 carbon-neutrality goals set by the European region. EDF is already involved in three nuclear reactors in Italy: the Nuward SMR, the mid-size EPR 1200 reactor, and the large-size EPR reactor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Power Market?

To stay informed about further developments, trends, and reports in the Europe Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence