Key Insights

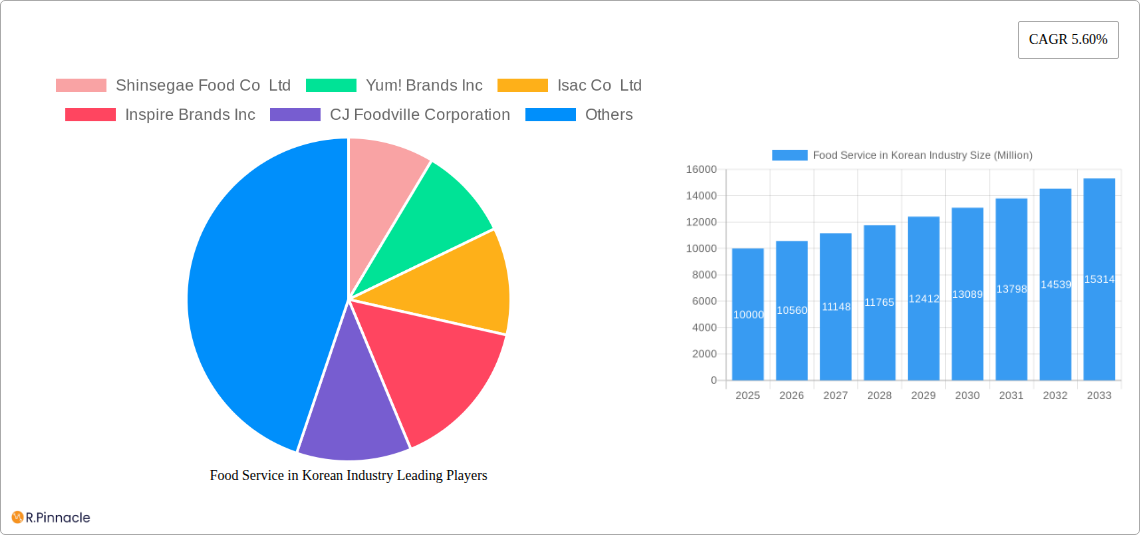

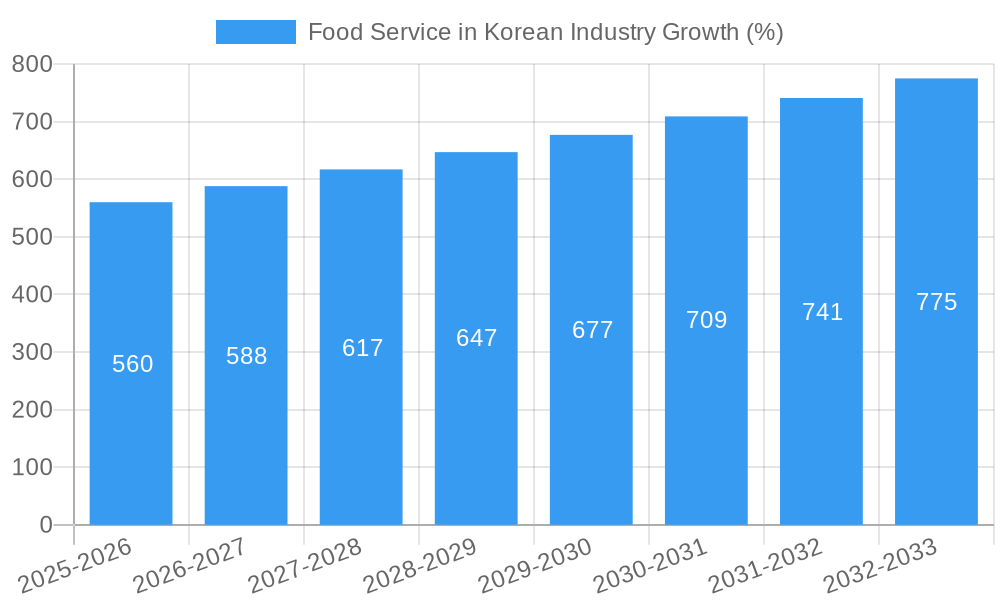

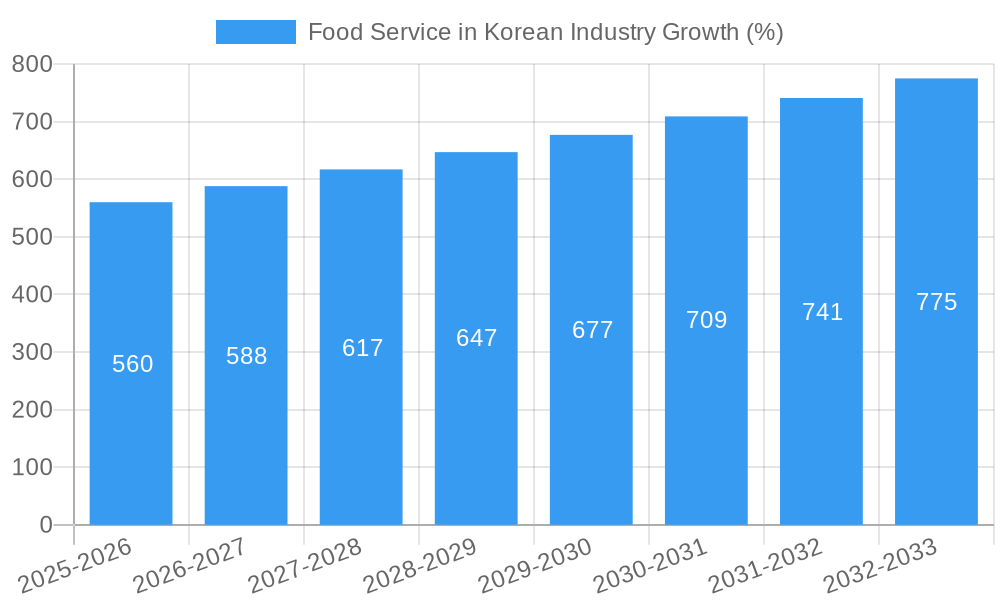

The South Korean food service industry, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.60% from 2019 to 2024, presents a dynamic market landscape. Driven by factors such as rising disposable incomes, changing consumer preferences towards convenience and diverse culinary experiences, and the increasing popularity of quick-service restaurants (QSRs), the sector shows significant growth potential. The market is segmented across various cuisines (including other QSR options beyond those explicitly listed), outlet types (chained and independent), locations (leisure, lodging, retail, standalone, travel), and food service formats (cafes and bars). Key players like Shinsegae Food Co Ltd, Yum! Brands Inc, and CJ Foodville Corporation are fiercely competing for market share, investing heavily in innovative menu offerings, technological advancements (e.g., mobile ordering, delivery services), and strategic partnerships to enhance customer engagement and loyalty. The industry's growth is also facilitated by a burgeoning tourism sector, further boosting demand within the leisure and travel segments.

However, challenges remain. Increasing operating costs, intense competition, and fluctuating raw material prices present hurdles for businesses. Furthermore, maintaining consistent food quality and service standards while managing expansion and operational efficiency is crucial for success. The future growth of the Korean food service industry hinges on adapting to evolving consumer demands, leveraging technological advancements to streamline operations and enhance the customer experience, and effectively navigating the complexities of a competitive market. A strong focus on brand building, innovative marketing strategies, and sustainable business practices will be essential for long-term profitability and market leadership. While precise market size figures for the base year (2025) are unavailable, leveraging the CAGR and industry knowledge, it can be reasonably estimated that the market value is considerable and continues to grow.

Food Service in Korean Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Korean food service industry, offering invaluable insights for industry professionals, investors, and strategic planners. Leveraging extensive data from 2019-2024 (historical period), the report establishes a robust base year of 2025 and projects market trends through 2033 (forecast period). Discover key market dynamics, growth drivers, challenges, and emerging opportunities within this dynamic sector. The report features a detailed segmentation analysis, covering key players, and examines recent strategic developments to illuminate the competitive landscape. Expect detailed market sizing in Millions for key segments, providing actionable intelligence for informed decision-making.

Food Service in Korean Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Korean food service industry, examining market concentration, innovation drivers, regulatory influences, and significant M&A activities. The study period covers 2019-2033, with 2025 as the base and estimated year.

The Korean food service market demonstrates a blend of established international chains and thriving domestic players. Market concentration is moderate, with a few dominant players like Shinsegae Food Co Ltd, Yum! Brands Inc, and McDonald's Corporation holding significant market share (estimated at xx% combined in 2025). However, a considerable number of smaller, independent outlets also contribute significantly to the overall market size.

- Market Share (2025 Estimate): Shinsegae Food Co Ltd (xx%), Yum! Brands Inc (xx%), McDonald's Corporation (xx%), Others (xx%).

- Innovation Drivers: Growing consumer demand for diverse cuisines, increasing disposable incomes, and the rise of food delivery platforms are key drivers of innovation.

- Regulatory Framework: The regulatory environment in South Korea impacts food safety standards, hygiene practices, and labor laws, influencing operational costs and strategies.

- Product Substitutes: The increasing popularity of home meal kits and meal delivery services presents a competitive challenge to traditional food service establishments.

- End-User Demographics: The Korean food service market caters to a diverse demographic, including young adults, families, and tourists, each with distinct preferences and spending habits.

- M&A Activities: Significant M&A activity has been observed in recent years, exemplified by Yum! Brands Inc.'s acquisition of KFC Korea in 2023 (deal value: xx Million). This consolidation trend is likely to continue, driven by the pursuit of market share and expansion.

Food Service in Korean Industry Market Dynamics & Trends

This section delves into the key factors influencing the growth and evolution of the Korean food service market.

The Korean food service industry is experiencing robust growth, driven by several key factors. Rising disposable incomes and a changing lifestyle favoring convenience and dining out have significantly boosted market expansion. Technological advancements, particularly in online ordering and delivery, have broadened market access and fuelled growth. The increasing popularity of diverse cuisines, from traditional Korean fare to international options, also contributes to market expansion. The CAGR for the period 2025-2033 is projected at xx%, with market penetration expected to reach xx% by 2033. Competitive dynamics are shaped by both established chains and the emergence of innovative, smaller players catering to niche segments. Consumer preferences are shifting towards healthier options, sustainable practices, and unique culinary experiences, prompting businesses to adapt their offerings and operational strategies. Technological disruptions in areas like AI-powered ordering systems, personalized meal recommendations, and automated kitchens are transforming operational efficiency and the overall customer experience.

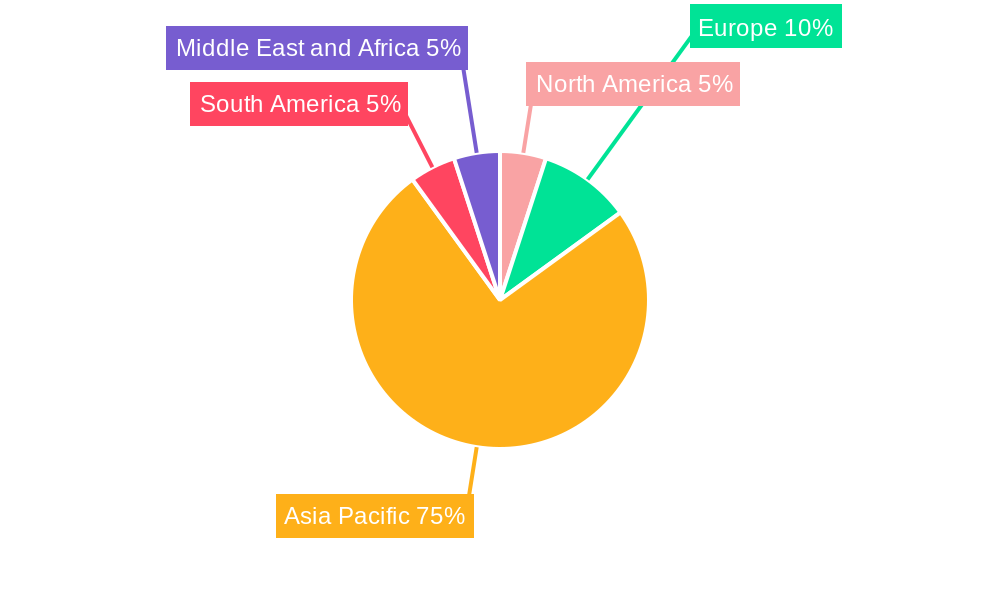

Dominant Regions & Segments in Food Service in Korean Industry

This section identifies the leading regions and segments within the Korean food service industry.

The Seoul metropolitan area remains the dominant region, accounting for the largest market share due to its high population density, strong economic activity, and significant tourist inflow. However, other major cities and regions are also experiencing considerable growth.

- Leading Segment: Chained outlets dominate the market, leveraging brand recognition, economies of scale, and standardized operational procedures.

- Key Drivers for Seoul's Dominance:

- High population density and disposable incomes.

- Extensive tourism.

- Developed infrastructure.

- High concentration of business activity.

- Other QSR Cuisines: The demand for diverse cuisines is driving growth in this segment, with international and fusion concepts gaining popularity.

- Independent Outlets: These outlets offer unique culinary experiences and cater to specific niches. While smaller in overall market share compared to chains, they contribute significantly to market diversity and innovation.

- Location-Based Segmentation: Standalone outlets remain the most prevalent, offering greater flexibility and location-specific advantages. However, the leisure and travel segments are also showing strong growth.

- Foodservice Type: Cafes and Bars, although a niche, are contributing to the growth owing to their unique offerings.

Food Service in Korean Industry Product Innovations

Recent product innovations reflect changing consumer preferences and technological advancements. The introduction of plant-based options, such as Shinsegae Food's Better Burger, showcases the growing demand for healthier and sustainable alternatives. The integration of technology is also evident in the adoption of automated ordering systems and AI-powered kitchen solutions, aiming to improve efficiency and provide a superior customer experience. These innovations provide competitive advantages by meeting evolving consumer demands and enhancing operational efficiency.

Report Scope & Segmentation Analysis

The report segments the Korean food service market across various parameters:

- Cuisine Type: Korean, Western, Japanese, Chinese, and Other QSR Cuisines. Each segment shows varying growth rates based on consumer preferences.

- Outlet Type: Chained Outlets and Independent Outlets. Chained outlets, due to their established brands and economies of scale, tend to hold a larger market share. Independent outlets offer unique, localized options.

- Location: Leisure, Lodging, Retail, Standalone, Travel. Locations with high foot traffic, like retail areas and tourist destinations, experience faster growth.

- Foodservice Type: Cafes & Bars, Quick Service Restaurants (QSR), Full-Service Restaurants (FSR). Each foodservice type has unique market characteristics and growth potentials. Growth projections for each segment vary, based on economic factors and consumer preferences. Competitive dynamics within each segment also differ, with varying degrees of competition and market concentration.

Key Drivers of Food Service in Korean Industry Growth

Several factors fuel the growth of the Korean food service industry:

- Rising Disposable Incomes: Increased purchasing power allows consumers to spend more on dining out.

- Changing Lifestyle: The preference for convenience and less time spent on cooking boosts the demand for food service.

- Tourism: Increased international tourism significantly contributes to the revenue of the food service sector, particularly in popular tourist destinations.

- Technological Advancements: Online ordering, delivery platforms, and automated systems improve efficiency and accessibility.

Challenges in the Food Service in Korean Industry Sector

The Korean food service industry faces several challenges:

- High Operating Costs: Rent, labor costs, and food prices significantly impact profitability.

- Intense Competition: The presence of both established international chains and numerous smaller independent outlets creates a fiercely competitive environment.

- Regulatory Compliance: Meeting stringent food safety and hygiene regulations requires significant investment.

Emerging Opportunities in Food Service in Korean Industry

The Korean food service sector presents several promising opportunities:

- Health-Conscious Consumers: Meeting demand for healthier options, including vegetarian and vegan cuisines.

- Technological Integration: Adopting AI, automation, and data analytics to enhance efficiency and personalization.

- Niche Markets: Catering to specific dietary requirements or cultural preferences.

Leading Players in the Food Service in Korean Industry Market

- Shinsegae Food Co Ltd

- Yum! Brands Inc

- Isac Co Ltd

- Inspire Brands Inc

- CJ Foodville Corporation

- Seven & I Holdings Co Ltd

- Kyochon Food&Beverage Co Ltd

- Doctor's Associate Inc

- MP DAESAN Inc

- Genesis Co Ltd

- Domino's Pizza Inc

- Starbucks Corporation

- Restaurant Brands International Inc

- Royal T Group Pte Ltd

- McDonald's Corporation

- Mom's Touch & Co

Key Developments in Food Service in Korean Industry Industry

- February 2023: McDonald's Korea collaborated with NewJeans, introducing a special meal, boosting brand visibility and sales.

- March 2023: Yum! Brands Inc. acquired KFC Korea Co., expanding its market presence and portfolio.

- April 2023: Shinsegae Food launched the Better Burger, a 100% plant-based burger, tapping into the growing demand for sustainable and healthy options. This demonstrates a proactive approach to changing consumer preferences.

Future Outlook for Food Service in Korean Industry Market

The Korean food service industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and the increasing integration of innovative business models. The market’s future hinges on adapting to health-conscious trends, leveraging technology for efficiency gains, and catering to increasingly diverse consumer demands. Strategic partnerships, innovative product development, and effective marketing strategies will be key for success in this dynamic and evolving market. Expansion into new regions and demographics, alongside the continued adoption of technology, will present significant opportunities for growth and market share gains.

Food Service in Korean Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service in Korean Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service in Korean Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. High demand for traditional cuisines and increased spending on dining increase the sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. North America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 France

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shinsegae Food Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Yum! Brands Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Isac Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Inspire Brands Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CJ Foodville Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Seven & I Holdings Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kyochon Food&Beverage Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Doctor's Associate Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 MP DAESAN Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Genesis Co Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Domino's Pizza Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Starbucks Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Restaurant Brands International Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Royal T Group Pte Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 McDonald's Corporation

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Mom's Touch & Co

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Shinsegae Food Co Ltd

List of Figures

- Figure 1: Global Food Service in Korean Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: North America Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: North America Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 15: North America Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: North America Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 17: North America Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 18: North America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: South America Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: South America Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 23: South America Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: South America Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 25: South America Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 26: South America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Europe Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Europe Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Europe Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Europe Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 33: Europe Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 34: Europe Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 41: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 42: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 45: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 46: Asia Pacific Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 47: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 48: Asia Pacific Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 49: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 50: Asia Pacific Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service in Korean Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service in Korean Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 34: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 36: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United States Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Canada Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Mexico Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 41: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 42: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 43: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Brazil Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Argentina Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of South America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 48: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 49: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 50: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: United Kingdom Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Germany Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: France Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Italy Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Spain Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Russia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Benelux Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Nordics Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Europe Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 61: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 62: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 63: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Turkey Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Israel Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: GCC Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: North Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Middle East & Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 71: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 72: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 73: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: China Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: India Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Japan Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: South Korea Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: ASEAN Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Oceania Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Asia Pacific Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service in Korean Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Food Service in Korean Industry?

Key companies in the market include Shinsegae Food Co Ltd, Yum! Brands Inc, Isac Co Ltd, Inspire Brands Inc, CJ Foodville Corporation, Seven & I Holdings Co Ltd, Kyochon Food&Beverage Co Ltd, Doctor's Associate Inc, MP DAESAN Inc, Genesis Co Ltd, Domino's Pizza Inc, Starbucks Corporation, Restaurant Brands International Inc, Royal T Group Pte Ltd, McDonald's Corporation, Mom's Touch & Co.

3. What are the main segments of the Food Service in Korean Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

High demand for traditional cuisines and increased spending on dining increase the sales.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

April 2023: Shinsegae Food introduced a 100% plant-based burger called Better Burger. Instead of using animal products like milk and eggs, the burger uses substitute meat, cheese, and buns created from plant-based proteins like soybeans and cashew nuts.March 2023: Yum! Brands Inc. teamed up with a Korean private equity fund to acquire KFC Korea Co.February 2023: McDonald's Korea collaborated with NewJeans and introduced a special crispy chicken sandwich meal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service in Korean Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service in Korean Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service in Korean Industry?

To stay informed about further developments, trends, and reports in the Food Service in Korean Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence