Key Insights

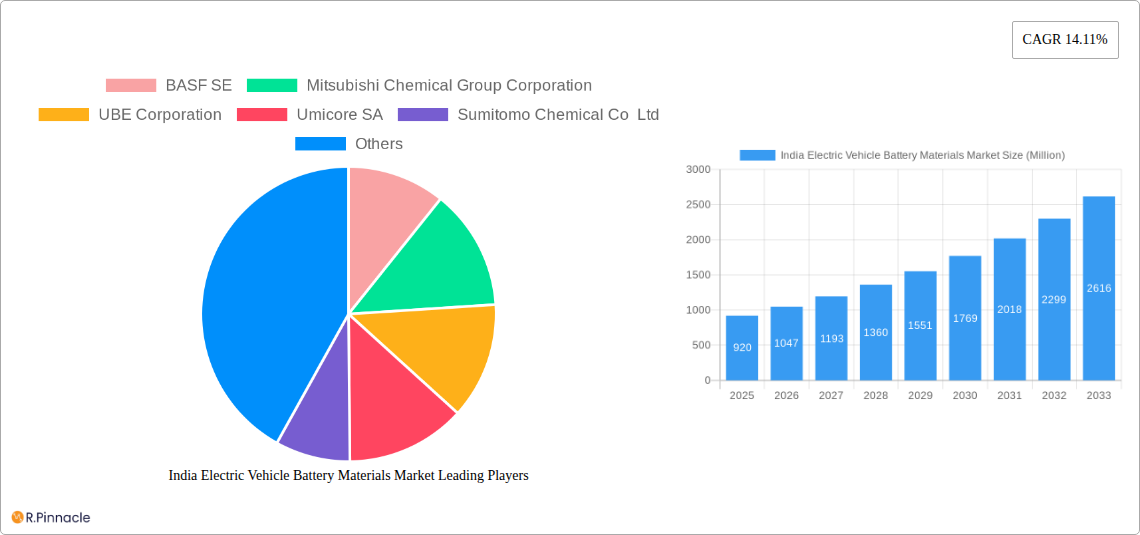

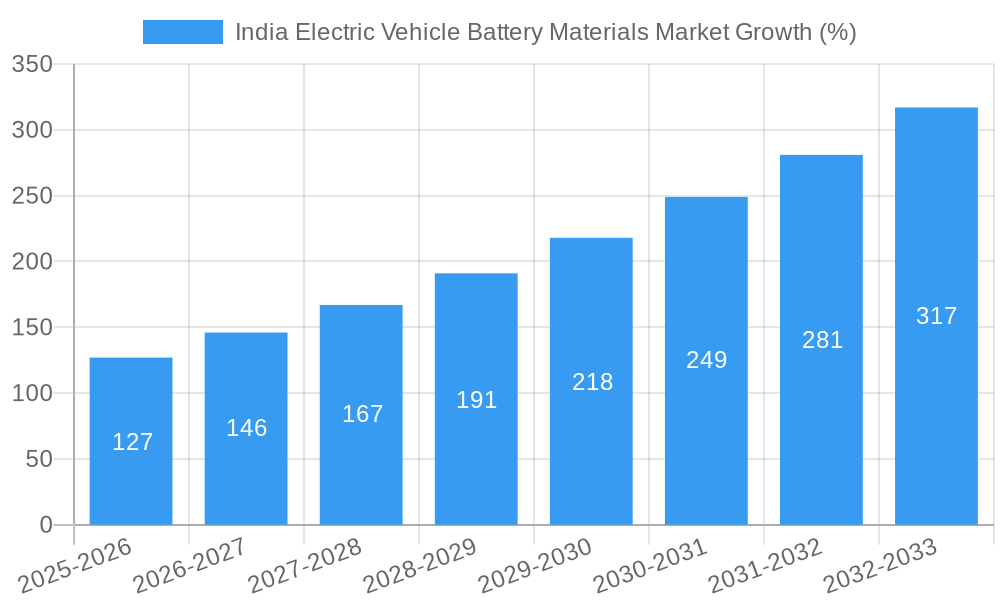

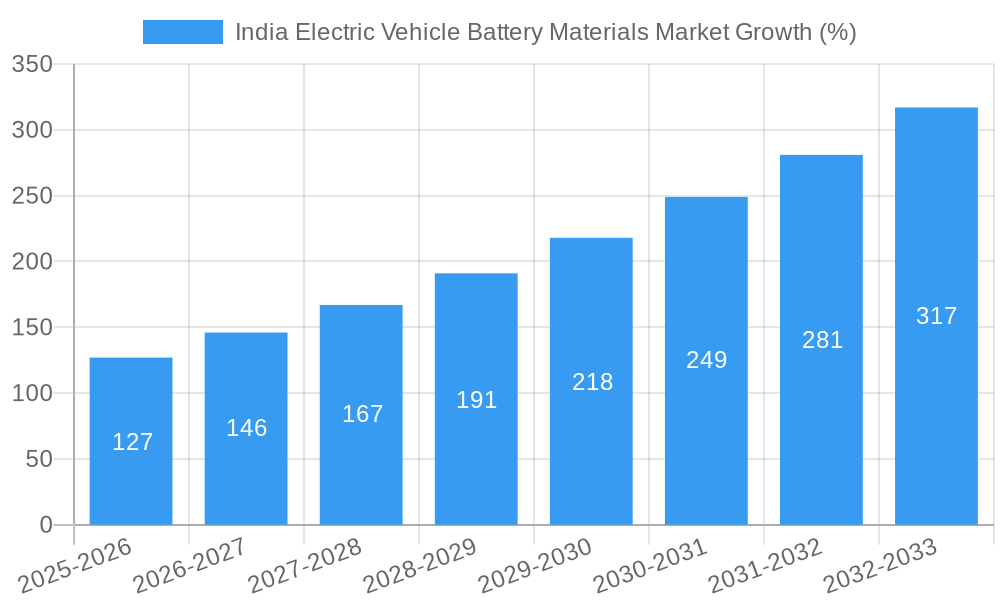

The India Electric Vehicle (EV) Battery Materials market is poised for significant growth, projected to reach a market size of $0.92 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 14.11% from 2019 to 2033. This robust expansion is driven by the Indian government's strong push towards EV adoption, including substantial investments in charging infrastructure and supportive policies. The rising environmental concerns and escalating fuel prices further contribute to the increasing demand for EVs, consequently boosting the need for battery materials like lithium-ion, lead-acid, and nickel-metal hydride. Key market trends include the increasing adoption of lithium-ion batteries due to their superior energy density and the rising focus on developing domestic sourcing of raw materials to reduce reliance on imports and enhance supply chain security. However, challenges like the high initial cost of EV batteries and the limited availability of critical battery materials like lithium and cobalt pose restraints to market growth. Leading players like BASF SE, Mitsubishi Chemical Group Corporation, and Umicore SA are actively investing in research and development to improve battery technology and enhance the overall market competitiveness. The market is segmented based on battery chemistry (lithium-ion, lead-acid, etc.), material type (cathode, anode, electrolyte), and application (two-wheelers, four-wheelers, etc.), each segment experiencing unique growth trajectories influenced by specific technological advancements and policy interventions. The forecast period (2025-2033) anticipates continued strong growth, fuelled by technological innovation and supportive government policies.

The competitive landscape is marked by both established international players and domestic manufacturers. Companies are focused on expanding their manufacturing capacity in India to cater to the growing demand and leverage the favorable government incentives. Strategic partnerships, mergers, and acquisitions are anticipated to reshape the market dynamics, driving further innovation and consolidation within the industry. Regional variations in market growth will be influenced by factors such as infrastructure development, government policies specific to each region, and the level of EV adoption in different parts of the country. The market is expected to witness the emergence of new technologies and materials, further enhancing battery performance and lowering costs, creating significant opportunities for companies across the value chain.

India Electric Vehicle Battery Materials Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India Electric Vehicle (EV) Battery Materials market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth prospects. Expect detailed segmentation, market sizing (in Millions), and CAGR projections, all contributing to a holistic understanding of this rapidly evolving sector.

India Electric Vehicle Battery Materials Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Indian EV battery materials market. We delve into market concentration, revealing the market share held by key players like BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, Exide Industries, Arkema SA, and Amara Raja, amongst others. The report also examines the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible and assessing their influence on market structure. Further analysis includes:

- Market Concentration: Analysis of market share distribution amongst leading players, indicating the level of competition and potential for consolidation. xx% of the market is currently controlled by the top 5 players.

- Innovation Drivers: Exploration of technological advancements, R&D investments, and government initiatives fostering innovation in battery materials.

- Regulatory Frameworks: Examination of government policies, environmental regulations, and safety standards impacting market development.

- Product Substitutes: Assessment of alternative materials and technologies posing potential threats or opportunities.

- End-User Demographics: Profiling the key consumers of EV battery materials, including manufacturers, distributors, and end-users.

- M&A Activities: Review of significant mergers, acquisitions, and joint ventures, including deal values (e.g., USD xx million) and their strategic implications.

India Electric Vehicle Battery Materials Market Dynamics & Trends

This section provides a comprehensive overview of the market's growth trajectory, highlighting key drivers, disruptive technologies, evolving consumer preferences, and competitive dynamics. We analyze historical data (2019-2024) and project future growth (2025-2033), providing a detailed CAGR and market penetration analysis. Specific market trends including government incentives, increasing EV adoption, and the rising demand for energy storage solutions are explored in detail. The impact of these factors on market growth is quantified through CAGR projections and penetration rates.

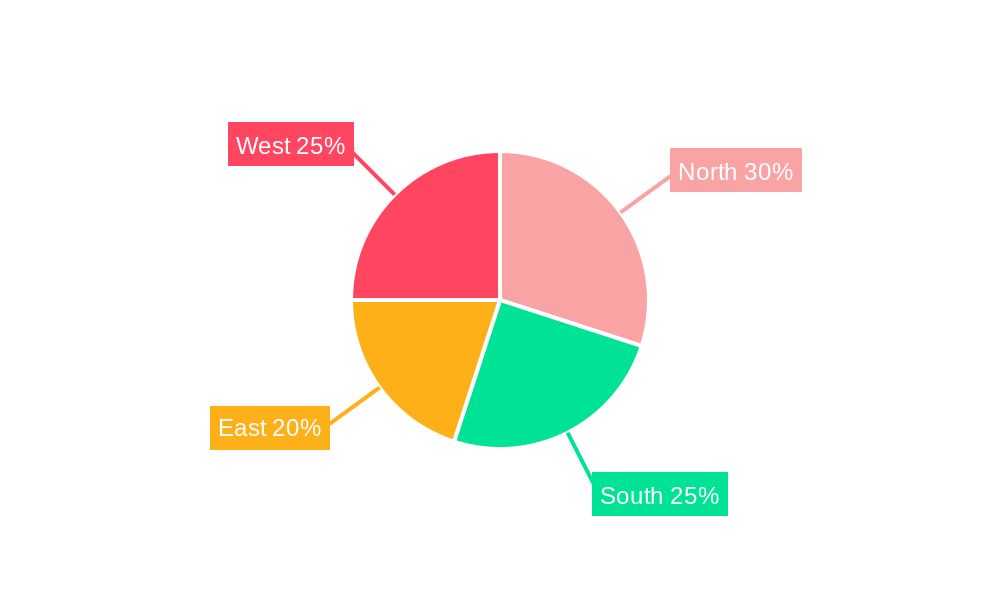

Dominant Regions & Segments in India Electric Vehicle Battery Materials Market

This section identifies the leading geographical regions and market segments within India's EV battery materials market. We provide a detailed analysis of the factors contributing to the dominance of specific regions, including:

- Key Drivers: Bullet points outlining the economic policies, infrastructure development, and consumer demand driving growth in leading regions.

- Dominance Analysis: Paragraphs detailing the specific factors contributing to the dominance of leading regions and segments, such as favorable government policies, established manufacturing infrastructure, and strong consumer demand. For example, the xx region is predicted to dominate due to its well-established automotive manufacturing base and supportive government incentives.

India Electric Vehicle Battery Materials Market Product Innovations

This section highlights recent advancements in EV battery materials, focusing on new product developments, applications, and their competitive advantages. We analyze technological trends influencing market dynamics and assess the market fit of innovative products.

Report Scope & Segmentation Analysis

The report comprehensively segments the Indian EV battery materials market based on various parameters, including material type (e.g., lithium-ion, nickel-metal hydride), application (e.g., passenger vehicles, two-wheelers, buses), and battery chemistry. Each segment’s growth projections, market size (in Millions), and competitive dynamics are analyzed.

Key Drivers of India Electric Vehicle Battery Materials Market Growth

This section outlines the primary factors propelling the growth of the Indian EV battery materials market. We discuss technological advancements (e.g., improved battery performance, reduced costs), supportive government policies (e.g., production-linked incentives), and the rising demand for EVs as key growth drivers, providing specific examples.

Challenges in the India Electric Vehicle Battery Materials Market Sector

This section identifies and analyzes the key challenges hindering the growth of the Indian EV battery materials market. We discuss regulatory hurdles, supply chain vulnerabilities, and the competitive intensity of the market, quantifying their impact on market growth where possible.

Emerging Opportunities in India Electric Vehicle Battery Materials Market

This section highlights the promising opportunities in the Indian EV battery materials market. We discuss emerging technologies, new market segments, and evolving consumer preferences as potential avenues for future growth.

Leading Players in the India Electric Vehicle Battery Materials Market Market

This section profiles the key players operating in the Indian EV battery materials market, including:

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- Exide Industries

- Arkema SA

- Amara Raja

- List Not Exhaustive

Key Developments in India Electric Vehicle Battery Materials Market Industry

- January 2024: Aether Industries, Himadri Speciality Chemicals, and Tata Chemicals invested significantly in lithium-ion battery production, with Aether Industries forming a strategic agreement for electrolyte additive supply and Himadri planning a 2 lakh tonne per annum manufacturing facility. Ami Organics also secured agreements for electrolyte manufacturing.

- February 2024: Hindalco Industries announced an INR 800 crore (~USD 96.4 million) investment in a new aluminum foil plant for EV and energy storage applications.

Future Outlook for India Electric Vehicle Battery Materials Market Market

This section summarizes the key growth accelerators and strategic opportunities expected to shape the future of the Indian EV battery materials market. We project continued market expansion driven by government support, technological progress, and rising EV adoption. The market is poised for significant growth, presenting attractive opportunities for both established players and new entrants.

India Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

India Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. India

India Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Chemical Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UBE Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Umicore SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sumitomo Chemical Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Exide Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arkema SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amara Raja*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: India Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Electric Vehicle Battery Materials Market Share (%) by Company 2024

List of Tables

- Table 1: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 5: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 11: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: India Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 14.11%.

2. Which companies are prominent players in the India Electric Vehicle Battery Materials Market?

Key companies in the market include BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, Exide Industries, Arkema SA, Amara Raja*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the India Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.92 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Battery Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

February 2024: Hindalco Industries planned to invest INR 800 crore (~USD 96.4 million) to build a new aluminum foil plant near Sambalpur in Odisha, India. The facility aims to produce high-quality battery foil for the rapidly growing electric vehicle and energy storage system markets.January 2024: Indian companies such as Aether Industries, Himadri Speciality Chemicals, and Tata Chemicals invested in lithium-ion battery production. Aether Industries has recently announced a strategic agreement with a global lithium-ion battery producer to expand into the electrolyte additives market. This agreement includes the commercial supply of one electrolyte additive, and discussions have begun to develop three additional products. Himadri Speciality Chemicals is also planning to establish a manufacturing facility for lithium-ion battery components with a total capacity of 2 lakh tonnes per annum. Ami Organics has signed a non-binding MoU with a global manufacturer of electrolytes. The company is also set to sign an MoU with the Gujarat government to set up a dedicated manufacturing facility at a cost of around USD 36 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the India Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence