Key Insights

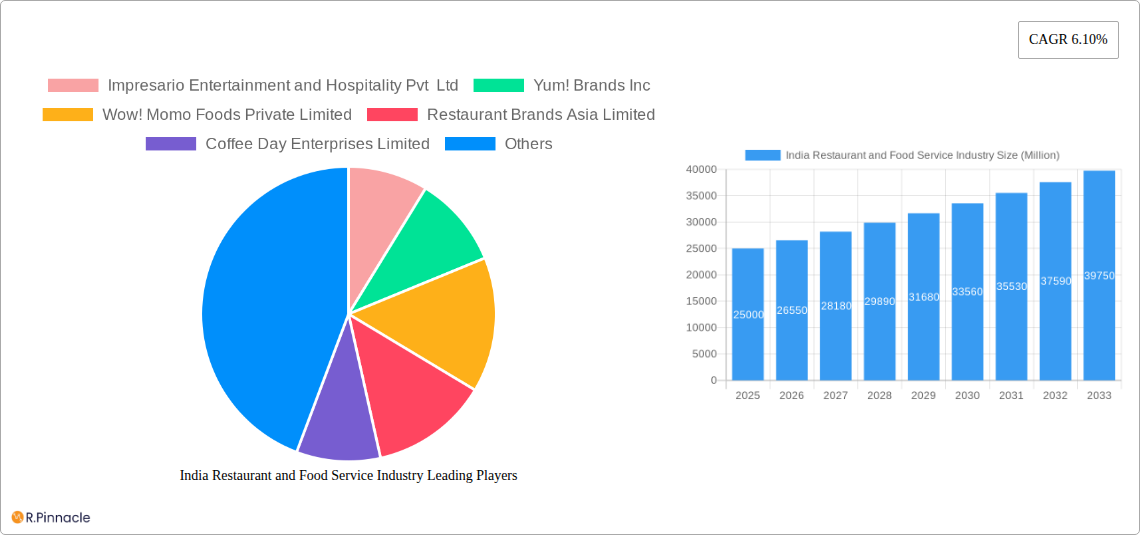

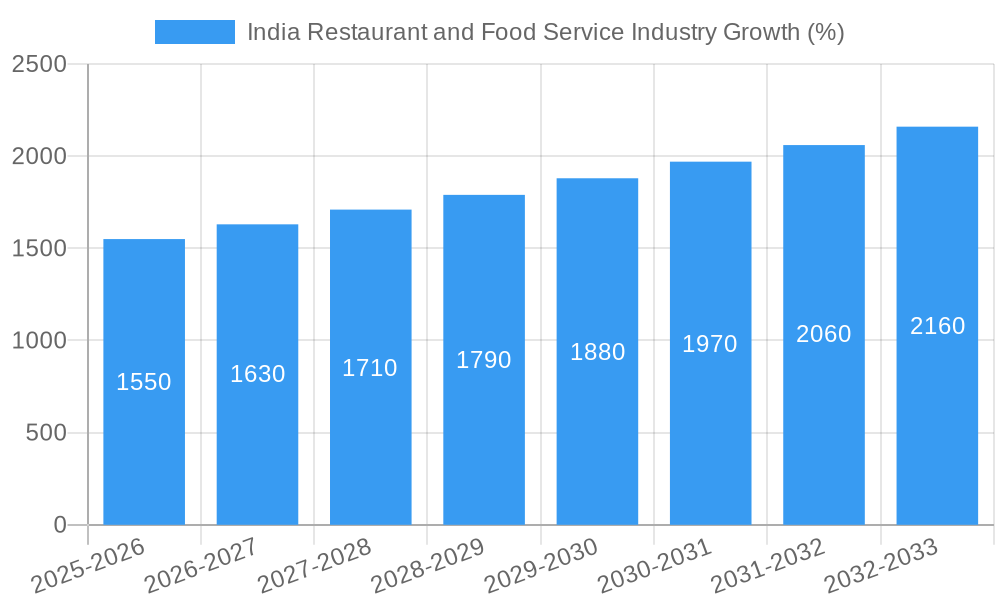

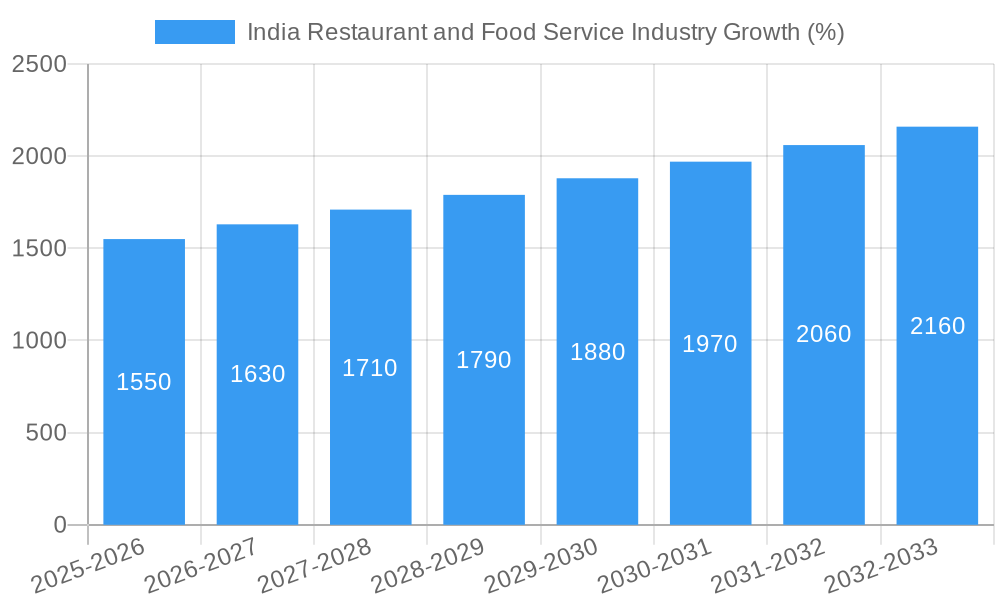

The Indian restaurant and food service industry, a vibrant and rapidly expanding sector, is poised for significant growth. Driven by factors like rising disposable incomes, a young and increasingly urban population with evolving tastes, and the proliferation of online food delivery platforms, the market exhibits a strong Compound Annual Growth Rate (CAGR) of 6.10%. This robust growth is fueled by the diversification of culinary offerings, catering to diverse preferences from traditional Indian cuisine to international fast-food chains and specialized cafes. The segmentation of the industry reveals a diverse landscape, with significant contributions from both chained and independent outlets across various locations like leisure destinations, hotels, retail spaces, and standalone restaurants. The presence of established players like Jubilant FoodWorks, McDonald's, and Impresario Entertainment, alongside emerging brands, indicates a competitive yet dynamic market with ample opportunities for innovation and expansion. The industry faces challenges such as rising input costs (ingredients, labor), increasing competition, and the need to maintain consistent food quality and hygiene standards. However, the sheer size of the market and the continued growth in consumer spending suggest that these challenges are likely to be overcome.

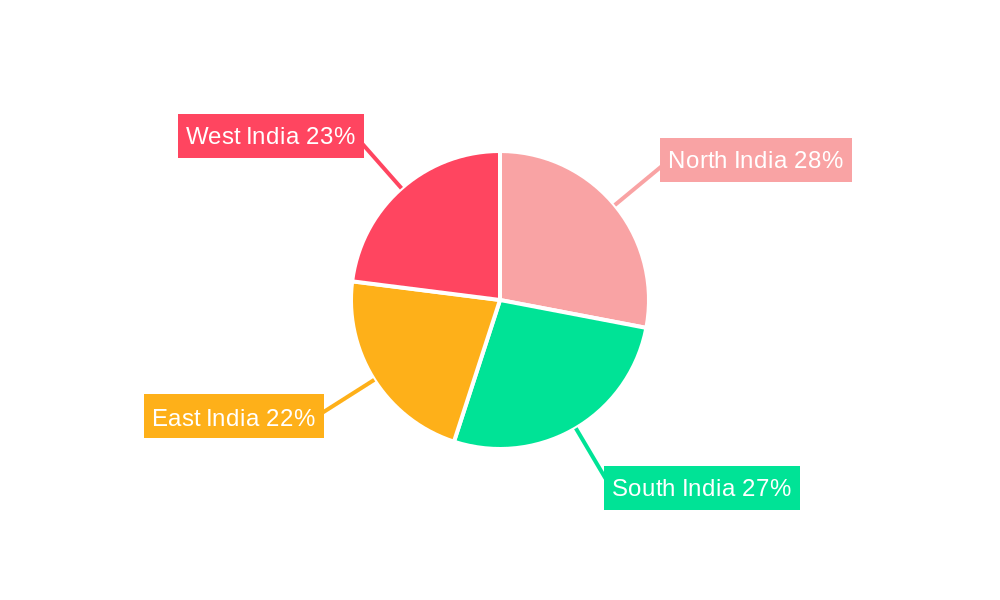

The regional distribution of the market reveals distinct opportunities. While data on specific regional shares is unavailable, the considerable size of India's population suggests substantial market presence across all regions (North, South, East, and West). The growth trajectory is likely to vary depending on local demographics, consumer preferences, and the concentration of established players and emerging brands. The future holds potential for further specialization within segments, such as healthier food options, personalized dining experiences, and enhanced customer service strategies, driven by technological advancements and shifting consumer expectations. A focus on sustainable practices and ethical sourcing is also emerging as a key factor influencing consumer choices and the long-term sustainability of the industry.

India Restaurant and Food Service Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India restaurant and food service industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive market data and expert analysis to reveal key trends, growth drivers, and future opportunities within this dynamic sector. The report forecasts a market value exceeding xx Million by 2033, driven by factors such as rising disposable incomes and evolving consumer preferences.

India Restaurant and Food Service Industry Market Structure & Innovation Trends

The Indian restaurant and food service industry exhibits a diverse market structure, encompassing large multinational chains like Yum! Brands Inc and McDonald's Corporation, alongside numerous independent outlets and regional players. Market concentration is moderate, with a few dominant players coexisting with a large number of smaller businesses. Innovation is driven by evolving consumer preferences, technological advancements (e.g., online ordering, delivery platforms), and increasing competition. Regulatory frameworks, including food safety regulations and licensing requirements, significantly influence market dynamics. Product substitutes, such as home-cooked meals and ready-to-eat options, exert competitive pressure. The end-user demographics are expanding, catering to diverse age groups and income levels. M&A activity is substantial, as evidenced by recent deals such as Rebel Foods’ acquisition of Wendy's franchise (USD xx Million valuation).

- Key Players: Yum! Brands Inc, McDonald's Corporation, Jubilant FoodWorks Limited, Impresario Entertainment and Hospitality Pvt Ltd.

- Market Share (2024 Estimate): Dominant players hold approximately xx% of the market share, with independent outlets accounting for the remaining xx%.

- M&A Deal Value (2019-2024): An estimated xx Million USD in mergers and acquisitions.

India Restaurant and Food Service Industry Market Dynamics & Trends

The Indian restaurant and food service industry is experiencing robust growth, fueled by several key drivers. Rising disposable incomes, urbanization, and changing lifestyles are contributing to increased foodservice spending. Technological disruptions, particularly the rise of online food delivery platforms and mobile payment systems, are transforming the industry landscape. Consumer preferences are shifting towards healthier options, diverse cuisines, and convenient delivery services. Intense competition is driving innovation and operational efficiency. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, with market penetration increasing across various segments.

Dominant Regions & Segments in India Restaurant and Food Service Industry

The Indian restaurant and food service industry demonstrates significant regional variations. Metropolitan areas like Mumbai, Delhi, and Bangalore lead in terms of market size and density of outlets. The QSR (Quick Service Restaurant) segment, particularly chained outlets, is dominant, driven by factors such as affordability, convenience, and brand recognition. Standalone restaurants and cafes cater to diverse customer preferences and market niches. The retail location segment is expanding significantly, while the lodging segment continues to show significant growth.

Key Drivers:

- Economic Growth: Rising disposable incomes and increasing urbanization.

- Infrastructure Development: Improved transportation and communication networks.

- Government Policies: Supportive regulations and initiatives promoting the food service sector.

Dominant Segments: Chained QSR outlets in metropolitan areas.

India Restaurant and Food Service Industry Product Innovations

The industry witnesses continuous product innovation, focusing on healthy options, customized menus, and technological integration. Technological trends such as AI-powered order management, automated kitchen systems, and personalized food recommendations are enhancing customer experience and operational efficiency. This innovation is crucial for maintaining a competitive edge and catering to the evolving needs of a diverse consumer base.

Report Scope & Segmentation Analysis

This report segments the Indian restaurant and food service industry based on foodservice type (Cafes & Bars, Other QSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Each segment exhibits unique growth trajectories and competitive dynamics. Growth projections for each segment are provided, alongside detailed market size estimations.

- Foodservice Type: Cafes & Bars are expected to show a CAGR of xx%, while Other QSR Cuisines are anticipated to grow at xx%.

- Outlet Type: Chained outlets are projected to dominate, with a larger market share and faster growth compared to independent outlets.

- Location: The retail and standalone segments are expected to experience the highest growth due to increased demand and market penetration.

Key Drivers of India Restaurant and Food Service Industry Growth

Several factors drive the growth of this industry. Rising disposable incomes and a burgeoning middle class fuel demand for diverse food options. Urbanization leads to increased concentration of potential customers in metropolitan areas. Technological advancements, including online ordering and delivery platforms, improve accessibility and convenience. Government initiatives promoting the food industry also stimulate market growth.

Challenges in the India Restaurant and Food Service Industry Sector

The industry faces several challenges. Maintaining consistent food quality and safety standards is crucial amidst rapid growth. Supply chain disruptions and rising input costs can negatively impact profitability. Intense competition puts pressure on pricing and profit margins. Regulatory compliance and labor costs also present ongoing challenges.

Emerging Opportunities in India Restaurant and Food Service Industry

Several opportunities exist. Expansion into smaller cities and towns offers substantial untapped potential. Specialization in niche cuisines and health-conscious options creates market differentiation. Integrating advanced technologies to enhance customer experience and streamline operations can improve efficiency and customer satisfaction.

Leading Players in the India Restaurant and Food Service Industry Market

- Impresario Entertainment and Hospitality Pvt Ltd

- Yum! Brands Inc

- Wow! Momo Foods Private Limited

- Restaurant Brands Asia Limited

- Coffee Day Enterprises Limited

- Doctor's Associate Inc

- Rebel Foods

- Barista Coffee Company Limited

- Hotel Saravana Bhavan

- Haldiram Food Private Limited

- Jubilant FoodWorks Limited

- Mountain Trail Foods Private Limited

- Barbeque Nation Hospitality Ltd

- Gujarat Cooperative Milk Marketing Federation

- McDonald's Corporation

- Tata Starbucks Private Limited

- Graviss Foods Private Limited

Key Developments in India Restaurant and Food Service Industry Industry

- February 2023: Rebel Foods acquired the Wendy's franchise, indicating expansion in the QSR segment.

- March 2023: McDonald's (MMG Group) announced significant investment in outlet reimaging and expansion, signaling confidence in the market.

- April 2023: Barista Coffee's expansion to 350 stores demonstrates growth in the cafe segment.

Future Outlook for India Restaurant and Food Service Industry Market

The Indian restaurant and food service industry is poised for continued expansion, driven by sustained economic growth, evolving consumer preferences, and technological advancements. Strategic partnerships, expansion into new markets, and investments in innovative technologies will be critical for success in this dynamic sector. The industry’s future growth is projected to be robust, with significant potential for both established players and new entrants.

India Restaurant and Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

India Restaurant and Food Service Industry Segmentation By Geography

- 1. India

India Restaurant and Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increased willingness of people to experiment with new cuisines and dining experiences propelling the market sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Restaurant and Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North India India Restaurant and Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Restaurant and Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Restaurant and Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Restaurant and Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Impresario Entertainment and Hospitality Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Yum! Brands Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wow! Momo Foods Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Restaurant Brands Asia Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Coffee Day Enterprises Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Doctor's Associate Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rebel Foods

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Barista Coffee Company Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hotel Saravana Bhavan

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Haldiram Food Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jubilant FoodWorks Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mountain Trail Foods Private Limited

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Barbeque Nation Hospitality Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gujarat Cooperative Milk Marketing Federation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 McDonald's Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Tata Starbucks Private Limited

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Graviss Foods Private Limited

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Impresario Entertainment and Hospitality Pvt Ltd

List of Figures

- Figure 1: India Restaurant and Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Restaurant and Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: India Restaurant and Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Restaurant and Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: India Restaurant and Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: India Restaurant and Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: India Restaurant and Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Restaurant and Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Restaurant and Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Restaurant and Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Restaurant and Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Restaurant and Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Restaurant and Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 12: India Restaurant and Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: India Restaurant and Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Restaurant and Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Restaurant and Food Service Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the India Restaurant and Food Service Industry?

Key companies in the market include Impresario Entertainment and Hospitality Pvt Ltd, Yum! Brands Inc, Wow! Momo Foods Private Limited, Restaurant Brands Asia Limited, Coffee Day Enterprises Limited, Doctor's Associate Inc, Rebel Foods, Barista Coffee Company Limited, Hotel Saravana Bhavan, Haldiram Food Private Limited, Jubilant FoodWorks Limited, Mountain Trail Foods Private Limited, Barbeque Nation Hospitality Ltd, Gujarat Cooperative Milk Marketing Federation, McDonald's Corporation, Tata Starbucks Private Limited, Graviss Foods Private Limited.

3. What are the main segments of the India Restaurant and Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increased willingness of people to experiment with new cuisines and dining experiences propelling the market sales.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

April 2023: Barista Coffee opened its 350th store in Udaipur and is planning to reach the count of 500 in two years.March 2023: MMG Group, which owns and operates McDonald's restaurants in northern and eastern India, announced to invest USD 47.8 to USD 73.1 million over the next three years on reimaging of outlets and opening new ones.February 2023: Rebel Foods acquired the Franchise deal for Wendy's from Sierra Nevada to operate its stores across India. Rebel Foods is aiming to open 150 new offline Wendy's restaurants over the next decade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Restaurant and Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Restaurant and Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Restaurant and Food Service Industry?

To stay informed about further developments, trends, and reports in the India Restaurant and Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence