Key Insights

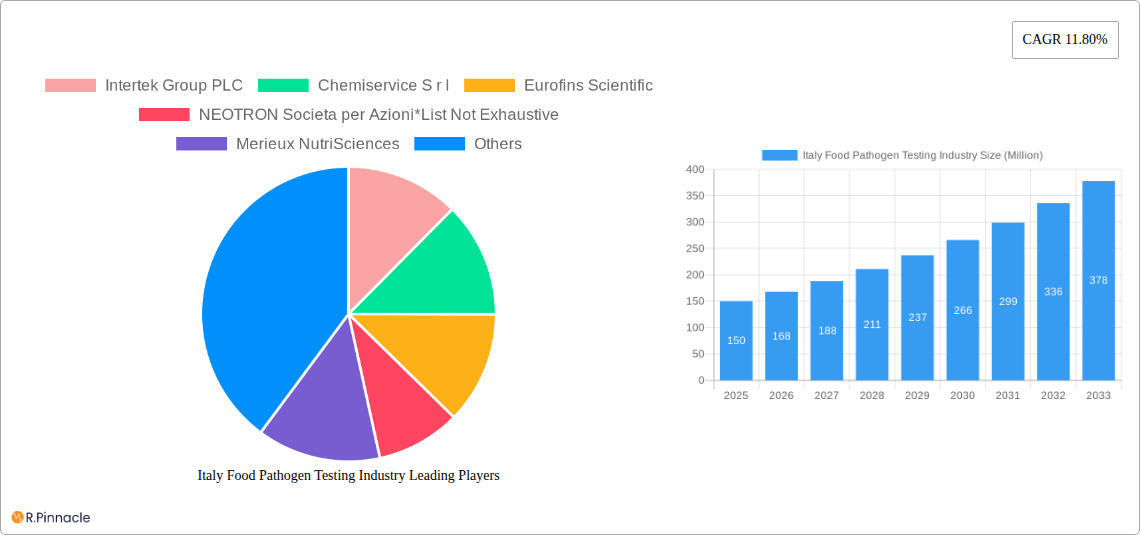

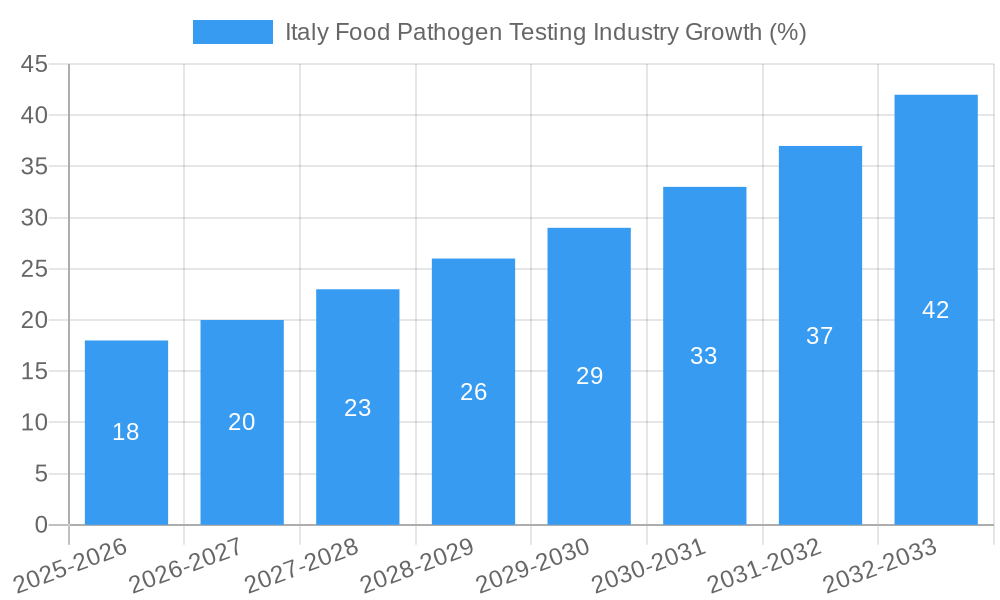

The Italian food pathogen testing market is experiencing robust growth, driven by stringent food safety regulations, increasing consumer awareness of foodborne illnesses, and the expanding food processing industry. The market, valued at approximately €150 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.80% from 2025 to 2033, reaching an estimated €450 million by 2033. This growth is fueled by several key factors. Firstly, the increasing prevalence of foodborne illnesses necessitates rigorous testing protocols throughout the food supply chain. Secondly, the rise of e-commerce and globalization of food distribution networks further emphasizes the need for efficient and reliable pathogen detection methods. Furthermore, advancements in testing technologies, such as PCR and advanced chromatography, are improving accuracy, speed, and cost-effectiveness, encouraging wider adoption across different segments. The segments showing the strongest growth include pathogen testing, particularly for Salmonella and Listeria, and mycotoxin testing, driven by concerns over contamination in grains and processed foods.

The market is segmented by application (animal feed and pet food, food, dietary supplements), contaminant type (pathogen, mycotoxin, pesticide residue, GMO, allergen, other), and technology (PCR, immunoassay, chromatography, other). While pathogen testing currently dominates, the mycotoxin testing segment is expected to show significant growth due to rising concerns regarding fungal contamination in agricultural products. Major players like Intertek, Eurofins, and Merieux NutriSciences are consolidating their market share through strategic acquisitions and technological advancements. However, challenges remain, including the high cost of advanced testing technologies, which can pose a barrier to entry for smaller businesses and potentially hinder market penetration in certain segments. Regulatory changes and evolving consumer preferences will also continue to shape the market's future trajectory. The Italian government's ongoing focus on food safety regulations and investments in research and development are expected to support the market's continued expansion in the coming years.

Italy Food Pathogen Testing Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Italy food pathogen testing industry, offering valuable insights for industry professionals, investors, and stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously analyzes market size, growth drivers, challenges, and opportunities, offering actionable intelligence for strategic decision-making. The market reached a value of xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Italy Food Pathogen Testing Industry Market Structure & Innovation Trends

This section delves into the competitive landscape of Italy's food pathogen testing market, examining market concentration, innovation drivers, and regulatory influences. The market is moderately consolidated, with key players including Intertek Group PLC, Chemiservice S.r.l, Eurofins Scientific, NEOTRON Societa per Azioni, Merieux NutriSciences, Bureau Veritas, ALS Limited, and NSF INTERNATIONAL. However, the presence of numerous smaller, specialized firms indicates a dynamic and competitive environment.

- Market Share: Intertek and Eurofins are estimated to hold the largest market share, collectively accounting for approximately xx% in 2025. The remaining market share is distributed among other players, with several regional firms holding significant local market presence.

- M&A Activity: The past five years have witnessed a moderate level of M&A activity, with deal values totaling approximately xx Million. These acquisitions primarily involved smaller specialized labs being acquired by larger multinational companies to expand their service portfolios and geographic reach.

- Innovation Drivers: The demand for rapid, accurate, and high-throughput testing methods is a key driver of innovation. This is fueled by evolving consumer demands for food safety and stricter regulatory frameworks.

- Regulatory Framework: Stringent food safety regulations imposed by the European Union and the Italian government are driving the growth of the food pathogen testing market. These regulations mandate regular testing for various contaminants, creating a substantial demand for testing services.

- Product Substitutes: While no direct substitutes exist for pathogen testing, advancements in predictive modeling and risk assessment techniques are gradually emerging as complementary solutions.

Italy Food Pathogen Testing Industry Market Dynamics & Trends

The Italy food pathogen testing market is experiencing robust growth driven by several factors. Increasing consumer awareness of foodborne illnesses, stringent government regulations, and the rising demand for safe and high-quality food products are key market growth catalysts. The market is witnessing technological advancements, including the adoption of sophisticated testing methods like PCR and next-generation sequencing, leading to faster and more accurate results. The increasing prevalence of food fraud and the need for effective allergen testing are also contributing to the market’s expansion.

The market's growth is further fueled by the rising demand for food safety certifications and traceability throughout the supply chain. The increasing adoption of advanced technologies, such as rapid diagnostic tests and automated systems, is improving efficiency and reducing testing times. Competitive dynamics are characterized by both price competition and differentiation through specialized testing services and advanced technological capabilities. The market penetration of rapid diagnostic technologies is expected to grow from xx% in 2025 to xx% by 2033.

Dominant Regions & Segments in Italy Food Pathogen Testing Industry

The northern regions of Italy, particularly Lombardy and Emilia-Romagna, due to their high concentration of food processing and agricultural activities, are the dominant regions in the food pathogen testing market. The "Food" segment accounts for the largest share of the market, followed by "Animal Feed and Pet Food."

Key Drivers for Northern Regions:

- High concentration of food processing and agricultural activities

- Developed infrastructure

- Strong regulatory enforcement

- Proximity to major consumer markets

Dominant Application Segment: The "Food" segment's dominance stems from the high demand for testing across diverse food categories, including fresh produce, meat, dairy, and processed foods. Stringent regulations and consumer concerns related to foodborne illnesses in these segments fuel this segment’s growth.

Dominant Contaminant Type: Pathogen testing accounts for the largest market share within the contaminant type segment, reflecting the critical need for detection and control of microbial contamination in the food supply chain. The demand for PCR-based testing is rapidly increasing due to its high sensitivity and specificity.

Italy Food Pathogen Testing Industry Product Innovations

Significant product innovations are driving market growth, including the development of rapid diagnostic tests (RDTs) that deliver results within minutes, reducing turnaround time and improving efficiency. Advancements in PCR technology, coupled with automation and data analytics, are enhancing the speed and accuracy of pathogen detection. The introduction of multiplex assays, enabling simultaneous testing for multiple pathogens, is also improving cost-effectiveness. These innovations directly address market needs for faster, more precise, and economically viable testing solutions, enhancing food safety and consumer confidence.

Report Scope & Segmentation Analysis

This report segments the Italy food pathogen testing market by application (Animal Feed and Pet Food, Food, Dietary Supplements – Crops and Other Foods), contaminant type (Pathogen Testing, Mycotoxin Testing, Pesticide and Residue Testing, GMO Testing, Allergen Testing, Other Contaminants Testing), and technology (Polymerase Chain Reaction (PCR), Immunoassay-based, Chromatography and Spectrometry, Other Technologies). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a detailed understanding of the market’s structure and potential. The "Food" application segment is projected to exhibit the highest growth rate, driven by stringent regulations and rising consumer awareness. Pathogen testing is the largest contaminant type segment, with PCR technology dominating the technology segment.

Key Drivers of Italy Food Pathogen Testing Industry Growth

Stringent food safety regulations, increasing consumer demand for safe food, and technological advancements are the key drivers of the Italy food pathogen testing industry's growth. The rising prevalence of foodborne illnesses fuels the demand for accurate and rapid testing methods. Continuous improvements in testing technologies, such as faster PCR and automated systems, contribute to improved efficiency and accuracy. Additionally, government initiatives promoting food safety and traceability within the supply chain actively support market growth.

Challenges in the Italy Food Pathogen Testing Industry Sector

The industry faces challenges such as high testing costs, the need for skilled personnel, and intense competition among testing labs. Supply chain disruptions and the emergence of novel pathogens pose additional challenges. Regulatory complexities and the need for continuous technological upgrades add to the operational hurdles faced by testing laboratories. The overall cost associated with setting up and maintaining high-quality testing facilities remains a significant barrier for entry into the market. These challenges result in xx Million annual revenue loss in the sector.

Emerging Opportunities in Italy Food Pathogen Testing Industry

Emerging opportunities include the growing demand for rapid and point-of-care testing, expanding applications into areas like personalized nutrition and dietary supplement testing, and the integration of big data analytics and AI for predictive food safety management. The rising adoption of advanced technologies, such as next-generation sequencing and mass spectrometry, offers further potential. Moreover, increased focus on traceability and supply chain transparency opens avenues for specialized testing services within the market.

Leading Players in the Italy Food Pathogen Testing Industry Market

- Intertek Group PLC

- Chemiservice S.r.l

- Eurofins Scientific

- NEOTRON Societa per Azioni

- Merieux NutriSciences

- Bureau Veritas

- ALS Limited

- NSF INTERNATIONAL

Key Developments in Italy Food Pathogen Testing Industry

- 2022 (October): Eurofins Scientific acquired a regional testing laboratory, expanding its geographic reach in Northern Italy.

- 2023 (March): Intertek launched a new rapid testing method for Listeria, improving detection speed and efficiency.

- 2024 (June): A new regulation mandates stricter allergen testing protocols, impacting the demand for specific testing services. (Further details of specific developments require additional information)

Future Outlook for Italy Food Pathogen Testing Industry Market

The Italy food pathogen testing market is poised for robust growth driven by continuous technological advancements, stringent regulations, and heightened consumer awareness. The market's future growth will be fueled by the expanding adoption of rapid and sensitive testing methods, along with the growing demand for comprehensive food safety solutions across the supply chain. Strategic partnerships and collaborations amongst testing laboratories and food producers will further drive market expansion and enhance food safety throughout Italy's food sector.

Italy Food Pathogen Testing Industry Segmentation

-

1. Contaminant Type

- 1.1. Pathogen Testing

- 1.2. Mycotoxin Testing

- 1.3. Pesticide and Residue Testing

- 1.4. GMO Testing

- 1.5. Allergen Testing

- 1.6. Other Contaminants Testing

-

2. Technology

- 2.1. Polymerase Chain Reaction (PCR)

- 2.2. Immunoassay-based

-

2.3. Chromatography and Spectrometry

- 2.3.1. HPLC Based

- 2.3.2. LC-MS/MS-Based

- 2.3.3. Other Chromatography and Spectrometry

- 2.4. Other Technologies

-

3. Application

- 3.1. Animal Feed and Pet Food

- 3.2. Meat and Poultry

- 3.3. Dairy

- 3.4. Fruits and Vegetables

- 3.5. Processed Food

- 3.6. Baby Food

- 3.7. Bakery Products

- 3.8. Savory and Sweet Snacks

- 3.9. Dietary Supplements

- 3.10. Crops

- 3.11. Other Foods

Italy Food Pathogen Testing Industry Segmentation By Geography

- 1. Italy

Italy Food Pathogen Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Rising Importance of Food Safety Supporting Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Food Pathogen Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 5.1.1. Pathogen Testing

- 5.1.2. Mycotoxin Testing

- 5.1.3. Pesticide and Residue Testing

- 5.1.4. GMO Testing

- 5.1.5. Allergen Testing

- 5.1.6. Other Contaminants Testing

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Polymerase Chain Reaction (PCR)

- 5.2.2. Immunoassay-based

- 5.2.3. Chromatography and Spectrometry

- 5.2.3.1. HPLC Based

- 5.2.3.2. LC-MS/MS-Based

- 5.2.3.3. Other Chromatography and Spectrometry

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Animal Feed and Pet Food

- 5.3.2. Meat and Poultry

- 5.3.3. Dairy

- 5.3.4. Fruits and Vegetables

- 5.3.5. Processed Food

- 5.3.6. Baby Food

- 5.3.7. Bakery Products

- 5.3.8. Savory and Sweet Snacks

- 5.3.9. Dietary Supplements

- 5.3.10. Crops

- 5.3.11. Other Foods

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemiservice S r l

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurofins Scientific

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEOTRON Societa per Azioni*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merieux NutriSciences

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bureau Veritas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALS Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NSF INTERNATIONAL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Italy Food Pathogen Testing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Food Pathogen Testing Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 3: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 8: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Food Pathogen Testing Industry?

The projected CAGR is approximately 11.80%.

2. Which companies are prominent players in the Italy Food Pathogen Testing Industry?

Key companies in the market include Intertek Group PLC, Chemiservice S r l, Eurofins Scientific, NEOTRON Societa per Azioni*List Not Exhaustive, Merieux NutriSciences, Bureau Veritas, ALS Limited, NSF INTERNATIONAL.

3. What are the main segments of the Italy Food Pathogen Testing Industry?

The market segments include Contaminant Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Rising Importance of Food Safety Supporting Market Demand.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Food Pathogen Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Food Pathogen Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Food Pathogen Testing Industry?

To stay informed about further developments, trends, and reports in the Italy Food Pathogen Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence