Key Insights

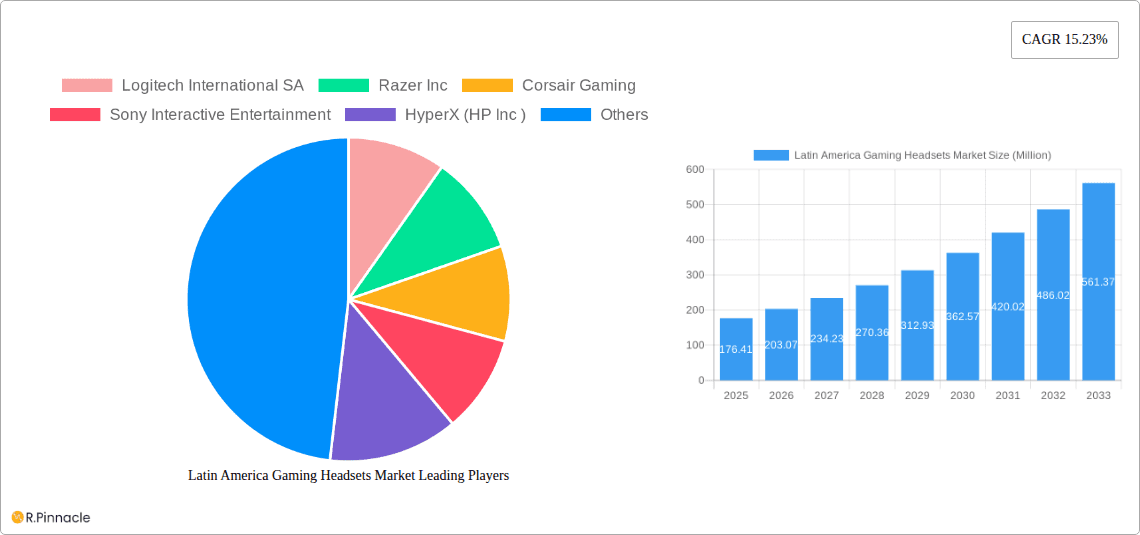

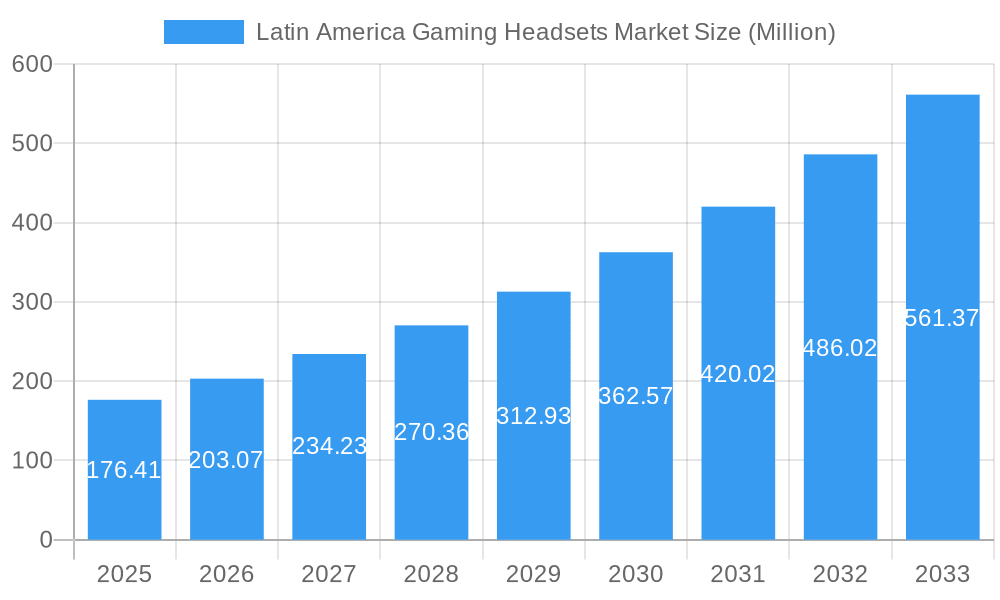

The Latin American gaming headset market, valued at $176.41 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15.23% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing penetration of high-speed internet and mobile gaming across the region is significantly boosting demand for immersive audio experiences. Furthermore, the rising popularity of esports and competitive gaming, coupled with a burgeoning young population actively engaged in online gaming, is creating a fertile ground for headset sales. Growing disposable incomes and increased spending on gaming accessories contribute significantly to market growth. However, economic fluctuations in certain Latin American countries and the presence of counterfeit products pose potential restraints. The market is segmented by various headset types (wired, wireless, etc.), price points, and platforms (PC, consoles, mobile). Key players like Logitech, Razer, Corsair, Sony, and HyperX dominate the market, leveraging strong brand recognition and innovative product offerings. The competitive landscape is dynamic, with companies constantly vying to improve audio quality, comfort, and features to attract consumers. The forecast period suggests a significant market expansion, driven by continuous technological advancements and the ever-increasing popularity of gaming within Latin America.

Latin America Gaming Headsets Market Market Size (In Million)

The market's growth trajectory is heavily influenced by the evolving preferences of gamers. The demand for premium features like surround sound, noise cancellation, and customizable EQ settings is escalating. This has prompted manufacturers to invest heavily in research and development, leading to advanced products that enhance the gaming experience. The increasing adoption of cloud gaming services, while still nascent in the region, presents a promising avenue for future growth, potentially impacting the demand for certain types of headsets. Furthermore, strategic partnerships between headset manufacturers and game developers can further accelerate market growth by promoting bundled offers and exclusive product features. The regional variations in market growth are likely influenced by factors like internet infrastructure development, economic conditions, and gaming culture within each country. Understanding these nuances is critical for companies aiming to effectively penetrate and thrive in the Latin American market.

Latin America Gaming Headsets Market Company Market Share

Latin America Gaming Headsets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America gaming headsets market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period spanning 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The report leverages extensive research and data analysis to deliver actionable intelligence on market segmentation, leading players, and emerging trends. The total market size in 2025 is estimated at xx Million.

Latin America Gaming Headsets Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin America gaming headsets market, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. We explore the impact of product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities on market growth.

Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. Logitech International SA, Razer Inc., and Corsair Gaming are among the leading brands, collectively holding an estimated xx% market share in 2025. However, the market also includes several smaller, niche players.

Innovation Drivers: The demand for enhanced audio quality, immersive gaming experiences, and comfortable designs drives innovation. Technological advancements in noise cancellation, surround sound, and lightweight materials contribute to product differentiation and market growth.

Regulatory Frameworks: Regulatory frameworks concerning consumer electronics and data privacy influence market dynamics. Compliance with these regulations impacts product development and distribution strategies.

Product Substitutes: The emergence of alternative audio solutions, such as in-ear headphones and earbuds, presents competitive pressure to traditional gaming headsets.

End-User Demographics: The primary end-users are young adults (18-35 years) with a strong interest in gaming, representing a significant portion of the market's growth.

M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values ranging from xx Million to xx Million. These activities have resulted in increased market consolidation and expansion of product portfolios.

Latin America Gaming Headsets Market Dynamics & Trends

This section delves into the key factors influencing the growth trajectory of the Latin America gaming headsets market. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape, quantifying growth using metrics like CAGR and market penetration. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing gaming penetration, rising disposable incomes, and technological advancements in headset technology. Market penetration in key segments is expected to reach xx% by 2033. The rising popularity of esports and the increasing availability of high-speed internet contribute significantly to market expansion. Consumer preferences are shifting towards wireless headsets with advanced features like noise cancellation and customizable audio profiles. Competitive dynamics are characterized by intense rivalry among established brands and emerging players, driving innovation and price competition.

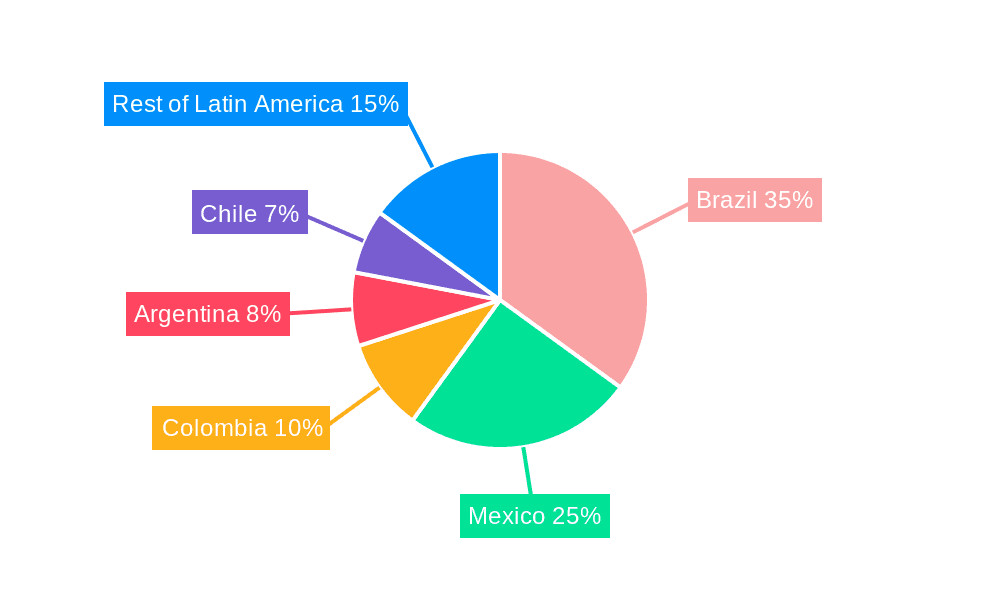

Dominant Regions & Segments in Latin America Gaming Headsets Market

This section identifies the leading regions and segments within the Latin America gaming headsets market, analyzing the factors contributing to their dominance.

Brazil: Brazil emerges as the dominant market, driven by a large gaming community, increasing smartphone penetration, and a growing middle class.

- Key Drivers: Strong economic growth, expanding internet access, and a flourishing esports scene.

Mexico: Mexico follows as a significant market, characterized by increasing adoption of gaming consoles and PCs, and expanding digital distribution channels.

- Key Drivers: Government initiatives promoting digital technology, rising disposable incomes, and increasing internet penetration.

Other key regions: Argentina, Colombia, and Chile also contribute significantly to market growth, exhibiting positive trends in gaming adoption. However, market size for these regions is predicted to be xx Million, xx Million, and xx Million respectively, compared to Brazil (xx Million) and Mexico (xx Million) by 2025.

Latin America Gaming Headsets Market Product Innovations

The market is witnessing continuous innovation in gaming headset technology. New products are incorporating advanced features such as enhanced audio quality, improved comfort, and customizable settings. The integration of noise cancellation, surround sound, and wireless connectivity are driving product differentiation and enhancing user experience. These advancements cater to the growing demand for immersive and high-quality gaming experiences. Lightweight and durable designs, along with improved microphone quality, are also key areas of focus.

Report Scope & Segmentation Analysis

This report segments the Latin America gaming headsets market based on several factors, providing granular insights into market size and growth potential for each segment.

By Product Type: This includes wired, wireless, and VR headsets, each exhibiting unique growth trajectories and competitive dynamics. The wireless segment is anticipated to experience the highest growth rate during the forecast period due to increasing demand for convenience and improved battery life.

By Platform: This encompasses PC, consoles (PlayStation, Xbox), and mobile gaming. The PC gaming segment is expected to remain dominant, driven by high-end gaming configurations and the popularity of PC esports.

By Price Range: The market is categorized into budget, mid-range, and premium segments, catering to diverse consumer needs and preferences.

By Distribution Channel: This includes online retailers (e-commerce), specialized gaming stores, and consumer electronics stores. Online channels are gaining significant traction, driven by convenience and wider reach.

Key Drivers of Latin America Gaming Headsets Market Growth

The Latin America gaming headsets market's expansion is fueled by several key drivers:

Rising Gaming Penetration: The increasing popularity of gaming across different platforms, particularly mobile and PC, fuels demand for enhanced audio devices.

Growing Disposable Incomes: The expanding middle class and increasing disposable incomes in many Latin American countries boost consumer spending on gaming accessories.

Technological Advancements: Innovations in audio technology, such as improved sound quality, noise cancellation, and wireless connectivity, drive product adoption.

Esports Growth: The booming esports industry significantly contributes to the market's growth, with professional gamers and enthusiasts driving demand for high-performance headsets.

Challenges in the Latin America Gaming Headsets Market Sector

Despite positive growth prospects, the Latin America gaming headsets market faces several challenges:

Economic Volatility: Fluctuations in economic conditions in certain Latin American countries can impact consumer spending on discretionary items like gaming accessories.

Counterfeit Products: The proliferation of counterfeit products undermines the market, impacting brand loyalty and sales of authentic products.

High Import Duties: Import duties and taxes on imported products can inflate prices, making them less competitive in the market.

Supply Chain Disruptions: Global supply chain issues can impact the availability of components and finished products, potentially disrupting market supply.

Emerging Opportunities in Latin America Gaming Headsets Market

Emerging trends present promising opportunities for growth:

Virtual Reality (VR) Gaming: The expansion of VR gaming presents significant opportunities for gaming headset manufacturers to cater to this rapidly evolving market segment.

Cloud Gaming: The increasing adoption of cloud gaming platforms creates new avenues for headset providers to reach a broader audience.

Integration with Smart Devices: The potential to integrate gaming headsets with smart devices and wearables opens up new avenues for growth.

Customization and Personalization: Offering greater customization options and personalization features in headsets can increase consumer appeal and brand loyalty.

Leading Players in the Latin America Gaming Headsets Market Market

Key Developments in Latin America Gaming Headsets Industry

May 2024: Sonos launched its first headphones, the Sonos Ace, challenging established brands with a focus on comfort, durability, and high-quality audio. This entry significantly impacts the premium segment and highlights growing competition.

April 2024: Meta's plan to extend its Meta Horizon OS to external hardware manufacturers opens opportunities for increased VR headset production and expands the market for compatible devices. This move is likely to foster innovation and broaden the VR gaming ecosystem.

Future Outlook for Latin America Gaming Headsets Market Market

The Latin America gaming headsets market is poised for continued growth, driven by factors such as increasing gaming adoption, technological advancements, and the expanding esports sector. The market's future potential is significant, particularly in emerging economies within the region. Strategic opportunities exist for companies to focus on product innovation, expansion into new markets, and the development of sustainable business practices. The expanding middle class and rising disposable incomes will continue to fuel market growth. The integration of VR and AR technologies into gaming headsets will create new market segments.

Latin America Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Latin America Gaming Headsets Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Gaming Headsets Market Regional Market Share

Geographic Coverage of Latin America Gaming Headsets Market

Latin America Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sony Interactive Entertainment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (HP Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASUS Computer International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harman International Industries Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SteelSeries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turtle Beach Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: Latin America Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Gaming Headsets Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 2: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 3: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 4: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 5: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Latin America Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Latin America Gaming Headsets Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 10: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 11: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 12: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 13: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Latin America Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Gaming Headsets Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Brazil Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Argentina Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Chile Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Chile Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Colombia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Colombia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Peru Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Peru Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Venezuela Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Ecuador Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ecuador Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Bolivia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Bolivia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Paraguay Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Paraguay Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Gaming Headsets Market?

The projected CAGR is approximately 15.23%.

2. Which companies are prominent players in the Latin America Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUS Computer International, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the Latin America Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 176.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

May 2024: Sonos made its foray into the headphone market with the debut of its inaugural model, the Sonos Ace. These headphones are positioned as a blend of comfort, durability, and top-tier audio quality, appealing to users who value both performance and sustainability. In a direct challenge to heavyweights like Apple's AirPods Max and Bose's QuietComfort Ultra, Sonos Ace headphones feature a construction of lightweight materials and plush memory foam, all wrapped in vegan leather. Moreover, their fold-flat design enhances portability and convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Latin America Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence