Key Insights

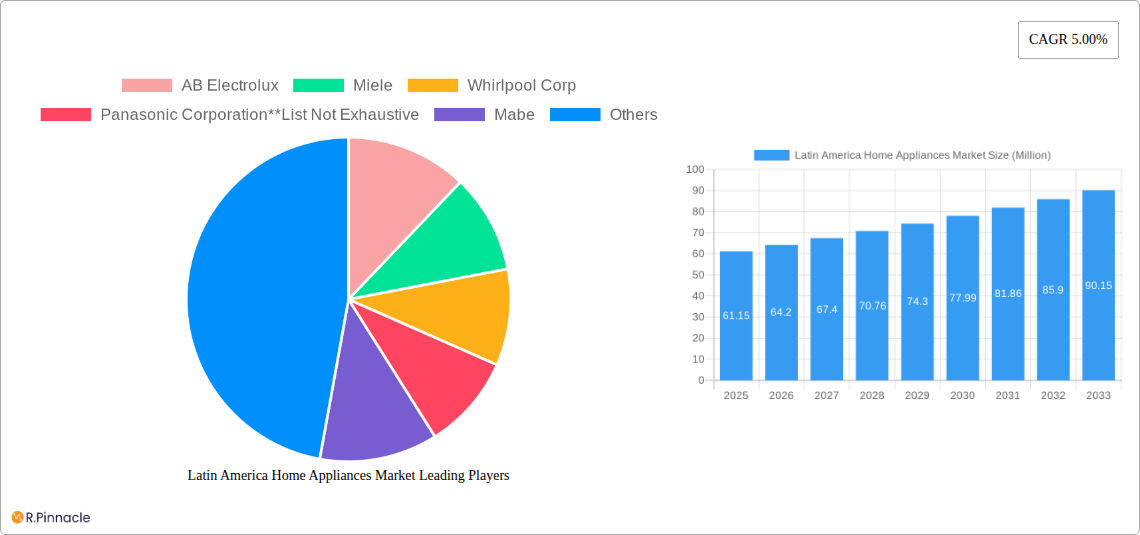

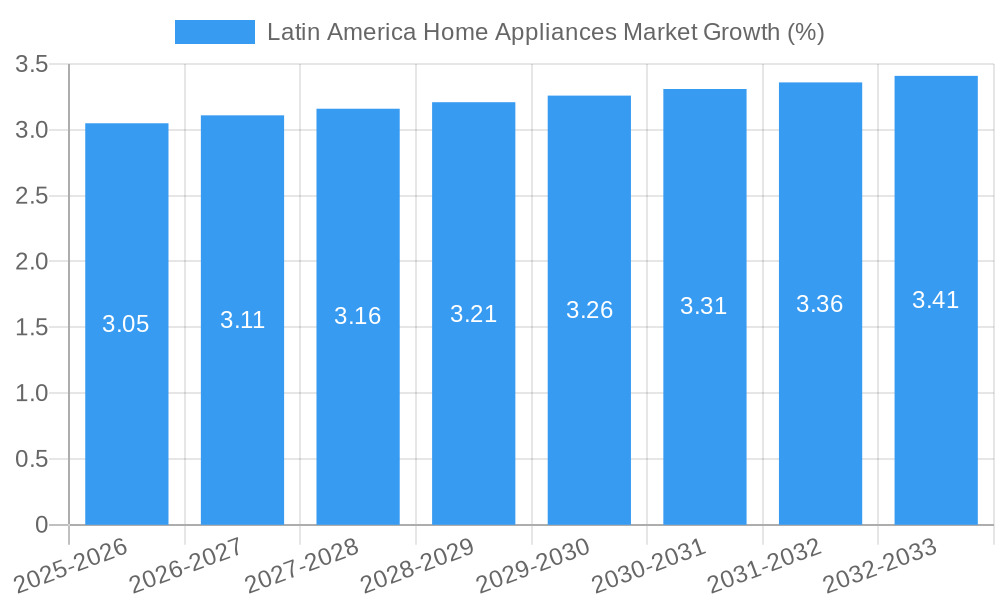

The Latin American home appliances market, valued at $61.15 million in 2025, is projected to experience robust growth, driven by a burgeoning middle class, rising disposable incomes, and increasing urbanization across the region. Key growth drivers include a preference for modern, energy-efficient appliances, coupled with expanding e-commerce penetration and aggressive marketing strategies employed by major players. Brazil, Mexico, and Argentina represent the largest national markets, accounting for a significant portion of overall sales. The market segmentation reveals a strong demand for major appliances like refrigerators and washing machines, followed by a growing interest in smaller appliances such as blenders and microwaves. Multi-brand stores remain the dominant distribution channel, although online sales are rapidly increasing, presenting opportunities for both established brands and new entrants. The competitive landscape is characterized by a mix of international giants like Electrolux, Whirlpool, and Samsung, alongside strong regional players like Mabe.

However, several restraints impact market growth. Economic instability in certain Latin American countries, fluctuating currency exchange rates, and the potential for import tariffs can affect the affordability and accessibility of home appliances. Furthermore, concerns regarding environmental sustainability are influencing consumer preferences towards eco-friendly appliances, putting pressure on manufacturers to innovate and adopt more sustainable practices. To maintain competitiveness, companies need to focus on offering affordable, yet high-quality, energy-efficient products tailored to the specific needs and preferences of each target market. Successful strategies will involve a blend of strong brand recognition, strategic partnerships with local distributors, and efficient online marketing campaigns that leverage the growing digital presence of Latin American consumers. The forecast period of 2025-2033 presents a considerable opportunity for growth, particularly as consumer demand and infrastructure development continue to evolve.

Latin America Home Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America home appliances market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth potential across various segments. The study period is 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and 2025-2033 as the Forecast Period. The market is valued at xx Million in 2025 and projected to reach xx Million by 2033.

Latin America Home Appliances Market Structure & Innovation Trends

This section analyzes the market structure, highlighting key players and their market share, identifying innovation drivers, and exploring regulatory influences shaping the Latin American home appliances market. The report delves into the impact of mergers and acquisitions (M&A) activities, examining deal values and their consequences on market concentration.

- Market Concentration: The Latin American home appliance market exhibits a moderately concentrated structure, with key players such as Whirlpool Corp, AB Electrolux, and Mabe holding significant market share. However, smaller regional players and emerging brands are also contributing to the market dynamism. The report quantifies the market share of major players and analyzes the level of competition.

- Innovation Drivers: Growing consumer demand for smart home appliances, energy-efficient products, and improved design features drives significant innovation. Government initiatives promoting energy efficiency also play a vital role.

- Regulatory Frameworks: The report explores the regulatory landscape, including safety standards, energy efficiency regulations, and labeling requirements, impacting market dynamics and product development.

- Product Substitutes: The report considers the presence and impact of substitute products, such as used appliances or alternative technologies, affecting market competition.

- End-User Demographics: The analysis considers evolving consumer preferences, income levels, and lifestyle changes, affecting demand for different appliance types and features.

- M&A Activities: Recent M&A activities are examined, including deal values, their rationales, and implications for market consolidation and competition. The report analyzes xx number of M&A deals, with an aggregated value of xx Million during the period of 2019-2024.

Latin America Home Appliances Market Dynamics & Trends

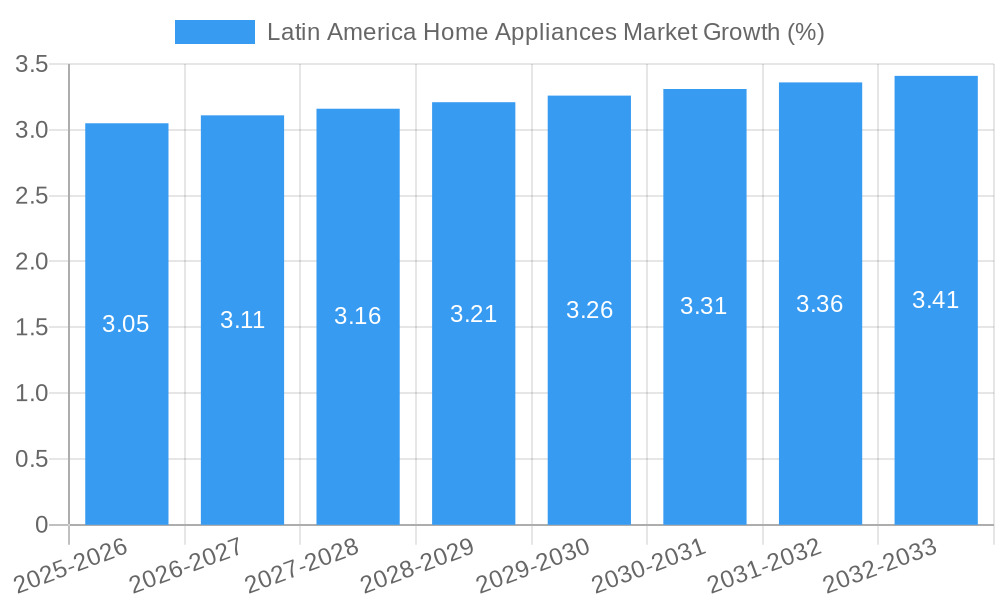

This section explores the key drivers and trends shaping the market's growth trajectory. The analysis focuses on factors influencing market expansion, technological advancements altering consumer preferences, and the competitive landscape. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration are included to provide quantitative insights.

The Latin American home appliance market is characterized by a growing middle class, rising disposable incomes, and increasing urbanization, driving significant demand for modern household appliances. Technological disruptions, such as the integration of smart features and IoT capabilities, are transforming consumer preferences. This trend is reflected in a CAGR of xx% for smart home appliances during the forecast period. The market penetration of smart refrigerators is projected to reach xx% by 2033, compared to xx% in 2025. Competitive dynamics, including pricing strategies, product differentiation, and branding efforts, significantly influence market share distribution and growth prospects.

Dominant Regions & Segments in Latin America Home Appliances Market

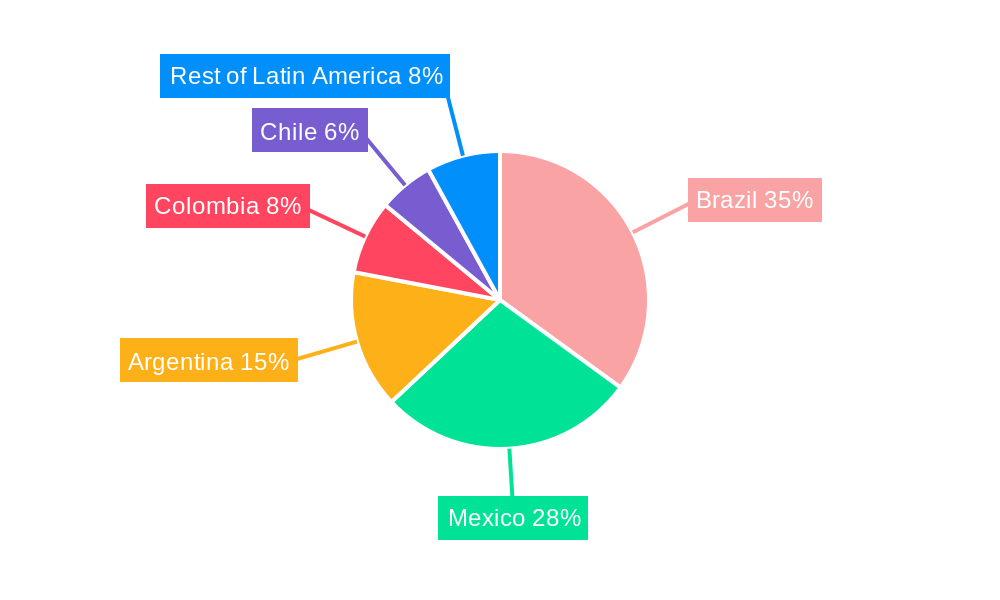

This section identifies the leading regions, countries, and segments within the Latin American home appliance market, using comprehensive analysis. The report delves into the factors driving the dominance of specific areas, considering economic policies, infrastructure development, and other key determinants.

- By Country: Brazil maintains its position as the largest market, driven by its large population and expanding middle class. Mexico and Argentina follow as significant markets, exhibiting considerable growth potential. Colombia and Chile represent smaller, but growing markets.

- Key Drivers (Brazil): Strong economic growth, increasing urbanization, government initiatives supporting infrastructure development.

- Key Drivers (Mexico): Growing consumer spending, a favorable business environment, and proximity to the US market.

- By Product: Major appliances (refrigerators, washing machines, etc.) represent the largest segment, driven by basic household needs. However, the small appliances segment is experiencing faster growth due to rising disposable incomes and a shift towards convenience.

- By Distribution Channel: Multibrand stores remain the dominant distribution channel, offering broad reach and accessibility. However, the online channel is growing rapidly, reflecting the increasing adoption of e-commerce.

Latin America Home Appliances Market Product Innovations

This section focuses on recent product innovations, highlighting their applications and competitive advantages. The discussion emphasizes technological advancements and market fit, indicating the direction of the industry.

Recent product innovations showcase a clear trend towards smart home appliances with advanced features, such as energy-efficient motors, improved connectivity, and user-friendly interfaces. These innovations enhance convenience, streamline household management, and cater to evolving consumer needs, providing competitive advantages to manufacturers. The integration of IoT technologies is transforming the sector, paving the way for smart home ecosystems and improved energy management.

Report Scope & Segmentation Analysis

This section details the scope of the report and offers a comprehensive breakdown of market segmentation. It provides growth projections, market sizes, and competitive dynamics for each segment.

By Country: The report analyzes Brazil, Argentina, Mexico, Colombia, Chile, and the Rest of Latin America, providing market size and growth projections for each country.

By Product: The report segments the market into Major Appliances (Refrigerators, Washing Machines, Dishwashers, Ovens), Other Major Appliances (Air Conditioners, Water Heaters), and Small Appliances (Blenders, Toasters, Irons, etc.), with individual market size and growth projections.

By Distribution Channel: The report covers Multibrand Stores, Exclusive Stores, Online Channels, and Other Distribution Channels, examining the market share and growth potential of each.

Key Drivers of Latin America Home Appliances Market Growth

This section outlines the primary growth drivers, encompassing technological, economic, and regulatory aspects.

Key growth drivers include rising disposable incomes, increasing urbanization, a growing middle class, and government initiatives promoting energy efficiency. Technological advancements, such as smart appliances and IoT integration, are significantly impacting market growth and consumer preferences. Favorable macroeconomic conditions and government policies that promote market expansion also play a critical role.

Challenges in the Latin America Home Appliances Market Sector

This section addresses the challenges and constraints impacting market development, including regulatory hurdles, supply chain vulnerabilities, and competitive pressures.

Challenges include fluctuating exchange rates, import tariffs, and inconsistent infrastructure in some regions. Supply chain disruptions and raw material price volatility pose significant challenges to manufacturers. Intense competition from both local and international brands also puts pressure on pricing and profitability.

Emerging Opportunities in Latin America Home Appliances Market

This section explores emerging trends and opportunities, focusing on new technologies, consumer preferences, and market expansion.

Opportunities lie in expanding into underserved rural markets, developing energy-efficient and eco-friendly products, and capitalizing on the growth of the smart home market. The increasing penetration of e-commerce provides significant opportunities for online sales and distribution. Targeted marketing strategies that resonate with the diverse demographic of Latin America are essential for success.

Leading Players in the Latin America Home Appliances Market Market

- AB Electrolux

- Miele

- Whirlpool Corp

- Panasonic Corporation

- Mabe

- AEG

- Groupe SEB

- Bosch

- Samsung

- LG Electronics

Key Developments in Latin America Home Appliances Market Industry

- June 2023: Tuya Smart partnered with Mirage to develop smart air conditioners for the Mexican market, signifying the growing adoption of IoT solutions in the home appliance sector.

- April 2023: Midea Group launched its third plant in Brazil with a USD 102.29 Million investment, highlighting the increasing focus on local production and smart appliance manufacturing.

Future Outlook for Latin America Home Appliances Market Market

The Latin America home appliances market is poised for continued growth driven by rising disposable incomes, urbanization, and technological advancements. The increasing adoption of smart home technology and the expansion of e-commerce will shape the future landscape. Strategic partnerships, product innovation, and targeted marketing efforts will be crucial for success in this dynamic market.

Latin America Home Appliances Market Segmentation

-

1. Product

-

1.1. By Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Cookers and Ovens

- 1.1.6. Other Major Appliances

-

1.2. By Small Appliances

- 1.2.1. Vacuum Cleaners

- 1.2.2. Food Processors

- 1.2.3. Irons

- 1.2.4. Toasters

- 1.2.5. Grills and Roasters

- 1.2.6. Coffee Machines

- 1.2.7. Hair Dryers

- 1.2.8. Other Small Appliances

-

1.1. By Major Appliances

-

2. Distribution Channel

- 2.1. Multibrand Stores

- 2.2. Exclusive Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Latin America Home Appliances Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Rising Sales of Major Appliances is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Cookers and Ovens

- 5.1.1.6. Other Major Appliances

- 5.1.2. By Small Appliances

- 5.1.2.1. Vacuum Cleaners

- 5.1.2.2. Food Processors

- 5.1.2.3. Irons

- 5.1.2.4. Toasters

- 5.1.2.5. Grills and Roasters

- 5.1.2.6. Coffee Machines

- 5.1.2.7. Hair Dryers

- 5.1.2.8. Other Small Appliances

- 5.1.1. By Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multibrand Stores

- 5.2.2. Exclusive Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Brazil Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 AB Electrolux

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Miele

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Whirlpool Corp

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Panasonic Corporation**List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mabe

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AEG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Groupe SEB

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bosch

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Samsung

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LG Electronics

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 AB Electrolux

List of Figures

- Figure 1: Latin America Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Latin America Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Latin America Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Latin America Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Latin America Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Home Appliances Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Latin America Home Appliances Market?

Key companies in the market include AB Electrolux, Miele, Whirlpool Corp, Panasonic Corporation**List Not Exhaustive, Mabe, AEG, Groupe SEB, Bosch, Samsung, LG Electronics.

3. What are the main segments of the Latin America Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Rising Sales of Major Appliances is Driving the Market.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

June 2023: Tuya Smart, which exists as an IoT development platform service provider, partnered with Mirage, an air conditioner manufacturer in Mexico. The partnership aims to develop smart air conditioner products for the Mexican market with the expansion of IoT solutions for promoting greener and smarter home appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Home Appliances Market?

To stay informed about further developments, trends, and reports in the Latin America Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence