Key Insights

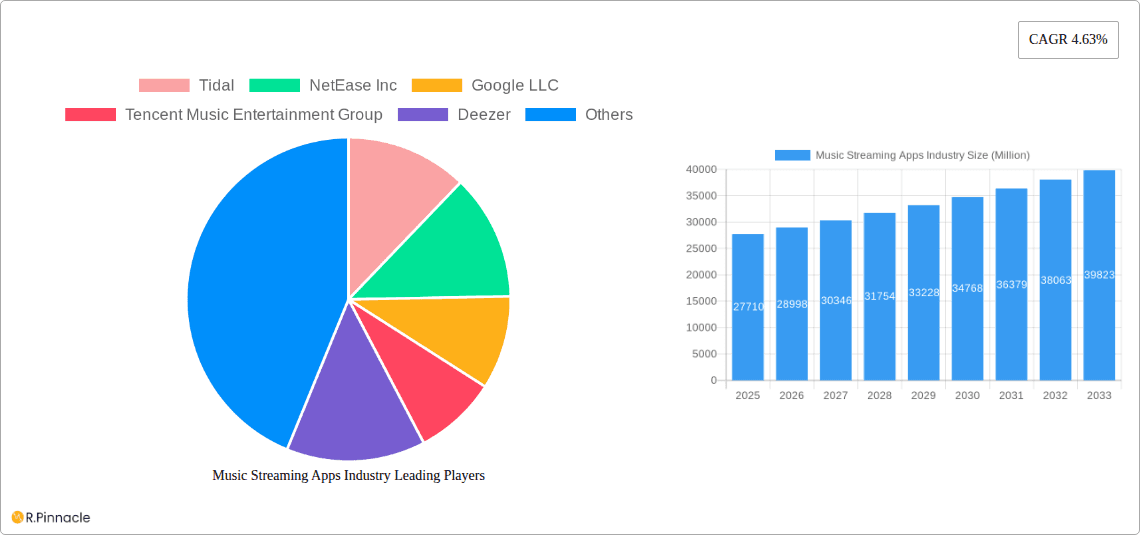

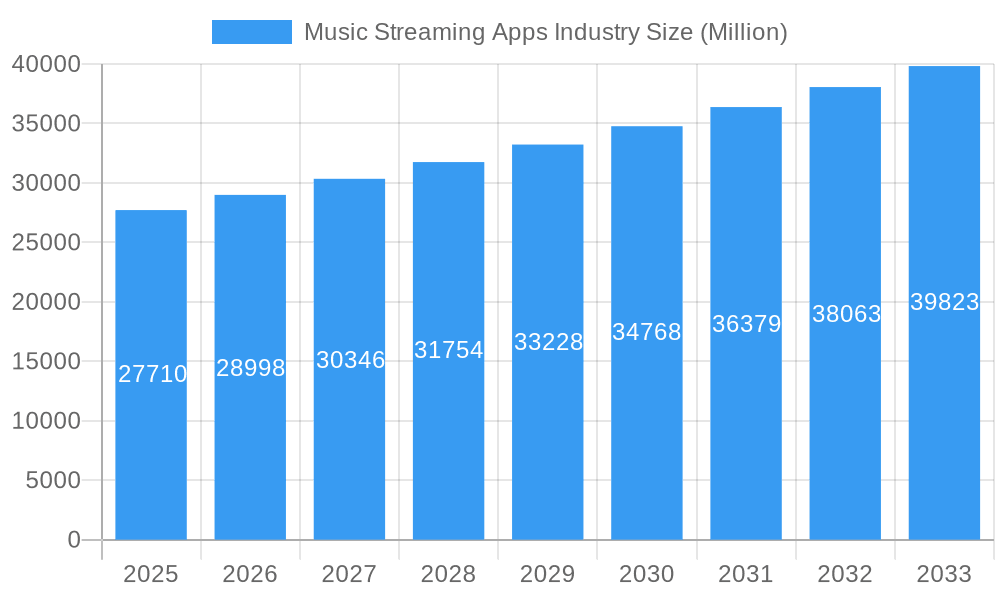

The global music streaming apps market, valued at $27.71 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, affordable data plans, and the rising popularity of on-demand music services. The compound annual growth rate (CAGR) of 4.63% from 2025 to 2033 indicates a steady expansion, fueled by continuous technological advancements enhancing user experience and the emergence of innovative features like personalized playlists and interactive live streaming capabilities. Key players like Spotify, Apple Music, and others are investing heavily in content acquisition and user engagement strategies to maintain their market share. The market is segmented by platform (Android and iOS) and revenue model (in-app purchases, advertising, and other models), allowing for diverse revenue streams and user acquisition strategies. The dominance of in-app purchases is likely to continue, given the preference for premium, ad-free experiences among a growing segment of music enthusiasts. Geographic diversification remains a key strategic focus, with North America and Europe currently leading the market, while the Asia-Pacific region displays significant growth potential due to its expanding digital economy and young population.

Music Streaming Apps Industry Market Size (In Billion)

Competition in the music streaming industry remains fierce, with established players constantly battling for market share against emerging competitors. Strategic partnerships, acquisitions, and exclusive content deals are critical for maintaining a competitive edge. Furthermore, the industry is adapting to changing consumer preferences, incorporating features such as podcasts, audiobooks, and social media integration to enhance platform engagement. While challenges such as piracy and fluctuations in data costs remain, the long-term outlook for the music streaming apps market is positive, with significant growth opportunities fueled by technological innovation and expanding global reach. Further market analysis would reveal a more detailed picture, specifically detailing regional growth projections and the competitive landscape within each region. An analysis of consumer preferences and segmentation could further refine our understanding of the market dynamics at play.

Music Streaming Apps Industry Company Market Share

Music Streaming Apps Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the global music streaming apps industry, covering market size, segmentation, competitive landscape, and future trends. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report leverages data from the historical period (2019-2024) to provide accurate predictions for the future, offering actionable insights for industry professionals. The total market value is projected to reach xx Million by 2033.

Music Streaming Apps Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the music streaming apps industry. We examine the market share held by key players, including Spotify AB, Apple Inc, Tencent Music Entertainment Group, and others, and evaluate the impact of mergers and acquisitions (M&A) on market structure. The total value of M&A deals in the sector during the historical period reached approximately xx Million.

- Market Concentration: The market is characterized by a few dominant players and a long tail of smaller competitors. Spotify and Apple Music hold significant market share, while regional players like NetEase Inc. in China maintain strong positions within their respective markets.

- Innovation Drivers: Key innovation drivers include advancements in AI-powered music recommendation systems, personalized playlists, high-fidelity audio streaming, and the integration of social features within the apps.

- Regulatory Frameworks: The regulatory environment varies across different regions, impacting data privacy, licensing agreements, and copyright protection. Compliance with these regulations is crucial for market participation.

- Product Substitutes: Competitors include other forms of music consumption, such as traditional radio, physical media, and other digital platforms.

- End-User Demographics: The target audience spans diverse age groups and preferences, requiring different marketing and product strategies. Millennials and Gen Z are major consumer groups.

- M&A Activities: Consolidation through mergers and acquisitions is ongoing, with larger companies acquiring smaller players to expand their market reach and product offerings.

Music Streaming Apps Industry Market Dynamics & Trends

This section explores the key market drivers, including technological advancements, evolving consumer preferences, and competitive landscape shifts. The Compound Annual Growth Rate (CAGR) during the forecast period is estimated to be xx%, driven by increased smartphone penetration, rising internet accessibility, and the increasing preference for on-demand digital content. Market penetration is projected to reach xx% by 2033. The section further analyses the challenges and opportunities presented by changing consumer behavior and technological disruptions.

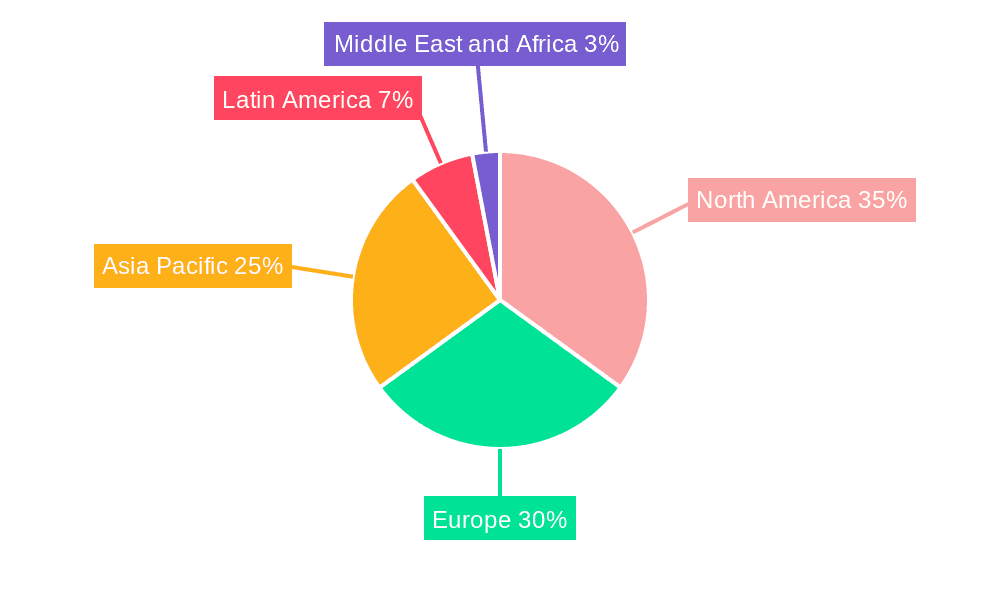

Dominant Regions & Segments in Music Streaming Apps Industry

This section analyzes regional and segment-wise market dominance, focusing on North America, Europe, and Asia-Pacific. Within these regions, specific countries demonstrate higher market penetration, driven by factors such as disposable income, internet infrastructure, and cultural preferences for music streaming.

By Type:

- In-app Purchases: This segment is driven by consumers' willingness to pay for premium features like ad-free listening and offline downloads. The in-app purchase segment is expected to maintain a substantial share of the overall revenue.

- Advertisement: This segment is characterized by a competitive pricing structure with numerous free options and a focus on user engagement to maximize ad impressions.

- Other Types: This segment includes revenue generated through subscriptions that bundle music streaming with other services or partnerships.

By Platform:

- Android: The Android platform benefits from widespread global adoption, leading to higher market penetration.

- iPhone: The iPhone platform boasts a loyal user base and a higher average revenue per user (ARPU), contributing to significant market share.

Key Drivers:

- Strong economic growth in developing countries

- Increased smartphone penetration

- Growing internet and mobile data accessibility

- Expanding consumer base with increased disposable income

Music Streaming Apps Industry Product Innovations

The music streaming apps industry is characterized by continuous innovation. Recent advancements include improvements to personalized recommendations through machine learning algorithms, the introduction of high-fidelity audio streaming, and the integration of social features to enhance user engagement. These innovations aim to improve user experience and maintain a competitive edge.

Report Scope & Segmentation Analysis

This report segments the market by type (In-app Purchases, Advertisement, Other Types) and platform (Android, iPhone). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics.

- In-app Purchases: This segment is expected to grow at a CAGR of xx% during the forecast period, driven by the increasing preference for premium features.

- Advertisement: The growth of the advertisement segment is anticipated to be influenced by factors such as ad targeting technologies and increasing ad spending by music streaming companies.

- Other Types: This segment exhibits a CAGR of xx% due to the growing adoption of bundled services.

- Android: The Android platform segment is projected to experience robust growth, driven by the platform’s accessibility.

- iPhone: This segment is expected to grow at a slower rate compared to Android, driven by the platform's established user base.

Key Drivers of Music Streaming Apps Industry Growth

The growth of the music streaming apps industry is driven by several factors:

- Technological advancements: AI-powered recommendation engines and high-fidelity audio streaming enhance the user experience.

- Economic factors: Rising disposable incomes and increased internet penetration, particularly in emerging markets, contribute significantly to market growth.

- Regulatory changes: The evolution of copyright laws and licensing agreements influences market expansion.

Challenges in the Music Streaming Apps Industry Sector

The industry faces challenges such as:

- Intense competition: The market is saturated with numerous players, leading to price wars and challenges in maintaining profitability.

- Royalty payments: High royalty payments to artists and record labels often compress margins.

- Data security and privacy: Ensuring user data privacy and security is essential, requiring significant investment in data protection measures.

Emerging Opportunities in Music Streaming Apps Industry

Emerging opportunities include:

- Expansion into new markets: Untapped potential exists in regions with growing internet access and smartphone penetration.

- Integration of immersive technologies: The use of VR/AR could create new ways for consumers to interact with music.

- Focus on niche markets: Catering to specific music genres or demographics can attract a devoted user base.

Leading Players in the Music Streaming Apps Industry Market

Key Developments in Music Streaming Apps Industry

- December 2022: YouTube Music introduced the Custom Radio Playlist feature, enhancing user customization.

- May 2022: JioSaavn and Warner Music India launched "Spotted," a program to discover and promote new artists.

Future Outlook for Music Streaming Apps Industry Market

The future outlook for the music streaming apps industry is positive, with continued growth anticipated driven by technological advancements, expansion into new markets, and increasing consumer adoption of digital music services. Strategic partnerships and collaborations will play a key role in shaping market dynamics and creating new avenues for growth.

Music Streaming Apps Industry Segmentation

-

1. Type

- 1.1. In-app Purchases

- 1.2. Advertisement

- 1.3. Other Types

-

2. Platform

- 2.1. Android

- 2.2. Iphone

Music Streaming Apps Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Music Streaming Apps Industry Regional Market Share

Geographic Coverage of Music Streaming Apps Industry

Music Streaming Apps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Rising Demand for In-App Purchases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-app Purchases

- 5.1.2. Advertisement

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Android

- 5.2.2. Iphone

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. In-app Purchases

- 6.1.2. Advertisement

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Android

- 6.2.2. Iphone

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. In-app Purchases

- 7.1.2. Advertisement

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Android

- 7.2.2. Iphone

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. In-app Purchases

- 8.1.2. Advertisement

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Android

- 8.2.2. Iphone

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. In-app Purchases

- 9.1.2. Advertisement

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Android

- 9.2.2. Iphone

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. In-app Purchases

- 10.1.2. Advertisement

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Android

- 10.2.2. Iphone

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tidal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NetEase Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencent Music Entertainment Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deezer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spotify AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SoundCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wynk Music*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pandora

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tidal

List of Figures

- Figure 1: Global Music Streaming Apps Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Latin America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Latin America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 29: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Music Streaming Apps Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 18: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Streaming Apps Industry?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Music Streaming Apps Industry?

Key companies in the market include Tidal, NetEase Inc, Google LLC, Tencent Music Entertainment Group, Deezer, Spotify AB, SoundCloud, Wynk Music*List Not Exhaustive, Pandora, Apple Inc.

3. What are the main segments of the Music Streaming Apps Industry?

The market segments include Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage.

6. What are the notable trends driving market growth?

Rising Demand for In-App Purchases.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

In December 2022, YouTube was on the verge of introducing the Custom Radio Playlist feature. Soon, customers of the Google-owned music streaming service would have the option to design their own station. The YouTube Music App would give consumers various options for musicians so they may discover their favorites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Streaming Apps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Streaming Apps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Streaming Apps Industry?

To stay informed about further developments, trends, and reports in the Music Streaming Apps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence