Key Insights

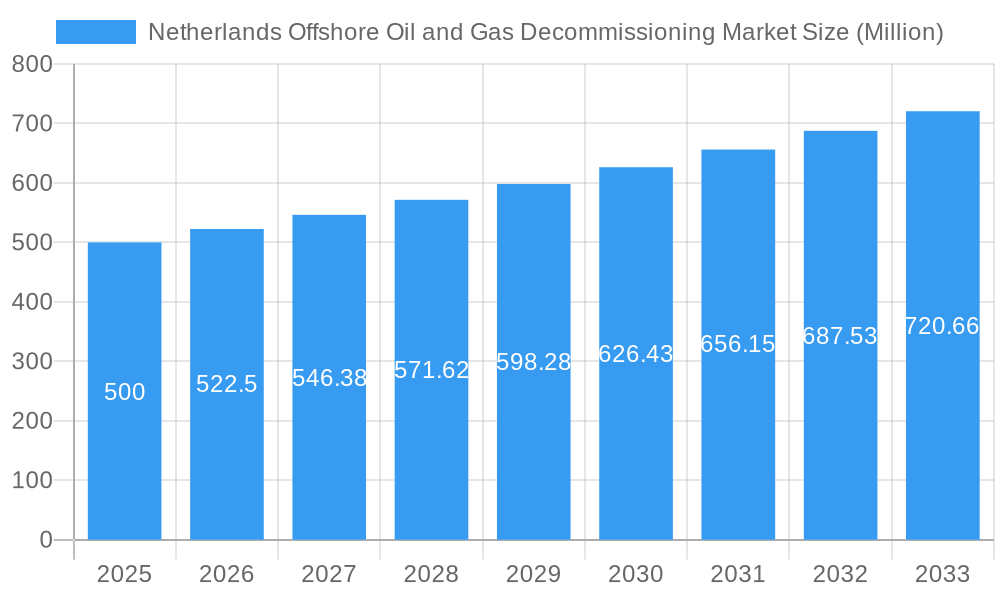

The Netherlands offshore oil and gas decommissioning market is experiencing robust growth, driven by aging infrastructure and stringent environmental regulations. The market is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of 6.5%. This growth is anticipated to result in a market size of 11.1 billion by 2025. Market segmentation encompasses diverse deployment locations (overhead, underground, submarine) and voltage levels (high, extra-high, ultra-high), requiring specialized expertise. Leading players, including ABB Ltd, Neptune Energy, and Royal Boskalis Westminster N.V., are actively engaged in this sector. The Netherlands' strategic North Sea location, strong regulatory framework, and commitment to sustainability make it a prime market for decommissioning services. Technological advancements are further enhancing efficiency, reducing costs, and minimizing environmental impact. However, high capital expenditure and logistical challenges in offshore operations present ongoing considerations.

Netherlands Offshore Oil and Gas Decommissioning Market Market Size (In Billion)

With a projected CAGR of 6.5% and a base year of 2025, the Netherlands offshore oil and gas decommissioning market demonstrates considerable potential. The market size is estimated to reach 11.1 billion by 2025. The active participation of numerous specialized companies highlights market competitiveness and sustained demand. Future expansion will be shaped by supportive government policies for environmental remediation, technological innovations driving efficiency and safety, and the natural decline of North Sea oil and gas production. Strategic planning is crucial for companies to navigate market complexities and leverage growth opportunities.

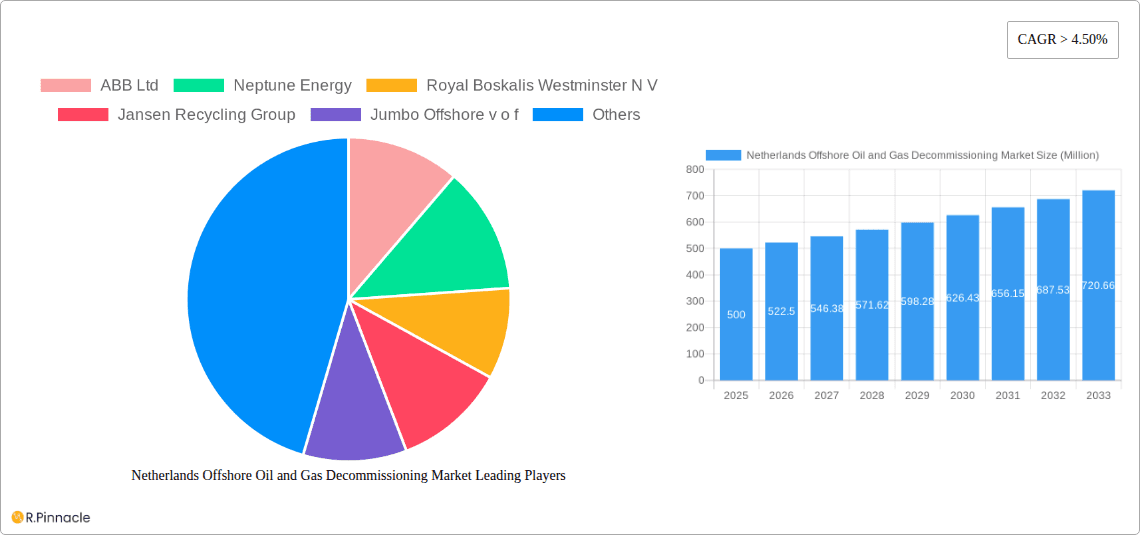

Netherlands Offshore Oil and Gas Decommissioning Market Company Market Share

Netherlands Offshore Oil and Gas Decommissioning Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Netherlands offshore oil and gas decommissioning market, offering invaluable insights for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to provide actionable intelligence, encompassing market structure, dynamics, key players, and future outlook.

Netherlands Offshore Oil and Gas Decommissioning Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory frameworks shaping the Netherlands offshore oil and gas decommissioning market. Market concentration is examined, revealing the market share held by key players like ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, Jansen Recycling Group, Jumbo Offshore v o f, SALTWATER ENGINEERING B V, Veolia Environnement SA, Nexstep, and others. The report assesses the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible (e.g., xx Million USD in M&A activity in 2024). Innovation drivers, including technological advancements in decommissioning techniques and stricter environmental regulations, are thoroughly explored. The influence of product substitutes and end-user demographics (e.g., oil and gas operators, specialized decommissioning firms) on market dynamics is also analyzed. The regulatory landscape, including permits and licensing requirements impacting market entry and operations, is detailed.

Netherlands Offshore Oil and Gas Decommissioning Market Market Dynamics & Trends

This section delves into the market's growth trajectory, analyzing key drivers, technological disruptions, and competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), based on meticulous market sizing and penetration rate analysis. Growth drivers are identified, including increasing numbers of aging offshore platforms requiring decommissioning, governmental mandates for environmental remediation, and technological advancements reducing decommissioning costs and risks. Market penetration by different decommissioning technologies and service offerings is also assessed, revealing shifts in consumer preferences (e.g., demand for sustainable and environmentally friendly decommissioning methods). Competitive dynamics, including strategic partnerships and market entry strategies employed by key players, are comprehensively analyzed.

Dominant Regions & Segments in Netherlands Offshore Oil and Gas Decommissioning Market

This section identifies the dominant regions and segments within the Netherlands offshore oil and gas decommissioning market. While specific regional breakdowns are not explicitly provided in the prompt, the report provides a detailed dominance analysis within the Netherlands, focusing on the performance of specific segments:

- Location of Deployment: The report analyzes market share and growth drivers for Overhead, Underground, and Submarine decommissioning projects. The dominance of a specific location type (e.g., Submarine decommissioning projects due to the prevalence of aging submarine pipelines) will be detailed, along with key drivers like infrastructure investments and policy support.

- Voltage Level: The report analyzes the market for High Voltage, Extra High Voltage, and Ultra High Voltage decommissioning services. The section explains how the dominance of a specific voltage level (e.g., High Voltage due to a larger number of existing platforms) is influenced by factors like the age and type of existing infrastructure.

Netherlands Offshore Oil and Gas Decommissioning Market Product Innovations

This section summarizes recent product developments and technological advancements in the Netherlands offshore oil and gas decommissioning market. The report emphasizes innovative decommissioning technologies, such as improved remote-operated vehicles (ROVs) and advanced recycling techniques, highlighting their competitive advantages (e.g., reduced costs, improved safety, and environmental benefits). The market fit and adoption rates of these innovations are also discussed, emphasizing trends toward more sustainable and cost-effective decommissioning solutions.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Netherlands offshore oil and gas decommissioning market based on:

- Location of Deployment: Overhead, Underground, and Submarine. Each segment's market size, growth projections, and competitive dynamics are analyzed, including the forecast market values for each segment for the period 2025-2033 (e.g., xx Million USD for Submarine segment in 2033).

- Voltage Level: High Voltage, Extra High Voltage, and Ultra High Voltage. Each segment's market size, growth projections, and competitive dynamics are assessed, including forecast market values (e.g., xx Million USD for High Voltage segment in 2033).

Key Drivers of Netherlands Offshore Oil and Gas Decommissioning Market Growth

Several factors drive growth in the Netherlands offshore oil and gas decommissioning market. These include:

- Stringent environmental regulations: The increasing focus on environmental protection and the need for responsible decommissioning practices fuel market expansion.

- Aging offshore infrastructure: A large number of aging platforms nearing the end of their operational life necessitates significant decommissioning efforts.

- Technological advancements: Improved technologies reduce decommissioning costs and risks, making it more economically viable.

Challenges in the Netherlands Offshore Oil and Gas Decommissioning Market Sector

The Netherlands offshore oil and gas decommissioning market faces several challenges:

- High decommissioning costs: The complex and often risky nature of decommissioning operations leads to significant financial burdens.

- Regulatory hurdles: Navigating complex permitting and licensing processes can delay projects and increase costs.

- Supply chain constraints: The specialized equipment and expertise required for decommissioning can lead to supply chain bottlenecks.

Emerging Opportunities in Netherlands Offshore Oil and Gas Decommissioning Market

Despite challenges, several opportunities exist for growth:

- Development of innovative decommissioning technologies: Investments in R&D to improve efficiency and reduce environmental impact present significant opportunities.

- Growth in the recycling and reuse of decommissioned materials: This area holds potential for cost savings and environmental benefits.

- Expansion into new decommissioning services: Specialized decommissioning services, such as well plugging and abandonment, are expected to see increased demand.

Leading Players in the Netherlands Offshore Oil and Gas Decommissioning Market Market

- ABB Ltd (ABB Ltd)

- Neptune Energy (Neptune Energy)

- Royal Boskalis Westminster N V (Royal Boskalis Westminster N V)

- Jansen Recycling Group

- Jumbo Offshore v o f

- SALTWATER ENGINEERING B V

- Veolia Environnement SA

- Nexstep

Key Developments in Netherlands Offshore Oil and Gas Decommissioning Market Industry

- September 2022: Neptune Energy awarded a USD 30 Million decommissioning contract to Well-Safe Solutions for over 20 wells across eight North Sea fields (Dutch and UK). This highlights the increasing outsourcing of decommissioning projects to specialized contractors.

- October 2022: TotalEnergies and AF Offshore Decom signed a contract for the EPRD (engineering, preparation, removal, transportation, dismantling, and recycling) of 10 production platforms from the L7 field. This signifies a significant decommissioning undertaking and underscores the scale of projects in the market.

Future Outlook for Netherlands Offshore Oil and Gas Decommissioning Market Market

The Netherlands offshore oil and gas decommissioning market is poised for continued growth. The aging infrastructure, coupled with increasing regulatory pressure and technological advancements, will drive demand for decommissioning services. Strategic partnerships and investments in innovative technologies are expected to shape the market's future, unlocking new opportunities for efficient and sustainable decommissioning practices. The market’s projected growth suggests a significant potential for investment and expansion in this sector.

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation By Geography

- 1. Netherlands

Netherlands Offshore Oil and Gas Decommissioning Market Regional Market Share

Geographic Coverage of Netherlands Offshore Oil and Gas Decommissioning Market

Netherlands Offshore Oil and Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Shallow Water Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Offshore Oil and Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neptune Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Boskalis Westminster N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jansen Recycling Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jumbo Offshore v o f

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SALTWATER ENGINEERING B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veolia Environnement SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nexstep

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Offshore Oil and Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Offshore Oil and Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Netherlands Offshore Oil and Gas Decommissioning Market?

Key companies in the market include ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, Jansen Recycling Group, Jumbo Offshore v o f, SALTWATER ENGINEERING B V, Veolia Environnement SA*List Not Exhaustive, Nexstep.

3. What are the main segments of the Netherlands Offshore Oil and Gas Decommissioning Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Shallow Water Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Neptune Energy announced the award of a USD 30 million decommissioning contract to Well-Safe Solutions, for a campaign covering more than 20 wells located across eight Dutch and UK North Sea fields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Offshore Oil and Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Offshore Oil and Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Offshore Oil and Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Netherlands Offshore Oil and Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence