Key Insights

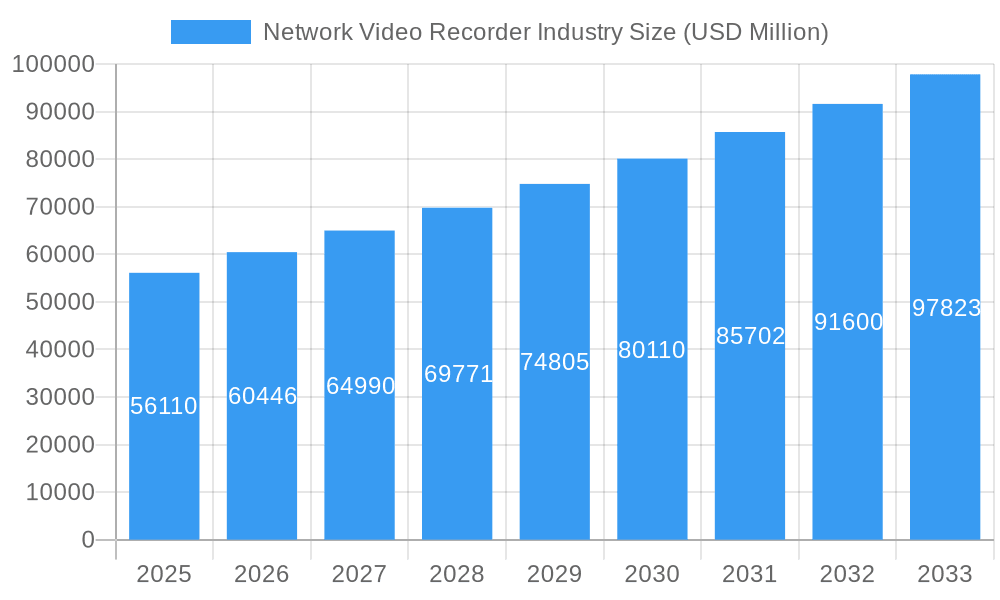

The global Network Video Recorder (NVR) market is poised for significant expansion, projected to reach an estimated $56.11 billion by 2025. This robust growth is driven by an increasing adoption of IP-based surveillance systems across residential, commercial, and industrial sectors, fueled by escalating security concerns and the need for advanced video management solutions. The market's upward trajectory is further bolstered by the continuous evolution of technology, including the integration of AI for intelligent video analytics, cloud-based NVR solutions for enhanced accessibility and scalability, and the demand for higher resolution video recording capabilities. These advancements are transforming how organizations and individuals manage their surveillance data, moving towards more intelligent, efficient, and integrated security ecosystems. The market's healthy CAGR of 7.8% signifies sustained investor confidence and a consistent demand for NVR solutions that offer superior performance, analytics, and remote access capabilities.

Network Video Recorder Industry Market Size (In Billion)

Key growth drivers for the Network Video Recorder market include the rising proliferation of smart cities initiatives globally, which necessitate comprehensive surveillance infrastructure, and the increasing demand for video analytics to detect anomalies, enhance operational efficiency, and improve public safety. The commercial segment, encompassing retail, hospitality, and corporate environments, is a major contributor due to the need for loss prevention, employee monitoring, and customer behavior analysis. Similarly, industrial applications, including manufacturing, logistics, and critical infrastructure, are adopting NVRs for site security and process monitoring. While the market enjoys strong growth, potential restraints could emerge from the complexities of cybersecurity threats targeting networked devices and the initial investment costs associated with high-end NVR systems. However, the ongoing innovation in affordability and enhanced security features within NVR technology is expected to mitigate these challenges, ensuring continued market dynamism.

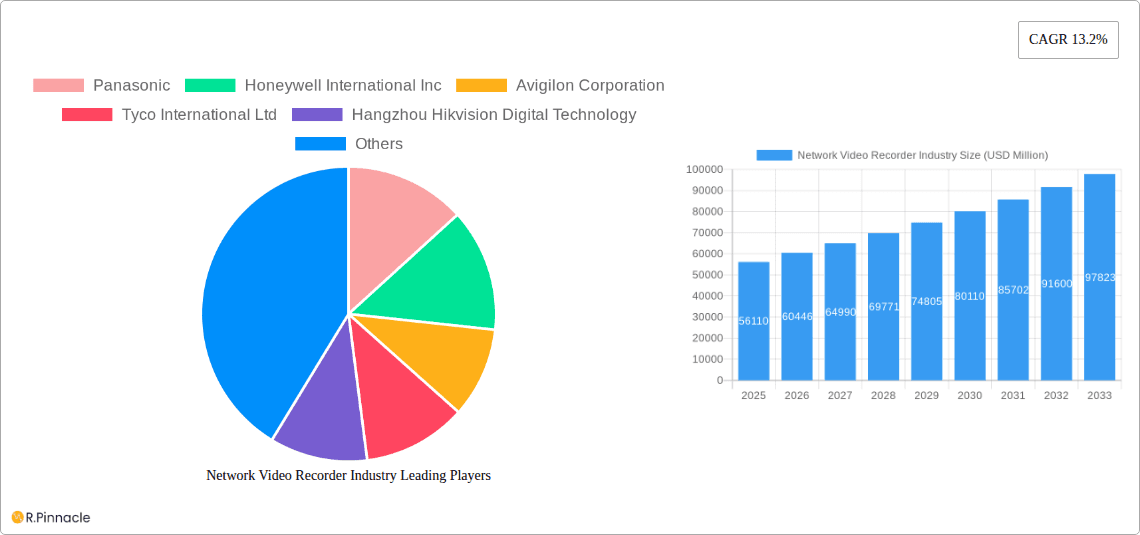

Network Video Recorder Industry Company Market Share

Unveiling the Future: Comprehensive Network Video Recorder (NVR) Industry Market Report (2019–2033)

This in-depth report delivers critical market intelligence on the global Network Video Recorder (NVR) industry, projecting a significant market expansion from an estimated XX billion in the base year 2025 to XX billion by 2033, with a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. Covering historical data from 2019–2024, this analysis provides a 360-degree view of market dynamics, innovation trends, dominant regions, and emerging opportunities. It is an essential resource for industry professionals, investors, and stakeholders seeking to navigate the evolving landscape of video surveillance technology.

Network Video Recorder Industry Market Structure & Innovation Trends

The Network Video Recorder (NVR) market is characterized by moderate to high concentration, with leading players like Hangzhou Hikvision Digital Technology, Dahua Technology Co Ltd, and Axis Communications AB holding substantial market shares, estimated to be in the billions. Innovation is a primary driver, fueled by advancements in AI, deep learning, and edge computing, enabling more sophisticated video analytics and on-device processing. Regulatory frameworks, particularly concerning data privacy and cybersecurity, are increasingly shaping product development and market access. While dedicated NVR solutions dominate, product substitutes like cloud-based video management systems (VMS) and digital video recorders (DVRs) present competitive pressures. End-user demographics span residential security seekers, commercial enterprises prioritizing loss prevention and operational efficiency, and industrial sectors demanding robust surveillance for safety and compliance. Mergers and acquisitions (M&A) activities, with deal values in the billions, are expected to continue as companies seek to consolidate market presence, acquire new technologies, and expand their global reach. The increasing adoption of IP cameras and the growing demand for intelligent video surveillance solutions are key indicators of the market's dynamic structure.

Network Video Recorder Industry Market Dynamics & Trends

The Network Video Recorder (NVR) market is experiencing robust growth driven by escalating global security concerns and the pervasive adoption of advanced surveillance technologies. The increasing prevalence of IP cameras, coupled with the declining cost of storage solutions, significantly propels market penetration across diverse sectors. Technological disruptions, particularly in artificial intelligence (AI) and machine learning (ML), are revolutionizing NVR capabilities, enabling sophisticated features like facial recognition, object detection, and behavioral analysis, which are crucial for proactive security measures and operational insights. Consumer preferences are shifting towards smarter, more integrated, and user-friendly NVR systems that offer remote accessibility and seamless integration with other smart home or building management systems. The competitive dynamics are intensifying, with established players continuously innovating to offer higher channel capacities, enhanced video analytics, and more robust cybersecurity features. The market penetration of NVR solutions is projected to surge as businesses and individuals recognize the value proposition of intelligent video surveillance for loss prevention, operational efficiency, and enhanced safety. The growing emphasis on cybersecurity and data integrity within NVR systems is also a significant trend, addressing critical concerns for end-users.

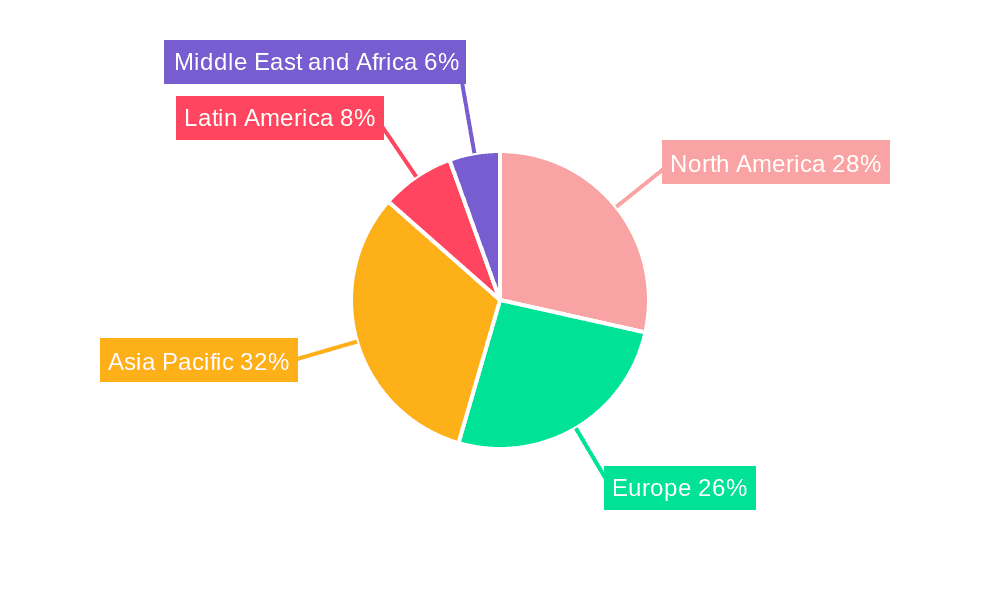

Dominant Regions & Segments in Network Video Recorder Industry

The Commercial segment is the dominant force within the Network Video Recorder (NVR) industry, driven by a confluence of economic policies, infrastructure development, and the inherent need for advanced security solutions in businesses. Leading countries in NVR adoption within this segment include the United States, China, and those within the European Union, owing to their robust economies and significant investments in commercial infrastructure such as retail spaces, corporate offices, and transportation hubs.

- Key Drivers for Commercial Segment Dominance:

- Enhanced Security and Loss Prevention: Commercial establishments require sophisticated surveillance to deter theft, monitor employee activity, and ensure the safety of customers and assets.

- Operational Efficiency and Compliance: NVRs provide valuable data for optimizing business operations, such as monitoring foot traffic, analyzing customer behavior, and ensuring compliance with industry regulations.

- Technological Advancement: The commercial sector is quick to adopt new technologies, leveraging AI-powered analytics for advanced threat detection and business intelligence.

- Infrastructure Investment: Significant investments in new commercial buildings and upgrades to existing facilities necessitate integrated security systems, including NVRs.

The Industrial segment also represents a substantial and growing market for NVRs, fueled by the critical need for safety, security, and operational monitoring in manufacturing plants, energy facilities, and logistics centers. Stringent safety regulations and the high value of assets in these environments necessitate advanced surveillance capabilities. The Residential segment, while smaller in terms of individual system value, is experiencing rapid growth due to increasing consumer awareness of home security and the proliferation of smart home devices. The Others segment, encompassing applications like public transportation, educational institutions, and government facilities, contributes significantly to overall market demand, driven by public safety initiatives and the need for comprehensive monitoring.

Network Video Recorder Industry Product Innovations

Product innovations in the NVR industry are primarily centered around enhancing processing power, improving video analytics, and bolstering cybersecurity. The integration of advanced chipsets, such as Intel Core series CPUs, enables higher channel counts and more sophisticated AI-powered features like real-time object detection and deep learning algorithms. Manufacturers are also focusing on developing more robust and scalable NVR solutions that can seamlessly integrate with a wider array of IP cameras and third-party security systems. The competitive advantage lies in offering solutions that provide superior image quality, faster data processing, more accurate analytics, and greater reliability for critical surveillance applications, thereby meeting the evolving demands of both commercial and industrial sectors.

Report Scope & Segmentation Analysis

This report meticulously segments the Network Video Recorder (NVR) industry across key application areas.

Residential: This segment focuses on NVR solutions tailored for home security, offering features like remote monitoring, motion detection alerts, and integration with smart home ecosystems. Growth is driven by increasing consumer demand for advanced home security and the proliferation of IP cameras.

Commercial: Encompassing a broad range of businesses, this segment includes retail, hospitality, banking, and office buildings. NVRs here are crucial for loss prevention, operational monitoring, and customer analytics. The segment is expected to experience substantial growth due to rising security threats and the need for sophisticated surveillance.

Industrial: This segment caters to manufacturing plants, warehouses, energy facilities, and critical infrastructure. Industrial NVRs are characterized by high channel counts, ruggedized designs, and advanced analytics for safety compliance and operational oversight. Growth is spurred by stringent safety regulations and the need to protect high-value assets.

Others: This segment includes applications in transportation, education, government, and public spaces. NVRs in these areas are vital for public safety, crowd management, and asset protection, exhibiting steady growth driven by public security initiatives and smart city projects.

Key Drivers of Network Video Recorder Industry Growth

The growth of the Network Video Recorder (NVR) industry is propelled by several key factors. Firstly, the escalating global concerns for security and safety, across both public and private sectors, are a primary driver. Secondly, the rapid advancement in IP camera technology and the increasing affordability of high-capacity storage solutions make NVR systems more accessible and cost-effective. Thirdly, the burgeoning integration of Artificial Intelligence (AI) and Machine Learning (ML) into NVRs is enabling sophisticated video analytics, such as facial recognition, object detection, and behavioral analysis, which are highly sought after for proactive security and operational insights. Lastly, favorable government initiatives and regulations mandating enhanced security measures in critical infrastructure and public spaces further contribute to market expansion.

Challenges in the Network Video Recorder Industry Sector

The Network Video Recorder (NVR) industry faces several challenges that can impede its growth trajectory. Cybersecurity threats remain a significant concern, as NVR systems can be vulnerable to hacking, leading to data breaches and system compromise, requiring continuous investment in robust security measures. The increasing complexity of video analytics and the need for skilled personnel to manage and interpret the data can pose a barrier for some end-users. Furthermore, interoperability issues between different brands and types of IP cameras and NVRs can create integration challenges. The high initial investment cost for sophisticated NVR systems, especially for smaller businesses, can also be a restraint, although this is gradually decreasing with technological advancements and increased competition. Supply chain disruptions and component shortages can also impact production and availability.

Emerging Opportunities in Network Video Recorder Industry

Emerging opportunities in the Network Video Recorder (NVR) industry are abundant, driven by technological advancements and evolving market demands. The widespread adoption of AI and deep learning is creating opportunities for NVRs capable of predictive analytics, anomaly detection, and intelligent incident response. The growth of edge computing presents a significant avenue, enabling NVRs to perform more processing locally, reducing bandwidth requirements and latency. The increasing demand for integrated security solutions opens doors for NVR manufacturers to develop platforms that seamlessly connect with access control systems, intrusion detection, and other IoT devices. Furthermore, the expansion of smart city initiatives and the need for comprehensive surveillance in urban environments offer substantial growth potential. The burgeoning remote work trend also fuels the demand for accessible and robust remote monitoring capabilities.

Leading Players in the Network Video Recorder Industry Market

- Panasonic

- Honeywell International Inc

- Avigilon Corporation

- Tyco International Ltd

- Hangzhou Hikvision Digital Technology

- VIVOTEK Inc

- D-Link Corporation

- Axis Communications AB

- Synology Inc

- Dahua Technology Co Ltd

- Teledyne FLIR LLC

- Surveon Technology Inc

Key Developments in Network Video Recorder Industry Industry

- May 2022: ICP Germany introduces the NV1 Network Video Recorder, featuring power-saving mobile Intel Core-I (Tiger-Lake) 11th generation CPUs and the iRIS Xe graphics unit. This NVR supports Intel CeleronTM 6305E, Intel Core-i3-1115G4E, Intel Core-i5-1145G7E, and Intel Core-i7-1185G7E processors, up to 64GB of DDR4 RAM, and the Intel iRIS Xe graphics processor capable of 1080p video decoding for up to 64 channels and 1080p video analysis and deep learning for up to ten channels at 7.1TOPS.

- March 2022: Quantum Corporation launches the Unified Surveillance Platform (USP), a resilient, flexible, and secure software platform for recording and storing video surveillance data. Alongside USP, Quantum introduces a new series of Smart Network Video Recording Servers that merge the USP software with specially designed NVR servers, enhancing their video surveillance product portfolio which includes long-term retention solutions and hyper-converged appliances.

Future Outlook for Network Video Recorder Industry Market

The future outlook for the Network Video Recorder (NVR) industry is exceptionally positive, driven by continuous technological innovation and an ever-increasing global emphasis on security. The widespread integration of AI-powered video analytics will transform NVRs from mere recording devices into intelligent security and operational management tools, offering predictive capabilities and proactive threat detection. The expansion of the Internet of Things (IoT) ecosystem will further fuel the demand for interconnected NVR solutions that can seamlessly integrate with a wide array of smart devices and platforms. The ongoing development of edge computing will empower NVRs with enhanced on-device processing, leading to greater efficiency and reduced reliance on cloud infrastructure for certain applications. As smart city initiatives gain momentum and the demand for comprehensive surveillance in urban environments grows, the NVR market is poised for sustained and significant expansion, promising substantial strategic opportunities for industry participants.

Network Video Recorder Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Others

Network Video Recorder Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Network Video Recorder Industry Regional Market Share

Geographic Coverage of Network Video Recorder Industry

Network Video Recorder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience of connecting with multiple video surveillance cameras to store data; Rising Smart City Initiatives; Growing Safety Concerns

- 3.3. Market Restrains

- 3.3.1. Gradual replacement with XDR; Rising Concerns Regarding Cybercrime

- 3.4. Market Trends

- 3.4.1. Increasing Adoption across Various End-User Industries is expected to drive market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Network Video Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avigilon Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tyco International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hangzhou Hikvision Digital Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VIVOTEK Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 D-Link Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axis Communications AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Synology Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dahua Technology Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne FLIR LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Surveon Technology Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Network Video Recorder Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Network Video Recorder Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Network Video Recorder Industry Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Network Video Recorder Industry Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Network Video Recorder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Network Video Recorder Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Network Video Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Network Video Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Network Video Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Network Video Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Network Video Recorder Industry Revenue (undefined), by Application 2025 & 2033

- Figure 12: Europe Network Video Recorder Industry Volume (K Unit), by Application 2025 & 2033

- Figure 13: Europe Network Video Recorder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Network Video Recorder Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: Europe Network Video Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Network Video Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Network Video Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Network Video Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Network Video Recorder Industry Revenue (undefined), by Application 2025 & 2033

- Figure 20: Asia Pacific Network Video Recorder Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Asia Pacific Network Video Recorder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Network Video Recorder Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Network Video Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Network Video Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Network Video Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Network Video Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Network Video Recorder Industry Revenue (undefined), by Application 2025 & 2033

- Figure 28: Latin America Network Video Recorder Industry Volume (K Unit), by Application 2025 & 2033

- Figure 29: Latin America Network Video Recorder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Network Video Recorder Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Latin America Network Video Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Latin America Network Video Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America Network Video Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Network Video Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Network Video Recorder Industry Revenue (undefined), by Application 2025 & 2033

- Figure 36: Middle East and Africa Network Video Recorder Industry Volume (K Unit), by Application 2025 & 2033

- Figure 37: Middle East and Africa Network Video Recorder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Network Video Recorder Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa Network Video Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 40: Middle East and Africa Network Video Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa Network Video Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Network Video Recorder Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Network Video Recorder Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Network Video Recorder Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Network Video Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Network Video Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Network Video Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Network Video Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Network Video Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Network Video Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: Global Network Video Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global Network Video Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Network Video Recorder Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Network Video Recorder Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Network Video Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Network Video Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Network Video Recorder Industry?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Network Video Recorder Industry?

Key companies in the market include Panasonic, Honeywell International Inc, Avigilon Corporation, Tyco International Ltd, Hangzhou Hikvision Digital Technology, VIVOTEK Inc, D-Link Corporation, Axis Communications AB, Synology Inc , Dahua Technology Co Ltd, Teledyne FLIR LLC, Surveon Technology Inc.

3. What are the main segments of the Network Video Recorder Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Convenience of connecting with multiple video surveillance cameras to store data; Rising Smart City Initiatives; Growing Safety Concerns.

6. What are the notable trends driving market growth?

Increasing Adoption across Various End-User Industries is expected to drive market growth.

7. Are there any restraints impacting market growth?

Gradual replacement with XDR; Rising Concerns Regarding Cybercrime.

8. Can you provide examples of recent developments in the market?

May 2022 - A Network Video Recorder (NVR) with the power-saving mobile Intel Core-I (Tiger-Lake) 11th generation CPUs and the iRIS Xe graphics unit is offered from ICP Germany under the name NV1. The Intel CeleronTM 6305E, Intel Core-i3-1115G4E, Intel Core-i5-1145G7E, and Intel Core-i7-1185G7E processors are all available for the NV1. The two SO-DIMM slots can hold up to 64GB of DDR4 RAM. The Intel iRIS Xe graphics processor offers 1080p video decoding, video capture, and playback on as many as 64 channels, as well as 1080p video analysis and deep learning for as many as ten channels at 7.1TOPS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Network Video Recorder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Network Video Recorder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Network Video Recorder Industry?

To stay informed about further developments, trends, and reports in the Network Video Recorder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence