Key Insights

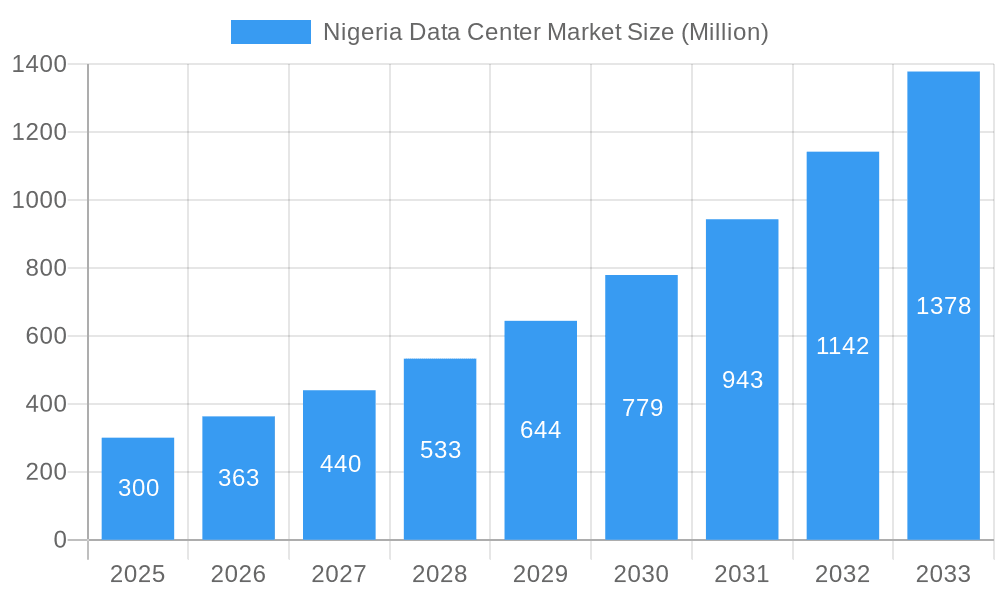

The Nigerian data center market is experiencing substantial expansion, fueled by accelerating digitalization, growing e-commerce, and widespread adoption of cloud services. The market is projected to reach $288 million by 2025, with a Compound Annual Growth Rate (CAGR) of 24.99% from 2025 to 2033. Lagos remains a focal point for data center development, attracting significant investment. Market segmentation encompasses Tier 1-4 data centers, serving hyperscale, retail, and wholesale colocation demands. Key industry participants include Africa Data Centers, WIOCC, MDXi (MainOne by Equinix), Rack Centre Limited, MTN Nigeria, and Digital Realty, actively contributing to market dynamics through infrastructure development and service offerings. Growth is further propelled by the increasing requirements of sectors such as BFSI, cloud providers, e-commerce, government, manufacturing, telecommunications, and media & entertainment.

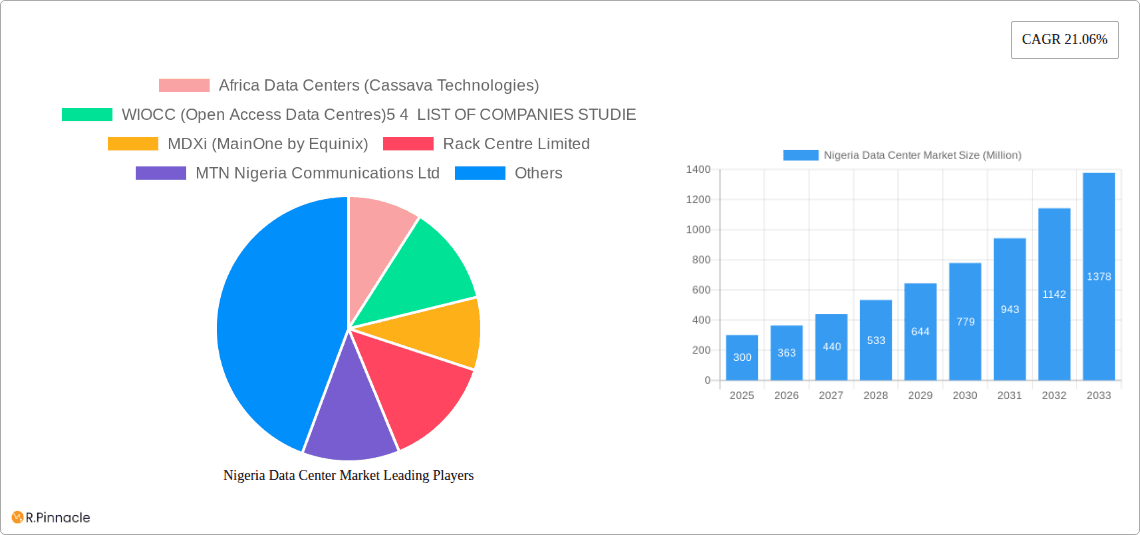

Nigeria Data Center Market Market Size (In Million)

Challenges include potential infrastructure limitations and the imperative for sustained investment in power and connectivity to meet escalating demand. Addressing these constraints through strategic alliances, refined regulatory frameworks, and continuous investment in robust infrastructure is crucial for future market success. The market's projected value of $288 million in 2025 (base year) is set to grow significantly throughout the forecast period (2025-2033). Ongoing expansion of digital services and government-backed digital transformation initiatives are expected to sustain the Nigerian data center market's remarkable growth trajectory.

Nigeria Data Center Market Company Market Share

Nigeria Data Center Market Analysis: 2025-2033 Growth & Forecast

This comprehensive report delivers an in-depth analysis of the expanding Nigeria data center market, providing critical insights for industry stakeholders, investors, and strategic planners. Based on extensive market research from 2019 to 2024, with 2025 as the base year and a forecast period extending to 2033, this report meticulously examines market structure, dynamics, key players, and future growth potential. All market values are presented in millions.

Nigeria Data Center Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Nigerian data center market, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report assesses the market share of key players like Africa Data Centers (Cassava Technologies), WIOCC (Open Access Data Centres), MDXi (MainOne by Equinix), Rack Centre Limited, MTN Nigeria Communications Ltd, and Digital Realty (Medallion Communications Ltd), highlighting their strategic initiatives and competitive advantages. The analysis includes a detailed examination of recent mergers and acquisitions (M&A), such as the USD 320 Million acquisition of MainOne by Equinix in April 2022, evaluating their impact on market consolidation and future growth trajectories. Metrics like market share and M&A deal values are presented to provide a quantitative overview of the market's structure and dynamism. The report also explores the influence of regulatory frameworks, technological advancements, and the adoption of new technologies on the overall market structure. The analysis considers the impact of substitute products and services, as well as demographic shifts in end-user segments. The xx% market share held by the top 3 players is projected to remain relatively stable until 2033, with slight shifts due to continued investments in infrastructure and innovation.

Nigeria Data Center Market Dynamics & Trends

This section delves into the key drivers and trends shaping the Nigerian data center market. It explores factors influencing market growth, including the increasing adoption of cloud computing, the expansion of e-commerce, and the growing demand for digital services across various sectors like BFSI, Telecom, and Government. The report analyses the impact of technological disruptions, such as the rise of edge computing and the increasing demand for hyperscale data centers, on market dynamics. Consumer preferences, competitive dynamics, and market penetration rates are examined to provide a holistic understanding of market evolution. The Compound Annual Growth Rate (CAGR) for the market is projected at xx% during the forecast period (2025-2033), driven by strong demand for digital transformation and infrastructure modernization. Market penetration of colocation services is expected to increase from xx% in 2025 to xx% by 2033, primarily due to the growing adoption of cloud-based services and the increasing need for reliable IT infrastructure.

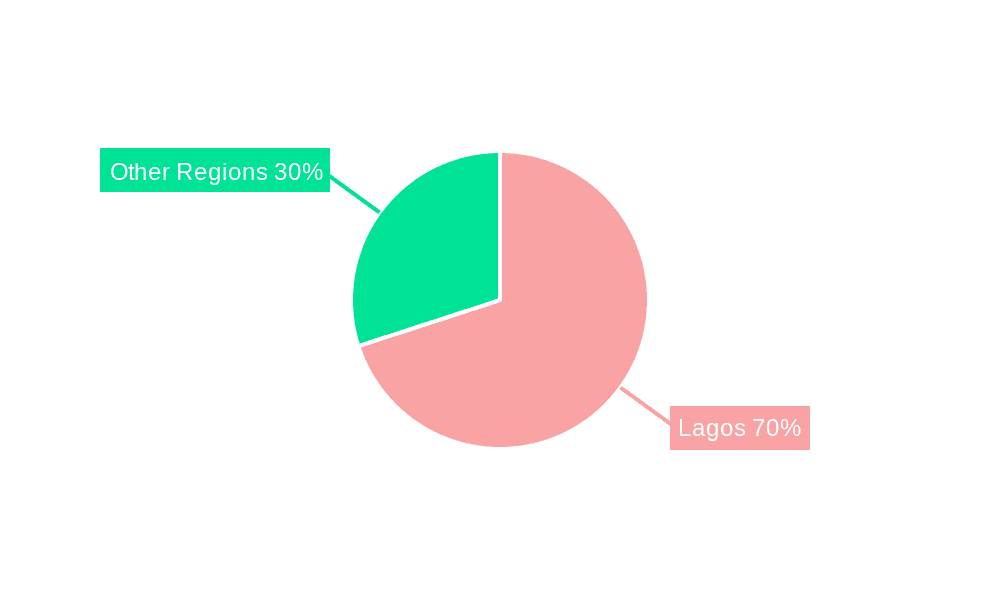

Dominant Regions & Segments in Nigeria Data Center Market

Lagos emerges as the dominant hotspot for data center development in Nigeria, driven by factors such as its established IT infrastructure, proximity to key businesses, and concentration of skilled workforce. The report provides a detailed analysis of the dominance of Lagos, supported by quantifiable data, showcasing its share of the total data center capacity and revenue.

- Key Drivers for Lagos's Dominance:

- Existing IT infrastructure and connectivity

- Concentration of key businesses and end-users

- Availability of skilled workforce

- Government support and initiatives

The report also analyzes the dominance of specific segments within the market, including:

- Data Center Size: Large and Mega data centers are projected to dominate due to the demand for hyperscale solutions.

- Tier Type: Tier III data centers are expected to be most prevalent, given the balance of redundancy and cost-effectiveness.

- Colocation Type: Retail colocation is expected to hold the largest market share initially, with a growing share for hyperscale colocation driven by the increasing demand for cloud services.

- End User: The Telecom, BFSI and Government sectors are projected as the leading end users of data center services.

This analysis is supported by detailed explanations, highlighting factors contributing to the growth and market share of each segment.

Nigeria Data Center Market Product Innovations

The Nigerian data center market is witnessing significant product innovation, with a focus on enhancing efficiency, scalability, and security. This includes the adoption of advanced cooling technologies, energy-efficient hardware, and robust security measures. The market is witnessing an increasing adoption of sustainable practices, reflecting a global trend towards environmentally friendly data centers. The development of hybrid and multi-cloud solutions also enhances the flexibility and resilience of data center operations, catering to the evolving needs of diverse clients. These technological advancements are designed to improve market fit by providing tailored solutions that meet specific business requirements and increase competitive advantages.

Report Scope & Segmentation Analysis

This report comprehensively segments the Nigerian data center market based on several key parameters:

- Hotspot: Lagos and other key cities.

- Data Center Size: Small, Medium, Mega, Large, Massive. Market size and growth projections are detailed for each category.

- Tier Type: Tier 1 & 2, Tier 3, Tier 4. Competitive dynamics and growth potential are analyzed for each tier.

- Absorption: Utilized and Non-Utilized capacity, with projections for future absorption rates.

- Colocation Type: Hyperscale, Retail, and Wholesale, with detailed market size estimations and competitive landscape analysis for each segment.

- End User: BFSI, Cloud, E-commerce, Government, Manufacturing, Telecom, Media & Entertainment, and Other End Users, with individual segment analysis including growth projections and market size.

Each segment's analysis includes specific data, such as market size, growth projections, and competitive dynamics, providing a detailed understanding of each market niche.

Key Drivers of Nigeria Data Center Market Growth

The growth of the Nigerian data center market is fueled by several key drivers: the increasing adoption of cloud computing and digital services across various sectors, the expanding e-commerce landscape, and government initiatives promoting digital transformation. Furthermore, the growing need for robust IT infrastructure to support business operations, coupled with improvements in internet penetration and mobile connectivity, are accelerating market growth. The influx of foreign investment and the growing presence of multinational technology companies are also playing a significant role.

Challenges in the Nigeria Data Center Market Sector

Despite its growth potential, the Nigerian data center market faces several challenges. Power outages and unreliable electricity supply remain significant obstacles, affecting operational costs and service reliability. The lack of skilled labor and high infrastructure costs also impede market expansion. Furthermore, regulatory uncertainties and limited access to financing can pose difficulties for data center operators. These challenges impact market growth by creating operational inefficiencies and raising operational costs. The quantifiable impact is reflected in higher operational expenditures and reduced return on investments.

Emerging Opportunities in Nigeria Data Center Market

The Nigerian data center market presents several promising opportunities. The expansion of 5G networks and the growing adoption of edge computing create opportunities for the deployment of new data centers closer to end-users. The increasing demand for digital services in underserved regions presents new market segments for data center operators. Moreover, government initiatives to improve the business environment and attract foreign investment create a favorable atmosphere for growth. This implies significant potential for expansion and market penetration in underserved areas.

Leading Players in the Nigeria Data Center Market Market

- Africa Data Centers (Cassava Technologies)

- WIOCC (Open Access Data Centres)

- MDXi (MainOne by Equinix)

- Rack Centre Limited

- MTN Nigeria Communications Ltd

- Digital Realty (Medallion Communications Ltd)

Key Developments in Nigeria Data Center Market Industry

- April 2022: Equinix, Inc. acquired MainOne, the parent company of MDX-I, for about USD 320 Million, marking a significant expansion into the African data center market. This acquisition significantly impacted market dynamics, increasing competition and consolidating market share.

Future Outlook for Nigeria Data Center Market Market

The Nigerian data center market is poised for sustained growth, driven by strong demand for digital services, government support for digital transformation, and increasing foreign investment. The expansion of 5G, edge computing, and cloud adoption will further fuel market growth. Strategic partnerships, acquisitions, and investments in infrastructure are expected to shape the future competitive landscape, creating significant opportunities for data center operators and investors alike. The market's future potential is significant, promising substantial returns on investment and contributing to Nigeria's overall digital economy growth.

Nigeria Data Center Market Segmentation

-

1. Hotspot

- 1.1. Lagos

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Telecom

- 6.7. Media & Entertainment

- 6.8. Other End User

Nigeria Data Center Market Segmentation By Geography

- 1. Niger

Nigeria Data Center Market Regional Market Share

Geographic Coverage of Nigeria Data Center Market

Nigeria Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Lagos

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Telecom

- 5.6.7. Media & Entertainment

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Africa Data Centers (Cassava Technologies)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MDXi (MainOne by Equinix)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rack Centre Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MTN Nigeria Communications Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Digital Realty (Medallion Communications Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Africa Data Centers (Cassava Technologies)

List of Figures

- Figure 1: Nigeria Data Center Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Nigeria Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Data Center Market Revenue million Forecast, by Hotspot 2020 & 2033

- Table 2: Nigeria Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Nigeria Data Center Market Revenue million Forecast, by Data Center Size 2020 & 2033

- Table 4: Nigeria Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Nigeria Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 6: Nigeria Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Nigeria Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 8: Nigeria Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Nigeria Data Center Market Revenue million Forecast, by Colocation Type 2020 & 2033

- Table 10: Nigeria Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 11: Nigeria Data Center Market Revenue million Forecast, by End User 2020 & 2033

- Table 12: Nigeria Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Nigeria Data Center Market Revenue million Forecast, by Region 2020 & 2033

- Table 14: Nigeria Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Nigeria Data Center Market Revenue million Forecast, by Hotspot 2020 & 2033

- Table 16: Nigeria Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 17: Nigeria Data Center Market Revenue million Forecast, by Data Center Size 2020 & 2033

- Table 18: Nigeria Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 19: Nigeria Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 20: Nigeria Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 21: Nigeria Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 22: Nigeria Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 23: Nigeria Data Center Market Revenue million Forecast, by Colocation Type 2020 & 2033

- Table 24: Nigeria Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 25: Nigeria Data Center Market Revenue million Forecast, by End User 2020 & 2033

- Table 26: Nigeria Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Nigeria Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Nigeria Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Data Center Market?

The projected CAGR is approximately 24.99%.

2. Which companies are prominent players in the Nigeria Data Center Market?

Key companies in the market include Africa Data Centers (Cassava Technologies), WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE, MDXi (MainOne by Equinix), Rack Centre Limited, MTN Nigeria Communications Ltd, Digital Realty (Medallion Communications Ltd).

3. What are the main segments of the Nigeria Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 288 million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

April 2022: Equinix, Inc. acquired MainOne, the parent company of MDX-I, for about USD 320 million to begin its expansion into the African region. This would allow Equinix to practise its long-term strategy to offer carrier-neutral data center services in Nigeria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Data Center Market?

To stay informed about further developments, trends, and reports in the Nigeria Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence