Key Insights

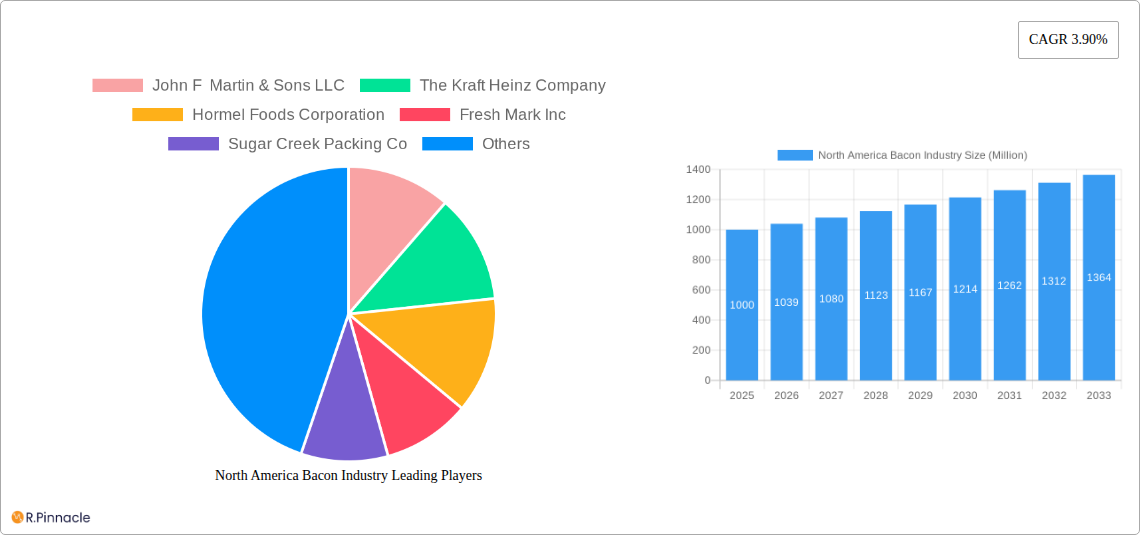

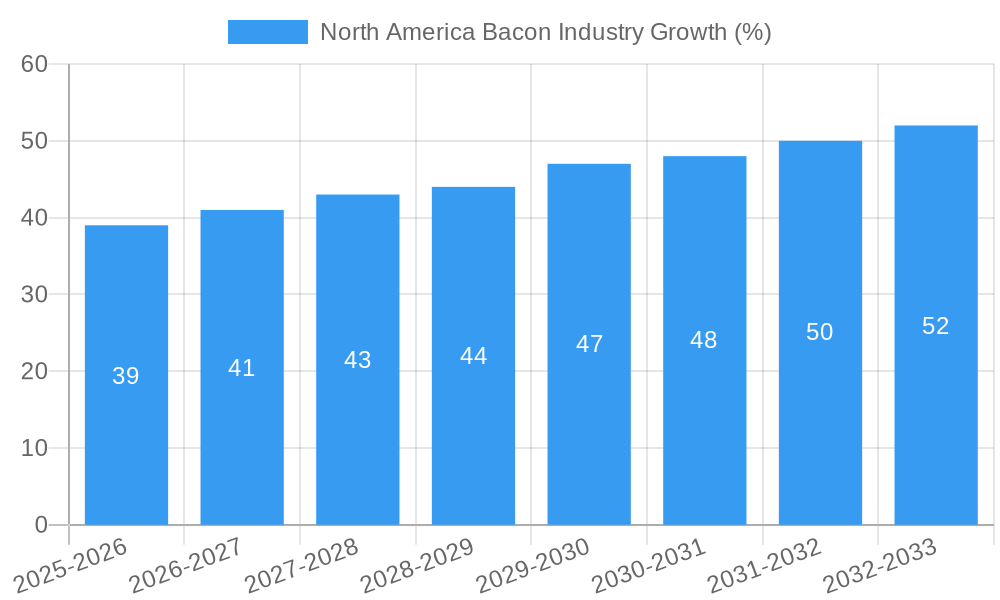

The North American bacon market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.90% from 2025 to 2033. This growth is driven by several key factors. Firstly, the enduring popularity of bacon as a breakfast staple and its increasing inclusion in various other dishes contributes significantly to demand. Secondly, innovative product offerings, such as ready-to-eat and microwavable bacon options, cater to the convenience-seeking consumer, fueling market expansion. The rise of food service channels, including restaurants and cafes, further boosts consumption. Increased consumer disposable income and a preference for convenient, protein-rich breakfast options also play a significant role.

However, certain restraints exist. Fluctuations in pork prices, a key input cost, directly impact bacon prices and profitability. Consumer concerns regarding saturated fat content and the overall health implications of regular bacon consumption also present challenges. Competition within the market is intense, with major players like Hormel Foods, Tyson Foods, and Kraft Heinz vying for market share. Segmentation within the market highlights a significant portion stemming from retail channels, while food service channels also contribute substantially. Growth opportunities exist in expanding into niche markets with specialized bacon varieties (e.g., organic, artisanal) and catering to evolving consumer preferences through innovative product formats and healthier alternatives. The continued expansion of ready-to-eat options across varied distribution channels presents a significant avenue for future growth.

This comprehensive report provides an in-depth analysis of the North America bacon industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth potential. The report leverages extensive market research and data analysis to provide actionable intelligence for navigating the complexities of this dynamic sector.

North America Bacon Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American bacon market, examining market concentration, key innovation drivers, regulatory influences, product substitutes, and the impact of mergers and acquisitions (M&A). The analysis covers the historical period (2019-2024) and projects the market's future trajectory (2025-2033). Key players such as John F Martin & Sons LLC, The Kraft Heinz Company, Hormel Foods Corporation, Fresh Mark Inc, Sugar Creek Packing Co, Maple Leaf Foods, JBS SA, Tyson Foods, and Seaboard Foods are examined in detail.

- Market Concentration: The North American bacon market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025. This concentration is influenced by economies of scale, established brand recognition, and efficient distribution networks.

- Innovation Drivers: Key innovation drivers include consumer demand for healthier options (e.g., reduced sodium, organic bacon), convenience-focused products (ready-to-eat options), and the exploration of novel protein sources (e.g., seaweed bacon).

- Regulatory Frameworks: Government regulations regarding food safety, labeling, and animal welfare significantly influence the industry's operations and product development.

- Product Substitutes: Plant-based bacon alternatives are emerging as significant substitutes, impacting market share and driving innovation in traditional bacon production.

- End-User Demographics: The target demographic primarily comprises consumers across various age groups and income levels, with significant demand driven by breakfast consumption, sandwiches, and other culinary applications.

- M&A Activities: The report analyzes recent M&A activities in the industry, including deal values and their impact on market consolidation. The total value of M&A deals in the period 2019-2024 is estimated at $xx Million.

North America Bacon Industry Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, evolving consumer preferences, and competitive landscape. The analysis utilizes a variety of metrics, including CAGR (Compound Annual Growth Rate) and market penetration rates, to present a comprehensive overview of market dynamics. The forecast period is 2025-2033, with 2025 serving as the base year.

The North American bacon market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include increasing consumer demand for convenient ready-to-eat bacon, the growing popularity of bacon in various culinary applications, and the ongoing expansion of food service channels. Technological advancements in automation and processing efficiency also contribute to market growth. However, competitive pressures from plant-based alternatives and fluctuating raw material prices present significant challenges. The market penetration of ready-to-eat bacon is expected to increase from xx% in 2025 to xx% by 2033, driven by changing consumer lifestyles and preferences.

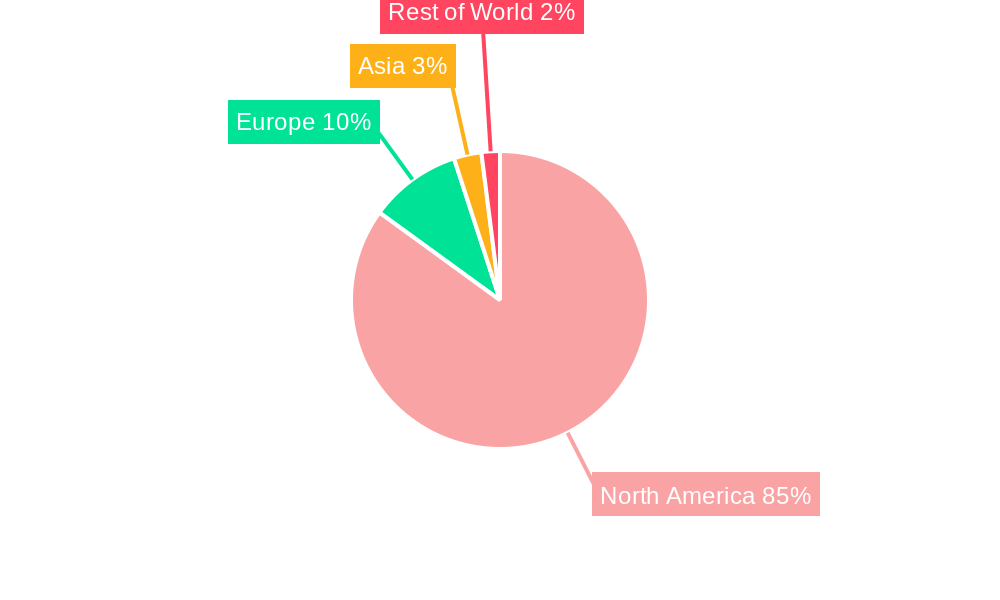

Dominant Regions & Segments in North America Bacon Industry

This section identifies the leading regions, countries, and product segments within the North American bacon market. The analysis focuses on product types (Standard Bacon, Ready-to-Eat Bacon), and distribution channels (Food Service, Retail).

Leading Region: The [Region Name] region is projected to dominate the market due to [reasons - e.g., high per capita consumption, strong economic growth, established distribution networks].

Leading Country: [Country Name] holds a leading market share due to [specific drivers, e.g., strong consumer preference for bacon, favorable regulatory environment].

Leading Product Segment: Ready-to-Eat Bacon is expected to witness faster growth than standard bacon, driven by convenience and time-saving factors. The Retail channel is projected to hold a larger market share than the Food Service channel due to increased consumer purchasing power and the expanding retail landscape.

Key Drivers (Bullet points):

- High per capita consumption of bacon

- Favorable economic conditions

- Established distribution networks

- Growing consumer preference for convenient food products

- Government policies supporting the food industry

North America Bacon Industry Product Innovations

This section summarizes key product developments, applications, and competitive advantages, emphasizing technological trends and market fit. Recent innovations include the introduction of seaweed-based bacon by Umaro Foods, and the launch of Seaboard Foods' "top tier" bacon under the Prairie Fresh USA Prime brand. These innovations highlight the industry's efforts to cater to evolving consumer preferences for healthier, sustainable, and premium products. Technological advancements in processing and automation are further enhancing product quality and efficiency.

Report Scope & Segmentation Analysis

This report segments the North American bacon market by product type (Standard Bacon, Ready-to-Eat Bacon) and distribution channel (Food Service, Retail). Growth projections, market sizes, and competitive dynamics are analyzed for each segment.

Product Type: The Ready-to-Eat Bacon segment is anticipated to experience robust growth due to increasing consumer demand for convenience. Standard Bacon will continue to hold a significant market share, particularly within traditional food service establishments.

Distribution Channel: The Retail channel is expected to dominate the market due to its extensive reach and accessibility to consumers. The Food Service channel, while smaller, is projected to experience steady growth driven by increasing demand in restaurants and other foodservice outlets.

Key Drivers of North America Bacon Industry Growth

Several factors drive the growth of the North American bacon industry. Increased consumer demand fueled by rising disposable incomes and changing dietary preferences contributes significantly. Technological advancements in processing and automation enhance efficiency and product quality. Lastly, favorable government policies and regulations related to food safety and production practices also contribute to market expansion.

Challenges in the North America Bacon Industry Sector

The North American bacon industry faces several challenges, including price volatility of raw materials (pork bellies), rising labor costs, stringent food safety regulations, and intense competition from plant-based alternatives. Supply chain disruptions and logistical complexities can also affect production and distribution. The combined effect of these factors may negatively impact profitability and overall market growth.

Emerging Opportunities in North America Bacon Industry

Emerging opportunities for the North American bacon industry include expanding into new markets (e.g., exploring export opportunities), developing innovative product offerings (e.g., exploring novel protein sources), and catering to health-conscious consumers (e.g., offering low-sodium or organic bacon). Embracing technological advancements in automation and sustainable practices further present opportunities for growth and competitive advantage.

Leading Players in the North America Bacon Industry Market

- John F Martin & Sons LLC

- The Kraft Heinz Company

- Hormel Foods Corporation

- Fresh Mark Inc

- Sugar Creek Packing Co

- Maple Leaf Foods

- JBS SA

- Tyson Foods

- Seaboard Foods

Key Developments in North America Bacon Industry

- June 2022: Umaro Foods launched seaweed bacon in several US restaurants, marking a significant innovation in plant-based alternatives.

- March 2022: Seaboard Foods launched its "top tier" Prairie Fresh USA Prime bacon, signifying a move towards premium product offerings.

- February 2022: Tyson Foods announced a USD 1.3 Billion investment in automation to enhance production efficiency. This investment was followed by announcements of new automated Kentucky bacon production facilities in October 2022.

Future Outlook for North America Bacon Industry Market

The North American bacon market is poised for continued growth, driven by innovation, changing consumer preferences, and technological advancements. Opportunities lie in expanding into new product categories, targeting health-conscious consumers, and leveraging technological improvements for increased efficiency and sustainability. Strategic partnerships and acquisitions will play a crucial role in shaping the market's future landscape.

North America Bacon Industry Segmentation

-

1. Product Type

- 1.1. Standard Bacon

- 1.2. Ready-to-Eat Bacon (Includes Microwavable)

-

2. Distribution Channel

-

2.1. Food Service Channel

- 2.1.1. Full-Service Restaurants

- 2.1.2. Quick-Service Restaurants

- 2.1.3. Cafes and Bars

- 2.1.4. Other Food Service Channels

-

2.2. Retail Channel

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Online Stores

- 2.2.4. Other Retail Channels

-

2.3. By Geography

- 2.3.1. United States

- 2.3.2. Canada

- 2.3.3. Mexico

- 2.3.4. Rest of North America

-

2.1. Food Service Channel

North America Bacon Industry Segmentation By Geography

-

1. United States

- 1.1. Canada

- 1.2. Mexico

- 1.3. Rest of North America

North America Bacon Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer Demand for Convenience Foods; Innovation in Bacon Varieties

- 3.3. Market Restrains

- 3.3.1. High fat and sodium content in bacon can lead to health issues impacting consumer preference

- 3.4. Market Trends

- 3.4.1. Increasing Preference for Premium Bacon Products as Breakfast Option

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bacon Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Standard Bacon

- 5.1.2. Ready-to-Eat Bacon (Includes Microwavable)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Food Service Channel

- 5.2.1.1. Full-Service Restaurants

- 5.2.1.2. Quick-Service Restaurants

- 5.2.1.3. Cafes and Bars

- 5.2.1.4. Other Food Service Channels

- 5.2.2. Retail Channel

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Retail Channels

- 5.2.3. By Geography

- 5.2.3.1. United States

- 5.2.3.2. Canada

- 5.2.3.3. Mexico

- 5.2.3.4. Rest of North America

- 5.2.1. Food Service Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Bacon Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Bacon Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Bacon Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Bacon Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 John F Martin & Sons LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Kraft Heinz Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hormel Foods Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fresh Mark Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sugar Creek Packing Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Maple Leaf Foods

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JBS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tyson Foods

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Seaboard Foods

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 John F Martin & Sons LLC

List of Figures

- Figure 1: North America Bacon Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Bacon Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Bacon Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Bacon Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Bacon Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Bacon Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Bacon Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Bacon Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: North America Bacon Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: North America Bacon Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Canada North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of North America North America Bacon Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bacon Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the North America Bacon Industry?

Key companies in the market include John F Martin & Sons LLC, The Kraft Heinz Company, Hormel Foods Corporation, Fresh Mark Inc, Sugar Creek Packing Co, Maple Leaf Foods, JBS SA, Tyson Foods, Seaboard Foods.

3. What are the main segments of the North America Bacon Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer Demand for Convenience Foods; Innovation in Bacon Varieties.

6. What are the notable trends driving market growth?

Increasing Preference for Premium Bacon Products as Breakfast Option.

7. Are there any restraints impacting market growth?

High fat and sodium content in bacon can lead to health issues impacting consumer preference.

8. Can you provide examples of recent developments in the market?

June 2022: Umaro Foods' novel seaweed bacon was launched in several renowned United States restaurants. Umaro Foods introduced seaweed-based bacon into three US restaurants for the first time, allowing customers to try the brand's novel protein. UMARO bacon was featured in various specialty dishes at San Francisco's Michelin-starred Sorrel Restaurant, New York City's Egg Shop, and Nashville's D'Andrews Bakery and Cafe. The company intends to expand into more restaurants in the Bay Area, Los Angeles, and elsewhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bacon Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bacon Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bacon Industry?

To stay informed about further developments, trends, and reports in the North America Bacon Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence