Key Insights

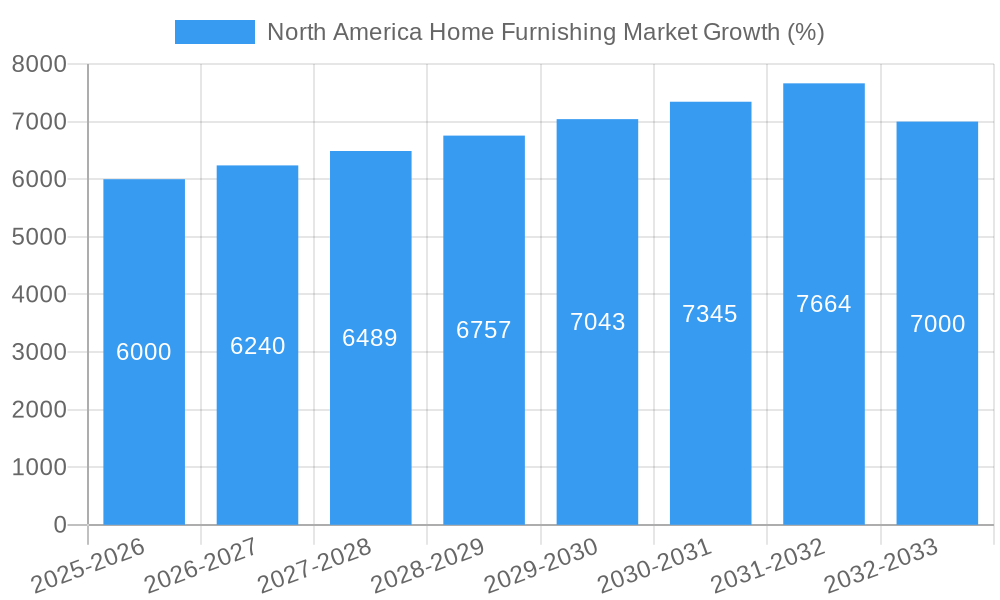

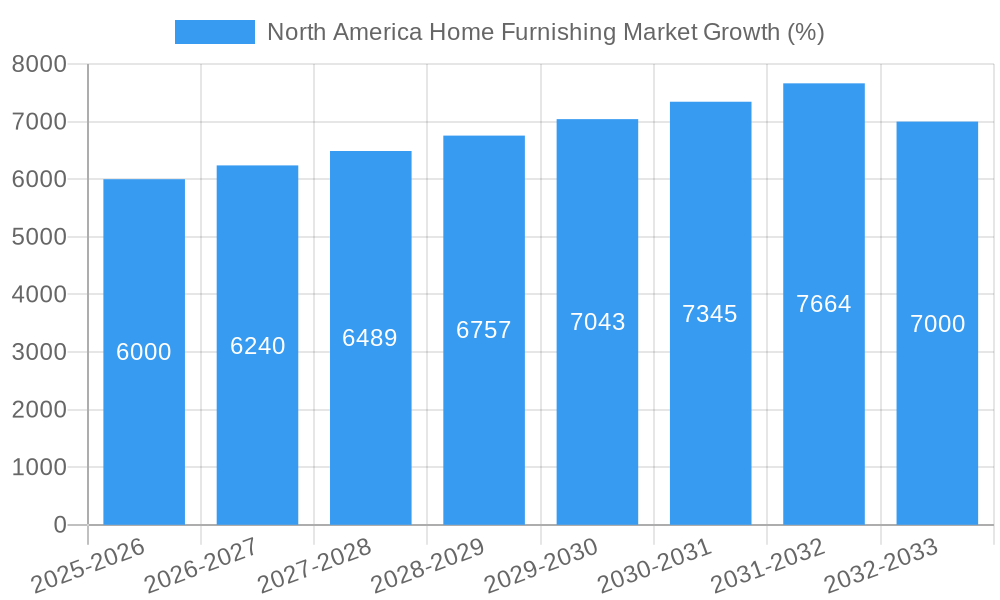

The North American home furnishing market, valued at approximately $150 billion in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 4% through 2033. This expansion is fueled by several key factors. Rising disposable incomes, particularly among millennials and Gen Z, are driving increased spending on home improvement and furnishing upgrades. The shift towards remote work and hybrid work models has also significantly boosted demand for comfortable and functional home office spaces, impacting sales across various furniture segments, including bedroom, living room, and office furniture. Furthermore, the growing emphasis on home aesthetics and personalized living spaces is encouraging consumers to invest in higher-quality, stylish furniture, leading to increased average order values. E-commerce penetration continues its upward trajectory, offering increased accessibility and convenience for consumers, with online retailers like Amazon and dedicated furniture e-tailers capturing a significant share of the market. However, challenges remain. Supply chain disruptions and inflation continue to exert pressure on pricing and profitability, impacting manufacturing and retail operations. Fluctuations in raw material costs, particularly for wood and metal, also pose a risk to overall market stability.

Despite these headwinds, the market demonstrates resilience and strong growth potential. The diversification of product offerings, encompassing sustainable and eco-friendly furniture, is also driving positive market trends. Segmentation by material (wood, metal, plastic, etc.), type (living room, bedroom, kitchen, etc.), and distribution channel (online, specialty stores, etc.) allows for targeted marketing strategies and further refinement of growth opportunities. Major players like IKEA, La-Z-Boy, Ashley Furniture, and others are leveraging branding, innovation, and omnichannel strategies to maintain market share and capture new customer segments. The focus on personalized experiences and improved customer service contributes to stronger brand loyalty and overall market expansion. The long-term outlook remains positive, driven by ongoing population growth, urbanization, and evolving consumer preferences in North America.

North America Home Furnishing Market Report: 2019-2033

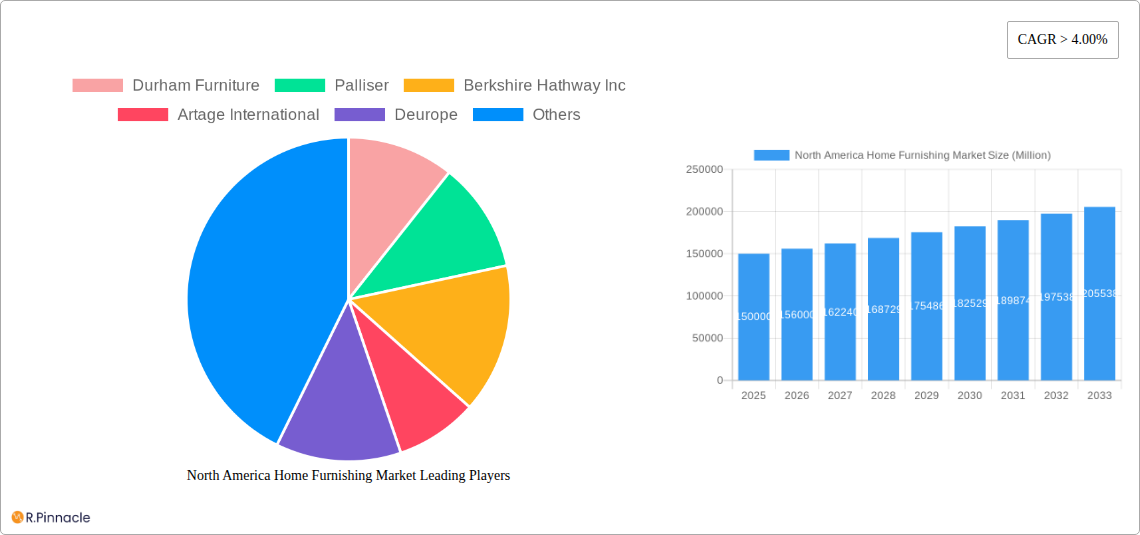

This comprehensive report provides an in-depth analysis of the North America home furnishing market, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on historical data (2019-2024) and future projections. The market is segmented by material (wood, metal, plastic, other), furniture type (living room, dining room, bedroom, kitchen, other), and distribution channel (supermarkets/hypermarkets, specialty stores, wholesalers, online & others). Key players analyzed include Durham Furniture, Palliser, Berkshire Hathaway Inc., Artage International, Deurope, Ashley Furniture Store, American Eco Furniture LLC, MiseWell, Bermex, IKEA, La-Z-Boy, Rooms To Go, and Bassett Furniture.

North America Home Furnishing Market Structure & Innovation Trends

The North American home furnishing market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters competition and innovation. Market share data for 2024 indicates IKEA holding approximately xx% market share, followed by Ashley Furniture with xx%, and La-Z-Boy with xx%. The remaining share is distributed among numerous regional and niche players. Innovation is driven by consumer demand for sustainable and technologically advanced furniture, including smart home integration and customizable options. Regulatory frameworks focusing on material safety and environmental impact are shaping product development. The market witnesses frequent M&A activities, with deal values exceeding USD xx Million in 2024. Key examples include the acquisition of xx by xx for USD xx Million, reflecting consolidation trends. Significant product substitution is occurring with increased use of sustainable materials like recycled plastic and reclaimed wood. The demographics of end-users are shifting towards younger generations with evolving preferences for aesthetics and functionality.

- Market Concentration: Moderately concentrated with several key players dominating.

- Innovation Drivers: Sustainability, smart home integration, customization.

- Regulatory Framework: Focus on material safety and environmental standards.

- Product Substitutes: Growing use of sustainable and recycled materials.

- End-User Demographics: Shifting towards younger, tech-savvy consumers.

- M&A Activity: Significant consolidation with deal values exceeding USD xx Million in 2024.

North America Home Furnishing Market Dynamics & Trends

The North American home furnishing market is experiencing robust growth, driven by several key factors. Rising disposable incomes and increasing urbanization are fueling demand for aesthetically pleasing and functional home furnishings. Technological advancements, such as 3D printing and augmented reality, are transforming design and manufacturing processes, enabling mass customization and reduced lead times. Consumer preferences are shifting towards sustainable and eco-friendly furniture, creating opportunities for manufacturers using recycled and responsibly sourced materials. E-commerce channels are witnessing significant growth, offering greater convenience and wider product selections. Competitive dynamics are intense, with companies constantly striving to differentiate themselves through innovative designs, superior quality, and competitive pricing. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with significant market penetration in the online sales channel expected to exceed xx% by 2033.

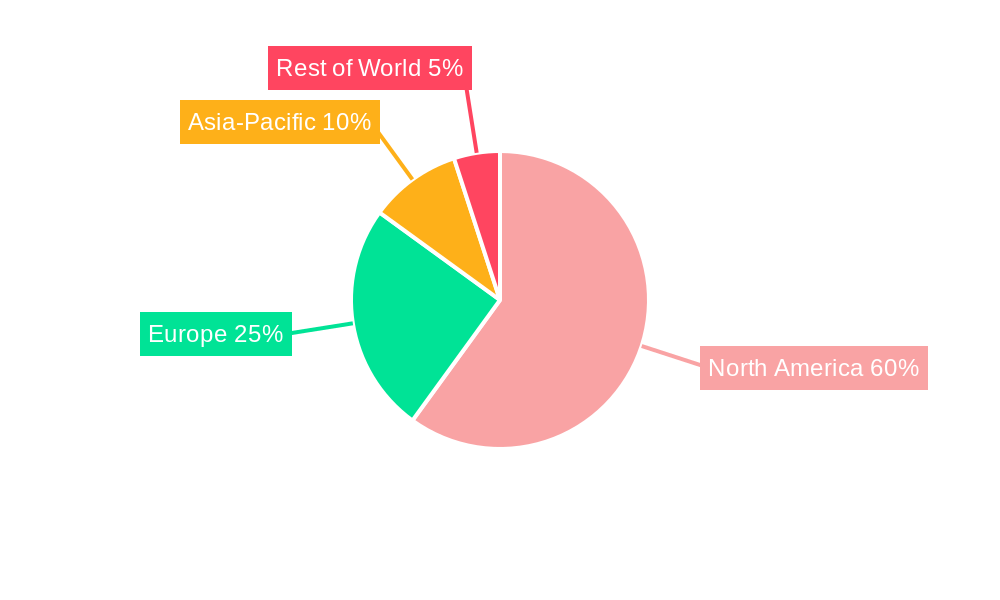

Dominant Regions & Segments in North America Home Furnishing Market

The United States dominates the North American home furnishing market, driven by a large population, high disposable incomes, and robust home construction activity. Within the United States, the South and West regions exhibit the strongest growth.

By Material: Wood remains the dominant material, driven by its aesthetic appeal and versatility. However, the market for metal and plastic furniture is steadily growing, driven by functional and cost-effective aspects. The "Other" segment includes innovative materials like bamboo and recycled plastics, reflecting growing sustainability concerns.

By Type: Living room furniture commands the largest market share, followed by bedroom and dining room furniture. Growth in the kitchen furniture segment is driven by renovation trends and increased interest in home improvement.

By Distribution Channel: Specialty stores remain the leading distribution channel, but online sales are experiencing rapid expansion, creating both opportunities and challenges for established players. Supermarkets and hypermarkets are emerging as supplementary channels for smaller-sized furniture items.

Key drivers for regional dominance include favorable economic policies, well-developed infrastructure, and a strong consumer base. The significant growth in online sales represents a disruptive force, altering traditional distribution channels and boosting customer reach.

North America Home Furnishing Market Product Innovations

The home furnishing market witnesses continuous product innovation, driven by technological advancements and evolving consumer preferences. Smart home integration features are becoming increasingly popular, with furniture incorporating voice control, ambient lighting, and charging capabilities. Sustainable and eco-friendly materials, including recycled plastic and reclaimed wood, are gaining traction. Modular and customizable furniture systems allow greater personalization and space optimization, catering to diverse lifestyle needs. These innovations offer manufacturers enhanced competitive advantages by catering to evolving consumer preferences, reducing environmental impact, and improving operational efficiency.

Report Scope & Segmentation Analysis

This report segments the North American home furnishing market by material, furniture type, and distribution channel. Each segment is analyzed for growth projections, market sizes, and competitive dynamics. The wood segment is projected to maintain its dominance, while plastic and metal segments show significant growth potential. Living room furniture remains the largest segment by type, with strong growth projected for kitchen furniture. Specialty stores maintain their market leadership, but online sales are rapidly expanding. Market sizes for each segment are detailed in the main report, with projected values ranging from USD xx Million to USD xx Million for different segments in 2033.

Key Drivers of North America Home Furnishing Market Growth

Several factors contribute to the North American home furnishing market's growth. Firstly, rising disposable incomes and a growing middle class enable higher spending on home improvement and furnishing. Secondly, urbanization leads to smaller living spaces, boosting demand for multi-functional and space-saving furniture. Thirdly, technological advancements like 3D printing and smart home integration drive innovation and customization options, further fueling demand. Finally, favorable government policies supporting homeownership and renovation projects stimulate market growth.

Challenges in the North America Home Furnishing Market Sector

The North American home furnishing market faces several challenges. Supply chain disruptions caused by global events and logistical issues can impact production and delivery timelines. Fluctuations in raw material costs can negatively affect profitability. Intense competition from both established players and new entrants requires constant innovation and differentiation. Finally, evolving consumer preferences and sustainability concerns require manufacturers to adapt quickly and adopt environmentally friendly practices. These challenges could collectively decrease annual growth rate by approximately xx percentage points by 2033.

Emerging Opportunities in North America Home Furnishing Market

Emerging opportunities include the growing demand for sustainable and eco-friendly furniture, increasing adoption of smart home technology in furnishings, and the rising popularity of customized and modular furniture. Expansion into underserved markets, such as rural areas and emerging demographics, presents significant potential. Furthermore, collaborations with interior design professionals and online platforms can enhance brand visibility and reach. These emerging areas are predicted to contribute an additional USD xx Million to the market by 2033.

Leading Players in the North America Home Furnishing Market Market

- Durham Furniture

- Palliser

- Berkshire Hathaway Inc.

- Artage International

- Deurope

- Ashley Furniture Store

- American Eco Furniture LLC

- MiseWell

- Bermex

- IKEA

- La-Z-Boy

- Rooms To Go

- Bassett Furniture

Key Developments in North America Home Furnishing Market Industry

- 2021 (Q[Unspecified]): Berkshire Hathaway Inc. invested USD 99 Million in Floor & Decor and USD 475 Million in Royalty Pharma, indicating increased interest in related sectors.

- 2021 (Q[Unspecified]): Bassett Furniture Industries, Inc. leased a 123,000 sq ft manufacturing facility in Newton, North Carolina, expanding its production capacity for various furniture lines.

Future Outlook for North America Home Furnishing Market Market

The North American home furnishing market is poised for continued growth, driven by sustained economic expansion, technological advancements, and shifting consumer preferences. Strategic opportunities lie in expanding e-commerce channels, investing in sustainable manufacturing practices, and developing innovative product offerings that cater to evolving lifestyles. The market is expected to witness strong growth, particularly in segments focused on customization, sustainability, and smart home integration. This positive outlook is anticipated to maintain a robust CAGR throughout the forecast period.

North America Home Furnishing Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Kitchen Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online & Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Home Furnishing Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Home Furnishing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Kitchen Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online & Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic

- 6.1.4. Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Living Room Furniture

- 6.2.2. Dining Room Furniture

- 6.2.3. Bedroom Furniture

- 6.2.4. Kitchen Furniture

- 6.2.5. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Wholesalers

- 6.3.4. Online & Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic

- 7.1.4. Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Living Room Furniture

- 7.2.2. Dining Room Furniture

- 7.2.3. Bedroom Furniture

- 7.2.4. Kitchen Furniture

- 7.2.5. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Wholesalers

- 7.3.4. Online & Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 9. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 10. Mexico North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of North America North America Home Furnishing Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Durham Furniture

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Palliser

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Berkshire Hathway Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Artage International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Deurope

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ashely Furniture Store

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 American Eco Furniture LLC**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MiseWell

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bermex

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 IKEA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 La-Z-Boy

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Rooms To Go

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Bassett Furniture

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Durham Furniture

List of Figures

- Figure 1: North America Home Furnishing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home Furnishing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Home Furnishing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Home Furnishing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Home Furnishing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 13: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Home Furnishing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: North America Home Furnishing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: North America Home Furnishing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Home Furnishing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Furnishing Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Home Furnishing Market?

Key companies in the market include Durham Furniture, Palliser, Berkshire Hathway Inc, Artage International, Deurope, Ashely Furniture Store, American Eco Furniture LLC**List Not Exhaustive, MiseWell, Bermex, IKEA, La-Z-Boy, Rooms To Go, Bassett Furniture.

3. What are the main segments of the North America Home Furnishing Market?

The market segments include Material, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market.

6. What are the notable trends driving market growth?

United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Berkshire Hathway built new stakes in Floor & Decor and Royalty Pharma. It disclosed a new, USD 99 million position in Floor & Decor, a flooring retailer, and a USD 475 million stake in Royalty Pharma, which funds clinical trials in exchange for royalties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Furnishing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Furnishing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Furnishing Market?

To stay informed about further developments, trends, and reports in the North America Home Furnishing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence