Key Insights

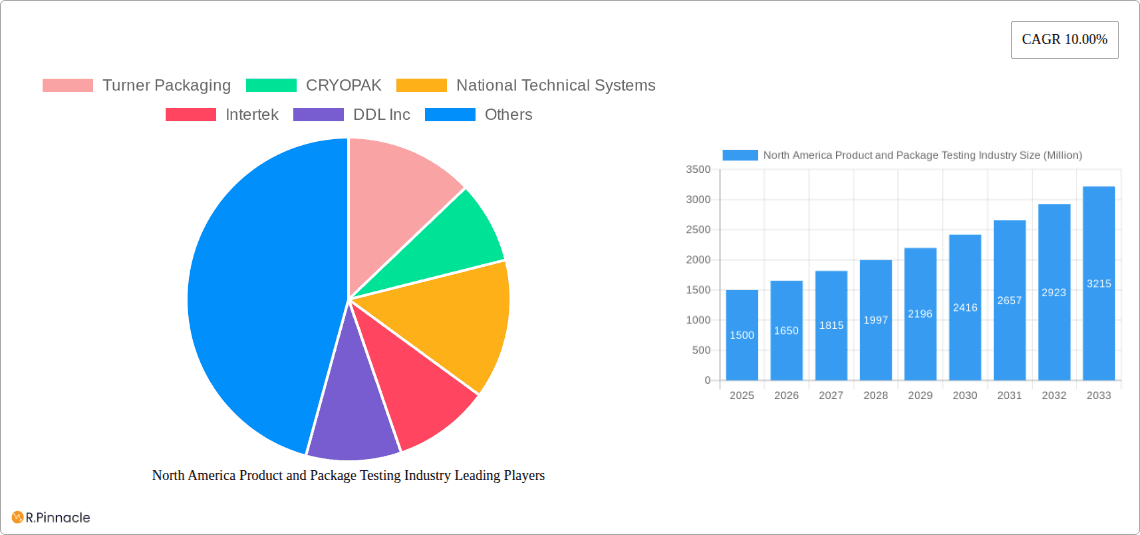

The North American product and package testing market is poised for significant expansion, driven by heightened consumer expectations for product safety and quality, evolving regulatory landscapes, and the burgeoning e-commerce sector. This market, valued at $2.5 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 10% through 2033. Key growth drivers include physical performance testing, essential for product durability, and chemical testing, critical for safety and compliance. The food & beverage, healthcare, and industrial sectors are prominent end-users, necessitating stringent testing for quality assurance and consumer protection. An increased focus on sustainable packaging solutions further stimulates demand for environmental testing services. The United States holds the dominant market share in North America, supported by its robust manufacturing infrastructure and stringent regulations. Canada also plays a vital role, underscoring the region's collective commitment to product integrity.

North America Product and Package Testing Industry Market Size (In Billion)

The competitive landscape features established global testing providers alongside specialized niche players. Companies are actively investing in cutting-edge testing technologies and expanding service portfolios to address dynamic client requirements. Key challenges include the substantial cost of testing, the demand for specialized expertise, and escalating regulatory complexity. Nevertheless, the sustained emphasis on product safety, regulatory adherence, and eco-friendly packaging will fuel market growth, presenting avenues for both existing and emerging enterprises. Market expansion is anticipated to remain steady, with a potential uptick in later forecast years driven by technological advancements and intensified regulatory oversight.

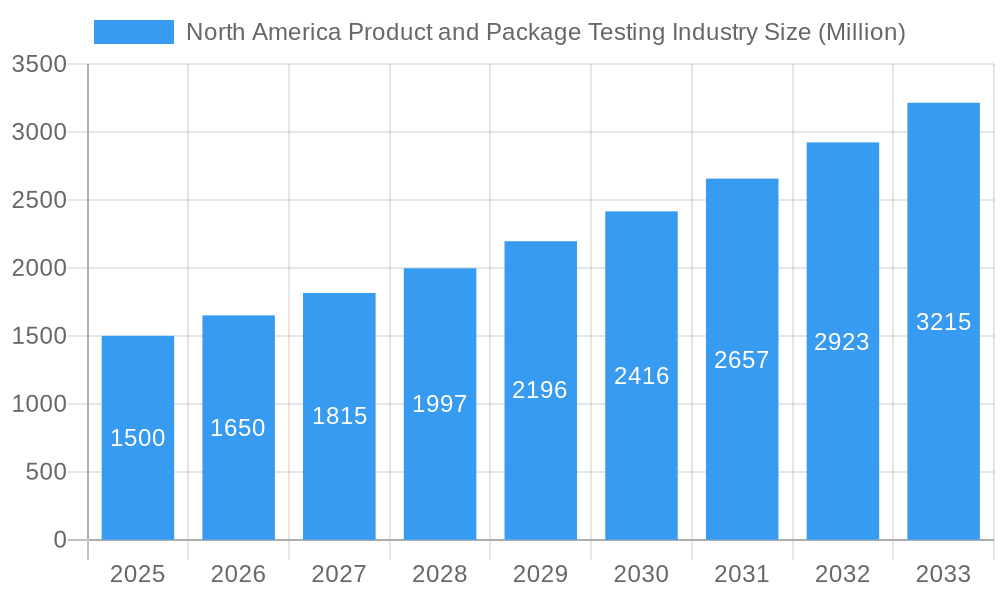

North America Product and Package Testing Industry Company Market Share

North America Product and Package Testing Industry Market Structure & Innovation Trends

This comprehensive report analyzes the North American product and package testing industry, encompassing the period 2019-2033. The market, valued at $xx Million in 2025, is expected to experience significant growth, driven by factors detailed within. Market concentration is moderate, with several key players holding substantial but not dominant shares. Turner Packaging, Cryopak, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, and CSZ Testing Services Laboratories are among the prominent companies shaping the landscape. Market share distribution varies across segments, with some players exhibiting stronger positions in specific niches like cold chain packaging (Cryopak) or specialized testing (SGS).

Innovation is a key driver, spurred by evolving consumer demands for sustainable and efficient packaging, stricter regulatory frameworks concerning material safety and environmental impact, and advancements in testing technologies. M&A activity has been relatively moderate, with deal values ranging from $xx Million to $xx Million in recent years, primarily focused on expanding service offerings and geographical reach. The regulatory landscape plays a crucial role, impacting material choices and testing requirements. Substitutes, while present, often lack the specialized capabilities and regulatory compliance certifications offered by established testing firms. End-user demographics are diverse, reflecting the wide range of industries relying on product and package testing services.

North America Product and Package Testing Industry Market Dynamics & Trends

The North American product and package testing market exhibits robust growth dynamics, projected at a CAGR of xx% from 2025 to 2033. Several factors contribute to this expansion. Firstly, the increasing focus on product safety and quality assurance across various sectors, including food & beverage, healthcare, and consumer goods, fuels demand for rigorous testing protocols. Secondly, heightened environmental consciousness drives the need for sustainable packaging, necessitating comprehensive environmental testing services. The adoption of advanced technologies, such as automated testing equipment and sophisticated analytical techniques, further enhances market growth.

Technological disruptions, such as the integration of AI and machine learning in data analysis and predictive modeling, are transforming industry operations. Consumer preferences toward eco-friendly and ethically sourced products place immense pressure on manufacturers to adopt sustainable packaging solutions and adhere to stringent testing standards to validate their claims. Competitive dynamics are characterized by both fierce competition among established players and the emergence of niche providers focusing on specialized testing needs. Market penetration remains high in established sectors, but opportunities exist in emerging areas like e-commerce packaging and personalized products.

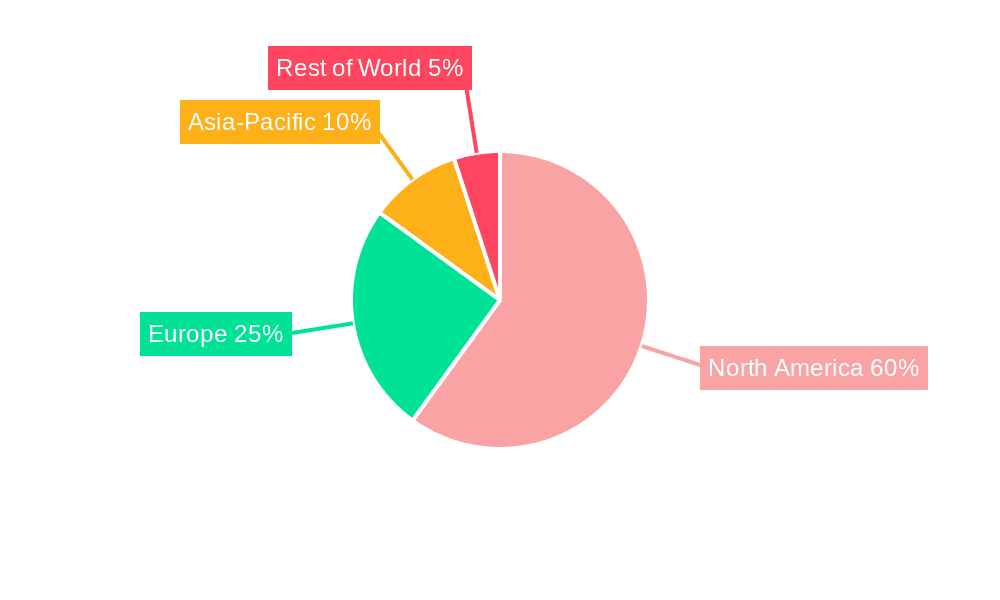

Dominant Regions & Segments in North America Product and Package Testing Industry

By Country: The United States dominates the North American product and package testing market, accounting for approximately xx% of the total revenue in 2025. This dominance is attributed to its large and diverse economy, extensive manufacturing base, and stringent regulatory environment. Canada represents a significant but smaller segment, exhibiting consistent growth driven by increasing industrial activity and focus on sustainable packaging solutions.

By Primary Material: Plastic packaging testing holds the largest share, reflecting its widespread use in various applications. Metal packaging testing maintains a substantial presence, driven by demand from the food and beverage and industrial sectors. Growth in paper and glass packaging testing is comparatively slower, though steady due to increasing consumer preference for sustainable options.

By Type of Testing: Physical performance testing (e.g., drop tests, compression tests) constitutes the largest segment, driven by the need to ensure product durability and structural integrity. Chemical testing, focusing on material composition and safety compliance, is another significant segment. Environmental testing, focusing on issues like recyclability and biodegradability, is experiencing rapid growth due to environmental regulations and consumer demand for sustainable packaging.

By End-user Industry: The food and beverage industry is the largest consumer of product and package testing services, followed by healthcare and industrial sectors. The personal and household products segment also contributes significantly. Growth drivers in these segments include product safety regulations, supply chain integrity, and increasingly sophisticated consumer preferences.

North America Product and Package Testing Industry Product Innovations

Recent innovations focus on faster, more accurate, and environmentally friendly testing methods. This includes advancements in analytical techniques, automated testing equipment, and the development of specialized testing protocols for emerging materials and packaging designs. These innovations enhance efficiency, reduce costs, and provide more comprehensive data for clients, improving the overall market value proposition. The growing adoption of digital technologies, like AI-powered data analysis, is improving the accuracy and speed of results, streamlining the testing process and enhancing decision-making.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American product and package testing industry, segmented by country (United States, Canada), primary material (glass, paper, plastic, metal), type of testing (physical performance, chemical, environmental), and end-user industry (food and beverage, healthcare, industrial, personal and household products, other). Each segment's market size, growth projections, and competitive landscape are thoroughly analyzed. For instance, the plastic packaging testing segment is forecast to grow at a CAGR of xx% during the forecast period (2025-2033), driven by the widespread use of plastic in packaging and stringent regulations regarding its safety and environmental impact.

Key Drivers of North America Product and Package Testing Industry Growth

Several key factors drive the growth of the North American product and package testing industry. Stringent government regulations and safety standards related to product and packaging quality, coupled with growing consumer awareness and demand for safe and sustainable products, significantly contribute to the market's expansion. Technological advancements leading to more efficient and accurate testing methods also play a crucial role. Furthermore, the increasing focus on supply chain transparency and the need to ensure the integrity of products throughout their lifecycle further fuels the demand for comprehensive testing services.

Challenges in the North America Product and Package Testing Industry Sector

The industry faces challenges such as the high cost of advanced testing equipment and skilled labor, potentially impacting smaller firms. Strict regulatory compliance requirements can also increase operational costs. Furthermore, intense competition among established players and the entry of new entrants can put pressure on pricing and profitability. Supply chain disruptions, impacting access to key materials and equipment, pose a further challenge. These issues can collectively affect the overall industry growth rate and profitability for individual companies.

Emerging Opportunities in North America Product and Package Testing Industry

The increasing adoption of sustainable and eco-friendly packaging materials presents significant opportunities for growth. The expansion of e-commerce and the rise of direct-to-consumer brands increase the need for robust packaging and testing solutions. Advancements in testing technologies, such as AI-powered automation and big data analytics, offer scope for enhanced efficiency and accuracy, creating lucrative opportunities for providers who can integrate these technologies effectively. Finally, niche markets focused on specialized testing solutions (e.g., for medical devices or aerospace components) offer growth potentials for firms with specialized expertise.

Leading Players in the North America Product and Package Testing Industry Market

- Turner Packaging

- Cryopak

- National Technical Systems

- Intertek

- DDL Inc

- SGS

- Nefab

- Advance Packaging

- Caskadetek

- CSZ Testing Services Laboratories

Key Developments in North America Product and Package Testing Industry Industry

- April 2021: SGS introduced a new comprehensive footwear packaging testing technique, enhancing its market position and meeting growing industry demand for sustainable and efficient packaging solutions.

- July 2021: Cryopak launched its PUR-Forma Long Range Duration line of polyurethane shipping solutions, expanding its product portfolio and addressing the need for reliable cold chain packaging options.

Future Outlook for North America Product and Package Testing Industry Market

The North American product and package testing industry is poised for continued growth, driven by several factors. The ongoing emphasis on product safety and quality, coupled with increasing environmental regulations, will fuel demand for comprehensive testing services. Technological advancements will continue to shape industry practices, offering opportunities for improved efficiency and enhanced testing capabilities. The rise of e-commerce and the growing focus on sustainable packaging will further contribute to the market's expansion in the coming years. Strategic acquisitions and partnerships will play a significant role in shaping the competitive landscape.

North America Product and Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

North America Product and Package Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Product and Package Testing Industry Regional Market Share

Geographic Coverage of North America Product and Package Testing Industry

North America Product and Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Glass Segment Observing Gradual Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Product and Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turner Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CRYOPAK

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Technical Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intertek

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DDL Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SGS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nefab

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advance Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caskadetek

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CSZ Testing Services Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Turner Packaging

List of Figures

- Figure 1: North America Product and Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Product and Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Product and Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 7: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Product and Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Product and Package Testing Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the North America Product and Package Testing Industry?

Key companies in the market include Turner Packaging, CRYOPAK, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, CSZ Testing Services Laboratories.

3. What are the main segments of the North America Product and Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Segment Observing Gradual Growth.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

In April 2021, SGS introduced a new comprehensive footwear packaging testing technique. The industry-first testing package assists brand owners and retailers, including e-commerce, in creating packaging that performs effectively, meets environmental and sustainability criteria, and ensures consumers receive quality footwear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Product and Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Product and Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Product and Package Testing Industry?

To stay informed about further developments, trends, and reports in the North America Product and Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence