Key Insights

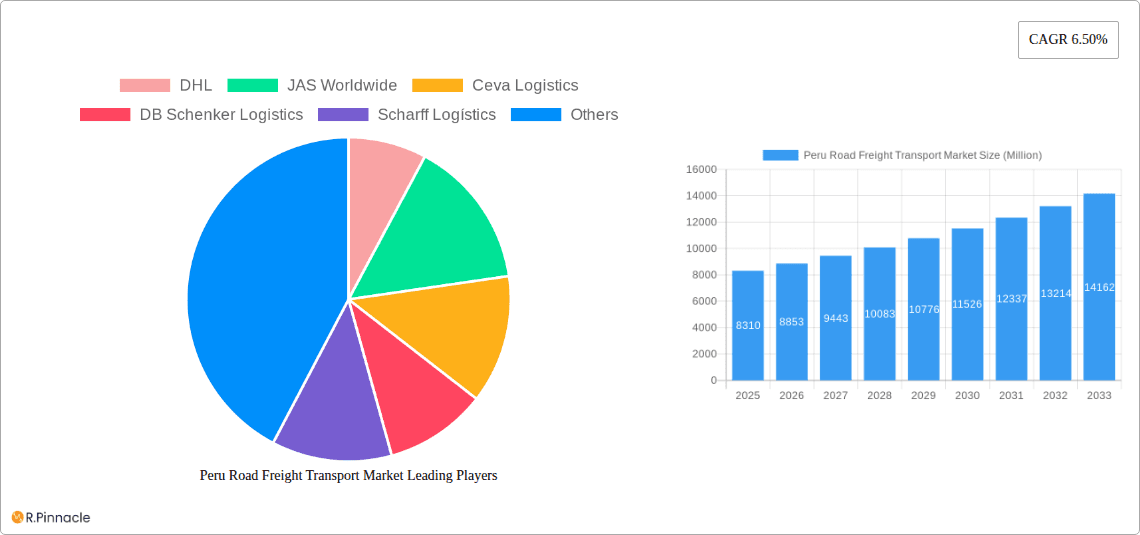

The Peruvian road freight transport market, valued at $8.31 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This expansion is fueled by several key factors. The increasing e-commerce penetration in Peru necessitates efficient last-mile delivery solutions, significantly boosting demand for road freight services. Furthermore, the nation's growing manufacturing and mining sectors require substantial transportation of raw materials and finished goods, further contributing to market growth. Infrastructure development initiatives by the Peruvian government, aimed at improving road networks and connectivity, are also expected to positively impact the sector's efficiency and capacity. While challenges remain, such as fluctuating fuel prices and potential regulatory hurdles, the overall outlook for the Peruvian road freight market remains optimistic.

Peru Road Freight Transport Market Market Size (In Billion)

The market segmentation reveals diverse opportunities. The containerized segment is likely to dominate, reflecting the increasing adoption of standardized shipping practices. Long-haul transportation will likely continue to hold a larger market share compared to short-haul due to the geographical expanse of Peru and the need for intercity movement of goods. The transportation of liquid and solid goods will see balanced growth, mirroring the diversified nature of the Peruvian economy. Similarly, both temperature-controlled and non-controlled freight will experience parallel growth, catering to different product types and industry needs. Manufacturing, mining, and agriculture are expected to remain major end-user segments, driving consistent demand. Finally, the full truckload (FTL) segment will likely command a greater share than less-than-truckload (LTL) due to the logistical advantages of efficient bulk transport, although LTL will witness growth, supporting smaller businesses and varied shipment sizes. Companies like DHL, Ceva Logistics, and DB Schenker Logistics, along with several prominent local players, are well-positioned to capitalize on these trends.

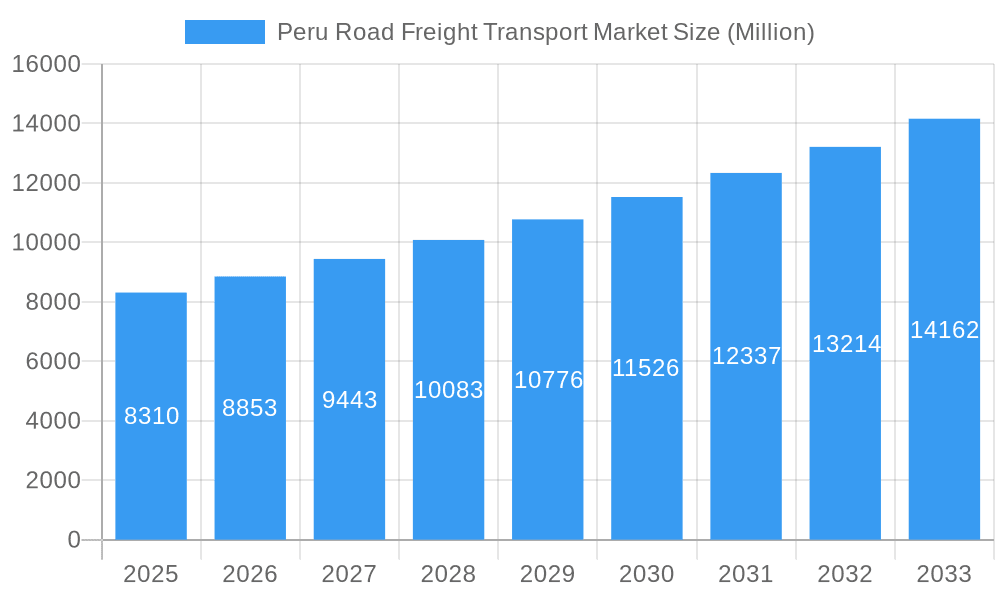

Peru Road Freight Transport Market Company Market Share

Peru Road Freight Transport Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Peru road freight transport market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. We analyze key segments, dominant players, and emerging opportunities, providing actionable intelligence for informed decision-making.

Peru Road Freight Transport Market Market Structure & Innovation Trends

The Peruvian road freight transport market exhibits a moderately concentrated structure, with a few large players like DHL, DB Schenker Logistics, and Ceva Logistics holding significant market share. However, a number of smaller, regional players, such as Andina Freight and Peru Logistic SAC, also contribute significantly to the overall market volume. The estimated combined market share of the top five players in 2025 is approximately xx%. Innovation is driven by the need for enhanced efficiency, improved logistics tracking, and compliance with stricter regulatory frameworks. Technological advancements such as telematics, GPS tracking, and route optimization software are becoming increasingly prevalent. Mergers and acquisitions (M&A) activity is moderate, with deal values averaging xx Million in recent years. Examples include the xx acquisition of xx in [Year]. The market is also influenced by substitute modes of transport such as rail and air freight, particularly for long-haul and high-value goods. End-user demographics are diverse, reflecting the varied economic sectors in Peru.

- Market Concentration: Moderately concentrated, with top five players holding xx% market share (2025 estimate).

- Innovation Drivers: Efficiency gains, enhanced tracking, regulatory compliance.

- Regulatory Framework: [Insert details about relevant Peruvian regulations concerning road freight].

- Product Substitutes: Rail, air freight.

- M&A Activity: Moderate, with average deal values of xx Million.

Peru Road Freight Transport Market Market Dynamics & Trends

The Peruvian road freight transport market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by factors such as increasing e-commerce activities, expanding manufacturing and mining sectors, and improving infrastructure. Technological disruptions, such as the adoption of autonomous vehicles and blockchain technology for improved supply chain transparency, are reshaping the competitive landscape. Consumer preferences are shifting towards faster, more reliable, and trackable delivery solutions. Market penetration of advanced logistics technologies is gradually increasing, with xx% of companies expected to adopt telematics by 2033. Competitive dynamics are characterized by price competition, service differentiation, and strategic alliances.

Dominant Regions & Segments in Peru Road Freight Transport Market

The Lima metropolitan area and surrounding regions dominate the Peruvian road freight transport market due to high population density, industrial activity, and port access. Within the market segments:

- By Containerization: Containerized freight constitutes a larger share due to its efficiency for standardized goods.

- By Distance: Long-haul transport commands a significant portion of the market, catering to inter-regional trade.

- By Product Type: Solid goods (e.g., mining products, manufactured goods) account for the largest share, followed by liquid goods.

- By Temperature Control: Controlled transport is growing rapidly, driven by the demand for pharmaceuticals and perishable goods.

- By Destination: Domestic transport represents the largest share of the market.

- By End User: The manufacturing (including automotive), mining, and quarrying sectors are the major end-users, driving the significant share of the market.

- By Truckload Specification: Full truckload (FTL) shipments hold a larger market share than less-than-truckload (LTL) shipments.

Key Drivers:

- Strong economic growth in key sectors.

- Government investments in road infrastructure.

- Increased e-commerce activity.

Peru Road Freight Transport Market Product Innovations

Recent product innovations focus on enhancing efficiency and tracking capabilities. This includes the implementation of advanced telematics systems, GPS tracking devices, and route optimization software. These innovations provide real-time visibility into shipment location, status, and estimated time of arrival (ETA), leading to improved delivery times, reduced operational costs, and enhanced customer satisfaction. The market is also witnessing the adoption of specialized trailers and containers designed for specific goods (e.g., temperature-controlled units for pharmaceuticals and refrigerated trailers for perishable goods).

Report Scope & Segmentation Analysis

This report segments the Peru road freight transport market by containerization (containerized, non-containerized), distance (long haul, short haul), product type (liquid goods, solid goods), temperature control (controlled, non-controlled), destination (domestic, international), end-user (manufacturing, oil and gas, mining, agriculture, construction, pharmaceutical and healthcare, other), and truckload specification (full truckload, less than truckload). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are analyzed in detail. For example, the containerized segment is projected to grow at a CAGR of xx%, while the manufacturing sector is expected to be the largest end-user segment.

Key Drivers of Peru Road Freight Transport Market Growth

The market's growth is driven by several factors: robust economic growth in key sectors like mining and manufacturing, increasing e-commerce penetration, ongoing government investments in road infrastructure upgrades, and the rising adoption of advanced logistics technologies. The expanding middle class and increasing urbanization also contribute to the rising demand for efficient and reliable freight transportation services.

Challenges in the Peru Road Freight Transport Market Sector

Challenges include insufficient road infrastructure in certain regions, leading to increased transportation times and costs. Bureaucratic hurdles and regulatory complexities also present significant challenges, impacting operational efficiency. Furthermore, intense competition and fluctuating fuel prices add pressure on profit margins. These challenges contribute to an estimated xx% increase in operational costs for businesses in the sector.

Emerging Opportunities in Peru Road Freight Transport Market

Emerging opportunities include the growing adoption of sustainable and eco-friendly transportation solutions, such as electric and hybrid trucks. The increasing demand for specialized logistics services, such as temperature-controlled transportation and time-sensitive deliveries, also presents significant opportunities. Furthermore, the integration of technology into logistics operations, such as utilizing real-time tracking and data analytics for improved efficiency, holds immense potential.

Leading Players in the Peru Road Freight Transport Market Market

- DHL

- JAS Worldwide

- Ceva Logistics

- DB Schenker Logistics

- Scharff Logistics

- Gold Cargo

- SAVAR CORPORACIÓN LOGISTICA

- ANDINA FREIGHT - We Think Big

- Impala Terminals

- Peru Logistic SAC

- Marvisur Express (List Not Exhaustive)

Key Developments in Peru Road Freight Transport Market Industry

- [Month, Year]: DHL announced expansion of its logistics network in Southern Peru.

- [Month, Year]: New regulations regarding driver safety and vehicle maintenance were implemented.

- [Month, Year]: DB Schenker Logistics partnered with a local technology provider to integrate advanced tracking systems.

- [Month, Year]: [Add further significant developments with dates].

Future Outlook for Peru Road Freight Transport Market Market

The Peruvian road freight transport market is poised for continued growth, driven by sustained economic expansion, investments in infrastructure, and the increasing adoption of advanced technologies. Strategic partnerships, expansion into new markets, and the development of specialized services will be key to success in this dynamic market. The market is expected to reach xx Million by 2033, presenting lucrative opportunities for both established players and new entrants.

Peru Road Freight Transport Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End User

- 2.1. Manufacturing (Including Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Pharmaceutical and Healthcare

- 2.6. Other End Users

-

3. Truckload Specification

- 3.1. Full Truckload

- 3.2. Less Than Truckload

-

4. Containerization

- 4.1. Containerized

- 4.2. Non- Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Product Type

- 6.1. Liquid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Controlled

- 7.2. Non-Controlled

Peru Road Freight Transport Market Segmentation By Geography

- 1. Peru

Peru Road Freight Transport Market Regional Market Share

Geographic Coverage of Peru Road Freight Transport Market

Peru Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trade Activities

- 3.3. Market Restrains

- 3.3.1. Truck Drivers Protest

- 3.4. Market Trends

- 3.4.1. Growth in Exports and Imports Boosting Road Freight Transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing (Including Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Pharmaceutical and Healthcare

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full Truckload

- 5.3.2. Less Than Truckload

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non- Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Product Type

- 5.6.1. Liquid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Controlled

- 5.7.2. Non-Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS Worldwide

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DB Schenker Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Scharff Logístics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gold Cargo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAVAR CORPORACIÓN LOGISTICA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ANDINA FREIGHT - We Think Big

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Impala Terminals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Peru Logistic SAC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Marvisur Express**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Peru Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Peru Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Peru Road Freight Transport Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Peru Road Freight Transport Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Peru Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2020 & 2033

- Table 4: Peru Road Freight Transport Market Revenue Million Forecast, by Containerization 2020 & 2033

- Table 5: Peru Road Freight Transport Market Revenue Million Forecast, by Distance 2020 & 2033

- Table 6: Peru Road Freight Transport Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Peru Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 8: Peru Road Freight Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 9: Peru Road Freight Transport Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 10: Peru Road Freight Transport Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Peru Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2020 & 2033

- Table 12: Peru Road Freight Transport Market Revenue Million Forecast, by Containerization 2020 & 2033

- Table 13: Peru Road Freight Transport Market Revenue Million Forecast, by Distance 2020 & 2033

- Table 14: Peru Road Freight Transport Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Peru Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 16: Peru Road Freight Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Road Freight Transport Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Peru Road Freight Transport Market?

Key companies in the market include DHL, JAS Worldwide, Ceva Logistics, DB Schenker Logistics, Scharff Logístics, Gold Cargo, SAVAR CORPORACIÓN LOGISTICA, ANDINA FREIGHT - We Think Big, Impala Terminals, Peru Logistic SAC, Marvisur Express**List Not Exhaustive.

3. What are the main segments of the Peru Road Freight Transport Market?

The market segments include Destination, End User, Truckload Specification, Containerization, Distance, Product Type, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trade Activities.

6. What are the notable trends driving market growth?

Growth in Exports and Imports Boosting Road Freight Transport:.

7. Are there any restraints impacting market growth?

Truck Drivers Protest.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Peru Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence