Key Insights

The German road freight transport market is poised for significant expansion, driven by a robust manufacturing sector, thriving e-commerce, and an advanced logistics infrastructure. Favorable economic conditions, coupled with increasing demand for efficient, timely deliveries across domestic and international routes, are key growth catalysts. While challenges such as fuel price volatility and driver availability persist, the market demonstrates strong resilience and a positive growth trajectory. Full-truckload (FTL) shipments are a cornerstone, supporting long-haul needs for manufacturing, construction, and retail industries. The growing demand for temperature-controlled logistics for sensitive goods and Germany's pivotal role as a European logistics hub further enhance market dynamism. Leading industry players are actively investing in technological advancements and strategic collaborations to maintain a competitive advantage. The forecast period, 2025-2033, anticipates sustained growth fueled by ongoing industrial expansion and e-commerce evolution.

Germany Road Freight Transport Market Market Size (In Billion)

The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.06%. Government initiatives promoting sustainable logistics, including infrastructure investment and the adoption of eco-friendly transportation technologies, will further influence growth. The proliferation of last-mile delivery services and the integration of digital solutions, such as advanced route optimization software and telematics, are redefining the competitive landscape, compelling companies to enhance operational efficiency and innovation. Despite regulatory compliance and environmental considerations, the overall outlook for the German road freight transport market remains optimistic, with continued growth anticipated due to strong economic activity and evolving logistics practices.

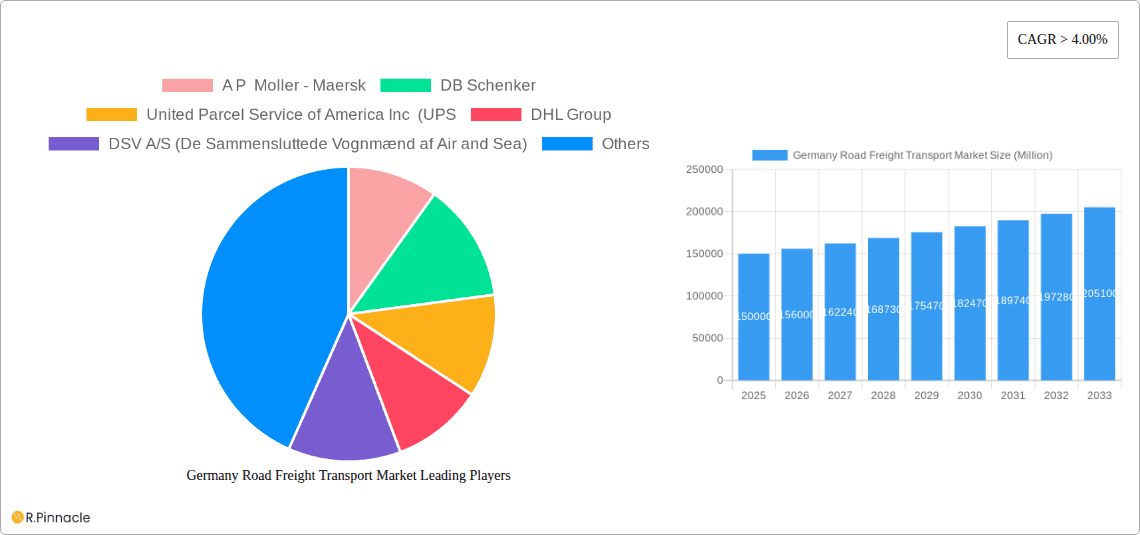

Germany Road Freight Transport Market Company Market Share

Germany Road Freight Transport Market Analysis: Forecast 2024-2033

This comprehensive market report offers in-depth analysis of the German road freight transport sector, providing critical insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2024-2033, with a specific focus on 2024 as the base year. It meticulously examines market dynamics, key participants, emerging trends, and future growth prospects, incorporating detailed segmentation by end-user industries, transport modalities, and geographical coverage. Gain a competitive advantage by downloading this essential market intelligence. The current market size is estimated at 76.23 billion.

Germany Road Freight Transport Market Market Structure & Innovation Trends

The German road freight transport market is characterized by a moderately concentrated structure, with several major players commanding significant market share. A P Moller - Maersk, DB Schenker, UPS, DHL Group, DSV A/S, Dachser, Raben Group, Kuehne + Nagel, and Expeditors International of Washington Inc. are among the key players, collectively holding an estimated xx% of the market in 2025. Market concentration is influenced by factors such as economies of scale, technological capabilities, and established logistics networks.

- Market Share (2025 Estimate): A P Moller - Maersk (xx%), DB Schenker (xx%), UPS (xx%), DHL Group (xx%), DSV A/S (xx%), Dachser (xx%), Raben Group (xx%), Kuehne + Nagel (xx%), Expeditors International (xx%), Others (xx%).

- Innovation Drivers: Stringent environmental regulations, the rising adoption of digital technologies (e.g., telematics, route optimization software), and the increasing demand for efficient and sustainable transportation solutions are driving innovation.

- Regulatory Framework: The German government's focus on sustainability and decarbonization is shaping the market, incentivizing the adoption of electric vehicles and promoting greener logistics practices.

- Product Substitutes: While road freight remains dominant, there is competition from rail and inland waterway transport, particularly for long-haul shipments. The extent of this substitution is limited by factors such as infrastructure limitations and delivery time constraints.

- End-User Demographics: The manufacturing, wholesale and retail trade, and construction sectors are major end-users of road freight services, with diverse demands in terms of shipment size, delivery speed, and goods characteristics.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values totaling approximately €xx Million in the period 2019-2024. These activities have primarily focused on expanding service offerings, geographical reach, and technological capabilities.

Germany Road Freight Transport Market Market Dynamics & Trends

The German road freight transport market is experiencing robust growth, driven by a surge in e-commerce, industrial production, and cross-border trade. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like telematics and route optimization software is steadily increasing, contributing to enhanced efficiency and cost savings. The rising consumer demand for faster delivery times and increased transparency in the supply chain are impacting market dynamics.

The competitive landscape is intensely competitive, with major players focusing on service differentiation, network optimization, and technological advancements to gain market share. The increasing focus on sustainability, driven by regulatory pressures and growing consumer awareness, is compelling companies to invest in greener transportation solutions. The adoption of electric and alternative fuel vehicles, along with optimization of routes to minimize fuel consumption and emissions is gaining momentum. Furthermore, the ongoing driver shortage and associated cost increases are reshaping the market. The penetration of autonomous driving technology is still limited in this market but is expected to impact the landscape in the coming years.

Dominant Regions & Segments in Germany Road Freight Transport Market

The German road freight transport market is geographically diverse, with significant activity across all major regions. However, regions with high industrial concentration and proximity to major transportation hubs experience higher demand. The manufacturing sector is the largest end-user industry, followed by wholesale and retail trade and construction. Within transport specifications, Full-Truck-Load (FTL) dominates the market, but Less-than-Truck-Load (LTL) is also significant. Domestic transport constitutes the larger share of the market compared to international transport, reflecting the robust domestic economy.

- Key Drivers:

- Economic strength: Germany's robust manufacturing base and export-oriented economy fuel high demand.

- Efficient infrastructure: Well-developed road networks facilitate efficient goods movement.

- Government policies: Supportive regulatory frameworks and incentives for efficient transportation.

- Dominant Segments:

- End-User Industry: Manufacturing

- Destination: Domestic

- Truckload Specification: Full-Truck-Load (FTL)

Germany Road Freight Transport Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and technological integration. This includes the adoption of electric and alternative fuel vehicles, the implementation of advanced telematics systems for real-time tracking and route optimization, and the integration of digital platforms for improved supply chain management. Companies are increasingly offering value-added services such as temperature-controlled transportation, specialized handling of sensitive goods, and customized logistics solutions to meet diverse customer needs. The market fit of these innovations is largely dependent on their cost-effectiveness and compatibility with existing infrastructure and operations.

Report Scope & Segmentation Analysis

This report segments the Germany road freight transport market comprehensively across several key parameters:

End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others. Each segment exhibits unique growth patterns and market dynamics. Manufacturing shows the highest projected growth in the forecast period.

Destination: Domestic; International. Domestic transport commands a larger market share.

Truckload Specification: Full-Truck-Load (FTL); Less-than-Truck-Load (LTL). FTL enjoys higher market share than LTL.

Containerization: Containerized; Non-Containerized. The prevalence of containerized transport is growing due to efficiency advantages.

Distance: Long Haul; Short Haul. Long-haul segments are showing a relatively higher growth rate compared to short-haul.

Goods Configuration: Fluid Goods; Solid Goods. The market is highly diversified, with both exhibiting robust growth.

Temperature Control: Non-Temperature Controlled; Temperature Controlled. The temperature-controlled segment is experiencing increasing demand driven by the food and pharmaceutical industries.

Key Drivers of Germany Road Freight Transport Market Growth

Several factors contribute to the growth of the German road freight transport market. Firstly, the robust domestic economy and strong manufacturing sector generate significant demand for freight services. Secondly, the expansion of e-commerce is driving the demand for faster and more efficient delivery options. Finally, government initiatives promoting sustainable transportation and infrastructure development create a positive environment for growth.

Challenges in the Germany Road Freight Transport Market Sector

The German road freight transport market faces several challenges. These include a shortage of qualified drivers leading to increased labor costs, the high cost of fuel and rising operational expenses and the need to reduce carbon emissions and adhere to strict environmental regulations. Furthermore, increased competition and fluctuating fuel prices create uncertainty for businesses. The impact of these challenges can be seen in varying profit margins across the market.

Emerging Opportunities in Germany Road Freight Transport Market

The adoption of innovative technologies like autonomous vehicles, blockchain for enhanced supply chain transparency and artificial intelligence for optimized route planning presents significant opportunities. Growing emphasis on sustainability is opening avenues for eco-friendly logistics solutions, including the use of electric vehicles and alternative fuels. The increasing demand for last-mile delivery services also presents opportunities for specialized logistics providers.

Leading Players in the Germany Road Freight Transport Market Market

Key Developments in Germany Road Freight Transport Market Industry

- June 2023: Maersk announced the purchase of 25 electric Volvo FH trucks in Germany to reduce GHG emissions in hinterland container transport and is exploring charging infrastructure at its warehouses.

- July 2023: Dachser expanded emission-free delivery to more city centers, aiming for twelve more European cities by 2025.

- September 2023: DB Schenker tested the Volta Zero electric truck in Norway, following a large pre-order of nearly 1,500 units for European urban deliveries.

Future Outlook for Germany Road Freight Transport Market Market

The German road freight transport market is poised for continued growth, driven by economic expansion, technological advancements, and the increasing focus on sustainability. Strategic investments in infrastructure, the adoption of innovative technologies, and proactive adaptation to evolving regulatory landscapes will be crucial for success. The integration of digital technologies and the adoption of sustainable practices will reshape the competitive dynamics in the coming years, presenting both challenges and opportunities for industry participants.

Germany Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Germany Road Freight Transport Market Segmentation By Geography

- 1. Germany

Germany Road Freight Transport Market Regional Market Share

Geographic Coverage of Germany Road Freight Transport Market

Germany Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service of America Inc (UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dachser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raben Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expeditors International of Washington Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Germany Road Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Germany Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Germany Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Germany Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Germany Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Germany Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Germany Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Germany Road Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Germany Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Germany Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Germany Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Germany Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Germany Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Germany Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Germany Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Germany Road Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Road Freight Transport Market?

The projected CAGR is approximately 3.06%.

2. Which companies are prominent players in the Germany Road Freight Transport Market?

Key companies in the market include A P Moller - Maersk, DB Schenker, United Parcel Service of America Inc (UPS, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, Raben Group, Kuehne + Nagel, Expeditors International of Washington Inc.

3. What are the main segments of the Germany Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

September 2023: DB Schenker in Norway conducted a test with the electrically powered and highly innovative Volta Zero from Volta Trucks. In 2021, DB Schenker and Volta Trucks announced a partnership. The subsequent pre-order of nearly 1,500 zer-tailpipe emission Volta Zero vehicles was the largest order of medium-duty electric trucks in Europe to date. DB Schenker plans to deploy the all-electric, 16-ton Volta Zero in its European terminals to deliver goods from distribution hubs to urban areas and city centers.July 2023: Dachser has expanded its emission-free delivery of non-chilled groupage shipments to defined downtown areas. By the end of 2025, it plans to launch DACHSER Emission-Free Delivery in twelve more European cities which are Amsterdam, Barcelona, Dublin, Hamburg, Cologne, London, Malaga, Rotterdam, Stockholm, Toulouse, Warsaw, and Vienna. In addition, the company will expand its existing zero-emission delivery area in Paris. This step is a part of its plan to meet improve its sustainable city deliveries.June 2023: Maersk announced a new initiative to reduce GHG emissions in hinterland container transports by purchasing 25 state-of-the-art Volvo FH electric trucks in Germany. Also, Maersk is currently also looking into setting up charging infrastructure with green electricity for its own e-truck fleet at its warehouses in Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Germany Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence