Key Insights

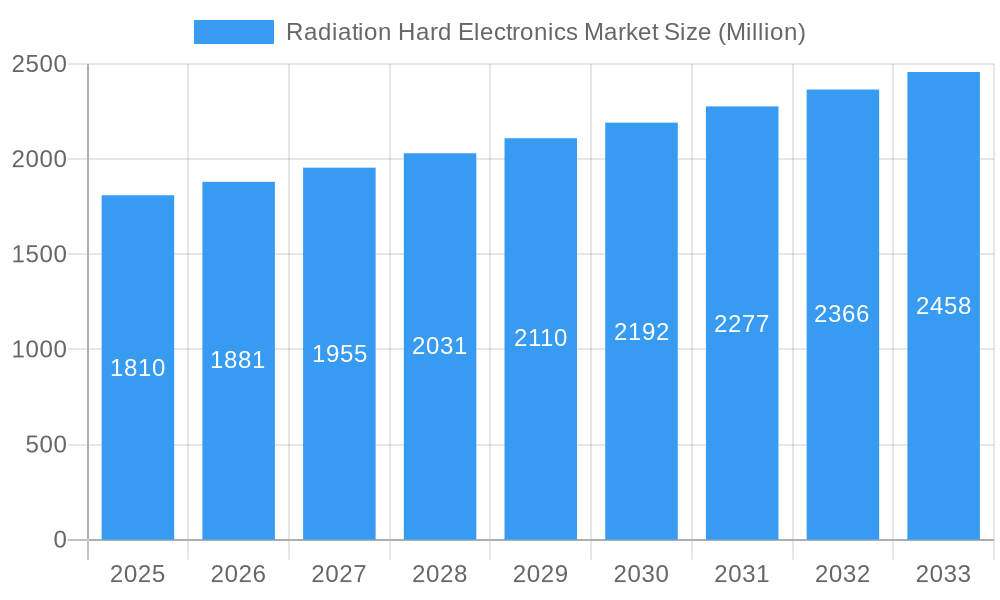

The Radiation Hard Electronics Market is experiencing robust expansion, currently valued at approximately $1.81 Billion in 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 3.87% over the forecast period (2025-2033), indicating a steady and sustained upward trajectory. The market's expansion is primarily driven by the escalating demand from critical sectors such as Space, Aerospace and Defense, and Nuclear Power Plants. These industries inherently operate in environments with significant radiation exposure, necessitating the use of highly resilient electronic components. As space exploration initiatives intensify, satellite constellations expand, and the defense sector invests in advanced, resilient technologies, the need for radiation-hardened electronics becomes paramount. Furthermore, the ongoing development and modernization of nuclear power facilities across the globe, emphasizing safety and operational longevity, contribute significantly to this demand.

Radiation Hard Electronics Market Market Size (In Billion)

The market is characterized by a diverse range of components, with Discrete, Sensors, Integrated Circuits, Microcontrollers and Microprocessors, and Memory segments all playing crucial roles. Each segment addresses specific needs for reliability and performance in radiation-intensive applications. While the market benefits from strong demand drivers, it also faces potential restraints that could influence its growth trajectory. These might include the high cost associated with developing and manufacturing radiation-hardened components, as well as the complexities of regulatory compliance and extensive testing procedures. Despite these challenges, the overarching trend towards increasing reliance on electronics in harsh environments, coupled with ongoing technological advancements in materials science and chip design, suggests a promising future for the Radiation Hard Electronics Market. Key industry players are actively engaged in research and development to offer innovative solutions that meet the stringent requirements of these demanding applications.

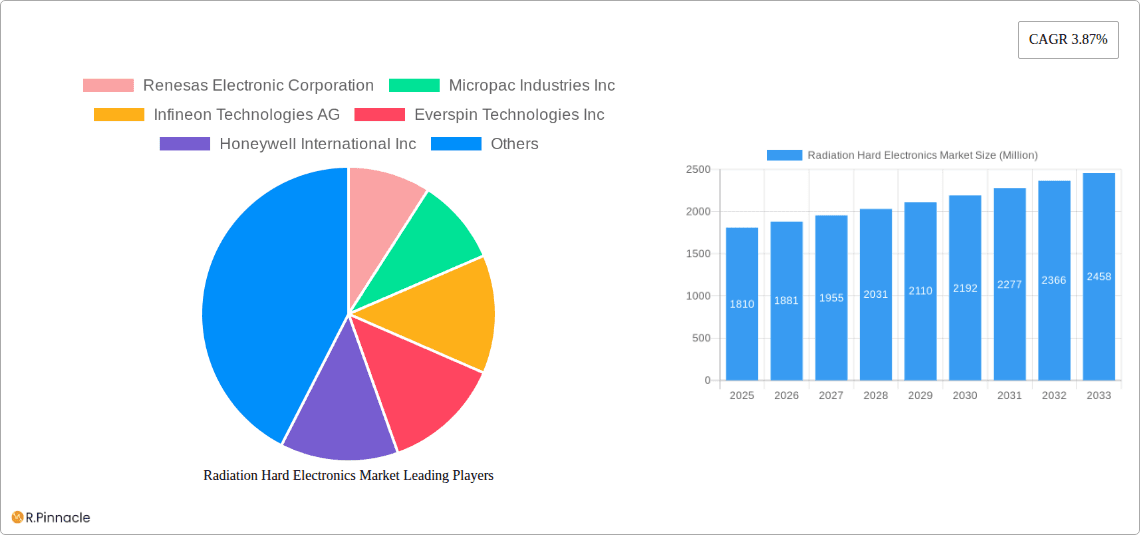

Radiation Hard Electronics Market Company Market Share

Radiation Hard Electronics Market: Comprehensive Market Analysis and Future Projections (2019-2033)

Report Description: Gain unparalleled insights into the global Radiation Hard Electronics Market with this in-depth report. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis leverages high-ranking keywords for maximum search visibility. This report provides strategic intelligence for industry professionals, covering market structure, dynamics, key segments, product innovations, growth drivers, challenges, emerging opportunities, leading players, and crucial industry developments. Understand the complex ecosystem of radiation-hardened components essential for space, aerospace, defense, and nuclear applications.

Radiation Hard Electronics Market Market Structure & Innovation Trends

The Radiation Hard Electronics Market exhibits a moderately consolidated structure, with key players like Honeywell International Inc., Texas Instruments, and BAE Systems PLC holding significant market share, estimated to be around 40% in the base year of 2025. Innovation is primarily driven by the relentless demand for higher reliability and performance in extreme radiation environments. The development of advanced materials, novel semiconductor architectures, and sophisticated testing methodologies are at the forefront. Regulatory frameworks, particularly stringent standards from space agencies like NASA and ESA, play a pivotal role in shaping product development and market entry. Product substitutes, while limited due to the specialized nature of radiation-hardened electronics, can include less robust but more cost-effective commercial-off-the-shelf (COTS) components for non-critical applications. End-user demographics are heavily skewed towards the Space, Aerospace, and Defense sectors, which are projected to account for over 70% of the market revenue by 2033. Mergers and acquisitions (M&A) activities are strategically focused on acquiring specialized expertise and expanding product portfolios, with deal values in the tens of millions of dollars over the historical period.

Radiation Hard Electronics Market Market Dynamics & Trends

The global Radiation Hard Electronics Market is poised for substantial growth, driven by an escalating demand for mission-critical electronics in environments characterized by high radiation levels. The forecast period from 2025 to 2033 anticipates a robust Compound Annual Growth Rate (CAGR) of approximately 7.5%, pushing the market value to an estimated USD 6.5 Billion by 2033. This growth is underpinned by several key dynamics. The ever-increasing complexity and reliance on electronic systems in space exploration, satellite communications, and deep-space missions necessitate the use of components that can withstand intense cosmic and solar radiation. Similarly, the defense sector's continuous innovation in electronic warfare, guidance systems, and surveillance technologies demands radiation-hardened solutions for enhanced survivability and operational integrity. The nuclear power industry, despite facing regulatory scrutiny, continues to require reliable electronics for monitoring, control, and safety systems within nuclear reactors.

Technological disruptions are a constant feature, with ongoing research into new materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) offering superior radiation tolerance compared to traditional silicon-based components. Furthermore, advancements in packaging techniques and circuit design, such as fault-tolerant architectures and error correction codes, are critical in mitigating the effects of radiation-induced single-event upsets (SEUs) and total ionizing dose (TID). Consumer preferences, while not directly dictating the demand for radiation-hardened electronics, indirectly influence the market through the proliferation of space-based services like high-speed internet and Earth observation, which in turn fuel the need for more advanced and resilient satellite constellations.

Competitive dynamics are characterized by a blend of established semiconductor giants and specialized niche players. Companies are increasingly focusing on vertical integration to secure supply chains and maintain quality control. The market penetration of radiation-hardened electronics remains high within its target sectors due to the inherent risks and costs associated with component failure in these critical applications. The strategic importance of these components also means that geopolitical factors and national security considerations can significantly influence market trends and investment in domestic manufacturing capabilities. The projected market size for 2025 is estimated to be around USD 4.0 Billion, showcasing a healthy expansion trajectory.

Dominant Regions & Segments in Radiation Hard Electronics Market

The Space segment is projected to dominate the Radiation Hard Electronics Market throughout the forecast period, driven by aggressive investment in satellite constellations for telecommunications, Earth observation, and navigation. Countries such as the United States and China are leading this charge, with substantial government funding and private sector initiatives aimed at expanding their space-based capabilities. The regulatory environment, often dictated by space agencies like NASA and ESA, mandates the highest levels of radiation tolerance, ensuring a steady demand for advanced rad-hard components. Economic policies supporting space exploration and commercialization further bolster this segment's growth.

The Aerospace and Defense segment also represents a significant and robust market. The increasing sophistication of military aircraft, drones, and missile systems, coupled with the need for reliable communication and navigation in contested electromagnetic environments, fuels the demand for radiation-hardened electronics. The United States, with its substantial defense budget and ongoing modernization programs, stands out as a dominant country within this segment. Key drivers include the deployment of new generation fighter jets, advanced surveillance platforms, and secure communication networks, all of which rely heavily on rad-hard components.

Within the component segmentation, Integrated Circuits (ICs), including microprocessors, microcontrollers, and ASICs, are expected to command the largest market share. Their central role in processing complex data and controlling critical functions makes them indispensable for radiation-hardened systems. The development of radiation-hardened FPGAs (Field-Programmable Gate Arrays) and ASICs specifically designed for space and defense applications is a key innovation trend.

Microcontrollers and Microprocessors are experiencing particularly strong growth due to their integration into a wide array of subsystems within satellites, aircraft, and defense platforms. The need for increased processing power and reduced form factors while maintaining radiation immunity is pushing advancements in this area.

The Memory segment, encompassing SRAM, DRAM, and non-volatile memory solutions, is also crucial. The ability to store and retrieve data reliably in radiation-rich environments is paramount for mission success. Innovations in error correction codes and advanced memory architectures are vital for mitigating data corruption.

Sensors, including radiation sensors, accelerometers, gyroscopes, and optical sensors, are essential for gathering environmental data and enabling system functionality. Their ability to operate accurately under irradiation is critical for mission performance and safety.

The Discrete components segment, while smaller in value compared to ICs, remains vital for power management, signal conditioning, and basic circuit functions. The demand for radiation-hardened transistors, diodes, and passive components continues to be a consistent requirement across all end-user segments.

Radiation Hard Electronics Market Product Innovations

Product innovations in the Radiation Hard Electronics Market are focused on enhancing performance, reliability, and miniaturization while maintaining exceptional radiation tolerance. Companies are developing advanced integrated circuits and microprocessors with embedded radiation mitigation techniques, enabling higher processing speeds for space-based computing and defense applications. Novel materials like Gallium Nitride (GaN) are being integrated into power devices and RF components, offering superior efficiency and radiation resistance. Furthermore, specialized memory solutions with built-in error correction codes are emerging to safeguard data integrity in harsh environments. These innovations provide competitive advantages by enabling more complex and autonomous systems with extended operational lifespans, crucial for long-duration space missions and critical defense operations.

Radiation Hard Electronics Market Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Radiation Hard Electronics Market, segmenting it across key end-users and component types. The Space segment, driven by satellite deployments, is projected for significant growth with an estimated market size of USD 2.2 Billion in 2025. The Aerospace and Defense sector is expected to reach USD 1.5 Billion by 2025, fueled by advanced military applications. Nuclear Power Plants, while a smaller segment at approximately USD 0.3 Billion in 2025, represents a stable demand for critical safety and control systems.

Within component segments, Integrated Circuits are anticipated to lead with a market size of USD 2.0 Billion in 2025, encompassing various specialized ICs. Microcontrollers and Microprocessors are projected to reach USD 1.0 Billion by 2025, reflecting their increasing integration. Memory components are estimated at USD 0.7 Billion in 2025, crucial for data integrity. Sensors are expected to contribute USD 0.4 Billion, vital for environmental monitoring and system feedback. Discrete components, essential for foundational circuitry, are projected at USD 0.1 Billion in 2025.

Key Drivers of Radiation Hard Electronics Market Growth

The Radiation Hard Electronics Market is propelled by a confluence of critical drivers. Foremost among these is the expansion of space exploration and commercialization, necessitating highly reliable electronics for satellites, probes, and deep-space missions, estimated to contribute over 35% of market growth. The increasing demand for advanced capabilities in the Aerospace and Defense sector, driven by evolving geopolitical landscapes and technological advancements in surveillance, communication, and weaponry, is another major catalyst, accounting for approximately 30% of growth. The ongoing need for safety and operational efficiency in nuclear power plants, despite potential shifts in energy policies, continues to provide a stable demand for radiation-hardened components, contributing around 15% of market expansion. Furthermore, government initiatives and funding for national security and space programs, particularly in major economies, play a significant role in driving research, development, and procurement. The intrinsic need for long-term mission success and the prevention of catastrophic failures in these high-stakes environments underscore the indispensable nature of radiation-hardened electronics.

Challenges in the Radiation Hard Electronics Market Sector

Despite robust growth prospects, the Radiation Hard Electronics Market faces several significant challenges. High development and manufacturing costs associated with specialized materials, rigorous testing protocols, and low-volume production runs are primary impediments, leading to significantly higher prices compared to commercial-grade electronics. The lengthy qualification and certification processes required by regulatory bodies in space and defense industries can extend product development cycles and increase time-to-market. Furthermore, supply chain vulnerabilities for specialized raw materials and components can lead to production delays and cost escalations. The limited pool of highly skilled engineers and technicians with expertise in radiation effects and hardened design also poses a recruitment challenge. Overcoming these hurdles requires substantial investment in R&D, process optimization, and talent development to ensure continued innovation and market accessibility.

Emerging Opportunities in Radiation Hard Electronics Market

Emerging opportunities within the Radiation Hard Electronics Market are centered on expanding applications and technological advancements. The burgeoning small satellite and CubeSat market presents a significant avenue for growth, demanding cost-effective and miniaturized radiation-hardened solutions. The increasing trend of AI and machine learning in space and defense applications necessitates the development of rad-hard processors capable of handling complex computational tasks. Furthermore, advancements in materials science, such as the exploration of novel semiconductor substrates beyond silicon, offer the potential for enhanced radiation tolerance and performance. The growing interest in deep space exploration, including missions to Mars and beyond, will drive demand for components with extreme radiation resistance and long-term reliability. Identifying and capitalizing on these evolving needs will be crucial for market leaders.

Leading Players in the Radiation Hard Electronics Market Market

- Renesas Electronic Corporation

- Micropac Industries Inc

- Infineon Technologies AG

- Everspin Technologies Inc

- Honeywell International Inc

- Microchip Technology Inc

- Texas Instruments

- Data Device Corporation

- Frontgrade Technologies

- BAE Systems PLC

- Vorago Technologie

- Solid State Devices Inc

- Advanced Micro Devices Inc

- STMicroelectronics International NV

Key Developments in Radiation Hard Electronics Market Industry

- October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies.

- June 2023: Texas Instruments (TI) announced an expansion of its manufacturing operation in Malaysia by building two new assembly and test factories in Kuala Lumpur and Melaka. Through this expansion, the company aims to extend its cost advantage and have greater control of the supply chain.

Future Outlook for Radiation Hard Electronics Market Market

The future outlook for the Radiation Hard Electronics Market is exceptionally promising, characterized by sustained growth and increasing strategic importance. The continued expansion of the global satellite industry, driven by demand for connectivity, Earth observation, and scientific research, will be a primary growth accelerator, projected to drive significant demand for rad-hard components. Advancements in AI and machine learning within aerospace and defense applications will necessitate more powerful and radiation-tolerant processing capabilities. Furthermore, emerging trends in commercial space travel and lunar exploration will open up new markets for specialized electronics. Strategic opportunities lie in developing more cost-effective solutions without compromising on reliability and in exploring novel materials and design techniques to push the boundaries of radiation tolerance. The market is expected to see continued innovation and investment, solidifying its role as a critical enabler of advanced technologies in extreme environments.

Radiation Hard Electronics Market Segmentation

-

1. End-user

- 1.1. Space

- 1.2. Aerospace and Defense

- 1.3. Nuclear Power Plants

-

2. Component

- 2.1. Discrete

- 2.2. Sensors

- 2.3. Integrated Circuit

- 2.4. Microcontrollers and Microprocessors

- 2.5. Memory

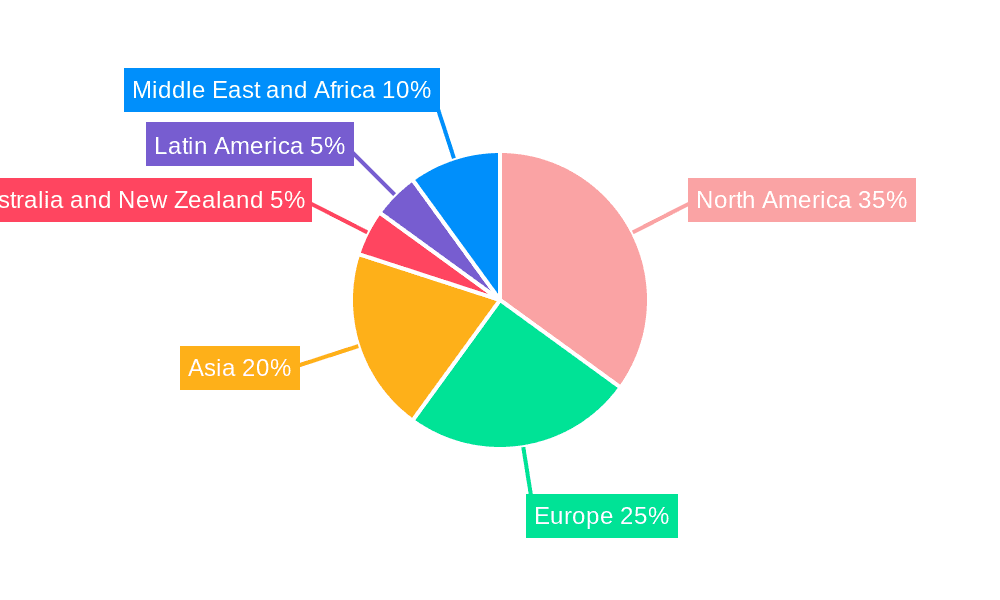

Radiation Hard Electronics Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Radiation Hard Electronics Market Regional Market Share

Geographic Coverage of Radiation Hard Electronics Market

Radiation Hard Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment

- 3.3. Market Restrains

- 3.3.1. High Designing and Development Cost

- 3.4. Market Trends

- 3.4.1. Nuclear Power Plants to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Space

- 5.1.2. Aerospace and Defense

- 5.1.3. Nuclear Power Plants

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Discrete

- 5.2.2. Sensors

- 5.2.3. Integrated Circuit

- 5.2.4. Microcontrollers and Microprocessors

- 5.2.5. Memory

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Americas Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Space

- 6.1.2. Aerospace and Defense

- 6.1.3. Nuclear Power Plants

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Discrete

- 6.2.2. Sensors

- 6.2.3. Integrated Circuit

- 6.2.4. Microcontrollers and Microprocessors

- 6.2.5. Memory

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Space

- 7.1.2. Aerospace and Defense

- 7.1.3. Nuclear Power Plants

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Discrete

- 7.2.2. Sensors

- 7.2.3. Integrated Circuit

- 7.2.4. Microcontrollers and Microprocessors

- 7.2.5. Memory

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Space

- 8.1.2. Aerospace and Defense

- 8.1.3. Nuclear Power Plants

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Discrete

- 8.2.2. Sensors

- 8.2.3. Integrated Circuit

- 8.2.4. Microcontrollers and Microprocessors

- 8.2.5. Memory

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Australia and New Zealand Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Space

- 9.1.2. Aerospace and Defense

- 9.1.3. Nuclear Power Plants

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Discrete

- 9.2.2. Sensors

- 9.2.3. Integrated Circuit

- 9.2.4. Microcontrollers and Microprocessors

- 9.2.5. Memory

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Latin America Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. Space

- 10.1.2. Aerospace and Defense

- 10.1.3. Nuclear Power Plants

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Discrete

- 10.2.2. Sensors

- 10.2.3. Integrated Circuit

- 10.2.4. Microcontrollers and Microprocessors

- 10.2.5. Memory

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Middle East and Africa Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 11.1.1. Space

- 11.1.2. Aerospace and Defense

- 11.1.3. Nuclear Power Plants

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Discrete

- 11.2.2. Sensors

- 11.2.3. Integrated Circuit

- 11.2.4. Microcontrollers and Microprocessors

- 11.2.5. Memory

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Micropac Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infineon Technologies AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Everspin Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microchip Technology Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Texas Instruments

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Data Device Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Frontgrade Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BAE Systems PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vorago Technologie

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Solid State Devices Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Advanced Micro Devices Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 STMicroelectronics International NV

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Radiation Hard Electronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 3: Americas Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: Americas Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 5: Americas Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: Americas Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Americas Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 9: Europe Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Europe Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Asia Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Asia Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 21: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 27: Latin America Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 28: Latin America Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 29: Latin America Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Latin America Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 33: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Radiation Hard Electronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 5: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 11: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 14: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 17: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Hard Electronics Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the Radiation Hard Electronics Market?

Key companies in the market include Renesas Electronic Corporation, Micropac Industries Inc, Infineon Technologies AG, Everspin Technologies Inc, Honeywell International Inc, Microchip Technology Inc, Texas Instruments, Data Device Corporation, Frontgrade Technologies, BAE Systems PLC, Vorago Technologie, Solid State Devices Inc, Advanced Micro Devices Inc, STMicroelectronics International NV.

3. What are the main segments of the Radiation Hard Electronics Market?

The market segments include End-user, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment.

6. What are the notable trends driving market growth?

Nuclear Power Plants to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Designing and Development Cost.

8. Can you provide examples of recent developments in the market?

October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Hard Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Hard Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Hard Electronics Market?

To stay informed about further developments, trends, and reports in the Radiation Hard Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence