Key Insights

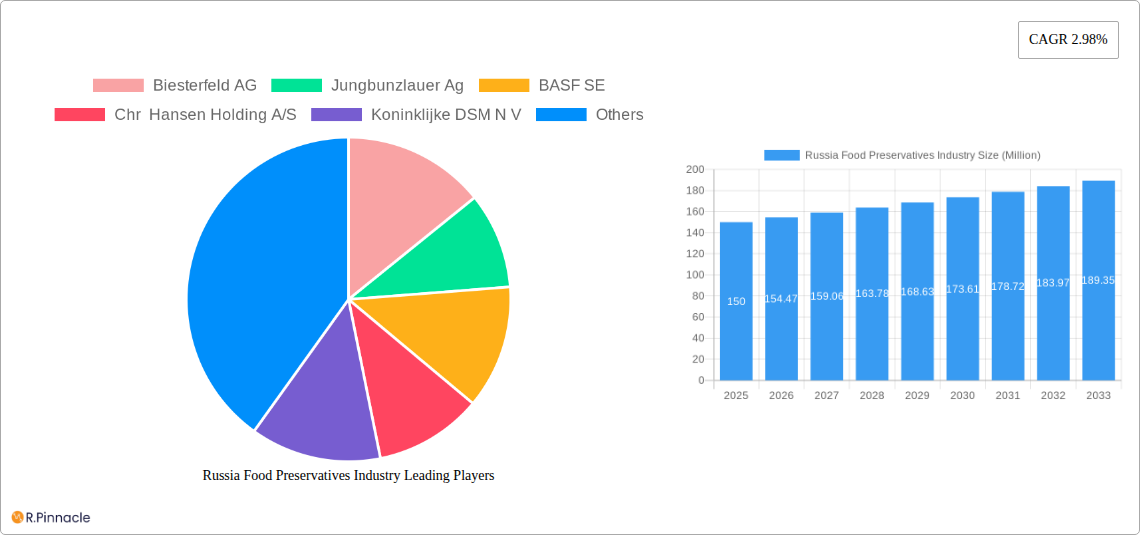

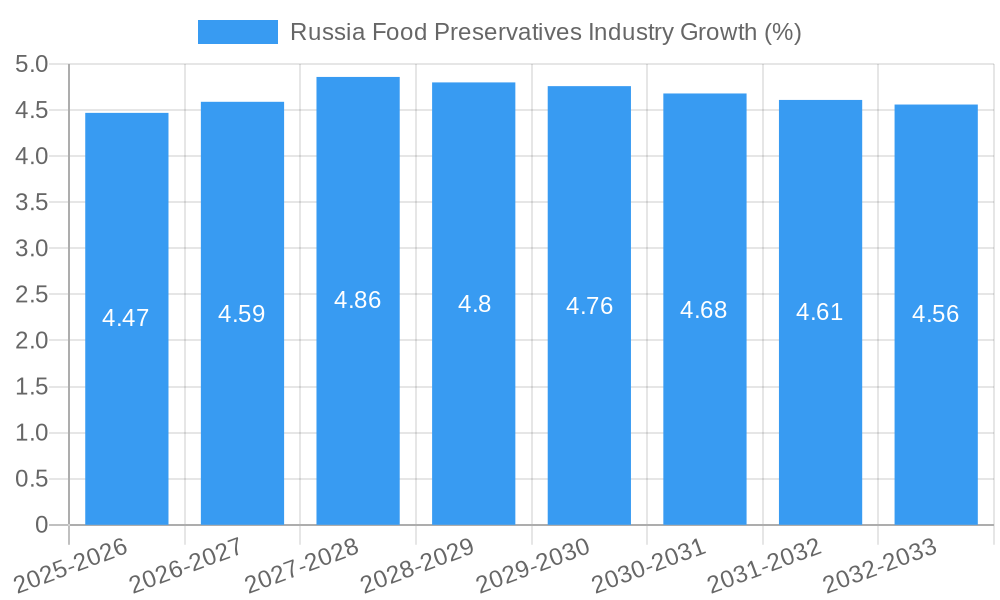

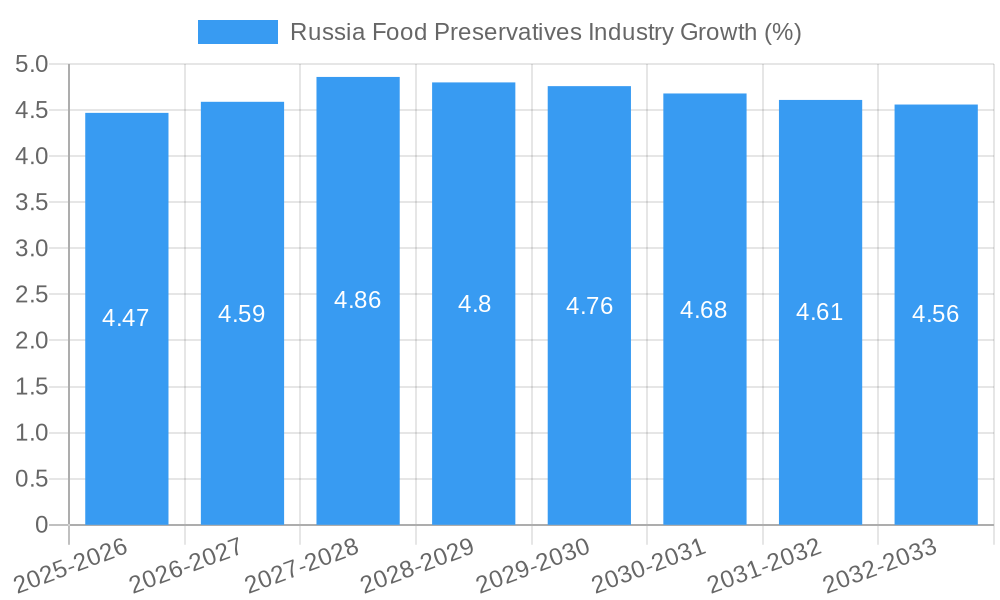

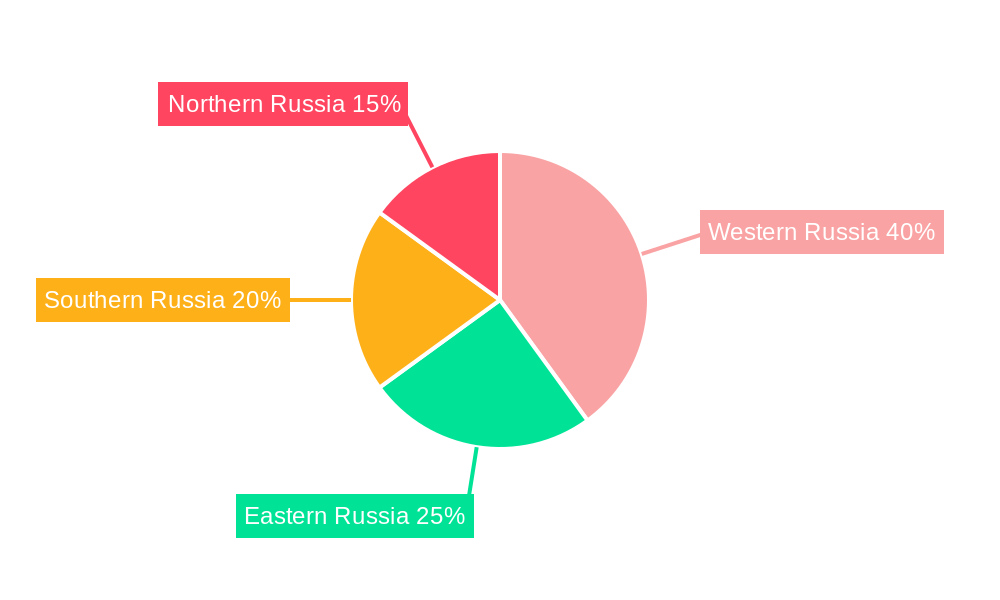

The Russia food preservatives market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by factors such as increasing demand for processed foods, extending shelf life of perishable goods, and rising consumer awareness regarding food safety. The market's Compound Annual Growth Rate (CAGR) of 2.98% from 2025 to 2033 indicates a consistent expansion, albeit moderate, reflecting a balanced market dynamic between growth stimulants and potential restraints. Significant growth is anticipated within the segments of natural preservatives, driven by consumer preference for cleaner label products and increased health consciousness. The beverage, dairy & frozen product, and bakery applications are expected to remain dominant segments, benefiting from the inherent need for preservation in these food categories. However, regulatory changes regarding permitted preservatives and fluctuating raw material prices pose potential restraints on market expansion. The geographical distribution within Russia is likely uneven, with Western Russia possibly exhibiting higher market penetration compared to other regions due to factors such as advanced infrastructure and higher consumer spending.

Competition in the Russian food preservatives market is moderately concentrated, with key players such as Biesterfeld AG, Jungbunzlauer AG, BASF SE, Chr. Hansen Holding A/S, Koninklijke DSM N.V., Corbion N.V., Kerry Group, and Globa (assuming Globa is a major player in the Russian market) actively vying for market share. These companies employ various strategies, including product innovation, strategic partnerships, and mergers & acquisitions, to maintain their competitive edge. The market’s future growth will likely depend on the interplay between consumer demand for safe and convenient food products, technological advancements in preservation techniques, and the regulatory landscape concerning the use of food additives. Continued expansion is projected, particularly in segments exhibiting strong consumer demand and innovation within the natural preservatives arena.

Russia Food Preservatives Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia food preservatives industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The study incorporates detailed segmentation by type (natural and synthetic) and application (beverages, dairy & frozen products, bakery, meat, poultry & seafood, confectionery, sauces & salad mixes, and others). Expected market value projections in Millions are included throughout.

Russia Food Preservatives Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Russian food preservatives market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report reveals the market share held by key players such as Biesterfeld AG, Jungbunzlauer Ag, BASF SE, Chr. Hansen Holding A/S, Koninklijke DSM N.V., Corbion N.V., Kerry Group, and Globa. The impact of recent mergers and acquisitions (M&A) deals, with estimated values, will be assessed to understand their influence on market consolidation and innovation. The analysis further explores the regulatory environment, identifying key regulations influencing product development and market entry. Finally, the report examines the influence of substitute products and evolving end-user demographics on market trends. The market structure is characterized by [insert description of market concentration, e.g., a moderately concentrated market with a few dominant players and several smaller niche players]. Total M&A deal value for the period 2019-2024 is estimated at xx Million.

- Market Share: [Insert market share data for key players – e.g., BASF SE holds approximately xx% market share, followed by Biesterfeld AG with xx%].

- M&A Activity: [List key M&A activities with deal values – e.g., Acquisition of X company by Y company for xx Million in 2022].

- Regulatory Framework: [Describe key regulations and their impact – e.g., Stringent regulations on the use of synthetic preservatives have driven demand for natural alternatives].

Russia Food Preservatives Industry Market Dynamics & Trends

This section delves into the dynamic forces shaping the Russian food preservatives market. It examines market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. Key factors influencing market growth, such as rising demand for processed foods, increasing consumer awareness of food safety, and changing dietary habits will be explored in detail. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration rates analyzed by application segment. The impact of technological advancements, such as improved preservation techniques and the adoption of innovative packaging solutions, will be assessed. The competitive intensity is [insert description, e.g., high, with companies competing on price, quality, and innovation]. Market penetration for natural preservatives is projected at xx% by 2033.

Dominant Regions & Segments in Russia Food Preservatives Industry

This section pinpoints the leading regions and segments within the Russian food preservatives market. It analyzes the dominance of specific regions or countries based on factors such as economic development, regulatory policies, and consumer demand. Likewise, it examines which application segments (Beverage, Dairy & Frozen Product, Bakery, Meat, Poultry & Seafood, Confectionery, Sauces and Salad Mixes, Others) and types of preservatives (Natural, Synthetic) exhibit the highest growth rates and market share.

- Leading Region: [Identify the leading region and provide reasons for its dominance, e.g., The Central Federal District dominates due to high population density and robust food processing sector].

- Key Drivers for Leading Segment:

- By Type: [e.g., The natural preservatives segment is experiencing rapid growth driven by increasing consumer preference for natural and clean-label products].

- By Application: [e.g., The meat, poultry & seafood segment exhibits the highest growth due to increasing demand for preserved meat products].

[Further detailed analysis of each segment’s dominance factors and growth projections are included here].

Russia Food Preservatives Industry Product Innovations

This section summarizes recent product developments, highlighting technological trends and the market fit of new preservative solutions. The focus will be on innovations improving food safety, extending shelf life, and enhancing the sensory attributes of food products. [Describe key innovations, e.g., The development of novel natural preservatives derived from plant extracts is gaining traction, offering a clean-label alternative to synthetic counterparts.] The successful integration of these innovations demonstrates a growing focus on aligning product development with evolving consumer preferences and regulatory requirements.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Russia food preservatives market, segmented by type (Natural and Synthetic) and application (Beverage, Dairy & Frozen Product, Bakery, Meat, Poultry & Seafood, Confectionery, Sauces & Salad Mixes, Others). Each segment's growth projections, market size, and competitive dynamics are detailed. [Include a paragraph for each segment detailing its market size (in Millions), growth rate, and competitive landscape].

Key Drivers of Russia Food Preservatives Industry Growth

Several factors contribute to the growth of the Russian food preservatives market. These include the increasing demand for processed and convenience foods, rising concerns about food safety and spoilage, and the adoption of advanced preservation technologies. Government regulations promoting food safety also play a crucial role. [Provide specific examples like growth in the processed food sector driving demand for preservatives; increasing consumer awareness of foodborne illnesses; government initiatives to improve food safety standards].

Challenges in the Russia Food Preservatives Industry Sector

The Russian food preservatives market faces challenges such as stringent regulations, fluctuating raw material prices, and intense competition among existing players. Supply chain disruptions can also impact market stability. These factors can collectively hinder market growth and profitability. [Quantify the impact of these challenges where possible; for example, quantify the impact of price fluctuation of raw materials on profit margins].

Emerging Opportunities in Russia Food Preservatives Industry

Despite challenges, the Russian food preservatives market presents several opportunities. The growing demand for clean-label and natural preservatives opens avenues for innovation and market expansion. The expansion of the food processing industry and increasing investments in food technology present further growth potential. [Describe specific emerging opportunities like the rising demand for natural preservatives; the potential for expansion into new food categories; opportunities to leverage new technologies for more effective and efficient preservation].

Leading Players in the Russia Food Preservatives Industry Market

- Biesterfeld AG

- Jungbunzlauer Ag

- BASF SE

- Chr. Hansen Holding A/S

- Koninklijke DSM N.V.

- Corbion N.V.

- Kerry Group

- Globa

Key Developments in Russia Food Preservatives Industry

- [List key developments with year/month – e.g., Launch of a new natural preservative by Company X in June 2023; Merger between Company Y and Company Z in December 2022].

Future Outlook for Russia Food Preservatives Industry Market

The Russian food preservatives market is poised for significant growth over the forecast period. Driven by increasing demand for processed foods, a growing focus on food safety, and the emergence of innovative preservation technologies, the market is expected to witness robust expansion. Strategic investments in research and development, along with the adoption of sustainable practices, will further shape the market's trajectory. The market's future hinges on successfully navigating regulatory hurdles and meeting evolving consumer preferences.

Russia Food Preservatives Industry Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Beverage

- 2.2. Dairy & Frozen Product

- 2.3. Bakery

- 2.4. Meat, Poultry & Seafood

- 2.5. Confectionery

- 2.6. Sauces and Salad Mixes

- 2.7. Others

Russia Food Preservatives Industry Segmentation By Geography

- 1. Russia

Russia Food Preservatives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Natural Preservatives Poised to Achieve Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Food Preservatives Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Dairy & Frozen Product

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry & Seafood

- 5.2.5. Confectionery

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Western Russia Russia Food Preservatives Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Food Preservatives Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Food Preservatives Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Food Preservatives Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Biesterfeld AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jungbunzlauer Ag

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BASF SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Chr Hansen Holding A/S

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Koninklijke DSM N V

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Corbion N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Globa

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Biesterfeld AG

List of Figures

- Figure 1: Russia Food Preservatives Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Food Preservatives Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Food Preservatives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Food Preservatives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Russia Food Preservatives Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Russia Food Preservatives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Food Preservatives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Food Preservatives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Food Preservatives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Food Preservatives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Food Preservatives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Food Preservatives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Russia Food Preservatives Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Russia Food Preservatives Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Food Preservatives Industry?

The projected CAGR is approximately 2.98%.

2. Which companies are prominent players in the Russia Food Preservatives Industry?

Key companies in the market include Biesterfeld AG, Jungbunzlauer Ag, BASF SE, Chr Hansen Holding A/S, Koninklijke DSM N V, Corbion N V, Kerry Group, Globa.

3. What are the main segments of the Russia Food Preservatives Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Natural Preservatives Poised to Achieve Significant Growth Rate.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Food Preservatives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Food Preservatives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Food Preservatives Industry?

To stay informed about further developments, trends, and reports in the Russia Food Preservatives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence