Key Insights

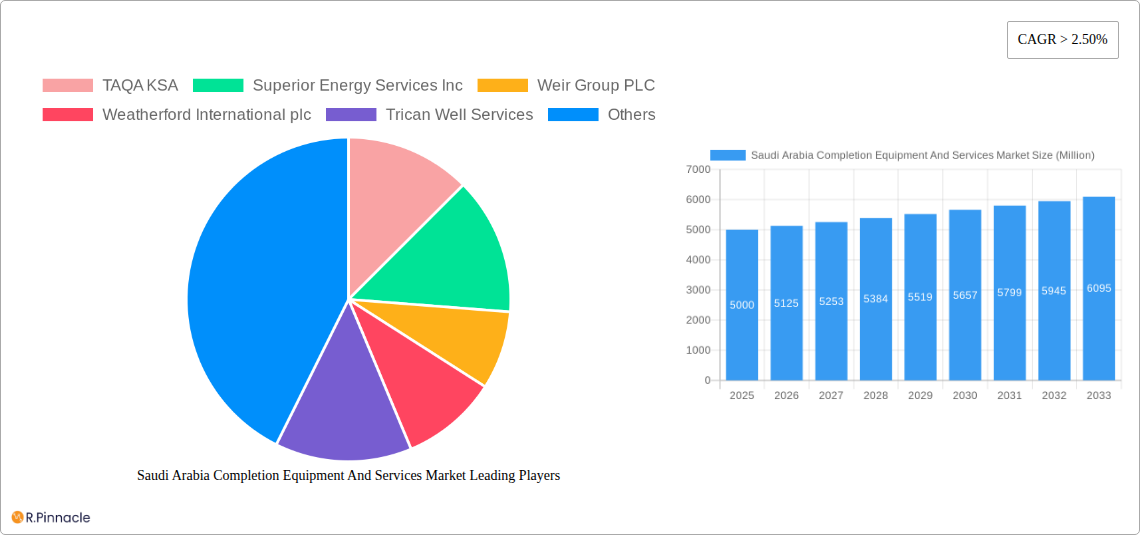

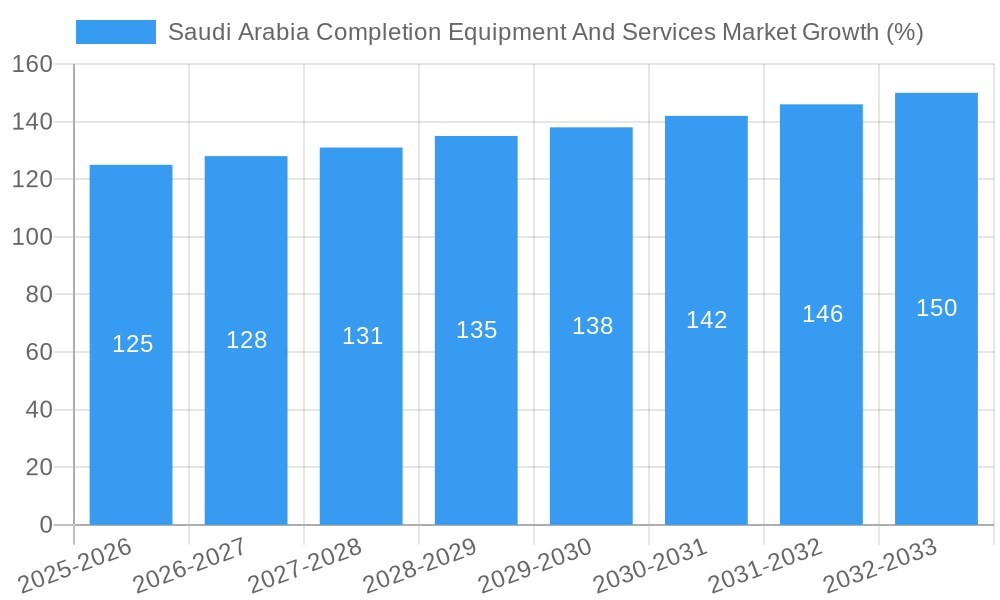

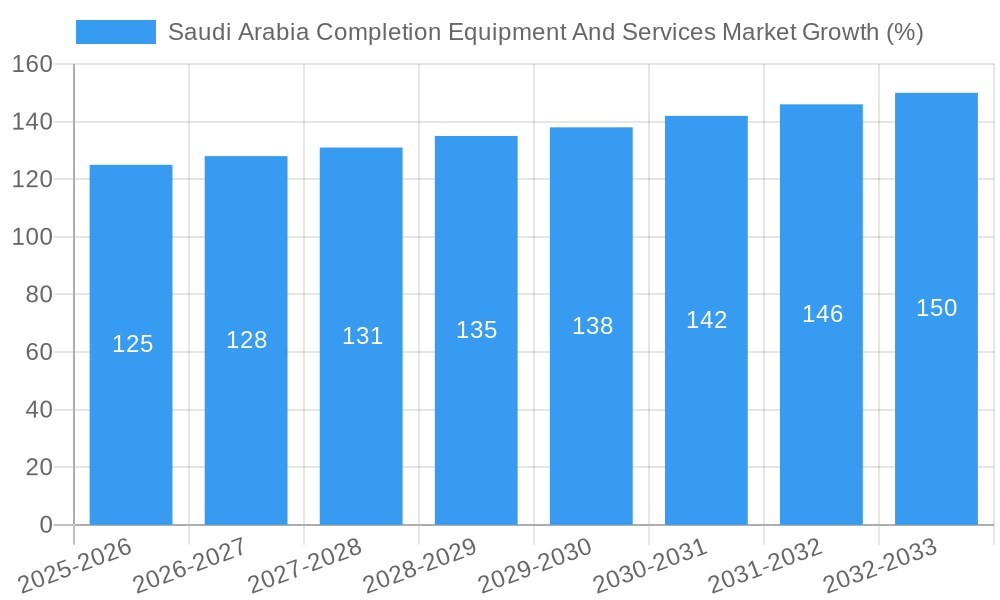

The Saudi Arabia Completion Equipment and Services Market is experiencing robust growth, driven by the nation's significant investments in oil and gas exploration and production. The market, encompassing drilling and completion fluids, wellhead and completion equipment, and wireline and logging services, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 2.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Saudi Arabia's ambitious energy production targets necessitate continuous investment in advanced completion technologies to optimize well performance and enhance recovery rates. Secondly, a growing focus on improving operational efficiency and reducing environmental impact is driving demand for technologically advanced and environmentally friendly completion equipment and services. Finally, ongoing exploration activities and the development of new oil and gas fields contribute significantly to the market's growth trajectory. Major players like Schlumberger, Halliburton, and Baker Hughes are actively engaged in this market, providing a competitive landscape with diverse offerings. However, factors such as fluctuating oil prices and global economic uncertainties could potentially moderate growth in the short-term.

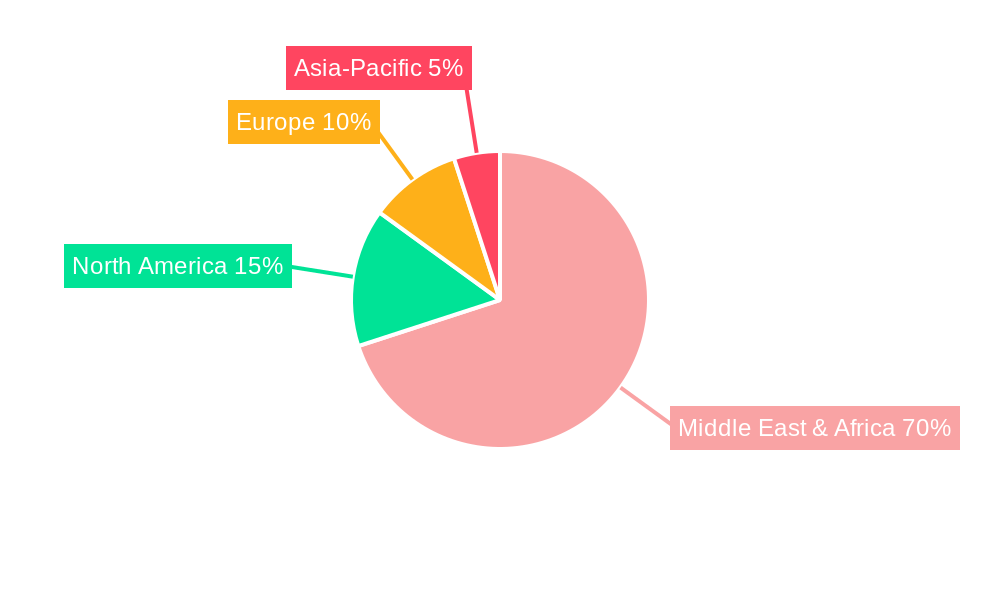

Despite potential headwinds, the long-term outlook for the Saudi Arabia Completion Equipment and Services Market remains positive. The continuous push for increased oil and gas production, coupled with the adoption of innovative technologies to address operational challenges and enhance sustainability, will sustain market growth. The market segmentation, with significant participation from oil and gas companies, drilling contractors, and service providers, indicates a healthy ecosystem driving demand. Specific market segments, such as wireline and logging services, may experience even faster growth driven by the need for precise wellbore information and improved production management. The Middle East and Africa region, with Saudi Arabia at its core, is a key focus for global energy companies, further reinforcing the market's growth potential. This strategic importance and the nation's commitment to energy security guarantee sustained demand for sophisticated completion equipment and services in the coming years.

Saudi Arabia Completion Equipment and Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia Completion Equipment and Services Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth prospects. The report leverages extensive data analysis to provide actionable intelligence, enabling informed strategies for navigating this dynamic market. The market is projected to reach xx Million by 2033.

Saudi Arabia Completion Equipment And Services Market Market Structure & Innovation Trends

The Saudi Arabia completion equipment and services market exhibits a moderately concentrated structure, dominated by international players like Schlumberger Ltd, Baker Hughes Company, and Halliburton Company, alongside regional players such as TAQA KSA. These companies hold a significant market share, estimated at approximately 60% collectively in 2025. However, smaller specialized service providers are also emerging, creating a competitive landscape.

Innovation is driven by the need for enhanced efficiency, reduced operational costs, and improved safety in oil and gas exploration and production. Stringent regulatory frameworks, including environmental regulations and safety standards imposed by the Saudi Arabian government, further influence technological advancements. The market witnesses continuous innovation in drilling and completion fluids, aiming for environmentally friendly alternatives, while wellhead and completion equipment incorporates advanced materials and automation for improved performance and longevity.

Mergers and acquisitions (M&A) activities are relatively frequent, with deal values fluctuating depending on market conditions. For example, in 2024, M&A activity in this segment totaled approximately xx Million, largely driven by consolidation efforts among service providers. The market is characterized by significant substitution potential; particularly in the area of drilling fluids, with several companies actively pursuing eco-friendly alternatives. End-user demographics consist primarily of large oil and gas companies like Aramco, alongside various drilling contractors and service providers.

- Market Concentration: Moderately concentrated, with major players holding ~60% market share (2025 estimate).

- Innovation Drivers: Efficiency gains, cost reduction, improved safety, and environmental regulations.

- M&A Activity: Significant, with an estimated xx Million in deal value in 2024.

- Product Substitution: Notable potential, particularly within drilling fluids segment.

Saudi Arabia Completion Equipment And Services Market Market Dynamics & Trends

The Saudi Arabia completion equipment and services market is experiencing robust growth, propelled by several factors. Increased oil and gas exploration and production activities, driven by rising global energy demand and Saudi Arabia's commitment to expanding its hydrocarbon reserves, are key growth drivers. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, reflecting substantial market expansion. Technological advancements, such as automation and digitalization, contribute to enhanced efficiency and improved data analysis, boosting market adoption. Furthermore, the growing emphasis on well abandonment and decommissioning projects presents a new avenue for market growth. Competitive dynamics remain intense, with established players and new entrants vying for market share. The market penetration rate for advanced completion technologies, such as intelligent completion systems, is steadily increasing, reaching an estimated xx% in 2025.

Dominant Regions & Segments in Saudi Arabia Completion Equipment And Services Market

The Eastern Province of Saudi Arabia is the dominant region within the completion equipment and services market, owing to its high concentration of oil and gas fields and established infrastructure.

- Key Drivers in Eastern Province:

- High concentration of oil and gas fields.

- Well-established infrastructure.

- Government support for energy sector development.

The largest market segment by product type is wellhead and completion equipment, driven by continuous investment in new and existing oil and gas projects. Within the end-use industry segment, oil and gas companies constitute the largest customer base, consuming a majority of the completion equipment and services. Oil and gas exploration and production are the most prominent applications.

- Dominant Segments:

- Product Type: Wellhead and completion equipment

- End-Use Industry: Oil and gas companies

- Application: Oil and gas exploration and production

Saudi Arabia Completion Equipment And Services Market Product Innovations

Recent innovations include the development of lightweight, high-strength materials for wellhead equipment, advanced drilling fluids that minimize environmental impact, and automated wireline and logging systems enhancing operational efficiency. These innovations aim to improve overall efficiency, enhance safety, and minimize environmental footprint, aligning with the industry's evolving demands.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia completion equipment and services market by:

Product Type: Drilling and completion fluids, wellhead and completion equipment, wireline and logging services. Each segment exhibits varying growth rates reflecting evolving technological demands and market preferences. Market size and competitive intensity varies across these segments.

End-Use Industry: Oil and gas companies, drilling contractors, service providers. The dominance of oil and gas companies as primary consumers shapes market dynamics and influences technological adoption rates.

Application: Oil and gas exploration and production, well abandonment. The increasing focus on well abandonment projects creates a unique segment with its own growth trajectory and competitive dynamics.

Growth projections vary significantly across these segments, reflecting unique market trends and specific technological adoption rates.

Key Drivers of Saudi Arabia Completion Equipment And Services Market Growth

Several key factors fuel market expansion: Saudi Arabia's ambitious Vision 2030 initiative, aimed at diversifying the economy while maintaining its oil and gas industry leadership, significantly impacts investment and expansion. The increasing focus on maximizing oil and gas recovery rates, coupled with technological advancements such as enhanced oil recovery (EOR) techniques, drives demand for advanced completion technologies. Government support for the energy sector, encompassing regulatory frameworks and investment incentives, is another major growth catalyst.

Challenges in the Saudi Arabia Completion Equipment And Services Market Sector

The market faces challenges including volatile oil prices, fluctuating demand, and intense competition among established and emerging players. Supply chain disruptions and potential geopolitical uncertainties also contribute to market volatility. Further challenges include the need for skilled labor and the stringent regulatory environment. The market has a supply chain complexity that impacts pricing, making it a challenge for smaller players.

Emerging Opportunities in Saudi Arabia Completion Equipment And Services Market

The growth of unconventional oil and gas resources presents significant opportunities. The increasing adoption of digital technologies, such as automation and data analytics, offers opportunities for efficiency improvements and cost optimization. Finally, the government's emphasis on environmental sustainability creates opportunities for environmentally friendly completion technologies and services.

Leading Players in the Saudi Arabia Completion Equipment And Services Market Market

- TAQA KSA

- Superior Energy Services Inc

- Weir Group PLC

- Weatherford International plc

- Trican Well Services

- Schlumberger Ltd

- Baker Hughes Company

- Halliburton Company

- National-Oilwell Varco Inc

- Welltec A/S

Key Developments in Saudi Arabia Completion Equipment And Services Market Industry

- June 2022: NPCC secured USD 673.2 Million in contracts from Aramco for the Jafurah Development Programme and MNIF 14 Jackets project, boosting demand for completion equipment and services.

- August 2022: Aramco's MoU with Sinopec signifies potential collaborations, fostering increased investment in the Saudi Arabian energy sector and further stimulating demand.

Future Outlook for Saudi Arabia Completion Equipment And Services Market Market

The Saudi Arabia completion equipment and services market is poised for continued growth, driven by ongoing investments in oil and gas exploration and production, technological advancements, and government initiatives. The market will likely witness increased adoption of sustainable technologies and a heightened focus on digitalization. This positive outlook presents attractive opportunities for companies in the sector to capitalize on the market's long-term potential.

Saudi Arabia Completion Equipment And Services Market Segmentation

- 1. Onshore

- 2. Offshore

Saudi Arabia Completion Equipment And Services Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Completion Equipment And Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Development of Gas Reserves and Advanced Technology

- 3.2.2 Tools

- 3.2.3 and Equipment4.; Increasing Investment in the Oilfield Services across World

- 3.3. Market Restrains

- 3.3.1 4.; The Volatile Oil Prices Over the Recent Period

- 3.3.2 Owing to the Supply-Demand Gap

- 3.4. Market Trends

- 3.4.1. Onshore Expected to be a Significant Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Completion Equipment And Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. UAE Saudi Arabia Completion Equipment And Services Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia Completion Equipment And Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia Completion Equipment And Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia Completion Equipment And Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 TAQA KSA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Superior Energy Services Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Weir Group PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Weatherford International plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Trican Well Services

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schlumberger Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Baker Hughes Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Halliburton Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 National-Oilwell Varco Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Welltec A/S

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TAQA KSA

List of Figures

- Figure 1: Saudi Arabia Completion Equipment And Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Completion Equipment And Services Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 3: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 4: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Saudi Arabia Completion Equipment And Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Saudi Arabia Completion Equipment And Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Saudi Arabia Completion Equipment And Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Saudi Arabia Completion Equipment And Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 11: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 12: Saudi Arabia Completion Equipment And Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Completion Equipment And Services Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Saudi Arabia Completion Equipment And Services Market?

Key companies in the market include TAQA KSA, Superior Energy Services Inc, Weir Group PLC, Weatherford International plc, Trican Well Services, Schlumberger Ltd, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Welltec A/S.

3. What are the main segments of the Saudi Arabia Completion Equipment And Services Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Development of Gas Reserves and Advanced Technology. Tools. and Equipment4.; Increasing Investment in the Oilfield Services across World.

6. What are the notable trends driving market growth?

Onshore Expected to be a Significant Sector.

7. Are there any restraints impacting market growth?

4.; The Volatile Oil Prices Over the Recent Period. Owing to the Supply-Demand Gap.

8. Can you provide examples of recent developments in the market?

June 2022: The National Petroleum Construction Company (NPCC) secured contracts worth USD 673.2 million from Saudi oil giant Aramco for two of its key projects: the Jafurah Development Programme and the MNIF 14 Jackets project in the kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Completion Equipment And Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Completion Equipment And Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Completion Equipment And Services Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Completion Equipment And Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence