Key Insights

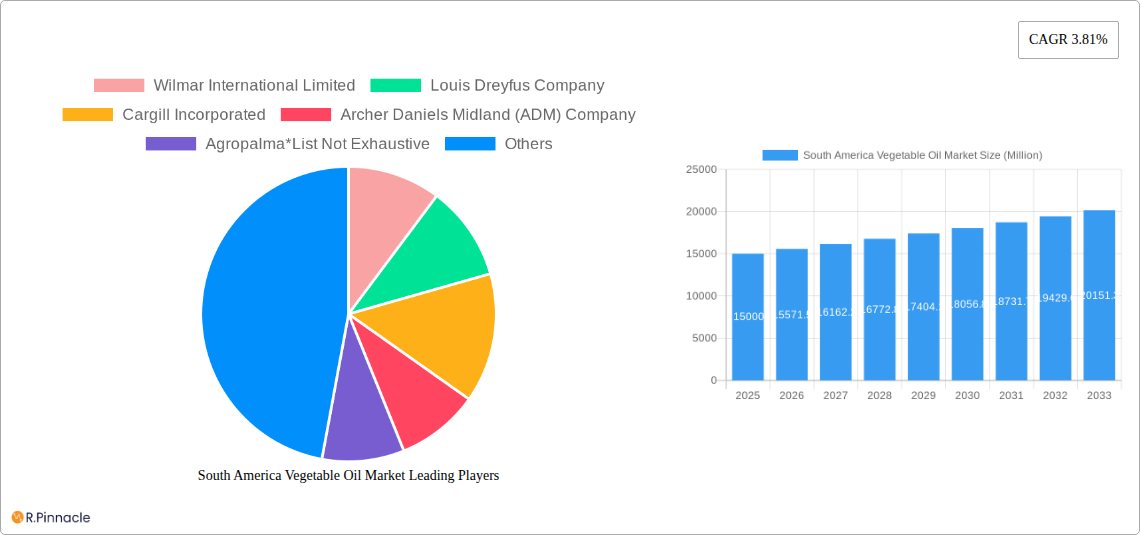

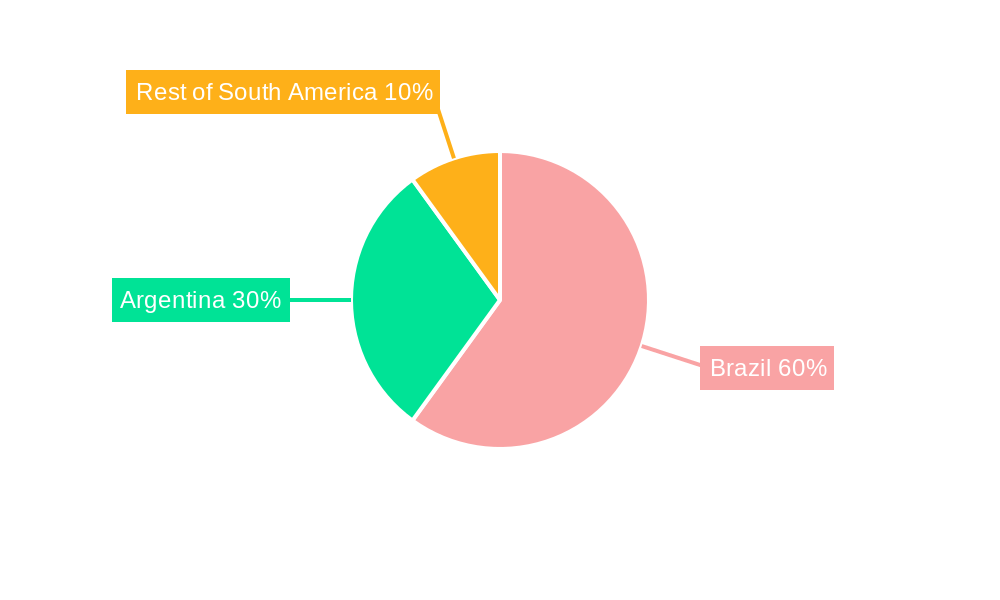

The South American vegetable oil market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven primarily by increasing demand from the food and feed industries within the region. Brazil and Argentina, the largest economies in South America, are key contributors to this market, with Brazil likely holding a larger market share due to its extensive agricultural production. The rising global population and increasing consumption of processed foods are significant factors fueling market expansion. Growth is further stimulated by the increasing use of vegetable oils in biofuel production, although this segment’s contribution might be relatively smaller compared to food and feed applications within the South American context. However, challenges remain, including fluctuating crop yields due to climate change and variations in global commodity prices that can impact profitability for producers and processors. The market is highly competitive, with major players like Wilmar International Limited, Cargill Incorporated, and Bunge Limited vying for market share. The diversification of oil types, including palm, soybean, rapeseed, sunflower, and olive oils, caters to diverse consumer preferences and industrial applications. Expansion into value-added products and sustainable sourcing practices are expected to shape the market's future trajectory.

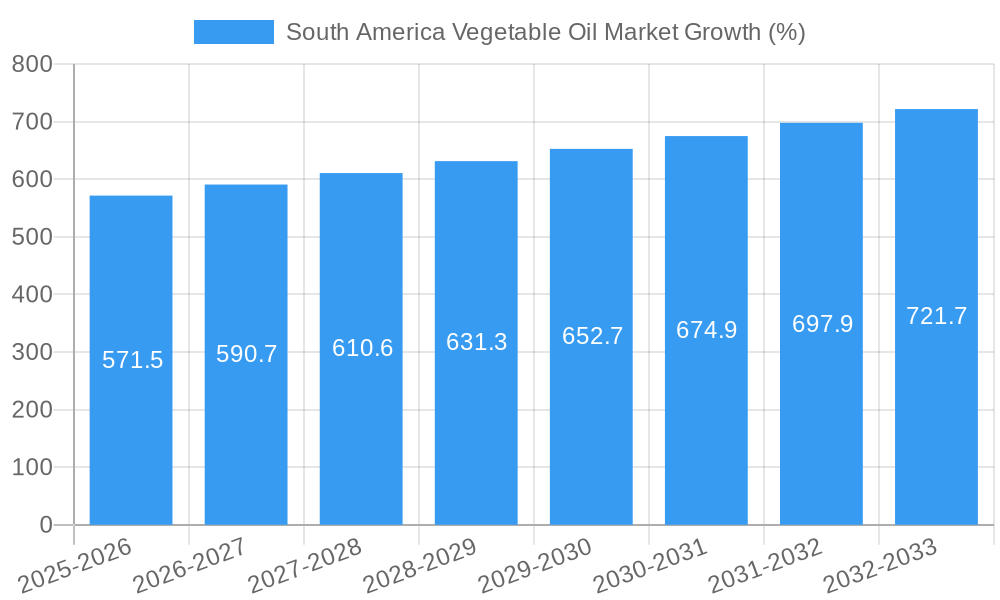

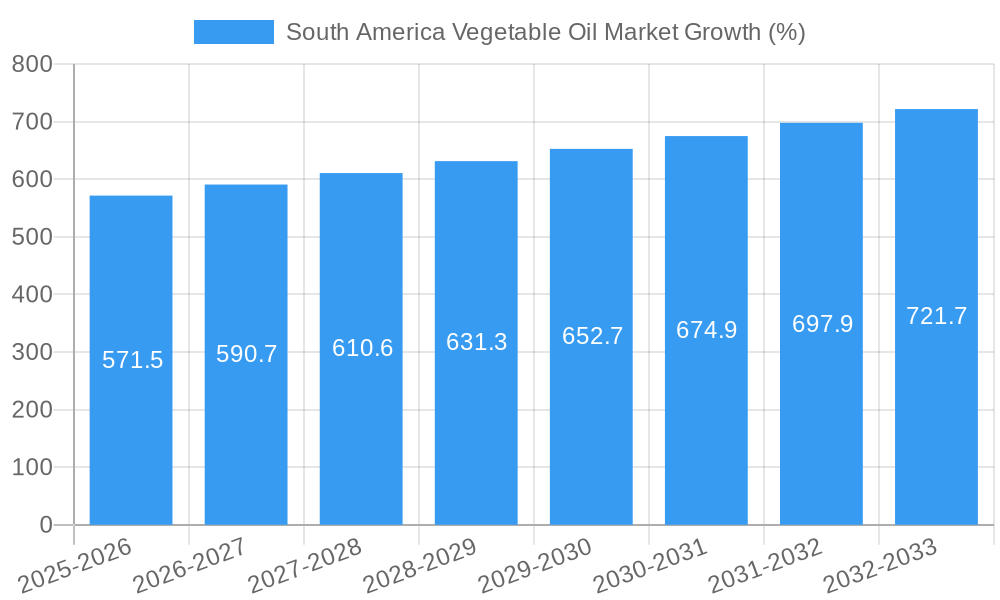

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 3.81%, indicating a consistent, albeit moderate, expansion. This growth will likely be influenced by factors like economic development in the region, changes in dietary habits, and government policies related to agriculture and biofuels. Within the application segments, the food sector will probably remain the dominant driver, followed by the feed sector, with industrial applications exhibiting a more moderate growth rate. Competitive pressures will necessitate innovation in processing technologies, supply chain optimization, and the development of new products to maintain market share. A closer look at the regional breakdown suggests that Brazil, given its substantial agricultural output, will likely dominate the market share within South America, followed by Argentina, with the "Rest of South America" segment contributing a smaller portion. Specific market segmentation data further detailing the percentage breakdown of oil types and applications would allow for a more precise analysis.

South America Vegetable Oil Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Vegetable Oil Market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The report is structured to deliver actionable intelligence, enabling informed decision-making within this dynamic sector.

South America Vegetable Oil Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the South American vegetable oil market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and regional players, leading to varying levels of market share. While precise market share figures for each player are proprietary data within the full report, we can state that the market exhibits moderate concentration, with the top five players – Wilmar International Limited, Louis Dreyfus Company, Cargill Incorporated, Archer Daniels Midland (ADM) Company, and Bunge Limited – holding a significant portion of the overall market. However, smaller, regionally focused companies also contribute significantly.

- Market Concentration: Moderate, with a few dominant players and several smaller, regional competitors.

- Innovation Drivers: Increasing demand for sustainable and organic vegetable oils, coupled with advancements in processing technologies.

- Regulatory Frameworks: Varying regulations across South American countries impacting production, labeling, and trade. These are detailed in the full report.

- Product Substitutes: Competition from other edible oils and fats, impacting market share for specific types of vegetable oils.

- End-User Demographics: Growing populations and changing dietary habits in South America fuel demand for vegetable oils across the food, feed, and industrial sectors.

- M&A Activities: The report details specific M&A activities, including deal values (xx Million) and their impact on market consolidation. Examples include recent partnerships and expansions (details within the full report).

South America Vegetable Oil Market Market Dynamics & Trends

The South American vegetable oil market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, reflecting a dynamic market environment. Increased consumer demand for processed foods, rising feed requirements for livestock, and the increasing use of vegetable oils in industrial applications are primary growth drivers. Technological advancements in oil extraction and processing techniques contribute to higher yields and improved product quality, further fueling market expansion. However, price volatility of raw materials and fluctuating global demand present challenges. The market penetration of sustainable and organic vegetable oils is also increasing, driven by consumer preferences for healthier and ethically sourced products. Competitive pressures among key players, as outlined earlier, lead to price wars and innovation in product offerings.

Dominant Regions & Segments in South America Vegetable Oil Market

Brazil dominates the South American vegetable oil market due to its extensive agricultural lands and favorable climatic conditions for oilseed cultivation. Other significant players include Argentina and Colombia.

Leading Segments:

- Type: Palm oil holds a significant share in the market owing to its high yield and versatility. Soybean oil ranks second due to high demand from the food and feed industries.

- Application: The food sector accounts for the largest application segment, followed by the feed and industrial sectors.

Key Drivers of Regional Dominance:

- Brazil: Favorable government policies supporting agricultural production, extensive land availability, and a well-established infrastructure for oilseed processing and distribution.

- Argentina: Large-scale soybean cultivation and strong export capabilities contribute to its significant market share.

- Colombia: Growing demand from the food industry and strategic location for export markets.

South America Vegetable Oil Market Product Innovations

Recent innovations focus on sustainable and organic vegetable oil production, responding to growing consumer demand for healthier and ethically sourced products. Improved extraction and refining technologies enhance oil yield and quality, while developments in biofuel production are creating new market opportunities. Competition among companies drives innovation in product formulations, packaging, and distribution channels, improving market fit and creating competitive advantages.

Report Scope & Segmentation Analysis

This report segments the South American vegetable oil market by type (Palm Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Olive Oil, Other Types) and application (Food, Feed, Industrial). Each segment's growth projections, market sizes (in Million), and competitive dynamics are analyzed in detail within the full report. For instance, the palm oil segment is expected to witness significant growth due to its wide application in the food and biofuel industries, whilst the soybean oil segment benefits from high demand from the feed sector. Detailed market sizes for each segment in the base year (2025) and forecast period (2025-2033) are provided in the full report.

Key Drivers of South America Vegetable Oil Market Growth

Several factors contribute to the growth of the South American vegetable oil market: growing populations leading to increased food demand; rising livestock numbers stimulating feed requirements; and increasing industrial applications of vegetable oils. Favorable government policies supporting agricultural development and increasing investments in modern processing technologies also drive market expansion. The expanding biofuel sector adds further momentum to the market's growth.

Challenges in the South America Vegetable Oil Market Sector

Challenges include price volatility of raw materials, impacting profitability; supply chain disruptions due to infrastructure limitations in certain regions; and intense competition among established players. Regulatory changes and environmental concerns around deforestation and sustainable sourcing practices also present significant hurdles, potentially impacting the growth trajectory of certain segments.

Emerging Opportunities in South America Vegetable Oil Market

Emerging opportunities lie in the growing demand for sustainable and organic vegetable oils; increasing use of vegetable oils in biofuels and other industrial applications; and expansion into new markets within South America and beyond. Technological advancements in processing and refining offer opportunities for enhanced efficiency and product quality.

Leading Players in the South America Vegetable Oil Market Market

- Wilmar International Limited

- Louis Dreyfus Company

- Cargill Incorporated

- Archer Daniels Midland (ADM) Company

- Agropalma

- AAK AB (formerly AarhusKarlshamn)

- Bunge Limited

- Sime Darby Plantation Berhad

- Olam International

- Aceitera General Deheza

Key Developments in South America Vegetable Oil Market Industry

- July 2021: Agropalma partnered with Ciranda to expand organic palm oil production, supplying the organic food sector.

- April 2022: Vibra Energia SA ventured into palm oil-based jet fuel production, leveraging its partnership with Brasil BioFuels.

- October 2022: BrasilBiofuels announced plans to build Brazil's first sustainable aviation fuel facility using palm oil as feedstock.

Future Outlook for South America Vegetable Oil Market Market

The South American vegetable oil market is poised for continued growth, driven by increasing demand, technological advancements, and the expanding biofuel sector. Strategic opportunities exist for companies focusing on sustainable and organic production, efficient processing technologies, and innovative product development to capitalize on the market's potential. The market is expected to maintain a strong growth trajectory throughout the forecast period.

South America Vegetable Oil Market Segmentation

-

1. Type

- 1.1. Palm Oil

- 1.2. Soybean Oil

- 1.3. Rapeseed Oil

- 1.4. Sunflower Oil

- 1.5. Olive Oil

- 1.6. Other Types

-

2. Application

- 2.1. Food

- 2.2. Feed

- 2.3. Industrial

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Vegetable Oil Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Vegetable Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth

- 3.3. Market Restrains

- 3.3.1. Availability of Substitute Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Biofuels to Support the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Palm Oil

- 5.1.2. Soybean Oil

- 5.1.3. Rapeseed Oil

- 5.1.4. Sunflower Oil

- 5.1.5. Olive Oil

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.2. Feed

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Palm Oil

- 6.1.2. Soybean Oil

- 6.1.3. Rapeseed Oil

- 6.1.4. Sunflower Oil

- 6.1.5. Olive Oil

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.2. Feed

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Palm Oil

- 7.1.2. Soybean Oil

- 7.1.3. Rapeseed Oil

- 7.1.4. Sunflower Oil

- 7.1.5. Olive Oil

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.2. Feed

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Palm Oil

- 8.1.2. Soybean Oil

- 8.1.3. Rapeseed Oil

- 8.1.4. Sunflower Oil

- 8.1.5. Olive Oil

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.2. Feed

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Vegetable Oil Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Wilmar International Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Louis Dreyfus Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cargill Incorporated

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Archer Daniels Midland (ADM) Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Agropalma*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AAK AB (formerly AarhusKarlshamn)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bunge Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sime Darby Plantation Berhad

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Olam International

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Aceitera General Deheza

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Wilmar International Limited

List of Figures

- Figure 1: South America Vegetable Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Vegetable Oil Market Share (%) by Company 2024

List of Tables

- Table 1: South America Vegetable Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Vegetable Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Vegetable Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Vegetable Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Vegetable Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Vegetable Oil Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Vegetable Oil Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Vegetable Oil Market?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the South America Vegetable Oil Market?

Key companies in the market include Wilmar International Limited, Louis Dreyfus Company, Cargill Incorporated, Archer Daniels Midland (ADM) Company, Agropalma*List Not Exhaustive, AAK AB (formerly AarhusKarlshamn), Bunge Limited, Sime Darby Plantation Berhad, Olam International, Aceitera General Deheza.

3. What are the main segments of the South America Vegetable Oil Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Biofuels to Support the Market Growth.

7. Are there any restraints impacting market growth?

Availability of Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: BrasilBiofuels announced its plans to build Brazil's first sustainability aviation fuel facility in Manaus using technology developed by Denmark's Topsoe Haldor. The company claimed that they would use palm oil which they will grow in Brazil, as feedstock for the biorefinery to meet the growing demand for renewable fuels, including SAF.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Vegetable Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Vegetable Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Vegetable Oil Market?

To stay informed about further developments, trends, and reports in the South America Vegetable Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence