Key Insights

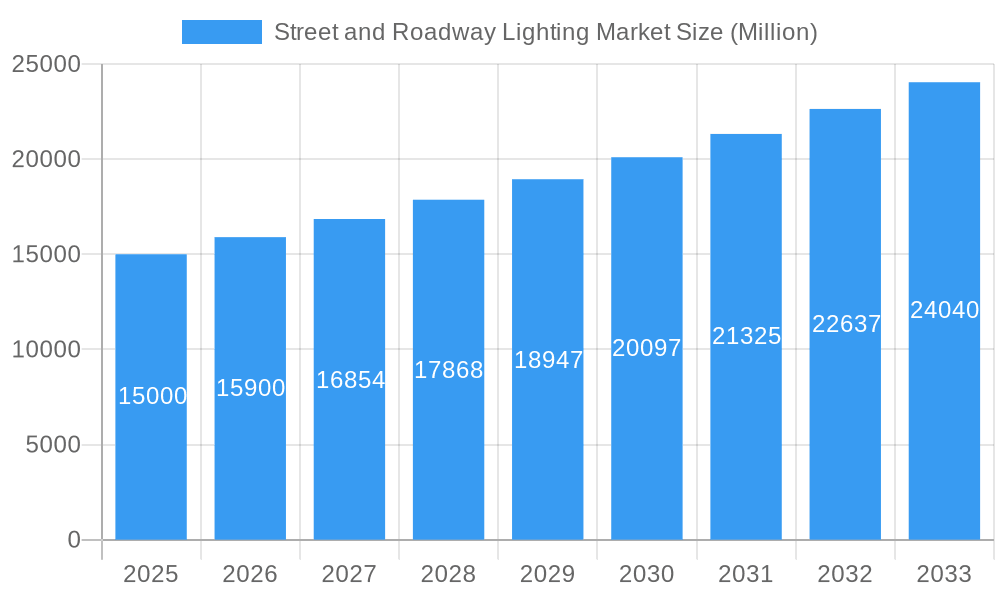

The street and roadway lighting market is poised for substantial expansion, fueled by escalating urbanization, heightened safety imperatives, and the global transition toward energy-efficient infrastructure. Projections indicate a Compound Annual Growth Rate (CAGR) of 7.2%, propelling the market size to an estimated $9.7 billion by 2025. Key growth drivers include governmental impetus for smart city development and the widespread adoption of energy-efficient LED lighting, delivering significant cost savings and reduced environmental impact. The integration of smart control systems further enhances operational efficiency, enabling remote monitoring and management. While initial investment in smart lighting infrastructure and the maintenance of aging systems present challenges, the overall market trajectory remains robust. LED light sources dominate, underscoring their energy efficiency and cost-effectiveness. The hardware segment currently leads in market share, though control systems (software and services) are experiencing rapid growth due to the increasing demand for intelligent lighting solutions. Geographically, North America and Europe are key markets, while the Asia-Pacific region is anticipated to exhibit the highest growth rate, driven by rapid urbanization and extensive infrastructure projects in China and India.

Street and Roadway Lighting Market Market Size (In Billion)

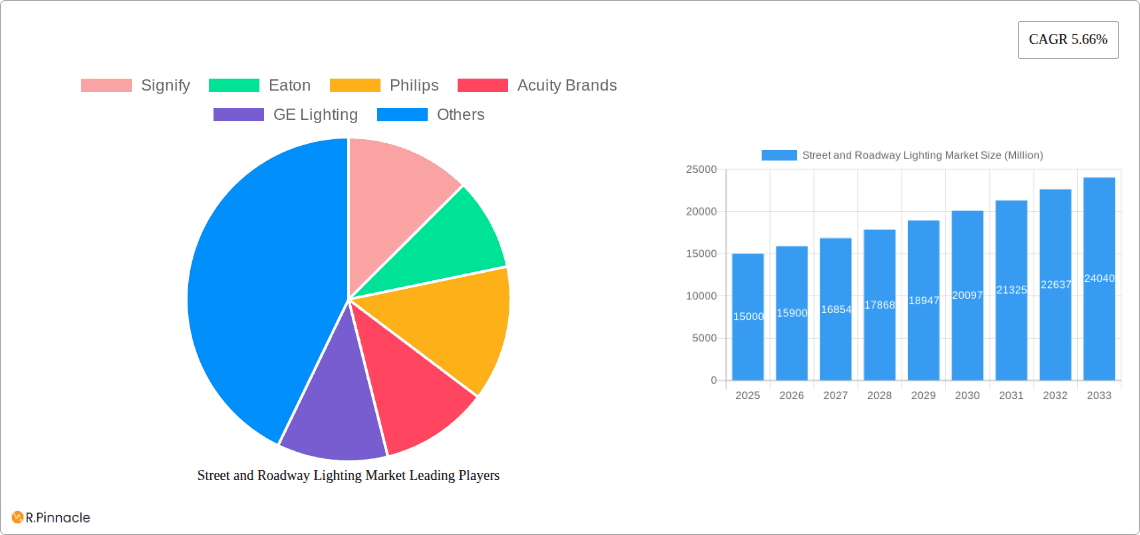

The competitive environment features established industry leaders such as Signify, Eaton, Philips, Acuity Brands, and GE Lighting, who are actively pursuing market share through innovation and strategic alliances. Increased market consolidation is anticipated, with larger entities acquiring smaller companies to access new technologies and broaden their reach. A continued focus on sustainability and smart city initiatives will shape market trends, encouraging the adoption of connected lighting solutions with features like remote management, dimming capabilities, and integration with broader smart city ecosystems. The growing demand for enhanced public safety and security will also contribute to market growth. Diverse application segments, including highways and street lighting, offer significant opportunities for market participants. Strategic understanding of regional demands and regulatory frameworks will be critical for global expansion and success in this dynamic market.

Street and Roadway Lighting Market Company Market Share

Street and Roadway Lighting Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Street and Roadway Lighting Market, offering actionable insights for industry professionals. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, key players, and future growth prospects. The report is invaluable for strategic decision-making, investment planning, and understanding the evolving landscape of street and roadway lighting.

Street and Roadway Lighting Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Street and Roadway Lighting Market. The market is moderately concentrated, with key players like Signify, Eaton, Philips, Acuity Brands, and GE Lighting holding significant market share, estimated at xx% collectively in 2025. However, smaller, innovative companies are emerging, driving competition and technological advancements.

- Market Concentration: The market exhibits moderate concentration, with the top five players controlling approximately xx% of the global market share in 2025.

- Innovation Drivers: Stringent environmental regulations promoting energy efficiency, the increasing adoption of smart city initiatives, and the decreasing cost of LED technology are key drivers of innovation.

- Regulatory Frameworks: Government regulations mandating energy-efficient lighting solutions and the integration of smart technologies are significantly influencing market growth.

- Product Substitutes: While few direct substitutes exist, alternative lighting solutions like solar-powered lighting systems are gaining traction, particularly in remote areas.

- End-User Demographics: The primary end-users are municipalities, government agencies, and private contractors responsible for street and roadway infrastructure.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values totaling approximately $xx Million in 2024. These activities reflect the industry’s consolidation and the pursuit of technological advancements.

Street and Roadway Lighting Market Dynamics & Trends

The Street and Roadway Lighting Market is experiencing robust growth, driven by several factors. The global market is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing urbanization, rising government investments in infrastructure development, and the growing adoption of smart lighting systems. Technological disruptions, such as the widespread adoption of LEDs and the integration of smart control systems, are further accelerating market expansion. Consumer preference is shifting towards energy-efficient and smart lighting solutions that offer improved safety, security, and cost savings. Competitive dynamics are intensifying with both established players and new entrants vying for market share through innovation and strategic partnerships. Market penetration of smart lighting solutions is steadily increasing, projected to reach xx% by 2033.

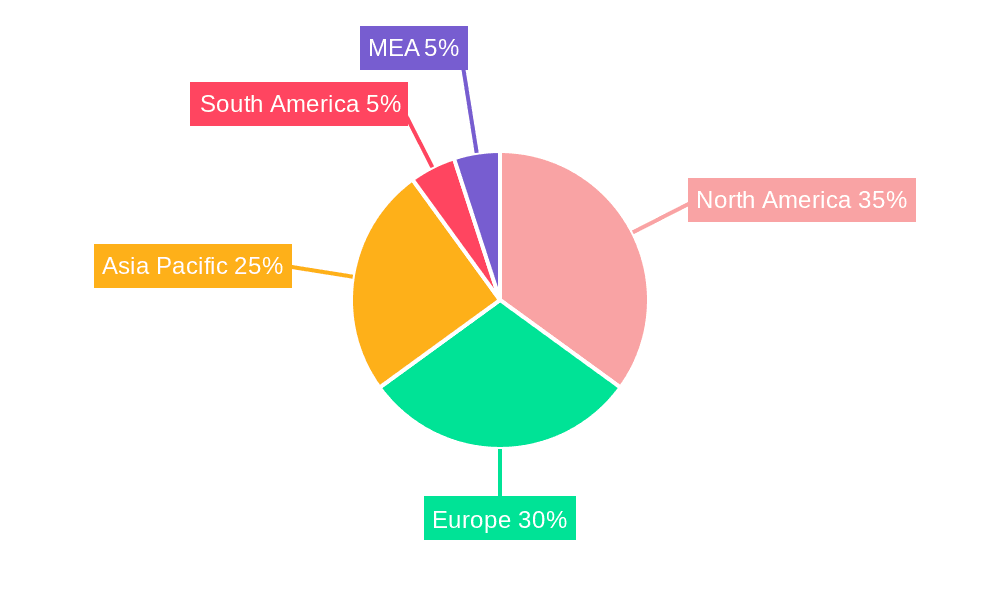

Dominant Regions & Segments in Street and Roadway Lighting Market

The Asia-Pacific region is currently the dominant market for street and roadway lighting, driven by rapid urbanization and significant infrastructure development projects. North America and Europe also hold substantial market share, with a focus on smart lighting technologies and energy efficiency initiatives.

Leading Regions: Asia-Pacific dominates due to substantial infrastructure investments and rapid urbanization. North America and Europe hold significant shares, driven by technological advancements and energy efficiency initiatives.

Dominant Segments:

- Lighting Type: LED lighting is the dominant segment, surpassing both conventional and smart lighting in market share. Smart lighting is experiencing rapid growth due to its energy efficiency and remote monitoring capabilities.

- Light Source: LEDs are the leading light source, owing to their energy efficiency, long lifespan, and superior performance. Fluorescent lamps and high-intensity discharge lamps are gradually being replaced.

- Offering: Hardware constitutes the largest segment, followed by control systems (software and services). The demand for integrated solutions is growing.

- Power: The segment of lights between 50W-150W holds the largest market share, driven by the widespread use of LEDs in street lighting applications.

- Application: Highways and street and roadways constitute the primary application segments.

Key Drivers:

- Economic policies: Government initiatives promoting sustainable infrastructure and energy efficiency.

- Infrastructure development: Ongoing investment in upgrading and expanding street and roadway lighting infrastructure worldwide.

Street and Roadway Lighting Market Product Innovations

Recent innovations focus on energy efficiency, smart functionalities, and improved durability. The introduction of solar-powered streetlights offers cost-effective and environmentally friendly solutions, particularly in off-grid areas. Advancements in LED technology are leading to higher lumen output, better color rendering, and longer lifespans. Smart lighting systems with remote monitoring and control capabilities are enhancing operational efficiency and reducing energy consumption. These innovations are tailored to meet the diverse needs of various applications, driving increased market penetration.

Report Scope & Segmentation Analysis

This report segments the Street and Roadway Lighting Market based on lighting type (conventional, smart), light source (LEDs, fluorescent lamps, high-intensity discharge lamps), offering (hardware, control systems, software & services), power (below 50W, 50W-150W, above 150W), and application (highways, streets & roadways). Each segment’s growth projections, market size, and competitive dynamics are comprehensively analyzed, providing a granular view of the market landscape. The smart lighting segment is projected to experience the fastest growth, driven by increasing adoption of smart city initiatives. LED-based lighting continues to dominate the light source segment.

Key Drivers of Street and Roadway Lighting Market Growth

The market is driven by several factors, including:

- Government regulations: Mandates for energy-efficient lighting solutions.

- Technological advancements: Development of energy-efficient and smart lighting technologies.

- Smart city initiatives: Integration of smart lighting into broader urban infrastructure development projects.

- Growing urbanization: Increased need for reliable and efficient street and roadway lighting in expanding cities.

- Cost reduction of LED technology: Making LED lighting a more economically viable option compared to conventional lighting.

Challenges in the Street and Roadway Lighting Market Sector

The Street and Roadway Lighting Market faces several challenges:

- High initial investment costs: Smart lighting systems and LED upgrades can involve substantial upfront investment for municipalities and other stakeholders.

- Maintenance and operational costs: Ongoing maintenance and repair can present significant costs.

- Cybersecurity risks: Smart lighting systems present potential cybersecurity vulnerabilities.

- Supply chain disruptions: Global supply chain challenges can impact the availability of components and materials.

- Competition: Intense competition among various vendors, often leading to price pressure.

Emerging Opportunities in Street and Roadway Lighting Market

Emerging opportunities include:

- Integration with other smart city technologies: Connecting street lighting to other smart city systems for enhanced functionality and efficiency.

- Development of innovative lighting solutions: Creation of new lighting designs and functionalities to cater to evolving needs.

- Expansion into new geographic markets: Growing demand in developing economies presents significant opportunities for market expansion.

- Adoption of energy harvesting technologies: Integrating solar or wind energy into street lighting systems for greater sustainability.

- Focus on data analytics: Utilizing data collected from smart lighting systems to optimize energy consumption and improve city management.

Leading Players in the Street and Roadway Lighting Market Market

Key Developments in Street and Roadway Lighting Market Industry

- July 2023: Crescent Lighting secures patents for its RAW LED Street Light (CRS70) and RAW LED Flood Light, marking a significant advancement in energy-efficient and durable street lighting solutions in India.

- June 2023: Streetleaf launches a new line of solar streetlights, providing a cost-effective and environmentally friendly alternative to grid-connected lighting solutions.

Future Outlook for Street and Roadway Lighting Market Market

The Street and Roadway Lighting Market is poised for continued growth, driven by technological innovation, increasing urbanization, and supportive government policies. The rising adoption of smart lighting technologies, particularly LED-based solutions, offers significant opportunities for market expansion. Furthermore, the integration of street lighting with other smart city infrastructure promises to create a more efficient and sustainable urban environment, driving further growth in the coming years. The market is expected to experience significant expansion as smart city initiatives continue to gain momentum.

Street and Roadway Lighting Market Segmentation

-

1. Lighting Type

- 1.1. Conventional Lighting

- 1.2. Smart Lighting

-

2. Light Source

- 2.1. LEDs

- 2.2. Fluorescent Lamps

- 2.3. High-intensity Discharge Lamps

-

3. Offering

-

3.1. Hardware

- 3.1.1. Lights and Bulbs

- 3.1.2. Luminaires

- 3.1.3. Control Systems

- 3.2. Software and Services

-

3.1. Hardware

-

4. Power

- 4.1. Below 50W

- 4.2. Between 50W - 150W

- 4.3. More Than 150W

-

5. Application

- 5.1. Highways

- 5.2. Street and Roadways

Street and Roadway Lighting Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Street and Roadway Lighting Market Regional Market Share

Geographic Coverage of Street and Roadway Lighting Market

Street and Roadway Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Intelligent Solutions in Street Lighting Systems; Increasing Adoption of Smart City Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Installation Cost of Smart Lighting

- 3.4. Market Trends

- 3.4.1. LED Lights Segment to Exhibit Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 5.1.1. Conventional Lighting

- 5.1.2. Smart Lighting

- 5.2. Market Analysis, Insights and Forecast - by Light Source

- 5.2.1. LEDs

- 5.2.2. Fluorescent Lamps

- 5.2.3. High-intensity Discharge Lamps

- 5.3. Market Analysis, Insights and Forecast - by Offering

- 5.3.1. Hardware

- 5.3.1.1. Lights and Bulbs

- 5.3.1.2. Luminaires

- 5.3.1.3. Control Systems

- 5.3.2. Software and Services

- 5.3.1. Hardware

- 5.4. Market Analysis, Insights and Forecast - by Power

- 5.4.1. Below 50W

- 5.4.2. Between 50W - 150W

- 5.4.3. More Than 150W

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Highways

- 5.5.2. Street and Roadways

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia

- 5.6.4. Latin America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6. North America Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6.1.1. Conventional Lighting

- 6.1.2. Smart Lighting

- 6.2. Market Analysis, Insights and Forecast - by Light Source

- 6.2.1. LEDs

- 6.2.2. Fluorescent Lamps

- 6.2.3. High-intensity Discharge Lamps

- 6.3. Market Analysis, Insights and Forecast - by Offering

- 6.3.1. Hardware

- 6.3.1.1. Lights and Bulbs

- 6.3.1.2. Luminaires

- 6.3.1.3. Control Systems

- 6.3.2. Software and Services

- 6.3.1. Hardware

- 6.4. Market Analysis, Insights and Forecast - by Power

- 6.4.1. Below 50W

- 6.4.2. Between 50W - 150W

- 6.4.3. More Than 150W

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Highways

- 6.5.2. Street and Roadways

- 6.1. Market Analysis, Insights and Forecast - by Lighting Type

- 7. Europe Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Lighting Type

- 7.1.1. Conventional Lighting

- 7.1.2. Smart Lighting

- 7.2. Market Analysis, Insights and Forecast - by Light Source

- 7.2.1. LEDs

- 7.2.2. Fluorescent Lamps

- 7.2.3. High-intensity Discharge Lamps

- 7.3. Market Analysis, Insights and Forecast - by Offering

- 7.3.1. Hardware

- 7.3.1.1. Lights and Bulbs

- 7.3.1.2. Luminaires

- 7.3.1.3. Control Systems

- 7.3.2. Software and Services

- 7.3.1. Hardware

- 7.4. Market Analysis, Insights and Forecast - by Power

- 7.4.1. Below 50W

- 7.4.2. Between 50W - 150W

- 7.4.3. More Than 150W

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Highways

- 7.5.2. Street and Roadways

- 7.1. Market Analysis, Insights and Forecast - by Lighting Type

- 8. Asia Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Lighting Type

- 8.1.1. Conventional Lighting

- 8.1.2. Smart Lighting

- 8.2. Market Analysis, Insights and Forecast - by Light Source

- 8.2.1. LEDs

- 8.2.2. Fluorescent Lamps

- 8.2.3. High-intensity Discharge Lamps

- 8.3. Market Analysis, Insights and Forecast - by Offering

- 8.3.1. Hardware

- 8.3.1.1. Lights and Bulbs

- 8.3.1.2. Luminaires

- 8.3.1.3. Control Systems

- 8.3.2. Software and Services

- 8.3.1. Hardware

- 8.4. Market Analysis, Insights and Forecast - by Power

- 8.4.1. Below 50W

- 8.4.2. Between 50W - 150W

- 8.4.3. More Than 150W

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Highways

- 8.5.2. Street and Roadways

- 8.1. Market Analysis, Insights and Forecast - by Lighting Type

- 9. Latin America Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Lighting Type

- 9.1.1. Conventional Lighting

- 9.1.2. Smart Lighting

- 9.2. Market Analysis, Insights and Forecast - by Light Source

- 9.2.1. LEDs

- 9.2.2. Fluorescent Lamps

- 9.2.3. High-intensity Discharge Lamps

- 9.3. Market Analysis, Insights and Forecast - by Offering

- 9.3.1. Hardware

- 9.3.1.1. Lights and Bulbs

- 9.3.1.2. Luminaires

- 9.3.1.3. Control Systems

- 9.3.2. Software and Services

- 9.3.1. Hardware

- 9.4. Market Analysis, Insights and Forecast - by Power

- 9.4.1. Below 50W

- 9.4.2. Between 50W - 150W

- 9.4.3. More Than 150W

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Highways

- 9.5.2. Street and Roadways

- 9.1. Market Analysis, Insights and Forecast - by Lighting Type

- 10. Middle East and Africa Street and Roadway Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Lighting Type

- 10.1.1. Conventional Lighting

- 10.1.2. Smart Lighting

- 10.2. Market Analysis, Insights and Forecast - by Light Source

- 10.2.1. LEDs

- 10.2.2. Fluorescent Lamps

- 10.2.3. High-intensity Discharge Lamps

- 10.3. Market Analysis, Insights and Forecast - by Offering

- 10.3.1. Hardware

- 10.3.1.1. Lights and Bulbs

- 10.3.1.2. Luminaires

- 10.3.1.3. Control Systems

- 10.3.2. Software and Services

- 10.3.1. Hardware

- 10.4. Market Analysis, Insights and Forecast - by Power

- 10.4.1. Below 50W

- 10.4.2. Between 50W - 150W

- 10.4.3. More Than 150W

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Highways

- 10.5.2. Street and Roadways

- 10.1. Market Analysis, Insights and Forecast - by Lighting Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Signify

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eaton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Philips

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acuity Brands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GE Lighting

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Signify

List of Figures

- Figure 1: Global Street and Roadway Lighting Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Street and Roadway Lighting Market Revenue (billion), by Lighting Type 2025 & 2033

- Figure 3: North America Street and Roadway Lighting Market Revenue Share (%), by Lighting Type 2025 & 2033

- Figure 4: North America Street and Roadway Lighting Market Revenue (billion), by Light Source 2025 & 2033

- Figure 5: North America Street and Roadway Lighting Market Revenue Share (%), by Light Source 2025 & 2033

- Figure 6: North America Street and Roadway Lighting Market Revenue (billion), by Offering 2025 & 2033

- Figure 7: North America Street and Roadway Lighting Market Revenue Share (%), by Offering 2025 & 2033

- Figure 8: North America Street and Roadway Lighting Market Revenue (billion), by Power 2025 & 2033

- Figure 9: North America Street and Roadway Lighting Market Revenue Share (%), by Power 2025 & 2033

- Figure 10: North America Street and Roadway Lighting Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Street and Roadway Lighting Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Street and Roadway Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Street and Roadway Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Street and Roadway Lighting Market Revenue (billion), by Lighting Type 2025 & 2033

- Figure 15: Europe Street and Roadway Lighting Market Revenue Share (%), by Lighting Type 2025 & 2033

- Figure 16: Europe Street and Roadway Lighting Market Revenue (billion), by Light Source 2025 & 2033

- Figure 17: Europe Street and Roadway Lighting Market Revenue Share (%), by Light Source 2025 & 2033

- Figure 18: Europe Street and Roadway Lighting Market Revenue (billion), by Offering 2025 & 2033

- Figure 19: Europe Street and Roadway Lighting Market Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Europe Street and Roadway Lighting Market Revenue (billion), by Power 2025 & 2033

- Figure 21: Europe Street and Roadway Lighting Market Revenue Share (%), by Power 2025 & 2033

- Figure 22: Europe Street and Roadway Lighting Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Street and Roadway Lighting Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Street and Roadway Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Street and Roadway Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Street and Roadway Lighting Market Revenue (billion), by Lighting Type 2025 & 2033

- Figure 27: Asia Street and Roadway Lighting Market Revenue Share (%), by Lighting Type 2025 & 2033

- Figure 28: Asia Street and Roadway Lighting Market Revenue (billion), by Light Source 2025 & 2033

- Figure 29: Asia Street and Roadway Lighting Market Revenue Share (%), by Light Source 2025 & 2033

- Figure 30: Asia Street and Roadway Lighting Market Revenue (billion), by Offering 2025 & 2033

- Figure 31: Asia Street and Roadway Lighting Market Revenue Share (%), by Offering 2025 & 2033

- Figure 32: Asia Street and Roadway Lighting Market Revenue (billion), by Power 2025 & 2033

- Figure 33: Asia Street and Roadway Lighting Market Revenue Share (%), by Power 2025 & 2033

- Figure 34: Asia Street and Roadway Lighting Market Revenue (billion), by Application 2025 & 2033

- Figure 35: Asia Street and Roadway Lighting Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Asia Street and Roadway Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Street and Roadway Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Street and Roadway Lighting Market Revenue (billion), by Lighting Type 2025 & 2033

- Figure 39: Latin America Street and Roadway Lighting Market Revenue Share (%), by Lighting Type 2025 & 2033

- Figure 40: Latin America Street and Roadway Lighting Market Revenue (billion), by Light Source 2025 & 2033

- Figure 41: Latin America Street and Roadway Lighting Market Revenue Share (%), by Light Source 2025 & 2033

- Figure 42: Latin America Street and Roadway Lighting Market Revenue (billion), by Offering 2025 & 2033

- Figure 43: Latin America Street and Roadway Lighting Market Revenue Share (%), by Offering 2025 & 2033

- Figure 44: Latin America Street and Roadway Lighting Market Revenue (billion), by Power 2025 & 2033

- Figure 45: Latin America Street and Roadway Lighting Market Revenue Share (%), by Power 2025 & 2033

- Figure 46: Latin America Street and Roadway Lighting Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Latin America Street and Roadway Lighting Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Latin America Street and Roadway Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Latin America Street and Roadway Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Lighting Type 2025 & 2033

- Figure 51: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Lighting Type 2025 & 2033

- Figure 52: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Light Source 2025 & 2033

- Figure 53: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Light Source 2025 & 2033

- Figure 54: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Offering 2025 & 2033

- Figure 55: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Offering 2025 & 2033

- Figure 56: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Power 2025 & 2033

- Figure 57: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Power 2025 & 2033

- Figure 58: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Application 2025 & 2033

- Figure 59: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Application 2025 & 2033

- Figure 60: Middle East and Africa Street and Roadway Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Street and Roadway Lighting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 2: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 3: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 4: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 5: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Street and Roadway Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 8: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 9: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 10: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 11: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Street and Roadway Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 14: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 15: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 16: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 17: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Street and Roadway Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 20: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 21: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 22: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 23: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Street and Roadway Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 26: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 27: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 28: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 29: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Street and Roadway Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Street and Roadway Lighting Market Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 32: Global Street and Roadway Lighting Market Revenue billion Forecast, by Light Source 2020 & 2033

- Table 33: Global Street and Roadway Lighting Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 34: Global Street and Roadway Lighting Market Revenue billion Forecast, by Power 2020 & 2033

- Table 35: Global Street and Roadway Lighting Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Street and Roadway Lighting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Street and Roadway Lighting Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Street and Roadway Lighting Market?

Key companies in the market include Signify , Eaton , Philips , Acuity Brands, GE Lighting .

3. What are the main segments of the Street and Roadway Lighting Market?

The market segments include Lighting Type, Light Source, Offering, Power, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Intelligent Solutions in Street Lighting Systems; Increasing Adoption of Smart City Infrastructure.

6. What are the notable trends driving market growth?

LED Lights Segment to Exhibit Significant Growth.

7. Are there any restraints impacting market growth?

High Installation Cost of Smart Lighting.

8. Can you provide examples of recent developments in the market?

July 2023: Crescent Lighting got the patent for two of their innovations, the RAW LED Street Light and the newly launched RAW LED Flood Light. The RAW LED Street Light- CRS70 has been claimed to be the first of its kind in India and utilizes PC (polycarbonate) material for delivering exceptional performance. It is expected to set up a new standard in energy efficiency and longevity, paving the way for a brighter and more sustainable future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Street and Roadway Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Street and Roadway Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Street and Roadway Lighting Market?

To stay informed about further developments, trends, and reports in the Street and Roadway Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence