Key Insights

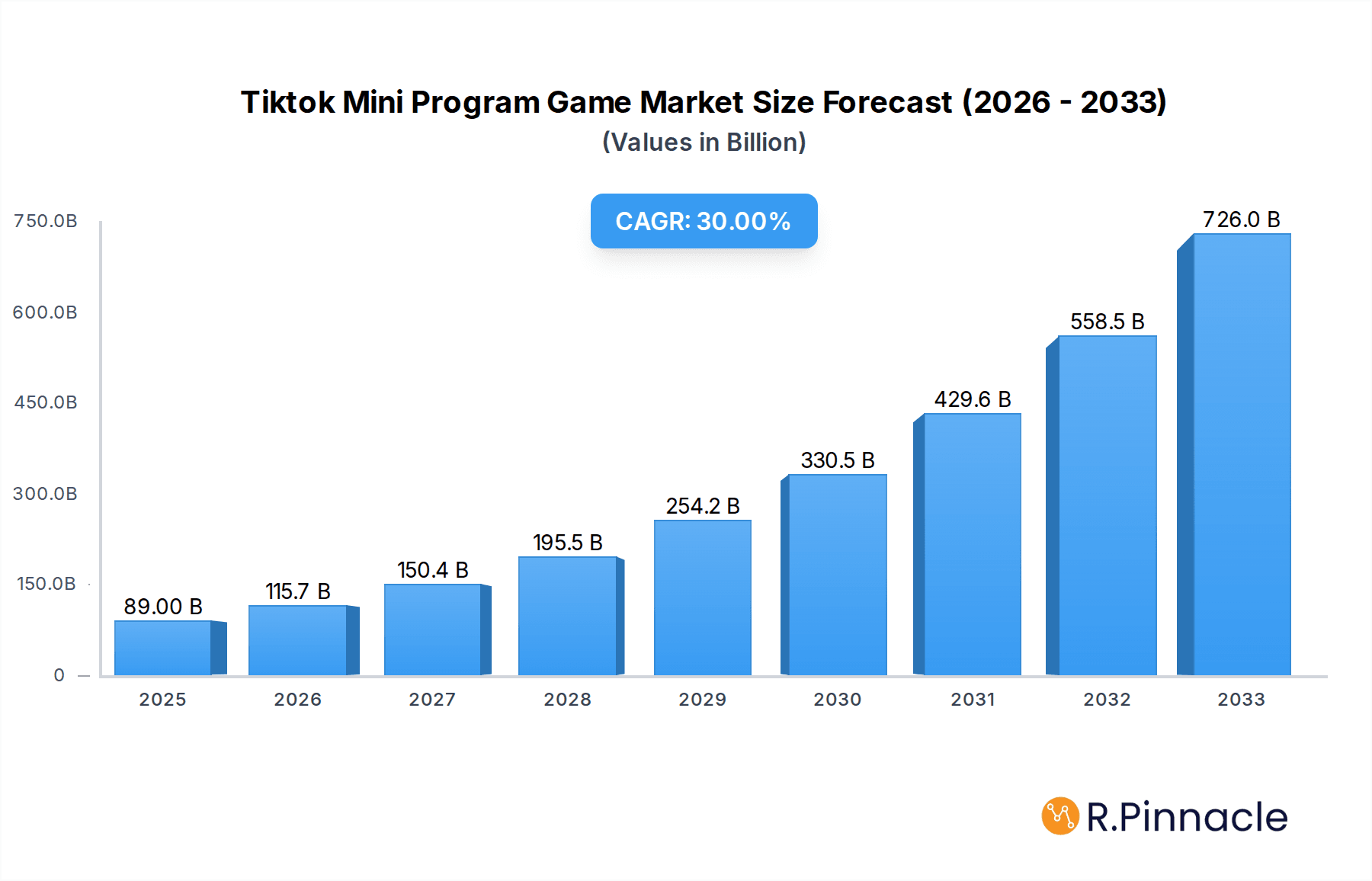

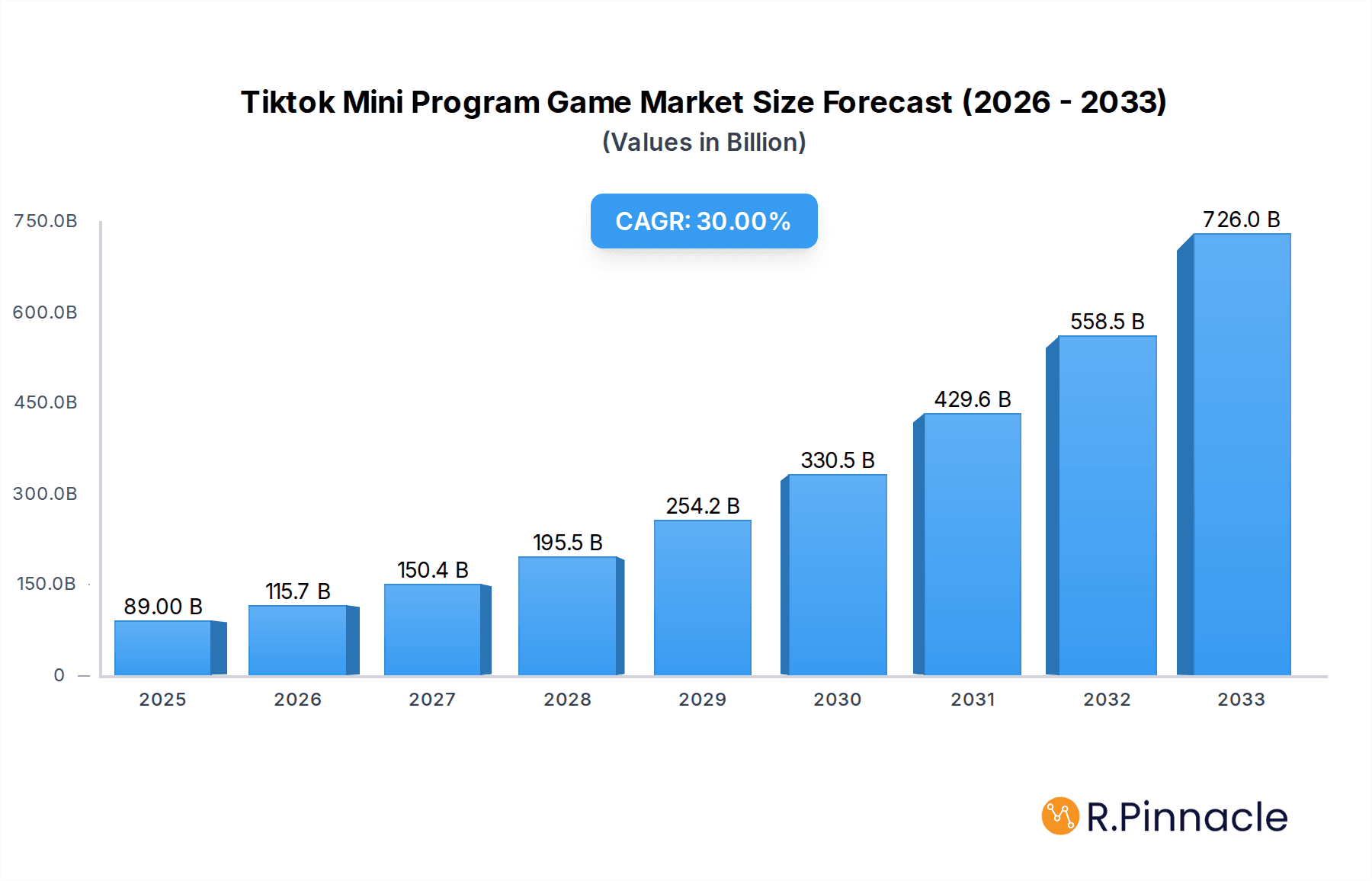

The TikTok Mini Program Game market is experiencing explosive growth, projected to reach an estimated $89 billion in 2025. This remarkable expansion is driven by a confluence of factors, including the platform's massive global user base, its inherent virality, and the increasing integration of gaming into social media experiences. The CAGR of 30% over the forecast period signifies a sustained and rapid upward trajectory. This growth is fueled by the appeal of lightweight, easily accessible games that can be played directly within the TikTok app, eliminating the need for separate downloads and offering immediate entertainment. Key applications within this burgeoning market include games designed for both Android and iOS platforms, with segments like Chess, Business simulations, and Puzzle games showing particular promise, alongside a diverse range of "Others" encompassing hyper-casual and arcade-style experiences. Emerging trends like social gaming, in-app purchases within mini-programs, and influencer-driven game promotion are further accelerating this market's ascent.

Tiktok Mini Program Game Market Size (In Billion)

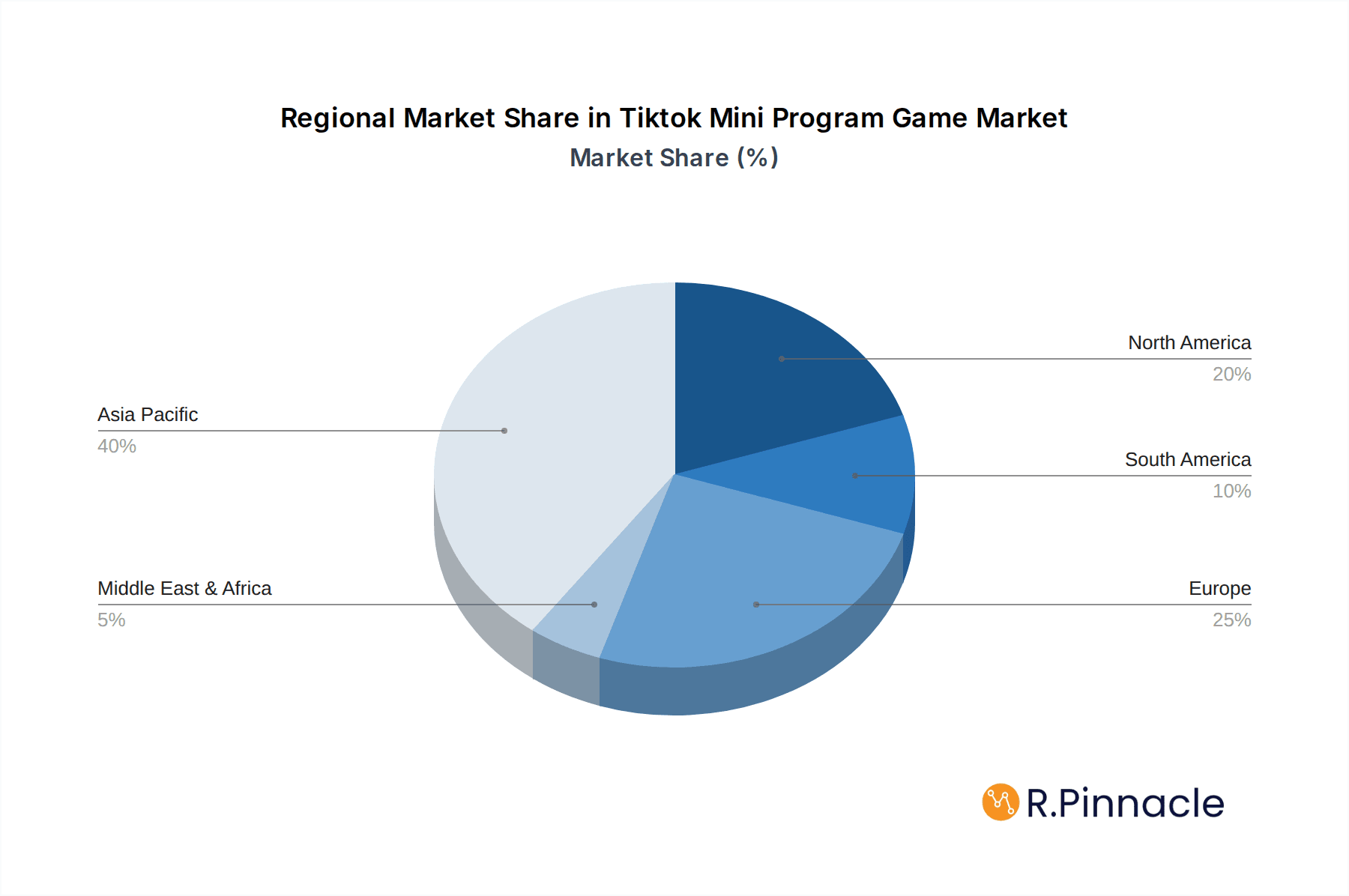

The market's impressive growth, however, is not without its potential challenges. While the drivers are strong, restrains such as the evolving regulatory landscape surrounding in-app monetization and data privacy, coupled with the intense competition from established mobile gaming giants and other entertainment platforms, will require strategic navigation by market players. Despite these potential headwinds, the sheer scale of TikTok's audience and the platform's innovative approach to content consumption create a fertile ground for mini-program games. Companies like Tencent Holdings Limited and Cheetah Mobile are well-positioned to capitalize on this trend, leveraging their expertise in game development and platform integration. The Asia Pacific region, particularly China, is expected to lead the market due to its early adoption of mini-program ecosystems and a highly engaged gaming demographic, while North America and Europe are also anticipated to witness substantial growth as more users discover and engage with these in-app gaming experiences.

Tiktok Mini Program Game Company Market Share

This in-depth report provides a granular analysis of the global Tiktok Mini Program Game market, offering critical insights for industry stakeholders. Covering the historical period of 2019–2024, a base year of 2025, and a forecast period extending to 2033, this study leverages extensive data to map market structures, understand evolving dynamics, and predict future trajectories. With an estimated market size of X billion USD in 2025, growing at a projected Compound Annual Growth Rate (CAGR) of X% during the forecast period, this report is an indispensable tool for navigating the rapidly expanding landscape of integrated social and gaming experiences on the TikTok platform. We meticulously examine market concentration, innovation trends, regulatory landscapes, product substitutes, end-user demographics, and strategic M&A activities, alongside crucial market dynamics, dominant regional segments, and pioneering product innovations.

Tiktok Mini Program Game Market Structure & Innovation Trends

The Tiktok Mini Program Game market exhibits a dynamic structure characterized by a growing number of specialized developers and publishers vying for user attention within a highly engaged social ecosystem. Market concentration is currently moderate, with a few key players holding substantial user bases, but innovation is a primary driver of market share shifts. Emerging trends indicate a move towards more social-integrated gameplay, leveraging TikTok's short-form video format for user acquisition and engagement, such as viral challenges and creator-led game promotion. The regulatory framework surrounding mini-program development and user data privacy on platforms like TikTok is continuously evolving, influencing development strategies. Product substitutes include traditional mobile games and other forms of in-app entertainment, but the seamless integration within the TikTok feed offers a unique value proposition. End-user demographics on TikTok are predominantly younger, tech-savvy individuals, with a growing older demographic showing interest in casual gaming experiences. Merger and acquisition activities are anticipated to increase as established gaming companies seek to expand their presence in the mini-program space, with an estimated X billion USD in M&A deal values expected over the forecast period.

- Market Concentration: Moderate, with an increasing number of specialized developers.

- Innovation Drivers: Social integration, viral mechanics, creator economy.

- Regulatory Frameworks: Evolving data privacy and platform policies.

- Product Substitutes: Traditional mobile games, other in-app entertainment.

- End-User Demographics: Predominantly Gen Z and Millennials, with expanding older demographics.

- M&A Activities: Expected to grow, with estimated deal values of X billion USD.

Tiktok Mini Program Game Market Dynamics & Trends

The Tiktok Mini Program Game market is experiencing robust growth, driven by several interconnected factors and technological disruptions. The platform's massive global user base, exceeding X billion active users, provides an unparalleled distribution channel for mini-program games. This vast audience, characterized by high engagement rates and a preference for short-form, interactive content, directly fuels market penetration for these games. The integration of gaming within the social media feed minimizes user acquisition friction, enabling rapid scaling for successful titles. Technological advancements, including improved in-app development tools and enhanced rendering capabilities for mini-programs, are allowing for more sophisticated and engaging gaming experiences to be delivered seamlessly within the TikTok ecosystem. Consumer preferences are increasingly leaning towards casual, accessible games that can be played in short bursts, aligning perfectly with the consumption habits fostered by TikTok. Furthermore, the rise of the creator economy plays a pivotal role; content creators on TikTok are becoming powerful influencers, driving game discovery and adoption through gameplay streams, reviews, and promotional content. This symbiotic relationship between creators and game developers is a significant growth accelerator. Competitive dynamics are intensifying, with both established gaming giants and agile indie studios vying for dominance. Companies like Tencent Holdings Limited, Cheetah Mobile, and Boom Bit are actively exploring and investing in this space, recognizing its potential for massive user reach and monetization. The increasing sophistication of in-app purchase models, coupled with ad-revenue streams, is also contributing to the market's economic viability. The estimated market penetration for Tiktok Mini Program Games is projected to reach XX% by 2033, underscoring its rapid expansion.

Dominant Regions & Segments in Tiktok Mini Program Game

The Tiktok Mini Program Game market's dominance is significantly influenced by regional user demographics, platform adoption rates, and local developer ecosystems. While North America and Europe represent substantial markets due to their high TikTok penetration and disposable income, the Asia-Pacific region, particularly China, is a powerhouse for mini-program innovation and consumption, historically due to platforms like WeChat. However, TikTok's global surge has significantly boosted its mini-program gaming potential across all major continents. Within application segments, Android currently holds a larger market share due to its global prevalence, but iOS users, often associated with higher spending potential, are a crucial target demographic. The Puzzle and Others categories, which encompass hyper-casual, arcade, and social simulation games, are currently dominating the landscape. These genres align well with the short-form, quick-play nature of TikTok content and appeal to a broad audience.

- Leading Region: Asia-Pacific, due to its historical mini-program adoption and strong developer base, followed closely by North America and Europe as TikTok's global reach expands.

- Dominant Application Segment: Android, owing to its wider global market share, with iOS as a key high-value market.

- Dominant Type Segment: Puzzle and Others (including hyper-casual, arcade, and social simulation games) are leading due to their accessibility and short-session playability, aligning perfectly with TikTok's user engagement patterns.

- Key Drivers of Dominance in Asia-Pacific:

- Economic Policies: Favorable policies encouraging digital innovation and app development.

- Infrastructure: Widespread internet penetration and smartphone adoption.

- Cultural Affinity: Strong existing culture of casual gaming and social interaction within digital platforms.

- Developer Ecosystem: A robust and innovative local developer community.

- Analysis of Dominance: The dominance of Puzzle and Others segments is directly tied to the core user behavior on TikTok – seeking quick, entertaining, and easily shareable content. These game types require minimal learning curves and offer immediate gratification, making them ideal for the platform's feed-driven discovery model.

Tiktok Mini Program Game Product Innovations

Product innovations in the Tiktok Mini Program Game market are primarily focused on seamless integration, social interactivity, and leveraging TikTok's unique content creation tools. Developers are increasingly incorporating features that encourage user-generated content related to gameplay, such as creating highlight clips or participating in in-game challenges that can be shared directly on TikTok. Competitive advantages are being forged through innovative monetization strategies, including hybrid models combining in-app purchases with opt-in advertising that feels less intrusive due to its context within engaging short-form video content. The development of hyper-casual games with simple yet addictive mechanics, coupled with visually appealing aesthetics, is a key trend. Furthermore, the exploration of AR/VR elements within mini-programs, though nascent, promises to unlock new dimensions of immersive gameplay and user engagement, pushing the boundaries of what's possible within a lightweight, in-app environment.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Tiktok Mini Program Game market, segmented by Application and Type. The Application segments include Android and iOS, each offering distinct user behaviors and monetization potentials. The Type segments encompass Chess, Business, Puzzle, and Others. Our analysis delves into the market size and projected growth for each of these segments, providing actionable intelligence on competitive dynamics and adoption rates.

- Application: Android: This segment is expected to maintain a significant market share due to its global reach and diverse user base. Growth projections indicate a steady upward trend, driven by increasing smartphone penetration and the accessibility of the Android ecosystem.

- Application: iOS: While having a smaller global user base than Android, the iOS segment represents a high-value market with users often exhibiting higher spending propensity on in-app purchases and subscriptions. Growth projections are robust, fueled by a dedicated user base and a premium app store experience.

- Type: Chess: This segment, while niche, caters to a dedicated audience appreciating strategic gameplay. Growth is expected to be moderate, driven by the enduring appeal of chess and potential for social integration within TikTok.

- Type: Business: This segment includes simulation and strategy games focused on economic or corporate themes. Growth is projected to be steady, appealing to users who enjoy strategic planning and management within a gamified environment.

- Type: Puzzle: This segment is a key driver of the market, encompassing a wide array of brain-teasing games. High growth is anticipated, leveraging the casual and engaging nature of puzzle games, which are highly shareable and suitable for short play sessions on TikTok.

- Type: Others: This broad category includes hyper-casual, arcade, action, and social simulation games. This segment is projected for explosive growth, as it aligns perfectly with TikTok's content consumption patterns and offers diverse gameplay experiences that can quickly go viral.

Key Drivers of Tiktok Mini Program Game Growth

The exponential growth of the Tiktok Mini Program Game market is propelled by a confluence of powerful factors. The platform's unprecedented global user base, exceeding X billion, provides an unparalleled distribution channel, enabling rapid user acquisition for games. The inherent virality of TikTok's content format, coupled with the integration of gaming, fosters organic discovery and sharing, significantly reducing customer acquisition costs. Technological advancements in in-app development and rendering capabilities are enabling more sophisticated and engaging gaming experiences to be delivered seamlessly. Furthermore, evolving consumer preferences for casual, short-session games that can be enjoyed on-the-go perfectly align with the nature of mini-program games. The burgeoning creator economy also plays a crucial role, with influencers driving game popularity through gameplay showcases and recommendations.

- Massive User Base & Reach: Access to over X billion active TikTok users.

- Virality & Content Integration: Seamless sharing and discovery within the TikTok feed.

- Technological Advancements: Improved development tools and enhanced in-app performance.

- Consumer Preferences: Demand for casual, short-form, and accessible gaming experiences.

- Creator Economy Influence: Influencer marketing driving game awareness and adoption.

Challenges in the Tiktok Mini Program Game Sector

Despite its immense potential, the Tiktok Mini Program Game sector faces several significant challenges that could impede its growth trajectory. Regulatory hurdles related to data privacy, content moderation, and in-app purchases are becoming increasingly complex as platforms mature. The highly saturated nature of the app stores and the constant demand for novelty mean that maintaining user engagement and preventing churn is a perpetual challenge, requiring continuous innovation and marketing efforts. Competition is fierce, not only from other mini-program games but also from traditional mobile games and other forms of digital entertainment vying for users' limited attention spans. Monetization can also be a hurdle, with a need to balance user experience with revenue generation, especially in markets with lower disposable income.

- Regulatory Landscape: Evolving policies on data privacy, content moderation, and in-app monetization.

- User Retention & Churn: Intense competition requires constant engagement and new content.

- Market Saturation: A crowded marketplace demanding unique value propositions.

- Monetization Strategies: Balancing revenue generation with user experience.

- Discovery Fatigue: Users may become overwhelmed by the sheer volume of available games.

Emerging Opportunities in Tiktok Mini Program Game

The Tiktok Mini Program Game market is ripe with emerging opportunities for innovation and expansion. The increasing integration of augmented reality (AR) and virtual reality (VR) elements within mini-programs promises to unlock more immersive and interactive gaming experiences, captivating users with novel gameplay. The platform's strong social features offer fertile ground for the development of cooperative and competitive multiplayer games that can foster vibrant communities. As the global reach of TikTok expands, there's a significant opportunity to cater to diverse cultural preferences and localize games for specific regional markets. Furthermore, advancements in AI and machine learning can be leveraged to personalize gameplay experiences and optimize in-app economies, leading to higher user satisfaction and retention. The growing interest in educational and skill-based mini-programs also presents a new avenue for content diversification.

- AR/VR Integration: Enhancing immersion and interactivity in gameplay.

- Social & Multiplayer Features: Building communities around cooperative and competitive games.

- Regional Localization: Tailoring games to diverse cultural preferences.

- AI & Personalization: Optimizing user experience and in-app economies.

- Educational & Skill-Based Games: Diversifying content beyond entertainment.

Leading Players in the Tiktok Mini Program Game Market

- Tencent Holdings Limited

- Cheetah Mobile

- Boom Bit

- SYBO Games

- Two Mile Technology Chengdu Co., Ltd.

- Beijing Haoteng Jiake Technology Co., Ltd.

- Qingdao Lanfei Interactive Entertainment Technology Co., Ltd.

- Crazy Games Citrus Studio

- Beijing Jianyou Technology Co., Ltd.

Key Developments in Tiktok Mini Program Game Industry

- 2023 Q4: Increased investment in hyper-casual game development specifically for TikTok mini-programs by major publishers.

- 2024 Q1: Rollout of enhanced in-app purchase SDKs by TikTok, offering developers more robust monetization tools.

- 2024 Q2: Launch of several viral puzzle games that achieved millions of downloads within weeks, highlighting the platform's discoverability potential.

- 2024 Q3: Greater adoption of creator-led game promotion strategies, with creators acting as early access testers and brand ambassadors.

- 2024 Q4: Emergence of early-stage AR-enhanced mini-game prototypes showcasing future immersive possibilities.

- 2025 Q1: Anticipated release of new API integrations for deeper social graph connectivity within mini-programs.

Future Outlook for Tiktok Mini Program Game Market

The future outlook for the Tiktok Mini Program Game market is exceptionally bright, poised for sustained growth and significant expansion. The platform's inherent virality and its integration into daily social media consumption habits provide a powerful, continually expanding user base. As development tools mature and monetization strategies become more sophisticated, we can expect a proliferation of high-quality, engaging gaming experiences. The increasing adoption of AI for personalized gameplay and the exploration of innovative technologies like AR/VR will further enhance the player experience and unlock new revenue streams. Strategic partnerships between content creators and game developers will likely become even more crucial, creating a self-reinforcing growth loop. The market is expected to see a diversification of game genres, moving beyond hyper-casual to encompass more complex and socially driven titles, solidifying its position as a major segment within the global gaming industry.

Tiktok Mini Program Game Segmentation

-

1. Application

- 1.1. Android

- 1.2. IOS

-

2. Type

- 2.1. Chess

- 2.2. Business

- 2.3. Puzzle

- 2.4. Others

Tiktok Mini Program Game Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tiktok Mini Program Game Regional Market Share

Geographic Coverage of Tiktok Mini Program Game

Tiktok Mini Program Game REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Android

- 5.1.2. IOS

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Chess

- 5.2.2. Business

- 5.2.3. Puzzle

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Android

- 6.1.2. IOS

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Chess

- 6.2.2. Business

- 6.2.3. Puzzle

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Android

- 7.1.2. IOS

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Chess

- 7.2.2. Business

- 7.2.3. Puzzle

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Android

- 8.1.2. IOS

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Chess

- 8.2.2. Business

- 8.2.3. Puzzle

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Android

- 9.1.2. IOS

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Chess

- 9.2.2. Business

- 9.2.3. Puzzle

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tiktok Mini Program Game Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Android

- 10.1.2. IOS

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Chess

- 10.2.2. Business

- 10.2.3. Puzzle

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boom Bit

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SYBO Games

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Two Mile Technology Chengdu Co. Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beijing Haoteng Jiake Technology Co. Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qingdao Lanfei Interactive Entertainment Technology Co. Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cheetah Mobile

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crazy Games Citrus Studio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tencent Holdings Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beijing Jianyou Technology Co. Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Boom Bit

List of Figures

- Figure 1: Global Tiktok Mini Program Game Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tiktok Mini Program Game Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Tiktok Mini Program Game Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Tiktok Mini Program Game Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Tiktok Mini Program Game Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Tiktok Mini Program Game Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Tiktok Mini Program Game Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Tiktok Mini Program Game Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Tiktok Mini Program Game Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Tiktok Mini Program Game Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Tiktok Mini Program Game Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Tiktok Mini Program Game Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Tiktok Mini Program Game Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Tiktok Mini Program Game Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Tiktok Mini Program Game Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Tiktok Mini Program Game Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Tiktok Mini Program Game Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Tiktok Mini Program Game Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Tiktok Mini Program Game Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Tiktok Mini Program Game Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Tiktok Mini Program Game Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Tiktok Mini Program Game Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Tiktok Mini Program Game Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Tiktok Mini Program Game Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Tiktok Mini Program Game Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Tiktok Mini Program Game Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Tiktok Mini Program Game Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Tiktok Mini Program Game Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Tiktok Mini Program Game Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Tiktok Mini Program Game Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Tiktok Mini Program Game Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Tiktok Mini Program Game Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Tiktok Mini Program Game Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Tiktok Mini Program Game Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Tiktok Mini Program Game Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Tiktok Mini Program Game Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Tiktok Mini Program Game Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Tiktok Mini Program Game Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Tiktok Mini Program Game Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Tiktok Mini Program Game Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tiktok Mini Program Game?

The projected CAGR is approximately 30%.

2. Which companies are prominent players in the Tiktok Mini Program Game?

Key companies in the market include Boom Bit, SYBO Games, Two Mile Technology Chengdu Co., Ltd., Beijing Haoteng Jiake Technology Co., Ltd., Qingdao Lanfei Interactive Entertainment Technology Co., Ltd., Cheetah Mobile, Crazy Games Citrus Studio, Tencent Holdings Limited, Beijing Jianyou Technology Co., Ltd..

3. What are the main segments of the Tiktok Mini Program Game?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tiktok Mini Program Game," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tiktok Mini Program Game report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tiktok Mini Program Game?

To stay informed about further developments, trends, and reports in the Tiktok Mini Program Game, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence