Key Insights

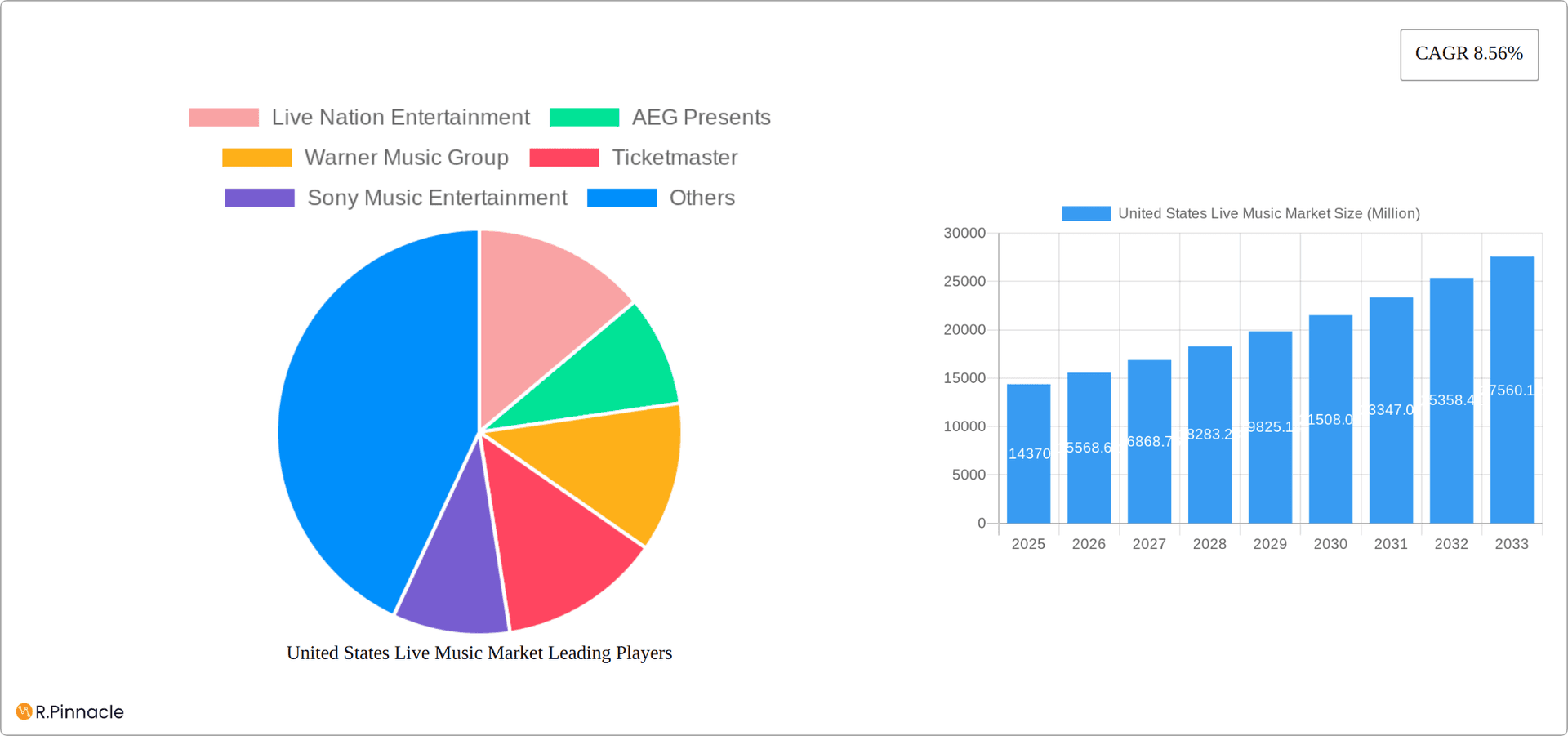

The United States live music market, valued at $14.37 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.56% from 2025 to 2033. This significant expansion is driven by several key factors. Increased disposable income among millennials and Gen Z, coupled with a resurgence in live entertainment post-pandemic, fuels strong demand for concerts and festivals. The rise of streaming services, while impacting music sales, paradoxically enhances artist discovery and creates a larger audience eager for live performances. Technological advancements, such as improved ticketing platforms and enhanced audio-visual experiences at venues, further contribute to market growth. While economic downturns could potentially restrain spending on entertainment, the enduring appeal of live music suggests this sector remains relatively resilient. The market is segmented by genre (rock, pop, country, etc.), venue size (small clubs to large stadiums), and event type (concerts, festivals, tours). Key players, including Live Nation Entertainment, AEG Presents, and Ticketmaster, dominate the landscape, leveraging their extensive networks and promotional capabilities. Competition remains fierce, however, with smaller promoters and independent venues carving out niches.

United States Live Music Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, though the rate of growth might fluctuate slightly year-over-year, reflecting broader economic conditions. The dominance of established players will likely persist, but innovative business models and emerging artists could challenge the status quo. Geographic variations will also exist, with major metropolitan areas generally exhibiting higher demand. The market will continue to adapt to evolving consumer preferences and technological disruptions, leading to new opportunities for growth and diversification within the live music industry. Factors such as sustainable practices and inclusivity are likely to become increasingly important considerations for both consumers and businesses in the years ahead.

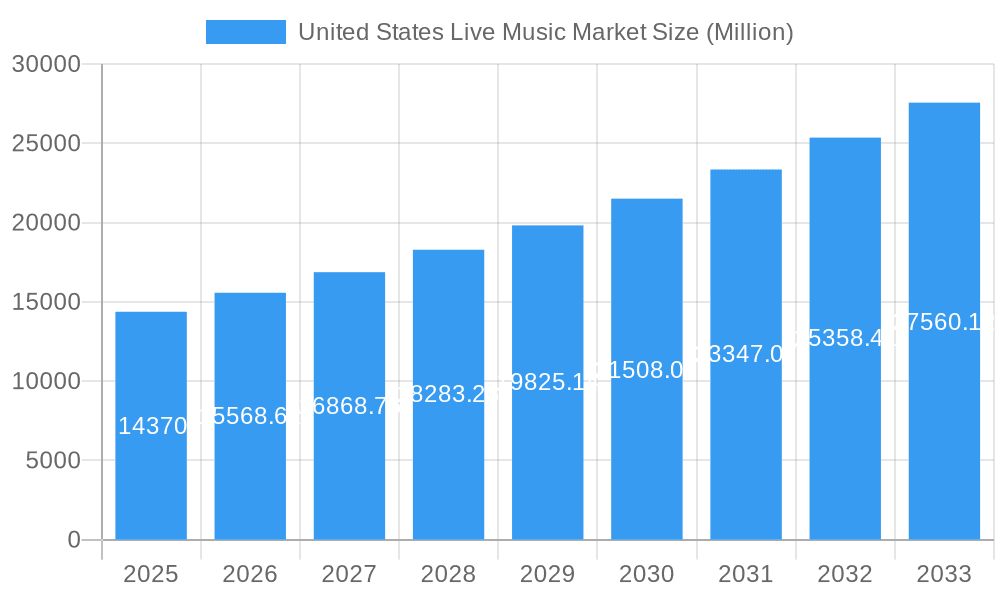

United States Live Music Market Company Market Share

United States Live Music Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States live music market, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a focus on market structure, dynamics, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report utilizes data from the historical period (2019-2024) to project future market growth and opportunities. Key players such as Live Nation Entertainment, AEG Presents, Warner Music Group, Ticketmaster, Sony Music Entertainment, C3 Presents, Wasserman Music, Anschutz Entertainment Group (AEG), Goldenvoice, and Bandsintown are analyzed, though this list is not exhaustive.

United States Live Music Market Market Structure & Innovation Trends

The US live music market is a dynamic landscape dominated by major players like Live Nation Entertainment and AEG Presents, who wield significant influence over pricing, venue availability, and artist bookings. This concentrated market structure is further solidified by the consolidation of ticketing giants such as Ticketmaster. Innovation is fueled by rapid technological advancements, encompassing high-fidelity streaming, sophisticated ticketing systems, immersive virtual experiences, and continuously evolving fan engagement strategies. The regulatory environment, particularly antitrust and intellectual property laws, plays a crucial role in shaping market dynamics. The market faces competition from substitute products, such as online streaming concerts and readily available recorded music. The diverse end-user demographic spans a wide range of ages and musical tastes, demanding a versatile and adaptable market response. Significant M&A activity, with deal values reaching into the hundreds of millions of dollars (specific figures unavailable for this update), has focused on acquiring smaller promoters, venues, and technology companies, further consolidating market power and resources.

- Market Share (Estimated 2025): Live Nation: 40%, AEG Presents: 25%, Others: 35% (Note: These figures are estimates and may vary based on the source and methodology used.)

- M&A Deal Value (2019-2024): [Insert Updated Value or Range Here] (Note: Please provide the accurate M&A deal value for a more precise report.)

- Key Innovation Drivers: Technological advancements in high-fidelity audio streaming, immersive virtual and augmented reality concerts, data analytics for personalized fan experiences, and AI-driven marketing and logistics.

United States Live Music Market Market Dynamics & Trends

The US live music market exhibits robust growth, fueled by increasing disposable incomes, a vibrant music scene, and technological advancements. The Compound Annual Growth Rate (CAGR) from 2025-2033 is projected to be xx%, driven by factors such as rising demand for live experiences, increased festival attendance, and innovative concert formats. Technological disruptions, such as the rise of virtual concerts and immersive audio technologies, have significantly changed the landscape. Consumer preferences are increasingly diverse, with demand for niche genres and personalized experiences growing rapidly. Competitive dynamics are intense, with major players investing heavily in technology, venue expansion, and artist development. Market penetration of live music experiences among younger demographics is high, contributing to continued expansion. However, economic downturns and evolving consumer spending habits could influence market growth.

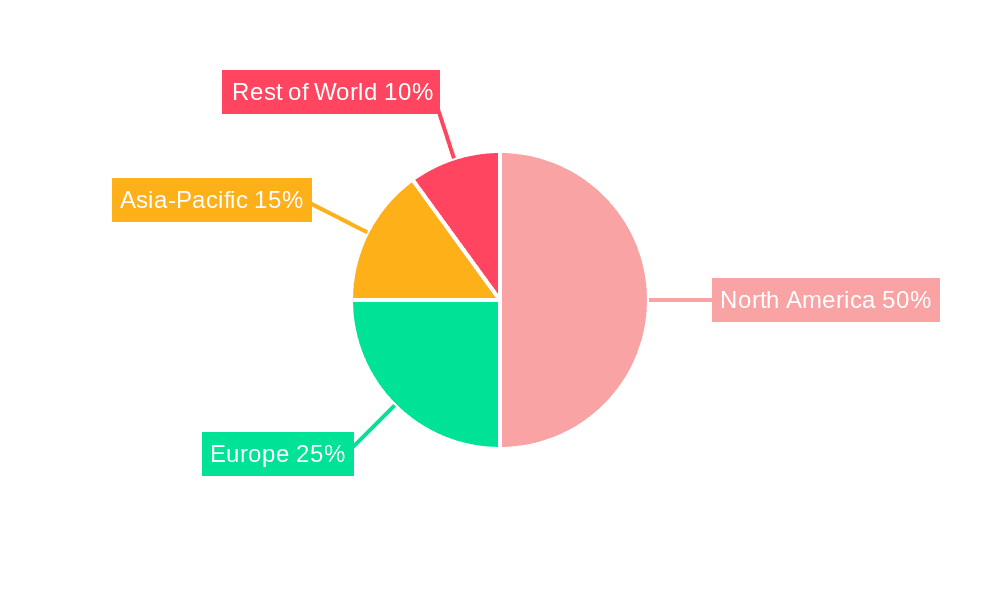

Dominant Regions & Segments in United States Live Music Market

The largest segment within the U.S. live music market is large-scale concerts and festivals, representing xx% of the market in 2025. This dominance is driven by the strong demand for these experiences, supported by significant investment in infrastructure and marketing. Other key segments include smaller venue concerts, club shows, and touring events.

- Key Drivers of Large-Scale Concert/Festival Dominance:

- Strong consumer demand for large-scale experiences

- Significant investment in infrastructure (venues, technology)

- Economies of scale in marketing and promotion

- High ticket prices generating substantial revenue

The Northeast and West Coast regions exhibit the highest levels of activity, benefitting from established music scenes, favorable regulatory environments, and significant tourism. Economic policies, such as tax incentives for cultural events and investments in infrastructure, further contribute to regional dominance.

United States Live Music Market Product Innovations

Recent product innovations are transforming the fan experience, including immersive audio technologies offering unparalleled sound quality, virtual reality concerts that blur the lines between physical and digital attendance, and enhanced fan engagement platforms through mobile apps and personalized communication channels. These innovations leverage cutting-edge technology to provide unique and personalized experiences, strengthening market positioning and competitiveness. Furthermore, the sophisticated integration of data analytics is enabling targeted marketing campaigns, improved operational efficiency, and better prediction of future market trends.

Report Scope & Segmentation Analysis

This report segments the US live music market across several key dimensions: venue size (large, mid-size, and small venues), event type (concerts, festivals, and tours), musical genre (pop, rock, country, electronic, hip-hop, and others), and ticket pricing tiers. Each segment presents unique growth patterns and competitive dynamics, reflecting the diverse nature of the market. Growth projections show variations across these segments, with large venue concerts and major music festivals generally expected to maintain the fastest growth rates. More detailed segmentation analysis is provided within the complete report.

Key Drivers of United States Live Music Market Growth

The growth of the US live music market is driven by several factors including rising disposable incomes, increasing demand for live experiences, technological advancements, and a thriving music scene. Government support for the arts and tourism also plays a role. The increasing popularity of music festivals and the expansion of venue capacities are significant contributors to overall market expansion.

Challenges in the United States Live Music Market Sector

The live music industry navigates a complex landscape of challenges, including substantial operating costs, intense competition from readily available streaming services, vulnerability to economic downturns, and regulatory hurdles related to ticketing, licensing, and venue permits. Supply chain disruptions and the fluctuating costs associated with artist fees further impact profitability. These challenges frequently contribute to ticket price increases and potentially limit access for some segments of the consumer base.

Emerging Opportunities in United States Live Music Market

Emerging opportunities include the expansion of virtual and augmented reality experiences, personalized fan engagement strategies, and the integration of new technologies, such as blockchain, for ticketing and access control. Exploring new market segments, such as regional music genres and underserved demographics, also presents promising avenues for growth.

Leading Players in the United States Live Music Market Market

- Live Nation Entertainment

- AEG Presents

- Warner Music Group

- Ticketmaster

- Sony Music Entertainment

- C3 Presents

- Wasserman Music

- Anschutz Entertainment Group (AEG)

- Goldenvoice

- Bandsintown

Key Developments in United States Live Music Market Industry

- July 2023: Sony Corporation launched its "For The Music" brand campaign, showcasing its advanced audio technology and potentially influencing consumer preferences towards higher-quality live music experiences.

- February 2024: The BMAC (replace with full name if known) and Live Nation partnered to launch a comprehensive music business intensive course and paid internship program, aiming to promote greater diversity and inclusion within the industry. This initiative could significantly impact the future talent pool and overall diversity of the market.

- [Add another recent key development here, with date and a brief description.]

Future Outlook for United States Live Music Market Market

The future of the US live music market is bright, with continued growth expected driven by technological innovation, evolving consumer preferences, and a resilient music industry. Strategic partnerships, investments in new technologies, and a focus on sustainability will be crucial for success. The market’s ability to adapt to changing consumer behaviors and leverage new technologies will be key to unlocking further growth potential.

United States Live Music Market Segmentation

-

1. Application

- 1.1. Concerts

- 1.2. Festivals

- 1.3. Theater

- 1.4. Corporate Events

- 1.5. Weddings

-

2. Revenue

- 2.1. Tickets

- 2.2. Sponsorship

- 2.3. Merchandising

-

3. Age Group

- 3.1. Children

- 3.2. Teenagers

- 3.3. Adults

- 3.4. Seniors

-

4. Venue Size

- 4.1. Small

- 4.2. Medium

- 4.3. Large

United States Live Music Market Segmentation By Geography

- 1. United States

United States Live Music Market Regional Market Share

Geographic Coverage of United States Live Music Market

United States Live Music Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.2.2 Including Concerts

- 3.2.3 Festivals

- 3.2.4 and Special Performances

- 3.3. Market Restrains

- 3.3.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.3.2 Including Concerts

- 3.3.3 Festivals

- 3.3.4 and Special Performances

- 3.4. Market Trends

- 3.4.1. The Live Music Ticket Sales Type is Thriving in the US Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Live Music Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Concerts

- 5.1.2. Festivals

- 5.1.3. Theater

- 5.1.4. Corporate Events

- 5.1.5. Weddings

- 5.2. Market Analysis, Insights and Forecast - by Revenue

- 5.2.1. Tickets

- 5.2.2. Sponsorship

- 5.2.3. Merchandising

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. Children

- 5.3.2. Teenagers

- 5.3.3. Adults

- 5.3.4. Seniors

- 5.4. Market Analysis, Insights and Forecast - by Venue Size

- 5.4.1. Small

- 5.4.2. Medium

- 5.4.3. Large

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Live Nation Entertainment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AEG Presents

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Warner Music Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ticketmaster

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Music Entertainment

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 C3 Presents

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wasserman Music

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anschutz Entertainment Group (AEG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Goldenvoice

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bandsintown**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Live Nation Entertainment

List of Figures

- Figure 1: United States Live Music Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Live Music Market Share (%) by Company 2025

List of Tables

- Table 1: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 4: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 5: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 6: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 7: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 8: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 9: United States Live Music Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United States Live Music Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 14: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 15: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 16: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 17: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 18: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 19: United States Live Music Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Live Music Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Live Music Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the United States Live Music Market?

Key companies in the market include Live Nation Entertainment, AEG Presents, Warner Music Group, Ticketmaster, Sony Music Entertainment, C3 Presents, Wasserman Music, Anschutz Entertainment Group (AEG), Goldenvoice, Bandsintown**List Not Exhaustive.

3. What are the main segments of the United States Live Music Market?

The market segments include Application, Revenue, Age Group, Venue Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

6. What are the notable trends driving market growth?

The Live Music Ticket Sales Type is Thriving in the US Market.

7. Are there any restraints impacting market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

8. Can you provide examples of recent developments in the market?

February 2024: The Black Music Action Coalition (BMAC) and Live Nation announced the launch of a music business intensive course and paid internship program for Summer 2024. Aimed at aspiring music professionals nationwide, it includes a week-long Los Angeles course, keynote talks, and opportunities for internships and apprenticeships with Live Nation to foster industry access and equity.July 2023: Sony Corporation, a subsidiary of Sony Music Entertainment, a leading advocate of creative freedom, unveiled its latest brand platform and campaign, "For The Music," highlighting its top-notch audio offerings and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Live Music Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Live Music Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Live Music Market?

To stay informed about further developments, trends, and reports in the United States Live Music Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence