Key Insights

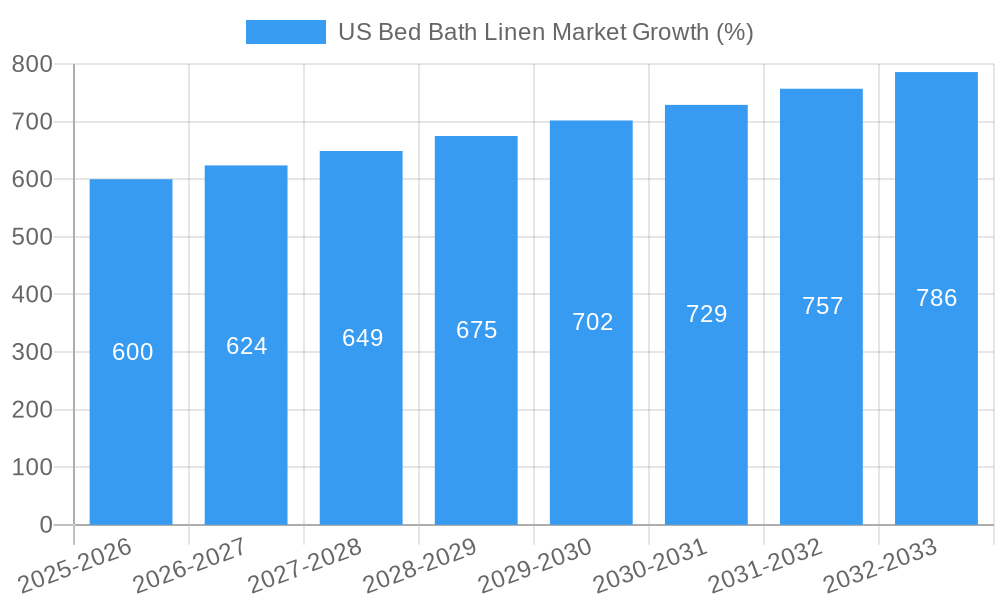

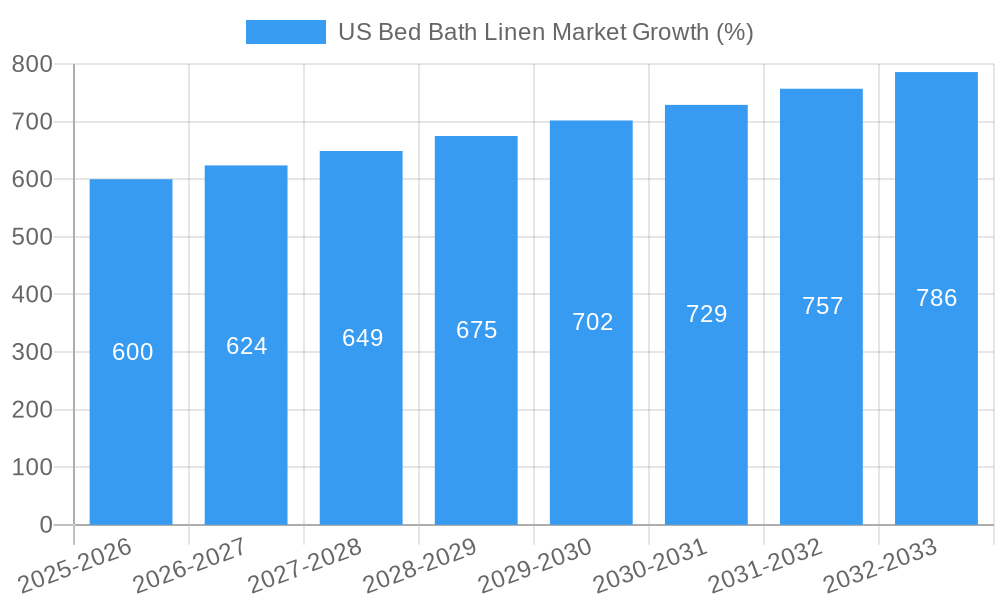

The US bed and bath linen market, currently exhibiting robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising disposable incomes and a growing preference for premium home furnishings amongst US consumers fuel demand for higher-quality bed and bath linens. Secondly, the increasing popularity of online shopping through e-commerce platforms like Amazon and dedicated bedding websites simplifies purchasing and expands market reach. The market segmentation reveals a significant contribution from the residential sector, indicating strong demand within individual households. Furthermore, the growth of the hospitality industry contributes to the commercial segment's expansion. The popularity of various types of bed linen such as organic cotton, bamboo, and sustainable options are further boosting sales. While the supermarkets and hypermarkets retain a considerable market share, specialty stores offering curated collections and personalized service are also experiencing significant growth, catering to discerning customers seeking unique products and exceptional customer experiences.

However, certain challenges hinder market growth. Fluctuations in raw material prices, particularly cotton, influence production costs and ultimately impact consumer pricing. The intensifying competition from both established brands and emerging players necessitates continuous innovation and strategic marketing to maintain market share. Moreover, potential economic downturns could impact consumer spending on non-essential items like premium linens, creating temporary market slowdowns. Despite these constraints, the long-term outlook for the US bed and bath linen market remains optimistic, fueled by evolving consumer preferences for comfort, luxury, and sustainable products, along with innovative product development and expansion of online sales channels. The market's diverse segmentation and substantial contribution from both residential and commercial sectors point to a sustained growth trajectory, offering substantial opportunities for businesses across all segments.

US Bed Bath Linen Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the US bed bath linen market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers market size, segmentation, growth drivers, challenges, and future outlook, with a focus on key players and emerging trends. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033.

US Bed Bath Linen Market Structure & Innovation Trends

The US bed bath linen market exhibits a moderately consolidated structure, with several key players vying for market share. Leading companies such as Brooklinen, Globaltex Fine Linens, Standard Textile Co Inc, Hollander, Bella Notte Linens, Cuddledown Marketing LLC, Linen Tales, Matteo Los Angeles, Red Land Cotton, U S Cotton, IKEA, Crane and Canopy, Ralph Lauren Corporation, Carousel, and Peacock Alley contribute significantly to the overall market volume, estimated at xx Million in 2025. However, the market also includes numerous smaller players, creating a dynamic competitive landscape. Innovation is driven by consumer demand for sustainable, high-quality, and aesthetically pleasing products, leading to the introduction of new materials, designs, and technologies. Regulatory frameworks concerning product safety and environmental standards influence market practices. The market witnesses occasional M&A activities, with deal values varying considerably depending on the size and strategic importance of the acquired companies. For example, a recent (hypothetical) acquisition of a smaller linen company by a larger player resulted in a xx Million deal. The market share of the top 5 players is estimated to be xx%. Product substitutes, such as synthetic bedding, pose a challenge, although natural materials like cotton and linen continue to dominate. End-user demographics, particularly the increasing preference for premium bedding among millennials and Gen Z, significantly impact market trends.

US Bed Bath Linen Market Dynamics & Trends

The US bed bath linen market is experiencing robust growth, driven by several key factors. Rising disposable incomes, a growing preference for comfortable and aesthetically pleasing home environments, and increased awareness of the importance of sleep hygiene are major contributors. Technological advancements, such as the introduction of innovative fabric technologies (e.g., temperature-regulating materials, antimicrobial treatments) and e-commerce platforms, are reshaping the market dynamics. Consumer preferences are shifting towards sustainable and ethically sourced products, putting pressure on companies to adopt environmentally friendly practices. The CAGR for the market during the forecast period (2025-2033) is projected at xx%, with market penetration of xx% in the residential segment by 2033. Competitive dynamics are marked by intense rivalry among established players and the emergence of new entrants, leading to price competition and innovation. The increasing popularity of subscription services for linen and bedding is another notable trend. Furthermore, changes in consumer lifestyles, including remote work and increased focus on home improvement, are also bolstering market growth.

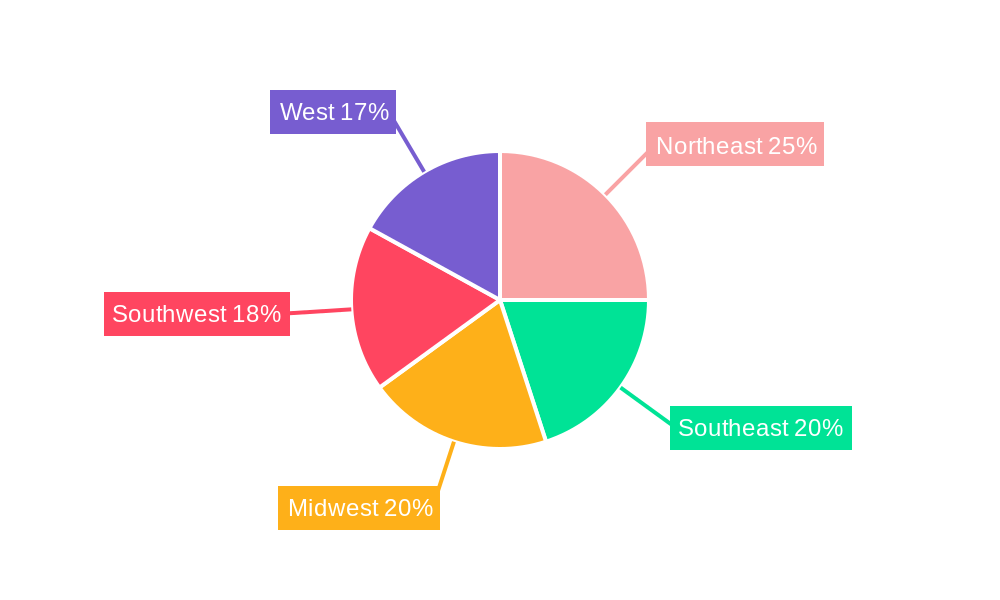

Dominant Regions & Segments in US Bed Bath Linen Market

The Northeast and West Coast regions are currently the dominant markets for bed bath linens within the US, driven by higher disposable incomes and a greater focus on home improvement in these areas. Specific key drivers vary by region; for example, the Northeast's strong tourism industry boosts demand for high-quality commercial linens, while the West Coast's eco-conscious population fuels demand for sustainable products.

By Distribution Channel: E-commerce is experiencing the fastest growth, benefiting from the convenience and accessibility offered to consumers. Specialty stores maintain a significant market share due to their ability to provide personalized customer service and curate unique product selections. Supermarkets and hypermarkets hold a smaller but stable market share.

By Type: Bed linens constitute the larger segment, with bath linens following closely. The demand for high-quality bed linens is particularly strong due to their direct impact on sleep quality.

By End Users: The residential segment is dominant, driven by increased household formation and rising disposable incomes. However, the commercial segment, encompassing hospitality and healthcare, shows promising growth due to increasing investments in upgrading facilities.

US Bed Bath Linen Market Product Innovations

Recent innovations in the US bed bath linen market include the development of sustainable materials, such as organic cotton and recycled fibers, addressing growing environmental concerns. Smart textiles with integrated temperature regulation and moisture-wicking properties are gaining traction, enhancing sleep comfort. Companies are focusing on innovative designs and patterns to appeal to diverse consumer preferences. The introduction of antimicrobial treatments further adds to product appeal and hygiene benefits. These innovations cater to the increasing demand for high-quality, comfortable, and sustainable bedding solutions.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the US bed bath linen market across various parameters.

By Distribution Channel: The analysis covers supermarkets and hypermarkets, specialty stores, e-commerce, and other distribution channels, detailing their respective market sizes and growth projections.

By Type: The market is segmented into bed linens (sheets, blankets, comforters) and other bed linens (bath towels, washcloths, bathrobes), outlining each segment's market size and competitive landscape.

By End Users: The report distinguishes between residential and commercial end-users, providing detailed insights into their consumption patterns and market dynamics.

Each segment's growth potential and competitive landscape are extensively analyzed in the report.

Key Drivers of US Bed Bath Linen Market Growth

Several factors contribute to the growth of the US bed bath linen market. Firstly, the increasing disposable income among consumers allows for greater spending on home goods and premium bedding. Secondly, the rising popularity of e-commerce platforms provides improved access and convenience for consumers. Thirdly, the growing awareness of sleep hygiene and its importance for overall health is driving demand for higher-quality bed linens. Finally, a growing preference for sustainable and eco-friendly products is influencing purchasing decisions.

Challenges in the US Bed Bath Linen Market Sector

The US bed bath linen market faces several challenges. Fluctuations in raw material prices, particularly cotton, impact production costs and profitability. Supply chain disruptions can lead to delays and increased costs. Intense competition from both domestic and international players creates price pressure. Furthermore, changing consumer preferences and the emergence of new technologies require companies to adapt constantly.

Emerging Opportunities in US Bed Bath Linen Market

The market presents several opportunities. The growing demand for personalized and customized linen products opens avenues for niche players. The increasing popularity of smart home technology creates potential for integration with bedding solutions. Expansion into new distribution channels and markets, particularly online channels, offers growth prospects. Focus on eco-friendly and sustainable products taps into the growing environmental consciousness of consumers.

Leading Players in the US Bed Bath Linen Market Market

- Brooklinen

- Globaltex Fine Linens

- Standard Textile Co Inc

- Hollander

- Bella Notte Linens

- Cuddledown Marketing LLC

- Linen Tales

- Matteo Los Angeles

- Red Land Cotton

- U S Cotton

- IKEA

- Crane and Canopy

- Ralph Lauren Corporation

- Carousel

- Peacock Alley

Key Developments in US Bed Bath Linen Market Industry

- January 2023: Brooklinen launches a new line of sustainable bedding.

- June 2022: Standard Textile Co Inc. announces a strategic partnership with a raw material supplier to secure supply chain stability.

- October 2021: IKEA expands its online presence and delivery options for bed bath linens. (Further developments to be added as per data)

Future Outlook for US Bed Bath Linen Market Market

The US bed bath linen market is poised for continued growth, driven by sustained consumer demand, technological innovation, and an increasing emphasis on sustainable and healthy living. Strategic investments in research and development, expansion into new markets, and a focus on building strong brand equity will be critical for players to succeed in this dynamic market. The growing preference for premium products and customized solutions creates further potential for market expansion and differentiation.

US Bed Bath Linen Market Segmentation

-

1. Type

-

1.1. Bed Linen

- 1.1.1. Sheets

- 1.1.2. Pillowcase

- 1.1.3. Duvet Case

- 1.1.4. Other Bed Linens

-

1.2. Bath Linen

- 1.2.1. Towels

- 1.2.2. Bathrobes

- 1.2.3. Other Bath Linens

-

1.1. Bed Linen

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. e-Commerce

- 3.4. Other Distribution Channels

US Bed Bath Linen Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Bed Bath Linen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovation In Electric Fireplace driving the market; Rising awareness toward using eco-friendly products

- 3.3. Market Restrains

- 3.3.1. Supply chain disruptions affecting the sales of Electric Fireplace; Increasing Inflation reducing the demand for luxury items globally

- 3.4. Market Trends

- 3.4.1. United States Household Developments Driving Force to Bed and Bath Linen Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bed Linen

- 5.1.1.1. Sheets

- 5.1.1.2. Pillowcase

- 5.1.1.3. Duvet Case

- 5.1.1.4. Other Bed Linens

- 5.1.2. Bath Linen

- 5.1.2.1. Towels

- 5.1.2.2. Bathrobes

- 5.1.2.3. Other Bath Linens

- 5.1.1. Bed Linen

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. e-Commerce

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Bed Linen

- 6.1.1.1. Sheets

- 6.1.1.2. Pillowcase

- 6.1.1.3. Duvet Case

- 6.1.1.4. Other Bed Linens

- 6.1.2. Bath Linen

- 6.1.2.1. Towels

- 6.1.2.2. Bathrobes

- 6.1.2.3. Other Bath Linens

- 6.1.1. Bed Linen

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets and Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. e-Commerce

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Bed Linen

- 7.1.1.1. Sheets

- 7.1.1.2. Pillowcase

- 7.1.1.3. Duvet Case

- 7.1.1.4. Other Bed Linens

- 7.1.2. Bath Linen

- 7.1.2.1. Towels

- 7.1.2.2. Bathrobes

- 7.1.2.3. Other Bath Linens

- 7.1.1. Bed Linen

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets and Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. e-Commerce

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Bed Linen

- 8.1.1.1. Sheets

- 8.1.1.2. Pillowcase

- 8.1.1.3. Duvet Case

- 8.1.1.4. Other Bed Linens

- 8.1.2. Bath Linen

- 8.1.2.1. Towels

- 8.1.2.2. Bathrobes

- 8.1.2.3. Other Bath Linens

- 8.1.1. Bed Linen

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets and Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. e-Commerce

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Bed Linen

- 9.1.1.1. Sheets

- 9.1.1.2. Pillowcase

- 9.1.1.3. Duvet Case

- 9.1.1.4. Other Bed Linens

- 9.1.2. Bath Linen

- 9.1.2.1. Towels

- 9.1.2.2. Bathrobes

- 9.1.2.3. Other Bath Linens

- 9.1.1. Bed Linen

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets and Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. e-Commerce

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Bed Linen

- 10.1.1.1. Sheets

- 10.1.1.2. Pillowcase

- 10.1.1.3. Duvet Case

- 10.1.1.4. Other Bed Linens

- 10.1.2. Bath Linen

- 10.1.2.1. Towels

- 10.1.2.2. Bathrobes

- 10.1.2.3. Other Bath Linens

- 10.1.1. Bed Linen

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets and Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. e-Commerce

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Northeast US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Bed Bath Linen Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Brooklinen

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Globaltex Fine Linens

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Other Prominent Companies (Standard Textile Co Inc Hollander Bella Notte Linens Cuddledown Marketing LLC and Linen Tales)**List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Matteo Los Angeles

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Red Land Cotton

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 U S Cotton

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 IKEA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Crane and Canopy

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Ralph Lauren Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Carousel

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Peacock Alley

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Brooklinen

List of Figures

- Figure 1: Global US Bed Bath Linen Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Bed Bath Linen Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America US Bed Bath Linen Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America US Bed Bath Linen Market Revenue (Million), by End User 2024 & 2032

- Figure 7: North America US Bed Bath Linen Market Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America US Bed Bath Linen Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America US Bed Bath Linen Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Bed Bath Linen Market Revenue (Million), by Type 2024 & 2032

- Figure 13: South America US Bed Bath Linen Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America US Bed Bath Linen Market Revenue (Million), by End User 2024 & 2032

- Figure 15: South America US Bed Bath Linen Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: South America US Bed Bath Linen Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America US Bed Bath Linen Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Bed Bath Linen Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe US Bed Bath Linen Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe US Bed Bath Linen Market Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe US Bed Bath Linen Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe US Bed Bath Linen Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe US Bed Bath Linen Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Bed Bath Linen Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa US Bed Bath Linen Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa US Bed Bath Linen Market Revenue (Million), by End User 2024 & 2032

- Figure 31: Middle East & Africa US Bed Bath Linen Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Middle East & Africa US Bed Bath Linen Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa US Bed Bath Linen Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Bed Bath Linen Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific US Bed Bath Linen Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific US Bed Bath Linen Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Asia Pacific US Bed Bath Linen Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia Pacific US Bed Bath Linen Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific US Bed Bath Linen Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific US Bed Bath Linen Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Bed Bath Linen Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Bed Bath Linen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global US Bed Bath Linen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global US Bed Bath Linen Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global US Bed Bath Linen Market Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Global US Bed Bath Linen Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global US Bed Bath Linen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific US Bed Bath Linen Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Bed Bath Linen Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the US Bed Bath Linen Market?

Key companies in the market include Brooklinen, Globaltex Fine Linens, Other Prominent Companies (Standard Textile Co Inc Hollander Bella Notte Linens Cuddledown Marketing LLC and Linen Tales)**List Not Exhaustive, Matteo Los Angeles, Red Land Cotton, U S Cotton, IKEA, Crane and Canopy, Ralph Lauren Corporation, Carousel, Peacock Alley.

3. What are the main segments of the US Bed Bath Linen Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovation In Electric Fireplace driving the market; Rising awareness toward using eco-friendly products.

6. What are the notable trends driving market growth?

United States Household Developments Driving Force to Bed and Bath Linen Market.

7. Are there any restraints impacting market growth?

Supply chain disruptions affecting the sales of Electric Fireplace; Increasing Inflation reducing the demand for luxury items globally.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Bed Bath Linen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Bed Bath Linen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Bed Bath Linen Market?

To stay informed about further developments, trends, and reports in the US Bed Bath Linen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence