Key Insights

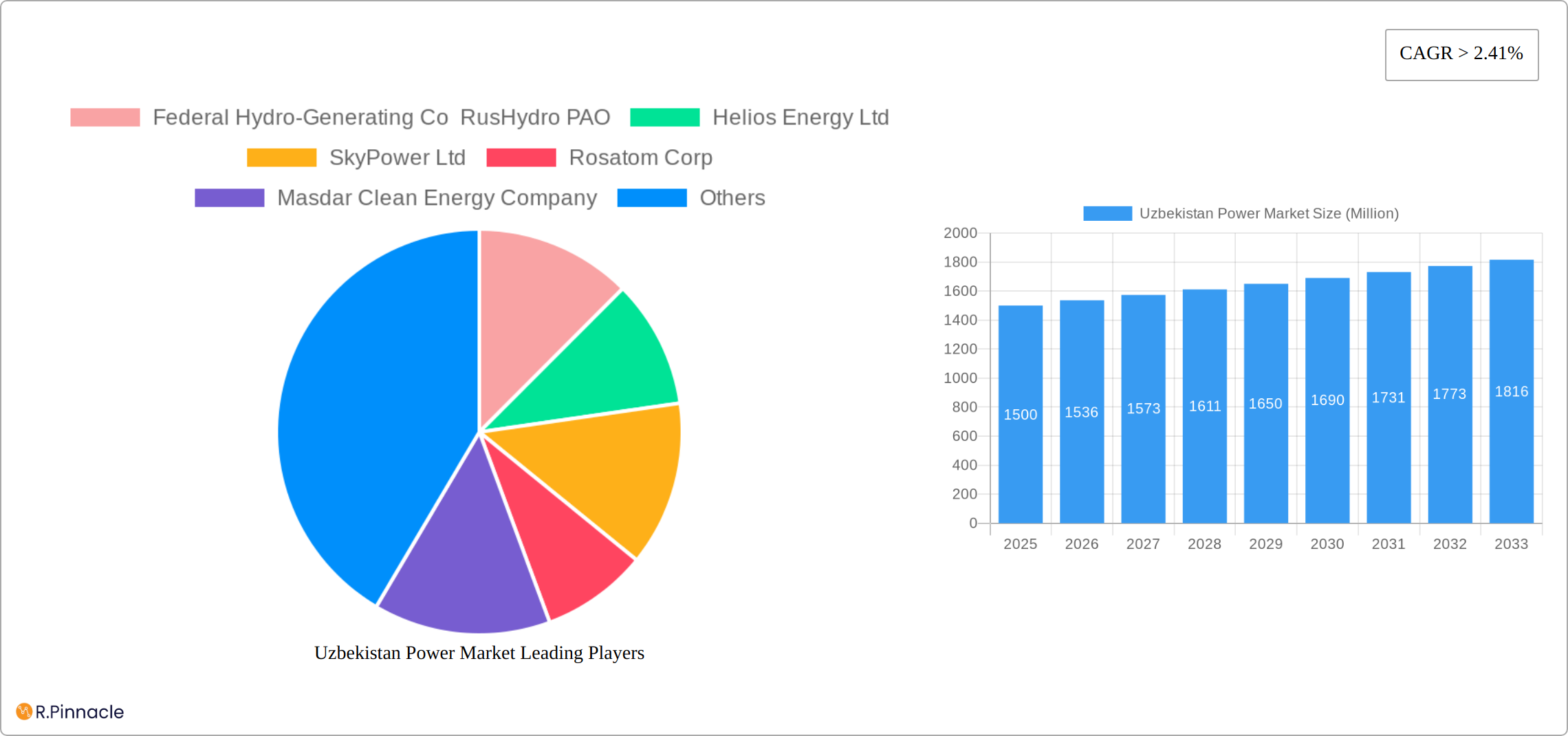

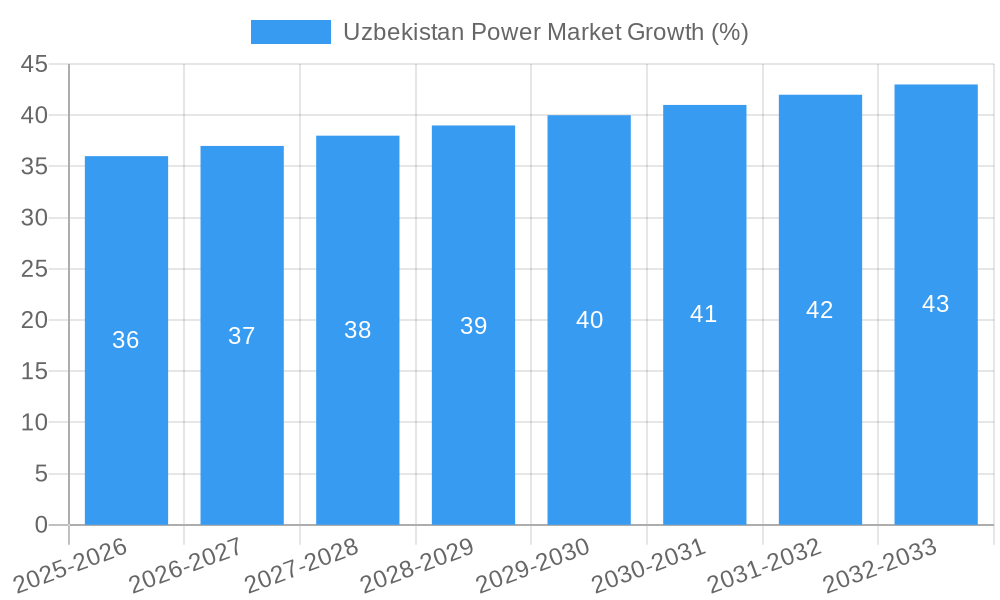

The Uzbekistan power market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 2.41% from 2025 to 2033. This growth is fueled by several key factors. Firstly, Uzbekistan's ongoing economic development and industrialization necessitate a significant increase in energy production to support expanding urban areas and industrial activities. Secondly, the government's commitment to improving energy infrastructure and diversifying its energy sources, including a greater emphasis on renewable energy such as solar and hydropower, is driving substantial investment in the sector. This includes initiatives to modernize aging power plants and expand the national grid. However, the market faces certain challenges. Constraints include the reliance on aging thermal power plants, which contribute significantly to pollution, and the need for substantial investments to develop and integrate renewable energy sources efficiently. Successfully managing these challenges will be crucial for sustaining the projected growth trajectory.

The market segmentation reveals a dynamic landscape. The thermal power segment currently dominates, reflecting Uzbekistan's existing infrastructure. However, the renewable energy segment, comprising hydropower and solar, is anticipated to witness the fastest growth over the forecast period due to government support and increasing global focus on sustainability. Key players such as Federal Hydro-Generating Co RusHydro PAO, Helios Energy Ltd, and Masdar Clean Energy Company are actively shaping the market, with their strategies focusing on both traditional and renewable energy sources. The regional focus is currently centered on Uzbekistan, but future expansion into neighboring Central Asian countries is a possibility, particularly considering the potential for regional power grid integration. The historical period (2019-2024) likely showed slower growth than projected, given the global economic climate and initial investment phases in renewable energy infrastructure. The consistent CAGR, however, suggests a positive and accelerating trend that should continue through 2033.

This comprehensive report provides an in-depth analysis of the Uzbekistan power market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market structure, dynamics, key players, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025. The report leverages extensive data analysis and expert insights to illuminate growth opportunities and potential challenges within this dynamic market.

Uzbekistan Power Market: Market Structure & Innovation Trends

This section analyzes the competitive landscape of Uzbekistan's power market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activity. The study period (2019-2024) reveals a market characterized by [Describe Market Concentration - e.g., moderate concentration with a few dominant players and numerous smaller participants]. Key innovation drivers include government initiatives promoting renewable energy and increasing energy efficiency.

- Market Share: [Insert estimated market share data for major players. For example: RusHydro: xx%, QISHLOQENERGOLOYIHA: xx%, Others: xx%]

- M&A Activity: While precise M&A deal values are unavailable for the historical period (2019-2024), [Describe the observed M&A activity – e.g., limited major M&A activity observed, with mostly smaller scale acquisitions focusing on renewable energy assets]. The forecast period (2025-2033) is expected to see [Predict M&A trends – e.g., increased M&A activity driven by the government’s push for renewable energy and foreign investment].

- Regulatory Framework: [Describe the regulatory framework, including its impact on market participants. Include details on any significant changes observed in the historical period and potential future changes.]

- Product Substitutes: [Describe substitute energy sources in Uzbekistan, analyzing their market penetration and potential impact on the power market].

- End-User Demographics: [Analyze end-user demographics - e.g., residential, industrial, commercial – and their changing energy consumption patterns].

Uzbekistan Power Market: Market Dynamics & Trends

This section delves into the key market dynamics driving growth and shaping the future of Uzbekistan's power sector. The market experienced a [Describe Growth Rate - e.g., moderate growth] during the historical period (2019-2024). Key growth drivers include increasing energy demand fueled by economic growth, government investments in infrastructure, and a growing focus on renewable energy sources. Technological disruptions, such as advancements in solar and wind energy technologies, are rapidly reshaping the market. Consumer preferences are shifting towards more sustainable and reliable energy sources. Competitive dynamics are characterized by [Describe competitive dynamics – e.g., increasing competition amongst renewable energy providers].

- CAGR (2025-2033): [Predict CAGR for the forecast period.]

- Market Penetration of Renewables: [Predict market penetration rates for renewables by 2033].

Dominant Regions & Segments in Uzbekistan Power Market

Uzbekistan's power market is geographically diverse, with consumption and generation varying significantly across regions. While precise data on regional electricity consumption and generation capacity is often considered commercially sensitive, the Tashkent region, due to its high population density and industrial activity, is undoubtedly a dominant consumer and likely a significant generation hub. Similarly, regions with substantial industrial concentrations, such as Fergana Valley and Samarkand, exhibit high energy demand. Analysis of publicly available data from Uzbekenergo (the national electricity company) and other official sources would provide a more precise breakdown.

The power generation sector is currently dominated by thermal power plants, leveraging Uzbekistan's substantial natural gas reserves. This segment benefits from established infrastructure and readily available fuel sources, contributing to a large market share. However, the sector faces increasing pressure to decarbonize. Hydropower, utilizing the country's abundant water resources in regions like the Surxondaryo and Kashkadarya provinces, constitutes a significant and growing portion of the energy mix. Furthermore, government initiatives are actively fostering the expansion of renewable energy sources, including solar and wind, driven by factors such as decreasing technology costs and a growing awareness of climate change mitigation.

- Thermal: Key drivers include existing infrastructure, readily available natural gas resources, and relatively low initial investment costs. However, ongoing challenges include environmental concerns and reliance on a finite fuel source, pushing the sector towards modernization and increased efficiency. This may involve exploring technologies such as combined cycle gas turbines for improved efficiency.

- Hydropower: Key drivers include abundant water resources, particularly in the southern regions, along with government support for large-scale hydropower projects. However, the sector must carefully balance energy generation with environmental concerns, such as the impact on downstream water resources and aquatic ecosystems. Careful site selection and environmental impact assessments are crucial for sustainable development.

- Renewables: Key drivers include strong government policy support, exemplified by ambitious renewable energy targets and favorable regulatory frameworks, as well as increasing international investment, particularly in solar and wind power. The rapid expansion of solar and wind capacity is evident in recent project announcements and government incentives. Challenges include intermittency and the need for further development of grid infrastructure to effectively integrate these variable sources.

Uzbekistan Power Market: Product Innovations

The Uzbekistan power market is witnessing significant product innovations, primarily driven by advancements in renewable energy technologies. New solar and wind power plants are being commissioned, featuring improved efficiency and lower costs. Smart grids and energy storage solutions are also gaining traction, improving grid stability and reliability. This aligns with the growing emphasis on sustainable energy solutions and the government's commitment to diversifying the energy mix.

Report Scope & Segmentation Analysis

This report segments the Uzbekistan power market by fuel type: Thermal, Hydropower, and Renewables.

Thermal: This segment includes coal, natural gas, and oil-fired power plants. Growth is projected to [Predict growth rate for thermal segment] due to [Explain the reasons behind projected growth or decline]. Competitive dynamics are characterized by [Describe the competitive dynamics in this segment].

Hydropower: This segment encompasses hydropower plants throughout Uzbekistan. Growth is anticipated to be [Predict growth rate for hydropower segment], driven by [Explain the drivers of projected growth or decline]. Competition in this area is [Describe the competitive dynamics in this segment].

Renewables: This segment encompasses solar, wind, and other renewable energy sources. Growth is expected to be [Predict growth rate for renewables segment] due to government initiatives and increasing investment. The competitive landscape is [Describe competitive dynamics in this segment].

Key Drivers of Uzbekistan Power Market Growth

Growth in Uzbekistan's power market is driven by several key factors: Firstly, the government's strong focus on expanding energy infrastructure and increasing electricity generation capacity is a significant driver. Secondly, the increasing demand for electricity due to economic growth and industrialization necessitates further capacity additions. Thirdly, international investments and collaborations, particularly in renewable energy projects, are fueling market expansion. Finally, advancements in renewable energy technologies are making them increasingly cost-competitive and attractive.

Challenges in the Uzbekistan Power Market Sector

Challenges facing the Uzbekistan power market include the need for modernization of existing infrastructure, which is often outdated and inefficient. Reliable data collection and market transparency remain a concern, potentially hindering effective investment decisions. Furthermore, the country’s dependence on imported technologies and expertise presents challenges, potentially increasing costs. Finally, integrating renewable energy sources into the existing grid requires significant investment and technical expertise.

Emerging Opportunities in Uzbekistan Power Market

The Uzbekistan power market presents a wealth of opportunities for investors and businesses. The government's commitment to expanding renewable energy capacity, coupled with increasing energy demand from a growing population and industrial sector, creates a significant market for renewable energy projects, including solar, wind, and potentially geothermal energy. Beyond generation, there's substantial scope for developing smart grid technologies, enabling better integration of renewable sources and improving grid reliability and efficiency. Furthermore, large-scale energy storage solutions are needed to address the intermittency of renewables. The increasing demand from industrial sectors, particularly in manufacturing and mining, will drive further expansion of power generation capacity. Finally, significant potential exists for improving energy efficiency in both the residential and industrial sectors, reducing energy consumption and costs.

Leading Players in the Uzbekistan Power Market Market

- Federal Hydro-Generating Co RusHydro PAO

- Helios Energy Ltd

- SkyPower Ltd

- Rosatom Corp

- Masdar Clean Energy Company

- QISHLOQENERGOLOYIHA

- Mitsubishi Heavy Industries Ltd

Key Developments in Uzbekistan Power Market Industry

November 2022: Launch of a new power plant in Syrdaryo province with an annual generating capacity of 1.7 Billion kWh. This state-of-the-art facility, [Specify type of plant - e.g., gas-fired, combined cycle], significantly boosts Uzbekistan's power generation capacity and enhances energy security in the region.

November 2022: Agreement between Uzbekistan's government and Voltalia to jointly develop 400-500 MW of renewable energy projects, including solar, wind, and battery storage. This substantial investment underscores Uzbekistan's commitment to diversifying its energy mix and achieving its renewable energy targets.

June 2022: World Bank grants USD 143 Million concessional credit to support energy efficiency projects and institutional framework development in the building industry. This funding will promote sustainable energy investments, driving technological upgrades and improving the energy efficiency of existing buildings.

[Add other key developments with dates and descriptions, if available]

Future Outlook for Uzbekistan Power Market Market

The Uzbekistan power market is poised for significant growth over the forecast period (2025-2033). Government initiatives promoting renewable energy, coupled with increasing energy demand and foreign investment, will drive this expansion. The integration of smart grids and energy storage solutions will enhance grid reliability and efficiency. This market presents attractive opportunities for investors and companies involved in power generation, transmission, and distribution.

Uzbekistan Power Market Segmentation

-

1. Power Generation Scenario - Fuel Type

-

1.1. Thermal

- 1.1.1. Overview

-

1.1.2. Key Project Information

- 1.1.2.1. Existing Projects

- 1.1.2.2. Planned and Upcoming Projects

- 1.2. Hydropower

- 1.3. Renewables

-

1.4. Nuclear

- 1.4.1. Planned Projects

-

1.1. Thermal

-

2. Power Transmission and Distribution Scenario

- 2.1. Overview

- 2.2. Projects

- 2.3. Planned and Upcoming Projects

Uzbekistan Power Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario - Fuel Type

- 5.1.1. Thermal

- 5.1.1.1. Overview

- 5.1.1.2. Key Project Information

- 5.1.1.2.1. Existing Projects

- 5.1.1.2.2. Planned and Upcoming Projects

- 5.1.2. Hydropower

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.4.1. Planned Projects

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution Scenario

- 5.2.1. Overview

- 5.2.2. Projects

- 5.2.3. Planned and Upcoming Projects

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Scenario - Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Federal Hydro-Generating Co RusHydro PAO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Helios Energy Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SkyPower Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rosatom Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masdar Clean Energy Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 QISHLOQENERGOLOYIHA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Federal Hydro-Generating Co RusHydro PAO

List of Figures

- Figure 1: Uzbekistan Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uzbekistan Power Market Share (%) by Company 2024

List of Tables

- Table 1: Uzbekistan Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uzbekistan Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Uzbekistan Power Market Revenue Million Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 4: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 5: Uzbekistan Power Market Revenue Million Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 6: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 7: Uzbekistan Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Uzbekistan Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Uzbekistan Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Uzbekistan Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Uzbekistan Power Market Revenue Million Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 12: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Generation Scenario - Fuel Type 2019 & 2032

- Table 13: Uzbekistan Power Market Revenue Million Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 14: Uzbekistan Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution Scenario 2019 & 2032

- Table 15: Uzbekistan Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Uzbekistan Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Power Market?

The projected CAGR is approximately > 2.41%.

2. Which companies are prominent players in the Uzbekistan Power Market?

Key companies in the market include Federal Hydro-Generating Co RusHydro PAO, Helios Energy Ltd, SkyPower Ltd, Rosatom Corp, Masdar Clean Energy Company, QISHLOQENERGOLOYIHA, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Uzbekistan Power Market?

The market segments include Power Generation Scenario - Fuel Type, Power Transmission and Distribution Scenario.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Thermal Power Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2022, Uzbekistan unveiled a new power plant that will extend its generating capacity. According to the Ministry of Energy, the power plant constructed in the Syrdaryo province's Khovos district will have the capacity to generate up to 1.7 billion KWh of electricity annually once it is fully operational.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Power Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence