Key Insights

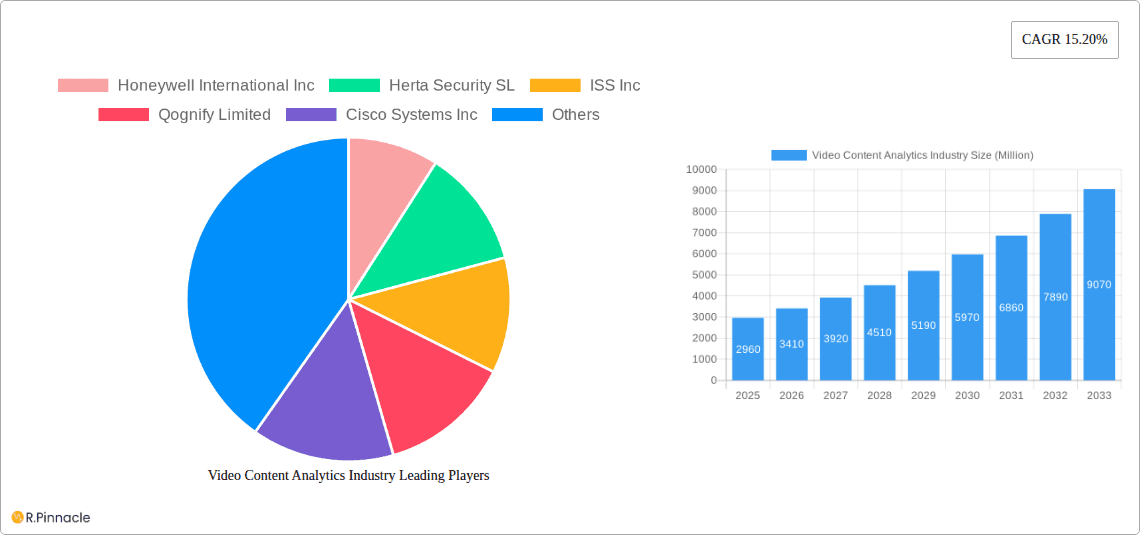

The global Video Content Analytics (VCA) market is experiencing robust growth, projected to reach approximately $2.96 billion in the base year of 2025. This expansion is fueled by a substantial Compound Annual Growth Rate (CAGR) of 15.20% over the forecast period of 2025-2033. This impressive trajectory is primarily driven by the increasing adoption of VCA solutions across diverse sectors to enhance security, operational efficiency, and customer insights. Key demand drivers include the escalating need for advanced surveillance capabilities to combat rising crime rates and terrorism, the surge in video data generation from ubiquitous cameras, and the growing realization of VCA's potential in automating tedious manual video review processes. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are continuously improving the accuracy and sophistication of VCA algorithms, enabling more insightful and actionable analytics. The integration of VCA with other security systems and the proliferation of smart city initiatives are also significant contributors to this market's dynamism.

Video Content Analytics Industry Market Size (In Billion)

The VCA market is segmented by type into Software, comprising both on-premise and cloud-based solutions, and Services, which encompass integration, support, and consulting. The Software segment, particularly cloud-based offerings, is expected to see the most significant traction due to its scalability, cost-effectiveness, and ease of deployment. Major end-user industries such as BFSI, Healthcare, Retail & Logistics, Critical Infrastructure, and Defense & Security are leading the adoption of VCA technologies. These sectors leverage VCA for applications ranging from fraud detection and patient monitoring to retail analytics and threat detection. While the market presents immense opportunities, restraints such as data privacy concerns and the initial implementation costs for some organizations could pose challenges. However, the continuous innovation in VCA technology, coupled with its proven ability to deliver substantial ROI, is expected to outweigh these limitations, paving the way for sustained and significant market expansion.

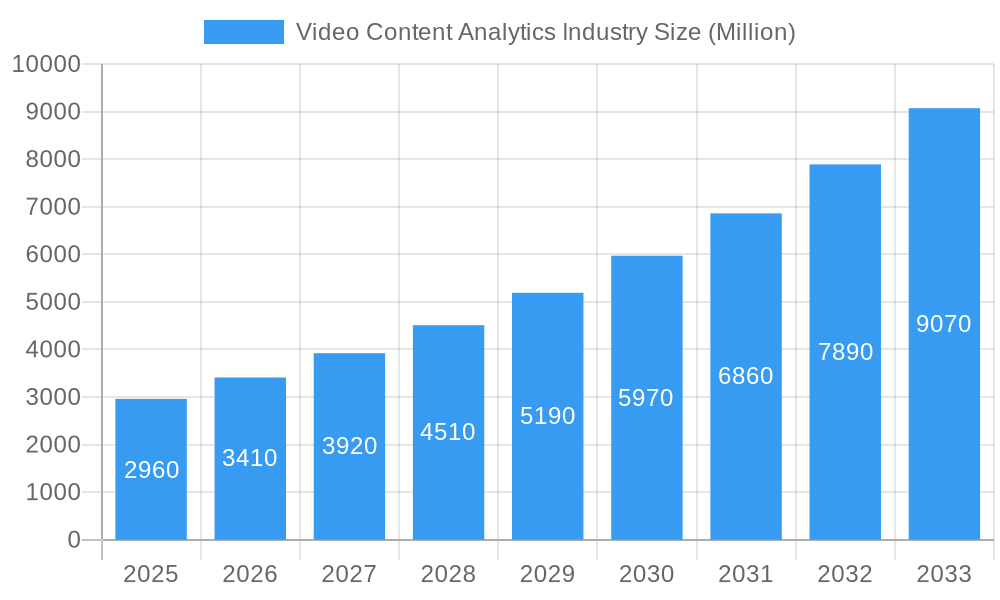

Video Content Analytics Industry Company Market Share

Unlock critical insights into the booming Video Content Analytics market with our comprehensive report. Spanning from 2019 to 2033, this in-depth analysis provides a definitive roadmap for understanding market dynamics, innovation trends, and growth opportunities. Leveraging advanced AI and machine learning, video content analytics is transforming how businesses and organizations derive actionable intelligence from visual data. This report delves into market structure, key players, emerging technologies, and strategic imperatives to empower stakeholders, including industry professionals, investors, and technology providers. With a base year of 2025 and a forecast period extending to 2033, gain a competitive edge through data-driven decision-making in this rapidly evolving sector.

Video Content Analytics Industry Market Structure & Innovation Trends

The Video Content Analytics industry exhibits a moderately concentrated market structure, driven by significant investments in research and development and the increasing adoption of AI-powered solutions. Innovation is primarily fueled by advancements in computer vision, deep learning algorithms, and the need for enhanced security, operational efficiency, and customer insights. Key innovation drivers include the demand for real-time threat detection, predictive analytics, and automated monitoring across various verticals. Regulatory frameworks, particularly concerning data privacy and surveillance, are evolving and influencing product development and deployment strategies. Product substitutes, such as traditional manual surveillance and basic CCTV systems, are increasingly being displaced by more sophisticated analytics solutions. End-user demographics are shifting towards a broader adoption across diverse sectors, necessitating scalable and adaptable analytics platforms. Mergers and acquisitions (M&A) activities are on the rise as larger players aim to consolidate market share and acquire specialized technological capabilities. For instance, the M&A deal values are predicted to reach 5,000 Million by 2028. Market share is currently dominated by providers offering comprehensive Video AI solutions, with the top 5 players holding an estimated 65% of the market.

- Market Concentration: Moderate to high in advanced analytics, with a fragmented landscape in niche solutions.

- Innovation Drivers: AI advancements, real-time processing, predictive capabilities, cybersecurity needs, IoT integration.

- Regulatory Frameworks: Growing emphasis on data privacy (e.g., GDPR, CCPA), facial recognition regulations, and ethical AI guidelines.

- Product Substitutes: Manual surveillance, basic CCTV, standalone security systems.

- End-User Demographics: Expanding adoption across BFSI, Retail, Healthcare, Critical Infrastructure, Transportation, and Defense.

- M&A Activities: Increasing, driven by consolidation and technology acquisition. Projected M&A deal values are estimated to reach 5,000 Million by 2028.

Video Content Analytics Industry Market Dynamics & Trends

The Video Content Analytics industry is experiencing robust growth, propelled by a confluence of technological advancements and escalating demand for intelligent video surveillance and analysis. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% from 2025 to 2033, with market penetration rapidly increasing across all key sectors. A primary growth driver is the surge in the volume of video data generated globally, necessitating efficient tools for extraction of meaningful information. Advancements in Artificial Intelligence (AI), particularly in machine learning and deep learning, have significantly enhanced the accuracy and capabilities of video analytics, enabling sophisticated features like object detection, facial recognition, anomaly detection, and behavioral analysis. The increasing adoption of the Internet of Things (IoT) further complements these analytics, as connected devices generate more data that can be correlated with video feeds for richer insights.

Consumer preferences are evolving towards proactive security measures, operational optimization, and personalized customer experiences, all of which can be significantly supported by video analytics. For instance, in retail, analytics are used for footfall analysis, customer behavior tracking, and inventory management, leading to improved store layouts and targeted marketing. In the BFSI sector, video analytics are crucial for fraud detection, compliance monitoring, and enhancing customer service in branches. Critical infrastructure and defense sectors are leveraging these technologies for enhanced security and situational awareness, reducing response times to incidents.

Technological disruptions, such as the development of edge computing solutions, are enabling real-time processing of video data closer to the source, reducing latency and bandwidth requirements. This is particularly important for applications in remote or bandwidth-constrained environments. The competitive landscape is dynamic, characterized by intense innovation and strategic partnerships. Companies are differentiating themselves through specialized algorithms, ease of integration, cloud-based offerings, and vertical-specific solutions. The ongoing quest for greater accuracy, scalability, and cost-effectiveness continues to shape market trends, pushing the boundaries of what is possible with video content analysis. The global market size is estimated to reach 95,000 Million by 2025, a significant leap driven by these evolving dynamics.

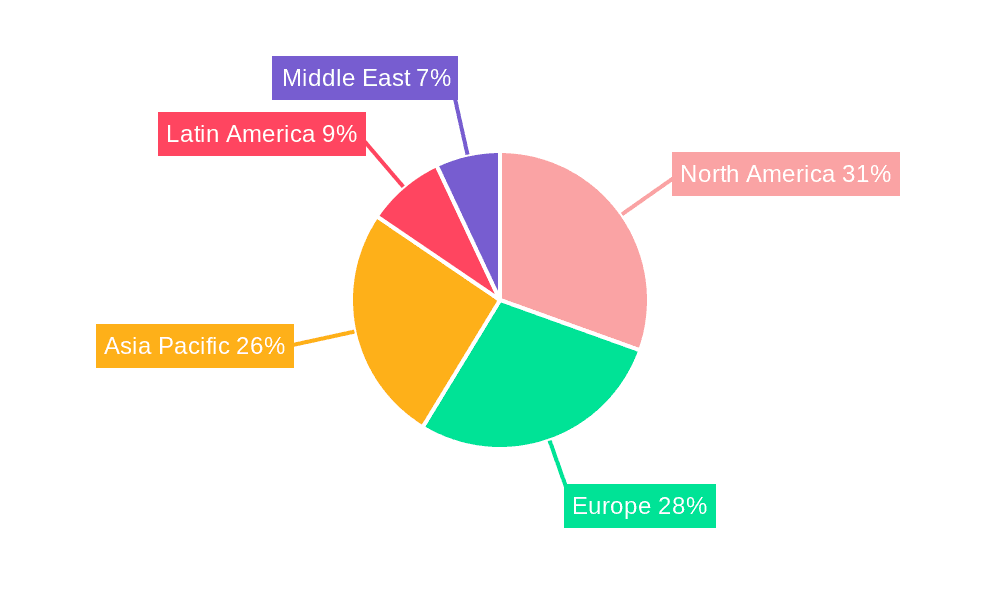

Dominant Regions & Segments in Video Content Analytics Industry

North America currently holds a dominant position in the Video Content Analytics industry, driven by substantial investments in advanced technologies, a robust cybersecurity infrastructure, and early adoption across key sectors such as defense, critical infrastructure, and BFSI. The region benefits from a strong presence of leading technology companies and a mature market for AI-driven solutions. Government initiatives focused on national security and public safety further bolster demand for sophisticated video analytics. The United States, in particular, leads this regional dominance due to its extensive research and development capabilities and high spending on security solutions.

Within this landscape, the Software (On-premise and Cloud) segment is poised for significant growth and currently represents a substantial portion of the market. The increasing shift towards cloud-based solutions is a major trend, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes. However, on-premise solutions remain critical for organizations with stringent data security and privacy requirements, particularly within government and defense sectors.

The Defense and Security end-user vertical is another leading segment, showcasing high demand for advanced video analytics for threat detection, surveillance, border security, and operational intelligence. The escalating global security concerns and geopolitical tensions continue to drive substantial investments in this area.

Key drivers for regional and segment dominance include:

- Economic Policies: Government funding for R&D, defense, and infrastructure projects.

- Infrastructure: Well-developed IT infrastructure and high internet penetration.

- Technological Advancement: Proactive development and adoption of AI, machine learning, and computer vision.

- Regulatory Environment: Supportive frameworks for technology innovation, balanced with data privacy considerations.

The BFSI and Critical Infrastructure segments also exhibit strong growth trajectories due to the paramount need for security, fraud prevention, and operational monitoring. The Retail & Logistics sector is increasingly leveraging video analytics for customer behavior insights, inventory management, and supply chain optimization. The Healthcare industry is exploring applications in patient monitoring, safety, and operational efficiency, while Hospitality and Transportation are adopting analytics for enhanced security, passenger flow management, and operational improvements. The Other End-user verticals (Manufacturing, etc.) are also showing increasing adoption for quality control, worker safety, and process optimization, further contributing to the diversified growth of the industry. The market size for software solutions is projected to reach 60,000 Million by 2025.

Video Content Analytics Industry Product Innovations

Product innovations in the Video Content Analytics industry are primarily focused on enhancing AI algorithms for greater accuracy and speed, expanding the range of identifiable objects and events, and improving integration capabilities. Advancements in deep learning are leading to more sophisticated anomaly detection, predictive analytics, and behavioral analysis features, moving beyond simple motion detection. The development of edge AI solutions allows for real-time processing directly on cameras or local devices, reducing latency and bandwidth dependence. Furthermore, increasing interoperability and API-driven architectures are enabling seamless integration with existing security systems, VMS (Video Management Systems), and other enterprise software, creating comprehensive intelligent solutions. Competitive advantages are being built through specialized analytics modules for specific verticals, real-time dashboards, and user-friendly interfaces that democratize the use of advanced video intelligence.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Video Content Analytics industry, segmented by Type, Services, and End User. The Type segmentation covers both Software (On-premise and Cloud) solutions, with cloud-based analytics projected for higher growth due to scalability and accessibility, and Services, encompassing installation, integration, customization, and ongoing support. The End User segmentation includes BFSI, Healthcare, Retail & Logistics, Critical Infrastructure, Hospitality and Transportation, Defense and Security, and Other End-user verticals (Manufacturing, etc.). Each segment is analyzed for its unique growth drivers, market penetration, and competitive dynamics. The BFSI and Defense & Security segments are expected to exhibit significant growth, followed by Retail & Logistics and Critical Infrastructure. The market size for services is estimated at 35,000 Million by 2025, with a healthy CAGR of 17.8%.

Key Drivers of Video Content Analytics Industry Growth

The growth of the Video Content Analytics industry is propelled by several key factors. Technologically, continuous advancements in Artificial Intelligence (AI), machine learning, and computer vision are enhancing the capabilities and accuracy of analytics platforms. The exponential increase in video data generation worldwide necessitates efficient methods for analysis and interpretation. Economically, the growing realization of ROI through improved operational efficiency, loss prevention, and enhanced security is driving adoption across sectors. Regulatory factors, such as stringent security mandates in critical infrastructure and evolving data privacy laws, are also influencing the demand for sophisticated compliance and security solutions. The increasing adoption of IoT devices further fuels the need for integrated data analysis, where video analytics plays a crucial role.

Challenges in the Video Content Analytics Industry Sector

Despite its robust growth, the Video Content Analytics industry faces several challenges. Regulatory hurdles, particularly concerning data privacy and the ethical use of facial recognition technology, can lead to compliance complexities and market access restrictions in certain regions. The high cost of implementation for advanced, customized solutions can be a barrier for small and medium-sized enterprises (SMEs). Supply chain issues, especially concerning specialized hardware components for edge analytics, can impact deployment timelines. Furthermore, the competitive pressure from numerous market players, including both established giants and agile startups, necessitates continuous innovation and differentiation. Skill gaps in data science and AI expertise can also hinder the effective deployment and management of complex video analytics systems, impacting the projected market penetration of 70% by 2028.

Emerging Opportunities in Video Content Analytics Industry

Emerging opportunities in the Video Content Analytics industry are vast, driven by untapped market potential and evolving technological capabilities. The increasing demand for predictive analytics, enabling proactive threat detection and incident prevention, presents a significant growth area. The expansion of AI-powered video analytics into new verticals like smart cities, agriculture, and environmental monitoring opens up substantial new markets. Furthermore, the integration of video analytics with other data sources, such as IoT sensors and social media, offers opportunities for creating more comprehensive and actionable intelligence. The development of more sophisticated and specialized AI models tailored for niche applications, alongside the continued growth of cloud-based and edge computing solutions, will further drive market expansion. The demand for real-time actionable insights, driven by hyper-personalization in retail and proactive public safety measures, will continue to shape innovation and market penetration.

Leading Players in the Video Content Analytics Industry Market

- Honeywell International Inc

- Herta Security SL

- ISS Inc

- Qognify Limited

- Cisco Systems Inc

- Genetec Inc

- Verint Systems Inc

- NEC Corporation

- Agent Video Intelligence Ltd

- Identiv Inc

- Aventura Technologies Inc

- International Business Machines Corporation

- Objectvideo Labs LLC

Key Developments in Video Content Analytics Industry Industry

- November 2022: Servian, Australia's data consulting firm, and VisualCortex, the video intelligence Platform bridging computer vision's potential to practical business outcomes, have signed a referral and services agreement. According to the terms of the collaboration agreement, Servian would be able to recommend VisualCortex's Video Intelligence Platform to its current and potential clients in Australia and New Zealand, as well as provide implementation, integration, model creation, and related professional services. This collaboration enhances service offerings and expands market reach.

- October 2022: Awiros will provide advanced video analytics for high-resolution surveillance cameras for the Bengaluru Safe City project. Awiros' AI-based Video Intelligence platform, automatic number plate recognition, facial recognition system, and other Video AI applications would empower the analysis of video feeds from over 7000 cameras spread across 3000+ locations in Bengaluru city. This partnership significantly bolsters public safety infrastructure through intelligent video analysis.

Future Outlook for Video Content Analytics Industry Market

The future outlook for the Video Content Analytics industry is exceptionally bright, characterized by sustained high growth and transformative potential. The ongoing advancements in AI and machine learning will continue to unlock new levels of accuracy and predictive capabilities, moving from reactive surveillance to proactive threat intelligence. The increasing integration of video analytics with other data streams, including IoT, sensor data, and operational systems, will create more holistic and intelligent decision-making environments across industries. The expansion of edge computing will enable faster, more localized analysis, critical for real-time applications and data privacy. Furthermore, the growing adoption in emerging markets and new application areas like smart cities, autonomous systems, and personalized customer experiences will further fuel market expansion. The industry is poised to become an indispensable tool for enhancing security, optimizing operations, and driving business insights, with projected market growth reaching 250,000 Million by 2033.

Video Content Analytics Industry Segmentation

-

1. Type

- 1.1. Software (On-premise and Cloud)

- 1.2. Services

-

2. End User

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Retail & Logistics

- 2.4. Critical Infrastructure

- 2.5. Hospitality and Transportation

- 2.6. Defense and Security

- 2.7. Other End-user verticals (Manufacturing, etc.)

Video Content Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Video Content Analytics Industry Regional Market Share

Geographic Coverage of Video Content Analytics Industry

Video Content Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis among Enterprises on Obtaining Actionable Insights; Technological Advancements coupled with High Investments in City Surveillance

- 3.3. Market Restrains

- 3.3.1. Steep Learning Curve Regarding Connected Agriculture

- 3.4. Market Trends

- 3.4.1. Retail Industry is expected to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software (On-premise and Cloud)

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Retail & Logistics

- 5.2.4. Critical Infrastructure

- 5.2.5. Hospitality and Transportation

- 5.2.6. Defense and Security

- 5.2.7. Other End-user verticals (Manufacturing, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software (On-premise and Cloud)

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Retail & Logistics

- 6.2.4. Critical Infrastructure

- 6.2.5. Hospitality and Transportation

- 6.2.6. Defense and Security

- 6.2.7. Other End-user verticals (Manufacturing, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software (On-premise and Cloud)

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Retail & Logistics

- 7.2.4. Critical Infrastructure

- 7.2.5. Hospitality and Transportation

- 7.2.6. Defense and Security

- 7.2.7. Other End-user verticals (Manufacturing, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software (On-premise and Cloud)

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Retail & Logistics

- 8.2.4. Critical Infrastructure

- 8.2.5. Hospitality and Transportation

- 8.2.6. Defense and Security

- 8.2.7. Other End-user verticals (Manufacturing, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software (On-premise and Cloud)

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Retail & Logistics

- 9.2.4. Critical Infrastructure

- 9.2.5. Hospitality and Transportation

- 9.2.6. Defense and Security

- 9.2.7. Other End-user verticals (Manufacturing, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Software (On-premise and Cloud)

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Retail & Logistics

- 10.2.4. Critical Infrastructure

- 10.2.5. Hospitality and Transportation

- 10.2.6. Defense and Security

- 10.2.7. Other End-user verticals (Manufacturing, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herta Security SL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ISS Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qognify Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Genetec Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Verint Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NEC Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agent Video Intelligence Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Identiv Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aventura Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 International Business Machines Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Objectvideo Labs LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Video Content Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Video Content Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Content Analytics Industry?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Video Content Analytics Industry?

Key companies in the market include Honeywell International Inc, Herta Security SL, ISS Inc, Qognify Limited, Cisco Systems Inc, Genetec Inc, Verint Systems Inc, NEC Corporation, Agent Video Intelligence Ltd, Identiv Inc, Aventura Technologies Inc, International Business Machines Corporation, Objectvideo Labs LLC.

3. What are the main segments of the Video Content Analytics Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis among Enterprises on Obtaining Actionable Insights; Technological Advancements coupled with High Investments in City Surveillance.

6. What are the notable trends driving market growth?

Retail Industry is expected to Hold a Major Share.

7. Are there any restraints impacting market growth?

Steep Learning Curve Regarding Connected Agriculture.

8. Can you provide examples of recent developments in the market?

November 2022: Servian, Australia's data consulting firm, and VisualCortex, the video intelligence Platform bridging computer vision's potential to practical business outcomes, have signed a referral and services agreement. According to the terms of the collaboration agreement, Servian would be able to recommend VisualCortex's Video Intelligence Platform to its current and potential clients in Australia and New Zealand, as well as provide implementation, integration, model creation, and related professional services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Video Content Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Video Content Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Video Content Analytics Industry?

To stay informed about further developments, trends, and reports in the Video Content Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence