Key Insights

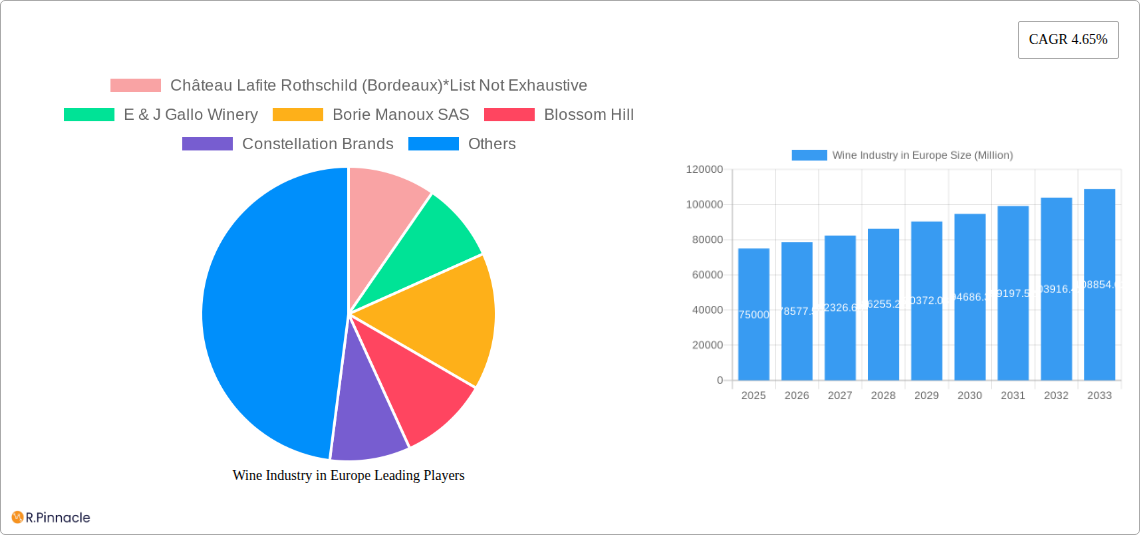

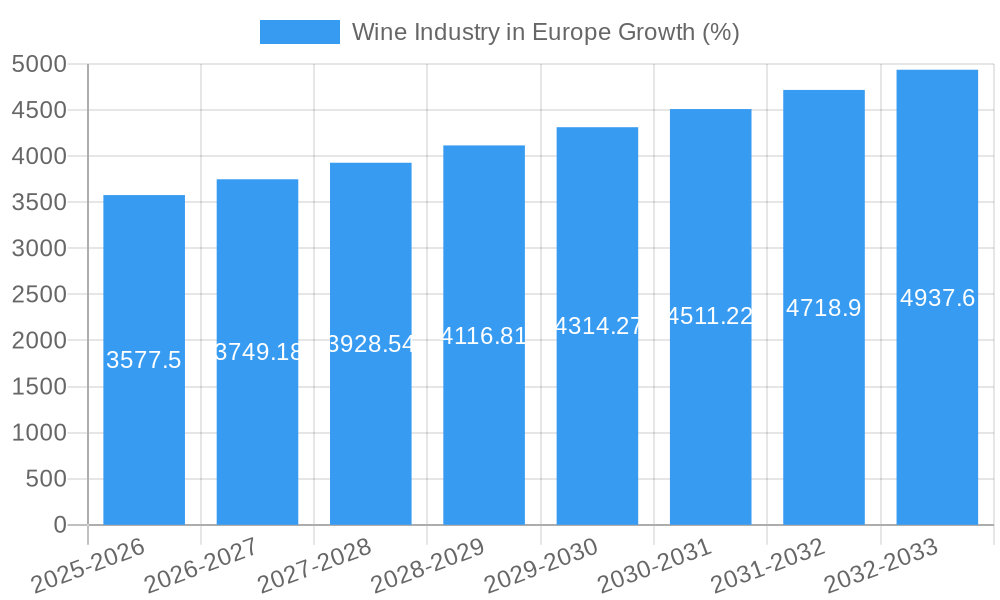

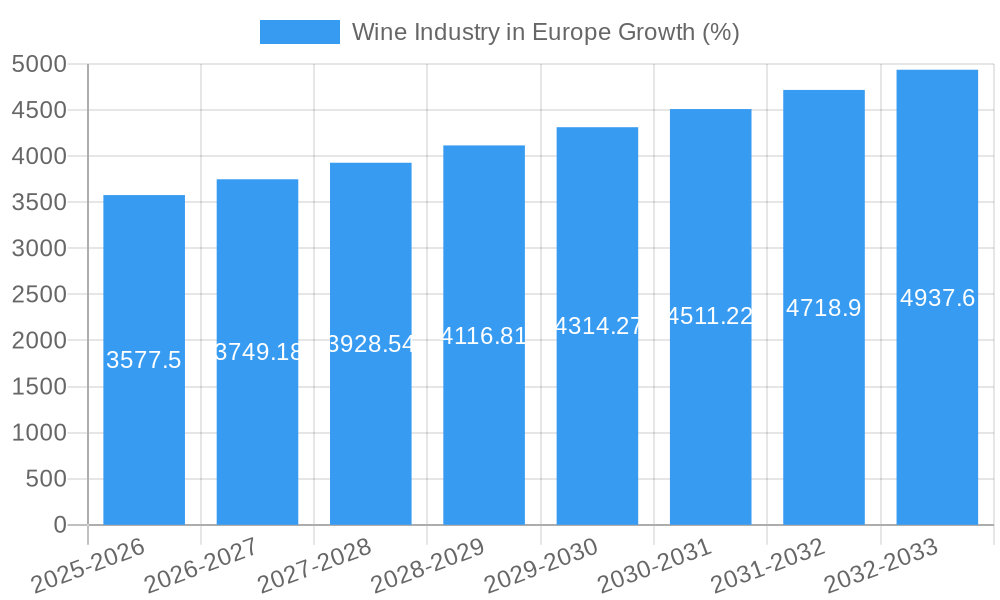

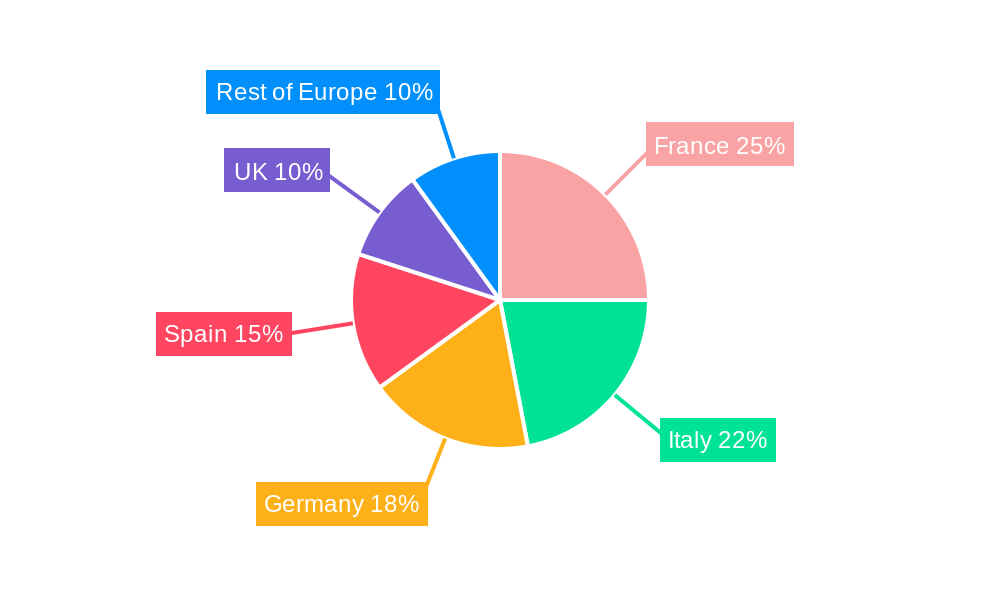

The European wine market, a significant global player, is projected to experience steady growth throughout the forecast period (2025-2033). With a current market size estimated at €XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 4.65% and unspecified 2019-2024 data), the market is driven by several factors. Increasing disposable incomes in key European countries, coupled with a growing appreciation for premium wine varieties and experiences, fuel consumer demand. The rise of online wine retailers and a broader adoption of e-commerce are reshaping the distribution landscape, offering convenience to consumers and increasing market access. Furthermore, innovative winemaking techniques and a focus on sustainable practices are attracting environmentally conscious consumers. However, fluctuating grape harvests due to climate change and increasing competition from other alcoholic beverages pose potential challenges. The market segmentation reveals a diversified landscape, with still wines maintaining a dominant position while sparkling wines are showing robust growth. Leading players, such as Château Lafite Rothschild and E & J Gallo Winery, alongside smaller boutique wineries, are actively competing within both the on-trade (restaurants, bars) and off-trade (retail stores) channels. The geographic breakdown indicates strong performance within established wine-producing nations like France, Italy, and Germany, alongside growth potential in other European markets.

The predicted CAGR of 4.65% suggests a continuous upward trend in market value. This growth is expected to be fueled by the increasing popularity of premium wines, especially within specific segments like organic and biodynamic wines. The rise of wine tourism, along with a focus on wine's health benefits (in moderation), further contributes to positive market momentum. However, potential economic downturns and shifts in consumer preferences could influence future growth trajectories. Strategies for success in this competitive market include product diversification, effective branding, and adaptation to evolving consumer demands. A focus on sustainable production methods will also become increasingly important in attracting environmentally conscious consumers.

Wine Industry in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European wine industry, encompassing market structure, dynamics, key players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. Expected market value in 2025 is estimated at XX Million.

Wine Industry in Europe Market Structure & Innovation Trends

The European wine market is characterized by a complex interplay of established players and emerging brands. Market concentration is moderate, with a few large players like E & J Gallo Winery and Constellation Brands holding significant shares, alongside numerous smaller, regional producers. The market's overall structure is influenced by various factors, including strong regional identities and consumer preference for specific grape varietals and wine styles. Innovation is driven by several forces:

- Consumer demand: Growing interest in organic, biodynamic, and sustainable wines fuels innovation in production methods and labeling.

- Technological advancements: Precision viticulture and winemaking technologies enhance quality and efficiency.

- Regulatory frameworks: EU regulations on labeling, production, and marketing influence both innovation and market access.

- Product substitution: The emergence of alternative alcoholic beverages creates competitive pressure, forcing wineries to innovate.

Mergers and acquisitions (M&A) activity plays a significant role in shaping market structure. Recent examples include E. & J. Gallo Winery's acquisition of over 30 wine brands from Constellation Brands in 2021. These deals often involve large sums of money, with the Gallo-Constellation transaction valued at XX Million (estimated).

Wine Industry in Europe Market Dynamics & Trends

The European wine market is experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and shifting economic conditions. Market growth is influenced by several key factors:

- Premiumization: A rising demand for higher-quality, premium wines is driving up average prices and profits.

- Health and wellness: Consumers are increasingly focused on healthier options, leading to increased demand for low-alcohol and organic wines.

- E-commerce: Online wine sales are steadily growing, expanding market access and reaching new customer segments.

- Tourism: Wine tourism remains a vital element, attracting visitors to vineyards and wineries, boosting sales and regional economies.

- Climate change: Shifting weather patterns pose challenges to viticulture, leading to innovations in irrigation and grape selection.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of premium wines is expected to reach xx% by 2033. Competitive dynamics are shaped by both global giants and smaller, regionally focused producers, resulting in a diverse and innovative landscape.

Dominant Regions & Segments in Wine Industry in Europe

France: Remains the largest wine producer in Europe, largely due to its vast vineyard area, diverse wine regions (Bordeaux, Burgundy, Champagne), and centuries-old winemaking expertise. This dominance is further fueled by the robust tourism industry centered around wine. Key factors contributing to France's lead include established export channels, a well-developed supply chain, and government support for the wine industry.

Italy: Ranks second, with strong regional identities and successful production of a wide range of wine styles. Factors including a strong domestic market and growing exports contribute to its position.

Spain: Another significant producer known for its value-oriented wines, and an increasing production of higher-quality wines.

Red Wine: This segment holds the largest market share due to widespread consumer preference.

Still Wine: The dominant product type, with continuous innovation in grape varietals and production techniques.

Off-trade: This channel is currently the largest, driven by convenient supermarket and online purchases.

Other significant regions include Portugal, Germany, and smaller wine producers throughout Eastern and Central Europe. Each region boasts unique grape varietals and wine styles, showcasing the diversity of European viticulture.

Wine Industry in Europe Product Innovations

Recent innovations within the European wine industry include sustainable winemaking practices, technological improvements in fermentation and aging, and a focus on developing new, regionally specific wine styles. The industry is increasingly embracing technology in areas like precision viticulture, drone technology for vineyard management, and data analytics for optimizing production processes. These innovations aim to improve quality, reduce costs, and enhance sustainability.

Report Scope & Segmentation Analysis

This report segments the European wine market across various parameters:

- Color: Red, Rosé, White, Other Wines. Red wine dominates the market, followed by white and rosé, with "other wines" encompassing fortified and dessert varieties.

- Distribution Channel: On-trade (restaurants, bars, hotels) and Off-trade (retail stores, online sales). Off-trade currently holds a larger market share.

- Product Type: Still, Sparkling, Other (e.g., fortified wines). Still wines constitute the largest segment, with sparkling wines holding a significant and growing share.

Each segment exhibits unique growth projections and competitive dynamics. Growth projections for each are presented within the full report.

Key Drivers of Wine Industry in Europe Growth

Several factors contribute to the ongoing growth of the European wine industry:

- Rising Disposable Incomes: Growing affluence in many European countries leads to increased spending on premium beverages.

- Tourism & Wine Tourism: Wine tourism provides a boost to sales and region-specific brands.

- Evolving Consumer Preferences: Increased demand for organic, sustainable, and niche wines fuels innovation.

Challenges in the Wine Industry in Europe Sector

The European wine industry faces several challenges:

- Climate Change: Changing weather patterns threaten grape yields and quality.

- Competition: Increased competition from other alcoholic beverages and imports.

- Regulatory Hurdles: Complex EU regulations impacting production and marketing.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of essential materials.

Emerging Opportunities in Wine Industry in Europe

Several emerging trends offer opportunities for growth:

- Health-conscious Wines: Demand for low-alcohol and organic options.

- Sustainable Practices: Consumers are increasingly seeking wines produced with sustainable methods.

- Premiumization: The demand for premium, higher-priced wines is driving innovation.

- Digital Marketing: E-commerce and targeted digital marketing offer new reach opportunities.

Leading Players in the Wine Industry in Europe Market

- Château Lafite Rothschild (Bordeaux)

- E & J Gallo Winery

- Borie Manoux SAS

- Blossom Hill

- Constellation Brands

- Pernod Ricard SA (Brancott)

- Financière Pinault SCA (Groupe Artemis SA)

- Treasury Wine Estates (Wolf Blass)

- Louis Roederer

- Castel Group (Baron de Lestac)

Key Developments in Wine Industry in Europe Industry

- July 2022: Pernod Ricard initiates a European pilot program for digital labeling on its wine and spirits products.

- August 2021: Pernod Ricard UK launches a new range of Australian wines inspired by dogs.

- January 2021: E. & J. Gallo Winery completes the acquisition of over 30 wine brands from Constellation Brands.

Future Outlook for Wine Industry in Europe Market

The European wine industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and increasing demand for premium and sustainable products. Strategic opportunities lie in embracing digital marketing, promoting sustainability, and catering to health-conscious consumers. The market is projected to expand steadily throughout the forecast period, with premium segments experiencing the most significant growth.

Wine Industry in Europe Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Wines

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Distribution Channels

Wine Industry in Europe Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Italy

- 6. Rest of Europe

Wine Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Large Vineyard Area is Likely to Drive the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Wines

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Germany

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Color

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.2.4. Other Wines

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Color

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.2.4. Other Wines

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Color

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.2.4. Other Wines

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Color

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.2.4. Other Wines

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade

- 9.3.2. Off-trade

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Specialty Stores

- 9.3.2.3. Online Retail Stores

- 9.3.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Color

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.2.4. Other Wines

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade

- 10.3.2. Off-trade

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Specialty Stores

- 10.3.2.3. Online Retail Stores

- 10.3.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Still Wine

- 11.1.2. Sparkling Wine

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Color

- 11.2.1. Red Wine

- 11.2.2. Rose Wine

- 11.2.3. White Wine

- 11.2.4. Other Wines

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-trade

- 11.3.2. Off-trade

- 11.3.2.1. Supermarkets/Hypermarkets

- 11.3.2.2. Specialty Stores

- 11.3.2.3. Online Retail Stores

- 11.3.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 E & J Gallo Winery

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Borie Manoux SAS

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Blossom Hill

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Constellation Brands

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Pernod Ricard SA (Brancott)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Financière Pinault SCA (Groupe Artemis SA)

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Treasury Wine Estates (Wolf Blass)

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Louis Roederer

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Castel Group (Baron de Lestac)

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

List of Figures

- Figure 1: Wine Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Wine Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 4: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 16: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 20: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 24: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 28: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 32: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 36: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Industry in Europe?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Wine Industry in Europe?

Key companies in the market include Château Lafite Rothschild (Bordeaux)*List Not Exhaustive, E & J Gallo Winery, Borie Manoux SAS, Blossom Hill, Constellation Brands, Pernod Ricard SA (Brancott), Financière Pinault SCA (Groupe Artemis SA), Treasury Wine Estates (Wolf Blass), Louis Roederer, Castel Group (Baron de Lestac).

3. What are the main segments of the Wine Industry in Europe?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Large Vineyard Area is Likely to Drive the Market in the Region.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

Pernod Ricard has announced the launch of a digital labeling project that will cover its entire portfolio, including wine and spirits. The project, under which every bottle of Pernod Ricard's products carries its QR code on the back label, is being implemented to provide consumers with more transparency on ingredient and health information. According to Pernod Richard, a European pilot program for the digital label solution will begin in July 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Industry in Europe?

To stay informed about further developments, trends, and reports in the Wine Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence