Key Insights

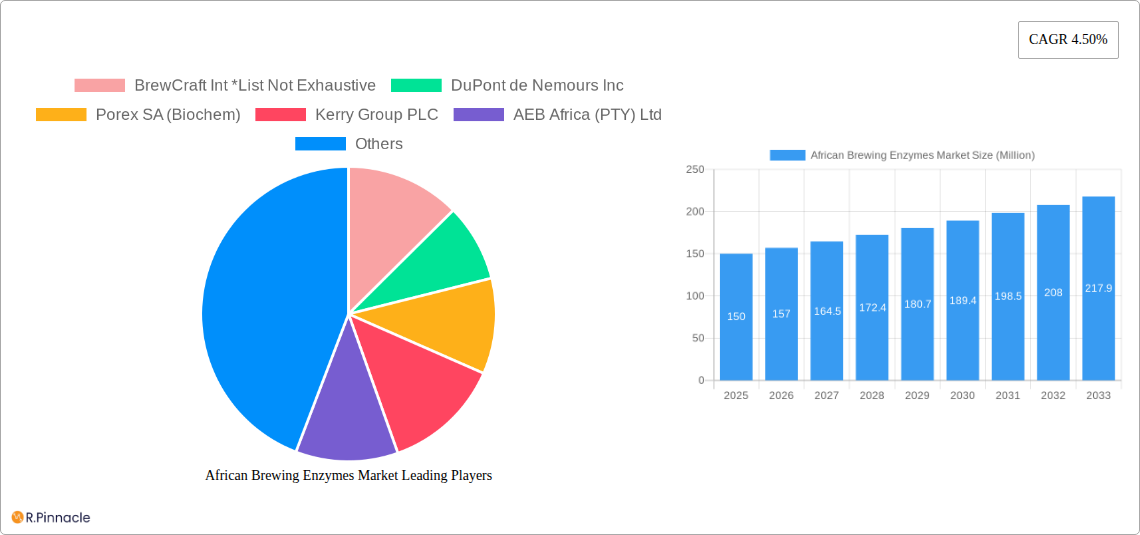

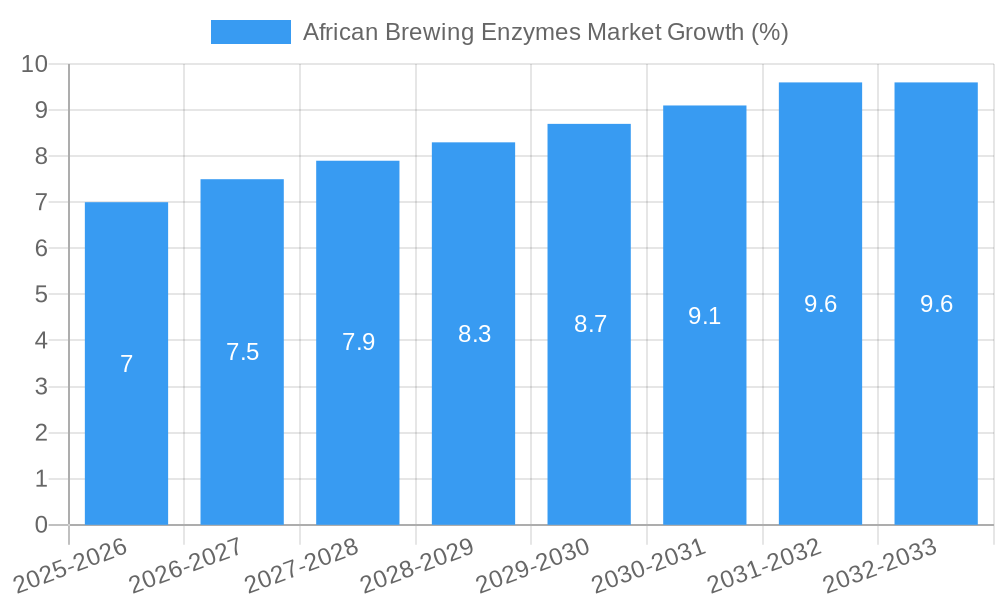

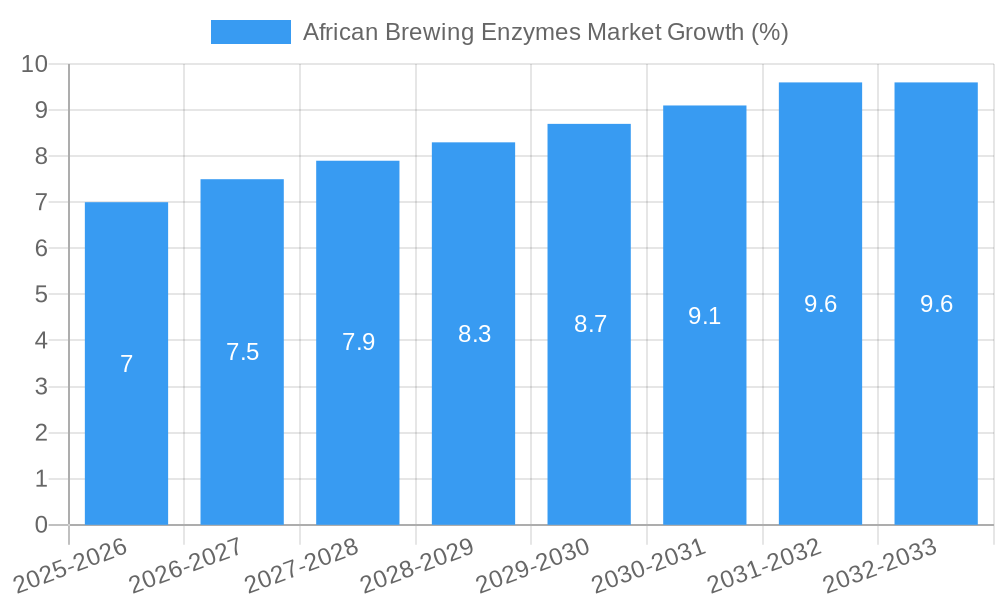

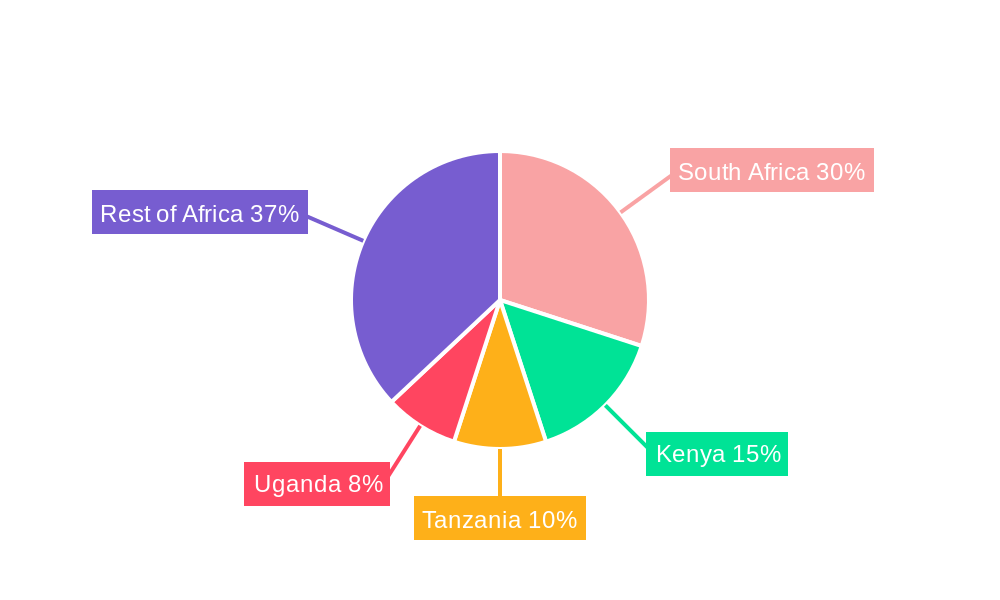

The African brewing enzymes market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for alcoholic and non-alcoholic beverages across the continent, driven by a burgeoning population and rising disposable incomes, is a significant driver. Furthermore, the growing preference for high-quality, consistent brews is pushing brewers to adopt advanced enzymatic technologies for enhanced efficiency and product quality. The market is segmented by form (liquid and dry), source (microbial and plant), and type (amylase, alpha-lase, protease, and others). Liquid enzymes currently hold a larger market share due to their ease of use and broader applications. However, the dry enzyme segment is witnessing significant growth due to its longer shelf life and improved stability, making it particularly suitable for regions with limited cold chain infrastructure. The microbial source segment dominates due to its cost-effectiveness and efficiency in enzymatic production. Amylase and protease enzymes are the most widely used, reflecting their crucial roles in starch conversion and protein modification during brewing processes. While opportunities abound, challenges remain, including inconsistent raw material quality, limited technological expertise in certain regions, and the potential for regulatory hurdles related to enzyme usage. Companies like BrewCraft Int, DuPont de Nemours Inc, Porex SA (Biochem), Kerry Group PLC, AEB Africa (PTY) Ltd, Novozymes AS, and Lallemand Inc are major players shaping the competitive landscape, each leveraging its unique strengths and expertise. Growth is expected to be particularly strong in countries like South Africa, Kenya, and Tanzania, due to their established brewing industries and growing middle class.

The forecast period of 2025-2033 is expected to see continued expansion, with significant opportunities for both established players and new entrants. Strategic partnerships between enzyme suppliers and brewing companies will be crucial in facilitating technological advancements and addressing regional challenges. Focus on research and development to improve enzyme efficiency and explore novel enzyme types tailored to specific African brewing conditions will further propel market growth. Increased investment in training and capacity building initiatives to enhance technical expertise among local brewers will also play a key role. The market's trajectory is strongly linked to the overall growth of the African beverage industry, indicating a promising future for brewing enzymes in the continent. A robust regulatory framework promoting the safe and sustainable use of enzymes will further unlock the market’s potential.

African Brewing Enzymes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the African Brewing Enzymes Market, offering invaluable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive market research to provide a detailed forecast from 2025 to 2033, encompassing key segments and trends shaping the market's future.

African Brewing Enzymes Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the African brewing enzymes market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market exhibits a moderately concentrated structure, with key players holding significant market share. For example, Novozymes AS and DuPont de Nemours Inc. are estimated to collectively control approximately xx% of the market in 2025. Innovation is driven by the need for improved enzyme efficiency, cost reduction, and sustainable brewing practices. Regulatory frameworks vary across African nations, impacting market entry and product approvals. Product substitutes, such as traditional fermentation methods, pose a competitive challenge, although enzymatic brewing offers advantages in consistency and efficiency. End-user demographics are influenced by the growth of the brewing industry in Africa, particularly in regions with increasing disposable income. M&A activities within the sector remain relatively limited, with the total value of deals in the past five years estimated at approximately $xx Million. However, we anticipate an increase in consolidation as larger players seek to expand their market presence.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Drivers: Improved enzyme efficiency, cost reduction, sustainability.

- Regulatory Frameworks: Vary across African nations, impacting market entry.

- M&A Activity: Limited, with estimated value of xx Million in the past five years.

African Brewing Enzymes Market Market Dynamics & Trends

The African brewing enzymes market is experiencing robust growth, driven by the expanding brewing industry, increasing consumer demand for beer and other alcoholic beverages, and rising disposable incomes across several African nations. The Compound Annual Growth Rate (CAGR) from 2025-2033 is projected at xx%, exceeding the global average. Technological disruptions, such as advancements in enzyme production and formulation, are enhancing enzyme efficiency and broadening application possibilities. Consumer preferences are shifting toward premium and craft beers, demanding higher quality enzymes and novel flavor profiles. Competitive dynamics are marked by both established global players and emerging local companies competing on price, quality, and innovation. Market penetration is highest in South Africa and Nigeria, while other regions show significant potential for growth.

Dominant Regions & Segments in African Brewing Enzymes Market

The market is currently dominated by South Africa and Nigeria, accounting for an estimated xx% of total market value in 2025. This dominance stems from several factors:

- South Africa: Established brewing industry, robust infrastructure, and access to technology.

- Nigeria: Large population, rising disposable incomes, and increasing beer consumption.

Segment Dominance:

- By Form: Liquid enzymes hold a larger market share due to ease of handling and application. However, dry enzymes are gaining traction due to improved stability and shelf life.

- By Source: Microbial enzymes dominate, driven by their cost-effectiveness and high production efficiency. Plant-based enzymes are a niche market, gaining popularity due to consumer demand for natural ingredients.

- By Type: Amylase and Protease are the leading enzyme types used in brewing, with Amylase holding a slight edge. Alphalase and other types represent a smaller but growing portion of the market.

Key Drivers:

- Economic growth and rising disposable incomes in key markets.

- Increased investment in brewing infrastructure.

- Favorable regulatory environment in some regions.

African Brewing Enzymes Market Product Innovations

Recent innovations focus on developing enzymes with enhanced performance, improved stability, and tailored functionalities. This includes enzymes designed for specific brewing processes, such as improved mashing efficiency and enhanced fermentation. Companies are also exploring novel enzyme applications, expanding beyond traditional beer production to include other alcoholic and non-alcoholic beverages. These advancements contribute to improved beer quality, reduced production costs, and enhanced sustainability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the African Brewing Enzymes Market, segmented by form (liquid, dry), source (microbial, plant), and type (Amylase, Alphalase, Protease, Other Types). Each segment's growth projection, market size, and competitive dynamics are meticulously examined. The market shows substantial growth potential across all segments, particularly in the dry form and microbial source categories. Competitive dynamics vary by segment, with some experiencing increased consolidation while others remain fragmented.

- By Form: Liquid enzymes are projected to grow at xx% CAGR, while dry enzymes are projected to grow at xx% CAGR.

- By Source: Microbial enzymes are expected to maintain their dominance, with a projected CAGR of xx%, while plant-based enzymes exhibit a faster CAGR of xx%.

- By Type: Amylase and Protease remain the key segments, with growth driven by increasing demand.

Key Drivers of African Brewing Enzymes Market Growth

Several factors propel the growth of the African brewing enzymes market. Expanding brewing capacity, rising beer consumption fueled by a growing young population and increasing disposable incomes, and a push for efficient and cost-effective brewing processes are crucial drivers. Furthermore, the adoption of advanced brewing technologies and the growing demand for high-quality, consistent products also contribute to market expansion. Government policies promoting local industries and investments in infrastructure further support the growth trajectory.

Challenges in the African Brewing Enzymes Market Sector

The African brewing enzymes market faces several challenges, including infrastructure limitations in some regions, hindering efficient logistics and supply chain management. This can lead to increased costs and delays. Fluctuations in raw material prices and currency exchange rates also present volatility. Regulatory inconsistencies across different African countries complicate market entry and product approval processes. Finally, competition from established international players and the presence of local producers can impact market share for individual companies.

Emerging Opportunities in African Brewing Enzymes Market

The market presents significant opportunities, including expanding into untapped regions with growing beer consumption. The development of specialized enzymes tailored to local brewing traditions and raw materials offers scope for innovation. Furthermore, increased adoption of sustainable and environmentally friendly brewing practices presents a unique market niche. Finally, collaboration between international and local companies can foster technological advancement and enhance market penetration.

Leading Players in the African Brewing Enzymes Market Market

- BrewCraft Int

- DuPont de Nemours Inc. (https://www.dupont.com/)

- Porex SA (Biochem)

- Kerry Group PLC (https://www.kerrygroup.com/)

- AEB Africa (PTY) Ltd

- Novozymes AS (https://www.novozymes.com/)

- Lallemand Inc. (https://www.lallemand.com/)

Key Developments in African Brewing Enzymes Market Industry

- 2022 Q4: Novozymes AS launched a new range of enzymes optimized for African brewing conditions.

- 2023 Q1: DuPont de Nemours Inc. announced a strategic partnership with a local African brewer to expand its market presence.

- 2023 Q3: A merger between two smaller African enzyme producers resulted in a more consolidated market segment. (Further details on merger values and companies are not available for this report)

Future Outlook for African Brewing Enzymes Market Market

The African brewing enzymes market exhibits significant growth potential, driven by continued expansion of the brewing sector and rising consumer demand. Strategic investments in research and development, focusing on enzyme optimization and sustainability, are anticipated. The market is poised for further consolidation, with larger players acquiring smaller companies to expand their reach. The increasing demand for high-quality, consistent products will drive innovation in enzyme technology.

African Brewing Enzymes Market Segmentation

-

1. Source

- 1.1. Microbial

- 1.2. Plant

-

2. Type

- 2.1. Amylase

- 2.2. Alphalase

- 2.3. Protease

- 2.4. Other Types

-

3. Form

- 3.1. Liquid

- 3.2. Dry

-

4. Geography

- 4.1. South Africa

- 4.2. Nigeria

- 4.3. Rest of Africa

African Brewing Enzymes Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Rest of Africa

African Brewing Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rising Demand for Protease in the Food Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Microbial

- 5.1.2. Plant

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Amylase

- 5.2.2. Alphalase

- 5.2.3. Protease

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Liquid

- 5.3.2. Dry

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Rest of Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. South Africa African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Microbial

- 6.1.2. Plant

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Amylase

- 6.2.2. Alphalase

- 6.2.3. Protease

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Form

- 6.3.1. Liquid

- 6.3.2. Dry

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Nigeria

- 6.4.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Nigeria African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Microbial

- 7.1.2. Plant

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Amylase

- 7.2.2. Alphalase

- 7.2.3. Protease

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Form

- 7.3.1. Liquid

- 7.3.2. Dry

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Nigeria

- 7.4.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of Africa African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Microbial

- 8.1.2. Plant

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Amylase

- 8.2.2. Alphalase

- 8.2.3. Protease

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Form

- 8.3.1. Liquid

- 8.3.2. Dry

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Nigeria

- 8.4.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South Africa African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa African Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 BrewCraft Int *List Not Exhaustive

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 DuPont de Nemours Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Porex SA (Biochem)

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Kerry Group PLC

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 AEB Africa (PTY) Ltd

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Novozymes AS

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Lallemand Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.1 BrewCraft Int *List Not Exhaustive

List of Figures

- Figure 1: African Brewing Enzymes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: African Brewing Enzymes Market Share (%) by Company 2024

List of Tables

- Table 1: African Brewing Enzymes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: African Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: African Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: African Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 5: African Brewing Enzymes Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: African Brewing Enzymes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: African Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa African Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: African Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 15: African Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: African Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 17: African Brewing Enzymes Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: African Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: African Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 20: African Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: African Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 22: African Brewing Enzymes Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: African Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: African Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 25: African Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: African Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 27: African Brewing Enzymes Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: African Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Brewing Enzymes Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the African Brewing Enzymes Market?

Key companies in the market include BrewCraft Int *List Not Exhaustive, DuPont de Nemours Inc, Porex SA (Biochem), Kerry Group PLC, AEB Africa (PTY) Ltd, Novozymes AS, Lallemand Inc.

3. What are the main segments of the African Brewing Enzymes Market?

The market segments include Source, Type, Form, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rising Demand for Protease in the Food Industries.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Brewing Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Brewing Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Brewing Enzymes Market?

To stay informed about further developments, trends, and reports in the African Brewing Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence