Key Insights

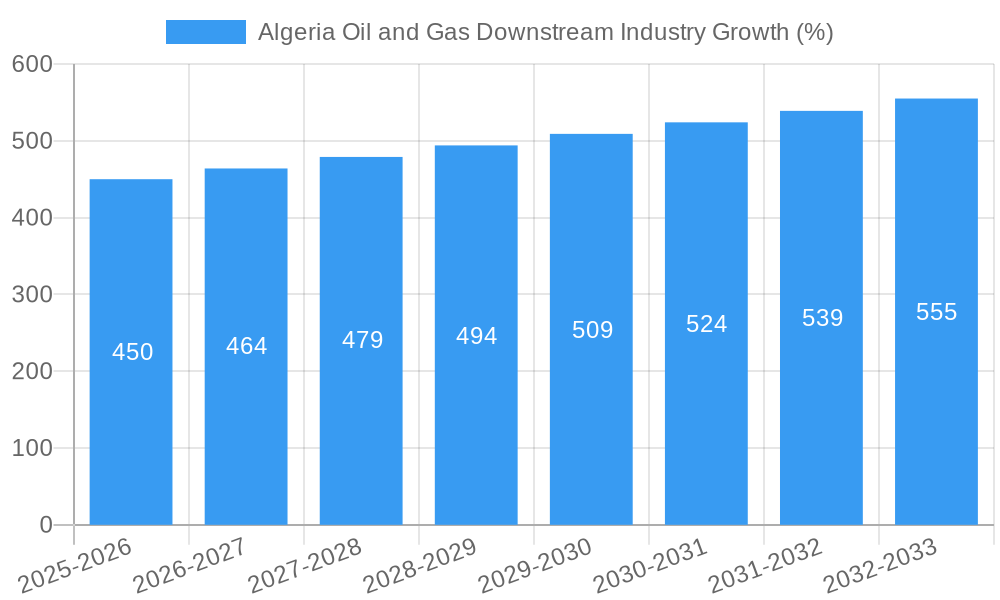

The Algerian oil and gas downstream industry, encompassing refining, petrochemicals, and distribution, presents a complex picture of growth and challenges. While Algeria possesses significant hydrocarbon reserves, its downstream sector faces hurdles in terms of modernization, investment, and integration with global markets. The period from 2019-2024 likely witnessed moderate growth, influenced by fluctuating global oil prices and domestic consumption patterns. Assuming a conservative average annual growth rate (CAGR) of 3% during this period, and considering a 2025 market size of approximately $15 billion (this figure is an educated estimate based on typical downstream sector values relative to upstream production in similar economies), the sector's value in 2019 would have been around $12 billion. This growth is anticipated to continue, albeit with variations influenced by government policies, infrastructure development, and global energy transitions. The forecast period (2025-2033) projects continued expansion, though likely at a slightly slower pace, perhaps averaging 2.5% CAGR, reflecting the need for significant investments in upgrading refineries and expanding petrochemical production to meet rising domestic demand and potentially explore export opportunities. This would require substantial foreign direct investment and technological upgrades to enhance efficiency and competitiveness.

The coming years will be crucial for the Algerian downstream sector. Success hinges on strategic investments in refinery modernization to improve product quality and yield, development of the petrochemical industry to diversify revenue streams beyond refined products, and enhancing distribution networks to ensure reliable supply across the country. Furthermore, aligning with global environmental standards and embracing sustainable practices will be vital for attracting investment and securing the sector's long-term future. Addressing regulatory complexities and fostering a more favorable investment climate will be key factors determining the industry's actual growth trajectory over the forecast period. The potential for growth is substantial, but realizing it requires a concerted effort from both the government and private sector players.

Algeria Oil and Gas Downstream Industry: Market Analysis & Forecast 2019-2033

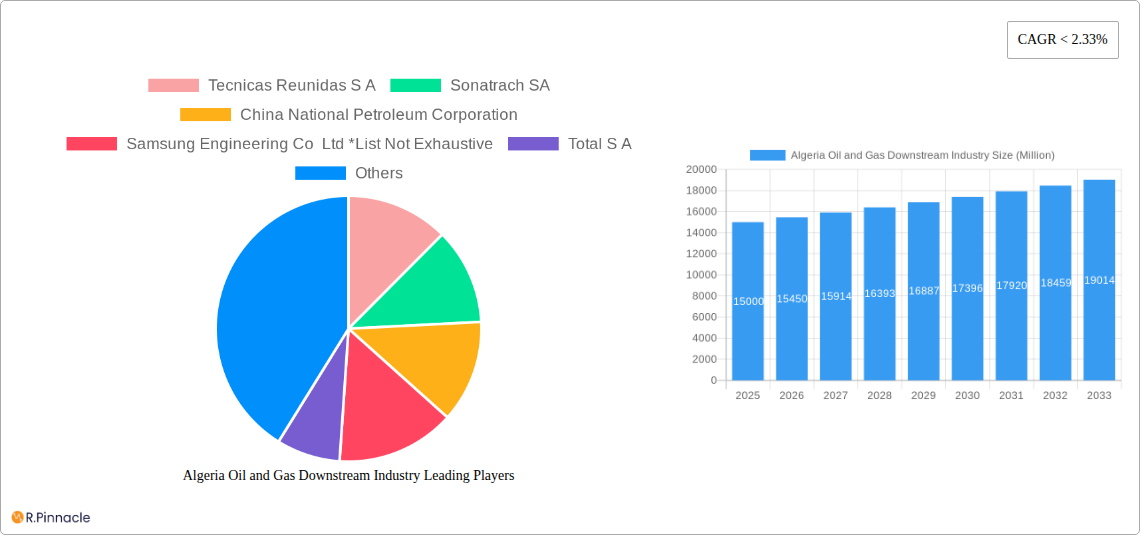

This comprehensive report provides a detailed analysis of the Algeria oil and gas downstream industry, offering actionable insights for industry professionals, investors, and strategic planners. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. Key players like Sonatrach SA, Tecnicas Reunidas S A, China National Petroleum Corporation, Samsung Engineering Co Ltd, and Total S A are analyzed, providing a robust understanding of the market landscape.

Algeria Oil and Gas Downstream Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Algeria's downstream oil and gas sector, examining market concentration, innovation drivers, and regulatory frameworks. We delve into the dynamics of mergers and acquisitions (M&A), providing insights into deal values and their impact on market share. The analysis includes an assessment of product substitutes and the evolving demographics of end-users within the transportation, power generation, and manufacturing sectors. Sonatrach SA, as the national oil company, holds a significant market share (estimated at xx%), while international players contribute the remaining xx%. M&A activity in the period 2019-2024 totalled approximately $XX Million, driven largely by consolidation efforts within the refining segment. The regulatory framework, while supportive of investment, presents challenges related to bureaucratic processes and licensing. Innovation drivers include government initiatives to enhance energy efficiency and promote the use of cleaner fuels.

Algeria Oil and Gas Downstream Industry Market Dynamics & Trends

This section provides a detailed examination of the market’s growth trajectory, driven by increasing domestic energy demand and government initiatives aimed at boosting industrial activity. Factors influencing market dynamics include technological advancements in refining processes, shifting consumer preferences towards cleaner fuels, and the intensified competition among domestic and international players. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033). Market penetration of new technologies, such as advanced refining catalysts, will be a key focus, with an anticipated increase from xx% in 2025 to xx% in 2033. Competitive dynamics are shaped by pricing strategies, capacity expansion plans, and investments in research and development.

Dominant Regions & Segments in Algeria Oil and Gas Downstream Industry

The Algerian oil and gas downstream industry is largely concentrated in the northern coastal regions, due to proximity to ports and existing infrastructure. The refining segment holds the largest market share, driven by growing domestic demand for refined petroleum products and government policies promoting local refining capacity. Petrochemical plants are also significant contributors, primarily serving the domestic manufacturing and packaging industries.

- Key Drivers for Refineries: Government investments in upgrading existing refineries, increasing domestic demand for fuels.

- Key Drivers for Petrochemical Plants: Growth in the plastics and packaging industries, expansion of downstream petrochemical production capacity.

- Application Segment Dominance: The transportation sector accounts for the largest share of demand (xx%), followed by power generation (xx%) and manufacturing (xx%).

Algeria Oil and Gas Downstream Industry Product Innovations

Recent innovations focus on enhancing refining efficiency, improving the quality of petroleum products, and minimizing environmental impact. Several projects are underway involving the deployment of advanced refining technologies to meet stricter environmental regulations and upgrade the country's refining capacity. This includes adoption of technologies that minimize sulfur content in fuels and optimize feedstock utilization.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Algerian downstream oil and gas industry across the following parameters:

Product: Refineries: The refining segment is projected to grow at a CAGR of xx% during the forecast period, driven by domestic demand and investments in refinery modernization. Market size in 2025 is estimated at $XX Million. Petrochemicals Plants: This segment will experience growth, with a projected CAGR of xx% driven by industrial expansion, particularly in the plastics and packaging sectors. The 2025 market size is estimated at $XX Million.

Application: Transportation: The transportation sector accounts for the bulk of demand. Power Generation: This sector shows steady growth driven by increasing electricity demand. Manufacturing: This sector is a significant consumer of refined products and petrochemicals.

Key Drivers of Algeria Oil and Gas Downstream Industry Growth

Growth is driven by rising domestic energy consumption, particularly in transportation and power generation. Government investments in infrastructure projects, coupled with expanding industrialization efforts, contribute significantly. Furthermore, strategic partnerships with international energy companies foster technological advancements and increase production capacities.

Challenges in the Algeria Oil and Gas Downstream Industry Sector

Challenges include aging infrastructure, reliance on imported feedstock (crude oil and natural gas), and competitive pressures from regional players. Bureaucratic hurdles and regulatory complexities also pose a challenge for new investors. The fluctuating global oil prices add further uncertainties to the market stability.

Emerging Opportunities in Algeria Oil and Gas Downstream Industry

Emerging opportunities lie in the development of petrochemical projects, enhancing the efficiency of refining operations, and increasing investments in renewable energy resources. Growing demand for cleaner fuels creates opportunities for investment in refinery upgrades and the development of biofuels.

Leading Players in the Algeria Oil and Gas Downstream Industry Market

- Sonatrach SA

- Tecnicas Reunidas S A

- China National Petroleum Corporation

- Samsung Engineering Co Ltd

- Total S A

Key Developments in Algeria Oil and Gas Downstream Industry Industry

- 2022-Q4: Sonatrach announces plans to upgrade its Skikda refinery.

- 2023-Q1: New petrochemical plant commences operations near Arzew.

- 2024-Q2: Government announces new incentives for investments in renewable energy.

Future Outlook for Algeria Oil and Gas Downstream Industry Market

The Algerian oil and gas downstream industry is expected to witness continued growth, driven by domestic demand and increasing investments in infrastructure development. Strategic partnerships with international players will play a crucial role in enhancing technology adoption and improving operational efficiency. Focusing on cleaner fuels and enhancing refining capacity will be critical for long-term growth and sustainability.

Algeria Oil and Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

Algeria Oil and Gas Downstream Industry Segmentation By Geography

- 1. Algeria

Algeria Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tecnicas Reunidas S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonatrach SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Engineering Co Ltd *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Tecnicas Reunidas S A

List of Figures

- Figure 1: Algeria Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Algeria Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Oil and Gas Downstream Industry?

The projected CAGR is approximately < 2.33%.

2. Which companies are prominent players in the Algeria Oil and Gas Downstream Industry?

Key companies in the market include Tecnicas Reunidas S A, Sonatrach SA, China National Petroleum Corporation, Samsung Engineering Co Ltd *List Not Exhaustive, Total S A.

3. What are the main segments of the Algeria Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Algeria Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence