Key Insights

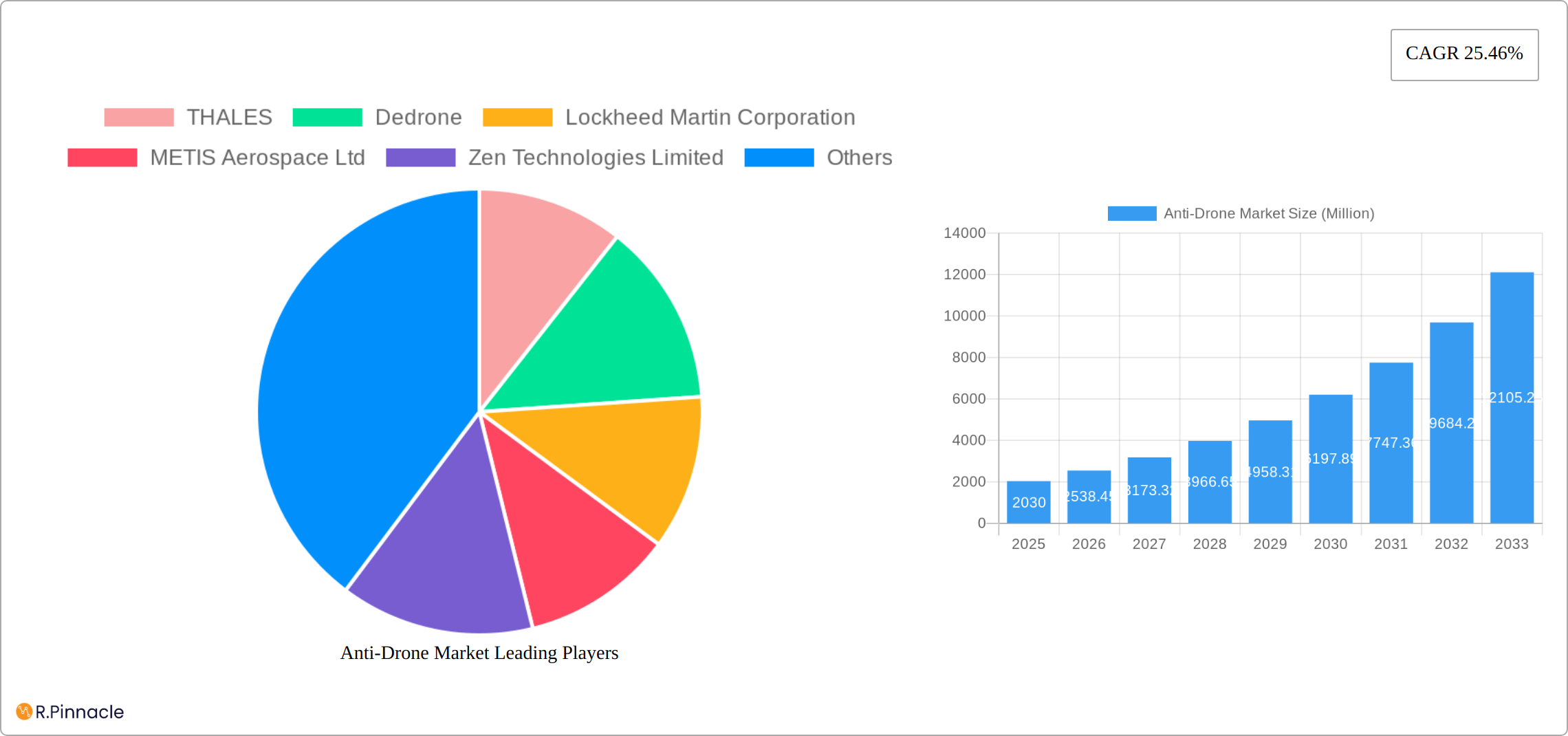

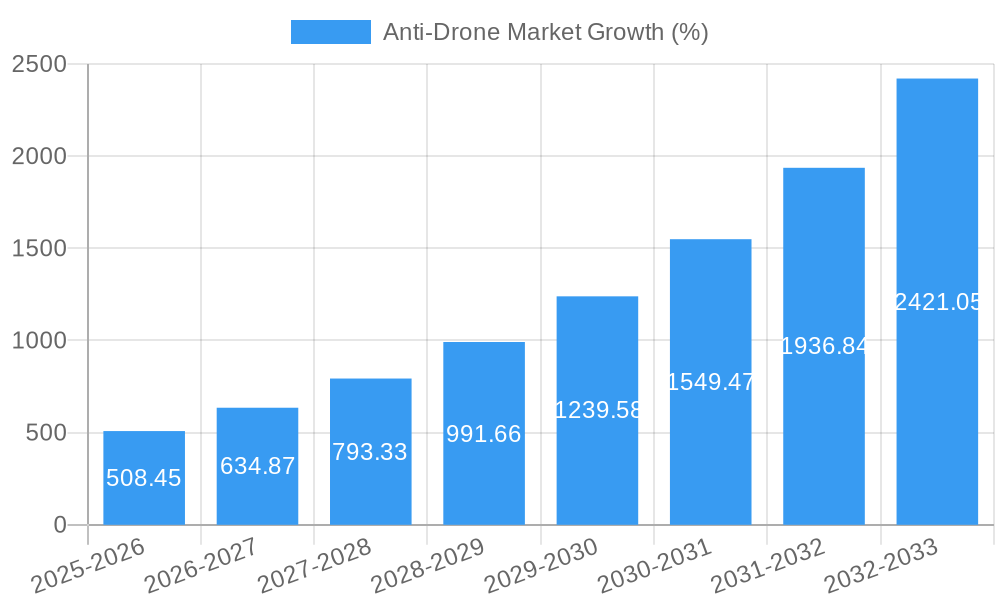

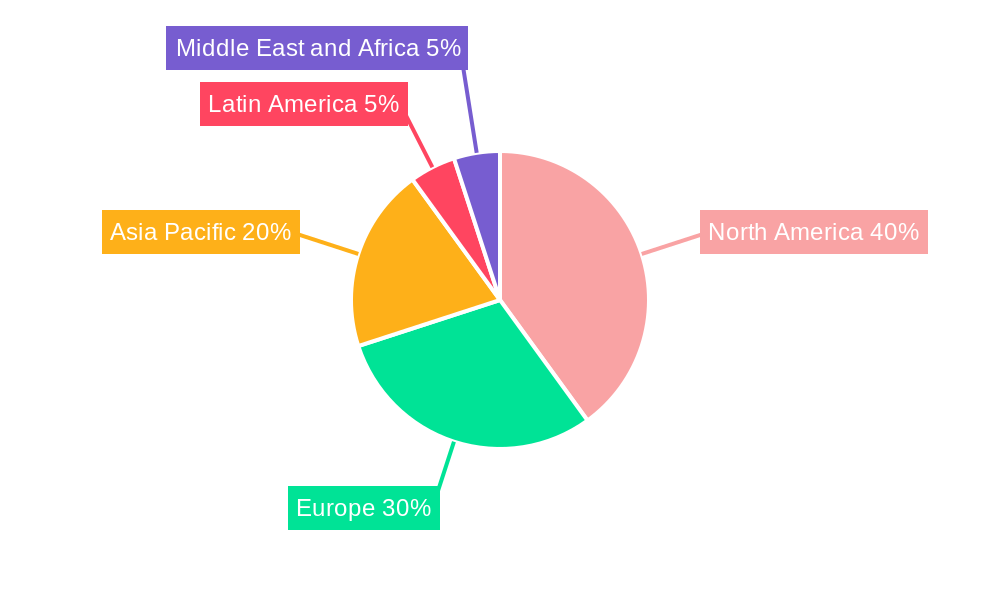

The anti-drone market is experiencing robust growth, projected to reach $2.03 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 25.46% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing sophistication and accessibility of drone technology, coupled with rising security concerns across diverse sectors, are creating a significant demand for effective counter-drone solutions. Governments and critical infrastructure operators, particularly in defense, airports, and other sensitive locations, are prioritizing investments in anti-drone systems to mitigate the risks associated with unauthorized drone activity, including surveillance, smuggling, and attacks. Furthermore, technological advancements in detection, jamming, and disruption technologies are enhancing the effectiveness and reliability of these systems, further boosting market growth. The market is segmented by application (detection and other sensors like jamming and disruption) and vertical (defense, airports, and other critical infrastructures). North America currently holds a significant market share due to high defense spending and early adoption of advanced technologies. However, the Asia-Pacific region is poised for rapid growth driven by increasing urbanization, infrastructure development, and rising security concerns.

The competitive landscape is characterized by a mix of established defense contractors like Thales and Lockheed Martin, alongside specialized anti-drone companies such as Dedrone and DroneShield. These companies are engaged in continuous innovation, introducing new products and services to meet the evolving threats posed by drones. The market is also witnessing strategic partnerships and mergers and acquisitions, further consolidating market players and driving technological advancements. While regulatory hurdles and cost considerations can pose challenges, the overall market outlook remains extremely positive, driven by ongoing technological progress and the persistent need to safeguard critical assets and national security. Future growth will likely be influenced by the development of AI-powered solutions, improved counter-drone techniques, and expanding government regulations aimed at managing drone usage.

Anti-Drone Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Anti-Drone Market, offering actionable insights for industry professionals and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market dynamics, technological advancements, and competitive landscapes. With a focus on key players like Thales, Dedrone, and Lockheed Martin, this report is your essential guide to navigating the complexities of this rapidly evolving market, projected to reach xx Million by 2033.

Anti-Drone Market Market Structure & Innovation Trends

The Anti-Drone market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. However, the market also features numerous smaller, specialized companies contributing to innovation and competition. The market is driven by increasing security concerns related to drone misuse, stringent regulatory frameworks concerning airspace security, and the continuous evolution of drone technology itself. This pushes manufacturers to develop increasingly sophisticated counter-drone technologies. Product substitutes are limited, primarily focusing on alternative security measures like physical barriers. End-user demographics include governments, defense agencies, airports, critical infrastructure operators, and private security firms. M&A activity in the sector remains relatively consistent, with deals primarily focused on consolidating technologies and expanding market reach. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of the market share.

- Innovation Drivers: Increasing drone threats, regulatory pressures, technological advancements.

- Regulatory Frameworks: Stringent regulations driving demand for compliant anti-drone solutions.

- Product Substitutes: Limited, mostly physical barriers and alternative security systems.

- End-User Demographics: Government, defense, airports, critical infrastructure, private security.

- M&A Activity: Consistent, focused on technological integration and market expansion. Total M&A deal value (2019-2024): xx Million.

Anti-Drone Market Market Dynamics & Trends

The Anti-Drone market is experiencing robust growth, driven by escalating concerns surrounding drone-related security breaches across diverse sectors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, fueled by the increasing adoption of anti-drone technologies in defense, airports, critical infrastructure, and other sensitive areas. This expansion is significantly impacted by technological advancements, including AI-powered detection systems boasting enhanced accuracy and range, advanced spectral analysis for precise target identification, and sophisticated jamming technologies minimizing collateral effects. Market participants are witnessing a shift in consumer preferences towards integrated, user-friendly solutions that offer high detection rates while ensuring minimal disruption to legitimate drone operations. The competitive landscape is highly dynamic, with companies striving for differentiation through technological leadership, cost-effectiveness, superior customer support, and strategic partnerships. Current market penetration stands at xx% and is projected to reach xx% by 2033, indicating substantial future growth potential.

Dominant Regions & Segments in Anti-Drone Market

The North American region currently holds the dominant position in the Anti-Drone market, primarily driven by strong defense spending and robust infrastructure security initiatives. However, the Asia-Pacific region is expected to witness significant growth over the forecast period, fueled by rapid urbanization and increasing investments in national security.

- Leading Region: North America.

- Key Drivers (North America): High defense expenditure, advanced technological infrastructure.

- Key Drivers (Asia-Pacific): Rapid urbanization, increasing investments in national security.

Segment Dominance:

- Application: Detection systems currently dominate, but the Jamming and Disruption segment is showing significant growth.

- Other Sensors: Jamming and Disruption systems are gaining traction due to their effectiveness in neutralizing hostile drones.

- Vertical: The Defense sector currently holds the largest market share, followed by Airports and Other Critical Infrastructures.

Anti-Drone Market Product Innovations

The Anti-Drone technology landscape is constantly evolving, with recent breakthroughs including AI-powered detection systems offering improved accuracy and extended range, advanced spectral analysis for precise target identification, and refined jamming and disruption technologies minimizing unintended consequences. These innovations are enhancing market penetration by effectively addressing the unique security challenges faced by various end-users, thereby fueling market competitiveness and driving increased adoption rates. Further innovation is focused on developing more resilient systems capable of countering evolving drone technology and tactics.

Report Scope & Segmentation Analysis

This report segments the Anti-Drone market by application (Detection, Jamming and Disruption), vertical (Defense, Airports, Other Critical Infrastructures), and geography. Each segment offers unique growth projections and competitive dynamics. The Detection segment is expected to maintain a significant market share throughout the forecast period. The Jamming and Disruption segment is experiencing the fastest growth due to technological advances and increased demand for effective neutralization techniques. The Defense vertical will remain dominant, while Airports and Other Critical Infrastructures segments are expected to show significant growth driven by heightened security concerns.

Key Drivers of Anti-Drone Market Growth

The growth trajectory of the Anti-Drone market is propelled by several key factors. The surge in drone-related security threats targeting critical infrastructure and sensitive locations is a primary driver. Stringent government regulations aimed at bolstering airspace security necessitate the implementation of advanced anti-drone solutions. Technological advancements, particularly in AI and sensor technologies, are contributing to significantly improved detection accuracy and effectiveness. Furthermore, substantial investments in national security and infrastructure protection across numerous countries are further stimulating market demand. The increasing awareness of the potential for malicious drone use in various scenarios (e.g., terrorism, crime, espionage) is also a significant factor.

Challenges in the Anti-Drone Market Sector

Despite its significant growth potential, the Anti-Drone market faces several challenges. High initial investment costs can be a barrier to entry for some organizations. The potential for interference with legitimate drone operations necessitates careful consideration of system design and deployment strategies. Regulatory hurdles surrounding the deployment of counter-drone technologies also present obstacles. Supply chain disruptions, particularly concerning critical components, can negatively impact production and availability. The intense competition and rapid technological advancements require continuous innovation and adaptation to maintain a competitive edge. These factors can influence profitability and market share, potentially moderating the overall market growth rate.

Emerging Opportunities in Anti-Drone Market

Significant opportunities exist for expansion into new markets, including private security, law enforcement, event security, and the protection of critical infrastructure beyond traditional sectors. Advancements in AI, machine learning, and sensor fusion provide avenues for developing more intelligent and effective counter-drone systems. The integration of anti-drone solutions with existing security systems and infrastructure presents significant growth potential. Furthermore, the development of specialized counter-drone solutions tailored to address the unique challenges posed by various drone types (e.g., size, payload, flight characteristics) can unlock new market segments and improve overall system effectiveness. The development of portable and easily deployable systems is another key area of opportunity.

Leading Players in the Anti-Drone Market Market

- THALES

- Dedrone

- Lockheed Martin Corporation

- METIS Aerospace Ltd

- Zen Technologies Limited

- Robin Radar System

- Drone Defence

- Citadel Defense

- SRC Inc

- DroneShield Ltd

- RTX Corporation

- Israel Aerospace Industries Ltd

- SAAB AB

- QinetiQ Group plc

- DeTect Inc

Key Developments in Anti-Drone Market Industry

- August 2023: DroneShield Ltd. introduced satellite denial systems for specific target areas, incorporating intelligent defeat capabilities for various GNSS systems (GPS, BeiDou, GLONASS, Galileo). This significantly expands the company's market reach and capabilities.

- July 2023: Thales partnered with the Swedish Defence Materiel Administration (FMV) to deliver SMART-L MM/F long-range radars with AESA technology, enhancing air and surface surveillance capabilities. This highlights the increasing demand for advanced radar systems in the defense sector.

Future Outlook for Anti-Drone Market Market

The Anti-Drone market is poised for continued growth, driven by technological advancements, increasing security concerns, and rising investments in national security. Strategic opportunities lie in developing AI-powered solutions, expanding into new markets, and focusing on integration with existing security infrastructure. The market will witness increased competition and consolidation, with companies prioritizing innovation and strategic partnerships to maintain a leading position. The market's future success hinges on effectively addressing the evolving threats posed by increasingly sophisticated drone technology.

Anti-Drone Market Segmentation

-

1. Application

-

1.1. Detection

- 1.1.1. RADARs

- 1.1.2. Other Sensors

- 1.2. Jamming and Disruption

-

1.1. Detection

-

2. Vertical

- 2.1. Defense

- 2.2. Airports

- 2.3. Other Critical Infrastructures

Anti-Drone Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Anti-Drone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Defense Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Detection

- 5.1.1.1. RADARs

- 5.1.1.2. Other Sensors

- 5.1.2. Jamming and Disruption

- 5.1.1. Detection

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Defense

- 5.2.2. Airports

- 5.2.3. Other Critical Infrastructures

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Detection

- 6.1.1.1. RADARs

- 6.1.1.2. Other Sensors

- 6.1.2. Jamming and Disruption

- 6.1.1. Detection

- 6.2. Market Analysis, Insights and Forecast - by Vertical

- 6.2.1. Defense

- 6.2.2. Airports

- 6.2.3. Other Critical Infrastructures

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Detection

- 7.1.1.1. RADARs

- 7.1.1.2. Other Sensors

- 7.1.2. Jamming and Disruption

- 7.1.1. Detection

- 7.2. Market Analysis, Insights and Forecast - by Vertical

- 7.2.1. Defense

- 7.2.2. Airports

- 7.2.3. Other Critical Infrastructures

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Detection

- 8.1.1.1. RADARs

- 8.1.1.2. Other Sensors

- 8.1.2. Jamming and Disruption

- 8.1.1. Detection

- 8.2. Market Analysis, Insights and Forecast - by Vertical

- 8.2.1. Defense

- 8.2.2. Airports

- 8.2.3. Other Critical Infrastructures

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Detection

- 9.1.1.1. RADARs

- 9.1.1.2. Other Sensors

- 9.1.2. Jamming and Disruption

- 9.1.1. Detection

- 9.2. Market Analysis, Insights and Forecast - by Vertical

- 9.2.1. Defense

- 9.2.2. Airports

- 9.2.3. Other Critical Infrastructures

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Detection

- 10.1.1.1. RADARs

- 10.1.1.2. Other Sensors

- 10.1.2. Jamming and Disruption

- 10.1.1. Detection

- 10.2. Market Analysis, Insights and Forecast - by Vertical

- 10.2.1. Defense

- 10.2.2. Airports

- 10.2.3. Other Critical Infrastructures

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Rest of Europe

- 13. Asia Pacific Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 THALES

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Dedrone

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lockheed Martin Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 METIS Aerospace Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Zen Technologies Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Robin Radar System

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Drone Defence

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Citadel Defense

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SRC Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 DroneShield Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 RTX Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Israel Aerospace Industries Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 SAAB AB

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 QinetiQ Group plc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 DeTect Inc

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 THALES

List of Figures

- Figure 1: Global Anti-Drone Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 15: North America Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 16: North America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 21: Europe Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 22: Europe Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 27: Asia Pacific Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 28: Asia Pacific Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 33: Latin America Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 34: Latin America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 39: Middle East and Africa Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 40: Middle East and Africa Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti-Drone Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 4: Global Anti-Drone Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Mexico Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Brazil Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Arab Emirates Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 29: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 34: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 41: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 49: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Mexico Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Brazil Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Latin America Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 55: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Saudi Arabia Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: United Arab Emirates Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East and Africa Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Drone Market?

The projected CAGR is approximately 25.46%.

2. Which companies are prominent players in the Anti-Drone Market?

Key companies in the market include THALES, Dedrone, Lockheed Martin Corporation, METIS Aerospace Ltd, Zen Technologies Limited, Robin Radar System, Drone Defence, Citadel Defense, SRC Inc, DroneShield Ltd, RTX Corporation, Israel Aerospace Industries Ltd, SAAB AB, QinetiQ Group plc, DeTect Inc.

3. What are the main segments of the Anti-Drone Market?

The market segments include Application, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Defense Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: DroneShield Ltd. introduced satellite denial systems for specific target areas. Various Global Navigation Satellite Systems (GNSS) are used worldwide, including the well-known US GPS, the Chinese BeiDou, the Russian GLONASS, and the European Galileo system. DroneShield’s GNSS disruption solutions for drones and UAVs incorporate intelligent defeat capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti-Drone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti-Drone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti-Drone Market?

To stay informed about further developments, trends, and reports in the Anti-Drone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence