Key Insights

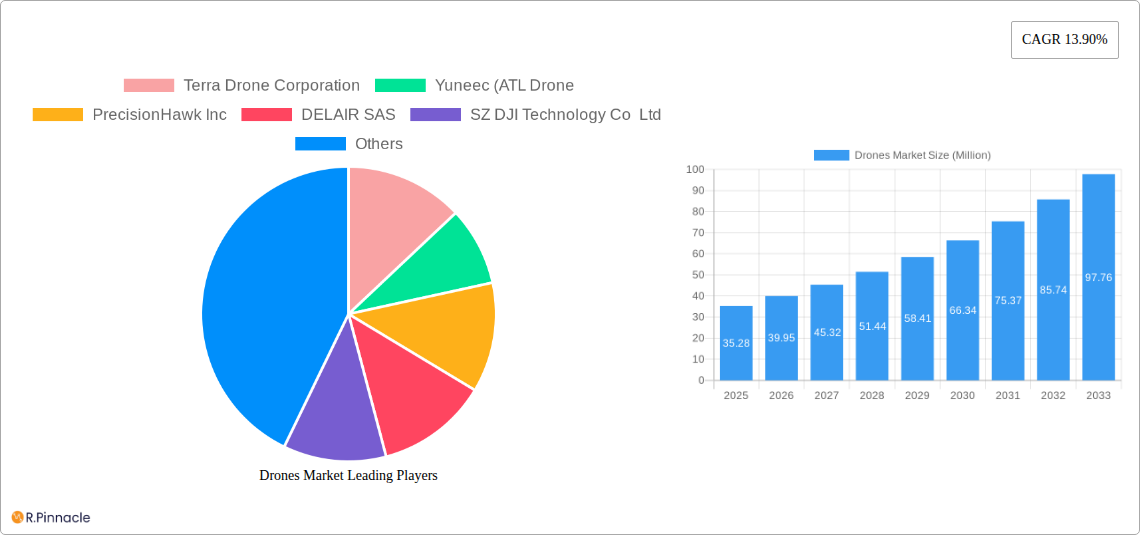

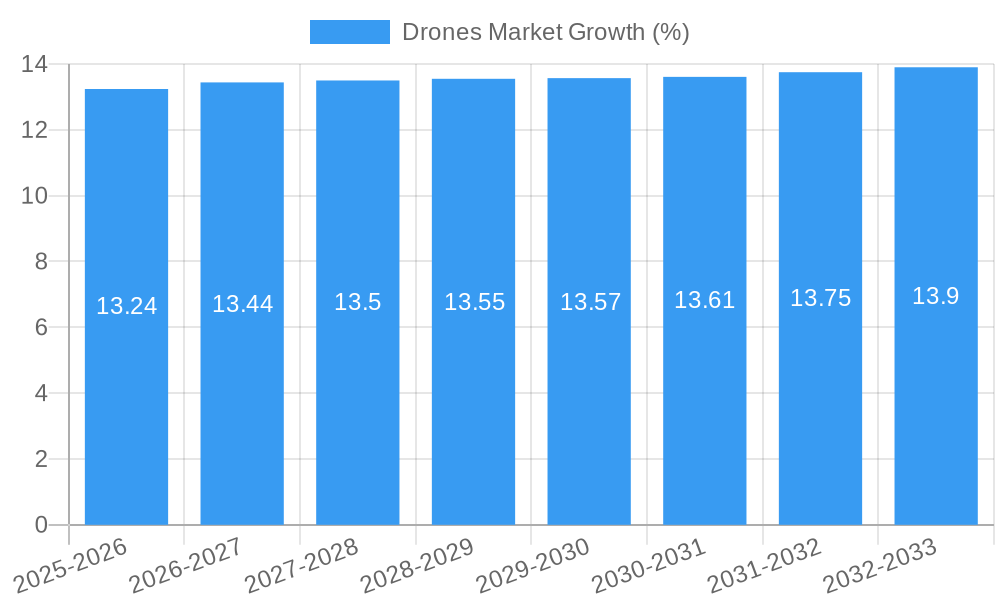

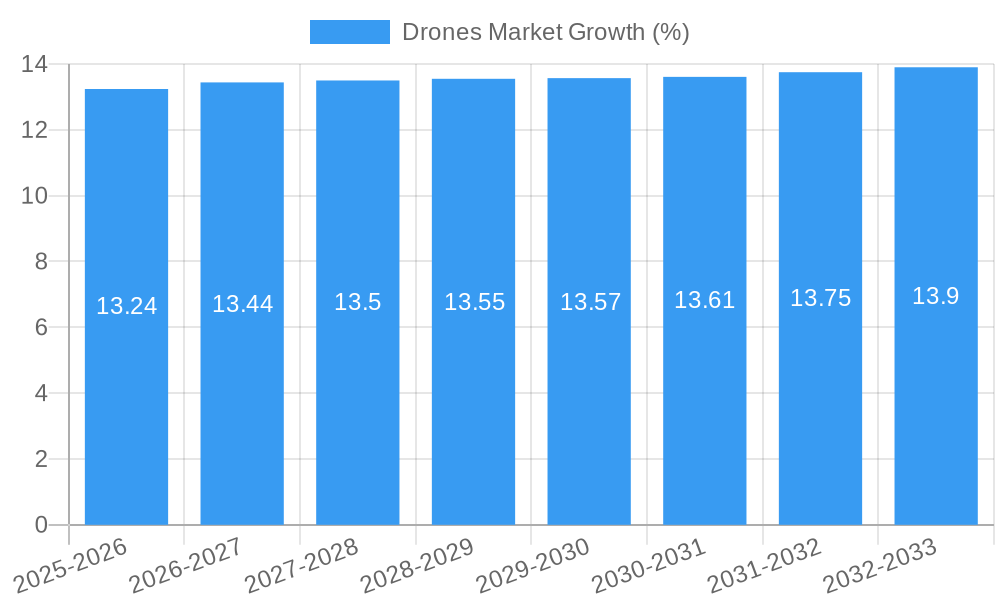

The global Drones Market is poised for substantial expansion, projected to reach a valuation of approximately $35.28 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 13.90% throughout the forecast period of 2025-2033. This significant growth is propelled by a confluence of factors, including the increasing adoption of drones across diverse industries for enhanced efficiency and data acquisition. Key drivers fueling this market surge include advancements in drone technology, such as improved battery life, enhanced payload capacities, and sophisticated sensor integration, making them indispensable tools for applications ranging from aerial surveying and infrastructure inspection to precision agriculture and last-mile delivery. The growing demand for aerial surveillance and security solutions in law enforcement and defense sectors is also a substantial contributor. Furthermore, the burgeoning entertainment industry's use of drones for cinematic capture and event coverage is creating new avenues for market penetration.

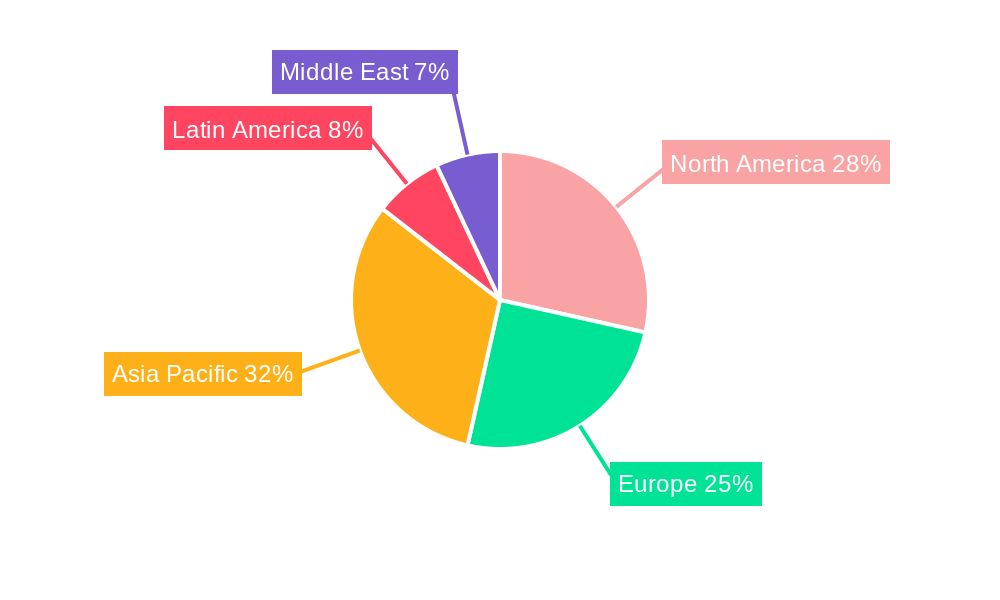

The market is segmenting significantly, with both fixed-wing and rotary-wing drones finding widespread application. Rotary-wing drones, known for their VTOL (Vertical Take-Off and Landing) capabilities, are dominating segments like construction, agriculture, and energy for tasks requiring high maneuverability and detailed aerial views. Fixed-wing drones, conversely, are gaining traction in applications demanding longer flight times and broader coverage, such as large-scale mapping and surveillance. Geographically, North America and Europe are leading the market adoption due to established regulatory frameworks and significant investments in drone technology. However, the Asia Pacific region, particularly China and India, is emerging as a high-growth market, driven by rapid industrialization, increasing demand for infrastructure development, and supportive government initiatives promoting drone technology. Key players like SZ DJI Technology Co. Ltd., Terra Drone Corporation, and Intel Corporation are actively innovating and expanding their product portfolios to cater to the evolving needs of these dynamic segments and regions.

Drones Market: Unlocking Future Growth - Comprehensive Industry Analysis 2025-2033

Gain unparalleled insights into the burgeoning global Drones Market with this in-depth report. Covering the historical period from 2019-2024 and projecting growth through 2033, this analysis provides strategic intelligence for industry leaders, investors, and innovators. Discover key market dynamics, dominant regional trends, cutting-edge product innovations, and the competitive landscape shaped by major players like Terra Drone Corporation, Yuneec, PrecisionHawk Inc., DELAIR SAS, SZ DJI Technology Co Ltd., Intel Corporation, The Boeing Company, and Parrot Drones S.A.S. Essential for understanding the future of drone technology across Construction, Agriculture, Energy, Entertainment, Law Enforcement, and other critical applications.

Drones Market Market Structure & Innovation Trends

The global Drones Market exhibits a dynamic and evolving structure, characterized by a mix of consolidated major players and a vibrant ecosystem of emerging technology providers. Market concentration is influenced by the significant R&D investments and manufacturing capabilities of giants like SZ DJI Technology Co Ltd., which holds a substantial market share estimated at over 30%. Innovation is primarily driven by advancements in artificial intelligence, sensor technology, battery life, and autonomous flight capabilities. Regulatory frameworks, while still developing in many regions, are crucial in shaping market access and operational parameters, particularly for commercial and industrial applications. Product substitutes, such as satellite imagery and manned aerial vehicles, are becoming increasingly challenged by the cost-effectiveness and specialized capabilities of drones. End-user demographics are broadening, with a significant shift from hobbyist use to professional applications across diverse industries. Mergers and acquisitions (M&A) activities are a key feature, with recent notable deals, such as the Precision Hawk and Field merger in March 2023, valued at an estimated $XX Million, indicating a trend towards consolidation and the integration of specialized geospatial data analysis solutions. The market is projected to witness a compound annual growth rate (CAGR) of approximately 15% between 2025 and 2033.

Drones Market Market Dynamics & Trends

The Drones Market is experiencing a robust growth trajectory, propelled by a confluence of technological advancements, increasing industrial adoption, and evolving regulatory landscapes. The primary growth driver is the escalating demand for aerial data acquisition and analysis across a multitude of sectors. In agriculture, drones are revolutionizing crop monitoring, spraying, and yield prediction, leading to increased efficiency and reduced resource wastage. The construction industry leverages drones for site surveying, progress monitoring, and inspection, significantly enhancing safety and project management. The energy sector utilizes drones for inspecting critical infrastructure like power lines, pipelines, and wind turbines, minimizing downtime and operational risks.

Technological disruptions are at the heart of this market expansion. Miniaturization of components, improvements in battery technology enabling longer flight times (currently averaging 45 minutes to 1 hour for commercial drones), and the integration of sophisticated AI algorithms for object recognition, autonomous navigation, and real-time data processing are continuously pushing the boundaries of drone capabilities. The development of specialized payloads, including high-resolution cameras, LiDAR sensors, and thermal imaging equipment, further enhances their applicability.

Consumer preferences are shifting from basic aerial photography to more specialized and data-driven applications. Businesses are increasingly recognizing the return on investment (ROI) offered by drone solutions, leading to a greater willingness to adopt these technologies. This is reflected in the projected market penetration for commercial drones, which is expected to reach 40% by 2033.

The competitive dynamics within the Drones Market are intense, with established players investing heavily in R&D and market expansion, while innovative startups are carving out niches with specialized solutions. Strategic partnerships and collaborations are becoming more prevalent, as seen with the May 2023 alliance between Parrot and Tinamu, aimed at developing advanced automated indoor monitoring solutions. The market is projected to grow from an estimated $30 Billion in 2025 to over $100 Billion by 2033, with a CAGR of approximately 15%.

Dominant Regions & Segments in Drones Market

The Drones Market's dominance is geographically diversified, with North America and Asia Pacific emerging as key growth engines. North America, particularly the United States, leads in terms of market size and adoption, driven by significant investments in defense, infrastructure development, and a robust technological innovation ecosystem. Government initiatives promoting drone research and development, coupled with favorable regulatory frameworks for commercial operations, are pivotal to this leadership. The United States government, for instance, has allocated substantial funding towards drone integration in public safety and logistics.

In the Asia Pacific region, China is a significant contributor, not only as a manufacturing hub but also as a rapidly growing consumer market for drones across various applications, especially in agriculture and logistics. Countries like Japan and South Korea are also witnessing substantial growth in the adoption of advanced drone technologies. Europe, while following closely, is characterized by a fragmented regulatory landscape that is gradually harmonizing, fostering increased adoption.

Analyzing by application, Construction represents a significant and rapidly expanding segment, valued at approximately $8 Billion in 2025. Key drivers include the need for efficient site surveying, progress monitoring, and safety inspections in large-scale infrastructure projects. The Agriculture segment, projected to reach $7 Billion by 2025, is driven by precision farming initiatives aimed at increasing crop yields and reducing input costs. The Energy sector, valued at $6 Billion in 2025, is propelled by the demand for inspecting and maintaining critical infrastructure such as power lines and pipelines. Law Enforcement and public safety applications, valued at $5 Billion in 2025, are expanding due to their utility in surveillance, search and rescue operations, and disaster management.

By type, Rotary-wing Drones currently dominate the market due to their versatility, hovering capabilities, and suitability for close-range inspections and aerial photography, holding an estimated 70% market share in 2025. However, Fixed-wing Drones are gaining traction for their longer flight times and ability to cover larger areas, making them ideal for mapping and surveillance, with their market share projected to grow to 30% by 2033.

Drones Market Product Innovations

The Drones Market is a hotbed of continuous product innovation, driven by the relentless pursuit of enhanced performance, expanded capabilities, and greater operational efficiency. Recent developments have focused on improving flight endurance, payload capacity, and the integration of advanced AI for autonomous operations and sophisticated data processing. Innovations such as swarming technology, allowing multiple drones to coordinate missions, and the development of specialized sensor payloads for environmental monitoring and industrial inspection are key trends. Competitive advantages are being forged through enhanced battery life, achieving flight times of over 60 minutes for some commercial models, improved sensor accuracy, and the development of robust, weather-resistant drone designs. The market is witnessing the introduction of drones with sophisticated object recognition capabilities and predictive maintenance features, significantly increasing their value proposition across diverse industries.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Drones Market, segmented by Application and Type. The Application segments include Construction (projected to reach $25 Billion by 2033), Agriculture (projected to reach $20 Billion by 2033), Energy (projected to reach $18 Billion by 2033), Entertainment (projected to reach $10 Billion by 2033), Law Enforcement (projected to reach $15 Billion by 2033), and Other Applications (projected to reach $12 Billion by 2033). Growth in these segments is driven by increasing industry-specific adoption and the development of tailored drone solutions. The Type segmentation includes Fixed-wing Drones (projected to reach $30 Billion by 2033), experiencing growth due to their extended flight capabilities for large-area coverage, and Rotary-wing Drones (projected to reach $60 Billion by 2033), which continue to dominate due to their versatility and hovering abilities. Competitive dynamics vary across these segments, with specialized players often dominating niche areas.

Key Drivers of Drones Market Growth

The Drones Market's expansion is fueled by several interconnected drivers. Technologically, advancements in AI, battery technology, and miniaturization are enabling more sophisticated and efficient drone operations. Economically, the increasing demand for cost-effective aerial data acquisition and analysis across industries like agriculture, construction, and energy is a primary catalyst. Drones offer significant ROI by reducing labor costs, improving efficiency, and enhancing safety. Regulatory frameworks, while sometimes challenging, are evolving to accommodate broader commercial and industrial applications, thereby unlocking new market opportunities. Furthermore, growing investments in drone research and development by both private companies and governments are fostering continuous innovation and market growth. The expansion of drone delivery services and the integration of drones into logistics networks also present significant growth prospects.

Challenges in the Drones Market Sector

Despite its robust growth, the Drones Market faces several critical challenges. Regulatory hurdles, including complex airspace management, privacy concerns, and varying operational restrictions across different countries, can impede widespread adoption and deployment. Supply chain issues, particularly concerning the availability of specialized components and raw materials, can impact production volumes and timelines. Intense competition, characterized by rapid technological obsolescence, pressures manufacturers to constantly innovate and reduce costs, leading to thinner profit margins for some. Cybersecurity threats to drone systems and the data they collect remain a significant concern, requiring robust security measures. Furthermore, the need for skilled operators and technicians to manage and maintain complex drone systems presents a human capital challenge.

Emerging Opportunities in Drones Market

The Drones Market is rife with emerging opportunities driven by technological convergence and evolving market demands. The integration of 5G technology is poised to enable real-time data transmission and control of drones over longer distances, facilitating applications in remote monitoring and autonomous operations. The burgeoning drone delivery market, particularly for last-mile logistics in urban and rural areas, represents a significant growth avenue, with potential to revolutionize e-commerce and healthcare. The development of advanced AI algorithms for sophisticated data analysis, such as predictive maintenance and anomaly detection, will further enhance the value proposition of drones in industrial sectors. Emerging applications in environmental monitoring, disaster response, and infrastructure inspection in remote or hazardous environments present substantial untapped potential. The increasing focus on sustainability is also driving opportunities for drones in precision agriculture and environmental conservation efforts.

Leading Players in the Drones Market Market

- Terra Drone Corporation

- Yuneec

- PrecisionHawk Inc.

- DELAIR SAS

- SZ DJI Technology Co Ltd.

- Intel Corporation

- The Boeing Company

- Parrot Drones S.A.S.

Key Developments in Drones Market Industry

- May 2023: Parrot and Tinamu partnered to integrate the Parrot ANAFI AI drone into Tinamu’s indoor monitoring solutions, creating an advanced, completely automated robotic solution.

- March 2023: Precision Hawk merged with European company Field, enhancing its geospatial data analysis capabilities for infrastructure and energy sectors in the US.

Future Outlook for Drones Market Market

The future outlook for the Drones Market is exceptionally bright, driven by ongoing technological advancements and expanding adoption across diverse industries. The continued evolution of AI and autonomous flight capabilities will unlock more complex and large-scale operations, particularly in areas like automated inspection, large-area surveillance, and sophisticated data analytics. The integration of drones into broader IoT ecosystems and smart city initiatives will create new avenues for data collection and service provision. The growth of the drone delivery market, supported by advancements in battery technology and regulatory clarity, is expected to significantly reshape logistics and supply chains. Strategic collaborations and the increasing focus on specialized, high-value applications will continue to shape the competitive landscape, leading to continued innovation and market expansion. The projected market size of over $100 Billion by 2033 signifies the transformative potential of this industry.

Drones Market Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Agriculture

- 1.3. Energy

- 1.4. Entertainment

- 1.5. Law Enforcement

- 1.6. Other Applications

-

2. Type

- 2.1. Fixed-wing Drones

- 2.2. Rotary-wing Drones

Drones Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Israel

- 6.3. Rest of Middle East

Drones Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Segment to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drones Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Agriculture

- 5.1.3. Energy

- 5.1.4. Entertainment

- 5.1.5. Law Enforcement

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed-wing Drones

- 5.2.2. Rotary-wing Drones

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Drones Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction

- 6.1.2. Agriculture

- 6.1.3. Energy

- 6.1.4. Entertainment

- 6.1.5. Law Enforcement

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed-wing Drones

- 6.2.2. Rotary-wing Drones

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction

- 7.1.2. Agriculture

- 7.1.3. Energy

- 7.1.4. Entertainment

- 7.1.5. Law Enforcement

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed-wing Drones

- 7.2.2. Rotary-wing Drones

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Drones Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction

- 8.1.2. Agriculture

- 8.1.3. Energy

- 8.1.4. Entertainment

- 8.1.5. Law Enforcement

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed-wing Drones

- 8.2.2. Rotary-wing Drones

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Drones Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction

- 9.1.2. Agriculture

- 9.1.3. Energy

- 9.1.4. Entertainment

- 9.1.5. Law Enforcement

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed-wing Drones

- 9.2.2. Rotary-wing Drones

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Drones Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction

- 10.1.2. Agriculture

- 10.1.3. Energy

- 10.1.4. Entertainment

- 10.1.5. Law Enforcement

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed-wing Drones

- 10.2.2. Rotary-wing Drones

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. United Arab Emirates Drones Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Construction

- 11.1.2. Agriculture

- 11.1.3. Energy

- 11.1.4. Entertainment

- 11.1.5. Law Enforcement

- 11.1.6. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Fixed-wing Drones

- 11.2.2. Rotary-wing Drones

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Drones Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 France

- 13.1.3 Germany

- 13.1.4 Italy

- 13.1.5 Rest of Europe

- 14. Asia Pacific Drones Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 India

- 14.1.3 Japan

- 14.1.4 South Korea

- 14.1.5 Rest of Asia Pacific

- 15. Latin America Drones Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Rest of Latin America

- 16. Middle East Drones Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. United Arab Emirates Drones Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Saudi Arabia

- 17.1.2 Israel

- 17.1.3 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Terra Drone Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Yuneec (ATL Drone

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 PrecisionHawk Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 DELAIR SAS

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 SZ DJI Technology Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Intel Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 The Boeing Company

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Parrot Drones S A S

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Terra Drone Corporation

List of Figures

- Figure 1: Global Drones Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: United Arab Emirates Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 13: United Arab Emirates Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Latin America Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Latin America Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 41: Middle East Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Middle East Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East Drones Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: United Arab Emirates Drones Market Revenue (Million), by Application 2024 & 2032

- Figure 45: United Arab Emirates Drones Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: United Arab Emirates Drones Market Revenue (Million), by Type 2024 & 2032

- Figure 47: United Arab Emirates Drones Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: United Arab Emirates Drones Market Revenue (Million), by Country 2024 & 2032

- Figure 49: United Arab Emirates Drones Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Saudi Arabia Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Germany Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Mexico Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Latin America Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 59: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Global Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Drones Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Saudi Arabia Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drones Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the Drones Market?

Key companies in the market include Terra Drone Corporation, Yuneec (ATL Drone, PrecisionHawk Inc, DELAIR SAS, SZ DJI Technology Co Ltd , Intel Corporation, The Boeing Company, Parrot Drones S A S.

3. What are the main segments of the Drones Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.28 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Segment to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2023, Parrot and Tinamu, the Swiss drone automation technology provider, partnered to integrate the Parrot ANAFI AI drone into Tinamu’s indoor monitoring solutions. The Parrot UAVs and Tinamu’s software capabilities are expected to result in an advanced, completely automated robotic solution built for the industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drones Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drones Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drones Market?

To stay informed about further developments, trends, and reports in the Drones Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence