Key Insights

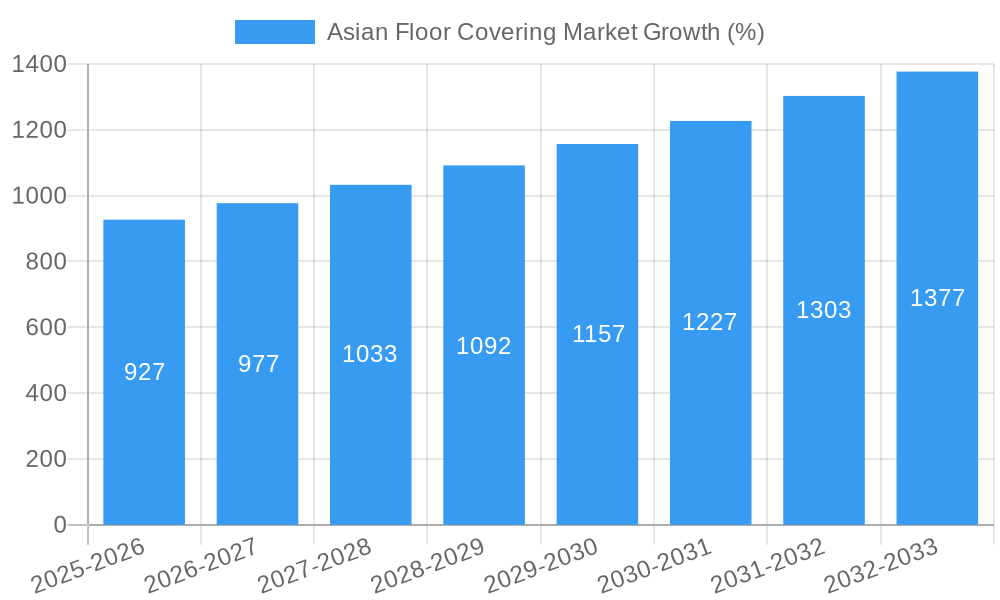

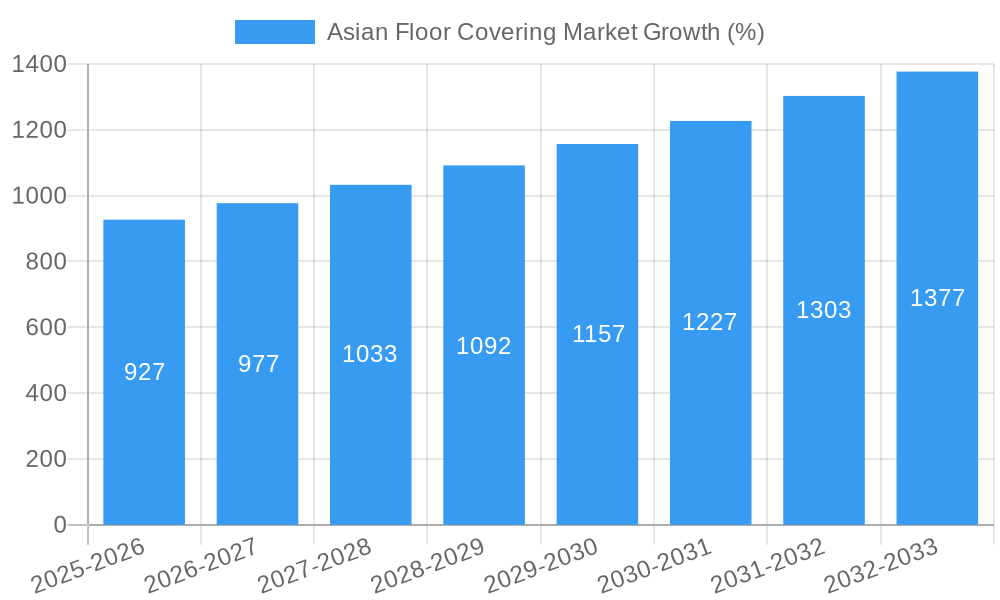

The Asia-Pacific floor covering market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Firstly, rapid urbanization and rising disposable incomes across major economies like China, India, and Southeast Asian nations are fueling significant demand for new residential and commercial construction, thereby boosting flooring material consumption. Secondly, a growing preference for aesthetically pleasing and durable flooring solutions, such as resilient flooring and stone flooring, is shifting consumer choices. Furthermore, government initiatives promoting infrastructure development across the region contribute to the market's growth trajectory. However, challenges remain, including fluctuations in raw material prices and potential supply chain disruptions impacting manufacturing and distribution. The market is segmented by distribution channel (contractors, specialty stores, home centers, others), end-user (residential replacement, commercial, builder), country (China, Japan, South Korea, Taiwan, India, Southeast Asian Countries, Australia), and material (carpet and area rugs, non-resilient flooring, resilient flooring, stone flooring). China and India are expected to remain dominant markets within the region due to their large populations and rapid economic growth.

The competitive landscape is marked by a mix of established international players and regional manufacturers. Key players like Asia-Pacific Ceramic, TOLI Corporation, and CERA Sanitaryware Limited are actively competing through product innovation, strategic partnerships, and expansion into new markets. The market's growth trajectory is expected to be influenced by the adoption of sustainable flooring materials, technological advancements in flooring production, and evolving consumer preferences toward eco-friendly and health-conscious options. The projected growth offers significant opportunities for businesses to capitalize on the increasing demand for high-quality, innovative floor coverings across diverse segments in the Asia-Pacific region. Understanding regional variations in consumer preferences and building strong distribution networks will be critical for success in this dynamic market.

Asian Floor Covering Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asian floor covering market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, challenges, and future trends. The study encompasses key Asian countries including China, Japan, South Korea, Taiwan, India, Southeast Asian countries, and Australia.

Asian Floor Covering Market Structure & Innovation Trends

The Asian floor covering market is characterized by a moderately concentrated structure with several key players commanding significant market share. Asia-Pacific Ceramic, TOLI Corporation, CERA Sanitaryware Limited, Welspun Flooring, Flooring India Company, Fujian Floors China Co Ltd, DAIKEN Corporation, Pergo, Inovar Resources Sdn Bhd, and Hanhent International China Co Ltd are among the prominent companies shaping the market landscape. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market, with xx Million in combined revenue (2024). Innovation is driven by increasing demand for sustainable, durable, and aesthetically appealing flooring solutions. Stringent environmental regulations are pushing manufacturers to adopt eco-friendly materials and processes. Significant M&A activities have been observed, with an estimated xx Million in deal value recorded between 2019 and 2024. These activities are primarily aimed at expanding market reach, acquiring new technologies, and strengthening competitive positions. The market is also witnessing the emergence of product substitutes such as innovative composite materials and advanced coatings, impacting the traditional materials' market share. End-user demographics are shifting towards younger, more design-conscious consumers who are increasingly demanding customized flooring solutions.

- Market Concentration: Top 5 players hold approximately xx% market share.

- M&A Activity (2019-2024): Estimated value of xx Million.

- Innovation Drivers: Sustainability, durability, aesthetics, regulatory pressures.

- Product Substitutes: Growing adoption of composite materials and advanced coatings.

Asian Floor Covering Market Dynamics & Trends

The Asian floor covering market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rapid urbanization, rising disposable incomes, and increasing construction activities across the region. Technological advancements, such as the introduction of smart flooring solutions and improved manufacturing processes, are further accelerating market expansion. Consumer preferences are shifting towards high-performance, low-maintenance flooring options, driving demand for resilient and non-resilient materials. Competitive dynamics are intense, with companies investing heavily in research and development, marketing, and distribution networks to gain a competitive edge. The market penetration of advanced flooring technologies is steadily increasing, with notable growth in the adoption of eco-friendly and sustainable products. The residential replacement segment is expected to witness the highest growth rate owing to a large housing stock in need of renovation.

Dominant Regions & Segments in Asian Floor Covering Market

China remains the dominant region in the Asian floor covering market, driven by substantial construction activity, rapid economic growth, and a large population. Other key markets include Japan, India, and Southeast Asian countries. Within the distribution channel, home centers and contractors hold the largest market share, followed by specialty stores. The residential replacement segment constitutes a significant portion of the overall end-user market, primarily driven by increased home renovations and remodeling activities.

- Key Drivers in China: Rapid urbanization, strong economic growth, significant construction activity.

- Key Drivers in India: Rising disposable incomes, increasing housing demand, government initiatives.

- Dominant Distribution Channel: Home Centers and Contractors.

- Dominant End-User Segment: Residential Replacement.

- Dominant Material: Resilient Flooring.

Asian Floor Covering Market Product Innovations

Recent innovations in the Asian floor covering market include the development of waterproof, scratch-resistant, and antimicrobial flooring materials. Companies are focusing on incorporating sustainable materials and eco-friendly manufacturing processes to cater to growing environmental concerns. These product developments offer significant competitive advantages by enhancing durability, performance, and aesthetic appeal. The integration of smart technology, such as sensors and connectivity features, is gaining traction, adding a new dimension to the functionality and usability of floor coverings.

Report Scope & Segmentation Analysis

This report segments the Asian floor covering market by distribution channel (contractors, specialty stores, home centers, others), end-user (residential replacement, commercial, builder), country (China, Japan, South Korea, Taiwan, India, Southeast Asian countries, Australia), and material (carpet and area rugs, resilient flooring, non-resilient flooring, stone flooring). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. For example, the resilient flooring segment is projected to grow at a CAGR of xx% during the forecast period, driven by its superior performance characteristics.

Key Drivers of Asian Floor Covering Market Growth

The growth of the Asian floor covering market is primarily driven by the rapid expansion of the construction industry, rising disposable incomes, and increasing awareness of the importance of aesthetically pleasing and functional flooring solutions. Government initiatives promoting sustainable building practices and infrastructure development further accelerate market growth. Technological advancements in material science and manufacturing processes contribute to the development of high-performance, eco-friendly products.

Challenges in the Asian Floor Covering Market Sector

The Asian floor covering market faces a complex interplay of challenges impacting its growth trajectory. Fluctuating raw material prices, particularly for petroleum-based products and natural fibers, create significant cost volatility. Intense competition, both from domestic and international players, necessitates continuous innovation and efficient cost management. Stringent environmental regulations, increasingly focused on sustainability and reduced carbon footprints, require manufacturers to adapt their production processes and material choices. Further complicating matters are supply chain disruptions and logistics bottlenecks, exacerbated by geopolitical events and global trade dynamics. These issues impact not only production efficiency but also timely delivery to customers. The rising cost of labor, particularly skilled labor, and transportation further increases overall production costs, potentially limiting market expansion if not addressed strategically.

Emerging Opportunities in Asian Floor Covering Market

Emerging opportunities include the growing demand for sustainable and eco-friendly flooring options, the increasing popularity of smart flooring solutions, and the expansion of e-commerce channels for floor covering sales. Moreover, the increasing demand for customized flooring solutions opens up avenues for niche market players. The focus on improving the overall look and ambiance of homes and workplaces through high-quality flooring solutions creates a positive growth outlook.

Leading Players in the Asian Floor Covering Market Market

- Asia-Pacific Ceramic

- TOLI Corporation

- CERA Sanitaryware Limited

- Welspun Flooring

- Flooring India Company

- Fujian Floors China Co Ltd

- DAIKEN Corporation

- Pergo

- Inovar Resources Sdn Bhd

- Hanhent International China Co Ltd

Key Developments in Asian Floor Covering Market Industry

- January 2023: TOLI Corporation launched a new eco-friendly resilient flooring product line, highlighting a growing industry trend towards sustainable materials and manufacturing processes.

- March 2022: Asia-Pacific Ceramic strategically acquired a smaller flooring manufacturer, expanding its market share and potentially gaining access to new technologies or distribution channels.

- June 2021: DAIKEN Corporation introduced innovative smart flooring technology, integrating features such as underfloor heating control and enhanced durability, showcasing the increasing demand for technologically advanced products.

- (Further key developments to be added based on available data)

Future Outlook for Asian Floor Covering Market Market

The Asian floor covering market is poised for sustained growth in the coming years, driven by factors such as expanding urbanization, rising disposable incomes, and continued advancements in flooring technology. The increasing focus on sustainability and the adoption of smart home technologies are expected to shape the future of the market. Strategic partnerships, product diversification, and investments in R&D will be crucial for companies to maintain a competitive edge.

Asian Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Non Resilient Flooring

- 1.2.1. Wood Flooring

- 1.2.2. Ceramic Floor and Wall Tile

- 1.2.3. Laminate Flooring

- 1.2.4. Stone Flooring

- 1.3. Vinyl sheet and Floor Tile

- 1.4. Other Resilient Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

Asian Floor Covering Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential.

- 3.3. Market Restrains

- 3.3.1 In many Asian markets

- 3.3.2 consumers are highly price-sensitive

- 3.3.3 which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 sustainably sourced wood

- 3.4.3 and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Non Resilient Flooring

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Ceramic Floor and Wall Tile

- 5.1.2.3. Laminate Flooring

- 5.1.2.4. Stone Flooring

- 5.1.3. Vinyl sheet and Floor Tile

- 5.1.4. Other Resilient Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. China Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asian Floor Covering Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Asia-Pacific Ceramic

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TOLI Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CERA Sanitaryware Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 6 COMPANY PROFILES

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Welspun Flooring

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Flooring India Company

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fujian Floors China Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 DAIKEN Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Pergo

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Inovar Resources Sdn Bhd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Hanhent International China Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Asia-Pacific Ceramic

List of Figures

- Figure 1: Asian Floor Covering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asian Floor Covering Market Share (%) by Company 2024

List of Tables

- Table 1: Asian Floor Covering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asian Floor Covering Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Asian Floor Covering Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asian Floor Covering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Asian Floor Covering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asian Floor Covering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asian Floor Covering Market Revenue Million Forecast, by Material 2019 & 2032

- Table 15: Asian Floor Covering Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Asian Floor Covering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Asian Floor Covering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bangladesh Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Pakistan Asian Floor Covering Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Floor Covering Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Asian Floor Covering Market?

Key companies in the market include Asia-Pacific Ceramic, TOLI Corporation, CERA Sanitaryware Limited, 6 COMPANY PROFILES, Welspun Flooring, Flooring India Company, Fujian Floors China Co Ltd, DAIKEN Corporation, Pergo, Inovar Resources Sdn Bhd, Hanhent International China Co Ltd.

3. What are the main segments of the Asian Floor Covering Market?

The market segments include Material, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials. sustainably sourced wood. and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity..

7. Are there any restraints impacting market growth?

In many Asian markets. consumers are highly price-sensitive. which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Floor Covering Market?

To stay informed about further developments, trends, and reports in the Asian Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence