Key Insights

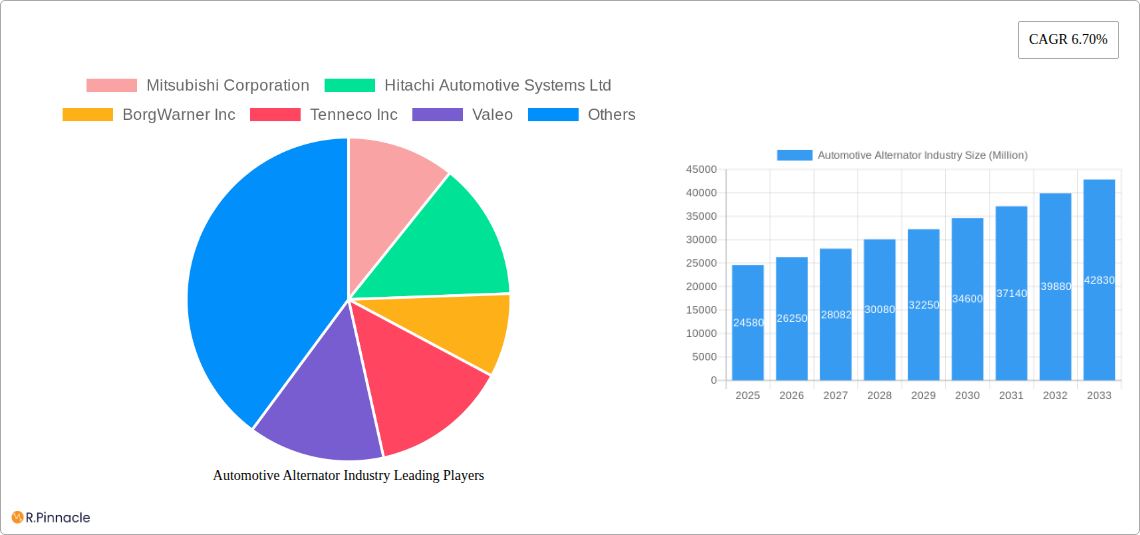

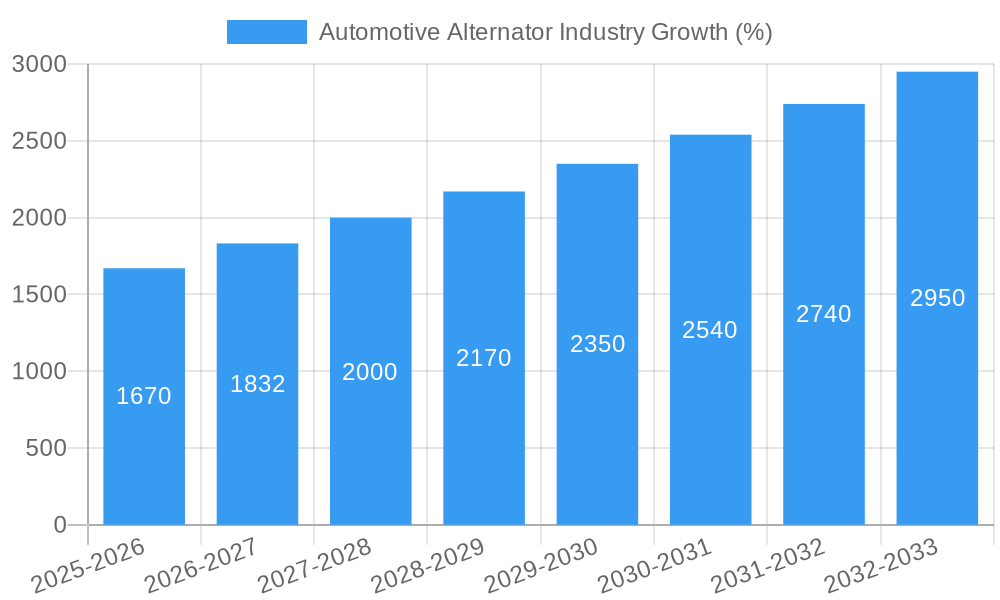

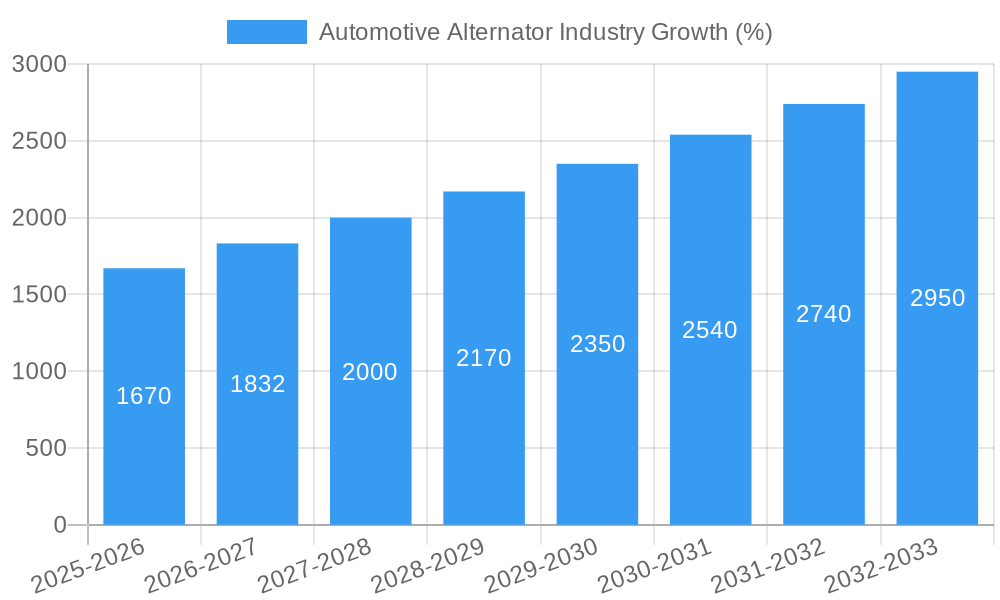

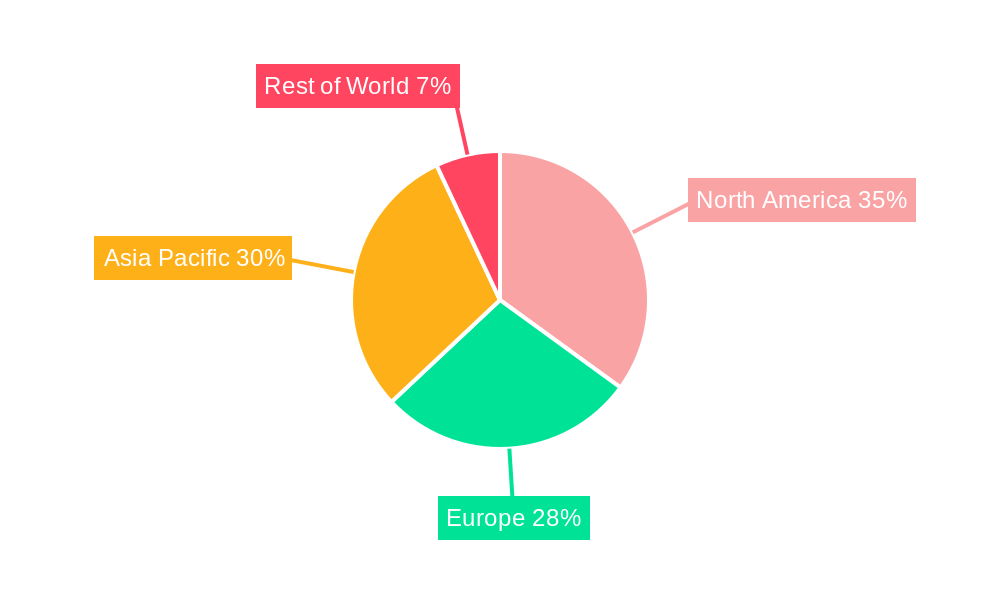

The automotive alternator market, valued at $24.58 billion in 2025, is projected to experience robust growth, driven by the increasing demand for vehicles globally and the rising adoption of advanced driver-assistance systems (ADAS). The market's Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033 indicates a significant expansion, fueled by technological advancements leading to higher alternator efficiency and the integration of smart functionalities. The shift towards hybrid and electric vehicles (HEVs and EVs), while initially presenting a challenge due to different power requirements, is ultimately expected to contribute to market growth as these vehicles still require alternators, albeit with potentially modified designs optimized for regenerative braking and energy management systems. Growth is further spurred by stricter emission regulations globally, prompting automakers to invest in more efficient powertrain components. Significant regional variations exist, with North America and Asia Pacific expected to lead the market due to high vehicle production and sales in these regions. Key players like Mitsubishi Corporation, Hitachi Automotive Systems, and Bosch are actively involved in innovation and strategic partnerships to maintain their market share amidst increasing competition. The commercial vehicle segment is also a crucial driver, owing to higher alternator capacity requirements compared to passenger cars. The market’s growth will be influenced by fluctuations in raw material prices and overall economic conditions. However, the long-term outlook remains positive, driven by increasing vehicle production and the continuous development of advanced alternator technologies.

The competitive landscape is marked by established players and emerging companies, each vying for market dominance through technological innovations, cost optimization, and strategic partnerships. While the transition to electric vehicles might initially seem disruptive, manufacturers are adapting by developing alternators tailored to the specific needs of HEVs and EVs, focusing on energy efficiency and integration with regenerative braking systems. The market is segmented by powertrain type (Internal Combustion Engine (ICE) vehicles, HEVs, and EVs) and vehicle type (passenger cars and commercial vehicles). This segmentation allows for a more targeted approach to market analysis, enabling companies to understand the specific needs and demands of different customer segments. Furthermore, regional variations in market growth are significant, highlighting the importance of understanding local regulations, market dynamics, and consumer preferences. This intricate interplay of factors will shape the future trajectory of the automotive alternator market.

Automotive Alternator Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global automotive alternator market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, technological advancements, regional variations, and competitive landscapes, providing a 360-degree view of this crucial automotive component sector. Expect detailed analysis of market size (valued in Millions), CAGR, market share, and key trends influencing the industry's trajectory.

Automotive Alternator Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the automotive alternator market, exploring market concentration, key innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activity. The report examines the market share held by leading players such as Mitsubishi Corporation, Hitachi Automotive Systems Ltd, BorgWarner Inc, Tenneco Inc, Valeo, Robert Bosch GmbH, Hella KGaA Hueck & Co, Mecc Alt, DENSO Corporation, and Lucas Industries PLC. We delve into the value of significant M&A deals and assess their impact on market dynamics. The analysis also considers the influence of product substitutes, end-user demographics, and prevailing regulatory frameworks. We estimate the total market size in 2025 to be approximately $XX Million, with a projected CAGR of XX% during the forecast period. Market concentration is analyzed using metrics such as the Herfindahl-Hirschman Index (HHI).

- Market Share Analysis: A detailed breakdown of market share held by key players. For example, Bosch may hold approximately XX% of the market in 2025.

- M&A Activity: Assessment of significant M&A deals over the past five years, including deal values (in Millions) and their impact on the competitive landscape. An example would be the impact of a hypothetical $XX Million acquisition on market dynamics.

- Innovation Drivers: Analysis of factors driving innovation, such as advancements in alternator technology, stricter emission regulations, and the growing demand for fuel-efficient vehicles.

- Regulatory Frameworks: Examination of government regulations influencing the automotive alternator market, including emission standards and safety regulations.

Automotive Alternator Industry Market Dynamics & Trends

This section delves into the key factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics within the automotive alternator industry. We examine the impact of factors such as the increasing adoption of advanced driver-assistance systems (ADAS), the rise of electric and hybrid vehicles, and changing consumer preferences towards fuel-efficient and environmentally friendly automobiles. The report details the CAGR and market penetration rates for various alternator types and applications across different vehicle segments. We project market growth to be driven by the increasing demand for vehicles globally, particularly in developing economies.

- Market Growth Drivers: Detailed analysis of factors such as rising vehicle production, increasing demand for advanced alternator technologies, and stricter emission norms.

- Technological Disruptions: Exploration of the impact of new technologies, such as high-efficiency alternators and smart alternators, on market dynamics.

- Consumer Preferences: Analysis of consumer preferences influencing the demand for alternators, including fuel efficiency, durability, and reliability.

- Competitive Dynamics: Assessment of the competitive intensity within the automotive alternator market, including pricing strategies and product differentiation.

Dominant Regions & Segments in Automotive Alternator Industry

This section identifies the leading regions and segments within the automotive alternator market, analyzing their dominance based on various factors. We analyze the market across different powertrain types (IC Engine Vehicles, Hybrid and Electric Vehicles) and vehicle types (Passenger Cars, Commercial Vehicles). This analysis includes key drivers such as economic policies, infrastructure development, and consumer spending patterns. The report indicates the strongest performing geographical regions (e.g., Asia-Pacific) and segmentations (e.g., Passenger Cars).

Leading Regions: Detailed analysis of the dominant regions, including factors contributing to their market leadership (e.g., robust automotive manufacturing sectors, government support, and high consumer demand).

Powertrain Type Segmentation: In-depth analysis of the market for IC engine vehicles, hybrid, and electric vehicles, including growth projections and competitive dynamics within each segment. Example: The market for alternators in hybrid vehicles is expected to witness significant growth due to increasing demand for fuel-efficient cars.

Vehicle Type Segmentation: Comprehensive analysis of the market for passenger cars and commercial vehicles, considering growth projections and competitive landscape. For example, the commercial vehicle segment may show slower growth compared to passenger cars.

Key Drivers for Dominant Regions: Bullet-point analysis of economic policies, infrastructure, and other factors influencing market leadership within each region. For example, China's strong automotive manufacturing base and government incentives contribute to its dominance in the alternator market.

Automotive Alternator Industry Product Innovations

This section summarizes the latest product developments, their applications, and competitive advantages. It emphasizes the technological advancements shaping the alternator market and their alignment with market demands. This includes the adoption of advanced materials, improved designs, and integrated functionalities. The focus is on innovations improving efficiency, durability, and integration with vehicle systems.

Report Scope & Segmentation Analysis

This section provides a detailed overview of the market segmentation and its scope, encompassing the analysis of market sizes and growth projections for different segments.

- Powertrain Type: IC Engine Vehicles, Hybrid and Electric Vehicles. Each paragraph provides a detailed market size analysis, growth projections, and competitive dynamics for each powertrain type. We predict the market for alternators in electric vehicles will experience slower but sustained growth.

- Vehicle Type: Passenger Cars, Commercial Vehicles. Each paragraph offers a detailed analysis of market size, growth projections and competitive dynamics within each vehicle type. The passenger car segment is expected to maintain dominance, with strong growth predicted in specific regions.

Key Drivers of Automotive Alternator Industry Growth

This section outlines the key factors driving growth in the automotive alternator industry. This includes technological advancements leading to higher efficiency and improved functionalities; economic factors such as increased vehicle production and rising disposable incomes; and regulatory changes that influence emission norms and fuel efficiency standards.

Challenges in the Automotive Alternator Industry Sector

This section discusses the challenges faced by the automotive alternator industry. This includes regulatory hurdles related to emission standards and safety regulations; supply chain disruptions affecting the availability of raw materials and components; and competitive pressures from both established players and new entrants. We'll quantify the impacts of these challenges where possible. For example, a disruption to a key raw material could result in a XX% increase in production costs.

Emerging Opportunities in Automotive Alternator Industry

This section highlights emerging opportunities in the automotive alternator industry. This includes exploring new markets with high growth potential, developing advanced alternator technologies (e.g., smart alternators, 48V systems), and responding to evolving consumer preferences towards sustainability and fuel efficiency.

Leading Players in the Automotive Alternator Industry Market

- Mitsubishi Corporation

- Hitachi Automotive Systems Ltd

- BorgWarner Inc

- Tenneco Inc

- Valeo

- Robert Bosch GmbH

- Hella KGaA Hueck & Co

- Mecc Alt

- DENSO Corporation

- Lucas Industries PLC

Key Developments in Automotive Alternator Industry

- January 2023: DENSO announces a new high-efficiency alternator for hybrid vehicles.

- June 2022: Bosch and Valeo announce a joint venture to develop advanced alternator technologies for electric vehicles.

- October 2021: Mitsubishi Corporation invests in a new alternator manufacturing facility in Southeast Asia. (Note: These are example dates and developments; actual data needs to be inserted.)

Future Outlook for Automotive Alternator Industry Market

The future of the automotive alternator market is closely tied to the broader automotive industry's transformation towards electrification and automation. While the demand for traditional alternators may decline, the market for advanced alternator technologies, particularly in hybrid and mild-hybrid vehicles, is poised for significant growth. The increasing demand for fuel-efficient vehicles and stricter emission regulations will continue to drive innovation and adoption of advanced alternator technologies. Strategic partnerships and investments in research and development will play a crucial role in shaping the future of the market.

Automotive Alternator Industry Segmentation

-

1. Powertrain Type

- 1.1. IC Engine Vehicles

- 1.2. Hybrid and Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Type

- 3.1. Single Phase

- 3.2. Three Phase

Automotive Alternator Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Asia Pacific

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Saudi Arabia

- 4.3. Other Countries

Automotive Alternator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Production

- 3.3. Market Restrains

- 3.3.1. Shift Towards Electric powertrain

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.1.1. IC Engine Vehicles

- 5.1.2. Hybrid and Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Single Phase

- 5.3.2. Three Phase

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 6. North America Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 6.1.1. IC Engine Vehicles

- 6.1.2. Hybrid and Electric Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Single Phase

- 6.3.2. Three Phase

- 6.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 7. Asia Pacific Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 7.1.1. IC Engine Vehicles

- 7.1.2. Hybrid and Electric Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Single Phase

- 7.3.2. Three Phase

- 7.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 8. Europe Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 8.1.1. IC Engine Vehicles

- 8.1.2. Hybrid and Electric Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Single Phase

- 8.3.2. Three Phase

- 8.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 9. Rest of the World Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 9.1.1. IC Engine Vehicles

- 9.1.2. Hybrid and Electric Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Single Phase

- 9.3.2. Three Phase

- 9.1. Market Analysis, Insights and Forecast - by Powertrain Type

- 10. North America Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 10.1.4 Rest of North America

- 11. Asia Pacific Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. Europe Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Rest of the World Automotive Alternator Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Saudi Arabia

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Mitsubishi Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Hitachi Automotive Systems Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 BorgWarner Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Tenneco Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Valeo

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Robert Bosch GmbH

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Hella KGaA Hueck & Co

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Mecc Alt

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 DENSO Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Lucas Industries PLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global Automotive Alternator Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Alternator Industry Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 11: North America Automotive Alternator Industry Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 12: North America Automotive Alternator Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America Automotive Alternator Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America Automotive Alternator Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Automotive Alternator Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive Alternator Industry Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 19: Asia Pacific Automotive Alternator Industry Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 20: Asia Pacific Automotive Alternator Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: Asia Pacific Automotive Alternator Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: Asia Pacific Automotive Alternator Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Automotive Alternator Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Automotive Alternator Industry Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 27: Europe Automotive Alternator Industry Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 28: Europe Automotive Alternator Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Europe Automotive Alternator Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Europe Automotive Alternator Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Europe Automotive Alternator Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Europe Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Alternator Industry Revenue (Million), by Powertrain Type 2024 & 2032

- Figure 35: Rest of the World Automotive Alternator Industry Revenue Share (%), by Powertrain Type 2024 & 2032

- Figure 36: Rest of the World Automotive Alternator Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 37: Rest of the World Automotive Alternator Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 38: Rest of the World Automotive Alternator Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Rest of the World Automotive Alternator Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Rest of the World Automotive Alternator Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Alternator Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Alternator Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Alternator Industry Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 3: Global Automotive Alternator Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Automotive Alternator Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global Automotive Alternator Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Korea Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Other Countries Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Automotive Alternator Industry Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 28: Global Automotive Alternator Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global Automotive Alternator Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Mexico Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of North America Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Alternator Industry Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 36: Global Automotive Alternator Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 37: Global Automotive Alternator Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: China Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Automotive Alternator Industry Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 45: Global Automotive Alternator Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 46: Global Automotive Alternator Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Germany Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: United Kingdom Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: France Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Italy Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Europe Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Automotive Alternator Industry Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 54: Global Automotive Alternator Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 55: Global Automotive Alternator Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Automotive Alternator Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Brazil Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Saudi Arabia Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Other Countries Automotive Alternator Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Alternator Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Automotive Alternator Industry?

Key companies in the market include Mitsubishi Corporation, Hitachi Automotive Systems Ltd, BorgWarner Inc, Tenneco Inc, Valeo, Robert Bosch GmbH, Hella KGaA Hueck & Co, Mecc Alt, DENSO Corporation, Lucas Industries PLC.

3. What are the main segments of the Automotive Alternator Industry?

The market segments include Powertrain Type, Vehicle Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Production.

6. What are the notable trends driving market growth?

Passenger Car Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Shift Towards Electric powertrain.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Alternator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Alternator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Alternator Industry?

To stay informed about further developments, trends, and reports in the Automotive Alternator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence