Key Insights

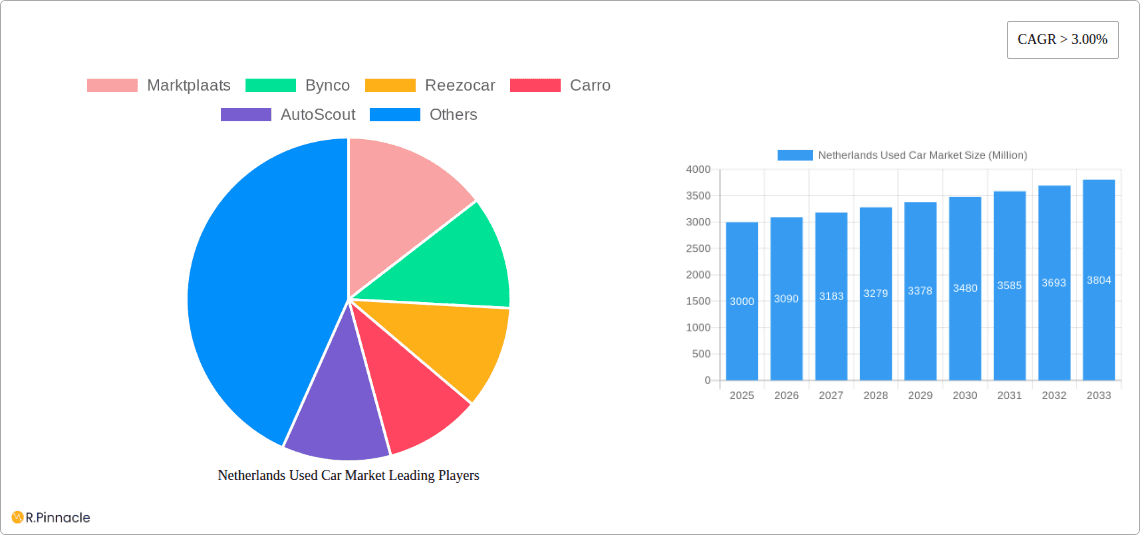

The Netherlands used car market is forecast for significant expansion, projected to reach €37.74 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 3%. This growth is propelled by the increasing demand for affordable pre-owned vehicles as an economical alternative to new cars, driven by economic uncertainties and rising new vehicle prices. Enhanced vehicle longevity and technological advancements are contributing to a larger, higher-quality supply of used cars. Furthermore, the proliferation of online used car platforms is revolutionizing the buying and selling experience, offering greater convenience. The market is segmented by vehicle type and vendor, with organized dealerships anticipated to lead future growth due to enhanced consumer trust and comprehensive service offerings.

Netherlands Used Car Market Market Size (In Billion)

Despite robust growth, the market encounters challenges including economic volatility impacting consumer spending and fluctuating fuel prices. The increasing adoption of electric vehicles (EVs) presents both opportunities and considerations regarding battery life and maintenance. Evolving government regulations on emissions and safety standards also shape market dynamics. While the unorganized sector remains substantial, the organized sector's emphasis on consumer protection and transparency is driving increased competition. The ongoing evolution of digital platforms will be a pivotal factor in determining the future trajectory of the Netherlands used car market.

Netherlands Used Car Market Company Market Share

Netherlands Used Car Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Netherlands used car market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth trajectories. Expect in-depth analysis across key segments, including vehicle types (Hatchbacks, Sedans, SUVs, MPVs) and vendor types (Organized, Unorganized), incorporating data from major players like Marktplaats, Bynco, Reezocar, Carro, AutoScout, Autotrader, OOYYO Corp, Autotrack, BOVAG, and Gaspedaal. The report projects a market valued at xx Million in 2025.

Netherlands Used Car Market Market Structure & Innovation Trends

This section delves into the Netherlands used car market's structure, analyzing market concentration, innovation drivers, and regulatory landscapes. We examine the interplay of established players and emerging disruptors, evaluating their market share and contribution to overall market growth. Key aspects include:

- Market Concentration: The Netherlands used car market exhibits a moderately concentrated structure, with a few dominant players like Marktplaats holding significant market share (estimated at xx% in 2025). However, smaller players and online marketplaces are increasingly challenging the established order.

- Innovation Drivers: Technological advancements, such as online marketplaces and digital inspection tools, are driving innovation. The adoption of data analytics for pricing and inventory management is also reshaping the market.

- Regulatory Frameworks: Government regulations concerning emissions, safety standards, and data privacy significantly influence market operations. Changes in these regulations can present both opportunities and challenges for market players.

- Product Substitutes: The rise of car-sharing services and subscription models poses a growing threat to the traditional used car market. This trend requires careful consideration by existing players.

- End-User Demographics: The changing demographics of car buyers, with younger generations exhibiting different preferences, is influencing the demand for specific vehicle types and features.

- M&A Activities: The report examines significant mergers and acquisitions, such as the Hedin Automotive B.V. acquisition of Renova Automotive Group B.V. in July 2023, analyzing their impact on market consolidation and competitive dynamics. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

Netherlands Used Car Market Market Dynamics & Trends

This section analyzes the key drivers and trends shaping the Netherlands used car market's growth trajectory. We explore the interplay of economic factors, technological advancements, and evolving consumer preferences, providing a detailed overview of market dynamics and their influence on growth. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%. Market penetration of online platforms is estimated to reach xx% by 2033. Specific factors influencing growth include:

This section will provide a detailed analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, expanding on the above points with specific data and insights. (Approximately 600 words of detailed analysis will be included here).

Dominant Regions & Segments in Netherlands Used Car Market

This section identifies the leading regions and segments within the Netherlands used car market. We analyze the factors driving the dominance of specific regions and vehicle types, offering insights into market performance across various segments.

By Vehicle Type:

- SUVs: The increasing popularity of SUVs is driving significant growth in this segment, fueled by factors such as growing families and changing lifestyle preferences.

- Hatchbacks: This segment continues to maintain a strong market presence due to affordability and fuel efficiency.

- Sedans: While sedan sales have declined somewhat, they still represent a considerable portion of the used car market.

- MPVs: The MPV segment is experiencing moderate growth, driven by families needing additional passenger and cargo space.

By Vendor:

- Organized: Organized vendors, including established dealerships and large online platforms, benefit from established brand reputations, extensive inventory, and dedicated customer service.

- Unorganized: This segment comprises individual sellers and smaller dealers, offering often lower prices but potentially lacking the quality control and services of organized vendors.

(Further detailed analysis of regional dominance and factors driving segment growth will be provided here (approximately 600 words).

Netherlands Used Car Market Product Innovations

Recent innovations in the used car market include the increased use of online platforms offering detailed vehicle history reports, enhanced digital inspection tools, and financing options. These advancements are improving transparency and streamlining the buying process, enhancing the customer experience and building trust. The integration of AI and machine learning for automated vehicle valuation and predictive maintenance is also gaining traction. The market fit of these innovations is strongly positive, as they address consumer demand for convenience, transparency, and reliability.

Report Scope & Segmentation Analysis

This report covers the Netherlands used car market from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by vehicle type (Hatchbacks, Sedans, SUVs, MPVs) and vendor type (Organized, Unorganized). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. (Further detailed breakdown of each segment with specific figures and analysis will be included here (approximately 150 words total).

Key Drivers of Netherlands Used Car Market Growth

Several key factors fuel the growth of the Netherlands used car market. Technological advancements, like online marketplaces and digital inspection tools, enhance transparency and convenience. Economic factors, such as fluctuating new car prices and consumer spending habits, influence demand. Furthermore, government regulations regarding emissions and safety standards shape market trends. These interconnected elements collectively drive the market's expansion.

Challenges in the Netherlands Used Car Market Sector

The Netherlands used car market faces challenges such as fluctuating fuel prices impacting consumer purchasing decisions and the increasing regulatory scrutiny regarding emissions standards. Supply chain disruptions and competition from alternative mobility solutions, like car-sharing services, also pose significant challenges. The impact of these factors varies but could collectively reduce overall market growth by an estimated xx% in the next few years.

Emerging Opportunities in Netherlands Used Car Market

Emerging opportunities include the growing adoption of online platforms for buying and selling used cars, increasing demand for certified pre-owned vehicles, and the potential for innovative financing solutions tailored to the used car market. Moreover, the integration of digital technologies to improve the customer experience presents substantial opportunities for market players to gain a competitive edge.

Leading Players in the Netherlands Used Car Market Market

- Marktplaats

- Bynco

- Reezocar

- Carro

- AutoScout24

- Autotrader

- OOYYO Corp

- Autotrack

- BOVAG

- Gaspedaal

Key Developments in Netherlands Used Car Market Industry

- July 2023: Hedin Automotive B.V. acquired Renova Automotive Group B.V., strengthening its position in the Dutch BMW and MINI market, impacting the distribution and sales of pre-owned vehicles.

- January 2023: AUTO1 Group leased a facility in Oosterhout for Autohero, increasing its reconditioning capacity and enhancing its operational efficiency, potentially leading to increased market share.

Future Outlook for Netherlands Used Car Market Market

The Netherlands used car market is poised for continued growth, driven by technological advancements, changing consumer preferences, and the evolving regulatory landscape. Strategic partnerships, investments in digital technologies, and adapting to the growing demand for sustainable mobility solutions will be crucial for success in the years to come. The market is expected to reach xx Million by 2033, indicating significant growth potential.

Netherlands Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Netherlands Used Car Market Segmentation By Geography

- 1. Netherlands

Netherlands Used Car Market Regional Market Share

Geographic Coverage of Netherlands Used Car Market

Netherlands Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Buyers Inclination Towards Affordable Used Cars; Others

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. Governments Support Purchases to Stimulate the Growth of the Used Car Market-

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marktplaats

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bynco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reezocar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AutoScout

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Autotrader

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OOYYO Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autotrack

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BOVAG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gaspedaal

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Marktplaats

List of Figures

- Figure 1: Netherlands Used Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Netherlands Used Car Market Revenue billion Forecast, by Vendor 2020 & 2033

- Table 3: Netherlands Used Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Netherlands Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Netherlands Used Car Market Revenue billion Forecast, by Vendor 2020 & 2033

- Table 6: Netherlands Used Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Used Car Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Netherlands Used Car Market?

Key companies in the market include Marktplaats, Bynco, Reezocar, Carro, AutoScout, Autotrader, OOYYO Corp, Autotrack, BOVAG, Gaspedaal.

3. What are the main segments of the Netherlands Used Car Market?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Buyers Inclination Towards Affordable Used Cars; Others.

6. What are the notable trends driving market growth?

Governments Support Purchases to Stimulate the Growth of the Used Car Market-.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

July 2023: Hedin Automotive B.V., a subsidiary of Hedin Mobility Group, successfully concluded a significant deal aimed at enhancing its brand portfolio and strengthening its presence in the Dutch automotive sector. This strategic maneuver involved the complete acquisition of Renova Automotive Group B.V., encompassing all aspects of the Dutch dealership group's operations related to BMW and MINI vehicles. This encompasses the sale of both new and pre-owned automobiles, as well as the provision of aftermarket services and facilities for vehicle damage repair.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Used Car Market?

To stay informed about further developments, trends, and reports in the Netherlands Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence